-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: RBNZ Hikes By 50bp, With Worry Re: Inflation Expectations Evident

EXECUTIVE SUMMARY

- FED'S BRAINARD SAYS BALANCE SHEET REDUCTION COULD START IN JUNE (RTRS)

- FED’S BULLARD: IT’S ‘FANTASY’ TO THINK MODEST RATE RISES WILL TAME INFLATION (FT)

- HARKER SAYS FED MUST BE CAREFUL AS IT RAISES RATES (MNI)

- FED'S BARKIN SAYS INTEREST RATES SHOULD BE MOVED RAPIDLY TO NEUTRAL (RTRS)

- RBNZ SOUNDS INFLATION WARNING WITH BIGGEST RATE HIKE IN 22 YEARS (BBG)

- NO SIGN OF JOHNSON OR SUNAK STEPPING DOWN IN WAKE OF “PARTYGATE” FINES

- TOP OIL MERCHANT VITOL WILL STOP TRADING RUSSIAN CRUDE (BBG)

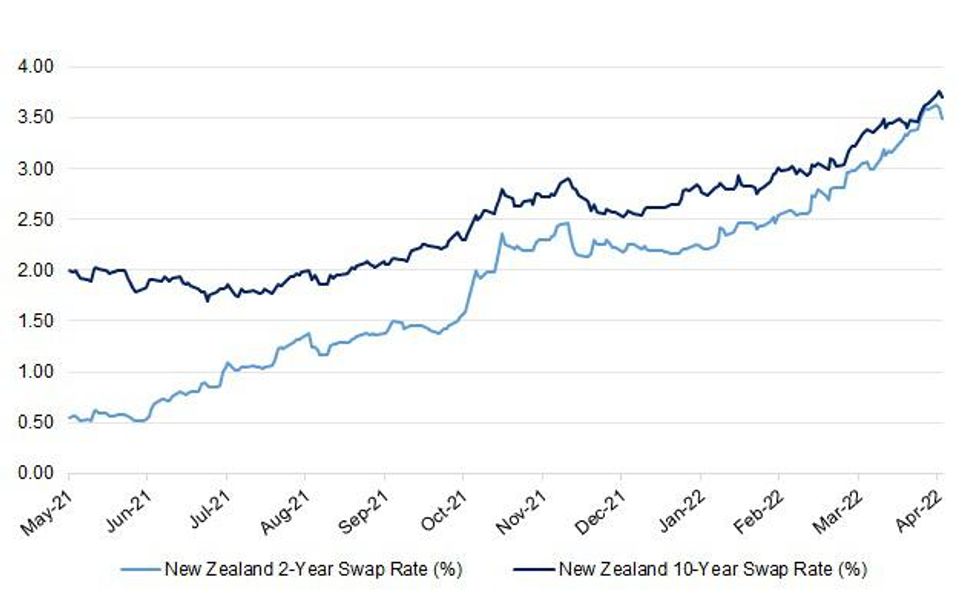

Fig. 1: New Zealand 2- & 10-Year Swap Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson has apologised after being fined by the Met Police for breaking lockdown rules but said he would not resign. The prime minister has faced calls to resign after he was fined for attending his own birthday party in the Cabinet room in Downing Street in June 2020. Mr Johnson said: "I have paid the fine and I once again offer a full apology." Asked if he would quit, Mr Johnson said: "I want to be able to get on and deliver the mandate that I have, but also to tackle the problems that the country must face right now." (Sky)

POLITICS: Rishi Sunak agonised for hours yesterday over whether to resign after the decision by police to fine him for attending Boris Johnson’s lockdown-breaking party. The chancellor spent yesterday afternoon discussing his political future with aides and allies, The Times understands, after the unexpected decision by the Metropolitan Police to issue him with a fixed penalty notice for attending the birthday event for Johnson in the Downing Street cabinet room. (The Times)

POLITICS: The Scottish Tory leader has said Boris Johnson should not be removed from office "at this time" despite his fine for breaking lockdown rules. Douglas Ross said he shared the fury of the public over the "unacceptable" actions of the prime minister. But he said it would be wrong to destabilise the UK government while the war in Ukraine was ongoing. (BBC)

POLITICS: Sir Keir Starmer has said "Britain deserves better", and that Boris Johnson and Rishi Sunak have to go, after the pair were fined for breaking Covid lockdown rules. (BBC)

EUROPE

GERMANY: Chieftains of German industry including the heads of Deutsche Bank AG, Mercedes-Benz AG and Siemens AG have met with Chancellor Olaf Scholz on Tuesday amid growing concern over fallout from sanctions targeting Russian energy supplies. While backing the sanctions introduced against Russia, the German industry heads outlined the challenges stemming from supply-chain disruptions and rising energy prices to Scholz, government spokesman Wolfgang Buechner said in a statement after the meeting. (BBG)

FRANCE: France's economy probably eked out meagre growth in the first quarter, but more difficult days lie ahead as the war in Ukraine weighs on activity, the central bank said on Tuesday, cutting its outlook. It estimated that the euro zone's second-biggest economy grew by 0.25% in the first three months from the previous quarter, trimming its forecast from 0.5% previously. The INSEE national statistics agency will release its first GDP reading for the quarter on April 29. "French growth seems to be holding up better than our neighbours but without a doubt we are heading for more difficult economic times," Villeroy said in an interview with the EBRA French regional newspapers group. "France is driving on a slippery road. Let's be careful to avoid economic lurches," he added. (RTRS)

ITALY: The government is ready to offer further fiscal support to families and businesses if needed, Italian Finance Minister Daniele Franco tells lawmakers in Rome. An option to fight inflation is to set a limit to the price of gas. Govt is working on it both at national and EU level. (BBG)

U.S.

FED: The Federal Reserve will conduct a series of interest rate hikes and begin reducing its massive bond holdings as soon as June to help bring down inflation that hit a fresh 40-year-high in March, Fed Governor Lael Brainard said on Tuesday. Getting inflation back down toward the Fed's 2% goal is the central bank's "most important task," Brainard told the Wall Street Journal in an interview. Consumer prices soared 8.5% in March, a government report showed on Tuesday. "In terms of exactly what the right pace of that set of increases in the policy rate from meeting to meeting, I don't really want to focus on that," Brainard told the Wall Street Journal in an interview. But combined with a shrinking balance sheet, she said, rate hikes will "bring the policy stance to more neutral posture expeditiously later this year," she said. (RTRS)

FED: A top Federal Reserve official has warned it is a “fantasy” to think the US central bank can bring inflation down sufficiently without raising interest rates to a level where they constrain the economy. James Bullard, president of the St Louis branch of the Fed, said the central bank needed to be more aggressive in its efforts to root out the highest inflation in four decades as he called for rates to rise to a point where they actively curtail growth. (FT)

FED: MNI BRIEF: Harker Says Fed Must Be Careful As It Raises Rates

- Philadelphia Federal Reserve President Patrick Harker said Tuesday policy makers are acting to raise interest rates as needed to slow inflation but must also beware of going too far and denting the economic expansion. "We need to take action but be careful at the same time," he said during a recorded interview with The Hill. "The economy is strong," Harker said, and "what we don't want to do is ruin the good things by being too aggressive." Inflation is "clearly an issue" that demands higher rates, though some elements are "outside what the Fed can do," he said - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: The U.S. Federal Reserve should quickly get interest rates up to a level where borrowing costs will no longer be stimulating the economy, and should raise them further if high inflation proves persistent, Richmond Fed President Thomas Barkin said on Tuesday. "How far we will need to raise rates, in fact, won’t be clear until we get closer to our destination, but rest assured we will do what we must to address this recent bout of above-target inflation," Barkin said in remarks prepared for delivery to the Money Marketeers in New York. "The best short-term path for us is to move rapidly to the neutral range and then test whether pandemic-era inflation pressures are easing, and how persistent inflation has become. If necessary, we can move further." (RTRS)

FED: Richmond Federal Reserve President Thomas Barkin said on Tuesday the central bank's campaign to quell too-high inflation will entail raising interest rates "to and ... in all likelihood beyond neutral" in the near term. (RTRS)

FED: MNI BRIEF: Two Fed Banks Wanted Bigger Discount Hike - Minutes

- The directors of the Federal Reserve Banks of New York and Dallas voted to raise the discount rate by 50bps in the period ahead of the March FOMC, according to minutes from meetings of the regional Bank boards, while the directors at the remaining ten regional banks sought quarter-point increases. The Fed's board of governors sided with the majority, the minutes said, increasing the rate by 25bp to 0.50%. "Federal Reserve Bank directors reported ongoing strong demand, tight labor markets, and supply chain disruptions" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

INFLATION: President Joe Biden blamed a four-decade inflation high-water mark on Russian President Vladimir Putin’s invasion of Ukraine as he touted his administration’s as-yet unsuccessful efforts to lower gasoline prices. “We saw in today’s inflation data: 70% of the increase in prices in March came from Putin’s price hike in gasoline,” Biden said at a Poet LLC ethanol mill in Menlo, Iowa. “We need to address this challenge with the urgency that it demands.” Biden said his administration would allow expanded sales of higher-ethanol gasoline this summer in an effort to lower fuel prices. Administration officials said the decision -- announced in Iowa, a top corn-producing U.S. state that that holds the first-in-the-nation presidential nominating contest -- could reduce the price of gasoline by as much as 10 cents per gallon. (BBG)

INFLATION: West Virginia Senator Joe Manchin, whose opposition derailed President Joe Biden’s economic agenda, blamed the White House and the Federal Reserve for failing to head off inflation, which hit a 40-year high. “The Federal Reserve and the administration failed to act fast enough, and today’s data is a snapshot in time of the consequences being felt across the country,” Manchin said Tuesday in a statement. “Instead of acting boldly, our elected leaders and the Federal Reserve continue to respond with half-measures and rhetorical failures searching for where to lay the blame.” (BBG)

OTHER

GLOBAL TRADE: Companies worldwide could collectively pay almost 14% more in corporate income taxes annually if a global tax accord is fully implemented, according to new estimates from the International Monetary Fund. The IMF’s projections foreshadow a sharp increase in corporate tax collections largely tied to a two-part pact struck last year with nearly 140 countries to implement a 15% minimum tax rate and an overhaul of some global taxing rights to require some of the largest companies to book income in the countries where revenues are generated. The minimum tax would increase corporate tax payments worldwide about 5.7% -- or roughly $150 billion, according to the IMF’s estimates. Corporate tax revenues could increase an additional 8.1% because of reduced tax competition -- meaning that companies have less incentive to use complex business structures to stash income in lower-tax countries because of the worldwide floor of 15%. (BBG)

U.S./CHINA/RUSSIA: China and Russia continue to develop and deploy weapons that can attack U.S. satellites even as they increase their own fleets of intelligence, surveillance and reconnaissance space vehicles, according to the Pentagon’s intelligence agency. Although the updated report issued Tuesday by the Defense Intelligence Agency is based mostly on news accounts and declarations from Chinese and Russian officials, it’s a useful summary of the threats that the U.S. says are driving major investments in the Pentagon’s proposed fiscal 2023 defense budget, specifically for the U.S. Space Force and Space Command. (BBG)

JAPAN: Japan will extend gasoline subsidies for oil refiners into May to continue offsetting the rise in crude oil prices, Yomiuri reports, citing unidentified government and ruling party officials. Move will be part of economic measures Prime Minister Fumio Kishida has ordered to be compiled by end-April. Ruling Liberal Democratic Party and others will continue to discuss whether to reintroduce a trigger clause that would lower gasoline tax. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki reiterates rapid changes in foreign exchange rates are “undesirable” and currency market stability is important. Currency moves determined by a variety of factors, not just interest-rate differentials, he says in response to a lawmaker’s questions in parliament. Will continue to watch currency market moves, including recent weakening of the yen, and their impact on the economy with great interest. Expect Bank of Japan to keep implementing monetary policy toward achieving 2% inflation target. (BBG)

RBNZ: New Zealand’s central bank raised interest rates by half a percentage point, its biggest hike in 22 years, indicating it’s worried that inflation is getting out of control. The Reserve Bank’s Monetary Policy Committee lifted the official cash rate to 1.5% from 1% Wednesday in Wellington, the first time it has delivered an increase of that magnitude since 2000. The move wrong-footed 15 of 20 economists in a Bloomberg survey who expected a quarter-point adjustment. However, five predicted the half-point increase and investors had assigned it a 70% probability. “The Committee agreed that their policy ‘path of least regret’ is to increase the OCR by more now, rather than later, to head off rising inflation expectations,” the RBNZ said. “It is appropriate to continue to tighten monetary conditions at pace.” (BBG)

NEW ZEALAND: Covid-19 Response Minister Chris Hipkins has confirmed the entire country will drop from red to the orange traffic light setting from 11.59pm tonight, saying the "overall picture is a very positive one". Hipkins said the change in alert levels was justified for several reasons, including an ongoing decline in cases. The change ot the orange traffic light setting means there are no indoor or outdoor capacity limits and no seated and separated rules. Face masks remain an important protection and are encouraged, but are largely no longer required. (Radio NZ)

SOUTH KOREA: South Korea's health ministry said on Wednesday it will administer a second COVID-19 vaccine booster shot for people over 60 as the country continues to battle the highly contagious Omicron variant. "The government plans to expand the fourth round of vaccination to those aged 60 and older," Health Minister Kwon Deok-cheol told a meeting, adding the infection rate in the age group has continued to rise to stand above 20%. (RTRS)

HONG KONG: Hong Kong will announce easing of social distancing restrictions on Thursday, Chief Executive Carrie Lam says at a briefing. H.K. sees no room for relaxing Covid curbs before April 21 as current measures will expire on April 20. Mask mandate and gathering restrictions will remain in place depending on the pandemic situation. City has no immediate plan to relax flight suspension on specific routes. (BBG)

HONG KONG: Hong Kong’s sole candidate in next month’s chief executive vote surpassed the threshold of support he needs to win, effectively confirming he’ll become the city’s next leader. Former Chief Secretary John Lee said Wednesday that he received 786 nominations from the roughly 1,500-member Election Committee that picks the city’s leader. That number is greater than the majority he needs from the committee dominated by Beijing loyalists in the May 8 election. (BBG)

TURKEY: Turkish Central Bank Governor Sahap Kavcioglu told exporters at a meeting that the bank was considering raising the share of foreign currency revenues that exporters are required to sell to the central bank to 40% from 25% now, sources said on Tuesday. On Monday, Reuters reported based on sources that Turkish authorities were planning to raise the foreign currency revenues exporters must sell to the central bank to as high as 50%, but that a final decision had not been made. (RTRS)

MEXICO: Mexico’s Foreign Ministry rejected the new border inspections implemented by the governor of Texas Greg Abbott on April 6, the ministry said in a statement. Governor Abbott ordered authorities to stop and inspect all trucks and buses that cross from Mexico into the U.S. arguing they are security measures to prevent the illegal transfer of migrants and drugs. These inspections are currently implemented at four border crossings with Texas: Zaragoza-Ysleta; Cordova-De las Americas; Colombia-Laredo; Reynosa-Pharr. Only a third of the usual trade is crossing at these four ports of entry. These measures could soon be extended to other crossings into the state of Texas. Mexican government is communicating with the U.S. embassy in Mexico, the Departments of State and Homeland Security and the Texas Governor’s Office to fully restore trade and identify alternatives. (BBG)

MEXICO: Mexico’s ruling party has moved to Easter Sunday a key vote on President Andres Manuel Lopez Obrador’s plan to regain state monopoly of the electricity sector in what critics described as an attempt to force the bill through when attendance in congress might be lower. The vote was initially set for Tuesday in the lower house, but Morena and its allies were expected to fall some 50 votes short of the required two-thirds majority for a constitutional change after opposition parties vowed to oppose it. (BBG)

MEXICO: Mexico President Andres Manuel Lopez Obrador said that remittances climbed 18% in 1Q y/y, according to remarks made in Mexico City at the presentation of a report on his administration’s work the first quarter. Lopez Obrador said that if his electricity reform fails in Congress on Sunday, his govt will present a bill as soon as April 18, the day after, to protect lithium as a public resource. (BBG)

BRAZIL/RATINGS: Moody’s affirmed Brazil at Ba2; Outlook Stable

RUSSIA: Russia is attempting to muster a force that will outnumber Ukrainian troops in the east of the country five to one. A Ukrainian military source said Russian troops were being brought in from across the region for what Moscow hoped would be a decisive battle in Donbas. They insisted the force, comprising tens of thousands of soldiers, would still fall short of the number needed for Russia to win. (The Times)

RUSSIA: The U.S. Defense Department has not seen anything to confirm social media reports of Russian military equipment being sent to the border with Finland, press secretary John Kirby said on Tuesday. (RTRS)

RUSSIA: Roughly $750 million in weaponry is expected to be sent under presidential drawdown authority, people familiar with the matter said. This allows Biden to transfer equipment from U.S. stocks without congressional approval to speed up delivery during an emergency. The types of weapons in the package are still being discussed and are not yet finalized, added the people, who requested anonymity to discuss the assistance before it was Announced. The U.S. has provided more than $2.4 billion in military assistance to Ukraine since Biden took office. Of that, more than $1.7 billion was delivered after the invasion began on Feb. 24. (BBG)

RUSSIA: The Pentagon will host leaders from the top eight U.S. weapons manufacturers on Wednesday to discuss the industry's capacity to meet Ukraine's weapons needs if the war with Russia lasts years, two people familiar with the meeting said on Tuesday. Demand for weapons has shot up after Russia's invasion on Feb. 24 spurred U.S. and allied weapons transfers to Ukraine. Resupplying as well as planning for a longer war is expected to be discussed at the meeting, the sources told Reuters on condition of anonymity. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy on Wednesday said it was not possible to draw 100% firm conclusions about whether Russian forces had used chemical weapons in Mariupol, noting it was not possible to conduct a proper probe in the besieged city. In an early morning address, Zelenskiy said what he called repeated threats by some in Russia to use chemical weapons meant that the West needed to act now to prevent such weapons from being deployed. He did not give details. (RTRS)

RUSSIA: U.S. President Joe Biden on Tuesday stood by his characterization of Russia's actions in Ukraine as "genocide," saying Russian President Vladimir Putin "is trying to wipe out the idea of being able to be Ukrainian." "I called it genocide because it has become clearer and clearer that Putin is just trying to wipe out the idea of being able to be Ukrainian and the evidence is mounting," Biden told reporters as he prepared to board Air Force One to return to Washington after an event on the economy in Iowa. "We'll let the lawyers decide internationally whether or not it qualifies, but it sure seems that way to me," he said. (RTRS)

RUSSIA: French president Emmanuel Macron told Le Point magazine that Vladimir Putin’s decision to attack Ukraine derived from anti-West resentment and paranoia. Covid-19 exacerbated Putin’s feeling of isolation, according to Macron. “He found himself in Sochi for months, he locked himself down, he had less contact with other thinking,” Macron said, predicting that Putin won’t stop his attacks and needs a military victory ahead of May 9, the day Russia marks its victory in World War II. The French leader stressed that he will continue to speak to his Russian counterpart to warn him about the dangers of continuing the cycle of violence. (BBG)

RUSSIA: German President Frank-Walter Steinmeier planned to visit Kyiv in a gesture of solidarity with the Ukrainian government, but he wasn’t welcome, according to Bild. “I was prepared for it,” the newspaper cited Steinmeier as saying in Warsaw on Tuesday. “But apparently, and I have to take this on board, that wasn’t wanted in Kyiv.” Steinmeier has been criticized by Ukrainian officials for his previous support of the Nord Stream 2 gas pipeline from Russia to Germany. In a rare admission, the former foreign minister said in a TV interview this month that he and other German officials had failed in their policy toward Russia and President Vladimir Putin over the past two decades. (BBG)

RUSSIA: A delegation from Germany's coalition government was visiting Ukraine on Tuesday, a source told AFP, as pressure grew on Chancellor Olaf Scholz to follow other Western leaders to Kyiv. The visit from the heads of the German parliament's committees on defence, foreign affairs and Europe, respectively, is the first trip by a high-level German government delegation since Russia invaded Ukraine in February. But following visits by several other leaders in recent days, including British Prime Minister Boris Johnson and EU chief Ursula von der Leyen, critics have asked why Scholz himself is not making the trip. While Johnson was "walking side by side with Ukrainian President Volodymyr Zelensky in Kyiv" on Saturday, "Scholz was waving at an election campaign rally in Luebeck" ahead of an upcoming regional vote, the Bild daily noted. (BBG)

SOUTH AFRICA: Load shedding will be extended for two days due to shortage of generation capacity, Eskom said. The power utility said stage 2 load shedding would be implemented overnight from 5pm until 5am on Tuesday and from 5pm to 5am on Wednesday. "Load shedding will then be suspended at 5am on Friday. The extension of load shedding is caused by the shortage of generation capacity and continued delays in returning to service four generating units at Camden power station and two generating units at Tutuka power station. Eskom teams are working hard to return as many of these units to service as possible," Eskom said. "A single unit that had tripped at Lethabo Power Station yesterday morning has returned to service. This unit, however, will take some time to reach full production." (Independent Online)

IRAN: Iran’s Supreme Leader Ayatollah Ali Khamenei said negotiations aimed at reviving the 2015 nuclear deal are “moving along well,” an assessment that diverged from a general mood of pessimism around the talks. Addressing a meeting in Tehran, Khamenei acknowledged that a diplomatic success isn’t guaranteed, urging the government not to “tie” its policies to the fate of the accord, state-run Islamic Republic News Agency reported. (BBG)

ENERGY: Diplomats from Italy and Spain are holding talks after Rome’s move to secure large volumes of Algerian gas stoked concerns in Madrid that its own access to the key fuel could be affected, according to people familiar with the situation. Europe is scrambling to displace Russian sources of energy following Moscow’s invasion of Ukraine. Italy’s deal for extra volumes from Algeria -- equivalent to about 12% of its demand -- is a significant step toward easing dependence on Russia. But the deal has raised concern in the Spanish gas industry that it may strengthen Algeria’s hand in talks with Spain, with which it’s been locked in months of negotiations over price. There’s also concern it could strain Algeria’s ability to keep up supplies to Spain, two of the people said. (BBG)

ENERGY: Russian oil and gas condensate production fell below 10 million barrels per day (bpd) on Monday to its lowest since July 2020, two sources familiar with data said on Tuesday, as sanctions and logistical constraints hampered trade. Russian oil production has been under a massive downward pressure amid sanctions from the West over Moscow's role in Ukraine. Sources said Russia's average oil output fell to 10.32 million bpd on April 1-11 from 11.01 million on average in March, a decline of more than 6%. (RTRS)

OIL: Vitol Group, the world’s top independent oil trader, intends to completely stop trading Russia-origin crude and products by the end of this year. Volumes of Russian oil handled by Vitol “will diminish significantly in the second quarter as current term contractual obligations decline,” a Vitol spokesperson said by email. It intends to cease trading crude and products unless directed otherwise, and “we anticipate this will be completed by end of 2022.” The Geneva-based firm reiterated that it will not enter into any new Russian crude and product transactions. The company has stressed since Russia’s invasion of Ukraine that its purchases have been part of pre-existing contracts. (BBG)

OIL: Russian Energy Minister Nikolai Shulginov told Izvestia newspaper that Moscow is ready to sell oil and oil products to "friendly countries in any price range", Interfax news agency said on Tuesday. Shulginov said crude prices in the range of $80 to $150 a barrel were in principle possible but said Moscow was more focused on ensuring the oil industry continues to function, Interfax said. (RTRS)

OIL: U.S. crude oil output is expected to rise 820,000 barrels per day to 12.01 million bpd in 2022, the government said in a monthly forecast on Tuesday. U.S. crude output is expected to rise 940,000 bpd to 12.95 million bpd in 2023, according to the same monthly report from the Energy Information Administration. U.S. total petroleum consumption is due to rise 800,000 bpd to 20.58 million bpd in 2022. (RTRS)

CHINA

FISCAL: China will continue to accelerate the sales of infrastructure-back local government special bonds and ensure the issuance of all CNY3.65 trillion of such bonds by the end of September, Shanghai Securities News reported citing Vice Minister of Finance Xu Hongcai at a Tuesday briefing. About CNY1.25 trillion of such bonds were issued as of end-March, and local governments have overcome difficulties to kick off investment projects despite the epidemic, with 75% of the projects funded by the bond having started construction so far, the newspaper said citing Xu. There are 71,000 projects in reserve awaiting to be used, covering the areas of urban pipeline network, water conservancy, information infrastructure, grain warehousing and logistics facilities, the newspaper said citing officials. (MNI)

CORONAVIRUS: China has launched pilot programs in Shanghai, Guangzhou and six other cities to test out looser quarantine requirements for residents in locked-down communities, travelers from outside the country and the close contacts of confirmed Covid-19 cases, a government document shows. However, high frequency of nucleic acid and antigen tests will be carried out during the reduced quarantine period for those individuals, as well as professionals stationed in some specific posts with high risk of infection, according to a document released by the State Council, China’s cabinet. (Caixin)

CORONAVIRUS: The Global Times tweeted the following on Wednesday: “Northeast China’s #Jilin Province will continue to conduct mass antigen testing combined with verification through nucleic acid testing in the cities of Changchun and Jilin, and accurate screening will cover all groups at high risk of #COVID19.” (MNI)

MARKETS: Some of the world’s largest asset management institutions are buying Chinese assets despite recent outbreaks of the epidemic, eyeing on China’s ample room for increased fiscal spending and monetary easing when other economies' growth momentum weakens on U.S. rate hikes and geopolitical conflicts, the 21st Century Business Herald reported citing an unidentified Wall Street hedge fund manager. Due to the recent low valuation of Chinese assets, more global asset managers are bottom-hunting boldly, or adjusting positions by selling high and repurchasing low, the newspaper said. Currently, the proportions of foreign capital in China’s bond and stock markets only accounts for 3% and 5%, the newspaper added. (MNI)

PROPERTY: The scope of China's effort to bail out the property market has expanded with 14 more cities having loosened their housing policies in April, mainly by relaxing restrictions on purchase, loan and sales as well as lowering down payment ratio and mortgage interest rates, the Securities Times reported. Cities including some housing hotspots like Nanjing started to relax and stimulate demand, and this could be followed by more second-tier big cities with greater downward pressure, the newspaper said citing Ding Zuyu, executive director of Shanghai E-House Real Estate Research Institute. The market rebound in bigger cities will gradually transmit to third- and fourth-tier cities, said Ding. More than 60 cities have issued more than 100 real estate-related policies to prop up the market in Q1, the newspaper added. (MNI)

OVERNIGHT DATA

CHINA MAR TRADE BALANCE +$47.38BN; MEDIAN +$21.70BN; FEB +30.58BN

CHINA MAR EXPORTS +14.7% Y/Y; MEDIAN +12.8%; FEB +6.2%

CHINA MAR IMPORTS -0.1% Y/Y; MEDIAN +8.4%; FEB +10.4%

CHINA MAR TRADE BALANCE +CNY300.58BN; FEB +CNY194.40BN

CHINA MAR EXPORTS CNY +12.9% Y/Y; MEDIAN +12.4%; FEB +4.1%

CHINA MAR IMPORTS CNY -1.7% Y/Y; MEDIAN +6.3%; FEB +8.3%

JAPAN FEB CORE MACHINE ORDERS +4.3% Y/Y; MEDIAN +14.3%; JAN +5.1%

JAPAN FEB CORE MACHINE ORDERS -9.8% M/M; MEDIAN -1.5%; JAN -2.0%

JAPAN MAR M2 MONEY STOCK +3.5% Y/Y; MEDIAN +3.6%; FEB +3.6%

JAPAN MAR M3 MONEY STOCK +3.1% Y/Y; MEDIAN +3.2%; FEB +3.2%

AUSTRALIA APR WESTPAC CONSUMER CONFIDENCE 95.8; MAR 96.6

AUSTRALIA APR WESTPAC CONSUMER CONFIDENCE SA -0.9% M/M; MAR -4.2%

This modest decline follows the sharp 4.2% fall in March. At that time concerns around interest rates and inflation were starting to weigh on confidence. These were compounded by Russia’s invasion of Ukraine, an associated spike in petrol prices, and severe weather events. Positive factors over the month that may have moderated the overall weakness included the Federal budget; further strength in the labour market; and a significant fall in petrol prices. The April Index read is the lowest since September 2020, when COVID pandemic fears were dominating. Recall that prior to the pandemic the Australian economy was lacklustre, weighed down by persistently low wages growth and a cautious consumer. In fact, the average print for the Index in the six months before the pandemic was 95.3 – in line with the current level. Last month’s detail pointed to geopolitics, floods, inflation, and interest rates as the key explanations for the sharp fall in the Index. There is further evidence that interest rates, inflation and weather continued to unnerve consumers in the current survey. (Westpac)

NEW ZEALAND MAR FOOD PRICES +0.7% M/M; FEB -0.1%

SOUTH KOREA MAR UNEMPLOYMENT RATE SA 2.7%; MEDIAN 3.0%; FEB 2.7%

SOUTH KOREA MAR BANK LENDING TO HOUSEHOLDS KRW1,059.0TN; FEB KRW 1,060.0TN

CHINA MARKETS

PBOC NET DRAINS CNY70 BILLION VIA OMOS WEDNESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Wednesday. The operation has led to a net drain of CNY70 billion after offsetting the maturity of CNY10 billion reverse repos and CNY70 billion of Treasury's deposits at commercial banks today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0862% at 09:32 am local time from the close of 1.9728% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 44 on Tuesday vs 41 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3752 WEDS VS 6.3795

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3752 on Wednesday, compared with 6.3795 set on Tuesday.

MARKETS

SNAPSHOT: RBNZ Hikes By 50bp, With Worry Re: Inflation Expectations Evident

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 394.27 points at 26729.11

- ASX 200 up 16.121 points at 7470.1

- Shanghai Comp. down 14.192 points at 3199.138

- JGB 10-Yr future up 7 ticks at 149.31, yield down 0.9bp at 0.236%

- Aussie 10-Yr future up 4.5 ticks at 96.905, yield down 3.8bp at 3.043%

- U.S. 10-Yr future -0-05+ at 120-10+, yield up 2.28bp at 2.744%

- WTI crude down $0.36 at $100.28, Gold up $2.48 at $1969.31

- USD/JPY up 22 pips at Y125.60

- FED'S BRAINARD SAYS BALANCE SHEET REDUCTION COULD START IN JUNE (RTRS)

- FED’S BULLARD: IT’S ‘FANTASY’ TO THINK MODEST RATE RISES WILL TAME INFLATION (FT)

- HARKER SAYS FED MUST BE CAREFUL AS IT RAISES RATES (MNI)

- FED'S BARKIN SAYS INTEREST RATES SHOULD BE MOVED RAPIDLY TO NEUTRAL (RTRS)

- RBNZ SOUNDS INFLATION WARNING WITH BIGGEST RATE HIKE IN 22 YEARS (BBG)

- NO SIGN OF JOHNSON OR SUNAK STEPPING DOWN IN WAKE OF “PARTYGATE” FINES

- TOP OIL MERCHANT VITOL WILL STOP TRADING RUSSIAN CRUDE (BBG)

US TSYS: A Touch Cheaper In Asia

The curve has bear steepened in Asia-Pac dealing, with the major benchmarks running little changed to 3.0bp cheaper across the curve, while TYM2 futures operate 0-02+ above the base of their 0-10+ session range, last -0-07 at 120-09.

- Tsys briefly joined the post-RBNZ squeeze higher, although the ACGB space is much more susceptible to RBNZ-related moves given the close geographical ties/historical cross-market correlations observed.

- Some cash Tsy selling around the re-open was enough to more than reverse the initial uptick in futures with hawkish comments from Messrs Bullard (’22 voter) & Barkin (’24 voter) observed overnight.

- Flow was dominated by block sellers of futures, covering the TU (-3,485) & TY (-2,107) contracts.

- An uptick in e-minis will have applied some pressure, at the margin (the S&P 500 contract is +0.5%), although we haven’t seen much in the way of meaningful news flow to drive that particular move.

- Looking ahead, Wednesday’s NY session will bring the release of PPI data for March, 30-Year Tsy supply and Fedspeak from Governor Waller. The latest BoC monetary policy decision will also provide some interest.

JGBS: Twisting Flatter, Back From Best Levels

The JGB curve has twist flattened, with the major benchmarks running 1.0bp cheaper to 2.5bp richer on the day, pivoting around 5s as the super-long end outperforms.

- The NY session bid in U.S. Tsys provided spill over support for the space during the Tokyo morning, although the (modest in comparison) Asia-Pac softening in U.S. Tsys capped JGB futures shortly after the re-open, meaning that the contract could not challenge its overnight high. The contract then drifted lower into the lunch bell.

- The offer to cover ratios for today’s BoJ Rinban operations can be observed below:

- 1- to 3-Year: 3.31x (prev. 2.62x)

- 5- to 10-Year: 2.48x (prev. 1.86x)

- 25+-Year: 4.73x (prev. 4.79x)

- The uptick in the 1- to 3- & 5- to 10-Year cover ratios seemingly applied some pressure to the space during afternoon dealing, with another modest round of cheapening in U.S. Tsys also playing into JGB softening after the lunch break.

- There hasn’t been much in the way of meaningful domestic headline flow to pick apart, with an extension of the country’s gasoline subsidy scheme providing the highlight, alongside some fairly run-of-the-mill commentary re: FX matters from the upper echelons of the ruling LDP party.

AUSSIE BONDS: Back From RBNZ-Inspired Peaks

Cross-market impetus has been the name of the game in Sydney dealing. A bid came back in after the space initially showed lower on the RBNZ’s 50bp OCR hike (vs. sell-side consensus of 25bp & pre-decision market pricing of ~42bp of tightening). The RBNZ language re: comfort with its Feb OCR track (a potential hat tip to the idea that the OCR track priced into the OIS strip may be getting ahead of itself) and the Bank highlighting that a larger move now provided future optionality against high levels of global uncertainty (alongside a focus on combatting rising long-term inflation expectations), as opposed to scope for more than previously envisaged tightening, allowed a bid to come back into the space.

- Outside of that, gyrations in U.S. Tsys seemed to dictate price action.

- YM breached its overnight session peak on the aforementioned trans-Tasman spill over as NZGB yields & NZ swap rates fell. The front-end led nature of the move extended the early bull steepening, before the richening and steepening pared back from extremes. YM +7.5 and XM +5.0 at typing. The 5- to 7-Year zone outperformed in cash trade, with 20+-Year ACGBs only ~1bp firmer on the day.

- The latest Westpac consumer confidence reading slid to levels not observed since late ’20, building on the heavy slide seen in Feb, with the survey noting that “at that time concerns around interest rates and inflation were starting to weigh on confidence. These were compounded by Russia’s invasion of Ukraine, an associated spike in petrol prices, and severe weather events.” A look deeper into the details revealed a split between the outlook of those who are more/less indebted, with Westpac flagging that “confidence amongst respondents with a mortgage fell by 9.2% in April amid concerns that the Reserve Bank will be raising the cash rate earlier than previously expected and at a faster pace. Notably, the prospect of interest rate rises may have buoyed sentiment across some sub-groups that stand to benefit. Confidence posted significant gains amongst those aged over 65 (+7%) and amongst freehold homeowners (+5.5%). These are segments without large mortgage debts that are also more likely to depend on interest incomes.”

EQUITIES: Mostly Higher As U.S. CPI Worry Set Aside

Asia-Pac equity indices are mostly better off at typing with several EM equity indices outperforming, bucking a negative lead from Wall St.

- The Nikkei 225 leads gains amongst major regional peers, sitting 1.7% better off at writing, largely reversing Tuesday’s decline in the process. Index heavyweights Fast Retailing and Tokyo Electron led gains, with broader gains across virtually all sub-indices neutralising notable weakness in financial-related names.

- The Chinese CSI300 underperformed, dealing 0.5% worse off at writing after opening lower. Cyclical equities bore the brunt of the downward pressure as the current trajectory of the country’s COVID-19 outbreak remains uncertain, with Nomura estimating that >25% of the country's population have been placed under either partial or full movement restrictions.

- The Hang Seng reversed opening losses to deal 0.2% higher at typing, with a rise in a gauge of real estate names countered by a downtick in utilities and financials sub-indices. Large-cap tech names contributed the most to the Hang Seng’s gains, with Tencent Holdings and JD.com Inc on track to lodge a second straight day of gains, broadly outperforming their China-based tech peers such as Alibaba and Meituan.

- U.S. e-mini equity index futures trade 0.4% to 0.5% higher at writing, operating a touch below session highs heading into European hours.

OIL: Little Changed In Asia; Russian Crude Production In Focus

WTI and Brent are ~$0.20 better off at typing, back from their best levels of the session, and operating a touch below their respective, recently-made one-week highs.

- Major crude benchmarks have caught a bid as RTRS source reports on Tuesday pointed to a decline in average Russian oil output in April so far, adding to worry re: more disruptions to Russian crude exports after Russian President Putin declared that Russia-Ukraine peace talks have hit a “dead-end”.

- Looking to China, despite a reported partial lifting of lockdowns in Shanghai, factories and “non-essential” businesses remain mostly shut. Worry re: risks to the economy has become increasingly evident, with Chinese Premier Li Keqiang noted to have made three separate statements warning of economic growth risks within the past week. Total fresh daily cases nationwide reported for Apr 12 edged up to ~27.9K (vs. ~24.5K Apr 11), with cases in Shanghai remaining elevated at ~26.3K (vs ~23.3K Apr 11).

- Elsewhere, the latest weekly U.S. API inventory estimates crossed late on Tuesday. Reports pointed to a larger than expected build in crude stockpiles and an increase in Cushing hub inventories, while there was a drawdown in gasoline and distillate stockpiles.

- Looking ahead, EIA data is due later on Wednesday (1430 GMT), with WSJ estimates calling for increases in crude stockpiles. Distillate stocks are tipped to remain unchanged, while gasoline inventories are expected to decline.

GOLD: Higher In Asia; Russia-Ukraine Talks Hit “Dead-End”

Gold deals ~$5/oz firmer to print $1,972/oz at typing, operating below four-week highs made on Tuesday ($1,978.6/oz) as U.S. real yields have broadly extended a move off their post-U.S. CPI troughs in Asia-Pac dealing.

- To recap, the precious metal closed ~$13/oz higher on Tuesday to record a fifth straight day of gains, with the move higher facilitated by a broad downtick in U.S. real yields. The largest moves came after U.S. CPI printed largely within expectations, easing worry from some quarters re: pressure on the Fed to further tighten policy later in ‘22.

- Elsewhere, Russian President Putin declared on Tuesday that peace talks with Ukraine have hit a “dead-end” while stating that the “special operation” would continue, likely ending already-faint hopes surrounding a diplomatic resolution to the conflict for now.

- Looking ahead, U.S. PPI data headlines the data docket later today (1230 GMT).

- From a technical perspective, initial resistance is located near recent highs at $1,980.3/oz (50.0% retracement of Mar8-29 downleg), and a break of that level would expose further resistance at $2,009.2/oz (Mar 10 high). On the other hand, support is seen around ~$1,913.0/oz (50-Day EMA).

FOREX: Kiwi Knee-Jerks Higher After Double-Barrel OCR Hike, Yen Sell-Off Continues

Post-RBNZ demand for the kiwi dollar quickly dissipated as the details of monetary policy review came under scrutiny. NZD crosses jumped in the initial reaction as the Reserve Bank raised the OCR by 50bp in the first half-point hike since 2000 citing concerns about mounting inflationary pressures. The upswing got unwound as the minutes suggested that the RBNZ has front-loaded policy tightening without necessarily seeing a higher terminal rate. Policymakers noted that they delivered a larger hike "now, rather than later" as a result of least regrets analysis. The kiwi is the worst G10 performer as we type.

- USD/JPY continued its unrelenting bull run, albeit without re-testing the Y125.76/77 cycle highs printed earlier this week. FinMin Suzuki reiterated that rapid FX moves are "undesirable" but the yen ignored his comments.

- The BoC is set to deliver its monetary policy decision, with most looking for a 25bp rate hike. It will come alongside the Bank's Quarterly Monetary Policy Report. The loonie caught a light bid amid positioning ahead of the policy announcement.

- Elsewhere, BoJ's Kuroda is due to speak today, while key data releases include UK inflation figures & China's trade balance.

FOREX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0720-35(E1.0bln), $1.0865-70(E985mln), $1.0900(E1.3bln), $1.0960-80(E903mln), $1.0995-05(E2.9bln)

- USD/JPY: Y123.90-00($655mln)

- EUR/JPY: Y136.00(E562mln)

- AUD/USD: $0.7300(A$682mln), $0.7380-00(A$941mln)

- USD/CAD: C$1.2485-00($593mln)

- USD/CNY: Cny6.3400($500mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 13/04/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 13/04/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/04/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.