-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Contained Fire At Ukrainian Nuclear Power Plant Creates Vol.

EXECUTIVE SUMMARY

- EUROPE’S LARGEST NUCLEAR PLANT ATTACKED BY RUSSIA, UKRAINE SAYS, FIRE EXTINGUISHED (BBG)

- UKRAINE-RUSSIA TALKS AGREED ON HUMANITARIAN CORRIDORS

- FED'S WILLIAMS SUPPORTS SERIES OF RATE HIKES, UKRAINE IMPACT NOT STAGFLATIONARY (MNI)

- GERMANY SUSPECTS BOND SHORTAGE IS CAUSED BY SANCTIONED HOLDERS

- BOJ IS SAID TO SEE OIL SURGE PUSHING PRICES BEYOND FORECAST (BBG)

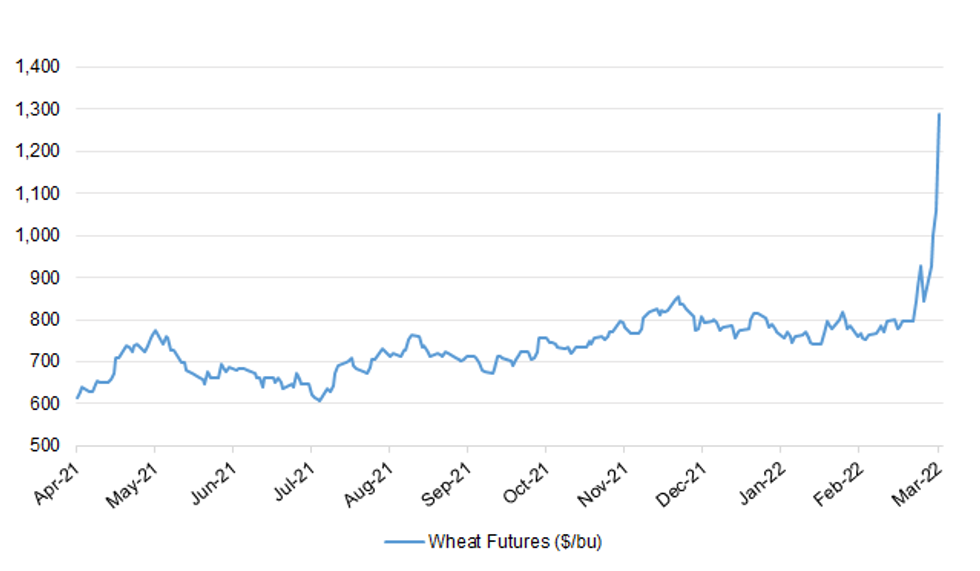

Fig. 1: Wheat Futures ($/bu) (continuation)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The U.K. economy will grow at half of last year’s pace in 2022 as soaring inflation, higher taxes and the war in Ukraine weigh on the recovery, according to the latest forecasts from a leading business group. The British Chambers of Commerce downgraded its forecast for gross domestic product, anticipating an expansion of 3.6%, down from 7.5% in 2021. Last year’s boom was the biggest since 1941, reflecting businesses reopening after the pandemic. (BBG)

BREXIT: Boris Johnson is unlikely to trigger Article 16 proceedings against the EU over the controversial Northern Ireland protocol ahead of May’s Stormont elections due to the war in Ukraine. The UK prime minister has threatened to activate the override mechanism and suspend part of the UK-EU accord covering post-Brexit trade with the region due to concerns that its implementation is too onerous and disruptive to trade between Great Britain and Northern Ireland. Negotiations between UK foreign secretary Liz Truss and European Commission vice-president Maros Sefcovic to agree a compromise over border arrangements for Northern Ireland have continued for months with little sign of any breakthrough. The purdah period for May’s elections begins at the end of March. (FT)

POLITICS: The U.K. opposition Labour Party held a key parliamentary seat in a special election, handing leader Keir Starmer a boost as he seeks to capitalize on faltering national support for Boris Johnson’s ruling Conservatives. Paulette Hamilton, a nurse and longtime district resident, won with a majority of 3,266 in Birmingham Erdington, the Press Association reported early Friday. The West Midlands seat has been in Labour hands since its creation in 1974, but the Tories slashed the party’s majority in 2019 when Johnson won an emphatic general election victory. Thursday’s so-called by-election in the district was triggered by the death of veteran Labour member of Parliament Jack Dromey. Just 27% of voters turned out for the election to replace him, the Press Association said. Hamilton received 9,413 votes, ahead of Tory candidate Robert Alden, who got 6,147. (BBG)

EUROPE

ECB: The European Central Bank is set to take a timeout from plotting its exit from stimulus as it assesses the damage Russia’s war in Ukraine could inflict on the continent’s Economy. Inflation is approaching 6% -- three times the official target -- while Europe’s pandemic rebound is in danger of being curbed as the invasion sends already lofty energy costs soaring further and threatens to curb trade and investment. Amid the extreme uncertainty, the challenge will be to provide support without allowing prices to spin out of control. Vowing to react flexibly and forcefully, ECB policy makers still agree that the path toward ending below-zero interest rates and years of bond-buying remains appropriate, though achieving that may now take longer. While economists surveyed by Bloomberg continue to predict an ECB rate hike in 2022, they expect no firm commitments on withdrawing stimulus when the Governing Council convenes on March 9-10 -- a meeting that was earlier billed as a crucial juncture for removing support. Come June, however, respondents see the ECB setting September as the end-date for net bond-buying, with only one predicting they’ll continue in 2023. (BBG)

GERMANY/BUNDS: The German government increased the supply of hard-to- source bonds that it believes are being held by institutions sanctioned because of Russia’s invasion of Ukraine. “We have reason to believe that some of the securities are held by institutions that have been excluded from trading because of the current crisis,” a finance agency spokeswoman said by email, without identifying the entities or their host country. “Today’s increase in the Federal Treasury note is our reaction to that in the interest of the market.” The nation’s finance agency will increase the volume of the 0% Federal Treasury note maturing in March 2024 to 8.5 billion euros ($9.4 billion), with the additional volume used exclusively for short-term repo and securities lending, according to an earlier statement. The reopening will be made to the federal government’s own holdings with effect from Thursday. (BBG)

FRANCE: Less than six weeks before the French presidential election, Emmanuel Macron finally announced what voters already knew: he’s running for re-election. “I’m requesting your trust for a new mandate as the President of the Republic,” Macron said in a letter to the French people published in several local newspapers on Thursday evening. “I am a candidate to invent, with you, in face of the century’s challenges, a unique French and European answer.” French presidents typically delay announcing their candidacies to appear statesmanlike for as long as possible. But Macron, 44, held off longer than most as he positioned himself at the center of efforts to end the Ukraine crisis. Writing a letter was a way to benefit from a “rally-round-the-flag effect,” Ifop opinion head Frederic Dabi told Le Figaro newspaper. (BBG)

RATINGS: Potential Sovereign Rating Reviews Of Note Scheduled For Friday Include

- S&P on Cyprus (current rating: BBB-; Outlook Positive) & Finland (current rating: AA+; Outlook Stable)

- Moody’s on Estonia (current rating: A1; Outlook Stable)

- DBRS Morningstar on Spain (current rating: A, Stable Trend)

U.S.

FED: MNI BRIEF: Fed's Williams Supports Series of Rate Hikes

- New York Federal Reserve President John Williams Thursday said he still sees the need to begin tightening monetary conditions with a series of rate hikes this year and next year toward neutral levels- on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI BRIEF: Fed's Williams - Ukraine Impact Not Stagflationary

- New York Fed President John Williams said Thursday the U.S. economy will face additional inflation pressure from the oil price surge related the war in Ukraine, but also some slowing in consumer demand, though he pushed back against the prospect of stagflation on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: Federal Reserve Bank of Richmond President Thomas Barkin said he would like to see the central bank raise interest rates relatively quickly to around the level that existed prior to Covid-19 pandemic, or around 1.5-1.75%. “The chairman gave some testimony yesterday that suggested that the time to lift rates was coming soon,” Barkin said to the CFA Society Baltimore “I see both the rate moves and the balance sheet announcements as just signaling that the worst of the pandemic is behind us. The economy is growing strongly.” (BBG)

INFLATION: U.S. Commerce Secretary Gina Raimondo said on Thursday the Biden administration was examining whether providing exclusions from tariffs inherited from the previous administration was a way to ease inflation. “The president has asked me, has asked members of his cabinet, (to) look at every possible tool in our toolbox to deal with inflation and go industry by industry to figure out how we can ease the pressure,” Raimondo said in an interview on CNBC. “And so, yes, we are looking carefully to see if it would make sense to provide any exclusions from tariffs to bring down prices.” (RTRS)

OTHER

GLOBAL TRADE: Costco Wholesale Corp beat Wall Street estimates for quarterly revenue and profit on Thursday, as consumers returning to its stores bought more groceries and splurged on high-margin items such as jewelry and home furnishing goods. There has been strong demand for high-margin items in recent months as social events and travel have resumed, boosting sales at retailers. However, the company said it was still pressured by container delays, higher labor and freight costs and chip shortages, which were impacting deliveries. "Despite all the supply chain issues, we're staying in stock and continue to work to mitigate cost and price increases as best we can," Chief Financial Officer Richard Galanti said. (RTRS)

BOJ: Japanese Prime Minister Fumio Kishida says it’s desirable to pick a successor for Bank of Japan Governor Haruhiko Kuroda who is receptive to the 2% price target. With Kuroda’s term ending in 2023, “the basic policy is to pick the person who is judged to be most appropriate as BOJ governor at that point”. Expect the BOJ to continue to aim for 2% inflation in line with the joint statement. (BBG)

BOJ: The Bank of Japan sees the rapid increase in oil prices following Russia’s invasion of Ukraine pushing inflation beyond its latest forecast, adding to the negative factors weighing on a fragile economy, according to people familiar with the matter. Depending on movements in commodity prices, inflation could temporarily hit 2% this year, the people added. The comments come ahead of a central bank meeting later this month. Still, the BOJ continues to see little need to discuss policy normalization for now as cost-push inflation by itself won’t be sustainable, the people said. The oil surge will increase the likelihood that the economy’s recovery will be delayed, they added. (BBG)

BOJ: MNI INSIGHT: BOJ Keeps Close Watch On Dollar Demand From Banks

- Bank of Japan officials are watching for any sharp rise in dollar demand from Japanese banks ahead of the March-end fiscal year with conditions stable now, but as uncertainty is heightened on Moscow's invasion of Ukraine and the blockage of SWIFT access to select Russian banks affecting European financials, MNI understands on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

JAPAN: Japan unveiled on Friday a package of steps to help small and midsize firms cope with surging global fuel prices amid the Ukraine crisis, with an increased subsidy ceiling on oil and the extension of corporate funding, ministers said on Friday. Prime Minister Fumio Kishida's cabinet approved the measures including lifting a subsidy ceiling on gasoline, diesel and kerosene to 25 yen a litre to help companies cope with rising energy prices, Chief Cabinet Secretary Hirokazu Matsuno said. The government will tap 350 billion yen ($3.03 billion) from this fiscal year's emergency budget reserves to fund the oil subsidy, he added. (RTRS)

NEW ZEALAND: New Zealand Finance Minister Grant Robertson is bracing for slower-than-expected economic growth and faster inflation as he prepares his annual budget. The country’s surging omicron outbreak will have an impact on the economy this year, although evidence from overseas is that demand bounces back quickly, Robertson said in an interview with Bloomberg late Thursday in Wellington. “There’ll be a hit, but I don’t think it’ll be a massive hit,” he said. “Obviously the final forecasts are not in my hands yet in terms of the budget, but I expect the economy to remain pretty resilient albeit with that shock on it.” (BBG)

SOUTH KOREA: South Korea's Finance minister, Hong Nam-ki, said on Friday the country will extend the tax cut in oil products by three months to minimise the impact of surging energy prices, pushed up by the Russia-Ukraine crisis. The tax cut was scheduled to end late in April after the government slashed domestic tax by 20% on key oil products such as gasoline, diesel fuel and liquefied petroleum gas. The 0% tariff for liquefied natural gas will also be extended to end of July. Hong added the finance ministry is reviewing whether to increase the rate of tax cuts should oil prices soar at a faster pace and intensify economic uncertainties. (RTRS)

BOC: MNI BRIEF: BOC Sees Live QT Discussion At April

- Bank of Canada Governor Tiff Macklem on Thursday gave one of the biggest signals yet that he's about to embrace balance sheet roll-off. "At our next monetary policy decision in April, we will certainly have a live discussion about ending reinvestment and beginning quantitative tightening," he said at a parliamentary hearing. On Wednesday the Bank raised rates and continued its reinvestment phase of bond purchases without saying when it could move to shrink the balance sheet on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MEXICO: A deputy governor of Mexico’s central bank on Thursday cautioned against interest rate hikes, saying they could complicate an economic rebound in Latin America’s second-largest economy. (RTRS)

BRAZIL: Brazil President Jair Bolsonaro said he hopes the BRL strengthens below 5/USD during this Friday’s trading session to balance fuel prices due to oil cost increases. Bolsonaro said during his weekly social media broadcast that Brazil will continue taking a balanced position on Russia’s invasion of Ukraine. Brazil may meet fertilizer production needs, Agriculture Minister Tereza Cristina said. The war will probably increase prices of supplies and food. Brazil has “totally ruled out the possibility of receiving fertilizers from Russia and Belarus during the war”. Minister defended Brazil changing its fertilizer policy by prioritizing national production over exports. (BBG)

RUSSIA: Europe’s largest nuclear power plant in eastern Ukraine came under attack from Russian shelling early Friday, Ukrainian officials said, raising the stakes in Vladimir Putin’s invasion as his forces bombarded cities across the nation. Ukraine’s Foreign Minister Dmytro Kuleba said a fire broke out at the plant and called on Russia’s military to immediately halt firing. Ukraine told the International Atomic Energy Agency the fire “has not affected ‘essential’ equipment” and plant personnel were taking “mitigatory actions.” Mariano Grossi, the IAEA’s director general, spoke with Ukrainian authorities about the nuclear power plant and warned of “severe danger” if its reactors were hit. Ukraine’s regulator told the agency there has been no change reported in radiation levels. (BBG)

RUSSIA: US Secretary of Energy Jennifer Granholm tweeted Thursday night that she spoke with Ukraine’s energy minister about the situation at the Zaporizhzhia nuclear power plant. The US has activated its Nuclear Incident Response Team, and is monitoring the situation along with the Department of Defense, the US Nuclear Regulatory Commission and the White House, she said. Radiation levels normal: “We have seen no elevated radiation readings near the facility. The plant’s reactors are protected by robust containment structures and reactors are being safely shut down," she said. (CNN)

RUSSIA: The US Department of State on Thursday said that the US has invoked the Organization for Security and Co-operation in Europe (OSCE) Moscow Mechanism to establish an expert mission to examine reported human rights abuses and violations of humanitarian law by Russia in Ukraine. “With Ukraine’s agreement, the United States and 44 other countries have invoked the OSCE Moscow Mechanism. This action will establish an expert mission to address our grave concerns regarding the humanitarian and human rights impacts on the people of Ukraine caused by Russia’s further invasion with the support of Belarus. We have seen the troubling media reports of human rights abuses and violations of humanitarian law by Russia’s forces, including the mounting number of civilian casualties and extensive damage to civilian infrastructure,” the US Department of State said in its release. (Mint)

RUSSIA: A Ukrainian negotiator said on Thursday that a second round of ceasefire talks with Russia had not yielded the results Kyiv hoped for, but the sides had reached an understanding on creating humanitarian corridors to evacuate civilians. Ukrainian presidential adviser Mykhailo Podolyak said the two sides envisaged a possible temporary ceasefire to allow for the evacuation of civilians. "That is, not everywhere, but only in those places where the humanitarian corridors themselves will be located, it will be possible to cease fire for the duration of the evacuation," he said. They had also reached an understanding on the delivery of medicines and food to the places where the fiercest fighting was taking place. It was the first time the two sides had agreed any form of progress on any issue since Russia invaded Ukraine a week ago. (RTRS)

RUSSIA: Talks between Russia and Ukraine have yielded some common ground on the need for “humanitarian corridors,” possibly protected by ceasefire agreements, for civilians fleeing dangerous areas in Ukraine, representatives for both countries said. “The Ministries of Defense of Russia and Ukraine have agreed on the format of maintaining humanitarian corridors for the exit of the population, and on the possible temporary ceasefire in the humanitarian corridor area for the period of the release of the civilian population,” said chief Russian negotiator Vladimir Medinsky. “I think this is a significant progress,” Medinsky said. (CNBC)

RUSSIA: Russian President Vladimir Putin has insisted the invasion of Ukraine is "going to plan" - as he praised his soldiers as "real heroes". "All objectives that were set are being resolved or achieved successfully," he said in a televised address, despite Western intelligence suggesting the invasion is behind the Kremlin's schedule. He also reiterated his claims Russia is fighting "neo-Nazis", referring to the war as a "special operation" - something that has been widely refuted by the West as propaganda. As Mr Putin said he will destroy this "Anti-Russia" created by the West, a spokesperson for the Russian foreign ministry claimed videos of missile strikes in Ukraine are part of the country's propaganda. He made a series of comments - for which he did not provide evidence - saying that Ukrainian forces were holding foreign citizens hostage and using human shields. He also maintained his military has offered safe corridors, so civilians can escape the war, which he has blamed on Ukraine. (Sky)

RUSSIA: President Zelensky has survived at least three assassination attempts in the past week, The Times has learnt. Two different outfits have been sent to kill the Ukrainian president — mercenaries of the Kremlin-backed Wagner group and Chechen special forces. Both have been thwarted by anti-war elements within Russia’s Federal Security Service (FSB). Wagner mercenaries in Kyiv have sustained losses during their attempts and are said to have been alarmed by how accurately the Ukrainians had anticipated their moves. A source close to the group said it was “eerie” how well briefed Zelensky’s security team appeared to be. On Saturday an attempt on Zelensky’s life was foiled on the outskirts of Kyiv. Ukrainian security officials said a cadre of Chechen assassins had been “eliminated” before. (The Times)

RUSSIA: The United States on Thursday announced a new round of sanctions targeting Russian oligarchs and their family members who are supporting President Vladimir Putin as he wages war in Ukraine. The new penalties include “full blocking sanctions” on at least eight so-called elites in the country and visa restrictions on 19 Russian oligarchs, their 47 family members and close associates, according to the Biden administration. (CNBC)

RUSSIA: The European Union is preparing for a prolonged war following Russian President Vladimir Putin’s invasion of Ukraine, according to Commissioner Mairead McGuinness, who warned there were no limits to further sanctions the bloc will consider. “Nothing is off the table,” said McGuinness, the EU’s commissioner for financial stability. “We would like to think that this war will not be prolonged, but I’m afraid we’re also planning for it being a very lengthy battle.” “Everything that we do will focus on attacking the war machine with pulling away money, but equally addressing the significant humanitarian needs of the people of Ukraine,” she said in an interview. (BBG)

RUSSIA: As the U.S. and allies tighten sanctions on Russia and choke off investor demand for its assets, parts of Wall Street are jumping on the buying opportunity that it’s creating. Goldman Sachs Group Inc. and JPMorgan Chase & Co. have been purchasing beaten-down company bonds tied to Russia in recent days, as hedge funds that specialize in buying cheap credit look to load up on the assets, according to people with knowledge of the private transactions. Banks routinely scoop up debt because clients asked them to, or because they expect to find ready buyers. (BBG)

RUSSIA: Russia’s central bank said on Friday that stock trading on the Moscow exchange won’t resume on March 4. (RTRS)

RUSSIA: Russia's central bank said on Friday it had lowered the fee on foreign exchange purchases by individuals via brokers to 12% from 30% and set the same fee for companies and other legal entities. (RTRS)

RUSSIA/RATINGS: S&P cut Russia to CCC-; CreditWatch Negative

IRAN: Iran said on Thursday "extra efforts" were needed to revive Tehran's 2015 nuclear deal with world powers and that issues remained to be dealt with as indirect talks with the United States continued. "#ViennaTalks still continue. Premature good news does not substitute good agreement," the Iranian Foreign Ministry spokesperson Saeed Khatibzadeh said on Twitter. "Premature good news does not substitute good agreement. Nobody can say the deal is done, until all the outstanding remaining issues are resolved. Extra efforts needed," he said. (RTRS)

IRAN: Indirect talks between Iran and the United States on salvaging the 2015 Iran nuclear deal are in the final stages but "definitely not there yet," the talks' coordinator, Enrique Mora of the European Union, said on Twitter on Thursday. "We are at the final stages of the #ViennaTalks on #JCPOA. Some relevant issues are still open and success is never guaranteed in such a complex negotiation. Doing our best in the coordinator's team. But we are definitely not there yet," he said. (RTRS)

IRAN: Russia's envoy to the Iran nuclear talks said on Thursday there were still some "relatively small" issues that needed to be finalised to revive the 2015 deal between Tehran and world powers, but that he did not believe talks would now collapse. Speaking to reporters, Mikhail Ulyanov said a ministerial meeting was likely to happen, but could not say whether it would happen on Saturday, Sunday or Monday. "There are some issues that need to be finalised ... the outstanding issues are relatively small, but not yet settled," he said. (RTRS)

ENERGY: The EU intends to more than double the amount of gas in storage before next winter by providing subsidies to reduce its reliance on Russian supplies. A European Commission draft proposal, obtained by the Financial Times, will set a target for 80 per cent of storage capacity to be filled by September 30, up from 29 per cent now. Brussels proposes to scrap transmission fees for any gas in store, doubling the current 50 per cent rebate, and allow governments to pay companies to hold it. The paper, expected to be adopted on Tuesday, suggests offering contracts for difference, which would guarantee a minimum price for the gas if its value drops while in storage, but other subsidies could be used. (FT)

OIL: Saudi Crown Prince Mohammed Bin Salman told Russia's President Vladimir Putin in a phone call on Thursday the kingdom is ready to exert all efforts to mediate between Russia, Ukraine and all parties related to the ongoing Ukrainian crisis, state media reported. The prince reiterated the kingdom's keenness on maintaining the stability of oil markets and stressed the OPEC+ role in keeping its balance, adding it is necessary to maintain the OPEC+ agreement, state media added. (RTRS)

OIL: Trafigura Group offered to sell Russia’s flagship Urals crude at another record discount, offering evidence that the country’s barrels are still struggling to clear after its invasion of Ukraine. The oil trading giant offered the cargo at a $22.70-a-barrel discount to Dated Brent, a benchmark for physical oil transactions globally. That surpassed the prior discount it offered by about $34. There were no bids. A mostly Kazakh oil that gets exported from a Russian terminal in the Black Sea also slumped. (BBG)

CHINA

POLICY: China should make greater efforts to develop new energy, and reduce crude oil import dependency in the next ten years, as the current high oil prices are reshaping the global energy supply chain, the Shanghai Securities News reported citing analysts. China's current dependence on foreign crude oil is still as high as 72%, and such imported inflation will push up the costs for industries including refining, chemical, transportation and logistics, the newspaper said citing Lin Boqiang, a professor at Xiamen University. China may still be less affected than Europe and the U.S. in the face of soaring oil prices, as crude oil accounts for a much lower proportion in its energy structure than that of Europe and the U.S., the newspaper cited Lin as saying. (MNI)

POLICY: China’s top financial regulator said it will take precise measures to firmly guard against systemic risks, even as the foundation of the country’s financial system remains stable, according to an article by the Financial Stability Bureau published on the social media account of the People’s Bank of China. Banking assets account for over 90% of China's total financial assets, with only 316 out of 4398 banks considered high risks in Q4 2021, the article said. The figure had dropped from a peak of 649 in Q3 2019 for six quarters, and is expected to decrease to less than 200 by the end of 2025, the article said. (MNI)

MARKETS: China's Financial Futures Exchange should research and design new products such as forward rate futures and treasury bond options, while top financial regulators should form a joint force to promote the listings of more futures and options to better cover the interest rate curve, the China Securities Journal reported citing Jiang Yang, a former vice chairman of the China Securities Regulatory Commission. China should also open treasury bond futures trading to foreign traders in specific varieties to meet their growing demand for managing risks, as foreign investors’ holdings of Chinese bonds have exceeded CNY4 trillion, the newspaper said citing Jiang. (MNI)

OVERNIGHT DATA

JAPAN JAN JOBLESS RATE 2.8%; MEDIAN 2.7%; DEC 2.7%

JAPAN JAN JOB-TO-APPLICANT RATIO 1.2; MEDIAN 1.15; DEC 1.16

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE INDEX 81.7; JAN 97.7

NEW ZEALAND FEB ANZ CONSUMER CONFIDENCE INDEX -16.4% M/M; JAN -0.6%

SOUTH KOREA FEB FOREIGN RESERVES $461.77BN; JAN $461.53BN

SOUTH KOREA FEB CPI +3.7% Y/Y; MEDIAN +3.5%; JAN +3.6%

SOUTH KOREA FEB CPI +0.6% M/M; MEDIAN +0.5%; JAN +0.6%

SOUTH KOREA FEB CORE CPI +3.2% Y/Y; MEDIAN +3.0%; JAN +3.0%

CHINA MARKETS

PBOC NET DRAINS CNY290 BILLION VIA OMOS FRIDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Friday. The operation has led to a net drain of CNY290 billion after offsetting the maturity of CNY300 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0794% at 09:42 am local time from the close of 1.9738% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 51 on Thursday vs 42 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3288 FRI VS 6.3016

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3288 on Friday, compared with 6.3016 set on Thursday.

MARKETS

SNAPSHOT: Contained Fire At Ukrainian Nuclear Power Plant Creates Vol.

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 625.31 points at 25952.99

- ASX 200 down 40.603 points at 7110.8

- Shanghai Comp. down 30.987 points at 3450.468

- JGB 10-Yr future up 8 ticks at 150.88, yield down 2.1bp at 0.156%

- Aussie 10-Yr future up 1.5 ticks at 97.845, yield down 1.5bp at 2.150%

- U.S. 10-Yr future +0-17 at 128-01+, yield down 5.16bp at 1.789%

- WTI crude up $1.83 at $109.48, Gold up $1.34 at $1937.01

- USD/JPY up 1 pip at Y115.47

- EUROPE’S LARGEST NUCLEAR PLANT ATTACKED BY RUSSIA, UKRAINE SAYS, FIRE EXTINGUISHED (BBG)

- UKRAINE-RUSSIA TALKS AGREED ON HUMANITARIAN CORRIDORS

- FED'S WILLIAMS SUPPORTS SERIES OF RATE HIKES, UKRAINE IMPACT NOT STAGFLATIONARY (MNI)

- GERMANY SUSPECTS BOND SHORTAGE IS CAUSED BY SANCTIONED HOLDERS

- BOJ IS SAID TO SEE OIL SURGE PUSHING PRICES BEYOND FORECAST (BBG)

BOND SUMMARY: Frenetic Asia Session Wire Fire At Ukrainian Nuclear Plant Controlled

Sharp risk-off flows kicked in as reports did the rounds of a fire at Ukraine’s largest nuclear power station (the largest such facility in Europe), with the Ukrainians pointing to a Russian shelling of the facility. It took some time before it became apparent that the fire was limited to an administrative building on the outskirts of the complex, with the nuclear reactors avoiding anything in the way of material damage. Caution remained apparent for the remainder of the session.

- TYM2 is +0-15 last, printing 127-31+, well shy of the peak of its 1-15 Asia range, operating on ~450K lots ahead of European hours. Cash Tsy trade sees the major benchmarks run 1.5-5.0bp richer, with 7s leading and 2s lagging. Comments from NY Fed President Williams didn’t move the market, as he looked to play down stagflationary worry and OK’d a series of rate hikes from March. Selling in the very front end of the Eurodollar strip has been apparent into European hours, perhaps as European traders look for an extension in yesterday’s EDH2/SFRH2 & FRA/OIS widening (which was primarily driven by a jump in the 3-month LIBOR fixing and 40K block sale of EDH2). Monthly NFPs headline the docket during NY hours.

- JGB futures finished 8 ticks higher, but 26 ticks off of their session peak. Cash JGBs ultimately bull flattened, with the 5- to 7-Year zone underperforming as JGB futures moved back towards neutral levels. There hasn’t been much in the way of meaningful domestic headline flow, with Japanese PM Kishida flagging the importance of FX rates moving in a stable manner. He also made a pledge that the government will do all it can to manage the economy and fiscal policy in an appropriate manner. Kishida then noted that he wants the BoJ to continue to aim for the 2% inflation level, while stressing that he will pick the “most appropriate” successor for BoJ Governor Kuroda. Finally, Kishida pointed to pressure on oil producing nations to boost supply, while Chief Cabinet Secretary Matsuno noted that the cabinet has approved a Y360bn response re: higher oil prices (with more to come next FY, if required).

- Aussie bond futures followed the broader gyrations when it came to risk appetite, with futures quickly unwinding overnight losses, before returning to near neutral levels. That left YM -2.0, while XM was +1.5 at the bell. Cash ACGB trade saw cheapening further out the strip (in the 15+-Year zone), while the 7- to 12-Year zone firmed a touch. The IR strip settled 3-9bp cheaper through the reds, after a volatile session, with the late whites and early reds leading the way lower. There wasn’t much in the way of meaningful domestic headline flow.

JGBS AUCTION: Japanese MOF sells Y4.6209tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.6209tn 3-Month Bills:

- Average Yield -0.0934% (prev. -0.0904%)

- Average Price 100.0251 (prev. 100.0243)

- High Yield: -0.0856% (prev. -0.0837%)

- Low Price 100.0230 (prev. 100.0225)

- % Allotted At High Yield: 44.8954% (prev. 97.6211%)

- Bid/Cover: 2.490x (prev. 3.096x)

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.50% 21 Jun ‘31 Bond, issue #TB157:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.50% 21 June 2031 Bond, issue #TB157:

- Average Yield: 2.1597% (prev. 1.7001%)

- High Yield: 2.1625% (prev. 1.7025%)

- Bid/Cover: 3.1650x (prev. 2.5950x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 45.7% (prev. 44.3%)

- Bidders 38 (prev. 39), successful 16 (prev. 16), allocated in full 7 (prev. 10)

AUSSIE BONDS: AOFM Weekly Issuance Slate

{AU} AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Monday 7 March it plans to sell A$1.0bn of the 0.25% 21 November 2024 Bond.

- On Tuesday 8 March it plans to sell A$150mn of the 0.25% 21 November 2032 Indexed Bond.

- On Wednesday 9 March it plans to sell A$1.0bn of the 1.75% 21 November 2032 Bond.

- On Thursday 10 March it plans to sell A$1.5bn of the 24 June 2022 Note & A$1.0bn of the 22 July 2022 Note.

EQUITIES: Taking A Tumble On Geopolitical Volatility

Major regional equity indices trade sharply lower at writing, failing to recover from losses observed earlier in the Asia-Pac session. The region-wide decline was facilitated by worry over a well-documented fire at the Ukrainian Zaporizhzhia nuclear plant (with Ukraine pointing to Russian shelling of the facility), spurring risk-off moves that saw high-beta stocks across various sectors again struggle on the day. Containment of the fire to an administrative building at the Ukrainian nuclear facility failed to provide a notable boost to the space.

- The Hang Seng leads losses, printing 2.7% worse off, on track for a third straight week of declines. China-based tech stocks bore the brunt of the selling, with steep declines witnessed in large caps Alibaba (-4.9%), Meituan (-7.1%), and Tencent (-3.8%). The Hang Seng Tech index correspondingly deals 4.1% weaker at typing, notching a fresh all-time low (its inception came in Jul ’20).

- The CSI300 is on track to close lower for a third consecutive day, sitting 0.9% weaker at typing. Losses in the richly valued consumer discretionary and consumer staples sub-indices continue to weigh on the index, with steep declines again seen in large Chinese liquor stocks such as Kweichow Moutai (-2.4%) and Wuliangye Yibin Co (-2.5%).

- The ASX200 fell to a lesser extent than the remainder of the major regional indices, closing 0.8% lower. The index snapped a five-day streak of gains, with major crude benchmarks operating a little shy of their cycle highs

- U.S. e-mini equity index futures sit 0.7% to 0.9% lower into European hours.

OIL: Slightly Higher After Early Moves

WTI is +$2.40 and Brent is +$1.90 at typing, printing ~$110.10 and ~$112.40respectively.

- Both benchmarks have pulled back from the session's best levels, with the earlier move higher driven by reports of Ukraine's Zaporizhzhia nuclear plant being hit by fire. Worry re: the situation has since eased, with the plant director stating to Ukrainian media that radiation security had been secured, while later reports pointed to damage being limited to a training building and an offline nuclear reactor (albeit containing nuclear fuel).

- To recap Thursday's movements, WTI and Brent hit fresh multi-year highs (highest since '08 and '12 respectively) on well-documented supply concerns re: Russian crude exports before closing lower, as elevated hope surrounding a possible Iranian nuclear deal applied some pressure to the space. To elaborate, the Russian envoy at the Iranian talks noted that a ministerial meeting to formalise the deal was now likely (although no timeline was provided), while the head of the International Atomic Energy Agency has announced a visit to Tehran on Saturday, with the aim of potentially addressing one of the final issues that have hindered talks (specifically on "outstanding safeguards").

- On the technical front, WTI and Brent see resistance at $120.00 (psychological round number), while support is located at the Mar 2 lows of $105.18 and $106.83 respectively.

GOLD: Slightly Higher As Knee-Jerk Reaction To Nuclear Plant Fire Moderates

Gold trades ~$4/oz firmer to print $1,940/oz at writing, back from best levels of the session ($1,950.88/oz) as the risk-off impulse from reports of Ukraine’s Zaporizhzhia nuclear plant being set ablaze by a Russian attack eased (the main nuclear facilities seemingly avoided meaningful damage, with a training facility providing the scene of the fire). The precious metal continues to operate around the top of Thursday’s range, as worry surrounding the Russia-Ukraine conflict continues to drive price action.

- On the wider Russia-Ukraine conflict, negotiators from both sides made some progress after meeting on Thursday, agreeing on the possibility of localised, temporary ceasefires for the establishment of “humanitarian corridors”. Both parties are due to meet for a third round “early next week”. Still, the conflict continues in full swing.

- Looking ahead, focus will turn to U.S. NFPs due later (1330 GMT), with March FOMC dated OIS now pricing in a little under 25bp of tightening (Fed Chair Powell’s recently voiced support for a 25bp hike at that meeting).

- From a technical perspective, gold remains in an uptrend and trades within a bull channel drawn from the Aug 9 low. Resistance is currently situated at $1,974.3/oz (Feb 24 high), while support is located some distance away at $1,878.4/oz (Feb 24 low and key short-term support).

FOREX: Russian Attack On Ukraine's Key Nuclear Power Plant Spooks Europe

European currencies got battered while the risk switch flicked to off as Russian troops shelled Ukraine's (and Europe's) largest nuclear plant setting it ablaze. Initial headlines flagged the danger posed by damaged reactors and suggested that Russian shelling prevents fire brigades from entering the plant. The news rattled markets by raising the prospect of potential radioactive contamination, but subsequent headlines helped soothe the nerves. Ukrainian officials clarified that the fire broke out in a training complex outside the main perimeter of the plant, leaving essential equipment intact and causing no change in radiation levels. The emergency services managed to put out the fire but the incident fuelled fears that continued fighting may lead to dramatic unforeseen consequences. President Zelensky and his ministers contacted their Western counterparts, with UK PM Johnson pledging to call an emergency session of UNSC to discuss the situation.

- Major continental European currencies got battered on the back of contagion risk, with events at Zaporizhzhia Nuclear Power Plant drawing attention to risks surrounding the war in Ukraine. EUR/CHF printed a session low of CHF1.0117, a fresh multi-year trough, before trimming some losses. The Scandies, EUR and CHF continue to trade on a softer footing as we head for the London session.

- The main Asia-Pac risk barometer AUD/JPY fell to Y84.16 in the initial reaction to the Zaporizhzhia NPP news before bouncing to a new four-month high. The Antipodeans gained the most from the unwinding of initial risk-off moves and jumped onto the top of the G10 pile. The yen is the third best performer as the attack on Ukraine's key nuclear facility continues to spook Europe.

- U.S. NFP report headlines the global data docket today, with EZ retail sales also due.

FOREX OPTIONS: Expiries for Mar04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1100-20(E1.4bln), $1.1300-15(E1.2bln), $1.1325-30(E681mln)

- USD/JPY: Y114.00($1.5bln), Y115.00($675mln), Y116.00($680mln)

- EUR/GBP: Gbp0.8530(E610mln)

- AUD/USD: $0.7030(A$1.2bln), $0.7300(A$841mln)

- USD/CAD: C$1.2495($520mln), C$1.2595-00($1.2bln), C$1.2700($1.4bln), C$1.2800($831mln)

- USD/CAD: C$1.2700-20($1.6bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/03/2022 | 0700/0800 | ** |  | DE | trade balance |

| 04/03/2022 | 0745/0845 | * |  | FR | industrial production |

| 04/03/2022 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/03/2022 | 0900/1000 | *** |  | IT | GDP (f) |

| 04/03/2022 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/03/2022 | 1000/1100 | ** |  | EU | retail sales |

| 04/03/2022 | 1330/0830 | *** |  | US | Employment Report |

| 04/03/2022 | 1500/1000 | * |  | CA | Ivey PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.