-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: China CFETS Yuan Index Down 0.36% In Week of Dec 6

MNI: PBOC Net Injects CNY13.8 Bln via OMO Monday

MNI BRIEF: PBOC Increases Gold Reserves

MNI EUROPEAN OPEN: Plenty To Digest Over Long Easter Weekend

EXECUTIVE SUMMARY

- CHINESE GDP TOPS ESTIMATES, MARCH ECONOMIC ACTIVITY DATA A LITTLE MORE MIXED

- MORE CHINESE CITIES INTRODUCE COVID RESTRICTIONS, SHANGHAI SKETCHES OUT EXIT PLAN

- PBOC CUT RRR BY SMALLER THAN EXPECTED AMOUNT

- UKRAINE-RUSSIA CONFLICT CONTINUES, WITH NO SIGN OF AN END, EU EYES MORE SANCTIONS

- ECB SHOULD RAISE RATES BY 50BPS IN FALL, HOLZMANN SAYS (BBG)

- BOJ’S KURODA WARNS RECENT YEN MOVES ‘QUITE SHARP,’ MAY HURT BUSINESSES (CNBC)

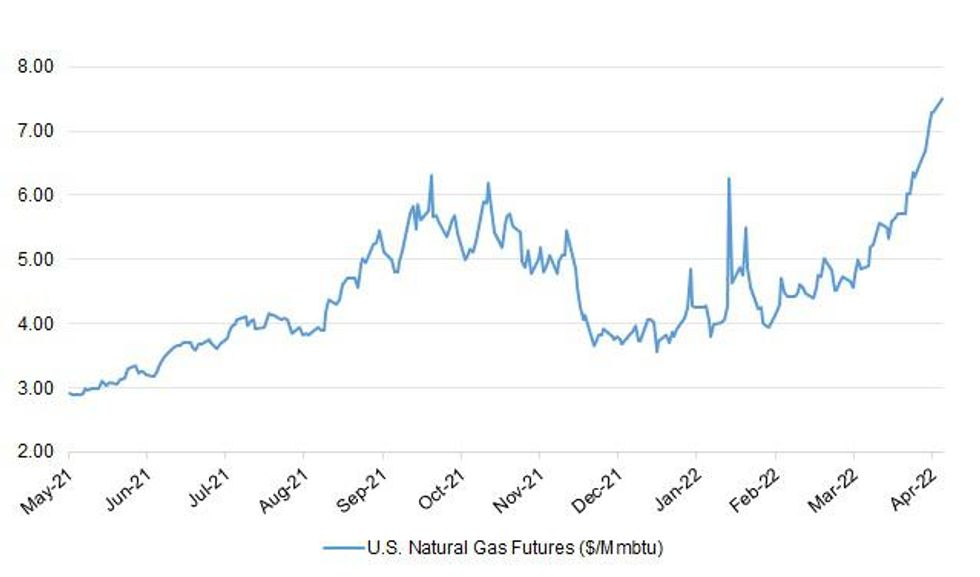

Fig. 1: U.S. Natural Gas Futures ($/Mmbtu)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British employers are offering annual pay settlements worth an average increase of 2.8% to staff, well below the rate of inflation, a survey showed on Monday. The Chartered Management Institute said many businesses were wary of offering pay rises when other costs were soaring and some feared that consumer demand would soon falter. "We've not really seen the full effects of the Ukraine conflict filter through yet, and it's clear that pressure is mounting across the board and there are undoubtedly some rocky times ahead," Anthony Painter, the CMI's director of policy, said. (RTRS)

ECONOMY/POLITICS: Almost four out of five people think Boris Johnson does not understand how soaring energy bills and inflation affect them, a poll has revealed. Even fewer people believe that Rishi Sunak, the chancellor, can relate to the cost-of-living crisis, with 18 per cent believing that he understands, according to a YouGov poll for The Times. It found that 44 per cent of the public believe his personal wealth makes him less suitable to be chancellor, compared with 39 per cent who think it makes no difference to his ability to do the job. (The Times)

POLITICS: Senior Tories have warned that traditional supporters are abandoning them after Boris Johnson’s Partygate fine, as another MP broke cover to say the prime minister should be removed over his conduct. Conservative MPs across the country said on Saturday they believed many people who had backed the party before were now raising concerns, with Downing Street braced for further fixed-penalty notices relating to parties in the coming days. Writing in the Observer, former immigration minister Caroline Nokes said she was sticking with her decision to submit a letter of no confidence in the prime minister. It makes her the latest MP to back a leadership contest since the lockdown breach fines were issued to the prime minister and the chancellor, Rishi Sunak. She also highlighted correspondence suggesting previously secure voters were expressing concerns. She wrote: “There are those who say these emails are only from ‘the usual suspects’. It is true to say there have been a smattering of them, the political activists who send an automated email at the drop of a hat. But they are very much in the minority. (Guardian)

POLITICS: Boris Johnson remains defiant that he did not break coronavirus rules despite being fined, close allies have said, as he plans to brush aside the controversy with a “business as usual” agenda this week. He will attempt to minimise the fallout of the scandal over lockdown parties as MPs return to Westminster tomorrow by emphasising his close engagement with President Zelensky, a renewed focus on combating the cost-of-living crisis and a trade visit to India on Thursday. He has ordered all relevant cabinet ministers to consider how their departments can help to reduce the cost of living and will summon them for a meeting to discuss the options next week. (The Times)

POLITICS: Labour accused Boris Johnson of demeaning the office of prime minister after a media report said he played a key role in a Downing Street party held during coronavirus restrictions to mark the departure of one of his key advisers. The Sunday Times cited government insiders as saying Johnson instigated the Downing Street event to say goodbye to Lee Cain, the prime minister’s head of communications, in November 2020. (FT)

POLITICS: A new poll has found that almost two thirds of British people think Boris Johnson should resign if he is hit with more fines for parties in Downing Street. Were the Prime Minister to be fined again over the parties, 63 percent of the British public say they think he should resign, according to a YouGov poll conducted on behalf of The Times. The poll also found that 36 percent of people who voted for Johnson's Conservative party in 2019 would want his resignation with more fines. That is compared to 49 percent of Conservative voters who said he should stay on in his position regardless of whether he is fined more or not, The Times reported. (The Daily Mail)

POLITICS: Boris Johnson faces the prospect of a crunch parliamentary vote on Tuesday over whether he misled the House of Commons in relation to the “partygate” scandal after the Metropolitan Police fined the prime minister for breaching Covid rules. The opposition Labour, Liberal Democrat and the Scottish National parties are in discussions over the best way to force a vote on whether Johnson brought parliament into disrepute when MPs return from the Easter break next week. Johnson told the house in December three times that “no rules were broken” at the heart of his government. But the Met’s decision to fine the prime minister and the chancellor Rishi Sunak confirmed that restrictions were breached. (FT)

EUROPE

ECB: “Given where we stand, it would be well advised to hike rates in the fall,” and reach 0% with the deposit facility rate, Governing Council member Robert Holzmann says on Austrian public radio Oe1. (BBG)

ECB: The ECB could end its asset purchase program in July, ECB Governing Council member Madis Muller says on Bank of Estonia’s website on Friday. “On Thursday, the Governing Council of the European Central Bank made it clearer than before that all other additional bond purchases will end during the third quarter”. “In the light of the latest news on price rises, I would not be surprised if ‘during the third quarter’ means already in July”. “This provides a possibility, in the event of a rapid rise in prices, to take the next logical step, which is to raise interest rates”. (BBG)

ECB: The euro zone economy faces slower economic growth and higher inflation as Russia's invasion of Ukraine pushes up costs, disrupts trade and hits confidence, a European Central Bank poll of economists showed on Friday. Economists polled in the ECB's Survey of Professional Forecasters (SPF) put inflation at 6% this year, or twice as high as predicted just two months ago, and saw it staying just above the ECB's 2% target in the longer term. "Regarding the near-term outlook, respondents viewed high inflation as being primarily determined by 'cost-push' rather than 'demand-pull' factors, and considered that the conflict in Ukraine had re-ignited and amplified price pressures that had started to show signs of peaking," the ECB said in a press release. (RTRS)

ECB: European Central Bank’s Governing Council member Gediminas Simkus said he sees “no reason why we shouldn’t consider an interest-rate increase” in the third quarter after ending the asset purchases program. The Governing Council’s decision will be data-driven as it proceeds with normalization process, Simkus tells reporters in Vilnius. Simkus called on the European Union to impose energy sanctions on Russia to prevent it from continuing the war in Ukraine. “I hope for principled EU-wide decisions on oil and gas.” (BBG)

FRANCE: President Emmanuel Macron has called for an EU-wide framework to cap “abusive” executive pay after anger in France over a €19.1mn package for the head of carmaker Stellantis. The criticism of the award to Carlos Tavares came as Macron entered the final weekend of the French election campaign seeking to fend off far-right challenger Marine Le Pen, who also condemned the pay for the head of the Franco-Italian company. (FT)

FRANCE: President Emmanuel Macron promised on Saturday to make France the “first great nation” to stop using oil, coal and gas as energy sources, in a pitch to young and green voters he fears could abstain in next week’s election runoff. (RTRS)

ITALY: Italy general government debt grew from EU2.714 trillion in Jan., Bank of Italy says in its public-finances supplement. Foreign ownership of Italy’s debt fell to 28.6% in Jan. from 29.1% in Dec. Foreign holding of Italy’s public securities fell by EU3.58 billion to EU681.08 billion in January. Bank of Italy didn’t give figures for Feb. (BBG)

U.S.

FED: President Joe Biden will nominate Michael Barr, a Treasury Department veteran and one of the architects of the Dodd-Frank Act of 2010, as the U.S. Federal Reserve’s chief banking supervisor. “Michael brings the expertise and experience necessary for this important position at a critical time for our economy and families across the country,” Biden said in a statement released Friday by the White House. Barr’s nomination as the Fed’s vice chair for supervision requires Senate approval. (BBG)

OTHER

GLOBAL TRADE: China's supply chains must be stabilised amid COVID-19 outbreaks, and the government will create a "white list" of key industrial firms, exporters and importers, the official Xinhua news agency quoted Vice Premier Liu He as saying. Liu said in meeting that the national uniform passes for key logistics operators should be granted adequately, and access shall not be limited on the ground of waiting for COVID-19 test results, Xinhua said on Monday. Growing COVID flare-ups in China have disrupted the country’s logistics chains, clogging highways and ports, stranding workers and shutting countless factories. (RTRS)

GLOBAL TRADE: The Chinese government is taking more concrete measures to relieve the congestion at the Shanghai port, the world's largest port in terms of container turnover, part of the move to ensure smooth logistics amid disruptions posed by COVID-19 outbreaks and minimize the impact on economic activities. Market players said that it is hard to see quick relief given that the congestion happens on the road instead of the port, and some carriers are shifting their goods to neighboring ports to shorten waiting time. "Shore congestion at the Shanghai port is very serious and nearly 60 percent of the cargo at sea and air terminals are "unclaimed," and the number is rising," Zhong Zhechao, founder of One Shipping, an international logistics service consulting company, told the Global Times on Friday. (Global Times)

GLOBAL TRADE: Chinese producers and exporters are diversifying China-Europe trade routes by redirecting some orders from ships to trains and planes in an effort to tackle disruptions and uncertainties posed by the COVID-19 epidemic in Shanghai and some neighboring regions in the Yangtze River Delta, a major production and trade center. The shift came as the port in Shanghai, the world's largest port in terms of container throughput, faces rising stockpiles of containers. Some large international shipping companies are suspending goods delivery at the port, posing serious challenges to the timely delivery of goods. Some 60 percent of the goods lying at Shanghai port are "unclaimed" due to logistics disruptions on the roads and at sea, while the port has reached its limit and can hardly accommodate more containers, industry insiders said. The pressure has been passed on to the neighboring Ningbo Zhoushan port in East China's Zhejiang Province. (Global Times)

GLOBAL TRADE: Ukraine’s state-owned railway company has temporarily restricted the transportation of some agricultural goods through border crossings to Poland and Romania, consultancy APK-Inform said on Saturday. It gave no reason for the restrictions. Ukraine, a major agricultural producer, used to export most of its goods through seaports but since Russia’s invasion has been forced to export by train via its western border. APK-Inform said restrictions on the movement of goods to Poland through Yahodyn have been put in place from April 16 to April 18. There are also restrictions on the transportation of cereals, oilseeds, grains and other food products through Izov to the Polish towns of Hrubeszew and Slawkov. From April 16 until further notice, there are restrictions on the export of grain and seeds to Romania through the Dyakovo and Vadul-Siret crossings, the consultancy said. The railway company was not available for immediate comment. (CNBC)

GLOBAL TRADE: The outlook for spring planting in much of Ukraine has improved somewhat as Russian troops narrow their offensive to focus on eastern areas. The government expects a 17% decline in planted area from last year, versus the 20% drop it forecast in early April. Planting of spring crops including wheat, barley, corn, soybeans and sunflowers is under way in all of Ukraine’s growing regions except Luhansk, according to the agriculture ministry. Ukraine is one of the world’s top producers and exporters of grains and oilseeds. More than 55% of the country is arable land, according to the U.S. Department of Agriculture. (BBG)

U.S./CHINA: China's securities regulator said on Saturday that Didi Global (DIDI.N) decision to delist from New York Stock Exchange was a decision the Chinese ride-hailing giant made on its own based on the market and the company's own situation. (RTRS)

U.S./CHINA/TAIWAN: China said it conducted military drills around Taiwan on Friday as a U.S. Congressional delegation visited the island in a show of support to a fellow democracy, with Beijing blaming the lawmakers for raising tensions with their "provocative" trip. (RTRS)

U.S./CHINA/TAIWAN: A group of senior U.S. senators delivered a message of support for Taiwan during a visit Friday, a move that China answered with a display of military force. Members of the delegation, including Republican Lindsey Graham, told Beijing that the U.S. will start making China account for bullying Taiwan and supporting Russian President Vladimir Putin’s invasion of Ukraine. “Here is my promise to you and the Taiwanese people: We are going to start making China pay a greater price for what they are doing all over the world,” Graham said during a meeting with President Tsai Ing-wen in Taipei. “The support for Putin must come with a price. The never-ending cyberattack on your economy and people by the Communist Chinese needs to come with a price.” (BBG)

GEOPOLITICS: U.S. President Joe Biden will host leaders of the Association of Southeast Asian Nations (ASEAN) at a summit in Washington on May 12 and May 13, White House spokeswoman Jen Psaki said in a statement on Saturday. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda said the recent drop in the yen has been “very rapid,” but he still considers a weak currency as positive for the country’s economy as a whole. Desirable for foreign exchange rates to reflect economic fundamentals and move in stable manner, he says in response to a lawmaker’s questions in parliament. Rapid weakness in yen fuels negative effects; effects are uneven among companies, sectors. State of the overall economy makes it appropriate to continue monetary easing; will discuss exit plans when BOJ’s 2% inflation goal is met; not time to discuss exit plans yet. (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Monday the yen’s recent moves have been “quite sharp” and could hurt companies’ business plans, offering his strongest warning to date of the demerits of the currency’s depreciation. Traders bought the yen on the comment, helping push the dollar down by 0.22% to 126.28 yen on Monday. “The recent falls in the yen, which lost about 10 yen to the dollar in about a month, is quite sharp and could make it hard for companies to set business plans,” Kuroda told parliament. “In that sense, we need to take into account the negative effect” of a weak yen, he said. Kuroda, however, repeated his view the BOJ must maintain its massive stimulus program to support a fragile economic recovery. (CNBC)

JAPAN: Japan’s Finance Minister Shunichi Suzuki reiterated his stance that excessive and disorderly moves in the foreign exchange market can have a negative effect. Stability in currencies is important, sudden volatility isn’t desirable, Suzuki says in parliament. Will continue to watch the foreign exchange market and its impact on Japan’s market with a sense of vigilance; will also monitor the weakening of the yen. Must refrain from commenting on the possibility of intervening in the market. Have no intention of changing 2013 joint statement on policy coordination with the Bank of Japan; the BOJ maintains independence over monetary policy. (BBG)

JAPAN: The Bank of Japan (BOJ) is likely to raise its inflation forecast for this fiscal year to near 2% at this month's policy meeting as global commodity inflation drives up energy and food costs, said three sources familiar with the bank's thinking. While the upgrade will bring inflation closer to its 2% target, the central bank will stress its resolve to keep monetary policy ultra-loose to underpin a fragile economic recovery, the sources said. "Consumer inflation may accelerate to near 2% this fiscal year, but mostly due to rising fuel and food costs," one of the sources said. (RTRS)

JAPAN/SOUTH KOREA: South Korean President-elect Yoon Suk Yeol will send a delegation to Japan this month for policy consultations on bilateral issues and cooperation in responding to threats by North Korea, his transition team said Sunday. The delegation, led by Chung Jin Suk, a member of Yoon's People Power Party, and also involving diplomatic experts, will arrive in Japan on April 24 and meet with lawmakers, diplomats and business leaders. Yoon, whose inauguration is scheduled for May 10, sent a similar delegation to the United States earlier this month. (Kyodo)

BOK: The nominee to lead the Bank of Korea (BOK) said Sunday inflationary pressure will likely remain high for a considerable period of time and stressed a focus on efforts for price stability. Rhee Chang-yong made the remarks in a written response to a lawmaker’s question on the direction of the central bank’s monetary policy, as he prepares for a confirmation hearing scheduled for Tuesday. “Inflationary pressure will likely persist for a considerable period of time amid the economic recovery. It is desirable for the BOK to promote price stability by adjusting its accommodative policy stance,” he said. (Yonhap)

NORTH KOREA: North Korean leader Kim Jong-un oversaw the successful test-firing of a new tactical guided weapon meaningful in improving the efficiency of tactical nuclear operations, Pyongyang's state media announced Sunday. The new weapon system is "of great significance in drastically improving the firepower of the frontline long-range artillery units and enhancing the efficiency in the operation of tactical nukes of the DPRK and diversification of their firepower missions," the official Korean Central News Agency (KCNA) said. The DPRK is the acronym for the North's official name, the Democratic People's Republic of Korea. "The test-fire was carried out successfully," it added without giving other details on the tested weapon, including its type. (Yonhap)

TURKEY: Turkey has added hard currency earned by the services sector to the list that must be exchanged with the central bank, in an effort to bolster the nation’s foreign exchange reserves. Banks must now convert 40% of foreign exchange earned and repatriated by Turkish residents from providing services, such as tourism, health care and construction, according to a notice from the Central Bank of Turkey. Previously only export earnings were subject to the rule. While exporters are obliged to convert their foreign exchange earnings, repatriation of service sector earnings is still optional. The announcement comes right after the central bank raised the percentage for export earnings to 40%, from 25%. (BBG)

MEXICO: Texas Governor Greg Abbott halted all Mexican truck inspections after a week of protests, traffic jams and mounting outrage from business interests on both sides of the border. The Republican leader of the second-largest U.S. state signed an agreement with the governor of the border state of Tamaulipas on Friday that ends vehicle-safety checks in exchange for increased vigilance south of the international line. Tamaulipas was the fourth and final border state to ink such a deal after Abbott triggered gridlock and angry trucker protests with an April 6 crackdown on northbound commercial traffic. Although Abbott initially said his decree was intended to curb undocumented immigration and drug smuggling, Texas state troopers targeted highway-safety issues such as bad brakes and other mechanical issues. (BBG)

MEXICO: President Andres Manuel Lopez Obrador failed Sunday night in his attempt to restore state control over Mexico’s electricity sector, falling short of the two-thirds majority needed in the lower house of congress to reform the constitution. Lawmakers voted 275 in favor and 223 against the bill in a vote held late on Easter Sunday, after the opposition united against the proposal. AMLO, as the president is known, had sought to use the bill to solidify his nationalist vision for the energy sector and reverse a privatization of the power industry that started over two decades ago. (BBG)

RUSSIA: Russian troops may start the next phase of the Kremlin’s military campaign in the next few days, NBC News reported. U.S. intelligence believes the Russian military could start moving some forces back into Ukraine as soon as this weekend or early next week, NBC News reported, citing two unnamed senior U.S. defense officials. Russian forces had retreated from around Kyiv and northern Ukraine. Officials at the time expected troops to regroup and begin an offensive on the Donbas region and southeastern Ukraine. Now, though, the Russian military could move troops back into Ukraine before all of its troops are ready to fight again, NBC News reported. (CNBC)

RUSSIA: Ukrainian President Volodymyr Zelensky said in an interview with CNN on Friday that the world should be prepared for the possibility of Russia using tactical nuclear weapons in its unprovoked invasion of his country. Zelensky told CNN that he believes Russian President Vladimir Putin could turn to nuclear or chemical weapons because he does not value Ukrainian lives. (Axios)

RUSSIA: Russian Ministry of Defense spokesperson Maj. Gen. Igor Konashenkov claimed in a statement Saturday the Russian military had shot down a Ukrainian military transport plane carrying military equipment from Western countries. The statement said "a Ukrainian military transport aircraft was shot down in the air" in the Odesa region while "delivering a large batch of weapons supplied to Ukraine by Western countries." No further evidence was provided. CNN could not verify the claim and reached out to the Pentagon for comment. (CNN)

RUSSIA: Russia says that it has destroyed production buildings of an armored vehicle plant in Kyiv and a military repair facility in the city of Mykolaiv, the Interfax news agency quoted Russia’s defence ministry as saying on Saturday. Russian Defense Ministry Igor Konashenkov said that Russia had used high-precision long-range weapons to carry out the strikes. Konashenkov also stating that a Ukrainian Su-25 aircraft was shot down by Russian air defense systems near the village of Izyum. (CNBC)

RUSSIA: Ukraine's defence ministry spokesman Oleksandr Motuzyanyk said on Friday that for, the first time since the start of its invasion, Russia used long-range bombers to attack the besieged port city of Mariupol. Motuzyanyk said Russia was concentrating its efforts on seizing the cities of Rubizhne, Popasna and Mariupol. (RTRS)

RUSSIA: Russia called on Ukrainian forces in the besieged industrial port city of Mariupol to lay down their arms on Sunday to avoid being killed. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskyy said he’s distrustful of Russian negotiators when it comes to the besieged city of Mariupol. “To be honest, there is no trust in the negotiators on Mariupol,” Zelenskyy said in an interview with a Ukrainian media outlet, according to an NBC translation. “We agreed that there would be humanitarian corridors. We wanted to take away the wounded, our women and children, but Russia refused.” (CNBC)

RUSSIA: Ukrainian Foreign Minister Dmytro Kuleba said there had not been any recent diplomatic communications between Russia and Ukraine at the level of their foreign ministries and that the situation in the port of Mariupol, which he described as "dire", may be a "red line" in the path of negotiations. "Mariupol may be a red line", he told CBS News in an interview on Sunday. (RTRS)

RUSSIA: The Black Sea port city of Mykolaiv and surrounding areas have come under continuous rocket attacks since Sunday morning, the region’s governor, Vitaliy Kim, told the BBC. The region’s military spokesman said targets have included power grids, houses and playgrounds. Earlier, on Telegram, Kim said Kalibr missiles had disrupted water and power supplies. (BBG)

RUSSIA: The regions of Kherson and Zaporizhzhia in Ukraine’s south are being transferred to “the ruble zone” and subordinated to Russian administration, Zelenskiy claimed in his latest address. The Ukrainian president said Russia’s actions in the territories are following the example of the so-called separatist republics of the DPR and LPR. The answer to the attempted “ruble occupation” of the Kherson and Zaporizhzhia regions must be full coverage of the Russian banking and financial systems by sanctions, Zelenskiy added. (The Guardian)

RUSSIA: Residents who fled Kyiv in late February and early March shouldn’t rush back, regional military governor Oleksandr Pavliuk said, according to Interfax. Many Kyivites are keen to return to their homes after the withdrawal of Russian troops ushered in a period of relative calm that’s seen foreign leaders flock to the capital and plans for some embassies to reopen. But a significant threat persists, Pavliuk said, with three Russian missile strikes in the region overnight and the prospect of hostilities increasing once again. (BBG)

RUSSIA: Pope Francis made a plea on Easter Sunday to end Russia’s invasion of Ukraine and warned of the threat of nuclear warfare. “May there be peace for war-torn Ukraine, so sorely tried by the violence and destruction of this cruel and senseless war into which it was dragged,” the pontiff said from the central balcony of St. Peter’s Square in Vatican City. (BBG)

RUSSIA: Billionaire Roman Abramovich has traveled to Kyiv in a bid to restart peace talks between Russia and Ukraine, which stalled after evidence emerged of Russian atrocities against civilians. Abramovich met with Ukrainian negotiators to discuss ways of reviving the negotiations, according to people with knowledge of the matter. (BBG)

RUSSIA: Ukrainian Prime Minister Denys Shmyhal and top Ukrainian finance officials will visit Washington next week during the spring meetings of the International Monetary Fund and World Bank, sources familiar with the plans said on Friday. Shmyhal, Finance Minister Serhiy Marchenko and central bank governor Kyrylo Shevchenko are slated to meet bilaterally with finance officials from the Group of Seven countries and others, and take part in a roundtable on Ukraine to be hosted by the World Bank on Thursday, the sources said.Thursday's event will be the first chance for key Ukrainian officials to meet in person with a host of financial officials from advanced economies since Russia's invasion of Ukraine on Feb. 24. (RTRS)

RUSSIA: Russia sent a diplomatic note to the U.S. this week saying U.S. and NATO supplies of the “most sensitive” weapons systems to Ukraine were stoking the war and could lead to “unpredictable consequences,” the Washington Post reported. The note, the latest of several warnings from Russia to the Biden administration, wasn’t signed by President Vladimir Putin or other senior Russian officials, the New York Times reported. A State Department official said the department won’t confirm private diplomatic correspondence. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskiy recently made a direct appeal to U.S. President Joe Biden for the United States to designate Russia a "state sponsor of terrorism," the Washington Post reported on Friday, citing people familiar with their conversation. (RTRS)

RUSSIA: Two Republican lawmakers traveled to Kyiv on Thursday, the first U.S. officials known to have visited Ukraine since the Russian invasion, NBC News reported. Senator Steve Daines of Montana and Representative Victoria Spartz of Indiana, the first Ukrainian-born member of Congress, also visited mass graves in Bucha, the site of alleged atrocities by the Russian military. (BBG)

RUSSIA: Lithanian President Gitanas Nauseda urged Finland and Sweden them to apply to join the NATO military alliance as soon as feasible, the Financial Times reported. He brushed off Moscow’s threats to increase its military presence in the Baltics, saying Russia has had such weapons in Kaliningrad, a Russian holding wedged between Poland and Lithuania, for years. “The Kaliningrad region is probably the most militarized region in Europe, and tactical nuclear weapons are already there,” Neuseda said. “I don’t think we should react to this rhetoric.” (BBG)

RUSSIA: The US has a “long playbook” of further sanctions planned against Russia and sees little scope for lifting existing ones, according to a senior state department official. Jose Fernandez, US under-secretary for economic growth, energy and the environment, said the US was working with Europe on additional punitive measures against Moscow, especially as the EU had warmed to the idea of further restrictions on Russian energy imports. “From day one everything is on the table . . . on sanctions, on oil, we have a long playbook. And in that playbook, several pages have not been read out,” Fernandez told the Financial Times. (FT)

RUSSIA: The EU is working on broadening sanctions on Russia to include oil and gas embargoes but such measures would take "several months", European officials told AFP on Friday. The bloc last week announced a ban on Russian coal in a first step against Russian energy exports -- together, Moscow's main hard currency earner. But the coal sanction only kicks in from mid-August, and would hit around eight billion euros ($8.7 billion) in Russia's sales abroad, annually. Russian oil and gas sales to the EU account for a far higher amount of revenue: between a quarter of a billion to a billion euros per day, per different estimates. (AFP)

RUSSIA: The European Union's forthcoming sanctions on Russia will target banks, in particular Sberbank, as well as oil, the head of the European Commission Ursula von der Leyen told a German newspaper. (RTRS)

RUSSIA: Europe can reduce energy dependence on Russia quicker than previously estimated, Mario Draghi said in an interview with Corriere della Sera. “Diversification is possible and feasible relatively quickly, shorter than we imagined just a month ago,” the Italian prime minister said after reaching an agreement to increase gas imports from Algeria. “We have gas in storage and will have new gas from other suppliers,” Draghi said, adding that the effects of any “containment measures” would be mild. “We are talking about a 1-2 degrees reduction in heating temperatures and similar variations for air conditioners.” (BBG)

RUSSIA: Austria could end Russian natural gas imports “maybe in a few years,” Chancellor Karl Nehammer told NBC’s “Meet the Press.” Austria is 80% dependent on Russian gas, so “it is not possible today, tomorrow,” he said. Nehammer, whose country is militarily neutral under a 1955 arrangement that ended its post-World War II occupation by Allied and Soviet forces, was received by Russian President Vladimir Putin in Moscow on Monday. He said he made the trip to “confront” Putin with evidence of civilian killings in Bucha, a Kyiv suburb that had been held by Russian forces. (BBG)

RUSSIA: Russian ships won’t be able to anchor at Italian ports as of Sunday, Ansa news agency reported. The move is part of the recent package of European Union sanctions against Moscow for the invasion of Ukraine, Ansa said. The change also applies to ships that changed their flag to any other nationality from Russia after Feb. 24, Ansa said. Vessels already moored in Italy should depart as soon as possible. (BBG)

RUSSIA: Russia’s 2022 current account surplus may be higher than $200 billion, against a record $120 billion in 2021, said Maxim Oreshkin, an aide to President Vladimir Putin. Imports fell by “dozens of percent” in March, Oreshkin said in an interview on Rossiya 24. At the same time, revenues from oil and gas exports have surged. The Institute of International Finance recently said Moscow’s current account surplus could hit $240 billion. (BBG)

RUSSIA: Moscow will expel 18 diplomats from the local EU mission to retaliate against the expulsion of 19 of Russia’s diplomats from the EU, the Foreign Ministry said, terming the EU responsible for “the consistent destruction of the architecture of bilateral dialog and cooperation.” (BBG)

RUSSIA: Several buyers of Russian gas have agreed to switch to payments in roubles, Russian Deputy Prime Minister Alexander Novak said on Friday. (RTRS)

RUSSIA: If more nations globally join the ban on Russian energy imports, “prices on key types of fuels may significantly exceed the already reached historic highs,” Russia’s Deputy Prime Minister Alexander Novak says in his op-ed for the Energy Ministry’s in-house magazine. “There is hardly any reasonable alternative to Russian energy now”. Renewable-energy resources are unreliable; Europe cannot hike its LNG imports quickly due to lack of infrastructure. LNG cargoes are less reliable as they may be redirected. Coal imports from South America and South Africa may be more expensive due to logistics. (BBG)

SOUTH AFRICA: South African state power utility Eskom said on Sunday that it would implement "Stage 2" scheduled power cuts from 16:00 local time (1400 GMT) until 0300 GMT on Wednesday to replenish its emergency generation reserves. Eskom added in a statement that the power system remained unpredictable and that any further deterioration in generation capacity may require higher stages of load-shedding, a term for power outages. (RTRS)

IRAN: Iran's Revolutionary Guards said on Friday they had seized two vessels along the country's coast on the Gulf and the nearby Gulf of Oman for allegedly smuggling fuel. (RTRS)

OIL: Russian President Vladimir Putin and Saudi Crown Prince Mohammed bin Salman “gave a positive assessment” of joint work in the OPEC+ format during a phone call, the Kremlin said in a statement on Saturday. They also discussed the situation in Ukraine and Yemen, the Kremlin said. (Al Arabiya)

OIL: Russian oil production has continued to slide in April, declining by 7.5% in the first half of the month from March, the Interfax news agency reported on Friday, citing a source familiar with the data. Oil output has been under pressure amid sanctions from the West over Moscow’s activities in Ukraine. Interfax said Russian oil and gas condensate output stood at 1.392 million tonnes per day on average in the first two weeks of April, down 7.45% from March. (RTRS)

OIL: Iraq was pressured to increase its oil production outside the remit of OPEC’s policy on output, Oil Minister Ihsan Abdul Jabbar said on Saturday. He also told Al Hadath TV that OPEC was committed to providing the oil supplies needed to compensate for any shortages(RTRS)

OIL: Iraq is still maintaining its position in the Indian oil imports market despite India's increased imports of Russian oil, state news agency INA reported on Friday, citing the state-owned marketer SOMO's head, Alaa al-Yasiri. (RTRS)

OIL: The Japanese industry ministry said on Friday it will release 6 million barrels of oil from privately-held reserves as part of its contribution to a second round of the International Energy Agency’s (IEA) coordinated release to calm crude oil prices. Japan will release the petroleum, equivalent to about three days of domestic consumption, by allowing local refiners to lower their mandatory stockpile level in private reserves by three days, to 63 days of domestic demand, from April 16 and October 8. (RTRS)

OIL: Libya’s National Oil Corporation (NOC) has announced the suspension of production at a major oil field in the country’s south, declaring a “force majeure” due to a protest at the site. Located some 750km (466 miles) southwest of Tripoli, the Al-Fil field is jointly managed by the NOC and Italian energy giant ENI and produces about 70,000 barrels of oil per day. The field was already forced to close temporarily in early March when an armed group shut down valves delivering crude. “On Saturday… the Al-Fil field was subjected to arbitrary closure attempts, due to the entry of a group of individuals and the prevention of the field’s workers from continuing production,” the NOC said in a post to Facebook on Sunday. (Al Jazeera)

OIL: Exports from Libya's Zueitina oil port were suspended after protesters got into the port on Sunday morning, two oil engineers at the port told Reuters. A tanker was prevented from loading one million barrels at the oil port, the engineers added. (RTRS)

ENERGY: The Biden administration announced lease sales for oil and gas drilling on federal land Friday, but said it would sharply reduce the acreage available for leases and charge higher royalties on the oil and gas produced. The Interior Department said it would make roughly 144,000 acres available for oil and gas drilling through a series of lease sales, an 80% reduction from the footprint of land that had been under evaluation for leasing. Companies will also be required to pay royalties of 18.75% of the value of what they extract, up from 12.5%. Royalties for onshore oil and gas drilling generated about $1.5 billion to $3 billion a year for the U.S.

CHINA

PBOC: China said on Friday it would cut the amount of cash that banks must hold as reserves for the first time this year, releasing about 530 billion yuan ($83.25 billion) in long-term liquidity to cushion a sharp slowdown in economic growth. The People's Bank of China (PBOC) said on its website it would cut the reserve requirement ratio (RRR) for all banks by 25 basis points (bps), effective from April 25, but analysts said it might not yet be enough to reverse the slowdown. For city commercial banks that do not have cross-provincial business and rural commercial banks that have an RRR of more than 5%, they are entitled to an additional cut of 25 bps. The weighted average RRR for financial institutions will be lowered to 8.1% after the cut, the central bank said. (RTRS)

PBOC: The Chinese central bank vows to use relending, rediscounting and other monetary policy tools to guide banks in increasing financial support for the logistics sector, according to a PBOC statement after a meeting Friday. Logistics companies and truck drivers will be given loan extensions as needed, in efforts to ensure smooth logistics and stable supply chains. PBOC vows to increase loans for the aviation sector, statement says, without giving details. (BBG)

PBOC: China may still cut interest rates as it needs increased loosening policies and more credit to support growth, the 21 Century Business Herald said citing analyst Li Zhan of China Merchant Fund. China may cut the loan prime rate (LPR) on this Wednesday, and should the pandemic continues to impact the economy, the rate on medium-lending facilities (MLF) could be further lowered in Q2, Li was cited as saying. On Friday, the central bank cut RRR by 25 bp. While the move wasn't enough to change the market’s overall direction, it helps boost investors’ confidence, the newspaper said. (MNI)

POLICY: China is planning more coordinated policies to boost growth and counter downward economic pressures that have persisted since Q1, Vice Minister of Finance Liao Min said in a blog post by China Finance 40 Forum. China should avoid introducing policies that have significant contractionary effects, but will take more forceful measures to protect businesses and jobs and improve people’s living standards, Liao said. Financial authorities have introduced relevant policies to help logistics companies and workers deal with the pandemic, Liao said. Financial institutions are encouraged to boost services to logistics, storage and E-merchants, and they should also help those employed reduce debt burdens, said Liao. (MNI)

CORONAVIRUS: Shanghai published plans to resume work in the city after weeks of Covid-19 lockdown snarled supply chains and dealt a blow to the Chinese economy. Businesses should formulate plans for closed-loop management, where workers live on-site and are tested regularly. They should also apply for approval to restart production with Covid-control authorities, Shanghai’s Economic and Information Technology Commission said in a statement on its WeChat account. The agency did not provide a timetable. (BBG)

CORONAVIRUS: On Friday, China's industry regulator said it had identified 666 companies in Shanghai in the semiconductor, automobile and medical sectors as priority firms that needed to resume work. (RTRS)

CORONAVIRUS: The Chinese financial hub of Shanghai said three people infected with COVID-19 died on Sunday, the first time during the current outbreak that it reported deaths among coronavirus patients. The city reported 19,831 new daily asymptomatic COVID-19 cases on April 17, down from 21,582 on the previous day. New symptomatic cases stood at 2,417, down from 3,238. (RTRS)

CORONAVIRUS: The Zhengzhou airport economic zone, a central Chinese manufacturing area that includes Apple supplier Foxconn, announced a 14-day lockdown on Friday “to be adjusted according to the epidemic situation”. In north-western China, the city of Xi’an urged residents to avoid unnecessary trips outside their residential compounds and encouraged companies to have employees work from home or live at their workplace, after dozens of Covid infections this month. A Xi’an government official, responding to residents’ concerns over potential food shortages, said on Saturday that the announcement did not constitute a lockdown and that the city would not impose one. The city of Suzhou, near Shanghai, said all employees capable of working from home must do so, and residential compounds and company campuses should avoid unnecessary entry of people and vehicles. It has reported more than 500 infections in its latest outbreak. (The Guardian)

OVERNIGHT DATA

CHINA Q1 GDP +4.8% Y/Y; MEDIAN +4.2%; Q4 +4.0%

CHINA Q1 GDP +1.3% Q/Q; MEDIAN +0.7%; Q4 +1.6%

CHINA Q1 GDP YTD +4.8% Y/Y; MEDIAN +4.2%; Q4 +8.1%

CHINA MAR INDUSTRIAL PRODUCTION +5.0% Y/Y; MEDIAN +4.0%; FEB +4.3%

CHINA MAR INDUSTRIAL PRODUCTION YTD +6.5% Y/Y; MEDIAN +6.2%; FEB +7.5%

CHINA MAR RETAIL SALES -3.5% Y/Y; MEDIAN -3.0%; FEB +1.7%

CHINA MAR RETAIL SALES YTD +3.3% Y/Y; MEDIAN +2.8%; FEB +6.7%

CHINA MAR FIXED ASSETS EX RURAL YTD +9.3% Y/Y; MEDIAN +8.4%; FEB +12.2%

CHINA MAR PROPERTY INVESTMENT YTD +0.7% Y/Y; MEDIAN +1.2%; FEB +3.7%

CHINA MAR RESIDENTIAL PROPERTY SALES YTD -25.6% Y/Y; FEB -22.1%

CHINA MAR SURVEYED JOBLESS RATE 5.8%; MEDIAN 5.5%; FEB 5.5%

JAPAN MAR TOKYO CONDOMINIUMS FOR SALE -19.7% Y/Y; FEB +2.0%

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0938% at 09:25 am local time from the close of 1.7295% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 40 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3763 MON VS 6.3896

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3763 on Monday, compared with 6.3896 set on Friday.

MARKETS

SNAPSHOT: Plenty To Digest Over Long Easter Weekend

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 329.67 points at 26763.52

- ASX 200 is closed

- Shanghai Comp. down 24.898 points at 3186.347

- JGB 10-Yr future down 9 ticks at 149.32, yield up 0.2bp at 0.243%

- ACGBs are closed

- U.S. 10-Yr future down 0-15 ticks at 119-15, yield up 4.45bp at 2.872%

- WTI crude up $0.95 at $107.90, Gold up $6.62 at $1984.85

- USD/JPY up 15 pips at Y126.61

- CHINESE GDP TOPS ESTIMATES, MARCH ECONOMIC ACTIVITY DATA A LITTLE MORE MIXED

- MORE CHINESE CITIES INTRODUCE COVID RESTRICTIONS, SHANGHAI SKETCHES OUT EXIT PLAN

- PBOC CUT RRR BY SMALLER THAN EXPECTED AMOUNT

- UKRAINE-RUSSIA CONFLICT CONTINUES, WITH NO SIGN OF AN END, EU EYES MORE SANCTIONS

- ECB SHOULD RAISE RATES BY 50BPS IN FALL, HOLZMANN SAYS (BBG)

- BOJ’S KURODA WARNS RECENT YEN MOVES ‘QUITE SHARP,’ MAY HURT BUSINESSES (CNBC)

US TSYS: Cheaper In Asia

TYM2 has nudged higher in recent trade, to last deal 0-12+ at 119-17+, 0-06 off the base of its 0-15 Asia range, on respectable volume of ~115K (given holidays in the likes of Hong Kong, Australia, London & Europe). Cash Tsys are 2.0-3.5bp cheaper across the curve, with 3s leading the way lower and the long end lagging the wider move at the margin.

- Tsys softened in early Asia-Pac dealing. with participants seemingly clinging to the uptick in crude oil (which has moderated from extremes), with that move, at least in part, facilitated by the Chinese city of Shanghai sketching out its re-opening plan.

- Meanwhile, growth negative factors e.g. a smaller than expected RRR cut from the PBoC, the ongoing Russia-Ukraine conflict and wider spread localised lockdowns in China had little impact.

- Chinese economic data was mixed, with firmer than expected Q1 GDP & Mar industrial production at least partially offset by a larger expected fall in retail sales and unexpected uptick in the unemployment rate.

- TYM2 drifted to fresh session lows in the wake of the data release, although the move was by no means immediate, before the aforementioned uptick in recent dealing.

- The latest NAHB housing data print and Fedspeak from Bullard (’22 voter) headline during NY hours.

JGBS: Curve Steepens, Futures In Narrow Range

The cheapening impetus from U.S. Tsys was felt in the JGB space, with benchmark JGBs running little changed to ~2bp cheaper as we move towards the Tokyo close.

- 5s lagged the wider sell off, while the super-long end of the curve led the way lower. JGB futures are 8 ticks softer on the day, off worst levels of the session, hugging a narrow range.

- Most of the local focus has fallen on the latest raft of policy maker communique re: FX matters. On that front, Japanese Finance Minister Suzuki reiterated the need for vigilance when it comes to monitoring FX rates, presenting some indecision when it came to the net impact of the recent JPY weakness.

- Elsewhere, there was a more guarded tone from BoJ Governor Kuroda re: JPY weakness, with a particular focus on the speed of moves and impact that such moves can have on different sectors of the economy (although he did ultimately reaffirm the overall net positive impact of a weaker JPY on the Japanese economy, noting that it is still “basically positive overall”)

EQUITIES: Mixed In Asia; Chinese GDP Provides Little Relief

Major Asia-Pac equity indices are mixed at writing, with Japanese and Chinese equities broadly underperforming.

- The Nikkei 225 brings up the rear amongst its major regional peers, rising from session lows to sit 1.4% weaker at typing. ~200 of the index’s 225 constituents are in the red, with large-cap names such as Nintendo Co and Fast Retailing Co leading losses. The financials sub-index bucked the broader trend of losses amongst peers, trading 0.8% higher largely on outperformance in Credit Saisson Co.

- The CSI300 deals 0.9% softer at typing, rising from session lows on the mixed Chinese Q1 GDP release (that saw faster GDP growth, but weaker retail sales and the highest jobless rate since May ‘20). Consumer staples and financials equities struggled, while stocks in semiconductor, automobile, and medical equipment production were notably bid, benefiting from the Chinese authorities announcing on Friday that 666 companies in those sectors would be allowed to resume production in Shanghai. The tech-heavy STAR50 has correspondingly caught a bid, trading 2.7% higher at writing.

- U.S. e-mini equity index futures sit 0.2% to 0.9% worse off at typing, with relatively high-beta NASDAQ contracts leading losses.

OIL: Light Bid On Libyan Disruption; EU Oil Sanctions In The Works

WTI is +$0.90 and Brent is +$1.10 at writing, back from best levels and on track to extend a three-session streak of gains. Both benchmarks have caught a light bid as focus turns to the European Commission’s preparations to include oil in the EU’s incoming sixth round of sanctions on Russia, with European Commission head von der Leyen touting “clever mechanisms” to include Russian oil in the package, adding to well-documented worry over shortfalls in global crude supplies.

- A note that both the IEA and OPEC revised their crude demand forecasts for ‘22 downwards last week, pointing to overall lower-than-expected consumption from OECD countries, and an ongoing COVID outbreak in China.

- To elaborate, the Chinese authorities continue to expand pandemic control measures, with more areas/cities being placed under some form of movement restrictions, most notably a partial lockdown on the city of Xian (pop. 13mn) on Friday.

- Elsewhere, some Libyan oil production and export operations were suspended after protestors forced their way into the Al-Fil oil field and two ports on Sunday, resulting in disruptions at all three locations. Production at the Al-Fil oil field is estimated at around 70K bpd, while a RTRS source report pointed to a tanker being blocked from loading ~1mn bbls at the port of Zueitina.

GOLD: Higher On Stagflation Worry

Gold is ~$5/oz better off at $1,983/oz, back from fresh five-week highs made earlier in the session. The overall move higher comes as major crude benchmarks have extended a three-day streak of gains in Asia-Pac dealing, fuelling worry from some quarters re: stagflation despite a broad uptick in nominal U.S. Tsy yields and the USD (DXY).

- To recap, the precious metal closed ~$5/oz firmer in the previous week on the highest headline U.S. CPI print since 1981, although the lower-than-expected M/M increase in Mar core CPI likely helped cap gains as some have regarded it as a possible sign of inflationary pressures peaking.

- Elsewhere, hope surrounding a diplomatic resolution to the Russia-Ukraine conflict has likely evaporated, with Ukrainian leaders stating over the weekend that peace talks would end if Russian forces eliminate the remaining defenders of the city of Mariupol.

- Debate over a “de facto” EU ban on Russian gas has also done the rounds in Asia (re: the EU’s inability to pay in rubles due to sanctions), raising worry over the potential for elevated energy prices.

- Looking ahead, focus will turn to the Fed’s Bullard as he speaks on the U.S. economy and monetary policy later in the U.S. session (2000 GMT).

- From a technical perspective, the short-term outlook is bullish, following the recent move above $1,966.1/oz (Mar 24 high). Resistance is situated at $2,001.6/oz (61.8% retracement of Mar8-29 downleg), while immediate support is seen at around ~$1,942.6/oz, near the 20-Day EMA.

FOREX: USD Benefits From Higher Tsy Yields

An uptick in U.S. Tsy yields has allowed the broader DXY to firm in G10 FX trade.

- The greenback is outperforming all of its G10 FX counterparts, with the Aussie & kiwi finding themselves at the bottom of the G10 FX table as questions re: the health of the Chinese economy continue to circle, weighing on the China-sensitive Antipodean currencies.

- On that front, Q1 Chinese GDP data topped exp., although monthly economic activity data for March was a little more mixed, with retail sales falling by a larger than expected clip (more worry is evident on that front owing to widening localised COVID lockdowns), unemployment unexpectedly ticking higher and industrial production beating expectations. NZD/USD moved to the lowest levels observed since late Feb, while AUD/USD softened to levels not seen since 17 March.

- USD/CNH stuck to a very narrow ~100 pip range, failing to really react to the data, news that Shanghai has started to sketch out the path away from mobility restrictions and after the PBoC delivered a smaller than expected RRR cut on Friday.

- Higher crude prices and Tsy yields saw USD/JPY print a fresh cycle high of Y126.79 before the combination of Tokyo fix-related flows, Japanese Finance Minister Suzuki reiterating the need for vigilance when it comes to monitoring the FX rate/presenting some indecision when it came to the net impact of the recent JPY weakness and a more guarded tone from BoJ Governor Kuroda re: JPY weakness, with a particular focus on the speed of moves and impact that such moves can have on different sectors of the economy (although he did ultimately reaffirm the overall net positive impact of a weaker JPY on the Japanese economy, noting that it is still “basically positive overall”), combining to push USD/JPY to session lows of Y126.25, before the cross rebounded to last deal around Y126.65.

- NAHB Housing data out of the U.S. & Fedspeak from St. Louis Fed President Bullard (’22 voter) headline the docket on Monday. A reminder that holidays in London, Europe, Australia & Hong Kong will thin out wider liquidity.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/04/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 18/04/2022 | 2000/1600 |  | US | St. Louis Fed's James Bullard | |

| 18/04/2022 | 2230/1830 |  | US | New York Fed's Lorie Logan | |

| 19/04/2022 | 0430/1330 | ** |  | JP | Industrial production |

| 19/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 19/04/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/04/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 19/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 19/04/2022 | 1605/1205 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.