-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ On Rinse & Repeat, JPY Back From Extremes

EXECUTIVE SUMMARY

- SCHUMER SETS UP VOTE ON ADVANCING COOK FED NOMINATION TO SENATE (BBG)

- BOJ DEFENDS TOP OF 10-YEAR JGB YIELD BAND AGAIN, TWICE

- JAPAN POLICYMAKERS WARN AGAINST RAPID YEN WEAKENING (RTRS)

- U.S. UNLIKELY TO BACK BOJ FX INTERVENTION (MNI)

- RUSSIA SAYS IT IS PREPARED TO LET KYIV JOIN THE EU (FT)

- SHANGHAI SAYS WILL HAND OUT $22 BLN IN TAX RELIEF TO FIRMS AMID COVID FIGHT (RTRS)

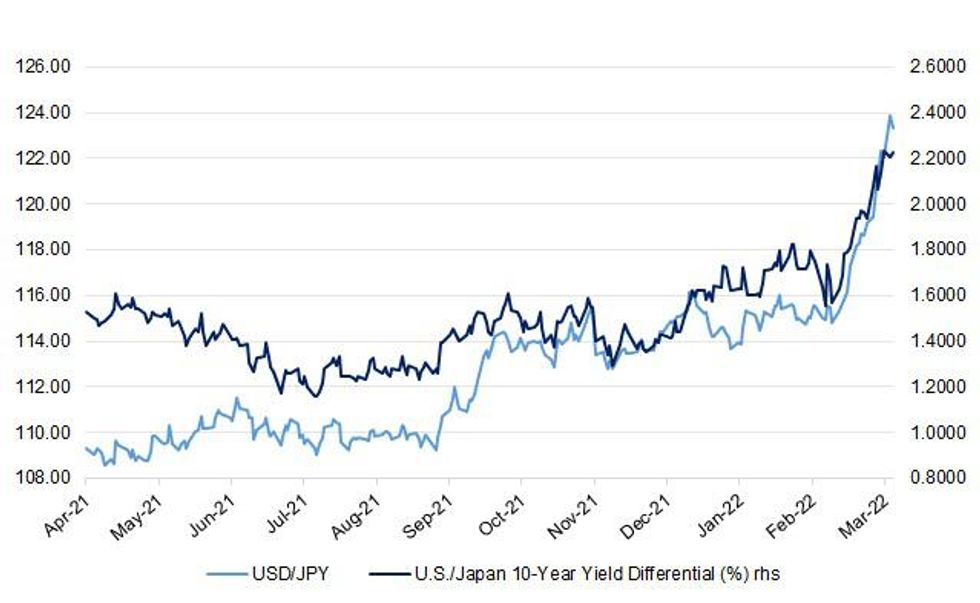

Fig. 1: USD/JPY Vs. U.S./Japan 10-Year Yield Differential (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Prime Minister Boris Johnson will host a team-bonding dinner for U.K. Conservative Members of Parliament on Tuesday, as he seeks to rebuild the relationship with his party after months of tensions. Tory MPs have been invited to a group photo shoot in Parliament before heading to a central London hotel for the main event, according to three people familiar with the matter. It comes after the Conservative Party postponed a planned “away day” at a countryside retreat in January due to the pandemic. (BBG)

POLITICS: London’s Metropolitan Police are set to issue at least 20 fines to government officials close to the prime minister who broke U.K. lockdown rules, according to a person familiar with their thinking. The first batch of fines are expected to be levied as soon as Tuesday, the person said, asking not to be identified discussing police business. Prime Minister Boris Johnson is unlikely to be touched by Tuesday’s tranche of fines, the person said. Some people may face more than one fine, they said. The police have been investigating a dozen gatherings on government premises, including the prime minister’s apartment, following a spate of reports that officials held boozy parties while the rest of the country was under lockdown to contain the coronavirus. (BBG)

U.S.

FED: Senate Majority Leader Chuck Schumer set up a vote to break a deadlock in the Banking Committee and force the nomination of Lisa Cook to the Federal Reserve Board of Governors to the Senate floor. The vote, scheduled for Tuesday morning, would bring Cook’s nomination out of the Banking Committee, which had cleared President Joe Biden’s other nominees: Jerome Powell to a second term as Fed chair, Lael Brainard as vice chair and Philip Jefferson as a governor all advanced. Powell and Jefferson have broad bipartisan support, while Brainard won four GOP votes in committee. Cook encountered GOP opposition in the committee with all Republicans on the evenly divided panel voted against her nomination. She could be confirmed by the Senate if Democrats stay unified in the 50-50 chamber, with Vice President Kamala Harris providing the tie-breaking vote. (BBG)

INFLATION: Russia's war in Ukraine will drive energy and food prices higher, but inflation rates should still ease in the coming year, U.S. President Joe Biden's top economic adviser said on Monday. Cecilia Rouse, who chairs the White House Council of Economic Advisers, said the $5.79 trillion budget plan for fiscal 2023 released by the White House on Monday was based on assumptions locked in on Nov. 10, well before the invasion, but the economy was generally stronger than expected then. "There's tremendous uncertainty, but we and other external forecasters expect that inflation will ease over the coming year," Rouse told reporters as the White House released the budget proposal, which must now be considered and enacted by a deeply divided Congress. Rouse said the White House would revise its economic assumptions later in the year, incorporating the war in Ukraine and its impact on inflation. (RTRS)

INFLATION: MNI INTERVIEW: US Rent Growth Seen Moderating In '22 - Yardi

- The surge in rents for new U.S. tenants should ease up over the next year and could soften to around half of what was seen in 2021, Doug Ressler of real estate data firm Yardi Matrix told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: House Budget Committee Chairman John Yarmuth says Congress may have to raise the debt limit around Jan. 1, 2023. A debt limit increase is a possibility and the budget process may be used for that purpose, he says, citing some estimates. (BBG)

FISCAL: U.S. Senate Republican leader Mitch McConnell rejected President Joe Biden's $5.79 trillion budget plan on Monday, saying it was unacceptably light on defense spending at a time of heightened international tensions over Ukraine. The proposed budget for the 2023 fiscal year, which starts on Oct. 1, lays out Biden administration priorities such as campaign promises to make the wealthy and companies pay more taxes that lawmakers on Capitol Hill will consider as they craft spending legislation. (RTRS)

OTHER

U.S./CHINA: The Senate Monday passed its version of a long-stalled bill to aid the domestic semiconductor industry and bolster U.S. competitiveness with China, a key step needed to kick off negotiations with the House on final legislation. The Senate voted 68-28 for the plan, which includes $52 billion in grants and incentives to bolster chip manufacturing as well as provisions aiming to jump-start innovation and bring key industries back to the U.S. amid a global supply chain crunch. “America cannot afford to come in second place when it comes to technologies like 5G, AI, quantum computing, semiconductors, bio-engineering and so much more,” Senate Majority Leader Chuck Schumer said before the vote “This bill is a necessary step towards securing the bright future of American ingenuity which has always helped us lead the way.” (BBG)

JAPAN: Japan will carefully watch foreign exchange market moves to avoid "bad yen weakening", Minister of Finance Shunichi Suzuki said on Tuesday, as Tokyo tries to navigate the economic impact of the rapidly rising cost of imports from a weakening currency. Previously, Suzuki has repeated that currency stability was important and the weak yen would be positive for exporters but negative for households already facing surging fuel prices amid the war in Ukraine. Following Suzuki's remarks, Chief Cabinet Secretary Hirokazu Matsuno warned against rapid yen swings as undesirable, saying that he would watch the market with "a sense of urgency." Both policymakers were speaking separately to reporters after the Japanese currency hit six-year lows beyond 125 yen versus the U.S. dollar on Monday, raising concern about the impact on the cost of living for the trade-reliant economy. (RTRS)

BOJ: MNI INSIGHT: U.S. Unlikely To Back BOJ FX Intervention

- Bank of Japan officials see little chance that Washington will sanction the use of large-scale forex intervention to strengthen the yen against the dollar, leaving them with little option but to try to talk up the currency from multi-year lows, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

BOJ: Bank of Japan policymakers stressed the need to keep monetary policy ultra-loose, even as some of them saw signs of growing inflationary pressure from the Ukraine crisis, a summary of opinions at their March meeting showed on Tuesday. Japan's consumer inflation will clearly accelerate from April and may hover around 2per cent for some time due mainly to the boost from energy price rises, one member was quoted as saying. Most of the opinions called on the need for the BOJ to stick to ultra-loose monetary policy as the war in Ukraine heightened uncertainty over the global outlook. "Unlike the United States or Britain, Japan isn't in a situation where inflation continuously exceeds 2per cent...It's therefore important to support the economy's recovery from the coronavirus pandemic by maintaining monetary easing," one member said. (RTRS)

JAPAN: Japan’s Prime Minister Fumio Kishida called for measures to cushion the impact of soaring energy prices, amplified by a sliding yen, as he looks to keep public support buoyant ahead of a summer election. Kishida ordered a compilation of the moves in a cabinet meeting Tuesday, Finance Minister Shunichi Suzuki said. While the premier’s approval ratings are still in good shape despite Japan’s worst wave of virus infections, simmering discontent over the fastest rising fuel and electricity bills in 41 years threaten to change the optics over the coming months. (BBG)

BOK: South Korea’s nominee to be the central bank chief on Tuesday said he will focus on risk management amid external uncertainties, including U.S. monetary policy tightening, which poses growth challenges for the Korean economy. “Short-term-wise, it is not easy to assess spillover impact of U.S. policy normalization, resurgence of Omicron, the Russia-Ukraine war, and the slowing Chinese economy as inflation and growth risks are both mounting,” the nominee, Rhee Chang-yong, a veteran International Monetary Fund official, said in a written note to reporters. (RTRS)

SOUTH KOREA: South Korea’s finance ministry offers 35t won of extra budget plan to President-elect Yoon Suk Yeol’s transition team, Korea Economic Dailyreports, citing unidentified people on Yoon’s team. Yoon’s team could accept the proposal, though it has been seeking a 50t won of extra budget. Finance ministry says in a statement the report “isn’t true”. Officials still need to resolve the issue of how to finance the budget; government bond sales may be inevitable. (BBG)

SOUTH KOREA: The International Monetary Fund (IMF) on Tuesday maintained its 2022 growth outlook for South Korea at 3 percent as exports and investment will likely remain robust despite heightened economic uncertainty. The IMF's latest projection is the same as its forecast made in January. It lowered its 2023 growth outlook for Asia's fourth-largest economy to 2.8 percent from 2.9 percent. The Washington-based organization said South Korea's economic growth is projected to remain robust in 2022 and 2023 on the back of continued strong exports and investment. "Softer growth in the first quarter of this year due to omicron is expected to be temporary. Supply bottlenecks that impacted production in several sectors in 2021 are also normalizing," the IMF said in a report on its annual consultations with South Korea. (Yonhap)

NORTH KOREA: North Korea looks set to detonate its first nuclear bomb in more than four years, as the U.S.’s sanctions disputes with Russia and China make further United Nations penalties against the country unlikely. Workers have been observed digging a new passageway at the Punggye-ri site where North Korea conducted all six of its previous nuclear tests, South Korean media including the DongA Ilbo newspaper reported. A test could come as soon as next month, when Kim Jong Un is preparing to mark the 110th anniversary of the birth of his grandfather, state founder Kim Il Sung, the paper said, citing a security official it didn’t identify. (BBG)

HONG KONG: Hong Kong’s stringent Covid restrictions turned the city into a dead end for the legions of finance workers decamping for other destinations. Those who choose to stay are being presented with the sort of opportunities that don’t come along very often. “When there’s a shortage of talent, people use this as an opportunity to bid up their wages,” said Christine Houston, the managing director of executive search firm ESGI who focuses on the finance industry. “They’re more in demand than they’d been a year ago.” Typically, finance workers in Hong Kong would get roughly a 15% “walking across the street money” pay increase to compensate for the risk of moving to a new employer, Houston said. Now, it’s “certainly no less than 20% to 30%.” (BBG)

TURKEY: Turkey introduced cuts to value added tax on several products to fight inflation, President Tayyip Erdogan announced on Monday, including hygiene products and medical equipment. "We have decided to reduce the VAT of products such as detergent, soap, toilet paper, napkins and baby diapers from 18 percent to 8 percent," he said. The lira's decline and rising food and energy prices pushed inflation to 54.4% in February, the highest in 20 years. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro was taken to hospital on Monday after feeling "discomfort", UOL news portal reported. It said the president was taken to the Army Hospital in Brasilia for tests. The report was not confirmed by Reuters. Bolsonaro was hospitalized in January for an intestinal obstruction that was cleared and he did not need surgery. The blockage was his latest complication from a stabbing at a campaign stop in 2018. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro has tapped a well-known academic and energy consultant as the next head of state-run oil company Petrobras, effectively ending the tenure of current CEO Joaquim Silva e Luna less than a year after he was appointed. In a statement on Monday, Brazil's Mines and Energy Ministry announced the slate of board members it would put forward at a shareholders' meeting in April, with Adriano Pires tapped for the CEO spot and Rodolfo Landim, a well-known sports magnate with significant oil experience, set to be the new chairman. The nomination comes as something of a surprise, given that Pires has consistently defended the market-oriented policies at Petrobras that have provoked criticism from Bolsonaro. (RTRS)

BRAZIL: Brazil’s Governor Eduardo Leite resigned his mandate to possibly run in the October presidential election, particularly if his party’s candidate fail to gain traction in polls. Leite, the 37-year-old head of the conservative state of Rio Grande do Sul, was defeated in the November primaries of his Brazilian Social Democracy Party by Sao Paulo Governor Joao Doria, 63. Despite having achieved national prominence by spearheading a successful campaign to bring Covid-19 vaccines into Brazil, Doria has performed poorly in recent opinion polls, where he comes in a distant fifth position. (BBG)

BRAZIL: Key Brazilian economic indicators, including a weekly survey that’s closely-watched by investors, are being delayed this week as central bank workers protest for higher salaries. The workers, unhappy with a pledge by President Jair Bolsonaro to increase wages for only some public servants such as police officers, have decided to strike after holding some walkouts this month. Public servants who haven’t been promised a salary increase, including those at the internal revenue system, have been protesting since December with temporary work stoppages. Some of them have resigned from leadership positions. (BBG)

RUSSIA: U.S President Joe Biden on Monday said his remark that Russian President Vladimir Putin should not remain in power reflected his own moral outrage at Russia's invasion of Ukraine, not a U.S. policy shift. "I wasn't then nor am I now articulating a policy change. I was expressing moral outrage that I felt, and I make no apologies," he told reporters at the White House. Biden on Monday said that he was "not walking anything back" by clarifying the remark. Asked whether the remark would spur a negative response from Putin, Biden said, "I don’t care what he thinks... He’s going to do what he’s going to do." But Biden once again suggested Putin should not be leading Russia. If Putin "continues on the course that he’s on, he’s going to become a pariah worldwide and who knows what he becomes at home in terms of support," Biden said. (RTRS)

RUSSIA: The Kremlin said on Monday that U.S. President Joe Biden's remark that Vladimir Putin "cannot remain in power" was a cause for alarm, a guarded response to the first public call from the United States for an end to Putin's 22-year rule. Asked about Biden's comment, which received little coverage on Russian state television, Kremlin spokesman Dmitry Peskov said: "This is a statement that is certainly alarming." "We will continue to track the statements of the U.S. president in the most attentive way," Peskov told reporters. Putin has not commented publicly on Biden's remark - which comes amid Moscow's biggest confrontation with the West since the end of the Cold War. (RTRS)

RUSSIA: No one in Russia is considering the idea of using nuclear weapons, Kremlin Spokesman Dmitry Peskov told PBS. When asked if he could rule out the use of nuclear weapons in the conflict on behalf of Russia, the Kremlin spokesman said: "No one is thinking about using… even about the idea of using nuclear weapons.". (TASS)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba on Monday said Ukraine's most ambitious goal at talks with Russia in Turkey this week was to agree a ceasefire. "The minimum programme will be humanitarian questions, and the maximum programme is reaching an agreement on a ceasefire," he said on national television, when asked about the scope of the latest round of peace negotiations that are expected to kick off tomorrow. (RTRS)

RUSSIA: Russia is no longer requesting Ukraine be “denazified” and is prepared to let Kyiv join the EU if it remains militarily non-aligned as part of ongoing ceasefire negotiations, according to four people briefed on the discussions. Moscow and Kyiv are discussing a pause in hostilities as part of a possible deal that would involve Ukraine abandoning its drive for Nato membership in exchange for security guarantees and the prospect to join the EU, the people said under the condition of anonymity because the matter is not yet finalised. The draft ceasefire document does not contain any discussion of three of Russia’s initial core demands — “denazification”, “demilitarisation”, and legal protection for the Russian language in Ukraine — the people added. (FT)

RUSSIA: Ukraine’s military recaptured the town of Irpin west of the capital from Russian troops, President Volodymyr Zelenskiy said in his daily video address. “Our defenders are pushing forward in the Kyiv region, regaining control over Ukrainian territory”, the president said. He said fighting continues in the area, while the southern port city of Mariupol remains blocked. (BBG)

RUSSIA: Russian billionaire Roman Abramovich suffered symptoms of suspected poisoning at peace talks on the Ukraine-Belarus border earlier this month, sources close to him say. The Chelsea FC owner - who has now recovered - reportedly suffered sore eyes and peeling skin. Two Ukrainian peace negotiators were also said to have been affected. One report said the alleged poisoning was orchestrated by Russian hardliners who wanted to sabotage the talks. (BBC)

RUSSIA: The Japanese government formalized plans on Tuesday to revise an ordinance to ban exports of luxury cars, jewelry and other luxury items to Russia starting April 5. The government will revise the foreign exchange law's export trade control ordinance to implement the ban as additional economic sanctions on Russia over its invasion of Ukraine. The ban comes in line with similar actions taken by the United States and European nations. The measure is targeted at oligarchs, rich Russian individuals who support President Vladimir Putin. "While continuing to closely monitor the situation in Ukraine, Japan will cooperate with the international community including Group of Seven partners to impose strict sanctions" on Russia, trade minister Koichi Hagiuda told a news conference. (Jiji Press)

ENERGY: The company behind a proposed liquefied natural gas project off Newfoundland’s coast could push forward its schedule after the Ukraine crises left Europe scrambling to find alternatives to Russian supplies. LNG Newfoundland and Labrador Ltd.’s C$5.5 billion project to take natural gas associated with offshore oil production and liquefy it on floating facilities at Grassy Point, could be pushed forward to start as early as 2028 from 2030 to accommodate European buyers, Leo Power, chief executive off the company, said in a phone interview. The export terminal will produce as much as 2.6 million tons a year of the chilled fuel. “We would seek to expedite the schedule,” he said. “Since the invasion of Ukraine, we have had a lot of interest from prospective buyers in Europe,” including Germany. The project would be advantaged in that Newfoundland is almost half the distance to Europe than LNG terminals in the Gulf of Mexico and the plant would be powered by hydro-power, keeping emissions minimal, Power said. (BBG)

OIL: The United Arab Emirates energy minister said on Monday the OPEC+ alliance of oil producers was not a political organisation and that its mission was to maintain a balanced market. (RTRS)

CHINA

CORONAVIRUS: China added 6,886 local Covid cases on Monday, the National Health Commission said in statement. The country reported 1,228 confirmed cases, including 1,055 in Jilin and 96 in Shanghai, as well as 5,658 local asymptomatic infections, including 4,381 in Shanghai, 812 in Jilin, 124 in Fujian and 108 in Hebei. A total of 6,215 cases had been reported for Sunday, according to CCTV state television, citing data from the NHC. (BBG)

CORONAVIRUS: Shanghai, China’s most populous city, on Tuesday again tightened the first phase of a two-stage COVID-19 lockdown, asking some residents to stay indoors unless they are getting tested as the number of daily cases rose beyond 4,400. While the Shanghai caseload remains modest by global standards - a record 4,381 asymptomatic cases and 96 symptomatic cases for March 28 - the city has become a testing ground for the country’s “zero-COVID” strategy as it tries to bring the highly infectious Omicron variant under control. Residents east of the Huangpu were initially locked down in housing compounds on Monday, but mostly allowed to roam around within. On Tuesday, however, two residents told Reuters they were informed by their neighbourhood committees they were no longer allowed to cross their doorsteps. Wu Qianyu, an official with the municipal health commission, told a press briefing on Tuesday that locked-down residents should not leave home, even to take pets for a walk or throw out trash. “This is in fact a key stage in nucleic acid testing and we have made a clear request for people in locked down areas to stay home,” she said. (RTRS)

CORONAVIRUS/FISCAL: China's Shanghai on Tuesday said it would roll out policies to help the local economy cope with a surge in COVID-19 cases in the city, including offering refunds that will reduce firms' tax burdens by 140 billion yuan ($22 billion) in 2022. Internet platforms will be encouraged to further lower service fees and telecom operators to provide three months' worth of free cloud services, for instance, the city government said in a statement on its website. Subsidy support will be given to companies in the retail and catering industries to send their staff for regular COVID tests, and will also be provided to front-line healthcare personnel and volunteers involved in the city's fight against the pandemic. The government will encourage financial institutions to increase credit support and reduce loan interest rates for firms involved in food supply, while support will also be provided to the tourism, transport and exhibition industries, it said. (RTRS)

CORONAVIRUS/FISCAL: Smaller businesses in China are calling for greater support from the government to deal with the impact of anti-Covid measures, the Securities Times reported. A week-long lockdown in Shenzhen, one of China’s top four megacities, has caused prolonged difficulties to SMEs and the service industry, and rescue measures should be strengthened including considering direct cash support, the newspaper said. Shenzhen has cut rents, lower social security costs, subsidize corporate spending on disinfection and increase financing guarantee support, but some businesses said the measures are not strong and targeted enough, the newspaper said. (MNI)

MONEY SUPPLY: China's aggregate finance may exceed CNY3.5 trillion in March, a jump from February’s disappointing CNY1.19 trillion, following top policymakers’ call to maintain moderate growth in credit and social financing, the Securities Daily reported citing analysts. Local government special bonds and corporate bond financing are expected to increase, though the credit demand of residents and enterprises may be muted amid more financial market volatility and rising energy and raw material prices, the newspaper citing Zhou Maohua, a researcher at Everbright Bank. New loans may also improve from February’s CNY1.23 trillion to as much as CNY3 trillion, the newspaper said citing Essence Securities. (MNI)

EQUITIES: China Huarong Asset Management Co. said state-owned Citic Group will replace the Ministry of Finance as its largest shareholder, marking the latest step in the overhaul of the troubled bad-debt manager. Citic Group will receive 2.41 billion domestic Huarong shares from the ministry to “optimize the layout of state-owned financial capital,” according to an exchange filing Tuesday. The transfer would increase Citic’s stake in Huarong to 26.46%, and bring the ministry’s ownership down to 24.76%. While Huarong remains a state-owned financial institution, the move would leave the company one step removed from direct government control -- a change that may unnerve some creditors. Huarong roiled Asian credit markets last year as it failed to release its annual report on time, eventually revealing a massive loss for 2020. (BBG)

OVERNIGHT DATA

JAPAN FEB JOBLESS RATE 2.7%; MEDIAN 2.8%; JAN 2.8%

JAPAN FEB JOB-TO-APPLICANT RATIO 1.21; MEDIAN 1.20; JAN 1.20

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 91.1; PREV 91.2

Inflation expectations surged 0.4ppt last week to a multi-year high of 6.4%, even though petrol prices declined slightly. Consumer confidence was essentially unchanged despite this, with a slight decline of just 0.1%. Within the detail, however, sentiment toward ‘current financial conditions’ dropped to its lowest since May 2020. Consumer confidence is very weak given the strength of employment, which we think is directly linked to concerns over cost-of-living pressures. It will be interesting to see whether the measures expected in the Federal Budget provide a boost to confidence. (ANZ)

AUSTRALIA FEB RETAIL SALES +1.8% M/M; MEDIAN +0.9% JAN +1.6%

SOUTH KOREA MAR CONSUMER CONFIDENCE 103.2; FEB 103.1

SOUTH KOREA FEB RETAIL SALES +4.7% Y/Y; JAN +13.9%

SOUTH KOREA FEB DEPT STORE SALES +9.3% Y/Y

SOUTH KOREA FEB DISCOUNT STORE SALES -24.0% Y/Y

CHINA MARKETS

PBOC NET INJECTS CNY130 BLN VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY150 billion via 7-day reverse repos with the rates unchanged at 2.10% on Tuesday. The operation has led to a net injection of CNY130 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1000% at 09:25 am local time from the close of 2.1891% on Monday.

- The CFETS-NEX money-market sentiment index closed at 45 on Monday vs 46 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3640 TUES VS 6.3732

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3640 on Tuesday, compared with 6.3732 set on Monday.

MARKETS

SNAPSHOT: BoJ On Rinse & Repeat, JPY Back From Extremes

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 200.23 points at 28144.66

- ASX 200 up 56.583 points at 7469

- Shanghai Comp. down 13.851 points at 3200.652

- JGB 10-Yr future down 12 ticks at 149.03, yield down 0bp at 0.251%

- Aussie 10-Yr future down 0.5 tick at 97.030, yield up 0.1bp at 2.902%

- U.S. 10-Yr future down -0-03+ at 121-19, yield up 1.68bp at 2.4753%

- WTI crude down $1.56 at $104.41, Gold down $0.02 at $1922.78

- USD/JPY down 55 pips at Y123.31

- SCHUMER SETS UP VOTE ON ADVANCING COOK FED NOMINATION TO SENATE (BBG)

- BOJ DEFENDS TOP OF 10-YEAR JGB YIELD BAND AGAIN, TWICE

- JAPAN POLICYMAKERS WARN AGAINST RAPID YEN WEAKENING (RTRS)

- U.S. UNLIKELY TO BACK BOJ FX INTERVENTION (MNI)

- RUSSIA SAYS IT IS PREPARED TO LET KYIV JOIN THE EU (FT)

- SHANGHAI SAYS WILL HAND OUT $22 BLN IN TAX RELIEF TO FIRMS AMID COVID FIGHT (RTRS)

BOND SUMMARY: BoJ Active, Tsys Soften

U. S. Tsys cheapened a touch in overnight trade, although it wasn’t one-way traffic, with spill over from the recovery off Monday’s session lows eventually negated by payside interest in swaps & some spill over from the JGB space (post-supply). That leaves the major cash Tsy benchmarks 2-5bp cheaper into London dealing, as the curve bear flattens. TYM2 is -0-05 at 121-17+, just off worst levels of the session. A block roll of FV 114.25 puts down into the 113.25 strike (10K in size) and a 5K block sale of the 114.25 puts in isolation (profit taking) headlined on the flow side in Asia. Tuesday’s NY docket includes consumer confidence & JOLTS job openings data, Fedspeak from NY Fed President Williams & Philly Fed President Harker (’23 voter) & 7-Year Tsy supply. The ongoing Russia-Ukraine summit in Turkey will also garner interest.

- JGBs pulled back from their overnight session lows, initially aided by the presence of the BoJ’s fixed rate operations to enforce the upper end of its permitted 10-Year JGB yield trading band (Scheduled through the end of March). Still, the curve ran steeper as concession was built in ahead of today’s 40-Year auction. The auction itself was particularly soft, with the high yield coming in 5.5bp above wider expectations, proxied by the BBG dealer poll. We also saw the cover ratio crater to the lowest level observed at a 40-Year auction since ’11. We would suggest that the ongoing market vol. and the lack of relative control exerted by the BoJ in this area of the curve deterred prospective bidders, while others were not willing to aggressively bid for access to the line owing to the same factors. The curve has steepened further post-auction, given the soft demand, with 40s now ~10bp cheaper on the day, while futures have softened to last trade -17 (well within the confines of the range observed since yesterday’s Tokyo close). 10-Year JGB yields continue to operate just above 0.250%, with the combination of a soft 40-Year auction and no pullback in 10-Year JGB yields seemingly dragging the BoJ back in to conduct a second round of fixed rate operations to enforce the upper end of its permitted 10-Year JGB yield trading band.

- There wasn’t much in the way of idiosyncrasies to go off when it came to the ACGB space. This evening’s budget has been subjected to the usual round of press leaks and pre-announcements, with more market focus set to fall on AOFM issuance matters surrounding the headline event (which will likely be released on Wednesday). YM -7.0 & XM +1.0 at typing. Longer dated cash ACGBs sit ~2.0bp richer on the day.

JGBS AUCTION: 40-Year Auction Results

The Japanese Ministry of Finance (MOF) sells Y599.8bn of 40-Year JGBs:

- High Yield: 1.095% (prev. 0.760%)

- Low Price 87.50 (prev. 97.97)

- % Allotted At High Yield: 77.6000% (prev. 39.9532%)

- Bid/Cover: 2.194x (prev. 2.574x)

EQUITIES: Mostly Higher As Crude Benchmarks Hold Monday’s Losses

Major Asia-Pac equity indices are mostly higher at typing, tracking a positive lead from Wall St. High-beta names across the region have caught a bid as major crude and commodity benchmarks have struggled to make headway in Asian hours, easing stagflation-related worry in some quarters.

- The ASX200 outperformed, building on an early lead to deal 0.8% firmer at writing. Technology and healthcare equities lead gains in the index, with the S&P/ASX All Technology Index sitting 2.6% better off at writing. The energy and materials sub-indices bucked the broader trend of gains amongst sub-index peers, on track to be the only sectors to close in the red for the day.

- The Hang Seng sits 0.4% higher at typing, with China-based tech leading gains for another day. The Hang Seng Tech Index trades 0.8% higher, with modest gains observed in internet giants Tencent, Meituan, and Trip.com. Real estate-related names within the Hang Seng remain under pressure as Hong Kong continues to pursue COVID-zero policies in the face of fresh daily case counts numbering in the thousands, seeing the Hang Seng Properties Index deal 0.4% softer at writing.

- The CSI300 underperformed against major regional equity index peers, dealing 0.4% softer come the lunch bell. Looking elsewhere domestically, Chinese real estate stocks broadly sold off as the list of developers declaring their inability to release financial results on time continues to grow, with sharp losses seen in names such as Sunac Holdings (-19.4%) and Shimao (-6.9%).

- U.S. e-mini equity index futures are virtually unchanged at typing, lacking momentum in either direction.

OIL: Lower As Shanghai Lockdown, Russia-Ukraine Talks In Focus

WTI is -$0.90 and Brent is -$1.20 at typing, operating a touch above Monday’s one-week lows as demand worry re: the two-stage lockdown of the Chinese city of Shanghai remains evident.

- To elaborate, Shanghai entered a phased lockdown on Monday despite earlier assurances to the contrary from city officials, with lingering worry evident re: other Chinese cities adopting similar pandemic control measures. BBG estimates have pointed to >60mn people in China either currently being under lockdown, or “facing one imminently”.

- Events surrounding the Russia-Ukraine conflict have applied further pressure, with hopes re: a diplomatic resolution seemingly rising ahead of scheduled ceasefire talks in Turkey later on Tuesday, raising expectations for a rapprochement between Russian crude exporters and international buyers.

- Elsewhere, RTRS source reports suggest that OPEC+ will stick to a 432K bpd target output increase at their policy meeting on Thursday, a slight increase (previous increases were set at 400k bpd) based on “internal recalculations” as opposed to consideration for ongoing tightness in global crude supplies. A note that the group has continued to miss its cumulative output targets, with IEA data showing a 1.1mn bpd shortfall in Feb.

GOLD: Slightly Higher In Asia

Gold deals ~$3 firmer at writing to print ~$1,926/oz, operating around the lower end of Monday’s range. The precious metal has regained some poise in Asia as U.S. real yields and the Dollar have backed away from their earlier intra-day highs.

- To recap, bullion closed ~$35/oz lower on Monday, with the move lower facilitated by an uptick in U.S. real yields and the USD, in a session that saw nominal U.S. 10-Year Tsy yields hit levels not witnessed since May 2019.

- Turning to the war in Ukraine, both sides will begin two days of face-to-face ceasefire talks in Turkey later on Tuesday. FT source reports have pointed to a possible softening in Russian positions, dropping “denazification” and “demilitarization” demands while allowing Ukraine to seek admittance to the EU (but not NATO). Still, questions re: Ukrainian sovereignty surrounding Crimea and the separatist regions of Luhansk and Donetsk remain unresolved, with Ukrainian negotiators already stating that this is “the most critical point” from their perspective.

- On the technical front, the short-term outlook for gold is still bearish. Resistance is situated at $1,966.1/oz (Mar 24 high), while support is located at ~$1,901.9/oz (50-day EMA).

FOREX: Still JPY Watching

It was another session of JPY watching overnight, with senior Japanese government officials underscoring a need for orderly FX market moves, while continuing to point to vigilance and a sense of urgency when it comes to monitoring the FX space. We also saw Finance Minister Suzuki flag the need to avoid “negative JPY weakness,” which was enough to allow XXX/JPY crosses to run higher into the Tokyo fix (no firm pushback on JPY weakness was apparent in that particular verse), further boosted by fixing-related demand, before a firmer round of JPY strength kicked in (aided by the previously flagged rhetoric). We also saw the BoJ step in to defend the upper limit of its permitted 10-Year JGB yield trading band on two occasions, with limited, if any, tangible spill over apparent in the FX space. JPY managed to work itself to the top of the G10 FX leader board. USD/JPY is 50 or so pips lower on the day at typing, printing ~Y123.30, after showing as low as Y123.11 (Monday’s high was Y125.09). As our technical analyst flagged on Monday, at current levels, USD/JPY is extremely overbought and the most recent portion of the uptrend is very steep. A correction is overdue. Still, he also noted that technical signals suggest that the pair is likely to continue to appreciate in Q2 and a clear break of Y125.00 and Y125.86 would strengthen the bullish condition. To the downside, initial support is located at Monday’s low (Y121.97),

- Elsewhere, the USD fluctuated, with a lack of wider themes and headline flow apparent. Bursts of Tsy weakness provided some sporadic support for the greenback, but didn’t provide a consistent source of support (there were no notable extensions through Monday’s highs in yield terms), leaving the majority of the major USD crosses (excluding USD/JPY) little changed into European hours.

- A deepening of Shanghai’s COVID restrictions failed to meaningfully impact the space.

- The economic docket is rather light on Tuesday, with focus set to fall on the ongoing Russia-Ukraine summit in Turkey, in addition to addresses from Fed’s Williams & Harker, ECB’s de Cos & Riksbank’s Floden.

FOREX OPTIONS: Expiries for Mar29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0900(E722mln), $1.0950-60(E1.2bln), $1.0975(E1bln), $1.1000(E2.5bln), $1.1086-00(E1.2bln)

- GBP/USD: $1.3400(Gbp1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/03/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/03/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 29/03/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 29/03/2022 | 0700/0900 |  | ES | Spain Retail Sales | |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/03/2022 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/03/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 29/03/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 29/03/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 29/03/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 29/03/2022 | 1300/0900 |  | US | New York Fed's John Williams | |

| 29/03/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 29/03/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 29/03/2022 | 1445/1045 |  | US | Philadelphia Fed's Patrick Harker | |

| 29/03/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.