-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Bunds Sell Off & EUR Benefits From Macron's Lead

- Bunds sold off on the back of French President Macron doing enough (in the eyes of pollsters) to garner a lead over rival Le Pen when it comes to the French Presidential election run off, with the pressure spilling over into U.S. Tsys.

- The related early Asia relief rally in the likes of the EUR/USD & EUR/GBP crosses was mostly unwound, although the EUR managed to hold its place at the top of the G10 FX table during Asia-Pac hours. Meanwhile the USD generally benefitted from higher U.S. Tsy yields. Still, the DXY failed to climb back above the 100.00 level after Friday’s foray above.

- UK activity indicators & Norwegian CPI headline the global data docket today, while comments are due from Fed's Bostic, Bowman, Waller & Evans. Focus will also fall on any comments coming out of EU Foreign Minister discussions re: Russian sanctions.

US TSYS: Fresh Cycle Highs For Most Benchmark Yields

Spill over from Bunds/French political matters weighed on the U.S. Tsy space during the first Asia-Pac session of the week, with TYM2 -0-16 at 119-20 ahead of London hours, 0-03 off the base of the 0-18 overnight range, on volume of ~150K. Cash Tsys are 4.5-7.5bp cheaper across the curve, with bear flattening in play. Note that 3- to 30-Year yields tagged fresh cycle highs during Asia-Pac dealing.

- French President Macron’s lead in the first round of the country’s Presidential election drove the space lower (pollster projections point to a narrow Macron victory vs. far right candidate Le Pen after the second round of voting, which is due in a couple of weeks), with Bunds shedding over 100 ticks at one point, before correcting from worst levels.

- Furthermore, oil futures were under pressure during the Asia-Pac session, shedding over $2.00/bbl, which reduced some of the stagflationary worry in markets. Although the fact that that dynamic was seemingly driven by Chinese growth/COVID worries may negate some of the explanatory power when it comes to the move in U.S. Tsys.

- Asia-Pac flow was headlined by FV put block sales which seemed to involve rollng down and out the expiry curve (-10.0K FVK2 113.25 puts vs. +15.0K FVM2 112.50 puts) and a block sale of TUM2 futures (-7.4K).

- Weekend Fedspeak from Cleveland Fed President Mester (’22 voter) pointed to elevated inflation through ’23, although she noted that Fed policy will allow the trajectory of inflation to shift lower, while expressing optimism re: the potential for continued economic expansion even as the central bank tightens policy.

- Fedspeak from Governors Bowman & Waller, Atlanta Fed President Bostic (’24 voter) & Chicago Fed President Evens (’23 voter) headline during NY hours.

JGBS: Curve Twist Steepens, BoJ Downgrades Economic View Of Most Regions

JGB futures operate just above session lows as we move towards the close of Tokyo trade, -20 on the day, extending on the overnight weakness that was observed at the backend of last week, although the move through overnight lows was limited and short-lived.

- Wider core FI market dynamics applied the pressure, with Tokyo participants reacting to offshore gyrations/playing catch up to Friday’s post-Tokyo trade.

- Cash JGB trade saw the curve twist steepen with benchmark JGBs running 0.5bp richer to 2.0bp cheaper. The curve pivoted around the 3-Year zone, with 20s providing the weak point on the curve. Note that the weakness in 10s was limited by the proximity to the upper end of the BoJ’s permitted 10-Year yield trading range (10-Year JGBs last deal at 0.24%)

- Local headline flow saw BoJ Governor Kuroda & senior BoJ official Uchida reaffirm the central view of the BoJ when it came to the economic overview and the recent gyrations in the JPY, although there was a little more uncertainty evident re: some of the rhetoric surrounding the Japanese economy. Subsequently, the BoJ downgraded the economic assessment of 8 of the 9 regions that it monitors.

AUSSIE BONDS: Election Called, Syndi Announced, Two-Way Flow To Start New Week

Overnight session lows in YM & held after the Sydney re-open, with a couple of bouts of directional flow then observed as we moved through Monday trade. That leaves YM +1.0 & XM -5.0 at typing, around the middle of their respective session ranges, with the wider dip in core FI markets pulling futures back from their respective Sydney peaks. There has been a parallel round of cheapening observed in the 10+-Year zone of the cash ACGB curve. Note that 10-Year ACGB yields have moved above 3.00% for the first time since ’15.

- Early Sydney trade saw some curve steepening kick in, likely surrounding the ACGB Nov-33 syndication, with little else in the way of other notable factors apparent to drive such a move.

- The AOFM launched the new ACGB Nov-33 via syndication, as expected, with initial price guidance in line to a touch wider than most exp. (when compared to sell-side fair value estimates). The syndication should price on Tuesday.

- Domestic weekend news was dominated by political matters, with PM Morrison declaring that the Federal Election will be held on 21 May.

FOREX: French Election Sparks EUR Relief Rally, JPY Slump Continues

The euro experienced a "Macron bounce" in early Asia-Pac trade as initial results of the first round of France's presidential election showed that the incumbent's edge over his far-right rival Le Pen was slightly wider than expected. The exit polls forecast a tight runoff but all predicted Macron's victory in the second round. The initial rally in EUR faded amid the realisation that the next two weeks of intense campaigning may still turn the election tide. While the euro remained the best G10 performer, it gave away some of its initial gains.

- The pullback in EUR/USD was facilitated by an uptick in U.S. Tsy yields, which lent support to the broader USD. The DXY index advanced towards the psychologically significant 100 level after briefly showing above there just ahead of the final WMR fix of last week.

- Yen sales resumed and the currency landed at the bottom of the G10 basket, with the familiar theme of Fed/BoJ policy divergence still in play. Gains in USD/JPY were capped at the round figure of Y125.00 as the rate narrowed in on its recent multi-year high (Y125.09).

- Commodity-tied currencies came under pressure amid weaker crude oil and iron ore prices. The NZD was the worst performer in that space, with eyes on the RBNZ's upcoming monetary policy review.

- Spot USD/CNH crept above the CNH6.38 mark as the yield on China's 10-Year bond fell below that on the U.S. counterpart for the first time since 2010. There was continued sense of concern about China's Covid-19 outbreak, with above-forecast PPI print underscoring pressure on local manufacturers.

- UK activity indicators & Norwegian CPI headline the global data docket today, while comments are due from Fed's Bostic, Bowman, Waller & Evans.

ASIA FX: KRW & PHP Lead Losses In Asia, China's Inflation Beats Expectations

Higher U.S. Tsy yields buoyed USD/Asia crosses at the start to the week, with Chinese inflation data providing the main point of note on the regional docket.

- CNH: Offshore yuan took a beating even as China's inflation figures topped forecasts. Faster than expected PPI growth was testament to price pressures on manufacturers, whose business operations are disrupted by the worsening outbreak of Covid-19. On that front, Shanghai's daily cases topped 26k despite harsh countermeasures, while Guangzhou announced a slew of new restrictions.

- KRW: Firmer U.S. Tsy yields pushed spot USD/KRW higher, resulting in the formation of a double-bottom pattern. South Korea's FinMin-nominee vowed to draw up an extra budget that could be unveiled in early May.

- IDR: Spot USD/IDR held marginally above neutral levels. Indonesia's retail sales rose 8.6% Y/Y in March, according to central bank estimates.

- MYR: The ringgit went offered, with spot USD/MYR printing its best levels in more than two weeks, as participants awaited the release of Malaysia's industrial output data.

- PHP: Spot USD/PHP surged past the PHP52 mark. BSP Gov Diokno continued to play down the significance of fallout from Russia's invasion of Ukraine for the Philippine economy.

- THB: Spot USD/THB extended recent gains to fresh monthly highs amid limited local headline flow.

EQUITIES: Mostly Lower As Tsy Yields Tick Higher; China-Based Stocks Slump

Nearly all Asia-Pac equity indices trade lower at writing on a mixed lead from Wall St. Tech-related names across the region are broadly weaker amidst evident worry re: inflation, with China-based tech coming under pressure over concerns of renewed regulatory crackdowns.

- The Hang Seng deals 2.5% softer, with virtually all constituents in the red at typing. Steep losses were observed in technology-related large-caps after the Chinese authorities released guidelines calling for strengthened anti-monopoly efforts and crackdowns on “unfair competition” late last week, with the Hang Seng Tech Index trading 4.0% lower at typing to hit fresh three-week lows.

- The Chinese CSI300 sits 2.4% worse off at writing, with large-cap consumer staples names (particularly liquor giant Kweichow Moutai Co) leading the index lower. Worry re: regulatory headwinds have also returned to the tech equity space, with the Chinext and STAR50 dealing 3.3% and 3.0% softer at typing. A note that Chinese equities have found little relief from the Chinese State Council’s statements issued late last Wednesday on the usage of multiple monetary policy tools (albeit unspecified) to support the economy, with most Chinese equity benchmarks trading lower since then.

- The Australian ASX200 is virtually unchanged, being the sole major equity index to deal above neutral levels at writing. Strength in consumer staples and financials-based names was countered by weakness in tech equities, with the S&P/ASX All Technology Index dealing 0.8% lower at typing.

- U.S. e-mini equity index futures sit 0.5% to 0.8% softer at typing, operating just above their respective session lows as U.S. Tsy yields across the curve have moved higher in Asia.

GOLD: Lower As Tsy Yields Push Higher, Oil Softens

Gold deals ~$4/oz softer to print $1,943/oz at writing, backing away from one-week highs made earlier in the session. The move lower was facilitated by nominal U.S. Tsy yields edging higher (with the U.S. Tsy 10-Year yield breaking past 2.75% for the first time since Mar ‘19), while inflationary worry from some quarters has eased as major crude benchmarks have come under pressure in Asian hours.

- To recap, the precious metal notched three straight days of gains to hit one-week highs on Friday, aided by broader U.S. real yields backing away from recent cycle highs during the session.

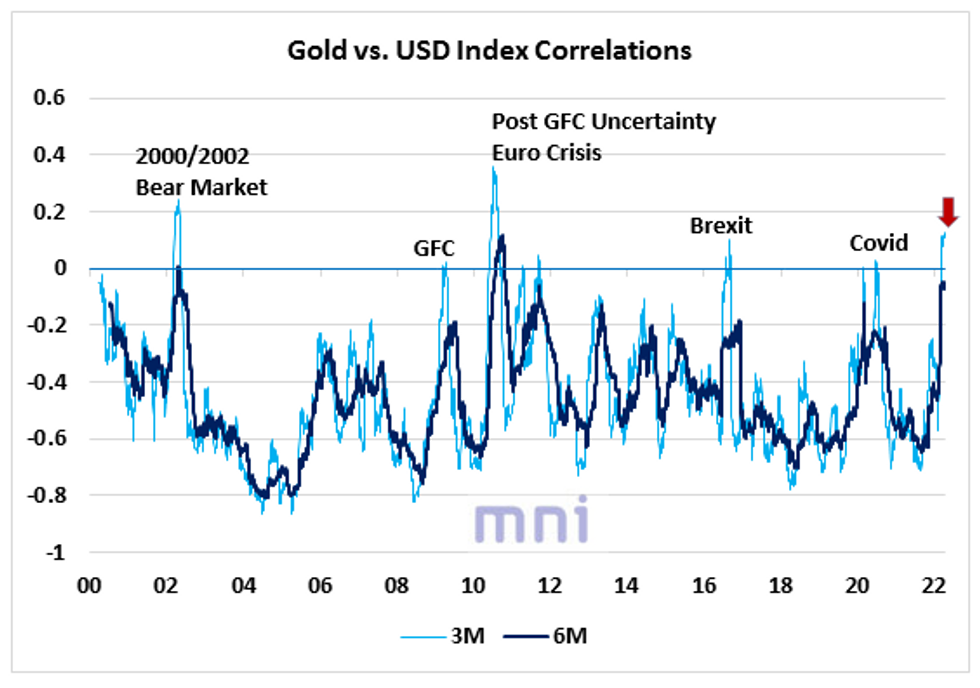

- A note that the correlation between the Dollar index (DXY) and gold has risen sharply, with the 3M correlation now crossing into positive territory. Some take this as a potential sign of market stress, suggesting demand for “safe havens” in both the USD and bullion amidst rising geopolitical risks.

- Looking ahead, Chicago Fed President Evans (‘23 voter) is scheduled to discuss the economy and monetary policy on Monday (1640 GMT), with Atlanta Fed Pres Bostic (‘24 voter) and Governors Bowman and Waller expected to deliver remarks at the Fed Listens event (1330 GMT). U.S. CPI is due on Tuesday (1230 GMT).

- From a technical perspective, gold remains range bound, with the outlook remaining bearish following the pullback from $2,070.4/oz (Mar 8 high). Initial support is situated around ~$1,909.8/oz (50-Day EMA), with further support at $1,890.2/oz (Mar 29 low and bear trigger). Resistance is seen at $1,966.1/oz (Mar 24 high).

GOLD/FOREX: Market Uncertainty Driving Both Gold and USD Higher

- Since the start of the year, the surge in geopolitical risk has led to a strong performance in ‘safe havens’ USD and Gold.

- Correlations between Gold and DXY index (daily returns) have been soaring, with the 3M correl bouncing back to positive territory in the past month (see chart).

- A simultaneous rise in both USD and Gold has historically been perceived as a sign of market stress by investors.

- Previous spikes in Gold/DXY correlations generally followed economic or/and market shocks (Covid, Brexit, Eurozone crisis…).

- Risk off environment has been mainly driven by the renewed geopolitical tensions with Western allies preparing for new sanctions.

- USD index broke above the psychological 100 level in today’s trading session; next level to watch on the topside stands at 100.5560.

Source: Bloomberg/MNI.

OIL: Weaker As COVID In China, IEA Release In Focus

WTI and Brent are -$2.30 apiece at writing, operating around the bottom of Friday’s range as energy demand worry re: China’s ongoing COVID outbreak remains elevated, mixing with lingering pressure from the International Energy Agency’s (IEA) planned release of crude from the strategic reserves of member countries.

- To elaborate on the former, the Chinese city of Shanghai reported a little over 26K cases (asymptomatic and symptomatic) for Apr 10, notching another record high. Elsewhere, the authorities announced mass testing and limited restrictions on indoor activities to the city of Guangzhou (pop. ~18mn, Guangzhou port ranked top 5 globally by cargo volume) over the weekend, with a handful of cases reported for Friday. Officials have warned that the likelihood of a wider outbreak in Guangzhou is “extremely high”, flagging the city’s dense population, and the high transmissibility of the Omicron variant.

- To recap the IEA’s plans announced last week, the group will release ~2mn bpd in crude supplies for two months (~120mn bbls), followed by ~1mn bpd from the U.S. for the following four months (~120 mn bbls).

- Elsewhere, virtually no progress has been made towards an Iranian nuclear deal, with well-documented sticking points between the U.S. and Iran remaining unresolved, particularly on the issue of the U.S. keeping Iran’s Quds Force on a designated list of terror groups.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/04/2022 | 0600/0800 | * |  | NO | CPI Norway |

| 11/04/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 11/04/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 11/04/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 11/04/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 11/04/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 11/04/2022 | 1330/0930 |  | US | Atlanta Fed's Raphael Bostic | |

| 11/04/2022 | 1330/0930 |  | US | Fed Governors Michelle Bowman and Christopher Waller | |

| 11/04/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 11/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 11/04/2022 | 1600/1200 |  | US | New York Fed's John Williams | |

| 11/04/2022 | 1640/1240 |  | US | Chicago Fed's Charles Evans | |

| 11/04/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.