-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Macron Leads After First Round Of Polls

EXECUTIVE SUMMARY

- MACRON AND LE PEN IN CLOSE RACE HEADING INTO FRENCH RUNOFF (BBG)

- GROWING FOCUS ON THE BATTLE FOR UKRAINE’S EAST, FURTHER SANCTIONS ON RUSSIA EYED

- COVID RESTRICTIONS NOW SEEN IN CHINA’S GUANGZHOU

- ANOTHER ROUND OF LOCALISED PROPERTY-RELATED EASING MEASURES SEEN IN CHINA

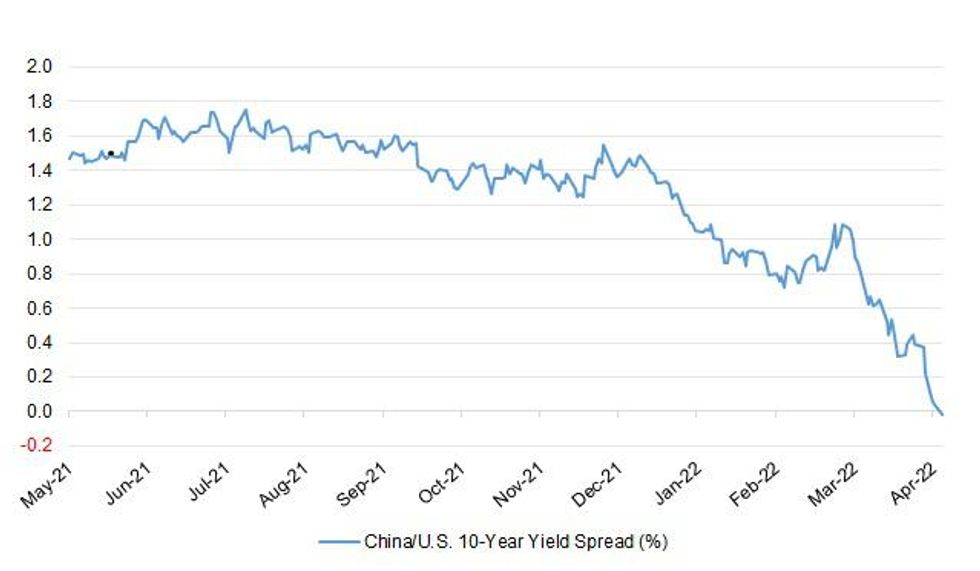

- CHINA 10-YEAR GOVERNMENT BOND YIELD PREMIUM OVER U.S. ERASED

- RUSSIA CUT TO SD AT S&P

- RUSSIA TO HALT BOND SALES FOR THIS YEAR AS INTEREST COSTS SURGE (BBG)

Fig. 1: China/U.S. 10-Year Yield Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Britain’s underlying wage growth stagnated after the coronavirus pandemic, a study by the Resolution Foundation showed, casting doubt on concerns that the nation faces an inflationary spiral. The researcher said its measure of average pay, adjusting for differences in the nature of individual workers, remained 2.7% last year, the same as in 2019 before the coronavirus hit. Resolution said that higher headline wage growth in official figures is mainly due to the end of the government’s furlough program and out-sized gains in four industries struggling to attract workers. The findings undercut the idea that a surge in pay growth is starting to add to inflationary pressures across the economy. (BBG)

BREXIT: The UK and France’s bitter dispute over fishing rights appears to have ended after the EU fishing commissioner praised the “successful and constructive relationship” between London and Brussels. Virginijus Sinkevicius said that almost all licences requested by French boats to work in waters off the UK since it left the bloc had been granted, with around 70 permits outstanding. “The commission fully intends to continue building a successful and constructive relationship with the UK. We managed to achieve most of the licences that have been requested,” he said in an interview with the Financial Times. (FT)

POLITICS: Rishi Sunak asked for a formal review into whether he properly declared his financial interests, as the U.K. Chancellor of the Exchequer tries to defuse a row over his tax affairs that threatens to derail his career. In a letter to Prime Minister Boris Johnson published late Sunday, Sunak said he wants a probe by the government’s adviser on ministerial standards to help ensure the public “retain confidence in the answers they are given.” (BBG)

POLITICS: Chancellor Rishi Sunak is demanding a Whitehall inquiry to find out who leaked details about his wife's tax arrangements, the BBC has been told. Akshata Murty has said she will pay UK taxes on her overseas income, following a row over her non-domicile status. (BBC)

POLITICS: British finance minister Rishi Sunak considered whether he should resign this week after a storm of criticism over his wealthy wife's tax status, the Sunday Times newspaper reported. "He was considering whether he could withstand his family taking this any more," the newspaper quoted an unidentified source as saying. A source familiar with the situation told Reuters that Sunak did not consider resigning. (RTRS)

POLITICS: Senior Conservatives have written off Rishi Sunak as a potential prime minister – and now believe Boris Johnson will have to remove him as chancellor in his next reshuffle – following the furore over his US green card and his wife’s tax affairs. One former Tory minister told the Observer that the fear among Conservative MPs with small majorities was that the party was now in a “death spiral” with its two leading figures – the PM and chancellor – both having lost respect among voters. (Observer)

POLITICS: Health Secretary Sajid Javid has become the latest Cabinet minister to find his private financial arrangements under scrutiny as he admitted to being a "non-dom" in the past. Mr Javid, who lived and worked in New York and Singapore during his career as a banker at Chase Manhattan and Deutsche Bank, also disclosed that before becoming a minister he had held some financial investments in an offshore trust. (Sky)

FISCAL/BREXIT: Liz Truss’s plan to entice 200 British businesses back into trading in Northern Ireland by offering them tax cuts has been dropped amid opposition by Rishi Sunak over the costs of the scheme. (Telegraph)

EUROPE

GERMANY: Germany’s economic growth could fall to 1.4%-1.5% this year, from 2.7% in 2021, with an average of around 590,000 people on reduced-hours lay-off schemes over the course of the year, Labour Minister Hubertus Heil said in an interview with Bild am Sonntag. “We will still be growing,” Heil said. “But this all subject to the proviso that the war does not spread further and that energy supply remains in place,” he added. The government would provide further aid and support for lay-offs where possible to safeguard jobs if the situation worsened, Heil said. Germany plans to offer more than 100 billion euros ($108.8 billion) worth of aid to companies hit by fallout from the war in Ukraine, according to a document seen by Reuters on Friday. Finance Minister Christian Lindner is also planning to submit a supplementary budget to parliament in coming weeks to reflect the economic impact of the war, which would likely be worth at least 24 billion euros. (RTRS)

FISCAL/ENERGY: The EU must act fast to combat soaring energy prices at a European level or member states will have to act unilaterally, Greek Prime Minister Kyriakos Mitsotakis said. Speaking at the Delphi Forum in Athens, together with Secretary-General of the Organisation for Economic Co-operation & Development (OECD) Mathias Cormann, Mitsotakis said the bloc should use the €230 billion of unused loans from the Recovery and Resilience Facility, created to help EU economies cope with the fallout of the coronavirus pandemic, to mitigate the crisis in the short term. (POLITICO)

FRANCE: President Emmanuel Macron is set to face his nationalist rival Marine Le Pen in the final round of the French election in a re-run of their 2017 contest. Macron got around 28% of the vote compared with about 24% for Le Pen, according to pollsters’ projections based on partial results from Sunday’s initial ballot. Far-left leader Jean-Luc Melenchon was third with around 20%. The top two candidates will go forward to a runoff on April 24 to decide who will lead Europe’s second-biggest economy. “The game isn’t over yet,” the 44-year-old president told supporters at a rally in the French capital. One snap poll of 1,700 voters taken by OpinionWay after voting closed in Sunday showed Macron leading Le Pen by 54% to 46%. Another survey of almost 1,000 people by Ifop had him ahead by 51% to 49%, less than the margin of error. (BBG)

ITALY/BTPS: Italy plans to sell up to EU3.75 billion ($4.08 billion) of bonds due Aug. 15, 2025 in an auction on April 13. Italy plans to sell up to EU1.5 billion ($1.63 billion) of 0.45% bonds due Feb. 15, 2029 in an auction on April 13. Italy plans to sell up to EU1 billion ($1.09 billion) of 3% bonds due Aug. 1, 2029 in an auction on April 13. Italy plans to sell up to EU750 million ($815.55 million) of 3.1% bonds due March 1, 2040 in an auction on April 13. Italy plans to sell up to EU1 billion ($1.09 billion) of 2.15% bonds due Sept. 1, 2052 in an auction on April 13. (BBG)

RATINGS: Sovereign rating reviews of note from Friday included:

- Fitch affirmed Austria at AA+; Outlook Stable

- Fitch affirmed Finland at AA+; Outlook Stable

- DBRS Morningstar upgraded Cyprus to BBB, Trend Changed to Stable

- DBRS Morningstar confirmed Norway at AAA, Stable Trend

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said she’s confident that the U.S. will avoid a recession as the Fed tightens policy, though the inflation rate will probably remain at more than 2% into next year. “I think that it will take some time to get inflation down,” Mester said on CBS’s “Face the Nation,” citing rising energy and commodity prices. “So I think inflation will remain above 2% this year and even next year, but the trajectory will be that it’ll be moving down.” China’s attempts to stamp out Covid-19 are also contributing, Mester said. “Certainly the lockdown in China is going to exacerbate the problems that we have in supply chains,” she said. “So that is putting upward pressure on prices.” (BBG)

EQUITIES: The largest US banks are set to report their biggest slowdown in investment banking revenue in years next week, as the dealmaking engine that helped propel Wall Street to record profits last year sputters. Banks started the year braced for a slowdown in dealmaking activity following a blockbuster 2021 supported by markets and widespread stimulus measures. The first quarter of 2021 in particular was a lucrative three months in which banks minted fees from a boom in initial public offerings of special purpose acquisition companies. The slowdown has been worse than expected. Bank executives have blamed Russia’s invasion of Ukraine and the subsequent market volatility. Equity capital markets and IPOs in particular have slowed dramatically in recent weeks. (FT)

OTHER

GLOBAL TRADE: Harvests of some of Ukraine’s most important crops could be cut in half this year, threatening its position as a major exporter and exacerbating already tight global supplies. Russia’s invasion is happening at a crucial time for crops. Ukrainian farmers have just started planting corn and sunflowers, progress of which is being hobbled by field mines and a lack of fuel and fertilizers. For wheat that was sown months before the war, a chunk of the area is occupied by troops. With ports mostly shut, farmers are also considering switching to crops more suited to local consumption than for export. Even at this early stage in the growing season the situation looks bleak, with analysts projecting output down between 30% and 55%, depending on the crop. That adds to risks for shortages of key staples and may further raise global food prices already at a record. (BBG)

U.S./CHINA: China has accelerated an expansion of its nuclear arsenal because of a change in its assessment of the threat posed by the U.S., people with knowledge of the Chinese leadership’s thinking say, shedding new light on a buildup that is raising tension between the two countries. The Chinese nuclear effort long predates Russia’s invasion of Ukraine, but the U.S.’s wariness about getting directly involved in the war there has likely reinforced Beijing’s decision to put greater emphasis on developing nuclear weapons as a deterrent, some of these people say. Chinese leaders see a stronger nuclear arsenal as a way to deter the U.S. from getting directly involved in a potential conflict over Taiwan. (WSJ)

U.S./CHINA: China defended its measures to curb the virus outbreak and expressed displeasure with the U.S. over what it calls a “groundless accusation” of Chinese pandemic policies, even as cases in Shanghai continued to spread despite an extensive lockdown. The U.S. State Department asked Americans to reconsider travel to China and avoid visiting virus hotspots including Shanghai due to what it calls an “arbitrary enforcement” of virus restrictions. It also allowed non-emergency employees and their family members from the U.S. consulate in Shanghai to leave, and notified Chinese officials of the voluntary departure decision while raising concerns regarding China’s Covid response. “The U.S. announcement of authorizing the voluntary departure of U.S. personnel and their family members at the U.S. Consulate General in Shanghai is the U.S.’ own decision,” China’s foreign ministry spokesperson Zhao Lijian said in a statement. “We are strongly dissatisfied with and firmly opposed to the U.S. side’s groundless accusation against China’s epidemic response policies, and have lodged solemn representations with the U.S. side,” Zhao said. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda on Monday warned that there was "very high uncertainty" over the impact the Ukraine crisis could have on Japan's economy through market moves and rising commodity prices. "Japan's economy is recovering as a trend, although there are some signs of weakness," Kuroda said in a speech delivered to a quarterly meeting of the central bank's branch managers. (RTRS)

BOJ: Bank of Japan Executive Director Shinichi Uchida said on Monday excess short-term volatility in the yen's moves would make it difficult for companies to create business plans. "It's desirable for currency rates to move stably reflecting economic and financial fundamentals. That's a policy confirmed by G7 and G20 countries," Uchida told parliament, when asked about the impact of the yen's recent declines on the economy. (RTRS)

AUSTRALIA: Australia’s federal election will be held on Saturday 21 May, with the prime minister, Scott Morrison, declaring the election a choice between a “strong future and an uncertain one”. Firing the opening salvo on the 41-day campaign at Parliament House on Sunday, Morrison said while his government had not been perfect, the choice was between a “government that you know and that has been delivering and a Labor opposition that you don’t”. “This election is about you – no one else,” he said. (Guardian)

AUSTRALIA: Scott Morrison has pulled ahead of Anthony Albanese as preferred prime minister but Labor remains in poll position despite a further fall in popular support, the latest Newspoll shows. The Newspoll conducted for The Australian on the eve of the election campaign shows Labor's primary vote has dropped a point to 37 per cent on top of a three-point fall last week. The coalition's primary vote remains unchanged on a low 36 per cent. The shift in underlying support for Labor has resulted in a one-point gain for the coalition on a two-party-preferred basis with Labor ahead 53-47. Mr Morrison has pulled ahead of the Labor leader as the better prime minister, the Newspoll shows. Mr Albanese fell three points to 39 per cent while Mr Morrison rose a point to 44 per cent. (AAP)

RBNZ: The Shadow Board is sharply divided over how much the Reserve Bank should increase the Official Cash Rate (OCR) at the April meeting, with views split over whether the OCR should increase by 25 or 50 basis points. The surge in inflation pressures has led to growing calls for the Reserve Bank to undertake monetary policy tightening at a more aggressive pace to rein in these inflation pressures. While supply-side constraints are driving much of the increase in inflation in the New Zealand economy, the recent rise in longer-term inflation expectations raises the risk of a wage-price spiral developing. (NZIER)

BOK: The nominee for chief of the Bank of Korea (BOK) on Sunday underlined the importance of inducing controls on household debt through signals on interest rates, hinting the central bank could raise borrowing costs to address the growing debt issue. Rhee Chang-yong made the remarks in writing in response to a lawmaker's question on the issue of rising household debt as he prepares for a confirmation hearing scheduled for April 19, according to the BOK. "The household debt issue is deeply related with the real estate issue and could turn into a factor that could slow down (economic) growth rates down the road, so it is a policy task that warrants urgency to stabilize the pace at which household debt expands," Lee said. "It is important that the BOK should induce economic players to manage household debt by using signals on interest rates," he added. Rhee still admitted monetary policy, including adjusting borrowing costs, is not enough to resolve the household debt issue, saying debt rescheduling and other macro policy steps are needed. (Yonhap)

SOUTH KOREA: South Korea's incoming President Yoon Suk-yeol on Sunday named Choo Kyung-ho as deputy prime minister and finance minister, as the country seeks to tackle surging inflation, household debt and demand for welfare. Yoon, who takes office in May 10, announced eight cabinet minister nominations, including defense, industry, health and land. All are subject to parliamentary confirmation hearings. As deputy prime minister, Choo, 62, would double as finance minister and oversee economic policy and replace incumbent Hong Nam-ki. (RTRS)

HONG KONG: Hong Kong’s leading candidate for the city’s top job pledged to maintain the financial hub’s international competitiveness and stressed his loyalty to China, as he formally kicked off his campaign after winning Beijing’s sole backing for the race. “Hong Kong must maintain its character of being an international metropolis,” said former chief secretary John Lee at a press briefing on Saturday. “Hong Kong must expand its international connectivity, establish a more favorable business environment, uphold the value of inclusion, diversity and openness, and further strengthen its competitiveness.” (BBG)

MEXICO: At least 90% of Mexicans taking part in President Andres Manuel Lopez Obrador's recall referendum on Sunday voted for him to stay in office, according to a preliminary estimate published by the National Electoral Institute (INE). The INE forecast between 90.3% and 91.9% of voters supported Lopez Obrador staying in office. Turnout in the vote was predicted to be between 17% and 18.2%, INE said, a figure far below the 40% threshold required to make the result binding. (RTRS)

BRAZIL: About half of the people in Brazil’s two most populous states disapprove of President Jair Bolsonaro, according to a poll by Datafolha. Around 49% in Sao Paulo say the government has been either bad or awful while 23% believe its performance has been normal, according to a poll published on Sunday by local newspaper Folha de Sao Paulo. In Rio de Janeiro, 48% feel the government has been bad while 23% say it has been regular. In Sao Paulo, however, the president’s disapproval rating is 16 percentage points lower than September of last year, when it hit 65%. According to other recent polls, he’s narrowed the gap with Luiz Inacio Lula da Silva, the frontrunner in October’s election, in the northern and southern states. (BBG)

RUSSIA: Ramzan Kadyrov, the powerful head of Russia's republic of Chechnya, said early on Monday that there will be an offensive by Russian forces not only on the besieged port of Mariupol, but also on Kyiv and other Ukrainian cities. "There will be an offensive ... not only on Mariupol, but also on other places, cities and villages," Kadyrov said in a video posted on his Telegram channel. "Luhansk and Donetsk - we will fully liberate in the first place ... and then take Kyiv and all other cities." (RTRS)

RUSSIA: Russia’s military declared missile strikes on Ukraine’s eastern Dnipropetrovsk and Kharkiv regions and southern Mykolaiv region Sunday. Russian defense ministry spokesman Maj. Gen. Igor Konashenkov said in a statement: “During the night in the village of Zvonetske — Dnipropetrovsk region — high-precision sea-based missiles destroyed the headquarters and base of the Dnipro nationalist battalion, where reinforcements from foreign mercenaries arrived the other day.” “High-precision air-launched missiles in the area of the settlement of Stara Bohdanivka, Mykolaiv region and at the Chuhuiv military airfield [in Kharkiv region] destroyed launchers of Ukrainian S-300 anti-aircraft missile systems identified by reconnaissance,” the statement added. (CNBC)

RUSSIA: Renewed missile attacks by Russian forces have demolished the airport at Dnipro in central Ukraine, according to the regional governor. Dnipro is the fourth-largest city in the country. The airport came under shelling in the morning and then again several hours later, with the subsequent attack injuring rescue workers on the scene, Valentyn Reznichenko said on his Telegram channel. Russian troops separately hit infrastructure sites in Zvonetske, also in the Dnipropetrovsk region, he said. (BBG)

RUSSIA: Russia has reportedly appointed a new commander to oversee its war on Ukraine, according to a U.S. official who spoke to the Associated Press on the condition of anonymity. Russia has now turned to one of its most experienced military officers, Gen. Alexander Dvornikov, the official told AP. Citing reports, NBC’s Molly Hunter explained on Sunday’s “Meet the Press” with Chuck Todd that the 60-year-old general has a record of brutality against civilians in Syria and is “apparently one of Putin’s favorites.” (CNBC)

RUSSIA: In response to mounting losses, and as it prepares for what’s expected to be a major offensive in Ukraine’s east, Russia is looking to bolster troop numbers with personnel discharged from military service since 2012, the U.K. said in an intelligence update. Moscow is also trying to recruit from Transnistria, the pro-Russian enclave in neighboring Moldova, the U.K. said. (BBG)

RUSSIA: Despite major losses, Russia still has a lot of manpower and that could drag on the conflict for a long time, a senior U.S. Defense official said. “This will be a knife fight,” the official said. “This could be very bloody and very ugly.” After failing to capture capital city Kyiv, Moscow is refocusing its efforts on eastern Ukraine, where Russia and Ukraine have fought for eight years. “The Russians are limiting their geographic aims, but they still have a lot of combat power available. This could go on for a long time,” the official said. The official also said some of the Russian units that attacked Kyiv were “severely mauled.” “We’ve seen indications of some units that are literally ... eradicated — there’s just nothing left at the BTG except a handful of troops and maybe a small number of vehicles,” the official said. (CNBC)

RUSSIA: Satellite images from Maxar Technologies show a convoy of military forces heading south toward the Donbas region on April 8. (CNBC)

RUSSIA: Nato is drawing up plans to deploy a permanent full-scale military force on its border in an effort to combat future Russian aggression following the invasion of Ukraine, the alliance’s secretary general has revealed. In an interview with The Telegraph, Jens Stoltenberg said Nato was “in the midst of a very fundamental transformation” that will reflect “the long-term consequences” of Vladimir Putin’s actions. As part of a major “reset”, the relatively small “tripwire” presence on the alliance’s eastern flank will be replaced with sufficient forces to repel an attempted invasion of member states such as Estonia and Latvia. Options for the reset are being developed by Nato military commanders. (Telegraph)

RUSSIA: President Volodymyr Zelenskiy suggested that the coming battle for Ukraine’s east could be decisive. Speaking at a joint press conference with Austrian Chancellor Karl Nehammer, Zelenskiy said that despite evidence of atrocities, Ukraine’s government is willing to continue talks with Moscow. “Ukraine has always said that it is ready for negotiations and will be seeking any ways to end the war,” Zelenskiy said. “At the same time, unfortunately we see preparations for an important, what some call a crucial, battle in the east of our state.” (BBG)

RUSSIA: Ukraine’s president has renewed calls for the “whole civilized world” to immediately ban Russian oil as “Ukraine does not have time to wait.” In his nightly address, Volodymyr Zelenskyy said: “Action must be taken immediately... And the oil embargo should be the first step.” It must be carried out “at the level of all democracies, the whole civilized world,” he said. “Then Russia will feel it. Then it will be an argument for them — to seek peace, to stop pointless violence.” (CNBC)

RUSSIA: Ukraine continues to stress its need for heavy weapons, including combat planes, to support ground forces ahead of major battles expected in the Donetsk and Luhansk regions once Russian troops regroup. “We are getting more and more supplies, but I must say that these supplies are not enough,” Defense Intelligence Chief Kyrylo Budanov told CNN. “Our priority is heavy artillery and missile systems” as well as anti-defense and aviation systems. When asked to elaborate, Budanov mentioned “combat planes” for potential use against Russian ground forces. Ukraine’s military staff is preparing for heavy fighting in the Donbas region. (BBG)

RUSSIA: President Joe Biden announced the deployment of a Patriot missile defense system to Slovakia after the NATO member said it was sending one of its own systems to Ukraine. “I have directed my administration to continue to spare no effort to identify and provide to the Ukrainian military the advanced weapons capabilities it needs,” Biden said. Defense Secretary Lloyd Austin said the Patriot battery will be manned by U.S. forces and should arrive in the coming days. The deployment length hasn’t been fixed, he said, adding that “we continue to consult with the Slovakian government about more permanent air defense solutions.” Slovakia gave a Russian-made S-300 air-defense system to neighboring Ukraine, Premier Eduard Heger said in a Twitter post on Friday. (BBG)

RUSSIA: Efforts to supply arms to Ukraine as Russian forces regroup in the east include “looking at systems that would require some training” for Ukrainian troops outside the country, National Security Adviser Jake Sullivan told CBS on Sunday. Sullivan said he and Mark Milley, chairman of the Joint Chiefs of Staff, “worked through a game plan” for delivering more weapons from the U.S. or its allies during a call last week with President Volodymyr Zelenskiy. “Some of that’s been delivered, some of it’s on the way and some of it we’re still working to source,” Sullivan said. (BBG)

RUSSIA: Ukrainian president Volodymyr Zelenskyy told “60 Minutes” he has doubts about whether the United States will meet his request for supplies and weapons for the next phase of the war against Russia, according to a preview of the interview released by CBS. “All depends on how fast we will be helped by the United States. To be honest, whether we will be able to survive depends on this,” Zelenskyy said. “I have 100% confidence in our people and in our armed forces, but unfortunately I do not have the confidence we will be receiving everything we need.” The Ukrainian leader also said he believes Russia is increasing its military equipment near the front as the fighting shifts toward the southern and eastern parts of Ukraine. (CNBC)

RUSSIA: Ukraine has started to pursue about 5,600 cases of war crimes linked to Russia’s invasion, Prosecutor General Iryna Venediktova told the U.K.’s Sky News. The suspects in only the main “anchor case” include more than 500 top military, political, and other officials in Russia, she said. “Almost every region of Ukraine was bombed, and we have a lot of concrete facts in every region and every city,” Venediktova said. The Kremlin denies targeting civilians and has blamed Ukraine for killing thousands of its own people, without providing evidence and despite satellite images, intercepted communications, eye-witness accounts and other reports indicating its troops are at fault. Venediktova said Vladimir Putin is “the main war criminal of the 21st century,” but while he remains Russian president he can’t be charged under international law without a decision from the International Criminal Court prosecutor. (BBG)

RUSSIA: White House National Security Adviser Jake Sullivan deemphasized the importance of labelling Russia’s atrocities on Ukrainians as “genocide.” “The label is less important,” Sullivan said on CNN’s “State of the Union.” It shouldn’t distract from the fact that “these acts are cruel and criminal and wrong and evil and need to be responded to decisively.” The U.S. is still determining whether the actions in Ukraine constitute genocide, Sullivan later said on ABC’s “This Week.” (CNBC)

RUSSIA: Ukrainian minister Olga Stefanishyna says she expects Ukraine to be given European Union candidate country status in June. Ukraine is “ready to move fast” with its application to become an EU member, Stefanishyna, who is Ukraine’s deputy prime minister for European and Euro-Atlantic integration, said. (CNBC)

RUSSIA: A key member of Finland’s ruling coalition opened the door to a potential NATO membership bid in yet another sign the Nordic country is nearing an application to join the defense alliance following neighboring Russia’s attack on Ukraine. The Center Party, part of a five-party cabinet run by Social Democrat Prime Minister Sanna Marin, is an important political force in Finland with widespread support in rural areas. The party has not previously advocated joining the bloc, traditionally leaning toward fostering a trade relationship with Russia instead. The party’s top leadership unanimously approved a proposal made by party leader, Finance Minister Annika Saarikko, to take any security-policy decisions deemed necessary, including an application to join the North Atlantic Treaty Organization, should the government want to take that step. Her proposal had been backed by Defense Minister Antti Kaikkonen, among others. (BBG)

RUSSIA: The leader of Sweden's second-biggest opposition party will, should neighbour Finland apply to join NATO, suggest that his party change its stance towards favouring a Swedish membership, he told daily Svenska Dagbladet. A change of stance by the Sweden Democrats party would mean a swing to a parliamentary majority in favour of long-neutral Sweden joining the alliance. (RTRS)

RUSSIA: Russia has made a “massive strategic blunder” as Finland and Sweden look poised to join Nato as early as the summer, according to officials. Washington is banking on the move that will stretch Russia’s military and enlarge the western alliance from 30 to 32 members as a direct consequence of President Putin’s invasion of Ukraine. US officials said Nato membership for both Nordic countries was “a topic of conversation and multiple sessions” during talks between the alliance’s foreign ministers last week attended by Sweden and Finland. “How can this be anything but a massive strategic blunder for Putin?,” one senior American official said. Finland’s application is expected in June, with Sweden expected to follow. (The Times)

RUSSIA: A bipartisan group of U.S. lawmakers arrived in Poland to meet with American forces, allies and Ukrainian refugees. Led by House leader Rep. Kevin McCarthy, R-Calif., the group included House Whip Steve Scalise, R-La. and Reps. Michael McCaul, R-Texas; Michael Turner, R-Ohio; Ken Calvert, R-Calif.; French Hill, R-Ark.; Kathleen Rice, D-New York; Stephanie Murphy, D-Fla.; Mike Garcia, R-Cal. and Michelle Fishbach, R-Minn. “We are here—as representatives of the United States—to ensure we are doing what is right to support Ukrainians as they defend themselves and their democracy,” McCarthy said in a release. (CNBC)

RUSSIA: The U.S. widened export controls on Russia and Belarus to effectively cut off access to more products. The restrictions were extended “to almost any sensitive dual-use technology, software, or commodities that could be used to support Russia’s war effort,” the Department of Commerce said Saturday. The rule expands license requirements to all items on the Commerce Control List, including certain composite materials, medical products, hydraulic fluids, pumps, valves, and lower-level machine tools. The action also puts on notice Belarus airlines and plane owners that they can’t fly or service any aircraft without U.S. authorization if more than 25% of the machinery’s value comes from American content subject to export controls. (BBG)

RUSSIA: The European Commission will pledge 1 billion euros to support Ukraine and countries receiving refugees fleeing the war following Russia’s invasion, the president of the EU’s executive, Ursula von der Leyen, said on Saturday. (CNBC)

RUSSIA: Ursula von der Leyen, the president of the European Commission, said on CNN’s “State of the Union” that the European Union “has to do more” for Ukraine as it fights Russia, including providing military supplies and potentially imposing additional sanctions. “We have to deliver arms, weapons so the Ukrainian people can defend themselves. It’s really urgent right now. A lot has been done but more has to be done. We have to support the refugees in Ukraine, but also very important we have to financially support Ukraine,” she said. Von der Leyen visited Bucha last week to witness aftermath of Russia’s invasion first hand. (CNBC)

RUSSIA: Ukrainian President Volodymyr Zelenskiy tweeted on Sunday that he had discussed possible additional sanctions on Russia in a call with German Chancellor Olaf Scholz. (RTRS)

RUSSIA: EU member states are at loggerheads over demands for an immediate blockade on Russian oil imports as the soaring cost of living weighs heavily on politicians considering how to punish Moscow over its war in Ukraine. Momentum is growing in the EU for fresh curbs on Russian fossil fuels as evidence mounts of atrocities against Ukrainian civilians. But while the European Commission is working on oil sanctions, there is scepticism about the idea of a rapid clampdown among some member states. Commission officials have prepared the rough outline of possible measures targeting Russian oil, as part of a basket of potential restrictions drawn up ahead of the invasion of Ukraine. But a lack of unanimous support for the measure means it is not on the official agenda of topics to be discussed at an EU foreign ministers meeting on Monday. It will only be raised informally for broad discussion. (FT)

RUSSIA: The European Union’s ambassador has returned to the Ukrainian capital Kyiv after his delegation’s evacuation from the country on Feb. 24, when Russian forces first invaded the country. “Our delegation is coming back, the EU is coming back to Kyiv, and I am sure that other delegations and embassies from member states will follow,” Josep Borrell, the EU high representative for foreign affairs, said. He made the announcement during a visit to Kyiv and also outlined plans to provide another 500 million euros in military aid to Ukraine. (CNBC)

RUSSIA: U.K. Prime Minister Boris Johnson made a surprise visit to Kyiv, the latest in a string of leaders traveling to Ukraine capital to meet with President Volodymyr Zelenskiy. Johnson pledged new military assistance of 120 armoured vehicles and new anti-ship missile systems. That’s on top of 100 million pounds ($130 million) in equipment announced Friday, including over 800 anti-tank missiles, Javelin anti-tank systems, Starstreak air defence systems and a range of helmets, armour and night-vision goggles. The U.K. said it has also liberalized tariffs on most imports from Ukraine as prt of its commitment to economic stability. (BBG)

RUSSIA: Austrian Chancellor Karl Nehammer said on Twitter that he plans to meet Russian President Vladimir Putin in Moscow on Monday. This would be the first face-to-face meeting between Putin and a European Union leader since Russia invaded Ukraine in late February. “I’m going to meet Vladimir #Putin in Moscow tomorrow,” Nehammer wrote. “We are militarily neutral, but [have] a clear position on the Russian war of aggression against #Ukraine. It must stop! It needs humanitarian corridors, ceasefire & full investigation of war crimes.” (CNBC)

RUSSIA: Vladimir Putin and Belarus leader Alexander Lukashenko will meet Tuesday at the Vostochny Cosmodrome in eastern Russia, Interfax reported. The pair are expected to discuss Lukashenko’s hopes of being part of negotiations with Ukraine. (BBG)

RUSSIA: The Russian offices of Human Rights Watch and Amnesty International were ordered to close, a move Amnesty’s secretary general vowed wouldn’t stop her organization’s work. “The authorities are deeply mistaken if they believe that by closing down our office in Moscow they will stop our work documenting and exposing human rights violations,” Secretary General Agnes Callamard said in a statement. “We will redouble our efforts to expose Russia’s egregious human rights violations both at home and abroad.” Russian government officials didn’t immediately respond to questions about the closings. Both groups have been critical of Russia’s actions in Ukraine. Human Rights Watch on Thursday applauded the United Nations’ decision to suspend Russia from the Human Rights Council. (BBG)

RUSSIA: President Vladimir Putin’s invasion of Ukraine will cause that country’s economy to contract by almost half -- or 45.1% -- this year, while Russia’s will shrink by 11.2%, according to the World Bank. Besides Russia and Ukraine, the economies of Belarus, Kyrgyzstan, Tajikistan and Moldova are also forecast to shrink in 2022, with the rest of the region growing at an “anemic pace,” according to the report. (BBG)

RUSSIA: Russia won’t default on its debt obligations and the economy is expected to recover to its 2021 level in a year, Izvestia reported, citing an interview with Deputy Economy Minister Ilya Torosov. Russia has enough resources to serve its debt, Torosov told the newspaper. (BBG)

RUSSIA: Russia will take legal action if the West tries to force Moscow to default on its sovereign debt, Finance Minister Anton Siluanov told the daily Izvestia newspaper in an interview early on Monday. "Of course we will sue, because we have taken all the necessary steps to ensure that investors receive their payments," Siluanov was quoted as saying in the pro-Kremlin newspaper. (RTRS)

RUSSIA: Russia will halt bond auctions for the remainder of 2022 due to prohibitive borrowing costs, Finance Minister Anton Siluanov was quoted as saying by Izvestia. “We do not plan to go to the local market or foreign markets this year,” Siluanov told the Russian outlet. “It makes no sense because the borrowing cost would be cosmic.” (BBG)

RUSSIA: Russia will increase its government reserve fund by 273.4 billion rubles ($3.4 billion) to “ensure the stability of the economy in the face of external sanctions,” the Kremlin said in a decree. The government will mainly finance the increase via “additional oil and gas revenues received in the first quarter of 2022,” it said, citing legal amendments approved in early March by President Vladimir Putin just after he launched the invasion. (BBG)

RUSSIA: Russia will relax temporary capital control measures aimed at limiting a drop in the rouble by allowing individuals to buy cash foreign currency and will also scrap commission for buying forex through brokerages, the central bank said on Friday. The rouble has rebounded on the Moscow Exchange from record lows in March to levels seen before Feb. 24, when Russia started what it calls "a special military operation" in Ukraine, as capital control measures suffocated demand for forex. (RTRS)

RUSSIA: VTB Bank PJSC, Russia’s second-largest lender, no longer controls its Frankfurt-based subsidiary VTB Bank Europe SE after the European Union’s latest round of sanctions. Germany’s Federal Financial Supervisory Authority BaFin has prohibited VTB Bank Europe’s management from following instructions from its parent, the regulator said in a statement Sunday. Bloomberg News reported last month that VTB Bank Europe has been put up for sale, with German regulators backing the plan as they seek to avoid a messy unraveling. (BBG)

RUSSIA/RATINGS: RATINGS: Sovereign rating reviews of note from Friday included:

- S&P cut Russia to SD

SOUTH AFRICA: South Africa’s ruling African National Congress elected a former mayor who has been charged with corruption to a top post in one of its key regions, dealing a blow to President Cyril Ramaphosa’s efforts to clean up the party. The ANC in the eastern eThekwini municipality, which has more branches than any other urban center, on Sunday chose Zandile Gumede as its chairwoman. She won 210 votes while Ramaphosa ally Thabani Nyawose, the municipality’s speaker, secured 181. (BBG)

IRAN: Iran said on Saturday it had imposed sanctions on 24 more Americans, including former Army Chief of Staff George Casey and former President Donald Trump's attorney Rudy Giuliani, as months of talks to revive a 2015 nuclear deal have stalled. Almost all the people named were officials who served during Trump's administration, which imposed sanctions on Iranian officials, politicians and companies and withdrew the United States from Iran's nuclear agreement with world powers. In a statement carried by local media, the Iranian Foreign Ministry accused the sanctioned Americans - who also included several business figures and politicians - of supporting "terrorist groups and terrorist acts" against Iran, and Israel's "repressive acts" in the region and against Palestinians. (RTRS)

ENERGY: President Joe Biden will meet virtually with Indian Prime Minister Narendra Modi on Monday, the White House said, at a time when the United States has made clear it does not want to see an uptick in Russian energy imports by India. “President Biden will continue our close consultations on the consequences of Russia’s brutal war against Ukraine and mitigating its destabilizing impact on global food supply and commodity markets,” Press Secretary Jen Psaki said in a statement on Sunday. Daleep Singh, U.S. Deputy National Security Adviser for International Economics, who visited India recently, said the United States will not set any “red line” for India on its energy imports from Russia but does not want to see a “rapid acceleration” in purchases. (RTRS)

ENERGY: Germany could end Russian oil imports this year, Chancellor Olaf Scholz said on Friday, signalling the urgency driving Europe's biggest economy to wean itself off energy from Russia following its invasion of Ukraine. (RTRS)

ENERGY: Italian prime minister Mario Draghi will visit Algeria on Monday to sign a new gas supply deal, as Rome strives to reduce its dependence on Russian fuel following the invasion of Ukraine. It is the latest in a series of moves made by European countries to secure alternative fuel sources as they seek to cut Russia off from the global economy in punishment for the war. Italy buys about 30bn cubic meters of gas a year from Russia, 40 per cent of its total consumption. Algeria is Italy’s second-largest supplier, providing 21bn cubic metres a year — about 31 per cent of annual consumption. (FT)

ENERGY: Chemicals and energy giant INEOS has offered to develop a shale gas test site in Britain to demonstrate to the government that extraction by fracking can be performed safely. (RTRS)

OIL: Traders of physical fuel in the U.S. are abandoning their annual storage contracts as holding onto products has become a losing proposition given current pricing structures. Futures markets for diesel, jet fuel and gasoline shifted into wide backwardations -- conditions in which future deliveries are priced lower than prompt levels -- after Russia’s invasion of Ukraine tightened global oil supplies and sent prompt prices surging. The backwardations are easing this month, but it remains true that fuels are losing value every day inside a storage tank. “There is no reason to hold onto storage capacity at this moment,” said Reid I’Anson, senior economist at consultancy Kpler. “As is often the case, prices are dictating behavior and prices are telling traders to sell whatever they have right now.” (BBG)

CHINA

PBOC: China has room to cut both banks’ reserve requirement ratios and interest rates in order to reduce financing costs of the real economy, said Guan Tao, the chief economist at BOC International, the Securities Times reported. Monetary policies must be accurate and targeted, Guan said. The economy could see a significant rebound in Q2 with the easing of pandemic measures and more investments, Guan said. China’s inflation could face some imported pressure as well as internal supply chain snags, so keeping inflation stable is also a major target, Guan said. China could use active fiscal policies to increase government investment leverage and improve private investment and consumption, said Guan. (MNI)

POLICY/ECONOMY: China on Sunday unveiled guidelines for accelerating the building of a unified national market that is highly efficient, rule-based, fair for competition, and open, Xinhua News Agency reported. It includes the accelerated development of a unified capital market, including an improved supervision system with clear rights and responsibilities, and setting up "dos and don’ts" to prevent the disorderly expansion of capital. The guideline also calls for promoting a free-flow bond market infrastructure, Xinhua reported. (MNI)

CORONAVIRUS: China must stick to “zero covid” policies to prevent a large-scale return of the pandemic, the official People’s Daily said in a commentary. Giving up in the face of the pandemic means surrendering and placing everyone’s life and safety at extreme risks, it said. While some have said the pandemic has destroyed lives and loosening up is acceptable given the Omicron’s less severe case, these thoughts are wrong and must be corrected, the newspaper said. (MNI)

CORONAVIRUS: Shanghai announced another round of mass coronavirus testing, while the southern metropolis of Guangzhou said it will do the same for all 18 million residents, as authorities accelerate efforts to curb China’s worst outbreak since the early days of the pandemic. Shanghai Deputy Mayor Zong Ming announced tweaks to the government’s lockdown policy at a press briefing Saturday. Overall measures remained stringent, however, as residents living in communities with Covid cases in the past seven days are barred from leaving their homes, while those residing in compounds without infections in the past week won’t need to be confined to their homes, but can’t leave those areas. In Guangzhou, all 11 districts of the city announced plans to begin coronavirus testing, China Central Television reported on Saturday. It reported two confirmed cases and an asymptomatic one for Friday, according to official data. Guangzhou, which hosts one of China’s top container ports, conducted mass testing in December after a cargo flight crew worker tested positive. (BBG)

CORONAVIRUS: The southern Chinese metropolis of Guangzhou Sunday announced the suspension of in-person classes at local primary and middle schools starting April 11 for COVID-19 control. From 8 a.m. Saturday to 2 p.m. Sunday, the city has registered 22 local infections amid its latest COVID-19 outbreak starting from Friday, said local authorities during a press conference held Sunday. (Xinhua)

CORONAVIRUS: Northeast China's epidemic-stricken Jilin Province will gradually resume work and life routines on condition of secure epidemic prevention, said local officials on Sunday, after the province achieved zero-COVID status at the community level on Friday. Jilin will promote work resumption, restore transportation and prepare for the reopening of schools in an orderly manner based on the health risks in different regions, Zhang Baozong, a senior official of the Jilin provincial government, said at a press briefing on Sunday. (Global Times)

CORONAVIRUS: Tangshan city in north China lifts the temporary lockdown imposed from March 22 as the city has effectively blocked the Covid spreading, the municipal govt says in statement on its official Weibo account. Tangshan reported zero Covid cases for nine consecutive days, statement says. (BBG)

CORONAVIRUS/PROPERTY: China’s largest banks are allowing residents in Shanghai to delay their mortgage payments as part of the nation’s broader efforts to support the financial hub in its Covid fight. Lenders including Industrial & Commercial Bank of China Ltd. and Bank of Communications Co. are offering Shanghai clients a payment holiday on their mortgage loans for as long as three months. China Construction Bank Corp.allowed clients to delay their payment on both mortgage and consumer loans for up to 28 days while Bank of China Ltd. said any records of overdue payment due to the pandemic will be removed. (BBG)

PROPERTY: Eastern Chinese city of Suzhou loosens sale limit on second-hand homes to three years after acquiring ownership certificates from five years, Cailian reports, citing the local property market and trading management center. (BBG)

EQUITIES: China’s top securities watchdog will speed up efforts to put new rules surrounding overseas IPOs into effect, according to an official release on Saturday. The China Securities Regulatory Commission (CSRC) will keep the channel of overseas listings unclogged, CSRC Chairman Yi Huiman said in a speech to a business group on the same day, according to the release. This is a reiteration of the commission’s commitment on March 16 following a meeting of the country’s top financial policy committee that aimed to address market concerns in the wake of massive sell-offs of Chinese stocks at home and abroad. One of the concerns was whether Beijing would support Chinese companies listing in the U.S. (Caixin)

OVERNIGHT DATA

CHINA MAR CPI +1.5% Y/Y; MEDIAN +1.4%; FEB +0.9%

CHINA MAR PPI +8.3% Y/Y; MEDIAN +8.1%; FEB +8.8%

NEW ZEALAND MAR CARD SPENDING TOTAL +1.6%; FEB -7.6%

NEW ZEALAND MAR CARD SPENDING RETAIL -1.3%; FEB -7.8%

CHINA MARKETS

PBOC Injects CNY10 Billion via OMOs, Liquidity Unchanged

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9469% at 09:30 am local time from the close of 1.9397% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 44 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3645 MON VS 6.3653

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3645 on Monday, compared with 6.3653 set on Friday.

MARKETS

SNAPSHOT: Macron Leads After First Round Of Polls

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 230.52 points at 26755.28

- ASX 200 up 3.31 points at 7481.3

- Shanghai Comp. down 56.777 points at 3195.073

- JGB 10-Yr future down 18 ticks at 149.31, yield up 0.9bp at 0.239%

- Aussie 10-Yr future down 5.0 ticks at 96.930, yield up 5bp at 3.014%

- U.S. 10-Yr future -0-16 at 119-20, yield up 6.84bp at 2.768%

- WTI crude down $2.65 at $95.61, Gold down $5.21 at $1942.33

- USD/JPY up 53 pips at Y124.87

- MACRON AND LE PEN IN CLOSE RACE HEADING INTO FRENCH RUNOFF (BBG)

- GROWING FOCUS ON THE BATTLE FOR UKRAINE’S EAST, FURTHER SANCTIONS ON RUSSIA EYED

- COVID RESTRICTIONS NOW SEEN IN CHINA’S GUANGZHOU

- ANOTHER ROUND OF LOCALISED PROPERTY-RELATED EASING MEASURES SEEN IN CHINA

- CHINA 10-YEAR GOVERNMENT BOND YIELD PREMIUM OVER U.S. ERASED

- RUSSIA CUT TO SD AT S&P

- RUSSIA TO HALT BOND SALES FOR THIS YEAR AS INTEREST COSTS SURGE (BBG)

US TSYS: Fresh Cycle Highs For Most Benchmark Yields

Spill over from Bunds/French political matters weighed on the U.S. Tsy space during the first Asia-Pac session of the week, with TYM2 -0-16 at 119-20 ahead of London hours, 0-03 off the base of the 0-18 overnight range, on volume of ~150K. Cash Tsys are 4.5-7.5bp cheaper across the curve, with bear flattening in play. Note that 3- to 30-Year yields tagged fresh cycle highs during Asia-Pac dealing.

- French President Macron’s lead in the first round of the country’s Presidential election drove the space lower (pollster projections point to a narrow Macron victory vs. far right candidate Le Pen after the second round of voting, which is due in a couple of weeks), with Bunds shedding over 100 ticks at one point, before correcting from worst levels.

- Furthermore, oil futures were under pressure during the Asia-Pac session, shedding over $2.00/bbl, which reduced some of the stagflationary worry in markets. Although the fact that that dynamic was seemingly driven by Chinese growth/COVID worries may negate some of the explanatory power when it comes to the move in U.S. Tsys.

- Asia-Pac flow was headlined by FV put block sales which seemed to involve rollng down and out the expiry curve (-10.0K FVK2 113.25 puts vs. +15.0K FVM2 112.50 puts) and a block sale of TUM2 futures (-7.4K).

- Weekend Fedspeak from Cleveland Fed President Mester (’22 voter) pointed to elevated inflation through ’23, although she noted that Fed policy will allow the trajectory of inflation to shift lower, while expressing optimism re: the potential for continued economic expansion even as the central bank tightens policy.

- Fedspeak from Governors Bowman & Waller, Atlanta Fed President Bostic (’24 voter) & Chicago Fed President Evens (’23 voter) headline during NY hours.

JGBS: Curve Twist Steepens, BoJ Downgrades Economic View Of Most Regions

JGB futures operate just above session lows as we move towards the close of Tokyo trade, -20 on the day, extending on the overnight weakness that was observed at the backend of last week, although the move through overnight lows was limited and short-lived.

- Wider core FI market dynamics applied the pressure, with Tokyo participants reacting to offshore gyrations/playing catch up to Friday’s post-Tokyo trade.

- Cash JGB trade saw the curve twist steepen with benchmark JGBs running 0.5bp richer to 2.0bp cheaper. The curve pivoted around the 3-Year zone, with 20s providing the weak point on the curve. Note that the weakness in 10s was limited by the proximity to the upper end of the BoJ’s permitted 10-Year yield trading range (10-Year JGBs last deal at 0.24%)

- Local headline flow saw BoJ Governor Kuroda & senior BoJ official Uchida reaffirm the central view of the BoJ when it came to the economic overview and the recent gyrations in the JPY, although there was a little more uncertainty evident re: some of the rhetoric surrounding the Japanese economy. Subsequently, the BoJ downgraded the economic assessment of 8 of the 9 regions that it monitors.

AUSSIE BONDS: Election Called, Syndi Announced, Two-Way Flow To Start New Week

Overnight session lows in YM & held after the Sydney re-open, with a couple of bouts of directional flow then observed as we moved through Monday trade. That leaves YM +1.0 & XM -5.0 at typing, around the middle of their respective session ranges, with the wider dip in core FI markets pulling futures back from their respective Sydney peaks. There has been a parallel round of cheapening observed in the 10+-Year zone of the cash ACGB curve. Note that 10-Year ACGB yields have moved above 3.00% for the first time since ’15.

- Early Sydney trade saw some curve steepening kick in, likely surrounding the ACGB Nov-33 syndication, with little else in the way of other notable factors apparent to drive such a move.

- The AOFM launched the new ACGB Nov-33 via syndication, as expected, with initial price guidance in line to a touch wider than most exp. (when compared to sell-side fair value estimates). The syndication should price on Tuesday.

- Domestic weekend news was dominated by political matters, with PM Morrison declaring that the Federal Election will be held on 21 May.

AUSSIE BONDS: AOFM Launches ACGB Nov-33

The AOFM announces "the issue by syndication of a new 3.00% 21 November 2033 Treasury Bond. The issue will be of a benchmark size. Initial price guidance for the issue is a spread of -1.5 to +1.5 basis points to the implied bid yield for the primary 10 year Treasury Bond futures contract. The issue is expected to be priced on Tuesday, 12 April 2022 and settle on Wednesday, 20 April 2022. Commonwealth Bank of Australia; Deutsche Bank; National Australia Bank; and UBS AG, Australia Branch will act as Joint-Lead Managers for the issue. The AOFM will be mindful of the performance of the bond when considering the timing of future issuance."

EQUITIES: Mostly Lower As Tsy Yields Tick Higher; China-Based Stocks Slump

Nearly all Asia-Pac equity indices trade lower at writing on a mixed lead from Wall St. Tech-related names across the region are broadly weaker amidst evident worry re: inflation, with China-based tech coming under pressure over concerns of renewed regulatory crackdowns.

- The Hang Seng deals 2.5% softer, with virtually all constituents in the red at typing. Steep losses were observed in technology-related large-caps after the Chinese authorities released guidelines calling for strengthened anti-monopoly efforts and crackdowns on “unfair competition” late last week, with the Hang Seng Tech Index trading 4.0% lower at typing to hit fresh three-week lows.

- The Chinese CSI300 sits 2.4% worse off at writing, with large-cap consumer staples names (particularly liquor giant Kweichow Moutai Co) leading the index lower. Worry re: regulatory headwinds have also returned to the tech equity space, with the Chinext and STAR50 dealing 3.3% and 3.0% softer at typing. A note that Chinese equities have found little relief from the Chinese State Council’s statements issued late last Wednesday on the usage of multiple monetary policy tools (albeit unspecified) to support the economy, with most Chinese equity benchmarks trading lower since then.

- The Australian ASX200 is virtually unchanged, being the sole major equity index to deal above neutral levels at writing. Strength in consumer staples and financials-based names was countered by weakness in tech equities, with the S&P/ASX All Technology Index dealing 0.8% lower at typing.

- U.S. e-mini equity index futures sit 0.5% to 0.8% softer at typing, operating just above their respective session lows as U.S. Tsy yields across the curve have moved higher in Asia.

OIL: Weaker As COVID In China, IEA Release In Focus

WTI and Brent are -$2.30 apiece at writing, operating around the bottom of Friday’s range as energy demand worry re: China’s ongoing COVID outbreak remains elevated, mixing with lingering pressure from the International Energy Agency’s (IEA) planned release of crude from the strategic reserves of member countries.

- To elaborate on the former, the Chinese city of Shanghai reported a little over 26K cases (asymptomatic and symptomatic) for Apr 10, notching another record high. Elsewhere, the authorities announced mass testing and limited restrictions on indoor activities to the city of Guangzhou (pop. ~18mn, Guangzhou port ranked top 5 globally by cargo volume) over the weekend, with a handful of cases reported for Friday. Officials have warned that the likelihood of a wider outbreak in Guangzhou is “extremely high”, flagging the city’s dense population, and the high transmissibility of the Omicron variant.

- To recap the IEA’s plans announced last week, the group will release ~2mn bpd in crude supplies for two months (~120mn bbls), followed by ~1mn bpd from the U.S. for the following four months (~120 mn bbls).

- Elsewhere, virtually no progress has been made towards an Iranian nuclear deal, with well-documented sticking points between the U.S. and Iran remaining unresolved, particularly on the issue of the U.S. keeping Iran’s Quds Force on a designated list of terror groups.

GOLD: Lower As Tsy Yields Push Higher, Oil Softens

Gold deals ~$4/oz softer to print $1,943/oz at writing, backing away from one-week highs made earlier in the session. The move lower was facilitated by nominal U.S. Tsy yields edging higher (with the U.S. Tsy 10-Year yield breaking past 2.75% for the first time since Mar ‘19), while inflationary worry from some quarters has eased as major crude benchmarks have come under pressure in Asian hours.

- To recap, the precious metal notched three straight days of gains to hit one-week highs on Friday, aided by broader U.S. real yields backing away from recent cycle highs during the session.

- A note that the correlation between the Dollar index (DXY) and gold has risen sharply, with the 3M correlation now crossing into positive territory. Some take this as a potential sign of market stress, suggesting demand for “safe havens” in both the USD and bullion amidst rising geopolitical risks.

- Looking ahead, Chicago Fed President Evans (‘23 voter) is scheduled to discuss the economy and monetary policy on Monday (1640 GMT), with Atlanta Fed Pres Bostic (‘24 voter) and Governors Bowman and Waller expected to deliver remarks at the Fed Listens event (1330 GMT). U.S. CPI is due on Tuesday (1230 GMT).

- From a technical perspective, gold remains range bound, with the outlook remaining bearish following the pullback from $2,070.4/oz (Mar 8 high). Initial support is situated around ~$1,909.8/oz (50-Day EMA), with further support at $1,890.2/oz (Mar 29 low and bear trigger). Resistance is seen at $1,966.1/oz (Mar 24 high).

FOREX: French Election Sparks EUR Relief Rally, JPY Slump Continues

The euro experienced a "Macron bounce" in early Asia-Pac trade as initial results of the first round of France's presidential election showed that the incumbent's edge over his far-right rival Le Pen was slightly wider than expected. The exit polls forecast a tight runoff but all predicted Macron's victory in the second round. The initial rally in EUR faded amid the realisation that the next two weeks of intense campaigning may still turn the election tide. While the euro remained the best G10 performer, it gave away some of its initial gains.

- The pullback in EUR/USD was facilitated by an uptick in U.S. Tsy yields, which lent support to the broader USD. The DXY index advanced towards the psychologically significant 100 level after briefly showing above there just ahead of the final WMR fix of last week.

- Yen sales resumed and the currency landed at the bottom of the G10 basket, with the familiar theme of Fed/BoJ policy divergence still in play. Gains in USD/JPY were capped at the round figure of Y125.00 as the rate narrowed in on its recent multi-year high (Y125.09).

- Commodity-tied currencies came under pressure amid weaker crude oil and iron ore prices. The NZD was the worst performer in that space, with eyes on the RBNZ's upcoming monetary policy review.

- Spot USD/CNH crept above the CNH6.38 mark as the yield on China's 10-Year bond fell below that on the U.S. counterpart for the first time since 2010. There was continued sense of concern about China's Covid-19 outbreak, with above-forecast PPI print underscoring pressure on local manufacturers.

- UK activity indicators & Norwegian CPI headline the global data docket today, while comments are due from Fed's Bostic, Bowman, Waller & Evans.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 11/04/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 11/04/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 11/04/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 11/04/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.