-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBNZ Provides A 'Dovish' 50bp Hike, NZD Gives Back Gains & More, NZ Yields Dip

- The RBNZ’s 50bp OCR hike (vs. sell-side consensus of 25bp & pre-decision market pricing of ~42bp of tightening) was seen as dovish by markets. The Bank's language re: comfort with its Feb OCR track (a potential hat tip to the idea that the OCR track priced into the OIS strip may be getting ahead of itself) and the Bank highlighting that a larger move now provided future optionality against high levels of global uncertainty (alongside a focus on combatting rising long-term inflation expectations), as opposed to scope for more than previously envisaged tightening, allowed NZGB & NZ swap rates to fall and the NZD to more than uniwnd its initial hike-inspired gains.

- The BoC is set to deliver its monetary policy decision, with most looking for a 25bp rate hike. It will come alongside the Bank's Quarterly Monetary Policy Report. Elsewhere, BoJ's Kuroda is due to speak today, while key data releases include UK inflation figures & China's trade balance.

US TSYS: A Touch Cheaper In Asia

The curve has bear steepened in Asia-Pac dealing, with the major benchmarks running little changed to 3.0bp cheaper across the curve, while TYM2 futures operate 0-02+ above the base of their 0-10+ session range, last -0-07 at 120-09.

- Tsys briefly joined the post-RBNZ squeeze higher, although the ACGB space is much more susceptible to RBNZ-related moves given the close geographical ties/historical cross-market correlations observed.

- Some cash Tsy selling around the re-open was enough to more than reverse the initial uptick in futures with hawkish comments from Messrs Bullard (’22 voter) & Barkin (’24 voter) observed overnight.

- Flow was dominated by block sellers of futures, covering the TU (-3,485) & TY (-2,107) contracts.

- An uptick in e-minis will have applied some pressure, at the margin (the S&P 500 contract is +0.5%), although we haven’t seen much in the way of meaningful news flow to drive that particular move.

- Looking ahead, Wednesday’s NY session will bring the release of PPI data for March, 30-Year Tsy supply and Fedspeak from Governor Waller. The latest BoC monetary policy decision will also provide some interest.

JGBS: Twisting Flatter, Back From Best Levels

The JGB curve has twist flattened, with the major benchmarks running 1.0bp cheaper to 2.5bp richer on the day, pivoting around 5s as the super-long end outperforms.

- The NY session bid in U.S. Tsys provided spill over support for the space during the Tokyo morning, although the (modest in comparison) Asia-Pac softening in U.S. Tsys capped JGB futures shortly after the re-open, meaning that the contract could not challenge its overnight high. The contract then drifted lower into the lunch bell.

- The offer to cover ratios for today’s BoJ Rinban operations can be observed below:

- 1- to 3-Year: 3.31x (prev. 2.62x)

- 5- to 10-Year: 2.48x (prev. 1.86x)

- 25+-Year: 4.73x (prev. 4.79x)

- The uptick in the 1- to 3- & 5- to 10-Year cover ratios seemingly applied some pressure to the space during afternoon dealing, with another modest round of cheapening in U.S. Tsys also playing into JGB softening after the lunch break.

- There hasn’t been much in the way of meaningful domestic headline flow to pick apart, with an extension of the country’s gasoline subsidy scheme providing the highlight, alongside some fairly run-of-the-mill commentary re: FX matters from the upper echelons of the ruling LDP party.

AUSSIE BONDS: Back From RBNZ-Inspired Peaks

Cross-market impetus has been the name of the game in Sydney dealing. A bid came back in after the space initially showed lower on the RBNZ’s 50bp OCR hike (vs. sell-side consensus of 25bp & pre-decision market pricing of ~42bp of tightening). The RBNZ language re: comfort with its Feb OCR track (a potential hat tip to the idea that the OCR track priced into the OIS strip may be getting ahead of itself) and the Bank highlighting that a larger move now provided future optionality against high levels of global uncertainty (alongside a focus on combatting rising long-term inflation expectations), as opposed to scope for more than previously envisaged tightening, allowed a bid to come back into the space.

- Outside of that, gyrations in U.S. Tsys seemed to dictate price action.

- YM breached its overnight session peak on the aforementioned trans-Tasman spill over as NZGB yields & NZ swap rates fell. The front-end led nature of the move extended the early bull steepening, before the richening and steepening pared back from extremes. YM +7.5 and XM +5.0 at typing. The 5- to 7-Year zone outperformed in cash trade, with 20+-Year ACGBs only ~1bp firmer on the day.

- The latest Westpac consumer confidence reading slid to levels not observed since late ’20, building on the heavy slide seen in Feb, with the survey noting that “at that time concerns around interest rates and inflation were starting to weigh on confidence. These were compounded by Russia’s invasion of Ukraine, an associated spike in petrol prices, and severe weather events.” A look deeper into the details revealed a split between the outlook of those who are more/less indebted, with Westpac flagging that “confidence amongst respondents with a mortgage fell by 9.2% in April amid concerns that the Reserve Bank will be raising the cash rate earlier than previously expected and at a faster pace. Notably, the prospect of interest rate rises may have buoyed sentiment across some sub-groups that stand to benefit. Confidence posted significant gains amongst those aged over 65 (+7%) and amongst freehold homeowners (+5.5%). These are segments without large mortgage debts that are also more likely to depend on interest incomes.”

FOREX: Kiwi Knee-Jerks Higher After Double-Barrel OCR Hike, Yen Sell-Off Continues

Post-RBNZ demand for the kiwi dollar quickly dissipated as the details of monetary policy review came under scrutiny. NZD crosses jumped in the initial reaction as the Reserve Bank raised the OCR by 50bp in the first half-point hike since 2000 citing concerns about mounting inflationary pressures. The upswing got unwound as the minutes suggested that the RBNZ has front-loaded policy tightening without necessarily seeing a higher terminal rate. Policymakers noted that they delivered a larger hike "now, rather than later" as a result of least regrets analysis. The kiwi is the worst G10 performer as we type.

- USD/JPY continued its unrelenting bull run, albeit without re-testing the Y125.76/77 cycle highs printed earlier this week. FinMin Suzuki reiterated that rapid FX moves are "undesirable" but the yen ignored his comments.

- The BoC is set to deliver its monetary policy decision, with most looking for a 25bp rate hike. It will come alongside the Bank's Quarterly Monetary Policy Report. The loonie caught a light bid amid positioning ahead of the policy announcement.

- Elsewhere, BoJ's Kuroda is due to speak today, while key data releases include UK inflation figures & China's trade balance.

FOREX OPTIONS: Expiries for Apr13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0720-35(E1.0bln), $1.0865-70(E985mln), $1.0900(E1.3bln), $1.0960-80(E903mln), $1.0995-05(E2.9bln)

- USD/JPY: Y123.90-00($655mln)

- EUR/JPY: Y136.00(E562mln)

- AUD/USD: $0.7300(A$682mln), $0.7380-00(A$941mln)

- USD/CAD: C$1.2485-00($593mln)

- USD/CNY: Cny6.3400($500mln)

ASIA FX: Overnight Dip In U.S. Tsy Yields Provides Reprieve To Asia EM FX

Asia EM FX got some reprieve in the wake of Tuesday's decline in U.S. Tsy yields, with participants assessing U.S. CPI data.

- CNH: Offshore yuan edged higher despite lingering sense of concern over China's Covid-19 situation. The government stepped up support for the economy by front-loading the allocation of special infrastructure bonds to provinces.

- KRW: The won outperformed in the Asia EM basket after the release of U.S. CPI data overnight, with core inflation narrowly missing expectations. Better than expected South Korean jobs data provided further support, as the unemployment rate held steady despite wider labour force participation.

- IDR: Spot USD/IDR clawed back its initial losses. Bank Indonesia Governor Warjiyo said that the central bank will wait with using monetary policy measures until there are signs of fundamental inflationary pressures.

- MYR: Spot USD/MYR retreated after printing a fresh multi-month high on Tuesday. Local headline flow was rather sparse.

- PHP: Spot USD/PHP fell after charting a dragonfly Doji candlestick on Tuesday. The Philippines has been hit by tropical storm Megi, which caused landslides and floods, claiming 56 lives so far.

- THB: Thai markets are shut in observance of a public holiday.

BOC: MNI BOC Preview, Apr-2022: Trying To Meet Market Hawkishness

The BoC is widely expected to hike its overnight rate by 50bp and end the reinvestment phase.

- The key inter-meeting nudge came from Dep Gov Kozicki saying she expects the pace and magnitude of hikes and the start of QT to be active parts of our deliberations at our next decision in April, with the Bank prepared to act forcefully.

- With the market pricing in close to 50bp of hikes for the meeting, 100bps over three months and 240bps over twelve months, the Bank is perhaps more likely to underwhelm than overdeliver (with form from its hawkish hold in Jan).

- Existing rate guidance could be changed to keep up with hawkish expectations - unchanged guidance would be viewed dovishly, barring more hawkish implications found in the new economic projections and any changes to neutral rate estimates in the MPR.

- More: https://marketnews.com/markets/pdfs/mni-boc-preview-trying-to-meet-market-hawkishness

EQUITIES: Mostly Higher As U.S. CPI Worry Set Aside

Asia-Pac equity indices are mostly better off at typing with several EM equity indices outperforming, bucking a negative lead from Wall St.

- The Nikkei 225 leads gains amongst major regional peers, sitting 1.7% better off at writing, largely reversing Tuesday’s decline in the process. Index heavyweights Fast Retailing and Tokyo Electron led gains, with broader gains across virtually all sub-indices neutralising notable weakness in financial-related names.

- The Chinese CSI300 underperformed, dealing 0.5% worse off at writing after opening lower. Cyclical equities bore the brunt of the downward pressure as the current trajectory of the country’s COVID-19 outbreak remains uncertain, with Nomura estimating that >25% of the country's population have been placed under either partial or full movement restrictions.

- The Hang Seng reversed opening losses to deal 0.2% higher at typing, with a rise in a gauge of real estate names countered by a downtick in utilities and financials sub-indices. Large-cap tech names contributed the most to the Hang Seng’s gains, with Tencent Holdings and JD.com Inc on track to lodge a second straight day of gains, broadly outperforming their China-based tech peers such as Alibaba and Meituan.

- U.S. e-mini equity index futures trade 0.4% to 0.5% higher at writing, operating a touch below session highs heading into European hours.

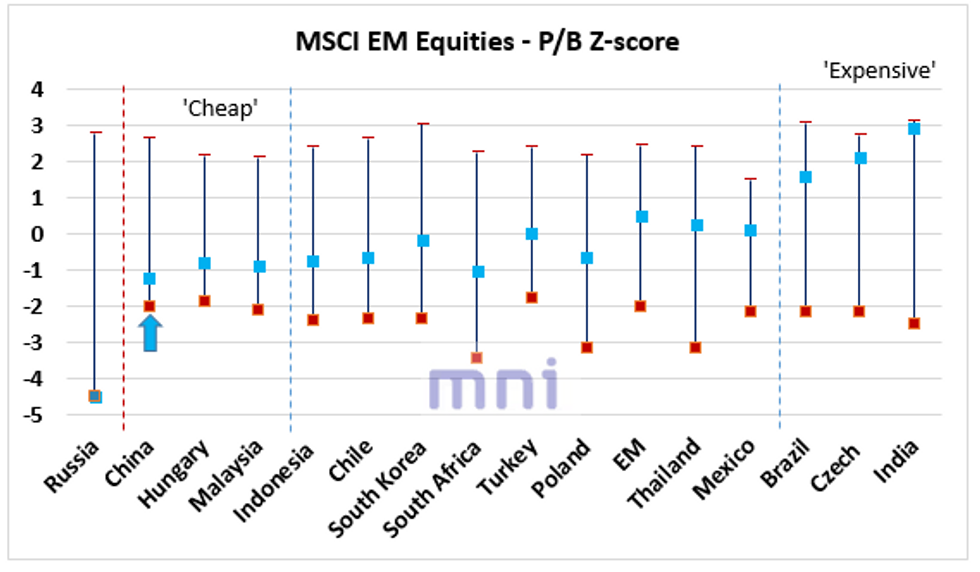

EQUITIES: China Is Now Cheapest Equity Market Among EM (P/B Z-Score Approach)

- China equities are now the ‘cheapest’ EM equity markets (excluding Russia from ranking as P/B value is 0) as zero-Covid policy continues to weigh on the real economy and domestic risky assets.

- Easing signals from China officials combined with the rebound in 'liquidity' (TSF 12M Sum) in recent months have not been enough to stimulate risky assets, which continue to trade at low levels relative to historical standards.

- Momentum on the Hang Seng Index has been bearish since the start of the month, with the index erasing nearly 40% of its March gains (following the headline that regulatory authorities are ‘mulling measures to jointly crackdown on malicious short sellers).

- In this chart, we compute the z-score of P/B ratios of the 16 EM equity markets (15 countries + MSCI Emerging Market index) using over 10 years of data (starting January 2010) and then rank them from 'cheapest' to 'most expensive' based on the distance between the minimum value and the current z-score.

- At the top, India remains the 'most expensive' market among the EM world, with a current price-to-book ratio of 4.03 (vs. 1.72 for EM MSCI index).

Source: Bloomberg/MNI.

GOLD: Higher In Asia; Russia-Ukraine Talks Hit “Dead-End”

Gold deals ~$5/oz firmer to print $1,972/oz at typing, operating below four-week highs made on Tuesday ($1,978.6/oz) as U.S. real yields have broadly extended a move off their post-U.S. CPI troughs in Asia-Pac dealing.

- To recap, the precious metal closed ~$13/oz higher on Tuesday to record a fifth straight day of gains, with the move higher facilitated by a broad downtick in U.S. real yields. The largest moves came after U.S. CPI printed largely within expectations, easing worry from some quarters re: pressure on the Fed to further tighten policy later in ‘22.

- Elsewhere, Russian President Putin declared on Tuesday that peace talks with Ukraine have hit a “dead-end” while stating that the “special operation” would continue, likely ending already-faint hopes surrounding a diplomatic resolution to the conflict for now.

- Looking ahead, U.S. PPI data headlines the data docket later today (1230 GMT).

- From a technical perspective, initial resistance is located near recent highs at $1,980.3/oz (50.0% retracement of Mar8-29 downleg), and a break of that level would expose further resistance at $2,009.2/oz (Mar 10 high). On the other hand, support is seen around ~$1,913.0/oz (50-Day EMA).

OIL: Little Changed In Asia; Russian Crude Production In Focus

WTI and Brent are ~$0.20 better off at typing, back from their best levels of the session, and operating a touch below their respective, recently-made one-week highs.

- Major crude benchmarks have caught a bid as RTRS source reports on Tuesday pointed to a decline in average Russian oil output in April so far, adding to worry re: more disruptions to Russian crude exports after Russian President Putin declared that Russia-Ukraine peace talks have hit a “dead-end”.

- Looking to China, despite a reported partial lifting of lockdowns in Shanghai, factories and “non-essential” businesses remain mostly shut. Worry re: risks to the economy has become increasingly evident, with Chinese Premier Li Keqiang noted to have made three separate statements warning of economic growth risks within the past week. Total fresh daily cases nationwide reported for Apr 12 edged up to ~27.9K (vs. ~24.5K Apr 11), with cases in Shanghai remaining elevated at ~26.3K (vs ~23.3K Apr 11).

- Elsewhere, the latest weekly U.S. API inventory estimates crossed late on Tuesday. Reports pointed to a larger than expected build in crude stockpiles and an increase in Cushing hub inventories, while there was a drawdown in gasoline and distillate stockpiles.

- Looking ahead, EIA data is due later on Wednesday (1430 GMT), with WSJ estimates calling for increases in crude stockpiles. Distillate stocks are tipped to remain unchanged, while gasoline inventories are expected to decline.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/04/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 13/04/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 13/04/2022 | 0700/0900 | *** |  | ES | HICP (f) |

| 13/04/2022 | 0800/1000 | * |  | IT | Industrial Production |

| 13/04/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 13/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 13/04/2022 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 13/04/2022 | 1400/1000 |  | CA | BOC Monetary Policy Report | |

| 13/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 13/04/2022 | 1500/1100 |  | CA | BOC Governor Press Conference | |

| 13/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 13/04/2022 | 1630/1230 |  | US | Richmond Fed's Thomas Barkin | |

| 13/04/2022 | 1700/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.