-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Russia Admits Losses Of Troops As EU Bans Its Coal Imports

EXECUTIVE SUMMARY

- FED’S BULLARD FAVOURS 3%-3.25% RATES THIS YEAR TO BLUNT INFLATION (BBG)

- FED’S BOSTIC, EVANS BACK RATE RISES WITH DOVISH OVERTONES (RTRS)

- EU BACKS RUSSIAN COAL BAN IN FIRST PUNCH AT ENERGY REVENUE (BBG)

- PUTIN’S SPOKESMAN ADMITS “SIGNIFICANT” RUSSIAN LOSSES IN UKRAINE (Sky)

- TOP CHINESE SECURITIES NEWSPAPER SEES LIKELY RRR CUT IN 2Q (BBG)

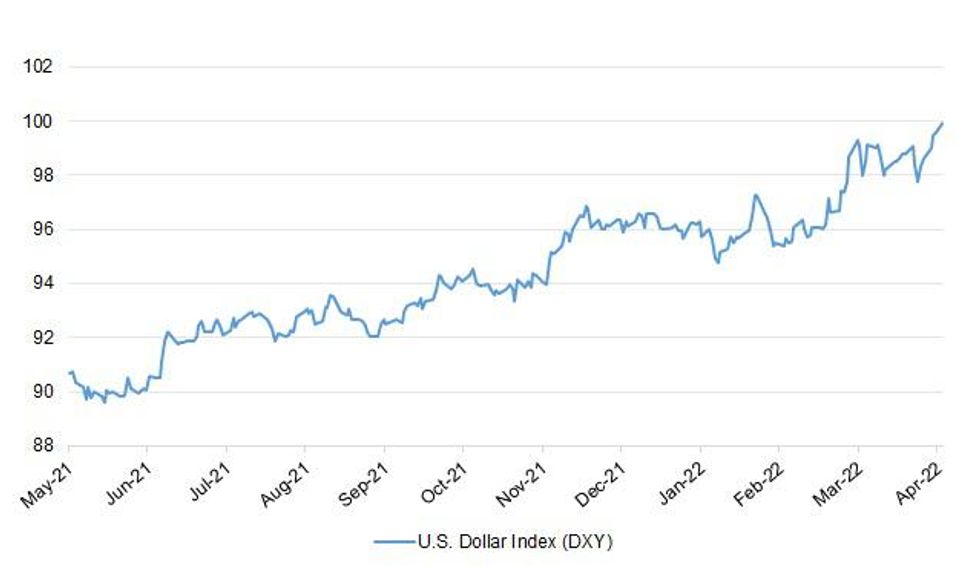

Fig. 1: U.S. Dollar Index (DXY)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak believes he is the victim of a “political hit job” designed to cause maximum damage after details of his wife’s tax affairs were leaked. The chancellor thinks the disclosure of her tax status on the day he increased national insurance was a “co-ordinated attack”. Allies even claimed that the leak represented a potential criminal offence. However, neither Sunak nor Akshata Murty, his wife, have gone to the police. “He thinks it’s a total smear,” one ally said. “It feels like there’s a full-time briefing operation against him. This is a hit job, a political hit job. Someone is trying to undermine his credibility.” (The Times)

ENERGY: The government has been accused of "incoherence" and "missed opportunities" in its Energy Security Strategy, by environmentalists who say it contradicts climate targets and overlooks cheaper, greener and faster alternatives. Policy experts, scientists, fuel poverty groups and campaigners have all picked out energy efficiency as the "missing piece" of the plans, with many pointing to the fact the cheapest, greenest form of energy is that which is currently wasted. Tessa Khan, director of campaign group Uplift, described the plans as a "betrayal of the millions of families across the UK... being pushed to the brink" by the cost of living crisis. Government advisers on the Climate Change Committee called it "disappointing", but acknowledged difficulties in implementing policy quickly. (Sky News)

EUROPE

GERMANY/UKRAINE: German Chancellor Olaf Scholz is delaying a final decision over whether to give Ukraine high-end tanks for its battle against Russia, despite pressure from several other top officials, according to four people familiar with the deliberations. The plan, pushed by Vice Chancellor and Economy Minister Robert Habeck and Foreign Minister Annalena Baerbock — both senior members of the Green party — would involve about 100 tanks. It comes amid a growing acceptance in Berlin and other Western capitals that Russia’s war in Ukraine could drag on for months or years, and as Kyiv directly appeals for such equipment. A decision on the matter was initially expected this week. But it’s now in limbo as the Social Democrat chancellor — much to the frustration of his governing coalition partners — argues Germany should first reach a common position with Western allies on the subject before delivering such heavy military equipment, the officials said.

GERMANY: German Chancellor Olaf Scholz said he was disappointed the lower house of parliament on Thursday voted against a COVID-19 vaccine mandate for people over 60, but would not launch a second attempt to push for a mandate. A cross-party proposal had envisaged a bill requiring citizens aged 60 and over to be vaccinated against COVID-19 from Oct. 15, in an attempt to avoid another wave of the virus in the autumn. (RTRS)

FINLAND: Public support and political momentum for Finland joining NATO has reached an all-time high as a result of the war in Ukraine, raising the very real possibility that the alliance's borders with Russia could extend by more than 830 miles in a matter of months. The Finnish government is expected to submit a report to parliament on the changed security environment by the end of this month, kicking off a debate and eventually a recommendation on applying for NATO membership. (Axios)

ESTONIA: Nato is stuck on a cold war footing in Europe and needs to acknowledge its eastern expansion by deploying far more forces in the Baltic states to repel a potential Russian attack, according to Estonia’s prime minister. (FT)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said he favors raising interest rates sharply to counter the highest inflation in four decades, and suggested he backs a half-point hike in May along with shrinking the Fed’s bloated balance sheet. “I would like the committee to get to 3-3.25% on the policy rate in the second half of this year,” Bullard told reporters Thursday after a speech at the University of Missouri. “We have to move forthrightly in order to get the policy rate to the right level to deal with the inflation we have got in front of us.” The Fed raised its benchmark overnight rate by 25 basis points last month to a target range of 0.25% to 0.5%. Bullard, who favored a half-point increase, was the lone dissenter in the 8-1 policy vote. (BBG)

FED: As expectations rise that the U.S. Federal Reserve will step up its efforts to contain inflation with bigger interest rate hikes, Chicago Fed President Charles Evans and Atlanta Fed President Raphael Bostic on Thursday provided a somewhat dovish counterpoint. "It's time that we get off of our emergency stance -- I think it's really appropriate that we move our policy closer to a neutral position -- but I think we need to do it in a measured way," Bostic told a Chicago Fed virtual conference on economic mobility. Evans said: "I'm optimistic that we can get to neutral, look around, and find that we're not necessarily that far from where we need to go." (RTRS)

FED: President Joe Biden's nominees to the Federal Reserve moved a step closer to confirmation Thursday after U.S. Senate Majority Leader Chuck Schumer entered procedural motions for two of them, setting up for a potential vote after lawmakers return from Easter Break on April 25. The filing of the motions on Michigan State University's Lisa Cook, nominated to fill a vacant seat on the Board, and Fed Governor Lael Brainard, nominated to be the Fed's vice chair, limits the time for floor debate and starts the clock toward a confirmation vote. A final vote on all four Fed nominees could take place as soon as late April, just days before the Fed is expected to deliver a large interest rate increase and begin shrinking its massive bond holdings in a double-barreled effort to fight decades-high inflation. (RTRS)

CORONAVIRUS: A U.S. appeals court panel on Thursday reinstated President Joe Biden's executive order mandating that federal civilian employees be vaccinated against COVID-19.By a 2-1 vote, the 5th Circuit Court of Appeals lifted an injunction issued by a U.S. district judge in Texas in January that had blocked enforcement of the federal employee vaccine mandate. (RTRS)

CORONAVIRUS: U.S. House of Representatives Speaker Nancy Pelosi has COVID-19 and is currently asymptomatic, her spokesman said on Thursday, after more than half a dozen other federal officials tested positive in recent days. The Democratic leader tested positive after a negative test result earlier in the week, spokesman Drew Hammill said in a statement. (RTRS)

POLITICS: Ketanji Brown Jackson was confirmed by the Senate on Thursday as the first Black woman to serve on the Supreme Court in a milestone for the United States and a victory for President Joe Biden, who made good on a campaign promise as he seeks to infuse the federal judiciary with a broader range of backgrounds. The vote to confirm the 51-year-old federal appellate judge to a lifetime job on the nation's top judicial body was 53-47, with three Republicans - Susan Collins, Lisa Murkowski and Mitt Romney - joining Biden's fellow Democrats. (RTRS)

OTHER

U.S./CHINA: Any visit to Taiwan by US House Speaker Nancy Pelosi would cross Beijing’s “red line”, China’s Foreign Minister Wang Yi warned on Thursday, in a rare direct comment on a specific American visitor to the self-ruled island. Wang warned that Washington would bear sole responsibility for the consequences of a visit, in a phone conversation with French diplomatic counsellor Emmanuel Bonne. (SCMP)

U.S./CHINA: A Chinese national has been sentenced to 29 months in prison after pleading guilty in January to conspiring to steal trade secrets from agricultural company Monsanto to benefit the Chinese government, the U.S. Justice Department said on Thursday. (RTRS)

G20: The Kremlin said on Thursday that it would make a decision on whether Russian President Vladimir Putin takes part in a G20 summit later this year in Indonesia based on how events evolve. Kremlin spokesperson Dmitry Peskov was responding to a question about calls by some leaders of G20 countries to exclude Putin from the summit over his decision to send tens of thousands of troops into Ukraine. "We will clarify this, after all Indonesia is the organiser," said Peskov. (RTRS)

CANADA: Finance Minister Chrystia Freeland tabled her second federal budget Thursday — a multi-billion dollar plan meant to help the country weather increasingly uncertain times through major investments to cool Canada's red-hot housing market and supercharge the transition to a cleaner, greener economy. Freeland signalled the days of eye-popping 12-digit budget deficits are coming to an end and promised a return to greater fiscal prudence now that the immediate threat of COVID-19 has abated. With corporate Canada jittery about Ottawa's sky-high deficit spending in recent years, Freeland acknowledged the country's ability to spend is "not infinite" and — with interest rates now rising to tame inflation — it's time for the government to "review and reduce" spending. (CBC)

PERU: Peru's government on Thursday ordered its armed forces to supervise the country's highways for the next month, amid crippling protests nationwide over rising food and fuel prices. (RTRS)

RUSSIA: The European Union agreed to ban coal imports from Russia in its first move targeting Moscow’s crucial energy revenue after reports of Russian atrocities in Ukraine propelled officials to expand its fifth round of sanctions. The sanctions package, which also includes a ban on most Russian trucks and ships from entering the EU, was signed off by the bloc’s diplomats Thursday, France announced. It was also coordinated with the U.S. and the U.K. Member states have until Friday morning to lodge final objections before the sanctions are formally adopted. (BBG)

RUSSIA: The United States is ramping up sanctions against Russia to deprive Moscow's "war machine" of money and components needed to sustain its invasion of Ukraine, but curbing a main source of funding, Russian energy exports, will take time, U.S. Deputy Treasury Secretary Wally Adeyemo told Reuters on Thursday. The United States and its allies have "a lot more that we can and we will do" to punish Moscow if Russia fails to halt its invasion, Adeyemo told Reuters in an interview. (RTRS)

RUSSIA: Vladimir Putin's spokesman has admitted a "significant" loss of Russian troops since the invasion of Ukraine began, telling Sky News their deaths are a "tragedy". Dmitry Peskov, in his first broadcast interview with Western media, also said Russia hopes "this operation" will reach its goals "in the coming days". He told Sky News' Mark Austin that "we're living in days of fakes and lies" and verified photos and satellite images of dead civilians in the streets of Ukrainian cities were a "bold fake". "We deny the Russian military can have something in common with these atrocities and that dead bodies were shown on the streets of Bucha," he told Sky News. He maintained the whole situation in Bucha, where photos show many murdered Ukrainian civilians, was a "well-staged insinuation, nothing else". (Sky News)

RUSSIA: The war in Ukraine is in a "precarious" phase with the Russian military "resetting and positioning" ahead of what may be an "even more brutal" campaign, according to the head of the Royal Air Force. Air Chief Marshall Sir Mike Wigton told Sky News: "Everything from our intelligence tells us that Russia is repositioning for another attack. "Potentially it will be even more brutal, even more barbaric, even more illegal than what we've already seen," he said. (Sky)

RUSSIA: Kremlin spokesperson Dmitry Peskov said on Thursday that if Finland and Sweden joined NATO then Russia would have to "rebalance the situation" with its own measures. If the two countries join, "we'll have to make our western flank more sophisticated in terms of ensuring our security," Peskov told Britain's Sky News. (RTRS)

RUSSIA: The world's third-largest coal importer Japan plans to reduce Russian coal imports gradually while looking for alternative suppliers in the wake of sanctions against Moscow, the industry minister said on Friday. The move also highlights a potential shift in Japan's energy procurement policy. (RTRS)

RUSSIA: Ukraine would expect Russia to suspend hostilities during an eventual papal visit to Kyiv, the Ukrainian ambassador to the Vatican told Reuters on Thursday. Ambassador Andriy Yurash spoke hours after he met Pope Francis and top Vatican officials to formally present his credentials. Francis told reporters during a visit to Malta at the weekend that he was considering a trip to Kyiv to make a peace appeal there. Francis said a trip was "on the table." (RTRS)

RUSSIA: The territory of Sumy region is completely free from the Russians. It is noted that the explosions are caused by rescuers and explosives technicians disposing of ammunition left by the Russian military. (Ukrainska Pravda)

PAKISTAN: Pakistan's Prime Minister Imran Khan is due to address the nation on Friday after the Supreme Court ruled he acted unconstitutionally in blocking an attempt to oust him - a decision that could end his premiership in days. (RTRS)

MIDDLE EAST: Saudi Arabia, Kuwait and Yemen on Thursday announced a return of their ambassadors to Lebanon in a sign of improving ties that hit rock bottom last year when the kingdom and other Gulf states withdrew their envoys. The Saudi foreign ministry said its ambassador returned in response to calls by "moderate" Lebanese political forces and after remarks by Prime Minister Najib Mikati regarding "ending all political, military and security activities" that affect Saudi Arabia and other Gulf states. (RTRS)

MIDDLE EAST: Yemen's president delegated power to a presidential council and dismissed his deputy on Thursday as Saudi Arabia moved to strengthen an anti-Houthi alliance amid U.N.-led efforts to revive negotiations to end the seven-year war. Riyadh announced $3 billion in financial aid to the Saudi-backed government after the announcement by President Abd-Rabbu Mansour Hadi. It called for talks with the Houthis who control the north and have been battling the Saudi-led coalition. (RTRS)

METALS: Commodity trader Trafigura and other firms are moving to take large amounts of zinc out of London Metal Exchange approved warehouses in Asia, sources familiar with the matter said, fuelling concern about more problems at the exchange after chaotic nickel trading last month. A Trafigura spokesperson in response to request for comment said "we don't usually comment on commercial matters". (RTRS)

OIL: Record volumes of fuel oil from Latin America landed in the United States in March, customs data showed, as refiners snapped up alternatives to Russian feedstocks ahead of Washington's April 22 deadline to end U.S. imports of Russian oil. U.S. Gulf Coast refiners that use fuel oil to supplement heavy crude went hunting for new supplies last month after U.S. President Joe Biden placed a ban on Russian crude and refined products with a 45-day wind-down period. (RTRS)

OIL: The International Energy Agency (IEA) on Thursday confirmed member country contributions to the second collective action to release oil stocks in response to Russia’s invasion of Ukraine. The commitments submitted by members reached 120 million barrels to be released over a six month period, the IEA added. The U.S. will release 60 million barrels of oil from storage and Japan will release 15 million barrels. (RTRS)

CHINA

PBOC: China is likely to cut banks’ reserve requirement ratio in the second quarter to stabilize the economy, China Securities Journal says in a front-page report, citing analysts. China is also expected to accelerate approval of local government special bond issuance quota to prop up investment: paper. Some analysts also hope there is room for deposit interest rate cut. (BBG)

CORONAVIRUS: The Chinese Communist Party’s flagship newspaper defended President Xi Jinping’s stringent virus strategy, saying the Covid Zero policy is essential to saving lives and keeping the economy going, as doubts grow with more than 21,000 new cases recorded in Shanghai alone. In a front-page commentary, the People’s Daily said that the more transmissible omicron variant “has made it more difficult to find the virus and prevent the epidemic.” It then went on to say that “the more this is the case, the more we should adhere to the general policy of ‘dynamic zero’ without hesitation or wavering,” using Beijing’s wording for the country’s virus approach. (BBG)

CORONAVIRUS: Shanghai is transforming conference centers and conscripting neighboring provinces to create isolation facilities for hundreds of thousands of people, a sign of its commitment to a zero tolerance approach to Covid-19 amid China’s worst outbreak to date. The Chinese financial hub is adding tens of thousands of beds to what are already some of the world’s biggest isolation sites as it sticks to a policy of quarantining all those positive for the virus, regardless of severity, plus everyone they interacted with while infected. Nearly 150,000 people have been identified as close contacts and put into isolation. More than 100,000 others are considered secondary contacts and are being monitored, according to the government. (BBG)

CORONAVIRUS: China's targeted and effective COVID-19 prevention and control efforts have ensured the safe and smooth hosting of Beijing Olympic and Paralympic Winter Games, Chinese President Xi Jinping said Friday. Xi, also general secretary of the Communist Party of China Central Committee and chairman of the Central Military Commission, made the remarks at a gathering in Beijing on Friday morning to honor those who have made outstanding contributions to the Beijing 2022 Olympic Winter Games and the Beijing 2022 Paralympic Winter Games. (Xinhua)

OVERNIGHT DATA

JAPAN FEB BOP TRADE BALANCE -Y176.8BN; MEDIAN -Y205.0BN; JAN -Y1,604.3BN

JAPAN FEB BOP CURRENT ACCOUNT BALANCE +Y1,648.3BN; MEDIAN +Y1,450.0BN; JAN -Y1,196.4BN

JAPAN FEB BOP CURRENT ACCOUNT ADJUSTED +Y516.6BN; MEDIAN +Y274.8BN; JAN +Y184.0BN

JAPAN MAR BANKRUPTCIES -6.46% Y/Y; FEB +2.91%

JAPAN MAR CONSUMER CONFIDENCE INDEX 32.8; MEDIAN 36.8; FEB 35.3

SOUTH KOREA FEB BOP CURRENT ACCOUNT BALANCE +$6,419.4MN; JAN +$1,915.5MN

SOUTH KOREA FEB BOP GOODS BALANCE +$4,273.3MN; JAN +$820.1MN

NEW ZEALAND MAR ANZ TRUCKOMETER HEAVY +1.8%; FEB +0.8%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.9893% at 09:30 am local time from the close of 2.0223% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 44 on Thursday vs 45 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3653 FRI VS 6.3659

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3653 on Friday, compared with 6.3659 set on Thursday.

MARKETS

SNAPSHOT: Russia Admits Losses Of Troops As EU Bans Its Coal Imports

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 36.67 points at 26926.08

- ASX 200 up 32.666 points at 7475.7

- Shanghai Comp. down 1.879 points at 3234.816

- JGB 10-Yr future down 3 ticks at 149.44, yield down 0.2bp at 0.231%

- Aussie 10-Yr future down 6 ticks at 96.965, yield up 6bp at 2.974%

- U.S. 10-Yr future -0-05 at 120-12+, yield unch. at 2.6578%

- WTI crude down $0.44 at $95.6, Gold down $3.16 at $1928.73

- USD/JPY up 3 pips at Y123.98

- FED’S BULLARD FAVOURS 3%-3.25% RATES THIS YEAR TO BLUNT INFLATION (BBG)

- FED’S BOSTIC, EVANS BACK RATE RISES WITH DOVISH OVERTONES (RTRS)

- EU BACKS RUSSIAN COAL BAN IN FIRST PUNCH AT ENERGY REVENUE (BBG)

- PUTIN’S SPOKESMAN ADMITS “SIGNIFICANT” RUSSIAN LOSSES IN UKRAINE (Sky)

- TOP CHINESE SECURITIES NEWSPAPER SEES LIKELY RRR CUT IN 2Q (BBG)

BOND SUMMARY: JGBs Keep Pushing Higher, U.S. Tsys & ACGBs Lose Initial Allure

JGBs maintained bullish momentum, diverging from U.S. Tsys and Aussie bonds which lost their initial strength. The prospect of hawkish FOMC action loomed large at the end of a week that witnessed fresh rounds of bullish Fedspeak.

- The initial uptick in T-Notes proved short-lived, with the contract plunging in afternoon trade and probing the water below Thursday's worst levels. TYM2 last changes hands -0-03+ at 120-14, hovering just above the session low of 120-11. Eurodollar futures run 1.5-6.0 ticks lower through the reds. Twist steepening evident in cash Tsy space, with yields last seen +4.1bp to -2.3bp across the curve. Wholesale inventories headline the U.S. docket on Friday.

- 10-Year Aussie bond futures moved in tandem with T-Notes, XM trades -6.0 when this is being typed. Bills run 1-4 ticks lower through the reds. Cash ACGB curve has bear steepened, with yields last seen 1.5bp-5.7bp higher, as Aussie bonds played catch up with impetus from the NY session. The RBA released the semi-annual Financial Stability Review, in which it warned against "elevated" medium-term systemic risks.

- JGB futures re-opened on a firmer footing and extended gains thereafter, posting a sharp upswing just after the Tokyo lunch break. JBM2 trades at 149.51 at typing, 4 ticks above last settlement. Cash trade saw JGBs register gains, with yields depressed across the curve, with the super-long end leading gains. Participants kept an eye on the scheduled round of 1-10 Year Rinban operations but purchase sizes were unchanged, albeit it is worth flagging downticks in bid/cover ratios, which may have supported underlying bullish momentum in afternoon trade:

- 1- to 3-Year: 2.62x (prev. 3.02x)

- 3- to 5-Year: 1.90x (prev. 2.64x)

- 5- to 10-Year: 1.86x (prev. 1.92x)

JGBS AUCTION: Japanese MOF sells Y4.7822tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.7822tn 3-Month Bills:

- Average Yield -0.1223% (prev. -0.0979%)

- Average Price 100.0332 (prev. 100.0263)

- High Yield: -0.1179% (prev. -0.0930%)

- Low Price 100.0320 (prev. 100.0250)

- % Allotted At High Yield: 70.2434% (prev. 58.9961%)

- Bid/Cover: 4.196x (prev. 3.579x)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Tuesday 12 April it plans to sell A$100mn of the 1.25% 21 August 2040 I/L Bond.

- On Thursday 14 April it plans to sell A$1.0bn of the 22 July 2022 Note & A$500mn of the 12 August 2022 Note.

- It also notes that subject to market conditions, a new 21 November 2033 Treasury Bond is planned to be issued via syndication in the week beginning 11 April 2022. The Joint Lead Managers for the planned syndication are Commonwealth Bank of Australia, Deutsche Bank, National Australia Bank and UBS AG, Australia Branch.

EQUITIES: Mixed As Chinese Regulatory Worry Rises, Hawkish Fed In View

Most major Asia-Pac equity indices are mixed, largely bucking a positive lead from Wall St. High-beta stocks across the region underperformed, with the spotlight on China-based tech as large-cap Tencent Holdings made a decision to shutter their video game streaming service, fanning familiar fears over regulatory risks.

- The Hang Seng sits 0.6% lower at typing, approaching the week’s worst levels after 3 consecutive lower daily closes. China-based tech bore the brunt of the downward pressure, with the Hang Seng Tech Index trading 2.3% weaker at writing, with steep losses observed in large-caps such as Bilibili (-7.8%), JD.com (-3.4%), and Netease Inc (-2.3%).

- The ASX200 was the sole index to record gains amongst major regional peers, dealing 0.4% firmer at typing, led by outperformance in materials and energy names. On the other hand, the S&P/ASX All Technology Index underperformed, sitting 0.4% worse off at typing, with large-cap Block Inc dragging the index lower.

- U.S. e-mini equity index futures sit virtually unchanged at writing, trading on either side of neutral throughout Asian hours.

OIL: Lower On Fading EU Sanction Worry, Ongoing Outbreak In China

WTI is ~-$0.30 and Brent is ~-$0.50, sitting ~$2 above Thursday’s trough at writing. Both benchmarks appear headed for their second straight lower weekly close (and on track for a fourth consecutive lower daily close), and trade a touch above levels last witnessed before the Russian invasion of Ukraine.

- Earlier worry surrounding the likelihood of an EU ban on Russian crude imports has eased from highs seen earlier in the week, with well-documented German and Hungarian-led opposition to the measure remaining intact for now. A note that BBG source reports have also pointed to Russian Sokol crude finding more buyers in Asia, with cargoes for May currently sold out.

- Looking ahead, the EU is due to soon pass a (phased) ban on Russian coal that RTRS source reports have suggested will take full effect in mid-August, while the EU’s top diplomat Borrell has said that the bloc’s FMs will meet on Apr 11 to discuss the possibility of sanctions on Russian crude.

- Elsewhere, concern re: China’s energy demand have intensified, as nationwide daily COVID case counts continue to rise. Authorities in Shanghai reported over 20K fresh cases (both symptomatic and asymptomatic) for Apr 7 with the city’s lockdown remaining indefinite for now, keeping most business and factories shuttered.

GOLD: A Little Lower As Fed Hawkishness, Developments In Ukraine Eyed

Gold is ~$3/oz lower to print $1929/oz at typing, backing away from best levels and operating at session lows as the greenback has strengthened, with the DXY notching fresh cycle highs in Asian hours.

- The precious metal has traded within a relatively tight ~$30/oz trading range throughout the week, struggling to make headway above ~$1,940/oz as the DXY and U.S. real yields have steadily climbed over the same period, hitting successive cycle highs in the process.

- Looking to the Russia-Ukraine conflict, there has been virtually no concrete progress in ongoing ceasefire/peace talks, with Russian FM Lavrov on Thursday describing the latest Ukrainian draft deal (submitted on Wednesday) as “unacceptable”. Elsewhere, the west continues to impose additional sanctions on Russia in the wake of alleged war crimes in Ukraine, but the EU’s progress towards closely-watched bans on Russian crude imports remains scant, with Germany and Hungary continuing to lead opposition to the measure.

- From a technical perspective, bullion remains range bound, with the outlook remaining bearish following the pullback from $2,070.4/oz (Mar 8 high). Initial support is situated around ~$1,908.9/oz (50-Day EMA), with further support at $1,890.2/oz (Mar 29 low and bear trigger). Resistance is seen at $1,966.1/oz (Mar 24 high).

FOREX: DXY Edges Higher, Yen Consolidates Around Y124

The latest headline flow failed to add much new to the familiar narrative. The key gauge of broader USD strength (DXY) lodged a fresh cycle high, approaching the psychologically important 100 level. The greenback gained as U.S. Tsy yields pushed higher, driven by a sell-off in short end of the curve, as a week marked by continued hawkish Fed drumbeat draws to an end.

- The kiwi dollar underperformed ahead of next week's monetary policy decision, with NZD/USD lodging its worst levels in more than two weeks. It is unclear whether New Zealand's central bank will opt for an outsized 50bp rate hike, albeit the OIS strip prices a ~67% chance of of such outcome. NZD/USD implied 1-week volatility holds near yesterday's multi-week high.

- USD/JPY consolidated around the round figure of Y124.00 which provided a firm layer of resistance on Thursday. A breach of that level entailed further buying in early trade, with the rate running as high as to Y124.23. Demand petered out and the rate sank into negative territory ahead of the Tokyo fix, before a bouncing towards neutral levels.

- Offshore yuan slipped as China Securities Journal ran a front-page report noting that China is likely to cut banks' RRR in Q2, while Shanghai declared more than 20k new Covid-19 infections.

- Today's data highlights include U.S. wholesale inventories, Canadian jobless rate & Japan's Eco Watchers Survey. Speeches are due from ECB's de Cos, Centeno, Panetta, Stournaras, Makhlouf & Herodotou.

FOREX OPTIONS: Expiries for Apr08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0825-50(E1.3bln), $1.0990-05(E3.3bln), $1.1045-50(E555mln)

- USD/JPY: Y119.75-95($1.3bln), Y124.00($730mln)

- USD/CAD: C$1.2500($859mln), C$1.2665-70($531mln), C$1.2750($616mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/04/2022 | 0001/0101 | ** |  | UK | IHS Markit/REC Jobs Report |

| 08/04/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 08/04/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 08/04/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/04/2022 | 1115/1315 |  | EU | ECB Panetta at IESE Business School Conference | |

| 08/04/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 08/04/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/04/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.