-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: BoJ Affirms Commitment To YCC

EXECUTIVE SUMMARY

- WEST REMAINS DUBIOUS OF PROGRESS IN RUSSIA-UKRAINE TALKS

- FED’S BOSTIC FAVORS FLEXIBLE APPROACH ON PACE OF RATE HIKES (BBG)

- BOJ RATCHETS UP PROTECTION OF PERMITTED 10-YEAR JGB YIELD TRADING BAND

- ECB INTEREST-RATE HIKE IS POSSIBLE THIS YEAR, VASLE SAYS (BBG)

- GREECE CAN RETURN TO INVESTMENT GRADE NEXT YEAR, PM SAYS (RTRS)

- CHINA’S XUZHOU ANNOUNCES 3-DAY LOCKDOWN

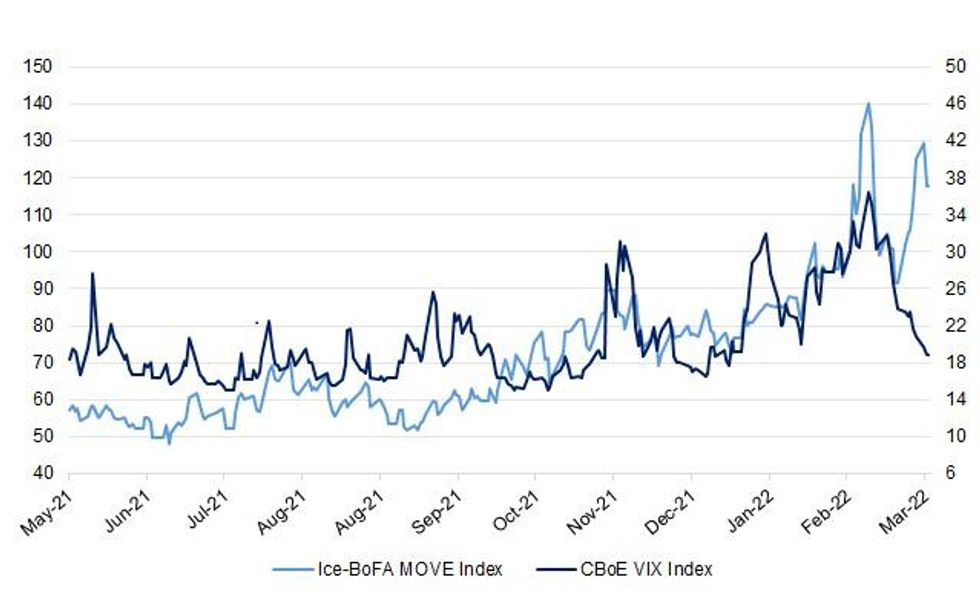

Fig. 1: ICE-BofA MOVE Index Vs. CBoE VIX Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL: Public services will not get any more money before the next election, the chief secretary to the Treasury has insisted. Simon Clarke told his cabinet colleagues that pet projects and staff pay rises would have to be funded from cuts elsewhere, as he insisted that the government had reached the “high-water mark” of spending. Promising a renewed focus on Whitehall cost-cutting, Clarke said that the Covid “era of exceptionalism” is over and fiscal discipline must return. An increase in the size of the civil service is “impossible to justify long term” and numbers must return to pre-pandemic levels by the next election, he said. (The Times)

BREXIT: Downing Street is exploring yet another delay to post-Brexit border checks on goods entering Britain from the EU to prevent what industry has warned would be a supply chain disaster. Ministers are considering whether to push back for the fourth time the introduction of full checks on imports from the EU, which were supposed to come into effect on July 1, as part of a drive to tackle trade friction and the crisis in the cost of living, officials briefed on discussions said. Jacob Rees-Mogg, Brexit opportunities minister, argued at a private meeting this week that one advantage of leaving the EU would be to allow Britain to apply only loose checks on imports. Goods arriving from the EU are not subject to safety and security declarations, while food and plant products are not physically checked. Boris Johnson, the prime minister, has not yet made a firm decision but is being urged to extend the “grace period” for EU imports by Rees-Mogg and former Brexit minister Lord David Frost. (FT)

EUROPE

ECB: Euro-zone inflation is still “transitory in nature,” European Central Bank Governing Council member Bostjan Vasle tells Radio Slovenija. If Russian aggression in Ukraine doesn’t escalate, Vasle sees ECB ending new asset purchases in 3Q, followed by a possible interest-rate hike. Vasle “wouldn’t exclude a rate hike in 2022 already,” citing current inflation data and financial-market conditions. Vasle stresses importance of predictability in ECB policy decisions, which shouldn’t add to current uncertainty. (BBG)

GERMANY: The German Council of Economic Experts has revised its economic forecast significantly downwards. In their current forecast, the “Wirtschaftswise” are only assuming growth in German gross domestic product of 1.8 percent in 2022. The forecast is available to the Handelsblatt. In their last economic estimate in November, the economic wise men were still assumed growth of 4.6 percent. The new growth forecast for 2023 is 3.6 percent. "Russia's war of aggression against Ukraine significantly increases uncertainty, dampens growth and contributes to rising energy and consumer prices," the forecast reads. Europe is particularly affected by this. The German Council of Economic Experts is forecasting economic growth of 2.9 percent for both 2022 and 2023 for the euro area. (Handelsblatt)

GREECE: Greek Prime Minister Kyriakos Mitsotakis said on Tuesday that regaining investment grade status in 2023 is "a feasible target" for the country despite current economic challenges. Speaking at an economic forum, Mitsotakis said that Greece, the euro zone's most indebted country, must reduce its debt and achieve small but significant primary surpluses. Greece's economy will be slightly affected by the energy crisis that has deepened due to the war in Ukraine but growth is not at risk and tourism, the economy's main driver, will not suffer a significant hit, he said. (RTRS)

SNB: Switzerland has become more vulnerable to a shock from its inflated property sector, Swiss National Bank Vice Chairman Fritz Zurbruegg said on Tuesday, adding it is not the job of monetary policy to curb the risks. The SNB estimates Swiss apartments to be overvalued by 10% to 35% at present, as ultra low interest rates and tight supply have driven up prices. “In Switzerland, vulnerabilities in the residential real estate and mortgage markets have increased since the onset of the pandemic,” Zurbruegg said in a speech in Geneva. “Monetary policy has no influence over these factors. Even more importantly, the focus of monetary policy is price stability and economic developments, and not curbing financial system vulnerabilities,” he said. (RTRS)

U.S.

FED: St. Louis Fed President Bullard noted that “in my view, getting underway with the removal of accommodation was appropriate given the strong real economy and the ongoing inflation shock. I believe that the FOMC should raise the policy rate to 3% by the end of the year and implement a plan to quickly reduce the size of the Fed’s balance sheet. Going forward, the extent and pace of these actions can be adjusted if macroeconomic conditions evolve differently than we expect today. And, of course, we must monitor risks, such as developments in the Russia-Ukraine war and their potential impact on the U.S. economy and inflation. But forthright and transparent monetary policy actions designed to keep inflation under control will give the U.S. economy the best possible chance at a long and durable expansion.” (MNI)

FED: Philadelphia Federal Reserve President Patrick Harker said on Tuesday he favors a "methodical" series of quarter-percentage-point interest rate increases, but is open to larger half-percentage-point hikes if inflation does not soon show signs of easing. "I have penciled in seven ... 25-basis-point increases for this year," including the one just approved at the U.S. central bank's March 15-16 policy meeting, Harker said in comments to the Center for Financial Stability in New York. If there is no improvement in inflation data, "I am open to sending a strong signal with a 50-basis-point increase at the next meeting," Harker said, adding that new coronavirus restrictions in China could throw a "wrench" into global supply chains and add inflation pressure beyond what's coming from the war in Ukraine and other factors. (RTRS)

FED: Federal Reserve Bank of Atlanta President Raphael Bosticrepeats that he favors raising interest rates six times this year but can go faster or slower depending on how the economy evolves. Says six hikes this year, two early next year “gets us to my estimate of neutral” but “the world is going to happen and that will temper my view on how fast or how slow we should get back to that neutral”. Says if demand stays strong and economy is stable “I’ll pull it all forward, I won’t have a problem doing that”.“If it turns out uncertainty causes some families to start to be a bit uncomfortable and worried and things look like they’re slowing down a bit then I’ll push some of them out” (BBG)

OTHER

EU/CHINA: China doesn’t respect the principles that Germany stands for and is a “systemic rival” to Europe’s biggest economy, according to Finance Minister Christian Lindner. “We have to recognize that we have an enormous risk,” the Free Democrat leader and junior partner in Chancellor Olaf Scholz’s coalition said in a speech on Tuesday. “China doesn’t respect our social model, our understanding of liberality, our recognition of international law.” Lindner is voicing his concerns at a sensitive time. On Friday, European Union officials will hold a video summit with President Xi Jinping where they may reinforce U.S. warnings that China would face serious consequences if it tried to cushion the blow of sanctions against Russia. (BBG)

BOJ: MNI INSIGHT: BOJ's Battle Focus On JGB Yields, Yen Can Wait

- The Bank of Japan on Wednesday showed its top priority is curbing higher Japanese Government Bond (JGB) yields with concerns over a weaker yen on the backburner as options to act are limited, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

RBNZ: Finance Minister Grant Robertson says Bob Buckle and Peter Harris have been reappointed as external members of the Reserve Bank’s Monetary Policy Committee. Buckle has been reappointed for a term of three years from April 1; Harris for a term of 18 months. “It was important to retain Dr Buckle’s and Mr Harris’ experience and expertise as external members of the MPC which responded to a one-in-100 year economic shock and provide continuity as the pandemic evolves”: Robertson in emailed statement. (BBG)

NORTH KOREA: North Korea tried to deceive the world about the type of missile it fired last week, claiming that it successfully tested a “huge,” new ICBM while actually firing off a rocket first launched in 2017, South Korean defense officials said. The intercontinental ballistic missile that North Korea launched last week was likely a Hwasong-15, which was successfully tested in November 2017 and designed to carry a single nuclear warhead, the South Korean defense ministry told lawmakers in a report Tuesday. That’s less advanced than the Hwasong- 17, a multiple-warhead missile, which Pyongyang triumphantly declared a success with a slick, highly produced video. (BBG)

CANADA: The federal government will table its next annual budget on Thursday, April 7 at 4 p.m. ET. Deputy Prime Minister and Minister of Finance Chrystia Freeland confirmed the budget's release date on Tuesday during question period. "Our government was re-elected on a commitment to grow our economy, make life more affordable and to continue building a Canada where nobody gets left behind," Freeland told the House of Commons. Government sources have told CBC News that the budget will be a "back to basics" document after two years of extraordinary government spending in response to the COVID-19 pandemic. (CBC)

BRAZIL: Brazil’s Central Bank workers decided to carry on striking after failing to achieve a concrete proposal in a meeting with the head of the monetary authority, Roberto Campos Neto, the Union says. Union representatives are scheduled to meet the Economy Ministry and Chief of Staff cabinet next week. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Tuesday said the signals from peace talks with Russia could be called positive but added that they did not drown out the explosions from Russian shells. In a late night address, Zelenskiy also expressed caution about Russia's promise to sharply curtail military action in some areas and said Ukraine would not be easing off its defensive efforts. "We can say the signals we are receiving from the talks are positive but they do not drown out the explosions of Russian shells," he said, adding that Ukraine could only trust a concrete result from the talks. (RTRS)

RUSSIA: Biden said he wants to see how Russia acts in Ukraine after Kremlin negotiators said its military would pull back from assaults on Kyiv and Chernihiv, following talks in Turkey. “I don’t read anything into it until I see what their actions are,” the president said at a news conference with Singapore’s prime minister. “We’ll see if they follow through on what they’re suggesting.” In a call with the leaders of the U.K., France, Germany and Italy earlier, Biden said, there also seemed to be “a consensus that, let’s just see what they have to offer. We’ll find out what they do.” (BBG)

RUSSIA: Russia has started moving very small numbers of troops away from positions around Kyiv in a move that is more of a repositioning than a retreat or a withdrawal from the war, the Pentagon said on Tuesday. "It does not mean that the threat to Kyiv is over," spokesman John Kirby told a news briefing. A total of 10 U.S. F-18 aircraft and more than 200 troops are being deployed to NATO member and Russian neighbour, Lithuania, and U.S. troops in Poland are "liaising" with Ukrainian forces as they hand over weapons to them, he added. (RTRS)

RUSSIA: French President Emmanuel Macron had a phone conversation with Putin Tuesday in which he demanded a truce in the besieged city of Mariupol to allow for the evacuation of civilians and the delivery of humanitarian aid, an Elysee official said. Putin said he would to respond to the French demands but no timeline was set, the French official added. The French leader also reiterated a previous rejection by European nations that Russian gas purchases be paid for in rubles, according to the person. Macron will report on his conversation with Putin to Ukraine’s Zelenskiy in the near future, the official said. According to the Kremlin, Putin told Macron that Ukrainian fighters should surrender in order to resolve the humanitarian crisis in Mariupol. (BBG)

RUSSIA: Ukraine and a number of non-NATO countries have been invited to attend part of a two-day meeting of NATO foreign ministers next week, according to a statement from the military alliance headquartered in Brussels. (CNN)

RUSSIA: The Pentagon on Tuesday clarified that U.S. troops in Poland were "liaising" with Ukrainian forces as they hand over weapons to them, but were not training "in the classic sense" following remarks from President Joe Biden on the matter. On Monday, Biden told reporters that while in Poland last week, he had been talking to U.S. troops who were helping "train" Ukrainian forces in Poland. Pentagon spokesman John Kirby told reporters that U.S. troops in Poland were "liaising" with Ukrainian forces when weapons are handed over to the forces fighting back against Russia's invasion. "It's not training in the classic sense that many people think of training. I would just say it's liaising," Kirby said. (RTRS)

RUSSIA: The United States and its allies are discussing another possible round of assistance for Ukraine that could reach a collective $500 million, a source familiar with the situation told Reuters on Tuesday. A U.S. official declined to confirm the figure but said the United States was "actively working on how best to continue our support for the Ukrainian government through security, humanitarian and financial assistance." (RTRS)

RUSSIA: Biden and his counterparts in France, Germany, Italy and the UK “affirmed their determination to continue raising costs on Russia for its brutal attacks in Ukraine, as well as to continue supplying Ukraine with security assistance to defend itself against this unjustified and unprovoked assault,” on a call this morning, according to a White House statement. (CNN)

RUSSIA: The Netherlands announced it was expelling 17 Russian intelligence officers, and Belgium said it would oust 21 for spying. North Macedonia also declared five diplomats personae non grata for breaching diplomatic conventions. The Czech Republic, which forced out scores of Russians from the embassy in Prague last year, said on Tuesday it was telling one more to leave. Since last month’s invasion, European Union members have expelled Russian diplomats, including the three Baltic nations, which expelled 10 people; Bulgaria, which expelled 10 more; and Poland, which ordered 45 to leave. Police in Slovakia expelled three Russian diplomats after it detained four people suspected of spying for Moscow. Germany is also considering expelling suspected spies, an official said Tuesday. (BBG)

RUSSIA: French President Emmanuel Macron on Tuesday told his Russian counterpart, Vladimir Putin, that it was not possible for Western gas clients to pay their bills in roubles, a French presidential official told journalists on Tuesday. "France is against paying in roubles," the official said. In his phone call with Putin, Macron also reiterated his preparedness to carry out a humanitarian rescue mission in the Ukrainian city of Mariupol, the official said, but added that the conditions for such a step were not yet in place. (RTRS)

RUSSIA: The Russian Union of Grain Exporters asked the central bank to consider making it possible for foreign buyers of grain to pay in rubles under export contracts, Kommersant reports. Initiative was discussed, among other topics, at a meeting with the central bank last week. Union asked the central bank to provide ruble liquidity to foreign banks serving grain buyers, the largest of which are Turkey, Egypt, Iran, and Saudi Arabia. While most contracts are now agreed in foreign currency, international sanctions that followed Russia’s invasion of Ukraine complicated payments in FX because some banks sometimes refuse to transfer money. (BBG)

MIDDLE EAST: U.S. Secretary of State Antony Blinken sought to assure Gulf monarchies on Tuesday that Washington is determined to help them fend off attacks from the Iran-aligned Houthi group in Yemen. (RTRS)

METALS: The LME is working to shore up confidence in the bourse amid tumult in nickel. The exchange halted nickel trading and canceled nearly $4 billion in transactions earlier this month after prices spiked by 250% in two days, as it sought to protect its brokers from huge margin calls owed by Tsingshan Holding Group and other short position holders. After a haphazard effort to restart trading, nickel has spent much of the past fortnight locked at the upper or lower limit of a new daily price cap designed to rein in the unprecedented volatility. Nickel trading on the LME is “back functioning again” in the wake of the historic short squeeze, Farnham said, acknowledging that it’s taking time for people to regain confidence. LME remains open to further measures after introducing price bands and over-the-counter reporting, he added. (BBG)

METALS: The London Metal Exchange has no plans to ban Russian metal from its platforms on the grounds that governments are responsible for setting any sanctions, according to a senior exchange official. The LME is “open for business,” Adrian Farnham, chief executive officer of the LME’s clearing house, who has been tapped to head the exchange on an interim basis, told the CRU World Copper Conference in Santiago. “Our view is that it’s up to governments to set sanctions. We don’t think it’s our role to go ahead.” Still, the bourse is listening to some in the industry who support sanctions amid an ongoing debate, he said. (BBG)

OIL: Asia will become the default market for Russian oil as the country tries to find buyers for its energy exports, said Dan Yergin, vice chairman of S&P Global. Major oil importers in Asia like China and India have been pressured by oil prices which have soared since Russia invaded Ukraine in late February. Besides the appeal of cheaper Russian oil, both Beijing and New Delhi have close ties with Moscow. Yergin told CNBC’s “Street Signs Asia” on Monday: “It does look like Asia would be the default market for barrels of Russian oil that would have normally gone to Europe.” (CNBC)

CHINA

PBOC: The People’s Bank of China may still stick to its own easing policy to support growth despite China's sovereign bonds losing yield advantage over its U.S. counterpart, the China Securities Journal reported citing analysts. However, the PBOC is now more likely to ease through RRR cuts or other structural adjustments, while the expectation for a rate cut has cooled, the newspaper said. The spread between yield on China's 10-year bonds and yield on U.S. 10-year Treasury note narrowed to about 30 bps from more than 100 bps in early March, the newspaper said. However, given China's lower inflation and high trade surplus, the narrowing spread may not cause significant depreciation of the yuan or capital outflow, the newspaper said. (MNI)

PROPERTY: Home sales in China's larger cities saw a more obvious increase from last month, with the figure in four first-tier cities rising by 12% in March from February, showing some signs of stabilization following the relaxation on mortgage loans, the China Securities Journal reported. However, housing markets in smaller cities still face sharp declines from the same period last year, the newspaper said. On the whole, the market remains muted as home buyers lack confidence and the repeated epidemics have further dragged down the pace of recovery, the newspaper said citing Chen Wenjing, an analyst at China Index Academy. (MNI)

CORONAVIRUS: Shanghai on Wednesday extended its shut downs to some western parts of the city, earlier than scheduled, as it reported a total of 5,982 new local cases. The financial hub of Shanghai, home to 26 million people, is in its third day of a lockdown authorities are imposing by dividing the city roughly along the Huangpu River, splitting the historic centre from the eastern financial and industrial district of Pudong to allow for staggered testing. While residents in the east have been locked down since Monday, those in the west were officially scheduled to start their 4 day lockdown on Friday. However, the city's southwestern district of Minhang, home to more than 2.5 million people, announced late on Tuesday it would suspend public bus services until April 5. (RTRS)

CORONAVIRUS: China is unlikely to have any prolonged period with zero covid cases due to the highly contagious variant that it is battling and the widespread infections within the country, the government-run Global Times said citing an unidentified expert from the Chinese Center for Disease Control and Prevention (CDC). China should find new ways to cope with large-scale outbreaks, the newspaper said citing Zeng Guang, a former chief epidemiologist of the Chinese CDC. (MNI)

CORONAVIRUS: Xuzhou city in eastern Chinese province of Jiangsu will lock down for three days from Wednesday while it conducts mass Covid tests in key areas, according to a government statement. All buses, subways, taxis will be suspended.

POLICY: China is planning new curbs on the country’s $30 billion live-streaming industry, according to people familiar with the matter, renewing a regulatory campaign aimed at reining in technology companies and exerting greater influence over the content consumed by its young people. Chinese authorities are drafting new regulations to cap internet users’ daily monetary spending on digital tipping, said people familiar with the situation. Officials are also planning to set a daily limit on how much live-streamers can receive from fans and are considering imposing tighter censorship over content, some of the people said. (WSJ)

EQUITIES: Alibaba Group Holding Ltd. led a $60 million investment in Chinese augmented reality glasses maker Nreal, joining rivals Tencent Holdings Ltd. and ByteDance Ltd. to stake a claim in the future of the metaverse. The so-called Series C+ funding round brings the total Nreal raised within 12 months to $200 million, the Beijing outfit said in a statement, without disclosing its latest valuation. The startup was valued at $700 million in a previous round announced in September 2021, CNBC reported at the time, citing an unnamed source. (BBG)

OVERNIGHT DATA

JAPAN FEB RETAIL SALES -0.8% Y/Y; MEDIAN -0.3%; JAN +1.1%

JAPAN FEB RETAIL SALES -0.8% M/M; MEDIAN -0.3%; JAN -0.9%

JAPAN FEB DEPT STORE & SUPERMARKET SALES +0.1% Y/Y; MEDIAN +0.5%; JAN +2.6%

NEW ZEALAND FEB BUILDING PERMITS +10.5% M/M; JAN -8.7%

NEW ZEALAND MAR ANZ BUSINESS CONFIDENCE -41.9; FEB -51.8

NEW ZEALAND MAR ANZ ACTIVITY OUTLOOK +3.3; FEB -2.2

The March ANZ Business Outlook survey saw most activity indicators bounce back a little, perhaps as the worst fears about the impact of Omicron waned. But it was nothing spectacular. And inflation pressures continued to lift, with the commodity price impact of Russia’s invasion of Ukraine giving pressures fresh impetus.Inflation expectations rose 0.3% pts to a new record high of 5.5% and pricing intentions took yet another meaningful leg higher to a net 81%. Indeed, the latter suggests CPI inflation is moon-bound. A remarkable net 96% of firms report that they expect higher costs. Can’t get much more broad based inflation pressure than that. (ANZ)

UK MAR BRC SHOP PRICE INDEX +2.1% Y/Y; FEB +1.8%

CHINA MARKETS

PBOC NET INJECTS CNY130 BLN VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY150 billion via 7-day reverse repos with the rates unchanged at 2.10% on Wednesday. The operation has led to a net injection of CNY130 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of the quarter, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 2.1512% at 09:48 am local time from the close of 2.1816% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Tuesday, flat from the close of Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3566 WEDS VS 6.3640

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3566 on Wednesday, compared with 6.3640 set on Tuesday.

MARKETS

SNAPSHOT: BoJ Affirms Commitment To YCC

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 462.29 points at 27791.36

- ASX 200 up 50.237 points at 7514.5

- Shanghai Comp. up 41.286 points at 3245.225

- JGB 10-Yr future up 61 ticks at 149.64, yield down 3.6bp at 0.216%

- Aussie 10-Yr future up 9.5 ticks at 97.135, yield down 9.6bp at 2.803%

- US 10-Yr future up 0-10 at 122-20+, yield down 4.2bp at 2.3524%

- WTI crude up $0.89 at $105.11, Gold up $5.04 at $1924.49

- USDJPY down 97 pips at 121.91

- WEST REMAINS DUBIOUS OF PROGRESS IN RUSSIA-UKRAINE TALKS

- FED’S BOSTIC FAVORS FLEXIBLE APPROACH ON PACE OF RATE HIKES (BBG)

- BOJ RATCHETS UP PROTECTION OF PERMITTED 10-YEAR JGB YIELD TRADING BAND

- ECB INTEREST-RATE HIKE IS POSSIBLE THIS YEAR, VASLE SAYS (BBG)

- GREECE CAN RETURN TO INVESTMENT GRADE NEXT YEAR, PM SAYS (RTRS)

- CHINA’S XUZHOU ANNOUNCES 3-DAY LOCKDOWN

BOND SUMMARY: BoJ Action Promotes Bid In Core FI

BoJ matters were at the fore overnight, with the central bank-driven bid supporting wider core fixed income.

- That allowed TYM2 to break above Tuesday’s peak, last dealing +0-10 at 122-20+, with volume topping 190K on the session. Cash Tsys run 3-5bp richer on the days, with 5s leading the bid. There wasn’t much else in the way of meaningful headline flow, with Atlanta Fed President Bostic (’24 voter) reaffirming his views re: rate hikes (flexibility required), while pointing to uncertainty promoting some relative demand for the longer end of the Tsy curve resulting in the current flattening dynamic. Markets looked through the latest city lockdown in China (implemented in the tavel hub of Xuzhou, population ~9mn). Flow was headlined by 2 block sales of FVK2 114.00 puts (10K in total) and a block buy of FVM2 futures (+1,945), which may have been related to the options flow. Wednesday’s NY session will bring the release of ADP employment data (ahead of Friday’s payrolls print) & Fedspeak from Richmond Fed President Barkin (’24 voter) & Kansas City Fed President George (’22 voter)

- The U.S./Japan 10-Year yield differential has edged further away from the recent wides, with U.S. 10-Year Tsys managing to outperform their JGB counterparts, even as the BoJ adjusted its Rinban operations to counter recent curve-wide moves higher in yields, with upsized and unscheduled Rinban operations evident this morning, before an unconventional, unscheduled second round of Rinban operations was tendered during the Tokyo afternoon (the wider than expected focus of today’s BoJ’s purchases means that the super-long end of the JGB curve has benefitted more than 10s). JGB futures surged as a result, but have pulled back from best levels, last +60 (25 ticks off their peak). Cash JGB trade has seen bull flattening, with 30s richening by 9bp, while 7s have outperformed nearby paper given the bid in futures. JGB-OIS spreads widened as the BoJ reaffirmed its dovish credentials.

- Aussie bonds traded as a wider function of core FI markets, with no immediate reaction to firm pricing in an auction of the illiquid ACGB Apr-24 (with the same illiquidity likely resulting in extremely strong pricing, even as the cover ratio printed below 2.50x), while the AOFM’s initial FY22/23 issuance outline wasn’t as high as expected (once again, this failed to inspire price action, as the lower issuance task likely points to completed pre-funding of an upcoming ACGB maturity). YM +13.0 & XM +9.0 into the bell.

AUSSIE BONDS: ACGB Apr-24 Auction Results

The Australian Office of Financial Management (AOFM) sells A$1.5bn of the 2.75% 21 April 2024 Bond, issue #TB137:

- Average Yield: 1.9215% (prev. 0.6718%)

- High Yield: 1.9300% (prev. 0.6800%)

- Bid/Cover: 2.3713x (prev. 2.5900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 80.0% (prev. 17.7%)

- Bidders 64 (prev. 57), successful 21 (prev. 26), allocated in full 16 (prev. 14)

EQUITIES: Mostly Higher As Russia-Ukraine Worry Moderates

Asia-Pac equity indices are mostly higher on a positive lead from U.S. and European markets, with Japanese stocks bucking the wider trend of gains. High-beta equities across the region broadly outperformed as hope re: a de-escalation in the Russia-Ukraine conflict has spilled over into Asian hours, adding to an easing in stagflation-linked worry as commodity benchmarks have backed away from recent highs as well.

- The CSI300 leads gains amongst regional peers, being 2.0% better off at writing and operating at session highs. Richly valued consumer staples and healthcare stocks lead gains, with the largest contributions observed in Chinese liquor stocks. Chinese tech stocks caught a strong bid as well, with the tech-heavy ChiNext and STAR50 sitting 2.9% and 2.3% higher at typing respectively.

- The Hang Seng trades 1.2% higher at typing, led by gains in the real estate and financials sub-indices. The index has backed away from session highs as China-based tech stocks pared earlier gains, with the Hang Seng Tech Index printing 0.3% better off at typing after recording gains of up to 2.3% earlier in the session. The pullback comes as WSJ source reports have pointed to Chinese authorities planning to place curbs on the country’s $30bn live-streaming industry, raising worry re: regulatory action on some large-cap technology names.

- The Japanese Nikkei 225 underperformed, sitting 1.4% lower at typing. The move lower comes as the JPY has retreated below Y122.00 in Asia, unwinding some of the recent dynamic re: yen weakness boosting hopes re: corporate earnings for Japanese companies.

- U.S. e-mini equity index futures deal 0.1% to 0.2% weaker at typing.

OIL: Slightly Higher Amidst Russia-Ukraine Worry As Chinese Demand Outlook Provides Balance

WTI and Brent are ~$0.70 firmer apiece, printing $104.9 and $110.9 respectively at typing. Both benchmarks operate comfortably above Tuesday’s trough as some hope re: progress in Russia-Ukraine ceasefire talks has turned to caution, with well-documented western scepticism towards Russia’s announcements of military de-escalations in the north of Ukraine doing the rounds in Asia.

- To recap, WTI and Brent fell to session lows at $98.44 and $104.84 respectively on Tuesday amidst perceived progress in ongoing Russia-Ukraine negotiations, before erasing losses as the top Russian negotiator stated that talks had “a long way to go”.

- Looking to China, demand worry remains elevated as authorities announced a rise in both symptomatic and asymptomatic cases (total of 8,825 cases for Mar 29 vs. 7,051 for Mar 28), with a 3-day lockdown announced in the Chinese city of Xuzhou as well (population ~9mn).

- Turning to the Middle East, there has been no discernible progress in indirect U.S.-Iran nuclear talks.

- Elsewhere, weekly U.S. API inventories crossed on Tuesday, with reports pointing to drawdowns in crude, gasoline, distillate, and Cushing hub stocks. Looking ahead, EIA data is due later on Wednesday (1430 GMT), with WSJ median estimates calling for declines in crude, gasoline, and distillate stockpiles as well.

GOLD: Higher In Asia

Gold deals ~$4/oz firmer to print ~$1,923/oz at writing, with the move higher facilitated by a downtick in the USD and U.S. Tsy yields.

- To recap, bullion briefly fell to one-month lows ($1,890.2/oz) on Tuesday as perceived progress in Russia-Ukraine talks facilitated risk-positive outflows. Still, the yellow metal pared losses when Russian negotiators cautioned that talks had “a long way to go”, while western-led scepticism over Russian concessions further shaved earlier optimism re: a de-escalation in the conflict, with prices ultimately closing ~$3/oz lower for the day.

- To elaborate, Russia’s announcement to scale back military activity around Ukraine’s north did not address recent Russian plans to concentrate forces in the east of the country, with the U.S. calling the former a “repositioning” rather than a withdrawal. Well-documented Russian demands for Ukraine to cede territories also saw incremental progress, with Ukraine offering to discuss the matter separately from ongoing ceasefire negotiations.

- On the technical front, gold’s move lower on Tuesday breached support at ~$1,902.7/oz (50-Day EMA) and $1,895.3/oz (Mar 16 low) exposing further support at $1,878.4/oz (Feb 24 low and key short-term support).

FOREX: JPY Firms In Asia, Despite BoJ Upping Defence of 10-Year Yield Target

It was another case of JPY watching during Asia-Pac hours. The U.S./Japan 10-Year yield differential has edged further away from the recent wides, with U.S. 10-Year Tsys managing to outperform their JGB counterparts, even as the BoJ adjusted its Rinban operations to counter recent curve-wide moves higher in yields, with upsizing and unscheduled Rinban operations evident this morning, before an unconventional, unscheduled second round of Rinban operations was tendered during the Tokyo afternoon (the wider focus of today’s BoJ’s purchases means that the super-long end of the JGB curve has benefitted more than 10s). We would suggest that the 2bp narrowing in the yield spread shouldn’t equate to the ~100 pip fall observed in USD/JPY (at least in isolation), but as our technical analyst previously noted, a pullback in the cross was overdue, given the overbought conditions, which is likely factoring into the move. JPY sits atop the G10 FX pile as a result, although it wasn’t all one-way trade, with the initial reaction to the BoJ’s first Rinban announcement being one of limited JPY weakness, before yield differential took control. USD/JPY last deals at Y121.85 (after printing as low as Y121.32), with initial technical support at Y121.97 breached, bears now look to the Mar 24 low (Y120.95) as the next meaningful target. JPY

- The aforementioned downtick in U.S. Tsy yields and pull lower in USD/JPY applied some pressure to the USD in a broader context, with the greenback finding itself at the bottom of the G10 FX pile as a result.

- There wasn’t much in the way of meaningful headline flow elsewhere, with the latest localised city-wide lockdown in China having little impact on broader price action.

- Looking ahead, U.S. ADP employment data, and German state & national CPI readings provide the highlights when it comes to Wednesday’s economic prints. Elsewhere, we will get a raft of central bank speakers from the Fed, ECB & BoE.

FOREX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000(E2.7bln), $1.1050-60(E1.7bln), $1.1100(E1.5bln), $1.1150-55(E1.1bln), $1.1195-00($1.6bln)

- GBP/USD: $1.3195-00(Gbp774mln)

- EUR/JPY: Y121.00-05(E636mln), Y122.00-05(E660mln), Y122.90-00(E870mln)

- USD/CAD: C$1.2500($503mln), C$1.2525($640mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/03/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 30/03/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 30/03/2022 | 0700/0900 | *** |  | ES | HICP (p) |

| 30/03/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/03/2022 | 0800/1000 | * |  | IT | Industrial Orders |

| 30/03/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 30/03/2022 | 0800/1000 |  | EU | ECB Lagarde Speech at Central Bank of Cyprus | |

| 30/03/2022 | 0810/0910 |  | UK | BOE Broadbent Speaks at NIESR | |

| 30/03/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 30/03/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 30/03/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 30/03/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 30/03/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 30/03/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 30/03/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 30/03/2022 | 1230/0830 | *** |  | US | GDP (3rd) |

| 30/03/2022 | 1315/0915 |  | US | Richmond Fed's Tom Barkin | |

| 30/03/2022 | 1415/1615 |  | EU | ECB Panetta Hearing on Digital Euro at ECON | |

| 30/03/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 30/03/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 30/03/2022 | 1700/1300 |  | US | Kansas City Fed's Esther George |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.