-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Friday, December 13

MNI US OPEN - UK Economy Contracts for Second Straight Month

MNI EUROPEAN OPEN: Bullard Beats Hawkish Drum, Yen Remains In Free Fall

EXECUTIVE SUMMARY

- FED’S BULLARD: 75BP HIKE COULD BE OPTION IF NEEDED (BBG)

- YELLEN TO ATTEND G-20 SESSIONS AS U.S. RETREATS ON BOYCOTT IDEA (BBG)

- SUZUKI: OFFICIALS MONITORING FX MOVES WITH STRONG SENSE OF VIGILANCE

- ZELENSKY: THE BATTLE OF DONBAS HAS BEGUN (Pravda)

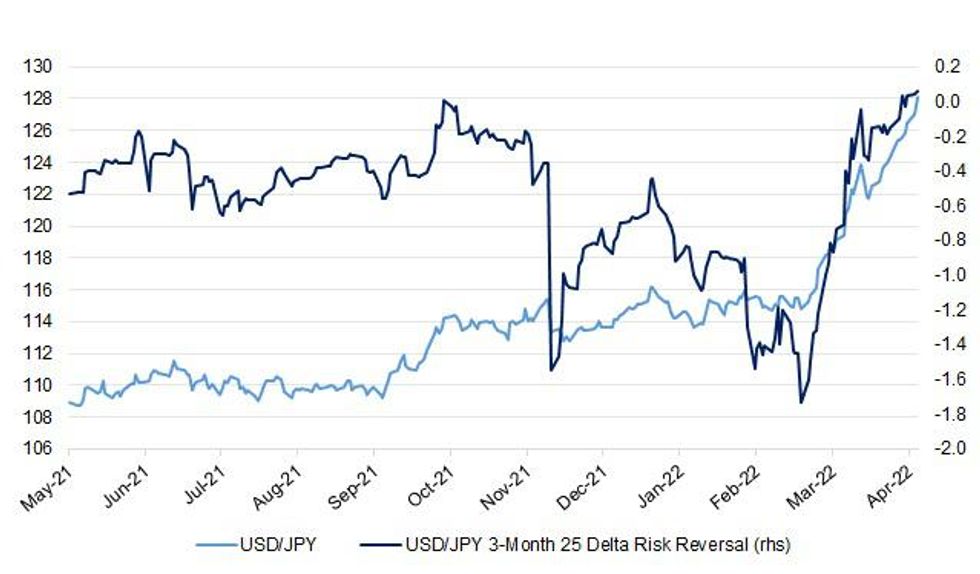

Fig. 1: USD/JPY vs. USD/JPY 3-Month 25 Delta Risk Reversal

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Tory MPs are considering the aftermath of dire local election results as their next chance to oust Boris Johnson, with the prime minister preparing to apologise for his Partygate penalty. However, Downing Street is feeling bullish that Johnson has “crossed the Rubicon” after receiving his first fixed-penalty notice earlier this month, and will cling on in the face of further charges. Johnson will face a challenging day on Tuesday, forced to deny misleading the Commons over his knowledge of illegal gatherings in No 10 by clarifying his previous insistence that no Covid rules were broken. (The Guardian)

POLITICS: Boris Johnson is preparing to set out his "version of events" on partygate as he faces MPs this week for the first time since being fined as a result of a police investigation. Mr Johnson is expected to update the House of Commons on the affair as parliament resumes following the Easter break - after new claims about the PM's involvement in alleged lockdown breaking emerged. He has already been fined for attending a gathering to celebrate his birthday in June 2020 and over the weekend it was claimed that he instigated a leaving drinks event the following November. Some Tory MPs have already publicly joined with calls from opposition politicians for Mr Johnson to quit - and Sky News is aware of at least one other who is ready potentially to put in a letter of no-confidence to add to those already sent. Mr Johnson has said he that he "would set the record straight" over the matter this week. (Sky News)

POLITICS: Boris Johnson is widely regarded as a liar by British voters, a new survey of public opinion has found. A poll by JLPartners found that just 16 per cent of people would use positive language to describe the prime minister with more than 70 per cent characterising him in negative terms. (The Independent)

SECURITY: Boris Johnson has been told his Downing Street office has been targeted with “multiple” suspected infections using Pegasus, the sophisticated hacking software that can turn a phone into a remote listening device, it was claimed on Monday. A report released by Citizen Lab at the University of Toronto said the United Arab Emirates was suspected of orchestrating spyware attacks on No 10 in 2020 and 2021. The researchers, considered among the world’s leading experts in detecting digital attacks, announced they had taken the rare step of notifying Whitehall of the attack as it “believes that our actions can reduce harm”. However, they were not able to identify the specific individuals within No 10 and the Foreign Office who are suspected of having been hacked. (The Guardian)

ECONOMY: Record numbers of U.K. business leaders expect operating costs to soar this year as inflation proves more sticky than thought, according to a survey by Deloitte. The accounting firm’s latest quarterly survey of chief finance officers at leading British companies found that 98% believe operating costs will rise in the year ahead, a level not seen since the question was first asked in 2011. Almost half of those, 46%, said the increase will be “significant.” More than three quarters of finance leaders, 78%, also expect inflation will still be well above the Bank of England’s target at 2.5% in two years’ time. (BBG)

EUROPE

FRANCE: Emmanuel Macron regained some momentum over far-right presidential candidate Marine Le Pen, as France enters the final week of a closely-watched election. Two polls released Monday showed Macron’s lead over Le Pen growing slightly. He would beat the nationalist leader 56%-44% in Sunday’s runoff, according to a poll conducted by Ipsos-Sopra Steria for France Info and Le Parisien, compared with 55.5%-44.5% two days earlier. A separate survey by Ifop-Fiducial for LCI, Paris Match and Sud Radio placed Macron ahead in the runoff, with 54.5% to 45.5% of voting intentions, up from 53.5%-46.5% three days earlier. (BBG)

FRANCE: A planned hijab ban if French presidential candidate Marine Le Pen is elected would come "little by little" and be determined by lawmakers, her allies said on Monday, marking a shift in tone less than a week ahead of the final presidential vote. (RTRS)

UKRAINE: Ukraine said Russia had started an anticipated new offensive in the east of the country, with explosions reported all along the front lines as well as attacks in other regions. Ukrainian President Volodymyr Zelenskiy said Russia had begun the "Battle of Donbas" in the east on Monday and a "very large part of the entire Russian army is now focused on this offensive." "No matter how many Russian troops they send there, we will fight. We will defend ourselves," he vowed in a video address. Zelenskiy's chief of staff Andriy Yermak called it "the second phase of the war" and assured Ukrainians that their forces could hold off the offensive. "Believe in our army, it is very strong," he said. (RTRS)

UKRAINE: President Volodymyr Zelensky has said that Russian generals have killed too many of their soldiers, so they are being more careful during the new offensive. "No matter how many Russian soldiers are expelled there, we will fight. We will defend ourselves. We will do it every day. We will not give anything Ukrainian, and we do not need someone else's. (Pravda)

UKRAINE: Russia's invasion has damaged or destroyed up to 30% of Ukraine's infrastructure at a cost of $100 billion, a Ukrainian minister said on Monday, adding reconstruction could be achieved in two years using frozen Russian assets to help finance it. Ukraine has not previously outlined the specific impact on infrastructure, such as roads and bridges, although officials say the total bill for damage to everything from transport to homes and other buildings runs to about $500 billion so far. (RTRS)

UKRAINE: The port city of Mariupol in eastern Ukraine was still contested as Russian appeared to have sent reinforcements into Ukraine in recent days, a senior U.S. defense official said on Monday. (RTRS)

UKRAINE: In the Black Sea, Russian missile and landing craft retreated almost 200 kilometers from shore. This was reported by the operational command "South". (Kyiv Independent)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said the central bank needs to move quickly to raise interest rates to around 3.5% this year with multiple half-point hikes and that it shouldn’t rule out rate increases of 75 basis points. “More than 50 basis points is not my base case at this point,” Bullard said in a virtual presentation to the Council on Foreign Relations on Monday adding the Fed under Alan Greenspan did such a hike in 1994 leading to a decade-long expansion. “I wouldn’t rule it out, but it is not my base case here.” Bullard repeated he favors an interest rate of about 3.5%, citing a version of the Taylor rule, a guideline developed by Stanford University’s John Taylor that uses inflation, the unemployment rate and an estimate of the neutral interest rate -- a rate neither contractionary nor expansionary -- to come up with his estimate. (BBG)

CORONAVIRUS: The Biden administration will no longer enforce a U.S. mask mandate on public transportation, after a federal judge in Florida on Monday ruled that the 14-month-old directive was unlawful, overturning a key White House effort to reduce the spread of COVID-19. The ruling by U.S. District Judge Kathryn Kimball Mizelle, an appointee of President Donald Trump, came in a lawsuit filed last year in Tampa, Florida, by a group called the Health Freedom Defense Fund. Judge Mizelle said the U.S. Centers for Disease Control and Prevention (CDC) had exceeded its authority with the mandate, had not sought public comment and did not adequately explain its decisions. (RTRS)

CORONAVIRUS: The U.S. Centers for Disease Control and Prevention (CDC) said on Monday it had dropped its "Do Not Travel" COVID-19 recommendations for about 90 international destinations. Last week, the CDC said it was revising its travel recommendations and said it would its reserve Level 4 travel health notices "for special circumstances, such as rapidly escalating case trajectory or extremely high case counts." (RTRS)

POLITICS: Joe Biden is about to start raising money on the road for the first time in his presidency, headlining fundraisers on Thursday in Portland, Ore., and Seattle for the Democratic National Committee, sources tell Axios. (Axios)

OTHER

G20: The U.S. backed further away from any suggestion that its officials would boycott Group of 20 meetings if their Russian counterparts attend, as the Treasury Department said Secretary Janet Yellen will participate in some sessions this week. Yellen will avoid some meetings of the G-20’s finance ministers in Washington, but will attend others focused on the economic fallout from Russia’s invasion of Ukraine. That includes the opening session, which will be attended by Ukraine’s finance minister, a senior Treasury official said. Speaking on a call with reporters Monday, the official said Yellen doesn’t want Russia’s participation to stop work the U.S. and its allies must do in the context of the G-20 meetings. Another official familiar with plans for the meetings said Yellen would not take part in sessions dedicated to international financial architecture and sustainable finance, meetings she would otherwise have attended. (BBG)

WORLD BANK: World Bank Chief Economist Carmen Reinhart said the global economy is passing through a period of “exceptional uncertainty” and added that she wouldn’t rule out further downgrades to the growth outlook. The Washington-based institution has lowered its estimate for global growth in 2022 to 3.2% from a January prediction of 4.1%, spurred by a cut in the outlook for Europe and central Asia that includes Russia and Ukraine. The new forecast compares with a 5.7% expansion in 2021. (BBG)

GLOBAL ECONOMY: U.S. Treasury Secretary Janet Yellen will convene a high-level panel on Tuesday to discuss the global response to an ongoing food security crisis exacerbated by Russia's war against Ukraine, the Treasury Department said in a statement. The meeting will include the heads of the International Monetary Fund, the World Bank and the International Fund for Agricultural Development, as well as ministers representing the G7 and G20 countries and technical experts from international financial institutions, it said on Monday. Treasury officials aim to ensure that international financial institutions are sharing knowledge about the key drivers of rising food insecurity, including Russia's invasion of Ukraine, and push them to step up the scale and urgency of their response, a senior Treasury official said. (RTRS)

U.S./CHINA/RUSSIA: China’s ambassador to the United States defended Beijing’s close ties with Moscow on Monday, adding that US-China-Russia relations were not a zero-sum game. Ambassador Qin Gang’s comments come as China is under growing pressure from the West to exert pressure on Russian leader Vladimir Putin over the war on Ukraine. “If the China-US relationship is messed up, that doesn’t augur well for Russia-US relations or the world,” Qin said in an opinion piece in The National Interest, a conservative international relations magazine based in Washington. “A worse Russia-US relationship doesn’t mean a better China-US relationship,” he added. “Likewise, a worse China-Russia relationship doesn’t mean a better US-Russia relationship.” (SCMP)

U.S./CHINA/AUSTRALIA: White House Indo-Pacific coordinator Kurt Campbell and the State Department's top official for Asia will travel this week to the Solomon Islands, the White House said on Monday, amid concerns that the Pacific Island country is making a security pact with China. Campbell and Assistant Secretary of State for East Asian and Pacific Affairs Daniel Kritenbrink will lead a delegation that includes Department of Defense and U.S. Agency for International Development officials to three countries: the Solomon Islands, Fiji and Papua New Guinea, the White House National Security Council said in a statement. The team will also stop in Hawaii to "consult with senior military officials and regional partners at United States Indo-Pacific Command," it said, without giving dates for the trip. (RTRS)

JAPAN: Japan’s Finance Minister Shunichi Suzuki went a step further in his language surrounding the yen, saying that the Japanese currency has been weakening rapidly, after it breached 127 against the U.S. dollar Tuesday. “There are positive aspects to it, but given the current economic climate, strong negative aspects exist,” said Suzuki, referring to the rise in import costs, and damage to firms that can’t pass on increasing costs as a result of the weaker currency. “We are monitoring moves in the foreign exchange market with a strong sense of vigilance.” Suzuki also reiterated that stability in the foreign exchange market is important, and that sudden moves aren’t desirable. (BBG)

RBNZ: The Reserve Bank of New Zealand has adopted an aggressive approach toward monetary tightening and expects to keep raising rates in coming quarters as it seeks to contain inflation expectations, Governor Adrian Orr said. “We’ve been acting reasonably aggressively to tighten monetary conditions,” Orr said in an International Monetary Fund Governor Talks interview published Monday in Wellington. “We’ve provided strong forward guidance that we expect to be doing more rate rises over coming quarters.” (BBG)

SOUTH KOREA: South Korea's central bank governor nominee Rhee Chang-yong said on Tuesday the bank will continue to tighten monetary policy, while ensuring the recovery momentum is not hurt as downside risks to growth is increasing. In a speech prepared for a parliamentary hearing, Rhee said both inflation and growth risks must be closely examined for future monetary policy settings, citing increased uncertainties around the Ukraine crisis, U.S. monetary policy, and COVID-19 resurgence in China. (RTRS)

NORTH KOREA: North Korea is expected to launch additional tactical guided weapons (short-range ballistic missiles) that it test-fired into the East Sea from the Hamhung area of South Hamgyong Province on April 16. South Korean military sees the possibility of further provocations within a few days at the earliest, or later this month. (DongA Ilbo)

MEXICO: Mexico's president on Monday excoriated opposition lawmakers for voting down a major electricity reform, though business groups were cheered by Sunday's vote, which lifted some of the investor uncertainty clouding the country's energy market. President Andres Manuel Lopez Obrador decried the defeat of his bid to change the constitution to tighten state control of the power market as "treason," though it could lower the risk of Mexico becoming embroiled in costly trade disputes. (RTRS)

MEXICO: Mexico’s lower house approved a mining bill Monday afternoon to confirm state control over lithium extraction. Fast-tracked by the ruling coalition of President Andres Manuel Lopez Obrador’s Morena party, the bill passed in general terms with 298 votes in favor and 197 abstentions. Lawmakers continued debating some articles of the bill after the vote. Lopez Obrador presented the initiative to secure lithium production after his bid to change the constitution to give the state utility control of the electricity market failed on Sunday night. (BBG)

RUSSIA: While Vladimir Putin boasts that Russia is holding up under Western sanctions, his central bank chief and the mayor of Moscow warned that the worst was yet to come. Russia’s central bank chief warned on Monday that the consequences of Western sanctions were only beginning to be felt, and Moscow’s mayor said that 200,000 jobs were at risk in the Russian capital alone, stark acknowledgments that undermined President Vladimir V. Putin’s contention that sanctions had failed to destabilize the Russian economy. The bleak assessments from two senior officials align with the forecast of many experts that Russia faces a steep economic downturn as its inventory of imported goods and parts runs low. How Russians react to the financial hardships resulting from Mr. Putin’s invasion of Ukraine will determine in part whether anything can weaken the Russian leader’s grip on power or sap support for the war. (NYT)

RUSSIA: Since April 18, banks have resumed selling cash to citizens for rubles, but you can only sell the currency that arrived at the cash desks after April 9. All banks maintain the temporary restriction of the Central Bank: you can withdraw from your account no more than $10,000 or the equivalent of this amount in euros. At the same time, you can withdraw only the currency that was credited to the account before March 9. If since then the client has already withdrawn the amount from the account within this limit, it will not be possible to withdraw money again. (Vedomosti)

RUSSIA/U.S.: The United States will use instruments of economic and financial pressure, primarily against the Russian military-industrial complex, to destroy any opportunity for Russia to regain its potential during the war in Ukraine. This was stated on Monday during a speech at the Peterson Institute of International Economics by US Deputy Secretary of the Treasury Wally Adeem, Ukrinform reports. (Ukrinform)

RUSSIA/FRANCE: French President Emmanuel Macron told Frace 5 TV channel that he will discuss fresh sanctions against Russia in a series of phone calls with U.S. President Biden and other European leaders on Tuesday. Macron backed a full embargo on Russian coal and oil, while noting that some European countries heavily depend on Russian gas imports. He said that France is not one of those countries, but stressed that the "European market is interconnected." The President refused to draw any clear red lines for Russia, arguing that this would effectively make France party to the conflict. Macron said that his dialogue with Putin has stopped after the discovery of Russian war crimes in Bucha and other Ukrainian towns but he refused to rule out renewed talks in future. (MNI)

RUSSIA/BRAZIL: Despite concern that sanctions against Russia would cause a shortfall of fertilizer in Brazil, preliminary shipping data shows orders being fulfilled and vessels heading for Brazil, potentially allowing a normal grain planting season. At least 24 vessels carrying almost 678,000 tonnes of Russian fertilizers from ports in the country are expected to reach Brazil in the next weeks, according to preliminary shipping data compiled by Agrinvest Commodities and seen by Reuters on Monday. (RTRS)

MIDDLE EAST: A number of U.S. officials engaged in phone calls with Israelis, Palestinians and Arab representatives in the region over the weekend to see to it that tensions in Jerusalem do not escalate, State Department spokesperson Ned Price told reporters on Monday. (RTRS)

METALS: MMG Ltd said on Monday its Las Bambas copper mine in Peru will suspend operations from April 20 after residents of a community nearby entered the property as part of a protest. Las Bambas accounts for 2% of the global copper supply and is a subject of recurring disruptions from impoverished local communities demanding higher financial contributions from the mine. Earlier this year, the mine were forced to slow down operations due to a road blockade. (RTRS)

OIL: Shale explorers in the Permian Basin chewed further into their supply of ready-made wells for a 20th straight month, leaving the smallest inventory of low-cost wells in the biggest U.S. oil field in more than half a decade. The lowest number of DUCs in West Texas and southeast New Mexico since February 2017 could eventually lead to a lag on new oil output hitting the market as producers must now call on more drilling rig crews to start the new-well process. (BBG)

OIL: A cargo of crude from the U.S. Strategic Petroleum Reserve departed a Texas port bound for Europe, a signal of increasing oil-market disarray as refiners shun Russian supplies and prices surge. A tanker known as the Advantage Spring loaded low-sulfur crude originally pumped from the strategic reserve caverns in Southwest Louisiana at a port in Nederland, Texas earlier this month, according to a person familiar with the matter. The ship, chartered by French energy giant TotalEnergies SE, is bound for the key European port of Rotterdam, according to ship-tracking data compiled by Bloomberg. (BBG)

CHINA

PBOC: The People’s Bank of China will step up financial support for industries and companies affected by the Covid-19 outbreaks, guide banks to expand lending and share more profits with the real economy, according to a statement on its website. The central bank will provide incentive funding that is as much as 1% of the incremental balance of inclusive SME loans, and timely increase the quota of relending to agriculture and small businesses, the statement said. Banks should purchase local government bonds to support infrastructure investment, it said. (MNI)

PBOC: China is likely to keep April's benchmark Loan Prime Rate unchanged on Wednesday as a 25 bp RRR cut announced last Friday won't be enough to drive down banks' own lending rates, the 21st Century Business Herald said. Banks would need at least two RRR cuts and other measures to improve their liabilities before deciding to lower their LPR quotations. (MNI)

ECONOMY: China's housing market may rebound in the second half of the year, as bigger cities further relax their housing policies and as the impact of the epidemic weakens, the China Securities Journal reported citing analysts. The central bank on Monday also urged local lenders to reasonably determine the minimum down payment ratio and loan interest rate, as well as support the financing needs of developers and construction companies to promote a more stable real estate market, the newspaper said. Home sales in China by area fell 13.8% y/y in the first quarter. (MNI)

ECONOMY: China sees multiple risks to the economy as Covid outbreaks worsen, yet pledged to still meet its ambitious growth target and stabilize jobs. The economy is facing “greater downward pressure, and difficulties and challenges have increased significantly,” the state-run Xinhua News Agency wrote in a set of questions and answers late Monday, citing unnamed “authoritative departments and persons.” Authorities are “firmly confident” and will strive to achieve the full-year targets as the economy still has “many strategic advantages,” it said in the report, which was also published on the front page of Communist Party’s flagship newspaper People’s Daily. (BBG)

CORONAVIRUS: Tangshan, a steelmaking hub about 100 miles from Beijing, has re-enforced Covid-19 lockdowns in some districts just over a week after lifting city-wide curbs. The city locked down five districts from 6 a.m. Tuesday and will conduct mass-testing, the local government said, after reporting 29 cases coronavirus cases on Monday. Tangshan hosts about 13% of China’s steel output, and some production was halted during a 20-day lockdown that ended on April 11. The partial reversal will raise fresh concerns about steel output, and underscores China’s difficulties in stamping out omicron’s spread. (BBG)

EQUITIES: Ant Group, the fintech unit of China's Alibaba Group, is set to become the majority investor in Singapore-based payments platform 2C2P as part of a partnership, the companies on Monday. The deal will lead to the integration of Ant's Alipay+ payment service with 2C2P's platform used by merchants in Asia, Europe, the Middle East and the Americas. (RTRS)

OVERNIGHT DATA

JAPAN FEB, F INDUSTRIAL PRODUCTION +0.5% Y/Y; FLASH +0.2%

JAPAN FEB, F INDUSTRIAL PRODUCTION +2.0% M/M; FLASH +0.1%

JAPAN FEB CAPACITY UTILISATION +1.5% M/M; JAN -3.2%

NEW ZEALAND MAR PERFORMANCE SERVICES INDEX 51.6; FEB 48.9

CHINA MARKETS

PBOC NET DRAINS CNY10 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0333% at 09:31 am local time from the close of 1.7921% on Monday.

- The CFETS-NEX money-market sentiment index closed at 43 on Monday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.3720 TUES VS 6.3763

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.3720 on Tuesday, compared with 6.3763 set on Monday.

MARKETS

SNAPSHOT: Bullard Beats Hawkish Drum, Yen Remains In Free Fall

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 188 points at 26987.71

- ASX 200 up 47.171 points at 7570.6

- Shanghai Comp. up 3.773 points at 3199.297

- JGB 10-Yr future up 5 ticks at 149.39, yield up 0.1bp at 0.246%

- Aussie 10-Yr future down 3 ticks at 96.885, yield up 9.8bp at 3.068%

- U.S. 10-Yr future +0-04+ at 119-25, yield down 1.35bp at 2.839%

- WTI crude up $0.01 at $108.22, Gold down $4.28 at $1974.63

- USD/JPY up 116 pips at Y128.15

- FED’S BULLARD: 75BP HIKE COULD BE OPTION IF NEEDED (BBG)

- YELLEN TO ATTEND G-20 SESSIONS AS U.S. RETREATS ON BOYCOTT IDEA (BBG)

- SUZUKI: OFFICIALS MONITORING FX MOVES WITH STRONG SENSE OF VIGILANCE

- ZELENSKY: THE BATTLE OF DONBAS HAS BEGUN (Pravda)

BOND SUMMARY: Core FI Regain Poise, ACGBs Pare Opening Post-Holiday Losses

Core bond markets found poise despite Fed hawk Bullard noting that he sees a 75bp rate hike as an option (although not his "base case"). Growing hawkish appetites among Fed members contrasted with the PBOC's intention to play a supportive role as China battles the outbreak of Covid-19.

- T-Notes edged higher and last change hands +0-05+ at 119-26, near session highs. Eurodollar futures run up to 3.0 ticks higher through the reds. Cash Tsy yields sit 1.1bp to 2.2bp lower at typing, the curve steepened a tad. The local data docket is limited to housing starts/building permits, with remarks from Chicago Fed Pres Evans also coming up. Worth noting that his colleague Bullard signalled that he sees a 75bp rate hike as an option.

- Aussie bond futures advanced, shrugging off hawkish rhetoric from Antipodean central bankers. YM last deals -2.5 & XM -2.5. Bills trade +2 to - 3 ticks through the reds. Cash ACGB curve bear steepened as trading restarted in Sydney after Easter holidays, but yields then pulled back from best levels. They last sit 6.5-8.7bp higher, off initial highs. The minutes from the RBA's April monetary policy meeting said that economic data warrants a quicker anticipated start to the rate-hike cycle.

- JGB futures climbed after a slightly softer re-open, extending gains after the lunch break. JBM2 trades at 149.42 at typing, 8 ticks above last settlement. Cash JGB yield curve flattened a tad, with 30s leading gains. Japan held a liquidity enhancement auction for off-the-run JGBs with 5-15.5 years until maturity.

JGBS AUCTION: Japanese MOF sells Y2.8372tn 1-Year Bills:

The Japanese Ministry of Finance (MOF) sells Y2.8372tn 1-Year Bills:

- Average Yield -0.0789% (prev. -0.0602%)

- Average Price 100.079 (prev. 100.060)

- High Yield: -0.0659% (prev. -0.0552%)

- Low Price 100.066 (prev. 100.055)

- % Allotted At High Yield: 1.5135% (prev. 20.9719%)

- Bid/Cover: 3.081x (prev. 3.380x)

JGBS AUCTION: Japanese MOF sells Y498.5bn of 5-15.5 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y498.5bn of 5-15.5 Year JGBs in a liquidity enhancement auction:

- Average Spread: -0.009% (prev. +0.014%)

- High Spread: -0.008% (prev. +0.015%)

- % Allotted At High Spread: 58.4130% (prev. 78.1838%)

- Bid/Cover: 4.651x (prev. 3.870x)

EQUITIES: Mixed As Chinese Regulatory Worry Takes Centre Stage

Major Asia-Pac equity indices are mixed at writing, following a mildly negative lead from Wall St. The dynamic of industry-specific crackdowns by the Chinese authorities continues to be assessed against the ongoing drumbeat of positive messaging pledging support for the Chinese economy being made in recent days, ultimately seeing Chinese and Hong Kong-based stocks underperform their regional peers.

- The Nikkei 225 is 0.6% better off at typing, backing away from session highs as losses in large-caps Softbank Group and Fast Retailing dragged the index lower, reflecting broader weakness in retail-related names. On the other hand, Tokyo Electron Ltd and Nintendo Co contributed the most to gains, adding to outperformance in energy and materials equities.

- The Hang Seng leads losses after returning from the Easter Monday holiday, rising off one-month lows made earlier in the session to trade 1.9% weaker at typing. China-based tech struggled as investors continue to balance concerns re: regulatory crackdowns against announcements of supportive measures from the Chinese authorities, seeing the Hang Seng Tech Index sit 2.8% softer. A sell-off in financials-related stocks was also observed, with China Merchants Bank Co (-11.5%) bearing the brunt of the selling after its top exec was removed by the board without a reason being given.

- A note that optimism earlier in the month re: the Chinese internet gaming sector (specifically the approval of 45 video games after a nine-month moratorium) has been largely unwound, following a ban on live streaming of “unauthorised” video games announced last Friday, adding to the sector-specific gloom after gaming giant Tencent Holdings’ move to shut down access to unapproved foreign video games on Thursday as well.

- Looking ahead, focus will likely turn to the PBoC’s LPR decision on Wednesday.

- U.S. e-mini equity index futures are 0.3% to 0.6% better off at typing, led by gains in NASDAQ contracts.

OIL: A Little Higher As Libyan Disruption Assessed Against Restart Of Chinese Factories

WTI is ~+$0.20 and Brent is ~+$0.50 at typing, operating a little below three-week highs made on Monday.

- Previously flagged disruptions to Libyan crude facilities due to anti-govt protests have expanded, exacerbating worry re: tightness in global supply. BBG source reports are pointing to >500K bpd in crude output being taken offline for now, a little under half of Libya’s current output.

- Looking to China, authorities in Shanghai have begun a conditional re-opening of some factories in the city (specifically a “whitelist” of 666 companies across a few industries), although reports continue to point to the potential for supply chain disruptions and restricted market access for goods produced amidst continued lockdowns elsewhere.

- Keeping within the country, five of seven districts in China’s largest steel production hub of Tangshan re-entered lockdown conditions after 29 COVID cases were reported for Monday, with a mass testing regime due to be implemented. This comes after the previous lockdown was recently ended (lasted between Mar 22 to Apr 11), raising expectations for national crude steel output to remain under pressure for now.

- Elsewhere, the U.S. EIA’s crude drilling report crossed on Monday, highlighting continued growth in U.S. shale production, with the forecast for May predicting the largest monthly production increase since Mar ‘20. A note that the report also flagged that inventories of low-cost, ready-made wells (DUCs) are hitting multi-year lows, pointing to potential difficulties in increasing crude production in the future.

GOLD: Flat In Asia; May FOMC Eyed

Gold deals ~$1/oz softer, printing $1,977/oz at writing. The precious metal operates near the bottom of Monday’s range as the USD (DXY) has hit another fresh two-year high, keeping within a tight ~$4 band in fairly limited Asia-Pac dealing.

- To recap Monday’s price action, bullion surrendered gains after hitting fresh five-week highs at $1,998.4/oz, backing away from best levels as nominal U.S. 10-Year Tsy yields and the USD (DXY) pushed higher in the NY session, with the latter hitting two-year highs in the process. Gold ultimately closed a shade above neutral levels for the day, bucking support from a broad downtick in U.S. real yields.

- Up next, Chicago Fed President Evans (‘23 voter) is due to speak at 1605 GMT. Looking further out, focus will shift to Fed Chair Powell at an IMF event on Thursday (1700 GMT), in what will be his final public remarks before the pre-FOMC blackout period.

- A note that May FOMC dated OIS now price in a little under 50bp of tightening for that meeting, largely in line with previous comments from Powell expressing support for such a move.

- Looking to technical levels, the short-term outlook remains bullish. Resistance is situated at $1,998.4/oz (Apr 18 high) and $2,001.6/oz (61.8% retracement of Mar8-29 downleg), while immediate support is seen around ~$1,942.6/oz, near the 20-Day EMA.

FOREX: Yen Keeps Sliding Even As Warnings From Japanese Officials Grow Louder

Japanese authorities further ramped up their warnings on yen weakening, but to no avail. The currency tumbled, even as FinMin Suzuki said that officials were monitoring FX moves with a "strong sense of vigilance," as rapid depreciation has "strong negative aspects" given the current economic climate. His insistence that the exchange rate is decided by the market signalled apparent reluctance to intervene, possibly adding fuel to the selling pressure.

- Spot USD/JPY was in demand into the Tokyo fix and extended gains on the back of Suzuki's comments. The rate soared towards the Y128.00 mark, albeit this round figure remains intact when this is being typed. Implied USD/JPY volatilities surged across the curve, with 1-year tenor printing two-year highs.

- Monday's comments from Fed & BoJ policymakers served as a reminder of growing policy divergence, the main driver of USD/JPY rally over the recent weeks. BoJ Gov Kuroda reaffirmed his commitment to powerful easing, while Fed's Bullard said that a 75bp rate hike was an option.

- Bullard's remarks helped push the dollar index (DXY) to a fresh cycle high as expectations of aggressive tightening by the Fed continued to build. While St. Louis Fed Pres "wouldn't rule it out" that the FOMC could raise interest rates by 75bp, it was not "his base case."

- High-beta currencies were better bid on firmer crude oil prices & upticks in U.S. e-mini futures. Antipodean central bankers showed hawkish inclinations, as RBNZ Gov Orr reaffirmed his team's strong tightening bias, while RBA minutes said that faster inflation/wage growth "have brought forward the likely timing of the first increase in interest rates."

- U.S. housing starts/building permits take focus on the data front, while the central bank speaker slate features Riksbank's Floden & Fed's Evans.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/04/2022 | - |  | EU | ECB Lagarde & Panetta in IMF/World Bank Meetings | |

| 19/04/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 19/04/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 19/04/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 19/04/2022 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 19/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 19/04/2022 | 1605/1205 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.