-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - EUR Vols Surge Ahead of US CPI

MNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN OPEN: Asian Equities Look Through Bond Market Sell Off & Hawkish Fed

EXECUTIVE SUMMARY

- FED'S MESTER CALLS FOR FRONTLOADING RATE HIKES, SEES RISE TO 2.5% IN 2022 (RTRS)

- FED'S DALY: RATES NEED TO RISE TO TAMP DOWN TOO-HIGH INFLATION (RTRS)

- UKRAINE'S ZELENSKIY: RUSSIA TALKS ARE TOUGH, SOMETIMES CONFRONTATIONAL (RTRS)

- UKRAINE’S ZELENSKIY WILL JOIN NATO SUMMIT VIA VIDEO LINK (BBG)

- GLOBAL BOND INDEX LOSES $2.6TN IN RECORD SLIDE FROM PEAK (BBG)

- SPECULATION SURROUNDING POTENTIAL FOR JAPANESE FISCAL STIMULUS PICKS UP

- CHINESE PRESS REPORTS FLAG ROOM FOR FURTHER RRR AND RATE CUT, WINDOW NARROWING

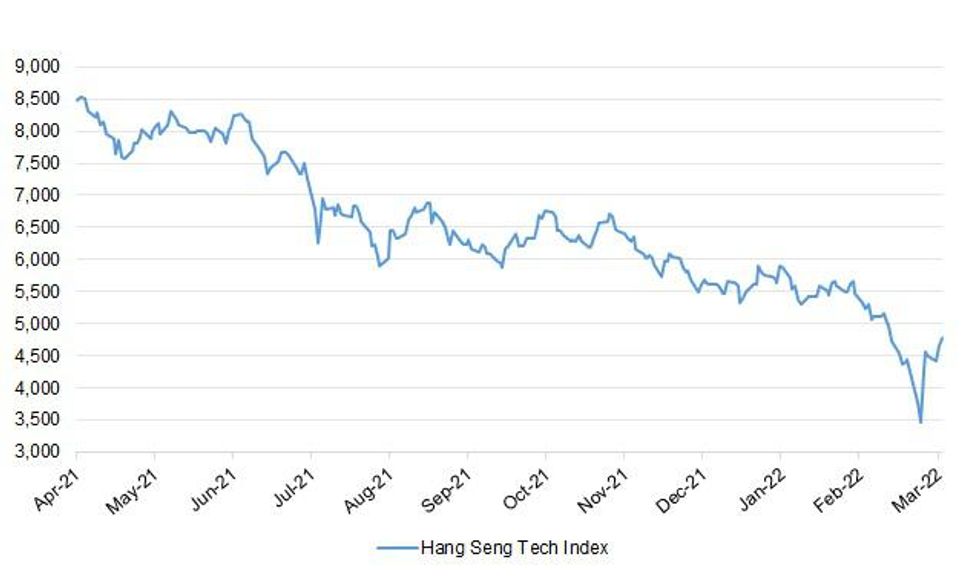

Fig. 1: Hang Seng Tech Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: The U.K. Chancellor of the Exchequer will use his Spring Statement on Wednesday to promise “security for working families as we help with the cost of living,” according to a Treasury statement late Tuesday. Sunak will also say Britain’s response to Russia’s invasion of Ukraine includes “strengthening our economy here at home.” (BBG)

FISCAL: Rishi Sunak will today pledge to do more to help families deal with the cost-of-living crisis by spending some of the government’s £30 billion “war chest” from higher tax receipts. The chancellor is expected to outline measures in his spring statement to reduce the burden of national insurance rises on the poorest families and cut taxes on petrol and diesel sales in response to rising fuel prices. He will, however, stand by the government’s decision to raise national insurance rates by 1.25 per cent to pay for health and social care and insist that he needs to prioritise “more resilient public finances”. (The Times)

FISCAL: Rishi Sunak is planning to set aside a large part of a windfall in UK public finances this year, risking a backlash from Tory MPs who want the chancellor to use all funds available to cushion the cost of living crisis hurting British families. The official forecasts in the Spring Statement will show the deficit is at least £20bn better than expected this year, but Sunak will use only some of the money to help households facing soaring gas, electricity, and fuel bills. Sunak will instead highlight the importance of “more resilient public finances” as he worries about a surge in the cost of servicing government debt instead of spending the entire windfall. (FT)

FISCAL: The cost of chicken could rise by up to 30 per cent, the environment secretary has warned as he said that more expensive food was “inevitable” after the invasion of Ukraine. Rishi Sunak, the chancellor, will promise today to help with the cost of living in a spring statement that he says will offer “security for working families” squeezed by rising fuel bills, higher inflation and an impending national insurance rise. He is expected to cut fuel duty and increase the income threshold at which people start paying national insurance. There is also speculation that universal credit allowances might be raised to support the most vulnerable families. (The Times)

FISCAL: Tax rises will cost people an extra £1,000 a year, an analysis has shown, as Rishi Sunak pledges extra help in Wednesday’s Spring Statement for hard-pressed families. (Telegraph)

FISCAL: North Sea energy companies believe they have a tacit agreement with UK ministers that if they step up investment in oil and gasfields they will be spared a windfall tax in the chancellor’s Spring Statement on Wednesday. Shell announced last week that it has resubmitted plans for approval of the large Jackdaw North Sea gasfield, while it has left open the possibility of reviving interest in the Cambo oilfield off Shetland. Chancellor Rishi Sunak is under heavy pressure from the Labour party to levy a windfall tax on the North Sea sector after soaring energy prices boosted companies’ profits, but he has consistently rejected the idea, warning this would undercut investment. (FT)

GILTS: British government bond issuance will fall closer towards pre-pandemic norms in the coming financial year, when the market's biggest buyer over the last decade - the Bank of England - will move to the sidelines, according to a Reuters poll of primary dealers. The Debt Management Office's 2022/23 gilt issuance remit is likely to show about 147 billion pounds ($193.8 billion) of bond sales, compared with 194.8 billion pounds in the current year, according to the median forecast in the poll. The remit is due to be published on Wednesday, shortly after finance minister Rishi Sunak delivers his Spring Statement budget update to parliament. (RTRS)

ENERGY: Boris Johnson's cabinet is split over proposals to ease planning rules in England to enable more onshore wind farms, sources have told the BBC. Ministers are next week due to set out plans to produce more energy in the UK to tackle spiralling household bills. Business secretary Kwasi Kwarteng is in favour of loosening planning regulations to make it easier to approve plans for more onshore wind. But the BBC has been told other cabinet ministers strongly oppose the plans. (BBC)

POLICY: The cost of living crisis will make Boris Johnson’s plans to tackle the UK’s regional inequalities much more difficult to achieve, according to Andy Haldane, outgoing head of the government’s levelling up task force. At the end of his six-month sabbatical overseeing the government’s levelling up white paper, Haldane acknowledged that some of the people who would be hit hardest by soaring inflation would be those living in the “left behind” areas that the prime minister’s flagship policy is meant to help. The former Bank of England chief economist accepted the government’s 12 key goals to reduce regional inequalities would be negatively affected as a result, but insisted this would not undermine the policy. “The cost of everything — including borrowing, energy, goods, service, of people — has gone up,” Haldane told the Financial Times. “It’s going to make [the levelling up goals] harder to achieve, and even more important to achieve.” He suggested that the burden of surging inflation would fall disproportionately on people and places most in need of the government’s levelling up agenda. (FT)

EUROPE

ECB: Russia’s war in Ukraine “creates stagflationary forces and monetary-policy dilemmas for the ECB as well as fiscal, energy and defense issues for the euro zone and national governments,” European Central Bank Governing Council member Yannis Stournaras says in speech. “The implications of the Russian invasion of Ukraine pose an important adverse supply side shock, which is expected to negatively affect output and further increase energy prices”. A potential further escalation “poses notable unfavorable risks to the outlook for the economy”. (BBG)

CORONAVIRUS: A third of European nations, including Germany, France and the U.K., are seeing a surge in Covid-19 cases after “brutally” easing restrictions, the World Health Organization’s regional head said. “The countries where we see in particular an increase are the United Kingdom, Ireland, Greece, Cyprus, France, Italy and Germany,” Hans Kluge, the WHO’s director for Europe, said at a briefing in Moldova on Tuesday. “Those countries are lifting restrictions brutally from too much to too few.” Europe is trying to leave Covid-19 behind, but the rush to unwind restrictions is now setting the stage for a revival of pandemic risks. Newly confirmed cases climbed to 5.4 million in the past seven days, up from 4.9 million at the end of February, according to WHO data. More than 12,400 people died from Covid in the past week, according to WHO. Still, Kluge said he is “optimistic and vigilant” about the pandemic in Europe because many people have built up immunity through vaccinations, winter is drawing to a close and omicron is a milder strain than previous variants. (BBG)

ITALY/BTPS: Italy plans to sell up to EU2 billion ($2.2 billion) of 0% bonds due Nov. 29, 2023 in an auction on March 25. Italy plans to sell up to EU1.5 billion ($1.65 billion) of 0.1% inflation-linked bonds due May 15, 2033 in an auction on March 25. (BBG)

U.S.

FED: Cleveland Federal Reserve Bank President Loretta Mester on Tuesday said she would like to raise interest rates to about 2.5% by year end, with bigger rate hikes in the first half, and further tightening next year to bring down high inflation and keep it from getting entrenched. (RTRS)

FED: San Francisco Federal Reserve Bank President Mary Daly said Tuesday she believes the "main risk" to the U.S. economy is from too-high inflation that could get worse as Russia's invasion of Ukraine boosts oil prices and China's crackdown on COVID-19 further disrupts supply chains. "Even though we have these uncertainties around Ukraine, and we have the uncertainties around the pandemic, it's still time to tighten policy in the United States," Daly said at a virtual Brookings Institution event, "marching" rates up to the neutral level and perhaps even higher to a level that would restrict the economy to ensure inflation comes back down. Daly on Tuesday said the labor market is tight enough to be unsustainable, pointing to worker churn including new hires who "ghost" their new employers by not showing up because they have other options. "In addition to pushing up wage inflation, which could ultimately push up price inflation, putting us in sort of a vicious cycle," she said, "it's just not a very sustainable way to manage the economy." She said she sought a "smooth landing" for the labor market as rate hikes help bring down inflation. (RTRS)

CORONAVIRUS: The U.S. Travel Association on Tuesday urged the White House to lift COVID-19 travel restrictions and repeal a mandate requiring masks on airplanes and in other transit modes by April 18, according to a letter seen by Reuters. In a letter to Dr. Ashish Jha, the incoming White House COVID response coordinator, the group called for an immediate end to the pre-departure testing requirement for all fully vaccinated inbound international persons and ending the mask mandate by April 18 "or announcing a plan and timeline to repeal the federal mask mandate within the subsequent 90 days." (RTRS)

POLITICS: U.S. President Joe Biden's public approval rating fell to a new low of 40% this week, a clear warning sign for his Democratic Party as it seeks to retain control of Congress in the Nov. 8 election, according to a Reuters/Ipsos opinion poll. The national poll, conducted on March 21 and 22, found that 54% of Americans disapprove of his job performance as the country struggles with high inflation and Russia's invasion of Ukraine has pushed geopolitical concerns to the fore. Biden's approval rating, down three percentage points from the prior week, mirrors that which his Republican predecessor, Donald Trump, received at this point in his presidency, as both stood at 40% in mid-March in their second year in office. (RTRS)

OTHER

GLOBAL TRADE: The US has agreed to remove Trump-era tariffs on UK steel and aluminium shipments, resolving an issue that had strained relations between the allies. The move follows earlier deals with the European Union and Japan over the controversial taxes, which were imposed by former President Donald Trump in 2018 in the name of national security. In exchange, the UK will suspend extra import taxes it had put on US products such as bourbon and Levi's jeans. Business groups welcomed the decision. Under the agreement, the US will replace the tariffs with a quota system, which ensures duty-free treatment to metals shipments up to a certain level, in this case comparable to 2019 shipments, according to the US. The deal will go into effect 1 June. (BBC)

U.S./CHINA: A U.S. judge on Tuesday ruled that China’s ZTE Corp, a top telecommunications equipment maker, should be allowed to end its five-year probation from its 2017 guilty plea. The ruling came on the final day of the company’s probation for illegally shipping U.S. technology to Iran and North Korea. ZTE had been accused of violating probation over an alleged conspiracy to bring Chinese nationals to the United States to conduct research at ZTE through visa fraud. While the judge said he found allegations of conspiracy to commit visa fraud to be true, he decided to not take any further action against ZTE, which had already reached the maximum probation for a felony. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida is likely to order an additional economic stimulus package by the end of March to cushion the impact of rising prices of oil and other goods on the economy, Yomiuri newspaper said on Wednesday. The move would follow Tuesday's parliamentary approval of a record $900 billion state budget for the fiscal year 2022. The size of the extra package is to be determined after scrutinising necessary measures to counter the effect of soaring costs, Yomiuri reported without citing sources. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida is considering additional economic stimulus given the war in Ukraine and soaring crude oil and wheat prices, Kyodo reports Natsuo Yamaguchi, head of the junior party in the ruling coalition, as saying after meeting the premier. (BBG)

JAPAN: Japan says it expects sufficient power supply for Tokyo after narrowly avoiding blackouts on Tuesday, as the worst power supply squeeze in more than a decade shows signs of easing. The government lifted its electricity shortage warning for Tokyo from 11 a.m. on Wednesday, with solar supplies expected to be more abundant and cold weather subsiding, according to the Ministry of Economy, Trade and Industry. Power demand from Thursday will ease more as temperatures rise, according to the ministry. (BBG)

NEW ZEALAND: New Zealand's government said on Wednesday it would lift vaccine mandates for a number of sectors including teaching and police from April 4 as the current COVID-19 outbreak nears its peak. New Zealand Prime Minister Jacinda Ardern said at a news conference that only those working with vulnerable people such as aged care and heath sectors and border workers would need to be vaccinated from April 4. Vaccine passes would also no longer be mandatory to visit restaurants, coffee shops and other public spaces, she added. "With more tools and one of the most highly vaccinated populations in the world we are able to keep moving forward safely," Ardern said as she announced the lifting of most mandates. (RTRS)

NEW ZEALAND: Higher interest rates as the Reserve Bank responds to high inflation will put pressure on New Zealand businesses and consumers, Finance Minister Grant Robertson told the Auckland Chamber of Commerce Wednesday. Says inflation will be challenging for economy, and government has role to be careful with spending, and with targeted measures such as fuel excise reduction. RBNZ “has signaled their course and that has its own impacts on households and businesses, but that is the system we have to manage price instability”. More broadly 2022 will be challenging to New Zealand and to the global economy because of inflation, war in Ukraine, rising energy prices and supply chain issues. Still, New Zealand economy is resilient and in strong position coming out of pandemic. (BBG)

SOUTH KOREA: President-elect Yoon Suk Yeol’s transition team seeks to draw up extra budget plan without bond issuance, Asia Business Daily reports, citing an unidentified official at the team. Yoon’s transition team will fund extra budget via main budget restructuring; budget related to carbon neutrality and so-called “Korean New Deal” may be adjusted. (BBG)

BOK: Changyong Rhee, Asia-Pacific director for the International Monetary Fund, has been nominated to take the helm at the Bank of Korea, a choice that economists say will favor a continuation of policy normalization. Rhee, if confirmed, would replace Governor Lee Ju-yeol, who steps down at the end of March. President Moon Jae-in discussed the nomination with his successor Yoon Suk Yeol before announcing it, the presidential office said in a statement. (BBG)

HONG KONG: Hong Kong still sees citywide mass testing as a feasible option to find remaining Covid cases once the current wave ebbs, Chief Executive Carrie Lam said at briefing. The resumption of quarantine-free travel with mainland China remains “a top priority,” but there’s no timetable for the reopening, Lam said. The city will resume discussions with the mainland on reopening once conditions permit. Hong Kong will resume full-day, in-person classes if 90% of students and all school staff receives two doses of vaccination, Secretary for Education Kevin Yeung said at the briefing. (BBG)

BRAZIL: Brazil's government must wait before adopting new measures to mitigate higher fuel prices, said Special Treasury and Budget Secretary Esteves Colnago on Tuesday, with the evolution of the exchange rate and the conflict in Ukraine seen as key inputs. Speaking at a press conference, Colnago stressed that reducing taxes on gasoline would not be a good policy because it would mainly benefit the middle and upper classes. He said the government could take more appropriate measures "if and when needed." (RTR)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Wednesday said peace talks with Russia to end the war were tough and sometimes confrontational but added "step by step we are moving forward." In an early morning video address, Zelenskiy also said 100,000 people were living in the besieged city of Mariupol in inhuman conditions, without food, water or medicine. (RTRS)

RUSSIA: About 100,000 people remain in the port of Mariupol, “under full blockade, without food, without water, without medicine, under constant shelling,” Zelenskiy said in his daily video address to the nation. Kyiv officials say another 6,000 people were evacuated from the city on Tuesday, while Russian troops seized buses and cars sent there by emergency services to help more people leave. The president said peace talks with Russia are “very difficult” but “step by step we are moving forward.” He also said he’s “grateful” to Greek Foreign Minister Nikos Dendias for announcing his intention to accompany an aid mission to Mariupol. (BBG)

RUSSIA: Russia's security policy dictates that the country would only use nuclear weapons if its very existence were threatened, Kremlin spokesman Dmitry Peskov told CNN in an interview on Tuesday. The comment, nearly four weeks after Russia sent its forces into Ukraine, came amid Western concern that the conflict there could escalate into a nuclear war. Peskov made the comment in an English-language interview when asked whether he was confident President Vladimir Putin would not use nuclear weapons. (RTRS)

RUSSIA: A cyberattack by Russia on a NATO country could trigger a collective response from the U.S. and its allies, but not necessarily a military one, National Security Adviser Jake Sullivan said at a White House press briefing. “We and other countries could bring capabilities to bear to help a country both defend itself and respond to a particular cyberattack,” Sullivan said. “That’s not necessarily the same thing as a military response. That response could take many different forms.” (BBG)

RUSSIA: During his trip to Europe this week, President Joe Biden could announce that the United States plans to permanently maintain an increased number of its troops deployed in NATO countries near Ukraine, according to four people familiar with the discussions. The president, who is attending a NATO summit Thursday, recently reviewed options for permanent increases in the number of U.S. troops in Eastern Europe, and Poland is among the possible locations for the additional forces, the sources said. “We are looking at additional troop posture adjustments,” an administration official said, adding that no final decisions have been made. “At the summit,” the official said, “we expect NATO leaders to review the alliance’s current deterrent and defensive force posture, especially in light of the deteriorated security environment caused by Russia’s unprovoked and unjustified further invasion of Ukraine.” (NBC News)

RUSSIA: Zelenskiy will take part via video in the North Atlantic Treaty Organisation meeting on March 24, where he’ll deliver an address and may “fully participate” in the talks, his spokesman Serhiy Nykyfotov said on television. The president will reiterate Ukraine’s demands for an end to “Russia’s crimes against civilians and civilian infrastructure,” Nykyforov said. “That is possible to do in several ways -- impose a no-fly zone, give Ukraine strong air defenses, and provide jets. It will be up to those countries what to choose.” (BBG)

RUSSIA: President Joe Biden and allies meeting Thursday in Brussels are expected to announce both new sanctions against Russia over its invasion of Ukraine and fresh measures designed to keep the Kremlin from sidestepping existing economic penalties, the White House said. The announcement will involve “not just on adding new sanctions but on ensuring there is joint effort to crack down on evasion,” White House national security adviser Jake Sullivan told reporters Tuesday. The moves are expected to cap an intense day of diplomacy that will see Biden attend an emergency NATO summit, a meeting of the Group of 7, and a session of the European Council. (BBG)

RUSSIA: The Biden administration is preparing sanctions on most members of Russia’s State Duma, the lower house of parliament, as part of an effort to punish Moscow over its invasion of Ukraine. President Biden intends to announce the sanctions on more than 300 members of the Russian State Duma as soon as Thursday during his trip to Europe, where he will meet with allies from the North Atlantic Treaty Organization to formulate their next steps, according to U.S. officials and internal documents viewed by The Wall Street Journal. (WSJ)

RUSSIA: The U.K. should press ahead with its sanctions against Russia because they are inflicting pain on Putin’s regime, but it should also help lower-income families cope with the knock-on effect of higher energy and other living costs, according to a report from the cross-party Treasury Committee. Economic punishments mooted by the U.S., EU and U.K. against Russian energy imports could have a “catastrophic and long-lasting” effect if fully implemented, while the existing measures placed on Russia’s central bank are particularly effective, the report said. (BBG)

RUSSIA: A bipartisan group of senators is working with the Treasury Department to try to lock down Russia's roughly $132 billion in gold reserves after its invasion of Ukraine. Why it matters: The collaborative approach is a departure from congressional efforts to shame and blame the Biden administration to shape moves on Russian oil imports, or the SWIFT banking system. If successful, it could drive more work across the aisle and along both ends of Pennsylvania Avenue, as the president balances diplomatic pressures abroad with political pressures at home. Treasury Secretary Janet Yellen will meet this week with Sens. Angus King (I-Maine), John Cornyn (R-Texas), Bill Hagerty (R-Tenn.) and Maggie Hassan (D-N.H.) to discuss the legislation, people familiar with the plans told Axios. (Axios)

RUSSIA: Credit Agricole SA has suspended its activities in Russia, joining a growing list of lenders scaling back their business in the country after the invasion of Ukraine. The Paris-based bank, which has stopped all commercial activity in Russia, contacted its international corporate clients to agree on suspension modalities for the services provided by its local unit, the bank said in a statement on Tuesday. (BBG)

RUSSIA: German Chancellor Olaf Scholz said it’s too soon to discuss Russia’s continued membership in the Group of Twenty and World Trade Organization, telling reporters “we first need direct negotiations between Russia and Ukraine that go beyond what we have seen so far.” Scholz didn’t rule out a discussion on Russia’s membership in future but said that should happen as a collective and not among individual states. Russia was excluded from the Group of Eight after its annexation of Crimea in 2014, but the G-20 is a more diverse group of nations including China and Saudi Arabia, so terminating its membership would also be more complex. (BBG)

SOUTH AFRICA: South African President Cyril Ramaphosa relaxed almost all remaining coronavirus restrictions as the number of new infections and related hospitalizations and deaths in the country continue to drop. Scientists estimate that 60% to 80% of the population have some form of immunity to Covid-19, either through vaccination or prior infection, making it possible to further open up the economy, Ramaphosa said Tuesday in a brief televised speech. “We feel the fear and despair of the last two years lifting from our shoulders,” he said. “We are now ready to enter a new phase in our management of the pandemic.” (BBG)

IRAN: U.S. State Department spokesperson Ned Price said on Tuesday that the onus is now on Iran on whether it is willing to enter into a mutual return to compliance with the 2015 nuclear deal with world powers. A return to the deal remained uncertain and was not imminent, Price said, despite optimism in recent weeks that indirect talks between Iran and the United States could soon produce an agreement. (RTRS)

ARGENTINA: Argentina’s central bank raised its benchmark rate Tuesday for the third time this year as inflation continues to speed up. Officials increased the key, 28-day Leliq rate by 200 basis points to 44.5%, according to a statement. The announcement comes after President Alberto Fernandez declared a “war on inflation” last week, adding days later that the government will take “all necessary measures” to combat price increases. (BBG)

BONDS: Global bond markets have suffered unprecedented losses since peaking last year, as central banks including the Federal Reserve look to tighten policy to combat surging inflation. The Bloomberg Global Aggregate Index, a benchmark for government and corporate debt total returns, has fallen 11% from a high in January 2021. That’s the biggest decline from a peak in data stretching back to 1990, surpassing a 10.8% drawdown during the financial crisis in 2008. It equates to a drop in the index market value of about $2.6 trillion, worse than about $2 trillion in 2008. (BBG)

EQUITIES: The EU is poised to unveil a landmark law designed to rein in the market power of Big Tech this week, after a deal was struck on crucial details such as the size of companies targeted by the long-anticipated legislation. The Digital Markets Act could be revealed as early as Thursday, following the European Commission, European Parliament and member states agreeing many of the final aspects of the law, despite intense lobbying efforts from the likes of Google and other large technology groups. The legislation is now expected to target companies that have a market capitalisation of at least €75bn and run one core online “platform” service such as a social network or web browser, according to two people directly involved in the deal. (FT)

ENERGY: Italy plans to boost its LNG capacity to lower dependence on Russian natural gas, mandating Snam SpA to start talks to acquire one floating storage and regasification unit and lease a second. The country could add as many as 24 billion cubic meters in the next 12-18 months through floating LNG terminals, Ecology Minister Roberto Cingolani told parliament Tuesday in Rome. Italy imports almost all of its gas, with about two-fifths -- approximately 30 billion cubic meters -- coming from Russia. Prime Minister Mario Draghi has said the government plans to accelerate energy diversification, with renewables also set to increase. “It’s going to be hard to completely end Russian imports and ensure supply for at least the next two winters,” Cingolani said. Measures to replace Russian supplies in the longer term include importing 20bcm from other producers, such as Algeria and Azerbaijan, and increasing domestic output by 2.2bcm, he said. (BBG)

ENERGY: French energy giant TotalEnergies said Tuesday it has decided to halt all its purchases of Russian oil and petroleum products by the end of the year at the latest. The French company said in a statement it will "gradually suspend its activities in Russia" amid the worsening situation in Ukraine. It stressed "the existence of alternative sources for supplying Europe" with oil. In its statement, Total committed to ensure "strict compliance with current and future European sanctions, no matter what the consequences on the management of its assets in Russia." Russia represented 17% of the company's oil and gas production in 2020. In addition, TotalEnergies holds a 19.4% stake in Russia's natural gas producer Novatek. (CBS News)

ENERGY: Central banks have intensified discussions with energy trading firms calling for help to ease market strains sparked by the war in Ukraine, but are unlikely to unlock immediate extra support, according to people with knowledge of their talks. Top energy market executives spoke to the Bank of England and European Central Bank this week to express alarm at large spikes in commodity futures prices, which are hampering risk management and threatening the smooth flow of physical assets around the world. Senior BoE officials are keen to understand how to ease strains in futures markets, and are aware of the potential risks to global trade, people familiar with the matter say. But the central bank thinks that existing facilities already offer a cushion against a potential worsening in market conditions. (FT)

OIL: Russia is throttling back capacity on a major pipeline that sends crude oil to global markets, driving prices higher and raising fears that Moscow was prepared to retaliate against western sanctions by curbing its own energy supplies. Up to 1mn barrels a day of oil shipped through the Caspian Pipeline Consortium’s pipeline from central Asia to the Black Sea could be cut for up to two months while repairs are made to storm-damaged loading facilities, Russia’s deputy energy minister said in a statement on Tuesday carried by the news agency Tass. (FT)

CHINA

PBOC: China may make a full-scale or targeted cut to banks’ reserve requirement ratios in April to boost liquidity and further stabilize growth, the Securities Daily said citing analysts. There is a narrowing window for China to cut its lending rates, as the U.S. Federal Reserve is expected to further hike interest rate by 50 bps and begin shrinking its balance sheet in May, the newspaper said. Growth in China's new loans in March may slow y/y, estimated at CNY2.2 trillion, continuing a slowdown in February, as policy effects weaken, while loans by residents and companies may not improve significantly, the newspaper said citing researcher Tao Jin of Suning Institute of Finance. (MNI)

PBOC: The People’s Bank of China is likely to lower its 5-year Loan Prime Rate in Q2 to guide mortgage rates lower and spur housing demand, the 21st Century Business Herald reported citing Wang Qing, analyst with Golden Credit Rating. Many of China's smaller cities with weak housing demand will further relax purchase restrictions, while migrant workers without local household registrations are expected to receive credit support, the newspaper said citing Xu Xiaole, analyst at Beike Research Institute. In March, 82 out of 103 key cities cut mortgage rates, registering the largest monthly drop since 2019, the newspaper cited Xu as saying. (MNI)

PROPERTY/CREDIT: China Evergrande Group said it will unveil a debt restructuring proposal for its creditors by the end of July while ensuring the delivery of its real estate projects, Yicai.com reported citing the company’s call with investors on Tuesday. The company will make efforts including promoting the restructuring of its property management and auto subsidiaries with third-party investors, Yicai said citing the company. Evergrande owes total USD21.7 billion in overseas debts, including USD19.4 billion offshore bonds and USD3.3 billion private and project financing, Yicai said citing the company. Evergrande delayed publishing its financial results for 2021 this week citing incompleted audit, the newspaper said. (MNI)

CORONAVIRUS: China’s worst Covid outbreak in more than two years continued to fester, with daily infections nearing 5,000 on Wednesday. The northeastern province Jilin, which has been put under lockdown, reported some 2,800 cases. Infections in Shanghai rose to almost 1,000 after testing was expanded. Cases appear to be declining in Shenzhen, which ended a week-long lockdown earlier this week. The flare-up, fueled by the highly infectious omicron variant, has been spotted in 28 out of 31 provinces on the Chinese mainland. The country has also seen a steady rise in severe Covid cases, though the overall number remains small, at 50 as of Wednesday.

CORONAVIRUS: Shanghai mandated residents in some areas for another round of nucleic acid tests on Wednesday and Thursday, Wu Jinglei, director of the Shanghai Heath Commission, says at press conference. The area for Covid tests is smaller than that of earlier rounds. (BBG)

CORONAVIRUS: Shanghai government denied online rumors that it will lock down the financial capital for one week, Chinese media cited local authorities as saying Tuesday night. The local authority urged residents not to hoard food and daily necessities. The mega city of 25 million people has seen sharp increases in Covid cases over the past few days. It reported 896 Covid-19 cases Monday, a record for a second straight day. Authorities have expanded testing to more residents to root out silent transmission chains. The city last week ruled out imposing a broad lockdown, but officials said Monday that some areas will remain locked down for further testing. Li Qiang, the Communist Party secretary of Shanghai, urged increased testing in a visit to some neighborhoods under lockdown Tuesday. The authority announced Tuesday evening it will halt some subway services at a few stations on a couple of lines starting today. Meanwhile, the State Council, China’s cabinet, has dispatched task forces to 10 provinces and municipalities including Shanghai to help oversee Covid control. (BBG)

OVERNIGHT DATA

JAPAN JAN, F LEADING INDEX 102.5; FLASH 103.7

JAPAN JAN, F COINCIDENT INDEX 95.6; FLASH 94.3

JAPAN FEB, F MACHINE TOOL ORDERS +31.6% Y/Y; FLASH +31.6%

SOUTH KOREA FEB PPI +8.4% Y/Y; JAN +8.9%

CHINA MARKETS

PBOC NET INJECTS CNY10 BLN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY20 billion via 7-day reverse repos with the rates unchanged at 2.10% on Wednesday. The operation has led to a net injection of CNY10 billion after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0793% at 09:26 am local time from the close of 2.0564% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday vs 43 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3558 WEDS VS 6.3664

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3558 on Wednesday, compared with 6.3664 set on Tuesday.

MARKETS

SNAPSHOT: Asian Equities Look Through Bond Market Sell Off & Hawkish Fed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 819.72 points at 28043.83

- ASX 200 up 36.796 points at 7377.9

- Shanghai Comp. up 8.219 points at 3268.081

- JGB 10-Yr future down 11 ticks at 149.76, yield up 0.9bp at 0.226%

- Aussie 10-Yr future down 5.5 ticks at 97.160, yield up 5.2bp at 2.775%

- U.S. 10-Yr future -0-07 at 122-17, yield up 1.66bp at 2.399%

- WTI crude up $1.21 at $110.48, Gold down $0.03 at $1921.67

- USD/JPY up 23 pips at Y121.03

- FED'S MESTER CALLS FOR FRONTLOADING RATE HIKES, SEES RISE TO 2.5% IN 2022 (RTRS)

- FED'S DALY: RATES NEED TO RISE TO TAMP DOWN TOO-HIGH INFLATION (RTRS)

- UKRAINE'S ZELENSKIY: RUSSIA TALKS ARE TOUGH, SOMETIMES CONFRONTATIONAL (RTRS)

- UKRAINE’S ZELENSKIY WILL JOIN NATO SUMMIT VIA VIDEO LINK (BBG)

- GLOBAL BOND INDEX LOSES $2.6TN IN RECORD SLIDE FROM PEAK (BBG)

- SPECULATION SURROUNDING POTENTIAL FOR JAPANESE FISCAL STIMULUS PICKS UP

- CHINESE PRESS REPORTS FLAG ROOM FOR FURTHER RRR AND RATE CUT, WINDOW NARROWING

BOND SUMMARY: TYM2 Support Holds On First Test

TYM2’s technical support at the Mar 12 ’19 low (122-12), based on a continuation chart, held to the tick on the first test during Asia-Pac hours, limiting volatility during the second half of Asia-Pac trade, with a lack of fresh headline flow evident during overnight dealing. TYM2 is last -0-07 at 122-17, after bouncing a little from the aforementioned support level on volume of 140K. Meanwhile, cash Tsys run 0.5-2.0bp cheaper on the day, bear steepening, with almost all of the major benchmark Tsy yields tagging fresh cycle highs in Asia hours, before pulling back from extremes. The aforementioned technical support in TYM2 and the long-term bear channel top in 10-Year Tsy yields (2.5419%) provide some market reference points that are worth watching in the immediate term. There wasn’t anything in the way of tangible reaction to comments from Cleveland Fed President Mester (’22 voter, hawk), who flagged her desire to raise rates to 2.50% by the end of the calendar year (above the median Fed dot of 1.875%), underscoring a desire to move at 50bp clips at some meetings. Asia-Pac flow was headlined by an FV/TY block (3K vs. 2K) although direction of the trades was hard to ascertain, some pointed to a steepener, but it is hard to be sure. Looking ahead, NY hours will bring new home sales data and Fedspeak from Powell, Daly & Bullard (all of whom have spoken in recent days). Tsy supply will consist of 20-Year Tsys and 2-Year FRNs

- JGB futures extended losses during the early rounds of Tokyo afternoon dealing, with a light uptick in the offer/cover ratio witnessed in today’s 5- to 10-Year BoJ Rinban operations pressuring that zone of the curve (note that the aforementioned offer/cover ratio was by no means elevated). The contract printed fresh cycle lows, before edging away from worst levels to close -11. Weakness in the longer end of the cash curve also extended, before paring back from extremes, with 30s and 40s ~1.5bp cheaper on the day at the bell, with twist steepening observed, as paper out to 5s traded little changed to 0.5bp richer. 10-Year JGB yields moved within 0.5bp of the level that triggered BoJ fixed rate operations back in in February (0.23%), before moving back from their peak.

- Offshore cues from U.S. Tsys remained front and centre for Aussie bonds, after the early Sydney vol., with futures closing above their respective session troughs (note that XM pushed through its early Sydney low before recovering). YM & XM were -5.5 at the bell, with light bear steepening observed in cash ACGB dealing.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.00% 21 Nov ‘31 Bond, issue #TB163:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 1.00% 21 November 2031 Bond, issue #TB163:

- Average Yield: 2.7542% (prev. 1.9267%)

- High Yield: 2.7575% (prev. 1.9275%)

- Bid/Cover: 2.6700x (prev. 3.2250x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 17.1% (prev. 83.6%)

- Bidders 35 (prev. 42), successful 14 (prev. 14), allocated in full 9 (prev. 5)

EQUITIES: Higher In Asia

Major Asia-Pac equity indices are flat to higher as high-beta and tech stocks across the region outperformed, following a positive lead from Wall St’s tech-led rally on Tuesday. Utilities and energy equities broadly lagged peers, as commodity and major crude benchmarks traded below Tuesday’s best levels in Asia-Pac dealing.

- The Nikkei 225 outpaced most regional peers for a second day to sit 2.9% firmer at writing, with 213 out of the index’s 225 constituents in the green. The JPY has continued to weaken with USD/JPY hitting fresh cycle highs at Y121.41 during the session, driving outperformance in large-caps and export-oriented names.

- The ASX200 struggled to extend the opening move higher, finishing 0.5% better off come the bell. Tech stocks (S&P/ASX All Technology Index: +2.3%) led gains, with rallies observed in healthcare equities as well, while energy and materials sub-indices underperformed their index peers.

- The Hang Seng is 1.6% better off, led by gains in China-based technology companies, with the Hang Seng Tech Index dealing 2.5% firmer at writing. Familiar large-cap names such as Alibaba and Xiaomi have lifted sentiment in the wider China-based tech space with announcements of share buyback schemes, while tech stocks have continued to find tailwinds from Chinese regulators recently announcing their intention to enact market-supportive measures.

- The CSI300 deals 0.4% firmer at typing, with gains in the consumer staples sector and healthcare equities offset by losses across virtually every other sector.

- U.S. e-mini equity index futures sit 0.1% to 0.2% higher at typing, operating a touch below the session’s best levels.

OIL: Higher Even Though Potential For EU Embargo Fades

WTI is +$1.40 and Brent +$1.60, printing ~$110.70 and ~$117.10 respectively. Both benchmarks have backed away from the week’s best levels, as earlier expectations of imminent EU sanctions on Russian energy exports have been pared back in the face of internal EU opposition led by Germany and Hungary.

- Elsewhere, news of the (partially Russian) Caspian Pipeline Consortium (CPC) shutting ~1mn bpd of crude production for up to two months due to storm damage saw little reaction from major crude benchmarks. A note that while crude exports from the CPC do not come under recent U.S. sanctions on Russian oil, CPC crude already faces difficulties in finding buyers amidst well-documented concerns re: buying Russian-linked crude, with some crude from the CPC pipeline mixing with Russian grades before being loaded from the Russian port of Novorossiysk.

- Looking to the supply dynamics for oil, participants continue to debate the likelihood and pace of demand destruction for crude in the face of elevated prices. While retail gasoline prices have hit record highs in many large economies (e.g. the U.S. and Japan), several governments have been raising related subsidies and slashing fuel taxes (such as in New Zealand, South Korea, and some U.S. states), as they look to support demand in the near-term.

- Weekly U.S. API inventory crossed late on Tuesday, with reports pointing to a surprise drawdown in crude stocks, alongside declines in gasoline and distillate stockpiles, while there was a build in Cushing hub inventories. Looking ahead to EIA data due later on Wednesday (1430 GMT), WSJ median estimates point to virtually unchanged headline crude inventories, with drawdowns in gasoline and distillates expected once again.

GOLD: Little Changed In Asia

Gold is virtually unchanged at typing, printing ~$1,921.7/oz after trading on either side of neutral levels during Asia-Pac dealing. The precious metal is off Monday’s low but has prolonged a pullback from cycle highs made in early March ($2,070.4/oz Mar 8 high), with focus turning to Fed messaging re: the potential/likelihood for > 25bp rate hikes at the upcoming FOMC meetings.

- To recap Tuesday’s price action, the precious metal pared losses from worst levels in the NY session ($1,910.9/oz) to close ~$15 lower, with the overall decline facilitated by an uptick in U.S. real yields.

- May FOMC dated OIS now prices in ~48bp of tightening, pointing to a >90% chance of a 50bp rate hike at that meeting. The move higher comes after Fed Chair Powell’s hawkish comments earlier in the week, with subsequent Fedspeak showing little to no pushback against the idea of 50bp rate rate hikes at some point in ‘22.

- Worry re: the Russia-Ukraine conflict has provided some support ahead of the $1,900/oz psychological level. To elaborate, ongoing ceasefire negotiations continue to yield little in the way of concrete developments, with both sides showing no real sign of conceding when it comes to their well-documented conditions for a peace deal.

- From a technical perspective, short-term conditions remain bearish for bullion, although it continues to operate within previously defined technical levels. Support is seen at $1,895.3/oz (Mar 15 low), while resistance is situated at $1,954.7 (Mar 15 high).

FOREX: Y121 Gives Way

There was no sign of respite for the languishing yen as rising U.S. Tsy yields helped lift USD/JPY as high as to Y121.41, a new cycle peak. The rate went offered over the Tokyo fix but promptly regained poise. The latest portion of hawkish Fedspeak served as a reminder of growing policy divergence between the BoJ and most of its major peers.

- Other yen crosses extended recent swings to fresh cycle extremes. EUR/JPY topped out just shy of the Y134.00 figure, while AUD/JPY cleared Sep 21, 2017 high of Y90.31 and soared to best levels since late 2015.

- Offshore yuan slipped as the PBOC reintroduced mild weak bias into the daily fixing of USD/CNY trading band mid-point. The gap between actual fixing and average sell-side estimate was just 18 pips but could still be treated as an indication of the PBOC's preferences re: yuan trajectory.

- The European docket will be fairly UK-centric, with monthly inflation data and the Spring Statement ("mini-budget") from Chancellor Sunak. The sterling garnered some strength in the lead-up to these events, with EUR/GBP probing the water below the GBP0.8300 mark.

- Elsewhere, EZ consumer confidence & U.S. new home sales as well as plenty of central bank rhetoric will take focus later today. The speaker slate includes Fed & BoE chiefs.

FOREX OPTIONS: Expiries for Mar23 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0850(E621mln), $1.1065-80(E1.1bln)

- EUR/JPY: Y130.50(E815mln)

- USD/CAD: C$1.2630-50($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/03/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 23/03/2022 | 0700/0700 | *** |  | UK | Producer Prices |

| 23/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 23/03/2022 | - |  | UK | OBR Economic and Fiscal Forecast | |

| 23/03/2022 | - |  | UK | DMO 2022-23 Financing Remit | |

| 23/03/2022 | 1200/1200 |  | UK | BOE Bailey Panels BIS Innovation Summit | |

| 23/03/2022 | 1200/0800 |  | US | Fed Chair Jerome Powell | |

| 23/03/2022 | 1230/1230 |  | UK | FY 2022/23 Budget statement | |

| 23/03/2022 | 1315/1415 |  | EU | ECB Lagarde Speech at BIS Innovation Summit | |

| 23/03/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 23/03/2022 | 1435/1035 |  | US | New York Fed's John Williams | |

| 23/03/2022 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/03/2022 | 1530/1530 |  | UK | DMO Quarterly Consultation Meetings Agenda | |

| 23/03/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 23/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/03/2022 | 1545/1145 |  | US | San Francisco Fed's Mary Daly | |

| 23/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 23/03/2022 | 1900/1500 |  | US | St. Louis Fed's James Bullard | |

| 24/03/2022 | 2200/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.