-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Turning Off The Tap

EXECUTIVE SUMMARY

- LAEL BRAINARD WINS SENATE CONFIRMATION TO BE FED VICE CHAIR (BBG)

- RUSSIA TURNS OFF GAS TAPS TO POLAND AND BULGARIA

- WESTERN NATIONS SEEK WIDER AUTHORITY TO SEIZE RUSSIAN ASSETS

- CHINA’S XI CALLS FOR ALL-OUT EFFORTS TO BOOST INFRASTRUCTURE CONSTRUCTION (Xinhua)

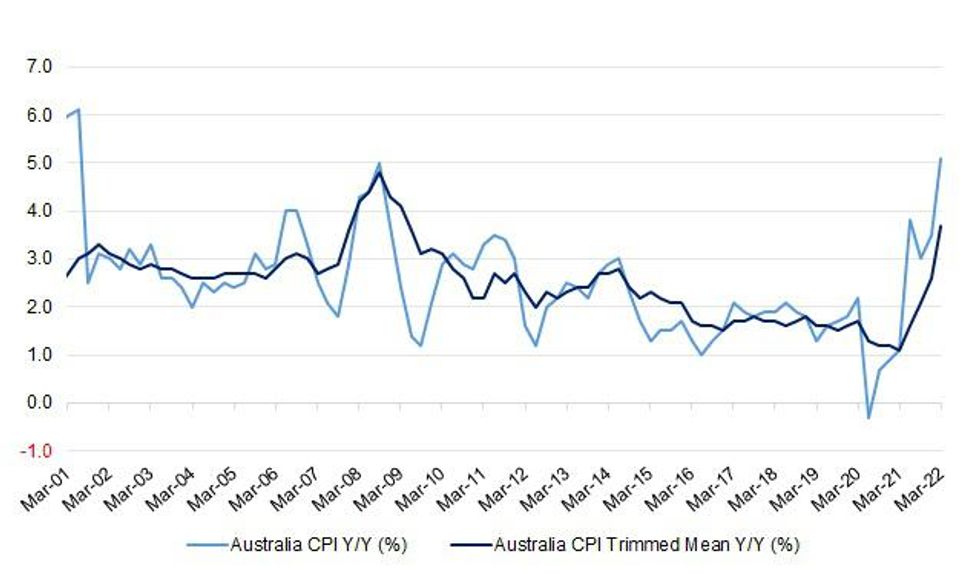

- AUSTRALIA’S INFLATION BEATS EXPECTATIONS

Fig. 1: Australia CPI vs. CPI Trimmed Mean

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: Brexit-related trade barriers have driven a 6% increase in U.K. food prices, adding to a squeeze on consumer spending power, according to a new report. Inflation for food products Britain tends to import from the European Union, like fresh pork, tomatoes and jam, was more pronounced than things like tuna and exotic fruits that come from other nations, according to the London School of Economics’ Centre for Economic Performance. (BBG)

ECONOMY: Cabinet tensions have broken out over a plan for Britain to unilaterally cut tariffs on food imports, after the price of groceries in the UK rose 5.9 per cent in the past year. Boris Johnson, prime minister, is backing a proposal to cut tariffs on foodstuffs such as rice and oranges, which are not produced in large quantities in Britain, to cut the cost of living. Anne-Marie Trevelyan, international trade secretary, is resisting the plan, arguing Britain would be throwing away its leverage in trade negotiations with third countries if it unilaterally cut tariffs. Jacob Rees-Mogg, Brexit opportunities minister, is pushing the idea of unilateral tariff reductions, arguing that Britain’s freedom to pursue its own trade policy is one of the gains from leaving the EU. However, his critics argue that the border friction that arose from Britain’s exit from the EU is a contributory factor to higher shop prices. (FT)

ECONOMY: British employers are starting to offer the biggest annual pay rises since 2008, but the increases are still not keeping up with fast-rising inflation, human resources data company XpertHR said on Wednesday. Provisional figures for April -- when almost half of British pay deals take effect -- showed a median annual pay award of 4%, up from 3% in the first three months of 2022. "We see a notable upturn in pay settlements for this month," XpertHR's pay and benefits editor, Sheila Attwood, said. (RTRS)

POLITICS: Labour chiefs have warned the party it is unlikely to be able to spin a compelling story of victory after next week’s local elections, calling Tory claims of 750 losses “ludicrous” and suggesting Labour may even lose “red wall” seats. Shadow cabinet ministers warned the party was on “thin ice” when it came to its poll lead. This week the shadow levelling up secretary, Lisa Nandy, warned the Labour leader, Keir Starmer, that the party needed to switch its focus from attacking the prime minister over Partygate, to talking about the cost of living crisis. (Guardian)

EUROPE

ITALY: Italy is considering temporary nationalisation of Lukoil-owned refinery ISAB as one of its options if sanctions are imposed on Russian oil, two government sources told Reuters. Industry Minister Giancarlo Giorgetti plans to raise the nationalisation of ISAB as an option when the Italian cabinet meets on Thursday, one of the sources said. Giorgetti's office said nationalization of the ISAB refinery was not currently on the agenda although there was "concern about the social implications for the area" and the situation was being examined by the ministry. (RTRS)

IRELAND: Francesca McDonagh has announced her surprise decision to step down as chief executive of Bank of Ireland, the country’s biggest lender, in what industry sources say is the latest high-profile casualty of a cap on top executives’ pay. (FT)

EASTERN EUROPE: Russia halted gas supplies to Poland under the Yamal contract on Wednesday, data from the European Union network of gas transmission operators showed, in a deepening of the rift between the West and Russia over its invasion of Ukraine. Bulgaria, like Poland a NATO and EU member, said earlier that Russia would also halt supplies of gas to it. There was no word early on Wednesday if Bulgaria's supplies were also cut. (RTRS)

POLAND: “We are ready for full independence from Russian resources. We are ready for a full cut-off,” said Minister of Climate and Environment Anna Moskwa. “Gaz-System is diversifying gas supplies to Poland. We are prepared for the scenario in which Russian gas supplies are cut off and it is being implemented. This is a scenario in which all customers will receive gas at the same level as it has been so far,” added Minister Piotr Naimski. (Onet)

POLAND: Gas supplies under the Yamal contract to Poland edged up after dropping to zero earlier, data from the European Union network of gas transmission operators showed on Wednesday. Physical gas flows via the Yamal-Europe pipeline from Belarus to Poland were at 3,449,688 kWh/hour at 0622 CET (0422 GMT). (RTRS)

BULGARIA: The Russian company Gazprom informed Bulgargaz about the termination of fuel supplies from April 27. On Tuesday, April 26, Nova TV channel reports with reference to the Ministry of Energy of Bulgaria. (Izvestia)

UKRAINE: The U.S. pressed its allies Tuesday to move “heaven and earth” to keep Kyiv well-supplied with weapons as Russian forces rained fire on eastern and southern Ukraine amid growing new fears the war could spill over the country’s borders. For the second day in a row, explosions rocked the separatist region of Trans-Dniester in neighboring Moldova, knocking out two powerful radio antennas close to the Ukrainian border. No one claimed responsibility for the attacks, but Ukraine all but blamed Russia. (AP)

UKRAINE: The United States and Ukraine are "largely aligned" on what military equipment Ukraine believes it needs to fight the Russian invasion and what Washington can provide, U.S. Secretary of State Antony Blinken said on Tuesday. (RTRS)

UKRAINE: Germany announced on Tuesday its first delivery of heavy weapons to Ukraine to help it fend off Russian attacks, after weeks of pressure at home and abroad to do so amid confusion over its stance. German Defence Minister Christine Lambrecht said the government, which is also racing to reduce its heavy reliance on imported Russian energy, had approved the delivery of Gepardtanks equipped with anti-aircraft guns from the stocks of company KMW on Monday. (RTRS)

UKRAINE: Seventy-three percent of Americans support U.S. efforts to supply Ukraine with weapons, the highest level of support since Russia invaded its neighbor in February, according to a Reuters/Ipsos poll completed on Tuesday. (RTRS)

UKRAINE: Russia sowed land mines and booby traps in areas of Ukraine as it withdrew from some areas, making it harder to resettle parts of the country until the deserted battle zones are painstakingly cleared, according to the head of a humanitarian organization. (BBG)

UKRAINE: Russian President Vladimir Putin agreed "in principle" to U.N. and International Committee for the Red Cross (ICRC) involvement in the evacuation of civilians from a besieged steel plant in Ukraine's southern city of Mariupol, the United Nations said on Tuesday. (RTRS)

UKRAINE: Norway will allocate 400 million crowns ($43.7 million) to a British-led initiative for buying weapons for Ukraine, the Norwegian prime minister said on Tuesday. Norway may also make additional direct shipments of weapons to Ukraine on top of those it has already made, Jonas Gahr Stoere told parliament. (RTRS)

U.S.

FED: Lael Brainard was confirmed as vice chair of the Federal Reserve Board of Governors Tuesday in a 52-43 Senate vote, but a combination of Covid-related absences and a political spat threatens to delay three other Fed nominees. Senate Majority Leader Chuck Schumer had planned to move next on the nomination of Lisa Cook to the board of governors. However, she is opposed by Republicans, and Democrats were unable to muster the 50 votes needed to move ahead on Cook after two senators and Vice President Kamala Harris -- who would provide a tie-breaking vote -- were absent after testing positive for the coronavirus. (BBG)

CORONAVIRUS: US vice-president Kamala Harris has tested positive for Covid-19, her office announced on Tuesday. Harris has not displayed any symptoms and will isolate and work from her vice-president’s residence in Washington DC, her office said, adding that she has also not been in close contact with Joe Biden or the first lady, Jill Biden. (The Guardian)

POLITICS: Bernie Sanders says Joe Biden’s the most pro-union president he’s ever seen, at least rhetorically speaking. Now he’s leaning on his 2020 primary rival to match those words with action. The Vermont senator sent Biden a Tuesday letter, obtained by POLITICO, asking the president to cut off federal contracts to Amazon until the massive company stops what he calls its “illegal anti-union activity.” As the Senate Budget Committee chair, Sanders will also hold a hearing next week dedicated to calculating how many federal contracts go to companies that are fighting back against unionization efforts, with a focus on Amazon. (POLITICO)

DEFENCE: U.S. weapons stockpiles could run out in several months if the Biden administration continues to send war-fighting supplies to Ukraine, defense experts told Congress. “It’s a huge threat to our security,” Ellen Lord, former under secretary of defense for acquisition and sustainment, said at an Armed Services Committee hearing. Lord said the U.S. has sent almost a quarter of its stockpile of Stinger missiles to Ukraine. David Berteau, president of the Professional Services Council, said that since the Russian invasion of Ukraine, the U.S. is readying almost one-third of available weapons stockpiles with no current contracts to replenish them. (BBG)

EQUITIES: The U.S. Consumer Financial Protection Bureau (CFPB) will promote competition and scrutinize the outsized influence Big Tech firms have in the marketplace, its director told the Senate Banking Committee during a hearing on Tuesday. (RTRS)

OTHER

GEOPOLITICS: UK foreign secretary will on Wednesday warn of “misery across Europe and terrible consequences across the globe” if Russia succeeds in Ukraine, after Moscow accused Britain of escalating the war and threatened retaliation. In a keynote foreign policy speech at London’s Mansion House, Liz Truss will argue that the existing global security architecture “designed to guarantee peace and prosperity” had failed Ukraine. As a result, the free world would need to “reboot, recast and remodel” its approach to “deterring aggressors”. She will add: “Ukraine has to be a catalyst for wider change.” (FT)

U.S./CHINA: U.S. Secretary of State Antony Blinken said on Tuesday he will address in the coming weeks a long-awaited national security strategy to deal with the emergence of China as a great power. "I will have an opportunity I think, very soon in the coming weeks to speak publicly and in some detail about the strategy," Blinken said at a Senate Foreign Relations Committee hearing. (RTRS)

U.S./CHINA: The U.S. hasn’t yet seen China provide “significant” military support for Russia’s invasion of Ukraine, Secretary of State Antony Blinken told the Senate Foreign Relations Committee. Blinken said China’s refusal to take a stand against the invasion is creating “significant reputational risk” for Beijing. (BBG)

U.S./CHINA: China's military on Wednesday condemned the United States after a U.S. warship sailed through the sensitive Taiwan Strait, saying such missions "deliberately" harm peace and stability. The U.S. Navy said the guided-missile destroyer USS Sampson conducted a "routine Taiwan Strait transit" on Tuesday, in accordance with international law. (RTRS)

U.S./CHINA/TAIWAN: The US government will support Taiwan’s efforts to build “asymmetric” defence capabilities meant to deter an attack by mainland China’s military, Secretary of State Antony Blinken told lawmakers on Tuesday, amid questions from members of both parties about US President Joe Biden’s resolve on the issue. Speaking before the Senate Foreign Relations Committee, Blinken said the administration was “determined to make sure that [Taiwan] has all necessary means to defend itself against any potential aggression, including unilateral action by China, to disrupt the status quo that’s been in place now for many decades”. “We’re focused on helping them think about how to strengthen asymmetric capabilities … as a deterrent,” he said. (SCMP)

CHINA/AUSTRALIA/JAPAN: Solomon Islands Prime Minister Mannaseh Sogavare told a visiting Japanese delegation on Tuesday that he had no intention of allowing China to build military bases in his country, Japanese Foreign Minister Yoshimasa Hayashi said. (RTRS)

JAPAN: A member of a Japan government advisory panel will call for easing Covid-19 border controls to allow tourists, Yomiuri reports without saying where it obtained the information. A private-sector member of the Council on Economic and Fiscal Policy, which advises Prime Minister Fumio Kishida, is expected to submit the proposal in a meeting Wed. Proposal to call for clear guidance on which conditions restrictions will be eased and simplifying entry procedures. (BBG)

RBNZ: The Reserve Bank of New Zealand on Wednesday said it intends to finalise a framework on debt servicing restrictions (DSRs) on residential mortgage lending by late 2022 and be able to introduce it, if required, by mid-2023. The central bank said first-home buyers are likely to be least impacted by a debt-to-income (DTI) restriction, a type of DSR which imposes a cap on how much debt a borrower owes as a multiple of income. It added that test interest rates of banks have begun to rise in-line with market rates, and a slowdown in high-DTI lending is expected in the next few months. (RTRS)

RUSSIA: Poland wants EU allies to agree new powers making it easier for sanctions-hit Russian assets to be seized and sold, as member states contemplate the vast costs of rebuilding Ukraine after the war. Warsaw says the property of Russian oligarchs hit by sanctions, as well as the hundreds of billions of euros of Russia’s central bank reserves frozen by western powers, should be available to help pay for reconstruction. “The most basic principle is that Russia started this war, and so they need to pay for it,” Pawel Jablonski, Poland’s deputy foreign minister, told the Financial Times. (FT)

RUSSIA: The Justice Department will ask Congress for expanded authority to confiscate and sell assets such as superyachts, jets and mansions held by wealthy Russians as part of a U.S. crackdown on Russia for invading Ukraine, Attorney General Merrick Garland said. The department will back new legislation that would make it easier to seize targeted Russian assets and to provide some of the proceeds from any sales directly to Ukraine, Garland said during a Senate budget hearing Tuesday. (BBG)

UKRAINE: Canada plans to give itself the power to seize the assets of sanctioned Russian individuals and companies and use them to compensate victims of the war in Ukraine. The new measures will be included in the government’s budget legislation, meaning they are almost certain to pass in parliament by summer. (BBG)

RUSSIA: British Prime Minister Boris Johnson said on Tuesday he did not expect any further Russian military failures in Ukraine to push President Vladimir Putin into using tactical nuclear weapons there, saying he had room to manoeuvre and end the conflict. (RTRS)

RUSSIA: In the area of the village of Staraya Nelidovka, Belgorod Region, an open fire was eliminated, Governor of the region Vyacheslav Gladkov said on Wednesday in a Telegram post. As the governor of the Belgorod region clarified in his VKontakte account, the regional authorities are waiting for information from the Russian Defense Ministry. “We are waiting for an official announcement from the Ministry of Defense regarding the morning, or rather, nighttime explosions.” Gladkov wrote. (TASS)

RUSSIA: The governor of the Kursk region, Roman Starovoit, said on Telegram that the air defense system worked at night, there were no casualties or destruction. (RIA Novosti)

PALM OIL: Indonesia's ban on palm oil exports is unlikely to last more than a month as Jakarta has limited infrastructure to store the surplus oil and the country faces mounting pressure from buyers to resume shipments, industry officials said. The world's top palm oil exporter announced plans to ban exports on Friday, in a shock move that lifted prices of all edible oils and sowed confusion and alarm among palm oil exporters and consumers alike. (RTRS)

METALS: Chinese-owned MMG Ltd's (1208.HK) huge Las Bambas copper mine in Peru is considering a plan to evict indigenous communities that have camped on the property and forced a production halt, according to an executive and a document seen by Reuters. "It's still in the process of being decided," Carlos Castro, Las Bambas head of corporate affairs, said in a text message, when asked about the eviction plan on Tuesday. "The repossession defense can be exercised within the 15 days established by law." (RTRS)

ENERGY: Diesel futures trading in New York surged to the highest level in records going back to 1986 as global demand for the fuel remains robust in the wake of Russia’s invasion of Ukraine. Nymex ultra-low sulfur diesel futures settled at $4.4679 a gallon on Tuesday, exceeding the prior record on March 8, when the U.S. formally sanctioned Russian oil. Since then, diesel has become the world’s most in-demand fuel as buyers in Latin America, Europe and within the U.S. compete for supplies as fast as refiners on the U.S. Gulf Coast can make them. (BBG)

OIL: Commodities trader Trafigura Group will stop buying crude from Russian state-backed producer Rosneft PJSC before a European Union deadline of May 15, as pressure mounts to stop dealing with the country. Trafigura will also substantially cut volumes of oil products bought from Rosneft, a spokesperson said, adding that those cargoes will be used solely to supply European customers. (BBG)

CHINA

PBOC: The People’s Bank of China is likely to further reduce the foreign exchange deposit reserve ratio for banks, and use measures such as raising the FX risk reserve ratio and restarting counter-cyclical policies should the depreciation of the yuan continue, wrote Guan Tao, former forex official and chief economist at BOC Securities in a blog post. The PBOC’s move to cut the FX deposit reserve ratio by one percentage point on Monday is more of a signal to express concern about the current sharp yuan drop, and it will help curb any momentum of shorting the yuan, Guan said. (MNI)

ECONOMY: China will step up infrastructure projects to drive economic growth, Xinhua News Agency reported late Tuesday citing a top economics meeting chaired by President Xi Jinping. Investments would be brought forward for projects that benefit industrial growth and safeguard national security, the meeting said. Optimising transportation, and oil and gas pipeline networks as well as new types of infrastructure, including computing platforms and broadband would be included, according to the meeting. Financing needs will be met and fiscal spending would be expanded, the meeting said. (MNI)

ECONOMY: China should increase counter-cyclical economic measures and activate reserve policies amid growing expectations for the economic growth to bottom in Q2, the China Securities Journal reported citing analysts. Expanding investment, restoring consumption, stabilising foreign trade, and smoothening supply chain logistics will become the main focus, the newspaper said. It is expected that infrastructure investment, the key driver this year, may increase 10% in H1, and grow 5-7% for the whole year, the newspaper said citing analysts. (MNI)

ECONOMY/CORONAVIRUS: Chinese port activity fell below levels seen during the first coronavirus outbreak in 2020 and construction has plummeted, satellite data show, suggesting official economic figures will likely worsen as Covid lockdowns spread. San Francisco-based SpaceKnow, which tracks activity at more than 1,300 factories from space, said manufacturing output remained strong through the lockdowns in March and early April, although inventories are building up. That’s likely a sign of logistical snarls as coronavirus restrictions cause major disruptions and shortages of trucks able to move goods to ports and around the country. (BBG)

OVERNIGHT DATA

CHINA MAR INDUSTRIAL PROFITS YTD +8.5% Y/Y; FEB +5.0%

AUSTRALIA Q1 CPI +5.1% Y/Y; MEDIAN +4.6%; Q4 +3.5%

AUSTRALIA Q1 CPI +2.1% Q/Q; MEDIAN +1.7%; Q4 +1.3%

AUSTRALIA Q1 CPI TRIMMED MEAN +3.7% Y/Y; MEDIAN +3.4%; Q4 +2.6%

AUSTRALIA Q1 CPI TRIMMED MEAN +1.4% Q/Q; MEDIAN +1.2%; Q4 +1.0%

AUSTRALIA Q1 CPI WEIGHTED MEDIAN +3.2% Y/Y; MEDIAN +3.2%; Q4 +2.5%

AUSTRALIA Q1 CPI WEIGHTED MEDIAN +1.0% Q/Q; MEDIAN +1.1%; Q4 +0.9%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 96.5; PREV 96.8

Consumer confidence was practically unchanged last week, despite the continued fall in inflation expectations. Confidence declined by a modest 0.3% as petrol prices increased a touch after four straight weeks of decline. Even with higher petrol prices, households’ inflation expectations dropped 0.2ppt to 5.1%, its lowest level since the week ended 20 February. Today’s inflation data could have a near-term impact on sentiment, with it expected to confirm that inflation has surged. Among the major states, confidence increased 5.5% in NSW, 2% in Queensland and 3.5% in SA, while it dropped 4.4% in Victoria and 12.5% in WA. NSW was the only state with confidence above the neutral level of 100. (ANZ)

SOUTH KOREA APR CONSUMER CONFIDENCE 103.8; MAR 103.2

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 09:25 am local time from the close of 1.6111% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Tuesday, flat from the close of Monday.

- The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5598 on Wednesday, compared with 6.5590 set on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.5598 WED VS 6.5590 TUE

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.5598 on Wednesday, compared with 6.5590 set on Tuesday.

MARKETS

SNAPSHOT: Turning Off The Tap

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 355.7 points at 26354.37

- ASX 200 down 47.779 points at 7270.8

- Shanghai Comp. up 10.988 points at 2897.414

- JGB 10-Yr future up 1 ticks at 149.33, yield down 0bp at 0.245%

- Aussie 10-Yr future down 0 ticks at 96.85, yield up 0.5bp at 3.109%

- US 10-Yr future up 3.125 ticks at 120.078125, yield up 4.96bp at 2.7701%

- WTI crude up $0.11 at $101.8, Gold down $8.48 at $1897.03

- USD/JPY up 42 pips at Y127.65

- LAEL BRAINARD WINS SENATE CONFIRMATION TO BE FED VICE CHAIR (BBG)

- RUSSIA TURNS OFF GAS TAPS TO POLAND AND BULGARIA

- WESTERN NATIONS SEEK WIDER AUTHORITY TO SEIZE RUSSIAN ASSETS

- CHINA’S XI CALLS FOR ALL-OUT EFFORTS TO BOOST INFRASTRUCTURE CONSTRUCTION (Xinhua)

- AUSTRALIA’S INFLATION BEATS EXPECTATIONS

BOND SUMMARY: Core FI Come Under Pressure, Domestic Inflation Data Add Pressure To ACGBs

Participants steered clear of safe haven assets following Tuesday's risk rout, with core FI losing shine as a result. Australian CPI data provided the main risk event of the Asia-Pac session, with ACGBs taking a hit as domestic inflation figures smashed expectations.

- A brief foray higher allowed T-Notes to show above yesterday's best levels but proved short-lived as broader selling pressure prevailed. The contract went bid as a block but in 5-Year U.S. Tsy futures coincided with geopolitical headlines noting that a Russian ammunition depot caught fire, while China said that its navy vessels tracked a U.S. destroyer transiting the Taiwan Strait. This upswing was capped at 120-18+ and T-Notes turned their tail again amid recovery in U.S. e-mini futures. TYM2 trades +0-04 at 120-05+ as we type, with Eurodollar futures last seen 0.5-3.0 ticks higher through the reds. Cash U.S. Tsys tracked fluctuations in T-Notes, yields quickly regained poise after a brief pullback. They last sit 2.2bp-5.0bp higher, with the curve running flatter. The U.S. docket for today features flash wholesale inventories & 5-Year Tsy auction.

- JGB futures sales ground to a halt ahead of the Tokyo lunch break but resumed thereafter, with the contract last sitting at 149.34, 2 ticks above previous settlement. Cash JGB yields are narrowly mixed as we type. The sale of 2-Year JGBs saw low price match dealer estimate, with bid/cover ratio moderating to 4.34x from 5.43x at the previous auction. The space showed little to no reaction to the offering.

- Better than expected CPI figures applied pressure to ACGBs as the data stepped up pressure on the RBA to raise interest rates. Headline CPI growth reached a two-decade high & core inflation breached the RBA's target range, which prompted participants to add hawkish cash rate bets ahead of next week's monetary policy meeting. YM last trades -7.5 & XM -0.5, both are testing session lows. Bills run -17 to +1 tick through the reds. The cash curve has bear flattened as yields sit 0.2bp-9.2bp higher.

JGBS AUCTION: Japanese MOF sells Y2.2584tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.2584tn 2-Year JGBs:

- Average Yield -0.054% (prev. -0.025%)

- Average Price 100.118 (prev. 100.062)

- High Yield: -0.050% (prev. -0.022%)

- Low Price 100.110 (prev. 100.055)

- % Allotted At High Yield: 4.8301% (prev. 29.0225%)

- Bid/Cover: 4.340x (prev. 5.427x)

EQUITIES: Mixed As Chinese Stocks Rebound; U.S. Tech Earnings Haunt Asian Session

Asia-Pac equity indices are mixed at writing, finding little support from Wall St.’s strongly negative lead. Tech stocks across the region struggled, with pessimistic spillover from the tech-heavy NASDAQ’s (-4.0%) dismal showing during Tuesday’s NY session evident.

- The CSI300 sits 1.1% higher at typing, outperforming regional peers by a relatively wide margin. Consumer staples names lead gains, with large-cap Kweichow Moutai (+4.0%) contributing the most to gains in the index after reporting a 24% Y/Y increase in net profit. Broader risk appetite also received a lift from Chinese President Xi Jinping announcing late on Tuesday that the government would go “all out” to boost infrastructure investment and spending in key identified industries, while sentiment benefitted from reports showing fresh daily COVID cases in Shanghai declining for a fourth consecutive day to three-week lows.

- The Hang Seng Index trades a little above neutral levels at typing, reversing earlier losses after opening lower with outperformance in the Hang Seng Tech Index helping to neutralise drag from the index’s property and utilities sub-indices.

- The Australian ASX200 trades 0.7% lower, led under on drag from technology stocks. The S&P/ASX All Technology Index is 1.7% worse off at typing, with large-cap Block Inc leading losses. Commodity-related names provided some counter to the bearish pressure as some commodity benchmarks have rallied, with notable outperformance in energy equities.

- Looking ahead, Meta’s earnings call later today (2100 GMT) possibly bears watching, following the observed market reaction to recent earnings reported by Netflix, Alphabet, and Microsoft.

- U.S. e-mini equity index futures sit 0.3% to 0.7% better off at typing, operating at their respective session highs after rising off of six-week lows made late on Tuesday.

OIL: WTI Back Above $100 As Ruble Row Unfolds; Shanghai Cases Fall

WTI and Brent are ~$0.20 firmer at typing, operating a little below their respective best levels for the week. Both benchmarks have extended gains made on Tuesday (after closing ~$3 higher in that session), with the move higher facilitated by possible signs of easing in Shanghai’s ongoing COVID outbreak.

- To elaborate, total fresh COVID cases in Shanghai for Tuesday came in at ~13.5K, declining for a fourth consecutive day to hit three-week lows. Speculation over the easing of lockdowns in the city has also risen following observed software updates on the ubiquitous Alipay payment app allowing for the display of COVID-relevant movement permits. Participants are however keeping an eye on fresh cases in Beijing (likely over lockdown risks), with authorities reporting 34 cases for Tuesday, a roughly similar rate to Monday’s figures.

- Elsewhere, major crude benchmarks caught a bid on Tuesday after Russia announced that natural gas supplies to Poland and Bulgaria would be cut after they had refused to make payment in rubles. The EU also continues to make well-documented progress towards a ban on Russian crude,

- Looking to the U.S., the latest round of API inventory reports crossed late on Tuesday, pointing to a larger than expected build in crude stockpiles that largely negated last week’s decline. An increase was reported in distillate and Cushing hub stocks as well, while there was a drawdown in gasoline inventories.

- Up next, U.S. DOE inventory data crosses at GMT1430 on Wednesday, with WSJ median estimates calling for a build in crude and gasoline stocks, with a drawdown in distillate stockpiles.

GOLD: Under Pressure In Asia; One-Month Low Remains In Sight

Gold trades ~$7/oz lower to print $1,898/oz at typing, operating a touch above Tuesday’s lows as nominal U.S. Tsy yields have rebounded in Asia-Pac dealing, while the USD (DXY) remains bid near two-year highs.

- To recap, the precious metal closed ~$8/oz higher on Tuesday to extend a move off of Monday’s one-month lows, aided by a broad downtick in U.S. real yields.

- Steadily rising tensions (and hints of rhetoric re: nuclear war) surrounding the Russia-Ukraine conflict continues to lend support to bullion, with the week-to-date seeing escalations in the scale and breadth of western arms supplies to Ukraine, as well as the EU’s progress towards energy sanctions.

- Looking to energy issues within Europe, Russia is set to cut natural gas supplies to Poland and Bulgaria on Wednesday, with some debate noted re: the ability of the latter to cope with the halt in Russian gas imports. Elsewhere, German Economy Minister Habeck has highlighted the possibility of replacing Russian crude “in days”, noting that the country has come “very, very close” to such a goal.

- From a technical perspective, the pullback from recent highs at $1,998.4/oz (Apr 18 high) continues to represent a bearish threat. Gold continues to hold key support at $1,890.2/oz (Mar 29 low and bear trigger) for now, and a break below that would open up further support at $1,878.4/oz (Feb 24 low).

FOREX: CPI Beat Boosts Aussie, Yen Loses Its Allure

Upbeat CPI data extended a helping hand to the Aussie dollar, helping it outperform all of its G10 peers. Headline inflation accelerated to a two-decade high of +5.1% Y/Y, while the key measure of core price growth breached the RBA's target range of +2.0%-3.0% Y/Y, with both printing above consensus forecasts. The report prompted participants to add hawkish RBA bets, with markets now fully pricing a 15bp cash rate hike next Tuesday.

- The yen sold off across the board amid reduced demand for safe haven currencies, even as regional headline flow failed to offer any reassurance on familiar growth risks. Participants were preparing for Thursday's BoJ monetary policy decision and a long weekend in Japan.

- Spillover from commodity markets may have helped underpin oil-tied FX at the yen's expense. Crude futures crept higher amid the latest escalation in energy spat between Russia and two Eastern European nations.

- Spot USD/CNH lost some altitude and is on track to snap its six-day impulsive winning streak. China's President Xi called on his officials to make "all out" efforts to boost infrastructure spending.

- Flash U.S. wholesale inventories headline today's particularly thin data docket. Comments are due from ECB's Lagarde, Lane & Muller as well as BoC's Macklem.

FOREX OPTIONS: Expiries for Apr27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E1.2bln), $1.0700-10(E1.0bln), $1.0800(E1.5bln), $1.0900(E1.4bln)

- USD/JPY: Y126.75($540mln)

- GBP/USD: $1.2900(Gbp1.1bln)

- AUD/USD: $0.7450(A$1.9bln)

- NZD/USD: $0.6735(N$1.4bln), $0.6835(N$1.8bln)

- USD/CNY: Cny6.5000($700mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/04/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 27/04/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/04/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 27/04/2022 | 0600/0800 | ** |  | SE | PPI |

| 27/04/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/04/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 27/04/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/04/2022 | - |  | JP | Bank of Japan policy meeting | |

| 27/04/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 27/04/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 27/04/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 27/04/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 27/04/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/04/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 27/04/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 27/04/2022 | 2230/1830 |  | CA | BOC's Macklem testifies at Senate |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.