-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Hawks Circle As Russia Faces More Sanctions

EXECUTIVE SUMMARY

- FED’S BRAINARD: FED TO SHRINK BALANCE SHEET AT RAPID PACE AS SOON AS MAY (BBG)

- FED’S DALY: FED COULD START BALANCE-SHEET REDUCTION AS EARLY AS MAY (BBG)

- YELLEN TO WARN OF “ENORMOUS ECONOMIC REPERCUSSIONS” OF UKRAINE INVASION (NYT)

- U.S. AND EU TO ANNOUNCE NEW SANCTIONS AGAINST RUSSIA WEDNESDAY

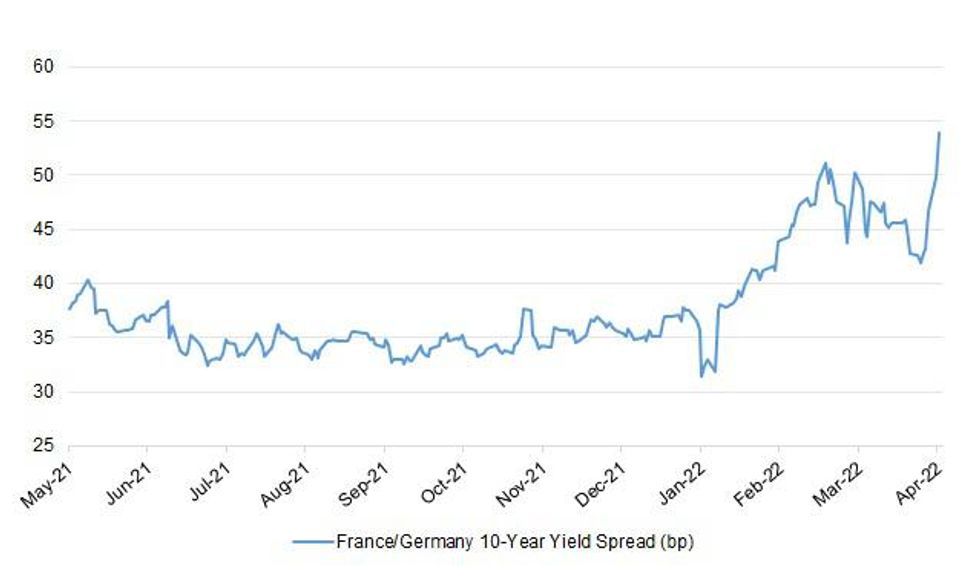

Fig. 1: France/Germany 10-Year Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Ministers are refusing to disclose any pictures taken by official No 10 photographers of illegal gatherings held inside Downing Street, prompting Labour to call on Boris Johnson to “come clean and release these photos”. The Cabinet Office refused to confirm or deny the existence of any photographs of events in the cabinet room, leaving parties, and a party in the prime minister’s Downing Street flat, after official pictures of the gatherings were requested under freedom of information laws. It said disclosing such information could prejudice the investigation, and contravene the principle of “fairness” under data protection regulations. (The Guardian)

POLITICS: Boris Johnson will struggle to get his plans to privatise Channel 4 through parliament after a backlash from within his party, senior Conservatives believe. The plans to raise £1bn-plus by selling off the state-owned channel sparked furious opposition from people such as Ruth Davidson, the former Scottish Tory leader, and former cabinet ministers Damian Green and Jeremy Hunt. Senior Tories told the Guardian that Johnson would probably struggle to get his plans through the House of Lords, and could face a revolt in the Commons as well. The proposal was not in the Conservative party manifesto, making it easier for peers to challenge the legislation necessary to make the sale. (The Guardian)

EUROPE

ECB: Euro-area inflation may peak by the middle of this year once the energy-price shock eases, according to European Central Bank Executive Board member Philip Lane. Price pressures at the moment are driven by steep surges in energy and gas, the ECB’s chief economist told Greece’s Antenna TV in an interview published Tuesday. “Most likely, with the nature of the energy shock, prices will either level off at these high prices or will start to decline,” Lane said. “But the momentum of inflation will slow down, so we do think that in the second half to the year, as you say, the inflation rate will come down. And we do think it will be a lot lower next year and the year after.” (BBG)

ECB: The European Central Bank could raise interest rates back to zero already this year to fight high inflation, Belgian central bank chief Pierre Wunsch said in a magazine interview, joining a growing group of policymakers now openly discussing a rate hike. The ECB has kept rates in negative territory since 2014 and has not raised them in more than a decade, but a surge in inflation is now making an increase in the minus 0.5% deposit rate increasingly topical. "Based on the current outlook, so with positive economic growth, we will raise interest rates to 0 by the end of the year," Wunsch told Belgian magazine Knack. "It's actually a no-brainer for me." "But I have to say that even within the ECB there has been no discussion about raising interest rates," he added. (RTRS)

EU/CHINA: The European Union’s foreign affairs chief Josep Borrell has dismissed last week’s high-profile summit with China as a “dialogue of the deaf”, saying that Chinese leaders “did not want to talk about Ukraine”. In a stronger than usual rebuke of Beijing by Brussels’ top diplomat, Borrell told the European Parliament on Tuesday evening that Chinese Premier Li Keqiang and President Xi Jinping wanted to “instead focus on the positive things”. “China wanted to set aside our differences on Ukraine, they didn’t want to talk about Ukraine. They didn’t want to talk about human rights and other stuff and instead focus on positive things,” Borrell said during a fiery debate on China in Strasbourg, France. (SCMP)

GERMANY: Germany’s property market is becoming “increasingly vulnerable” due to rising prices and regulators could take steps to restrict lending if more risks accumulate, Joachim Wuermeling, a member of the Bundesbank’s executive board, says in interview with Handelsblatt newspaper. “Loans with an initial fixed interest rate of more than ten years now account for half of household loans for house purchases.” (BBG)

FRANCE: French President Emmanuel Macron would beat Marine Le Pen in the country's presidential election later this month, though Le Pen has gained ground in recent weeks, showed an Ipsos Sopra Steria Cevipof poll for Le Monde newspaper. The poll showed Macron would lead in the first round of votes on April 10, with 26.5% versus 21.5% for Le Pen in second place. Those figures compared to 28% for Macron and 17.5% for Le Pen in the last poll conducted March 21-24, said Ipsos Sopra Steria Cevipof. Macron would then beat Le Pen in the second round run-off vote on April 24 by 54% to 46%. (RTRS)

UKRAINE: Two senators urged President Joe Biden to remove 25% tariffs on Ukrainian steel imposed by his predecessor to help the war-torn nation stabilize and rebuild its economy. Dianne Feinstein, a California Democrat, and Pat Toomey, a Pennsylvania Republican, wrote to Biden in a letter dated Tuesday, saying that the move would be in line with his efforts to punish Russia and help Ukraine counter the invasion. Metal production is a “cornerstone” of Ukraine’s economy, the senators said. The nation is the world’s 13th-largest steel producer, and the metal and related sectors account for 12% of Ukraine’s gross domestic product, with 80% of production typically exported, the senators said. (BBG)

U.S.

FED: Federal Reserve Governor Lael Brainard called the task of reducing inflation pressures “paramount” and said the central bank will raise interest rates steadily while starting balance sheet reduction as soon as next month. The Federal Open Market Committee “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting,” Brainard said Tuesday in a virtual speech to the Minneapolis Fed. Policy makers next meet May 3-4. “Given that the recovery has been considerably stronger and faster than in the previous cycle, I expect the balance sheet to shrink considerably more rapidly than in the previous recovery,” she said, adding that the “caps” set to govern the pace of asset roll-off could be “significantly larger” and phased in much faster than last time around. (BBG)

FED: Interest rate hikes aimed at bringing down too-high inflation will slow economic growth but will not tip the U.S. economy into recession, San Francisco Federal Reserve Bank President Mary Daly said on Tuesday. “I’m not expecting that we’ll fall into recession,” Daly told a meeting of the Native American Finance Officers Association in Seattle, noting there is a lot of “momentum” in the economy. “We could slow so it looks like we are teetering close to it, that’s possible, but it will be a short-lived event I expect, and then we’ll be back up.” (RTRS)

ECONOMY: Treasury Secretary Janet L. Yellen plans on Wednesday to warn of major consequences for the global economy as a result of Russia’s invasion of Ukraine, with both the conflict and global sanctions imposed in response to Russia’s aggression disrupting the flow of food and energy around the world. The comments by Ms. Yellen, who will appear before a House committee on Wednesday, come as the United States and the European Union are poised to announce another round of sanctions on Russian financial institutions, government officials and state-owned enterprises as the war in Ukraine shows no sign of abating. (NYT)

POLITICS: Senate Republicans are refusing to say if they would fill a future potential Supreme Court vacancy during President Biden’s remaining tenure in a warning shot to the White House as the GOP aims to take back control of Congress after the midterms. Senate Minority Leader Mitch McConnell (R-Ky.), who would be majority leader again if Republicans took back the chamber, is so far refusing to tip his hand. “I’m not going to go forward with any prediction on what our strategy might be should we become the majority,” McConnell said when asked about a potential vacancy in 2023 or 2024. (The Hill)

CORONAVIRUS: President Joe Biden on Tuesday tasked the U.S. health department with developing a national action plan to tackle the looming health crisis of long COVID, a complex, multi-symptom condition that leaves many of its sufferers unable to work. Long COVID, which arises months after a COVID-19 infection, affects nearly 7% of all U.S. adults and 2.3% of the overall population and has cost an estimated $386 billion in lost wages, savings and medical bills, according to an analysis by the Solve Long Covid Initiative, a non-profit research and advocacy group. The plan will expand research, care and disability services for people suffering from the condition, the White House said. Becerra will release the jointly developed National Research Action Plan within 120 days, Biden said in a presidential memorandum. (RTRS)

OTHER

GEOPOLITICS: The top US military officer told lawmakers Tuesday that the world is becoming more unstable and the "potential for significant international conflict is increasing, not decreasing." Chairman of the Joint Chiefs Gen. Mark Milley and Defense Secretary Lloyd Austin appeared before the House Armed Services Committee in their first testimony before Congress since Russia's invasion of Ukraine. The two Pentagon leaders said the threats from both Russia and China remain significant, while they defended the US approach to the war and the flow of arms the US is sending to Ukraine. (CNN)

CORONAVIRUS: Chinese drug maker Kintor Pharmaceutical Ltd. soared in Hong Kong after saying its pill was highly effective in reducing the risk of hospitalization or deaths related to Covid-19, raising the prospect of a first homegrown antiviral treatment. (BBG)

G20: Russia’s war in Ukraine is looming large over a Group of 20 summit that’s still seven months off, with officials frantically preparing in case President Vladimir Putin decides to turn up. The range of possible scenarios includes some leaders staying away, sending lower-level delegations or only dialing in from afar, according to people familiar with the discussions among member countries. The meeting could very well end without a formal communique for the first time. This year’s G-20, which includes conversations among chief negotiators, a slate of ministerial meetings and then the summit in November, is being hosted by Indonesia, which finds itself in a very uncomfortable position given the conflict in Ukraine. (BBG)

AUKUS: Britain, the US and Australia will work together on the development of hypersonic weapons and the technology to shoot them down after Russia claimed to have tested the weapons in Ukraine. The landmark Aukus security pact will be expanded to include co-operation on the advanced high speed weapons, and the sharing of electronic warfare and cyber capabilities. Hiding key targets and the development of laser weapons, which could disrupt the missile’s flight path, could form part of the plans for anti-hypersonic weaponry, British officials said. (The Times)

ASIA: Growth in developing Asia will likely be slower this year than previously thought, the Asian Development Bank said on Wednesday, as the war in Ukraine is expected to derail economic recovery in the region still reeling from the COVID-19 pandemic. The bloc's combined economy, which includes China and India, is projected to expand 5.2% this year, the ADB said in a report, down slightly from 5.3% forecast in December, and sharply lower than the previous year's 6.9% growth. For 2023, the region is forecast to grow 5.3%. "The Russian invasion of Ukraine has severely disrupted the outlook for developing Asia which is still contending with COVID-19," the ADB said in its Asian Development Outlook report. (RTRS)

BOK: South Korean parliament will hold confirmation hearing on Bank of Korea Governor nominee Rhee Chang-yong on April 19, Korea Economic Daily reports. This means that the central bank will hold its next monetary policy meeting on April 14 without Governor. (MNI)

HONG KONG: Beijing officials have told Hong Kong’s political elites that the city’s No 2 official, John Lee Ka-chiu, will be the sole candidate to receive the blessing of the central government in this year’s chief executive election, the Post has learned. Chief Secretary Lee is expected to tender his resignation on Wednesday to pave the way for a run at the city’s top job, with no other heavyweight candidates likely to challenge him, two sources said. (SCMP)

TAIWAN: The U.S. State Department has approved the potential sale to Taiwan of equipment, training and other items to support the Patriot Air Defense System in a deal valued at up to $95 million, the Pentagon said on Tuesday. (RTRS)

MEXICO: Mexico's president on Tuesday ramped up pressure on opposition lawmakers to support a constitutional energy reform a day after they said they would reject the bill, suggesting those who did not would be "traitors" to the country. The bill, which congressional leaders have said they want to vote on next week, is a central plank of President Andres Manuel Lopez Obrador's drive to give greater control of the electricity market to the state over private companies. (RTRS)

MEXICO: Mexican President Andres Manuel Lopez Obrador expressed concern about food inflation and asked U.S. Agriculture Secretary Tom Vilsack to work with Mexico to curb the impact of rising prices, Mexican Agriculture Minister Victor Villalobos said on Tuesday. Vilsack is in Mexico meeting with Villalobos to discuss cooperation on "shared priorities including open trade, science-based policy making and sustainable and climate-smart agricultural production," the two governments said in a statement. (RTRS)

BRAZIL: A dinner between Brazil's Workers Party (PT) leader Gleisi Hoffmann and 30 businessmen on Monday ended with two pieces of information well-received by the latter: The party will work with central bank chief Roberto Campos Neto and there is no thought of controlling fuel prices if former president Luiz Inacio Lula da Silva wins the October election. The event, hosted by think tank Esfera Brasil, brought together Hoffmann and heavyweights such as retail tycoon Abilio Diniz and Guararapes Chairman Flavio Rocha, who discussed economic policies to be adopted by a potential new Lula administration. According to sources, Hoffmann assured them the party does not intend to try to remove Campos Neto from office. She made it clear the PT will respect his mandate and does not wish to change the law that made the central bank independent. (RTRS)

PERU: Peruvian President Pedro Castillo on Tuesday afternoon lifted a curfew order following widespread defiance on the streets, as protests spiraled against rising fuel and fertilizer prices triggered by the Ukraine conflict. "I must announce that from this moment on we are going to cancel the curfew order," Castillo said in a meeting with Congress. "We now call on the Peruvian people to keep calm." (RTRS)

RUSSIA: The United States will ask the U.N. General Assembly to suspend Russia from the Human Rights Council, the U.S. ambassador to the United Nations said on Monday, after Ukraine accused Russian troops of killing dozens of civilians in the town of Bucha. A two-thirds majority vote by the 193-member assembly in New York can suspend a state for persistently committing gross and systematic violations of human rights. "Russia's participation on the Human Rights Council is a farce," U.S. Ambassador Linda Thomas-Greenfield said on a visit to Romania. "And it is wrong, which is why we believe it is time the UN General Assembly vote to remove them." (RTRS)

RUSSIA: The U.S. Internal Revenue Service has suspended information exchanges with Russia's tax authorities in a bid to hamper Moscow's ability to collect taxes and fund its war against Ukraine, the Treasury Department told Reuters on Tuesday. Under a 30-year-old tax treaty, the IRS and Russia's Federal Tax Service have shared information to aid domestic tax collections and enforcement of tax laws in both countries. The IRS can request information about U.S. taxpayers from Russian authorities and vice-versa. The Treasury said it has not shared any tax information with Russian authorities since Russia's invasion of Ukraine began on Feb. 24, but the action disclosed on Tuesday formalizes the suspension. "This ensures that the United States is not providing any information that could contribute to the enrichment of the Russian government through increased tax collections or facilitating in any way the persecution of Russian dissidents or the targeting of Ukrainian citizens or businesses," the Treasury said in a statement to Reuters. (RTRS)

RUSSIA: The United States and its allies will on Wednesday impose new sanctions on Russian banks and officials and ban new investment in Russia, the White House said, after officials in Washington and Kyiv accused Moscow of committing war crimes in the Ukrainian town of Bucha. The sanctions will increase curbs on financial institutions and state-owned enterprises in Russia and target Russian government officials and their families, White House press secretary Jen Psaki told reporters on Tuesday. "Tomorrow, what we're going to announce... in coordination with the G7 and EU, (is) an additional sweeping package of sanctions measures that will impose costs on Russia and send it further down the road of economic, financial and technological isolation," Psaki said, noting that the G7 and EU comprised around 50% of the global economy. (RTRS)

RUSSIA: The European Union has proposed sanctioning two daughters of President Vladimir Putin, according to diplomats familiar with the plan, a move that would add the Russian leader’s closest family members to a growing list of individuals sanctioned in response to Russia’s invasion of Ukraine. (WSJ)

RUSSIA: The United States will provide an additional $100 million in security assistance to Ukraine, including anti-armor systems, Secretary of State Antony Blinken said on Tuesday. (RTRS)

RUSSIA: EU members will on Wednesday begin negotiations over a proposed ban on Russian coal imports as part of a new package of sanctions from Brussels that includes a block on transactions with four banks and the cutting of transport links. Unveiling the plans, Ursula von der Leyen, the European Commission president, said on Tuesday that she would propose to close EU ports to Russian vessels and ban Russian and Belarusian road transport operators from the region.“This ban will drastically limit the options for the Russian industry to obtain key goods,” she added. The new penalties will be discussed by EU ambassadors with a view to obtaining a unanimous agreement among the 27 member states. The coal import ban is one of the boldest because Russia is a big supplier of thermal coal to the EU, accounting for 70 per cent, or 36mn tonnes, of the bloc’s imports last year, according to Eurostat. (FT)

RUSSIA: The Czech Republic has been sending tanks and infantry fighting vehicles to Ukraine, in a below-the-radar bid to bolster the eastern European nation’s capacity to resist Russia’s invasion. The deliveries are the first known time that a foreign country has supplied tanks to Ukraine, whose president, Volodymyr Zelensky, has repeatedly appealed for western military support against the Russian onslaught. Czech officials said the country had been providing a range of equipment, including Soviet-designed T-72 tanks, infantry fighting vehicles, armoured personnel carriers and howitzers to Ukraine for several weeks. (FT)

RUSSIA: The American company Intel, which is one of the leading suppliers of microprocessors, suspends its activities in Russia due to the situation around Ukraine. This was announced on Tuesday by the press service of the company. (TASS)

RUSSIA: Russia is turning to microchip manufacturers in China to circumvent western sanctions which have boosted demand for bank cards linked to the Mir payment system, an executive with the domestic payment system said. Western sanctions imposed on Russia over its invasion of Ukraine have cut Moscow off the global financial system and from nearly half of its $640 billion in gold and foreign exchange reserves. Oleg Tishakov, a board member with the National Card Payment System (NSPK), said Russia is facing a shortage of microchips as Asian manufactures suspend production amid a coronavirus pandemic and European suppliers have stopped cooperating with Moscow following sanctions. "We are looking for new microchip suppliers and [have] found a couple in China, with certification process ongoing," Tishakov told a conference on Tuesday, without giving further details. (RTRS)

CHINA

PBOC: The People’s Bank of China should consider cutting medium and long-term interest rates moderately, as the relatively high rates are still dampening longer-term financing especially mortgage lending, the Securities Times reported citing Zeng Gang, deputy director of the National Institution for Finance & Development. Weak credit demand is the core problem constraining credit expansion, said Zeng. More efforts should be made to smoothen the monetary policy transmission mechanism, such as better using government funds to drive private capital in investment, the newspaper cited Zeng as saying. (MNI)

CORONAVIRUS: Shanghai has had to switch some of its exporting cargo containers to smaller neighboring ports of Ningbo or Nanjing to avoid Covid restrictions imposed at the world’s busiest port, Yicai.com said. Export goods from Shanghai may have fallen as much as 40% recently, the newspaper said citing a shipping executive. Covid measures have also caused supply chain snags and reduced demand for containers, with prices of container shipping to the U.S. west coast down by over 30% from February, it said. (MNI)

ECONOMY: China’s Q1 GDP may come in at 4-5% amid the impact of Covid-19 outbreaks, the Shanghai Securities News reported citing analysts. Industrial production slowed significantly as the manufacturing PMI contracted to 49.5 while in many places factories were shut, the newspaper said citing Lian Ping, head of Zhixin Investment Research Institute. Infrastructure investment though maintained a rapid growth, supporting an overall 10% growth in fixed-asset investment, said Lian. Consumption even affected by the epidemic can still maintain a positive growth of around 2.0%, Lian added. (MNI)

ECONOMY: Spending during China’s three-day Qingming Festival holidays that ended on Tuesday plunged 30.9% from a year ago to CNY18.8 billion, about 39.2% of the level seen in 2019, the Securities Times reported citing the Ministry of Culture and Tourism. The number of people who undertook trips fell 26.2% to 75 million from last year, or 68% of the level in 2019, it said. (MNI)

OVERNIGHT DATA

CHINA MAR CAIXIN SERVICES PMI 42.0; MEDIAN 49.7; FEB 50.2

CHINA MAR CAIXIN COMPOSITE PMI 43.9; FEB 50.1

“The Caixin China General Services Business Activity Index came in at 42 in March, down from 50.2 the previous month. The March reading was the lowest since February 2020. The latest wave of the Covid-19 epidemic hit China’s services sector hard. “Both supply and demand in the services sector contracted sharply after the latest wave of Covid outbreaks started to take off in early March. The services PMI dropped to its lowest since February 2020, while the gauge of total new business dropped to its lowest since March 2020. Overseas demand remained weak, with the gauge of new export business falling to its lowest since October 2020. “Services employment fell slightly. The measure for employment remained in contractionary territory for the third consecutive month. Amid the new wave of outbreaks, market demand was lacking and there was little motivation for enterprises to expand their operations and increase staff. As a result, the backlog of work in the services sector increased. “Price gauges rose, increasing service enterprises’ costs. The gauge of input costs stayed in positive territory and rose, indicating that the increase in cost pressure accelerated. Labor costs and prices of raw materials, food and freight all increased. The gauge of prices charged was slightly over 50 in March and lower than the previous month, impacted by weak demand. “Businesses grew less optimistic. Entrepreneurs were still confident that the epidemic would be brought under control eventually, but this optimism faded. In March, the measure for planned future activity hit a 19-month low." (IHS Markit)

NEW ZEALAND MAR ANZ COMMODITY PRICE +3.9% M/M; FEB +3.9%

CHINA MARKETS

PBOC NET DRAINS CNY440 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY440 billion after offsetting the maturity of CNY450 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0664% at 09:30 am local time from the close of 1.7927% on Saturday.

- The CFETS-NEX money-market sentiment index closed at 41 on Saturday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3799 WEDS VS 6.3509

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.3799 on Wednesday, compared with 6.3509 set before three-day public holiday.

MARKETS

SNAPSHOT: Fed Hawks Circle As Russia Faces More Sanctions

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 444.96 points at 27347.89

- ASX 200 down 39.555 points at 7488.5

- Shanghai Comp. down 7.263 points at 3275.454

- JGB 10-Yr future down 46 ticks at 149.3, yield up 1.7bp at 0.236%

- Aussie 10-Yr future down 12 ticks at 96.965, yield up 11.7bp at 2.971%

- U.S. 10-Yr future -0-21+ at 120-08, US 10-Yr yield up 8.04bp at 2.627%

- WTI crude up $0.04 at $101.98, Gold down $2.46 at $1921.24

- USD/JPY up 30 pips at Y123.89

- FED’S BRAINARD: FED TO SHRINK BALANCE SHEET AT RAPID PACE AS SOON AS MAY (BBG)

- FED’S DALY: FED COULD START BALANCE-SHEET REDUCTION AS EARLY AS MAY (BBG)

- YELLEN TO WARN OF “ENORMOUS ECONOMIC REPERCUSSIONS” OF UKRAINE INVASION (NYT)

- U.S. AND EU TO ANNOUNCE NEW SANCTIONS AGAINST RUSSIA WEDNESDAY

BOND SUMMARY: Core FI Crumble Under Pressure Of Hawkish Fed, BoJ Stays On Sidelines

Asia-Pacific reaction to Tuesday's hawkish Fedspeak resulted in continued selling pressure on core FI, with participants assessing remarks from FOMC's Brainard, who called for rapid balance-sheet reduction to start as soon as next month, a view later echoed by her Fed colleague Mary Daly. A bleak Caixin Services PMI reading failed to provide any support to the space, with markets in China, Hong Kong and Taiwan open again after a holiday-elongated weekend.

- T-Notes extended their rout to a fresh cycle low of 120-11. TYM2 still hovers just above there, last -0-16 at 120-13. Eurodollar futures run 1.5-11.0 ticks lower through the reds. Cash Tsy yields sit 5.1-7.0bp higher across the curve, with benchmark 10-Year yield running as high as to 2.616% at its peak. The minutes from the FOMC's March monetary policy meeting headline the local docket on Wednesday, with Fed's Harker due to discuss the economic outlook.

- It seemed like BoJ inaction vs. upward pressure on yields exacerbated JGB weakness, with futures posting a downtick after the Bank stayed on the sidelines despite earlier speculation re: potential for unscheduled bond purchases. JBM2 changes hands at 149.34, 42 ticks below last settlement and 2 ticks above session low. JGB yields pressed higher in cash Tokyo trade, with bear steepening evident amid particular weakness in the super-long end. The 10-Year yield targeted by the BoJ sits at 0.230%, not too far from the official cap of 0.250%.

- 10-Year ACGB yield surged to multi-year highs as Aussie bonds sold-off, extending the prior day's drop caused by a hawkish tilt in the RBA's rhetoric on interest rates outlook. Cash ACGB yields trade 8.2-12.7bp higher across the curve. Futures also slipped, with YM last -9.0 & XM -10.0. Bills run 6-18 ticks lower through the reds. The space paid little attention to an auction for ACGB May '30 as focus turns to a parliamentary testimony from RBA's Bullock & Kent.

AUSSIE BONDS: The AOFM sells A$500mn of the 2.50% 21 May '30 Bond, issue #TB155:

The Australian Office of Financial Management (AOFM) sells A$500mn of the 2.50% 21 May 2030 Bond, issue #TB155:

- Average Yield: 2.9136% (prev. 1.5282%)

- High Yield: 2.9150% (prev. 1.5300%)

- Bid/Cover: 3.0200x (prev. 4.5167x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 63.2% (prev. 37.8%)

- Bidders 35 (prev. 39), successful 14 (prev. 13), allocated in full 7 (prev. 7)

EQUITIES: Lower As Fedspeak Spurs Caution

Most Asia-Pac equity indices are in the red at writing, following a negative lead from Wall St. Bearish spillover in the wake of Fed Gov Brainard’s hawkish comments on Tuesday was evident, with high-beta equities across the region struggling as U.S. Tsy yields have pushed higher in Asian hours.

- The Chinese CSI300 sits 0.5% worse off at typing, with a large miss in the Caixin Services PMI earlier in the session sending the index tumbling from neutral levels. The richly valued consumer staples sub-index struggled, while the large-cap ChiNext and tech-heavy STAR50 indices underperformed as well, with the latter duo dealing 1.3% and 2.3% softer respectively at writing.

- The Hang Seng trades 1.4% lower at typing, having pared losses from worst levels earlier in the session. China-based tech stocks underperformed, with the Hang Seng Tech Index dealing 3.2% weaker.

- Japan’s Nikkei 225 leads losses amongst regional peers, sitting 1.7% lower at typing. Tech-related stocks were mostly softer, while favoured names such as Tokyo Electron and Fast Retailing provided the most drag on the index. Elsewhere, financial and energy-related equities fared a little better, with limited gains observed in banking stocks.

- U.S. e-mini equity index futures sit flat to 0.2% worse off with NASDAQ contracts leading losses, each trading a touch above recently made one-week lows at typing.

OIL: Flat As EU Sanctions Miss Russian Crude For Now

WTI and Brent are either side of unchanged at typing, having risen from session lows below neutral levels. Both benchmarks however operate around the lower end of Tuesday’s range as the impulse from expectations surrounding an EU embargo on Russian energy has weakened from earlier in the week.

- To elaborate, the bloc has announced a phased ban on Russian coal imports in their latest round of sanctions in response to alleged war crimes in Ukraine, missing expectations from some quarters for similar measures on Russian crude. EC President Ursula von der Leyen has since stated that members will continue working on ending imports of Russian oil and gas, with no timeline specified.

- Looking to China, concerns re: energy demand remain elevated as fresh COVID case counts nationwide for Apr 5 surged past 20K (both symptomatic and asymptomatic). Shanghai will remain under lockdown as the authorities announced another round of mass testing to begin on Wednesday, while transport ministry data reported late on Tuesday revealed that travel by road and air over the recent Qingming national holiday had declined by much more than expected as the country expands pandemic control measures in some areas.

- Elsewhere, some worry re: tightness in crude supplies was alleviated as weekly U.S. API inventory estimates crossed late on Tuesday. Reports pointed to a surprise build in U.S. crude stockpiles and increases in distillate and Cushing hub inventories, while there was a drawdown in gasoline inventories.

- Up next, U.S. EIA data is due later on Wednesday (1430 GMT), with WSJ estimates calling for declines in crude, gasoline, and distillate stockpiles.

GOLD: Flat As Fed Takes Focus

Gold is back from session lows to be virtually unchanged at writing, printing ~$1,924/oz. The precious metal has struggled to make headway above neutral levels as nominal U.S. Tsy yields have risen in Asian hours (with the 10-Year Tsy yield hitting levels last witnessed since Apr ‘19), continuing to operate around the bottom of Tuesday’s range.

- To recap, gold closed ~$9/oz lower on Tuesday as U.S. real yields and the USD (DXY) ticked higher, facilitated by hawkish comments from Fed Gov Brainard pointing to a “rapid pace” of Fed balance sheet reduction that could begin as soon as May.

- Looking ahead, focus will turn to comments on the economic outlook from the Fed’s Harker (1330 GMT), as well as the release of the FOMC’s March meeting minutes (1800 GMT).

- From a technical perspective, bullion remains range bound, while the outlook is bearish following the pullback from $2,070.4 (Mar 8 high). Key support is located at ~$1,906.6/oz (50-Day EMA), with further support at $1,895.3/oz. While both support levels were probed last week, a clear break lower would likely signal room for deeper moves lower. On the other hand, resistance is situated at $1,966.1/oz (Mar 24 high).

FOREX: Fed's Brainard Cranks Up Hawkish Talk, Widening Policy Gap Saps Yen

The Asia-Pacific woke up to reports of hawkish comments from Fed policymaker Lael Brainard which rattled markets on Tuesday. As a reminder, she voiced support for starting a swift balance-book reduction as soon as next month. Regional headline flow failed to offer anything that could steal attention from Brainard, even as China, Hong Kong and Taiwan returned from holidays.

- Renewed awareness of a growing Fed/BoJ policy divergence pulled the rug from beneath yen, making it the worst G10 performer. Yesterday's remarks from BoJ Kuroda, who frowned upon "somewhat rapid" moves in the yen, failed to prevent the currency from losing ground. USD/JPY added ~30 pips and had a look above the Y124.00 mark, while its RSI moved further into overbought territory.

- The greenback garnered some strength amid a relentless upswing in U.S. Tsy yields. The DXY lodged its best levels since mid-2020.

- The Aussie dollar traded on a firmer footing as 10-Year ACGB yield surged to its highest point since 2015.

- In today's most awaited risk event, the FOMC will release the minutes from their March monetary policy meeting. German factory orders and comments from Fed's Harker, ECB's Lane & de Guindos, RBA's Bullock & Kent and Riksbank's Floden are also due.

FOREX OPTIONS: Expiries for Apr06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0935-55(E2.5bln), $1.1000(E1.1bln), $1.1035-41(E665mln)

- USD/JPY: Y121.00-10($670mln), Y121.75-80($752mln)

- USD/CAD: C$1.2500($598mln)

- USD/CNY: Cny6.4000($1.4bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/04/2022 | 0145/0945 | ** |  | CN | IHS Markit Final China Services PMI |

| 06/04/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 06/04/2022 | 0700/0900 |  | EU | ECB VP de Guindos speaks | |

| 06/04/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/04/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/04/2022 | 0900/1100 | ** |  | EU | PPI |

| 06/04/2022 | 0900/1100 |  | EU | ECB Schnabel Panel Moderation at ECB/EC Conference | |

| 06/04/2022 | 0900/1100 |  | EU | ECB Exec Board member Fabio Panetta speech | |

| 06/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/04/2022 | 1145/1345 |  | EU | ECB Philip Lane panel appearance | |

| 06/04/2022 | 1330/0930 |  | US | Philadelphia Fed's Patrick Harker | |

| 06/04/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 06/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 06/04/2022 | 1800/1400 | * |  | US | FOMC Minutes |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.