-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China Crude Oil Imports Accelerate In November

MNI BRIEF: RBA Holds, Notes Declining Inflation Risk

MNI EUROPEAN OPEN: The Caps Are (Almost) Set

EXECUTIVE SUMMARY

- FED TO AIM FOR USD95B CAP TO SHRINK BALANCE SHEET (MNI)

- ECB TO TAKE NEW DECISIONS ON POLICY PATH IN JUNE, NAGEL SAYS (BBG)

- SCHUMER: THURSDAY VOTE EXPECTED ON RUSSIA OIL BAN (BBG)

- UKRAINE URGES CIVILIANS TO FLEE LOOMING RUSSIAN OFFENSIVE IN EASTERN REGIONS (WSJ)

- RUSSIA GOVT SEES WEST CLOSING ROUTE TO AVOID DEFAULT (VEDOMOSTI)

- CHINA MARKET LIQUIDITY SEEN STABLE IN APRIL (SEC. DAILY)

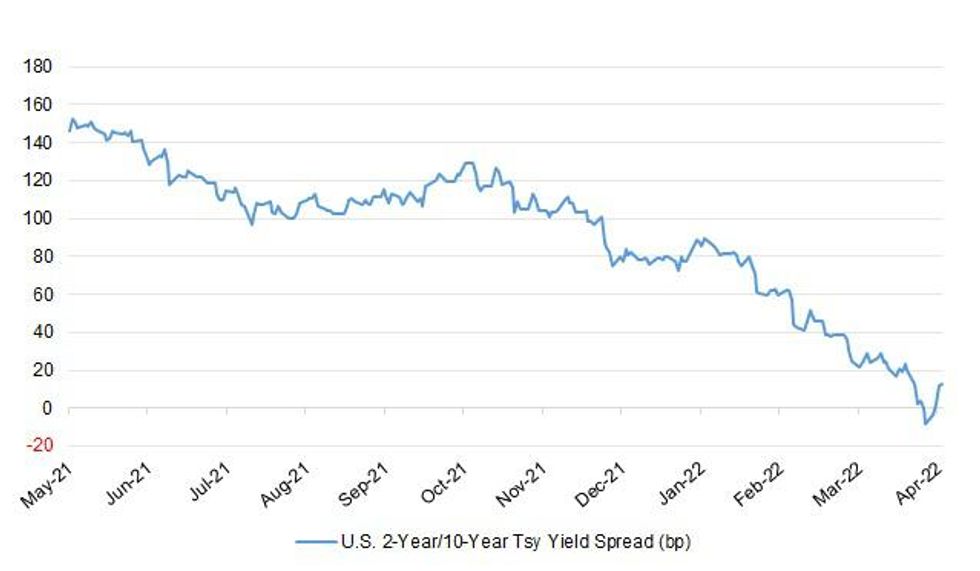

Fig. 1: U.S. 2-/10-Year Tsy Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: UK households are draining their savings at the fastest rate for nine years as the cost-of-living squeeze bites. About 40 per cent of households built up their savings during lockdown but 60 per cent did not, according to the Scottish Widows Household Finance Index. It found that the amount of cash left for discretionary spending after living expenses has fallen by the sharpest amount since 2013. The measure of people’s perceptions of financial wellbeing fell to 38.5 per cent in the first quarter of this year, its lowest since the start of the pandemic two years ago. A score of 50 per cent indicates no change on the previous quarter. (The Times)

EUROPE

ECB: The European Central Bank will decide on the next monetary-policy steps before the summer, and an interest-rate increase could be on the cards soon, according to Bundesbank President Joachim Nagel. “We’ll take new decisions on the basis of numbers that we’ll see in June,” Nagel told German public broadcaster ARD in an interview. “What we’re seeing at the moment suggests that savers could potentially enjoy higher rates soon.” The Bundesbank president also said inflation could average 6% this year, driven in part by a range of special factors. He said this level of price increases “mustn’t become entrenched, which will surely be a task for us in the eurosystem this year.” (BBG)

FISCAL: Ukraine needs a new version of the Marshall plan to rebuild the country in the aftermath of Russia’s invasion, a senior EU official said. EU budget chief Johannes Hahn told reporters Wednesday that a loan program under conditions would help Kyiv to recover quickly and “it might lead to a faster approximation to the EU.” The bloc is assessing Ukraine’s request to join the club. Hahn said that some of the conditions imposed by the EU could be addressed with this new instrument “provided it is well-designed”. (BBG)

ITALY: Italy on Wednesday slashed its gross domestic product (GDP) growth forecast for this year and next year, with the Russia-Ukraine conflict acting as a drag on economic growth. The country's economy is expected to grow 3.1 percent in 2022, compared to 4.7 percent based on previous estimate, according to a press briefing from Italian Prime Minister Mario Draghi and Economy and Finance Minister Daniele Franco. For 2023, the government expects a growth rate of 2.4 percent, down from a previous target of 2.8 percent. According to Franco, the government expects the budget deficit to be 5.6 percent of the country's GDP this year, while government debt is targeted at 147 percent of GDP. Italy remains one of Europe's most indebted nations in GDP terms. (Xinhua)

U.S.

FED: MNI: Fed To Aim For USD95B Cap To Shrink Balance Sheet

- The Federal Reserve will begin rapidly shrinking its USD8.9 trillion balance sheet starting as early as May as part of a broader tightening campaign that has officials considering one or more 50BP rate hikes this year, minutes from the central bank's March meeting showed. "Participants generally agreed that monthly caps of about $60 billion for Treasury securities and about $35 billion for agency MBS would likely be appropriate. Participants also generally agreed that the caps could be phased in over a period of three months or modestly longer if market conditions warrant," the March FOMC minutes said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ECONOMY: MNI BRIEF: Atlanta Fed's Wage Growth Tracker Edges Up To 6.0%

- The Atlanta Fed's Wage Growth Tracker continued to edge up in March, with the 3-month moving average increasing to 6.0% from 5.8% in February, matching a high going back to August of 1990 - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

CORONAVIRUS: White House medical adviser Anthony Fauci said he expects the BA.2 omicron subvariant to fuel a U.S. increase in Covid-19 cases and that a more serious surge could arrive with cooler fall weather. While it’s difficult to predict the next significant wave, “I would not be surprised if we see an uptick in cases,” Fauci, who’s also the longtime director of U.S. National Institute of Allergy and Infectious Diseases, said in an interview on Bloomberg Television. (BBG)

OTHER

U.S./CHINA/TAIWAN: U.S. House of Representatives Speaker Nancy Pelosi is planning to visit Taiwan after her trip to Japan this weekend, in what would be the first visit to the self-governed island by the holder of the office in a quarter century, broadcaster FNN reports, citing an unidentified person. U.S. side hastily arranged the visit in order to show support for Taiwan amid growing military and economic pressure from China and Russia’s invasion of Ukraine. Planned stop in South Korea cancelled as a result. Pelosi is scheduled to arrive in Taiwan on April 10, Taipei-based United Daily News reports, citing people familiar with the matter. Pelosi’s office did not confirm or deny the trip in response to an inquiry from Bloomberg News. (BBG)

BOJ: Bank of Japan board member Asahi Noguchi said on Thursday the central bank must maintain ultra-easy monetary policy as it will take "significant" time to achieve its 2% inflation target. "Japan is not experiencing the kind of high inflation seen in many other countries," Noguchi told a speech, adding that policymakers must continue to focus on ending deflation rather than curbing inflation. (RTRS)

JAPAN: The International Monetary Fund (IMF) cut Japan's economic growth forecast on Thursday and urged policymakers to consider preparing a contingency plan in case the Ukraine crisis derails a fragile recovery. "Escalation of the Ukraine conflict poses significant downside risks to the Japanese economy," the IMF said in a staff report after its Article 4 policy consultation with Japan, pointing to rising commodity prices and the potential hit to trade. The IMF said it now expects Japan's economy to grow 2.4% this year, lower than a projection for 3.3% expansion made in January, due to an expected contraction in the first quarter and the spillover effects of the Ukraine war. (RTRS)

NORTH KOREA: North Korea might be considering conducting a nuclear test next week to coincide with national celebrations to mark the birthday of its deceased founder, the Biden administration’s point man for Pyongyang warned. Sung Kim, the U.S.’s special envoy for North Korea, told reporters Wednesday that Pyongyang might be looking at some sort of display of its military power in conjunction with the April 15 anniversary of the birth of the late Kim Il Sung. An atomic test would be the first globally in more than four years and add to concerns about the risks of nuclear brinkmanship amid Russia’s war in Ukraine. “I don’t want to speculate too much, but I think it could be another missile launch, it could be a nuclear test,” he said in a conference call. The holiday celebrating the grandfather of the current leader, Kim Jong Un, is one of the most important events on the North Korean calendar. (BBG)

CANADA: Canada will earmark C$15 billion ($12 billion) over five years for a Growth Fund to attract private investment in new and green technologies, a senior government source said on Wednesday, a day before this year's budget presentation. The money being set aside for the fund will come from the "existing fiscal framework" and the government will seek to attract C$3 of private investment for every C$1 of public funding, the source said. The finance ministry declined to comment. Finance Minister Chrystia Freeland is due to present the 2022 budget around 4 p.m. ET (2000 GMT) on Thursday. (RTRS)

CANADA: Canada will ban most foreigners from buying homes for two years and provide billions of dollars to spur construction activity in an attempt to cool off a surging real-estate market. The measures will be contained in Finance Minister Chrystia Freeland’s budget on Thursday, according to a person familiar with the matter, asking not to be named because the matter is private. The foreign-buyer ban won’t apply to students, foreign workers or foreign citizens who are permanent residents of Canada, the person said. (BBG)

BRAZIL: A vacuum in the government’s political articulation motivated Viana’s appointment to the role, reports newspaper Estado based on confirmation by the senator himself. Position has been vacant since December 2021, after Fernando Bezerra resigned. Carlos Viana also changed parties, leaving the MDB towards the President Jair Bolsonaro’s PL. (BBG)

BRAZIL: Brazil's government appointed Jose Mauro Coelho on Wednesday to be the next chief executive of state-run oil company Petrobras (PETR4.SA), after a prior appointee declined to accept the offer. Coelho, a former deputy at Brazil's Mines and Energy Ministry, has more than 25 years of professional experience, working in the oil, natural gas and biofuels sectors. The government also appointed current board member Marcio Andrade Weber as Petrobras' next chairman. Weber initially joined Petrobras in 1976 where he worked for 16 years, being one of the pioneers in the development of the Campos Basin. (RTRS)

RUSSIA: Russia has withdrawn the forces — as many as 40,000 soldiers — it had arrayed around Kyiv and Chernihiv, two cities in the north, to rearm and resupply in Russia and neighboring Belarus before most likely repositioning them in eastern Ukraine in the next few weeks, U.S. officials say. (New York Times)

RUSSIA: Ukraine urged civilians to leave the eastern Donetsk, Luhansk and parts of the Kharkiv regions as it braced for a major new Russian offensive following Moscow’s withdrawal from the north of the country. “You need to evacuate now, while this possibility still exists,” Ukraine’s deputy prime minister and minister for occupied territories, Iryna Vereshchuk, said on Ukrainian TV on Wednesday. “Later, people will be under fire and under threat of death. We won’t be able to help because it will be practically impossible to cease fire.” (WSJ)

RUSSIA: Russia's defence ministry said on Wednesday that a Ukrainian fuel storage base was destroyed by Russian missiles in the Kharkiv region, the RIA news agency quoted it as saying. (RTRS)

RUSSIA: A small number of Ukrainians who were already in the U.S. for military education have been trained on how to use dive-bombing Switchblade drones and will soon return to their country with that expertise, a senior American defense official told reporters. The U.S. is sending Ukraine more than 100 of the armed drones, including 10 of the newest model equipped with tank-busting warheads. (BBG)

RUSSIA: British military chiefs are drawing up plans to send armoured vehicles to Ukraine, The Times has learnt. The UK is adding to its offer of lethal weapons in the belief that the next three weeks will be critical in determining the outcome of the war. Options under consideration in the Ministry of Defence include sending a protected patrol vehicle, such as the Mastiff, or a vehicle like the Jackal, which can be used as a reconnaissance or long-range patrol vehicle. These could enable Ukrainian forces to push further forward towards Russian lines. (The Times)

RUSSIA: Biden said that Russia has committed “major war crimes” in Ukraine and that U.S. sanctions are crushing its economy. “There’s nothing less happening than major war crimes. Responsible nations have to come together to hold these perpetrators responsible,” Biden said in a speech to a convention of construction unions in Washington on Wednesday. He said that sanctions already imposed by the U.S. and allies are predicted to shrink the Russian economy by “double digits this year alone” and added that “we’re going to stifle Russia’s ability to grow its economy for years to come.” (BBG)

RUSSIA: Secretary of State Antony Blinken said war crime probes just getting underway as Russian troops withdraw from parts of Ukraine could take years but added, “I can guarantee you there will be a relentless effort to make sure that those responsible for what we’re seeing are held accountable.” Blinken said in an interview with NBC News in Brussels that the scenes of civilian killings in Bucha and other areas where Russian troops have pulled back are worse than expected. Russia has denied committing atrocities. (BBG)

RUSSIA: The international community shouldn’t push for “peace at any price” with Vladimir Putin, Estonia Prime Minister Kaja Kallas told Axios in an interview on Tuesday. Estonia, like Latvia and Lithuania, is a member of NATO and the EU but also a neighbor to Russia. The Baltic states fear if Putin is not defeated in Ukraine he could become more aggressive. (Axios)

RUSSIA: Ukraine wants sanctions that are economically destructive enough for Russia to end its war after accusing some countries of still prioritising money over punishment for civilian killings that the West condemns as war crimes. The democratic world must reject Russian oil and completely block Russian banks from the international finance system, President Volodymyr Zelensky said, in his daily video address early on Thursday (April 7). After grisly images of dead civilians in the streets of Bucha sparked international condemnation, Zelensky said Kremlin forces were trying to cover up evidence of atrocities. "We have information that the Russian military has changed its tactics and is trying to remove people who have been killed from streets and basements... this is just an attempt to hide the evidence and nothing more," Zelensky said, but did not provide evidence. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Thursday urged the democratic world to reject Russian oil and said the failure to quickly agree to an embargo was costing Ukrainian lives. In an early morning video address, Zelinskiy also said he would continue to insist that Russian banks be completely blocked from the international finance system

RUSSIA: The United National General Assembly will vote Thursday on whether to suspend Russia from the UN’s Human Rights Council over accusations of atrocities that include the murder of unarmed civilians, AFP and the Associated Press reported, citing spokeswoman Paulina Kubiak. A two-thirds majority vote from the assembly would be needed to suspend a state from the council. (BBG)

RUSSIA: Senate Majority Leader Chuck Schumer, the top Democrat in the chamber, said President Putin must be held accountable for the “despicable war crimes he is committing against Ukraine.” “When we murder wantonly innocent civilians because of who they are, whether it be their religion, their race, or their nationality, that is genocide, and Mr. Putin is guilty of it,” Schumer said in remarks on the Senate floor Wednesday. The Senate will vote Thursday on measures to revoke normal trade relations with Russia and ban oil imports from the country. (BBG)

RUSSIA: The United States won't participate in G20 meetings that Russia is participating in, US Treasury Secretary Janet Yellen said Wednesday. Speaking at the House Financial Services Committee, Yellen said she'd made that position clear to other finance ministers in the group. (CNN)

RUSSIA: Japan’s government doesn’t plan to include a ban of imports of Russian coal as part of its latest round of sanctions in order to avoid further pushing up energy prices, Mainichi reports, without saying where it obtained the information. Japan gets ~15% of its coal imports from Russia. Yomiuri separately reports Japan is considering an asset freeze on Sberbank as well as a ban on Russian farm imports. (BBG)

RUSSIA: The Russian ruble's near complete recovery in recent weeks is not a signal that the Russian economy is weathering the sanctions Washington and its allies have imposed since Russia invaded Ukraine, U.S. Treasury Secretary Janet Yellen said on Wednesday. The Russian economy is "reeling" from the sanctions imposed after the late February invasion, Yellen told the House Financial Services Committee. The market for rubles has become so distorted by actions of the Russian government and its central bank to limit capital outflows that "you should not infer anything" from the value of the ruble, which fell to a record low against the U.S. dollar immediately after the invasion but has since retraced most of those losses. (RTRS)

RUSSIA: Russia’s government now views investors from “unfriendly” countries declaring that it has defaulted on its FX-denominated debt as the base case scenario, Vedomosti reports, citing three unidentified people close to the cabinet. (BBG)

IRAN: Secretary of State Antony Blinken said on Wednesday that he is not “overly optimistic” at the prospects of bringing the nuclear agreement with Iran to a conclusion. In an interview with MSNBC he said, “Despite all the efforts we put into it, we’re not there and time is getting extremely short, but this is something that we will be talking to our European partners about this afternoon and on the next day.” (Jerusalem Post)

MIDDLE EAST: Three missiles fell near an oil refinery in Iraq's Erbil on Wednesday without causing any damages or casualties, Kurdistan anti-terrorism authorities said in a statement. (RTRS)

EQUITIES: Samsung Electronics Co. reported preliminary earnings for the first quarter that beat analysts’ estimates on robust demand for new smartphone models and memory chips that go into servers. Operating profit increased 50% to 14.1 trillion won ($11.6 billion) for the three months ended March, South Korea’s biggest company said Thursday in a statement. Analysts estimated 13.4 trillion won on average. Sales advanced 18% to 77 trillion won, also higher than expected. Samsung will provide net income and divisional performance when it reports full earnings on Apr. 28. (BBG)

ENERGY: Germany should explore its domestic oil and gas reserves in the North Sea, Finance Minister Christian Lindner was quoted as saying on Wednesday, as Europe's biggest economy looks for alternatives to cut its dependence on Russian fossil fuels. After years of prospering from Russian energy imports, Germany is convulsed by a debate over how to unwind a business relationship that critics say is financing Russia's invasion of Ukraine. Russia supplies 40% of Europe's gas needs. (RTRS)

ENERGY: Italian Prime Minister Mario Draghi said on Wednesday that halting gas imports from Russia is not being considered at the EU level, but if a consensus on the matter is reached Italy will willingly go along with it. (RTRS)

ENERGY: MNI: EU Officials See Ban On Russian Gas Closer

- The European Union could move closer to extending sanctions to Russian oil and even natural gas in coming weeks, EU officials told MNI, adding that German opposition to such a move is likely to eventually cede but that if there is to be an import ban on gas it would have to be in place before the summer - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

OIL: The International Energy Agency on Wednesday said its member countries had agreed to release 120 million barrels of oil, with the United States contributing half, in a bid to cool oil prices after Russia's invasion of Ukraine. "The @IEA is moving ahead with a collective oil stock release of 120 million barrels (including 60 million barrels contributed by the US as part of its overall draw from its Strategic Petroleum Reserve)," IEA Executive Director Fatih Birol tweeted. (RTRS)

OIL: U.S. Treasury Secretary Janet Yellen said on Wednesday that sanctions imposing a full ban on Russian oil exports would likely result in “skyrocketing” global prices that would hurt the United States and its democratic allies. Yellen told the U.S. House Financial Services Committee she hopes oil companies in the United States and elsewhere can ramp up production in the next six moths, enticed by higher prices, which may allow for tougher restrictions on Russian oil. (RTRS)

OIL: Tankers carrying 22 million barrels of Russian, Iranian and Venezuelan oil are piling up off China, according to Kpler, as the country battles a virus outbreak that’s sapping demand and causing logistics problems. China has been one of the only buyers of sanctioned Iranian and Venezuelan oil over the last few years. The world’s largest crude importer is also still taking Russian supplies that are being largely shunned since the invasion of Ukraine. The trade in the discounted oil is now being disrupted by the country’s worsening virus outbreak, with waiting times to unload ships increasing. Kpler estimates that daily oil demand will drop by at least 450,000 barrels in April, mainly due to falling consumption of gasoline and jet fuel, according to Jane Xie, a senior oil analyst at the data and analytics firm in Singapore. “The ongoing lockdowns in China are definitely having a massive impact on the country’s mobility and consequent oil demand,” she said. “There are also logistical bottlenecks.” (BBG)

OIL: The Canadian government on Wednesday approved a $12 billion offshore oil project proposed by Norway's Equinor ASA, after an environmental assessment concluded it would not cause significant adverse effects. The Bay du Nord project would involve building a floating platform to drill an estimated resource of 300 million barrels of light crude oil in the Atlantic Ocean, about 500 km (310 miles) off the coast of Canada's Newfoundland and Labrador province. (RTRS)

CHINA

POLICY: China’s economy faces greater downward pressure with complex uncertainties that are greater than expected, Xinhua News Agency said following a meeting of the State Council on Wednesday chaired by Premier Li Keqiang. China should flexibly use refinancing and other monetary tools at the right time to boost support for the real economy, including greater monetary policy impact, keeping liquidity reasonable and increasing loans to small businesses, Xinhua said. China will also increase support for those businesses in difficulty, such as those in retail and tourism, including postponing their endowment insurance payments in the second quarter, as well as increasing assistance for the unemployed, Xinhua said. (MNI)

POLICY: China's key to dealing with its economic headwinds is promoting large projects and vigorously helping enterprises in difficulties, China Securities Journal said citing policy intentions given by the National Development and Reform Commission. Q1 growth is likely to be dragged down by increasing internal and external risks and challenges, the newspaper said. Infrastructure investment, which will be the biggest growth driver this year, is expected to expand by 5-7%, the newspaper said citing analysts. The central bank is still likely to cut interest rates and inject more liquidity via medium-term lending facilities, the newspaper said. Real estate policies will also be optimized in accordance with different cities, it said. (MNI)

PBOC: Market liquidity in China is expected to remain stable this month under fiscal policy effects and PBOC’s flexible operations, despite impact from bond issuance and MLF maturities, Zhou Maohua, a macro-economic analyst at China Everbright Bank, tells the Securities Daily in an interview. Bank of China analyst Liang Si expects PBOC to offer MLF with an amount larger than the maturities, report says. There’s still a possibility that PBOC may cut interest rate and RRR this month given increasing downward economic pressure, according to Everbright Bank’s Zhou. (BBG)

ECONOMY: China's economy is expected to grow 5% in 2022, according to an average of forecasts from 30 economists in a March survey by Nikkei and Nikkei Quick News. (Nikkei)

PROPERTY: Several Chinese lenders have been told they can file legal cases against China Evergrande Group in local courts, in an apparent easing of a restriction that required all such lawsuits to be handled in a single court, according to people familiar with the matter. The move may help onshore creditors gain control of assets ahead of a looming debt restructuring. At least three lenders in Zhejiang and Shandong province were told by courts last month that they can file the cases against the embattled developer in their own jurisdictions rather than to a court in Guangzhou, where Evergrande was based for decades, said the people, asking not to be identified discussing a private matter. Some cases have already been accepted, said the people. (BBG)

OVERNIGHT DATA

JAPAN MAR TOKYO AVG OFFICE VACANCIES 6.37; FEB 6.41

JAPAN FEB, P LEADING INDEX CI 100.9; MEDIAN 100.8; JAN 102.5

JAPAN FEB, P COINCIDENT INDEX 95.5; MEDIAN 95.5; JAN 95.6

AUSTRALIA FEB TRADE BALANCE A$7,457MN; A$11,650MN; JAN A$11,786MN

AUSTRALIA FEB EXPORTS +0% M/M; MEDIAN +0%; JAN +6%

AUSTRALIA FEB IMPORTS +12% M/M; MEDIAN +2%; JAN -2%

CHINA MARKETS

PBOC NET DRAINS CNY140 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY140 billion after offsetting the maturity of CNY150 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0589% at 09:32 am local time from the close of 1.9733% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 45 on Wednesday vs 41 on Saturday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3659 THURS VS 6.3799

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3659 on Thursday, compared with 6.3799 set on Wednesday.

MARKETS

SNAPSHOT: The Caps Are (Almost) Set

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 449.31 points at 26900.99

- ASX 200 down 44.889 points at 7445.2

- Shanghai Comp. down 32.361 points at 3251.065

- JGB 10-Yr future up 15 ticks at 149.40, yield down 0.9bp at 0.236%

- Aussie 10-Yr future unch. at 97.010, yield up 0.3bp at 2.934%

- U.S. 10-Yr future +0-07+ at 120-29+, yield down 1.5bp at 2.583%

- WTI crude up $1.13 at $97.36, Gold down $3.99 at $1921.37

- USD/JPY down 13 pips at Y123.67

- FED TO AIM FOR USD95B CAP TO SHRINK BALANCE SHEET (MNI)

- ECB TO TAKE NEW DECISIONS ON POLICY PATH IN JUNE, NAGEL SAYS (BBG)

- SCHUMER: THURSDAY VOTE EXPECTED ON RUSSIA OIL BAN

- UKRAINE URGES CIVILIANS TO FLEE LOOMING RUSSIAN OFFENSIVE IN EASTERN REGIONS (WSJ)

- RUSSIA GOVT SEES WEST CLOSING ROUTE TO AVOID DEFAULT (VEDOMOSTI)

- CHINA MARKET LIQUIDITY SEEN STABLE IN APRIL (SEC. DAILY)

US TSYS: All About The Caps

Tsys operate shy of best levels as we move towards London trade, after a couple of rounds of richening were seen in Asia (with the second round failing to extend on the first round), with some of the gains then pared. It seems that growth worries stemming from the Fed’s B/S run off plans drove the bid in Asia. TYM2 +0-09 at 120-31, 0-06+ shy of the session peak, operating around the middle of its Asia range on volume of ~145K. Cash Tsys are 1.5-3.0bp richer across the curve, with 5s outperforming and bull steepening apparent. The 2- to 10-Year zone printed through Wednesday’s yield troughs, with the more pronounced breaks coming in the front end of the curve, but those benchmarks now operate back around Wednesday’s lows (in yield terms). Asia flow was headlined by block sales of FVK2 113.25 puts (-5K in total) and block FV/TY flow (2 blocks totalling 9,016 vs. 5,553, potentially steepener flow, but unsure).

- To recap, the minutes from the March FOMC meeting saw the Fed outline the parameters that it has identified when it comes to shrinking its B/S. The Fed will limit B/S runoff to $95bn/month ($60bn Tsys, $35bn MBS), phased in over 3 months/modestly longer (if market conditions continue to warrant) with all indications that the formal announcement will come at the May FOMC meeting. Interestingly, many participants would have preferred to hike rates by 50bp at the March meeting, although Ukraine proved to be the limiting factor on this front (Bullard was the only dissenter who called for a 50bp hike), with many participants noting that “one or more 50 basis point increases in the target range could be appropriate at future meetings, particularly if inflation pressures remained elevated or intensified.” Market reaction was two-way in nature, with benchmark yields across the curve finishing Wednesday around pre-minute levels after fresh YtD highs were registered across the curve. The 2-/10-Year and 5-/30-Year yield curves went out around session steeps, as the wider curve twist steepened.

- Weekly jobless claims data and Fedspeak from Bullard (’22 voter), Bostic (’24 voter) & Evans (’23 voter) will cross during NY hours.

JGBS: 7s Lead The Bid On Futures Uptick, 30-Year JGB Supply Sees Soft Cover

JGB futures generally followed the broader ebb and flow of wider core global FI markets during the Tokyo morning, although the bid has been a little stickier during the afternoon. Still, JGB futures have failed to test early Tokyo highs, last +19 vs. Wednesday’s settlement. Cash JGBs are little changed to ~2bp richer, with 7s maintaining their early outperformance, aided by the bid in futures, while 20s provided the weakest point on the curve.

- BoJ board member Noguchi stuck to the wider dovish script provided by the central bank, underlining the need for continued easing, while BoJ Exec. Dir. Uchida flagged the positives surrounding the BoJ’s ultra-loose policy settings.

- The latest round of 30-Year JGB supply saw firm enough pricing, with the low price providing a modest beat vs. wider expectations, although the cover ratio softened at the margin, holding comfortably below the 6-auction average (3.29x). It would seem that the previously flagged worry re: continued market vol. and spill over from offshore bond market gyrations stood in the way of wider interest at today’s auction.

JGBS AUCTION: Japanese MOF sells Y2.7563tn 6-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y2.7563tn 6-Month Bills:

- Average Yield -0.0976% (prev. -0.0769%)

- Average Price 100.049 (prev. 100.039)

- High Yield: -0.0956% (prev. -0.0769%)

- Low Price 100.048 (prev. 100.039)

- % Allotted At High Yield: 34.6509% (prev. 61.0473%)

- Bid/Cover: 4.981x (prev. 3.923x)

JGBS AUCTION: Japanese MOF sells Y730.3bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y730.3bn 30-Year JGBs:

- Average Yield 0.989% (prev. 0.893%)

- Average Price 100.25 (prev. 95.45)

- High Yield: 0.993% (prev. 0.895%)

- Low Price 100.15 (prev. 95.40)

- % Allotted At High Yield: 13.0925% (prev. 32.1513%)

- Bid/Cover: 3.049x (prev. 3.118x)

AUSSIE BONDS: Curve Steepens, YM Unwinds Some Of Early Squeeze Higher

YMM2 has erased some of the early squeeze higher, but hasn’t gotten anywhere near neutral levels, last +4.5, while XM has generally marched to the beat of U.S. TY futures, with a lack of meaningful idiosyncratic drivers evident, to last deal unch. The YM/XM curve has bull steepened, although it sits off the early session wides, while 10+-Year cash ACGBS are marginally cheaper on the day, resulting in twist steepening of the broader ACGB curve. EFPs are mixed, with some notable twist flattening of the 3-/10-Year box apparent. Meanwhile, Bills run 1-8 ticks higher through the reds, with the post-FOMC minutes move higher in U.S. Eurodollar futures providing at least some of the impetus there, n addition to the squeeze in YM.

- Elsewhere, the latest round of ABS payrolls data revealed that “payroll jobs fell 0.6% in the month to 12 March 2022. There were differences across the fortnights, with payroll jobs falling by 0.8% in the second half of February and then rising slightly, by 0.2%, in the first half of March. These changes in payroll jobs coincided with adverse weather conditions and flooding in New South Wales and Queensland (in late February), the continuing influence of the COVID-19 Omicron variant and easing of pandemic restrictions across the country. Given the disruption to business operations from the weather and Omicron infections, the increase in payroll jobs in early 2022 continued to be weaker than in both 2020 and 2021, particularly over the last month.”

EQUITIES: Lower As Fed Worry Spills Into Asia

Virtually all Asia-Pac equity indices are in the red for a second day, following another negative lead from Wall St. Tech-related names across the region struggled in the wake of the tech-heavy Nasdaq’s underperformance, while Chinese and Hong Kong markets received some support from the Chinese authorities again voicing their intention to increase monetary stimulus “at an appropriate time”.

- The CSI300 fell to a lesser extent than most major regional peers, dealing 0.9% softer at typing. The move lower comes despite Chinese officials from a State Council meeting late on Wednesday declaring their intention to support the economy amidst intensifying “complexity and uncertainty of domestic and foreign environments” that have “exceeded expectations”. A note that there was a lack of details re: specific easing measures (e.g. reserve ratio cuts), likely limiting optimism for now, with the CSI300 seen operating around session lows below Wednesday troughs at typing.

- The Hang Seng sits 1.2% worse off after reversing gains made earlier in the session, with nearly all constituents trading flat to lower at writing. The real estate sub-index brings up the rear, pulling back from six-week highs made on Wednesday amidst evident pressure from an ongoing COVID outbreak in Hong Kong and China. China-based tech sold off as well, with the Hang Seng Tech Index trading 2.0% lower at typing.

- U.S. e-mini equity index futures sit 0.4% weaker apiece at typing.

OIL: A Touch Above Three-Week Lows As IEA Release, COVID Outbreak In China Eyed

WTI is ~+$1.60 and Brent is ~+$1.80, printing $97.80 and $102.90 respectively at writing and operating a little above three-week lows recorded on Wednesday.

- To recap, both benchmarks closed ~$6 softer apiece on Wednesday, with non-U.S. International Energy Agency (IEA) member countries announcing plans to release 60mn bbls of crude from strategic reserves, alleviating some worry driving crude prices re: supply tightness. A note that the planned commitment comes on top of U.S. announcements last week to release 180mn bbls from the U.S. SPR.

- Looking to China, Shanghai has notched its sixth record-high daily COVID case count, with the tally for Apr 6 coming in just shy of 20K. Well-documented concern re: weaker Chinese energy demand has persisted as the city’s lockdown has been extended indefinitely, with most businesses and factories remaining shut for now.

- Elsewhere, EIA data released on Wednesday saw a surprise build in U.S. crude and distillate stockpiles, but a larger than expected drawdown in gasoline inventories and a decline in Cushing hub stocks as well. This comes after figures observed in reports of Tuesday’s weekly API estimates, which had pointed to increases in crude, distillate, and hub stocks, but a drawdown in gasoline stockpiles.

GOLD: Slightly Lower In Asia

Gold sits ~$3/oz lower to print $1,922/oz at writing, operating just above session lows as an initial downtick in nominal U.S. Tsy yields has eased, giving way to lingering impetus from the relatively hawkish Mar FOMC minutes release on Wednesday.

- To elaborate, aforementioned FOMC minutes saw Fed officials propose potentially phased caps of $95bn per month in balance sheet reductions (largely in line with expectations from some quarters), while many attendees favoured “one or more” 50bp hikes going forward, flagging dependence on inflation data.

- Looking at Wednesday's price action, the precious metal closed little changed, struggling to make headway above the $1,930/oz price level as the USD (DXY) and U.S. real yields made fresh cycle highs.

- Elsewhere, OIS markets are pricing a cumulative ~215bp of Fed tightening for the rest of calendar ‘22, pointing to the potential for multiple 50bp rate hikes in the remaining six meetings for the year.

- From a technical perspective, bullion remains range bound. Key support is located around ~$1,908./oz (50-Day EMA), with further support at $1,890.2/oz (Mar 29 low and bear trigger). On the other hand, resistance is unchanged at $1,966.1/oz (Mar 24 high).

FOREX: Caution Takes Hold, Circling Fed Hawks Cast Shadow Over Asia

Initial defensive feel deepened as the Asia-Pac session progressed, with G10 FX trading in a typical risk-off fashion. Regional players assessed the minutes from the FOMC's March monetary policy meeting, which reaffirmed intensifying hawkish leanings among Fed policymakers. The prospect of rapid balance-sheet reduction and the Fed's apparent sense of comfort with a potential 50bp rate hike undermined risk appetite, albeit the greenback struggled for meaningful topside impetus.

- As one might expect, high-beta currencies went offered and safe havens caught a bid. This brought some reprieve to the embattled yen, even as BoJ's Noguchi reaffirmed the Bank's commitment to its ultra-loose policy stance. USD/JPY shed a handful of pips but its RSI remained in overbought territory.

- Risk aversion translated into AUD/USD sales, preventing a golden cross formation from materialising on the daily chart. The pair's ascending 50-DMA now intersects just a few pips shy of the 200-DMA.

- Offshore yuan lost ground after China's State Council signalled intention to loosen monetary policy "at appropriate time" in a bid to stimulate the real economy amid heightened domestic and global economic risks.

- On the data front, EZ retail sales, German industrial output & U.S. weekly jobless claims take focus from here. Comments are due from BoE's Pill as well as Fed's Bullard, Bostic & Evans. In addition, the ECB will publish the account of its March monetary policy meeting.

FOREX OPTIONS: Expiries for Apr07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0800(E1.5bln), $1.0875(E828mln), $1.0900-15(E3.1bln), $1.0920-36(E3.1bln), $1.0965-70(E556mln), $1.1000-10(E2.2bln), $1.1025(E2.0bln), $1.1100-10(E1.1bln)

- GBP/USD: $1.3200-15(Gbp544mln)

- EUR/GBP: Gbp0.8375-90(E519mln)

- EUR/JPY: Y134.50(E677mln), Y136.00(E521mln)

- AUD/USD: $0.7575-85(A$624mln)

- USD/CAD: C$1.2500($635mln), C$1.2535-45($540mln), C$1.2575-90($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/04/2022 | 0545/0745 | ** |  | CH | unemployment |

| 07/04/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/04/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 07/04/2022 | 0900/1100 | ** |  | EU | retail sales |

| 07/04/2022 | 1130/1330 |  | EU | ECB March meet Accts published | |

| 07/04/2022 | 1215/1315 |  | UK | BOE Pill Opening at BOE Sovereign Bond Market Conference | |

| 07/04/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 07/04/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 07/04/2022 | 1300/0900 |  | US | St. Louis Fed's James Bullard | |

| 07/04/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 07/04/2022 | 1530/1130 | ** |  | US | NY Fed Weekly Economic Index |

| 07/04/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 07/04/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 07/04/2022 | 1800/1400 |  | US | Atlanta Fed's Raphael Bostic, Chicago Fed's Charles Evans | |

| 07/04/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 07/04/2022 | 2005/1605 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.