-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China Sticks To Covid-Zero, Tech Equities Take Focus

EXECUTIVE SUMMARY

- RUSSIAN ATTACK TARGETS UKRAINIAN CAPITAL AMID UN CHIEF’S VISIT TO KYIV (AP)

- CHINA AND U.S. NEGOTIATE ON-SITE AUDIT CHECKS AS DELISTINGS LOOM (BBG)

- CHINA WON’T WAIVER ON COVID ZERO, WILL OPTIMIZE RESPONSE (BBG)

- CHINA POLITBURO URGES EFFORTS TO MEET ECONOMIC GROWTH TARGETS (BBG)

- APPLE & AMAZON FORECASTS, LEAKED DETAILS OF MUSK’S TWITTER PITCH CAUSE FRET

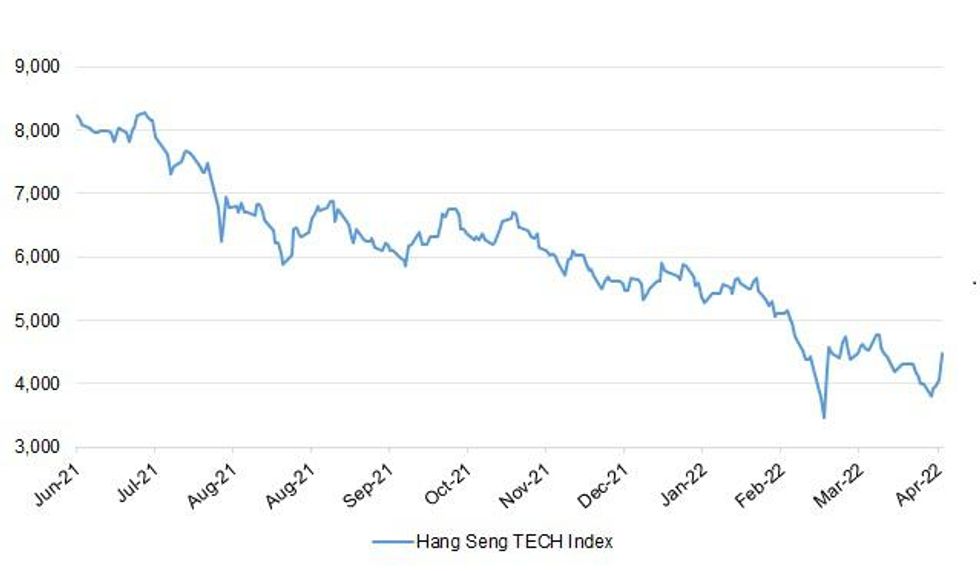

Fig. 1: Hang Seng TECH Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Jacob Rees-Mogg, the UK’s Brexit opportunities minister, has defended his decision to delay for a fourth time full post-Brexit border checks on imports from the EU, claiming it would save £1bn a year and control rising living costs. Port operators were critical, saying the £100mn they had spent in preparation for the checks from July 1 “now looks like wasted time, effort and money”, and that they would seek government reimbursement. (FT)

DEFENCE: About 8,000 British army troops will take part in exercises across eastern Europe to combat Russian aggression in one of the largest deployments since the cold war. Dozens of tanks will be deployed to countries ranging from Finland to North Macedonia this summer under plans that have been enhanced since Russia invaded Ukraine. (Guardian)

NORTHERN IRELAND: The DUP is failing to significantly narrow the electoral gap with Sinn Fein with less than a week until the Assembly election. A new poll shows Sir Jeffrey Donaldson’s party lagging six percentage points behind Michelle O’Neill’s. (Belfast Telegraph)

EUROPE

EU: One of the most prized positions in the EU bureaucracy will remain vacant, potentially for weeks or months, as European Council President Charles Michel ponders his choices for the next secretary-general of the Council of the EU. A vacancy in such a coveted post is highly unusual and reflects the swift departure of outgoing Secretary-General Jeppe Tranholm-Mikkelsen. The Danish diplomat announced at the end of March that he was moving to the top civil service post in the foreign ministry in his home country and expected to begin his new job on May 1. (POLITICO)

FINLAND: 61 percent of Finns, a clear majority, would agree that a permanent base or bases of the Defense League NATO would be located in Finland in peacetime if Finland joined NATO. This is evident from the USU poll of Uutissuomalainen. (ESS)

UKRAINE: Russia pounded targets from practically one end of Ukraine to the other Thursday, including Kyiv, bombarding the city while the head of the United Nations was visiting in the boldest attack on the capital since Moscow’s forces retreated weeks ago. Several people were wounded in the attack on Kyiv, including one who lost a leg and others who were trapped in the rubble when two buildings were hit, rescue officials said. (AP)

UKRAINE: President Joe Biden has broad support in Congress for a massive $33 billion Ukraine aid package, but the proposal risks getting tangled in a long-simmering partisan dispute over immigration and Covid-19 funding. The Senate could vote on the emergency spending package next week, but the House will be on recess. Congress could finish by the week of May 9 and send it to Biden for his signature. But if Democrats insist on attaching long-stalled funding for coronavirus vaccinations and treatment to the package, action could be delayed indefinitely. “That’s not going to happen. That’s an awful way to do business,” Senator Jim Risch of Idaho, the top Republican on the Foreign Relations Committee, said about combining the two spending requests. (BBG)

UKRAINE: U.S. Defense Secretary Lloyd Austin and Canadian Defense Minister Anita Anand said howitzers and other weaponry promised to Ukraine are being delivered quickly. Canada has also been training Ukrainian forces on the use of the howitzers, Anand said during a joint news conference at the Pentagon. Austin urged Congress to quickly approve Biden’s proposed $33 billion supplemental for Ukraine. (BBG)

UKRAINE: Direct Russian-Ukrainian talks to end the war are “somewhat on pause” as the Kremlin presses ahead with its attack, one of Ukraine’s main negotiators said in an interview. Potential additional war crimes, the destruction of Mariupol and organizing fake referendums on Ukrainian territory are “red lines” that could bring a halt to negotiations, Mykhaylo Podolyak told Bloomberg Television. “There isn’t even a subject for discussion because everything is going to be decided in terms of direct combat in the east of Ukraine,” he said. (BBG)

UKRAINE: The "Battle of Donbas" remains Russia’s main strategic focus in order to achieve its stated aim of securing control over the Donetsk and Luhansk regions, Britain's defence ministry said on Friday. (RTRS)

UKRAINE: Riga is encouraging Western allies to train Ukrainian forces on advanced Western weapons and even send Western-made fighter planes as allies plot how to arm Kyiv for the long haul, Latvia’s foreign minister said Thursday. Speaking to POLITICO, Edgars Rinkēvičs insisted Ukraine’s partners were warming to the idea, which would have seemed unthinkable just three months ago. (POLITICO)

UKRAINE: OSCE Chairman-in-Office, Foreign Minister of Poland Zbigniew Rau and OSCE Secretary General Helga Maria Schmid have today announced that the OSCE would take immediate steps to implement the closure of the Special Monitoring Mission to Ukraine. This decision follows the lack of consensus at the OSCE Permanent Council on 31 March 2022 to extend the Mission’s mandate. (OSCE)

UKRAINE: The Russians continue to shell the cities of the Zaporizhia region, use civilian Ukrainians as human shields and force the introduction of a "ruble zone". (Pravda)

UKRAINE: At least one Ukrainian defender was killed and nearly a hundred other wounded were killed in the rubble of a field hospital at the Azovstal plant. (Pravda)

UKRAINE: Russia's foreign spy chief accused the United States and Poland on Thursday of plotting to gain a sphere of influence in Ukraine, a claim denied by Warsaw as disinformation aimed at sowing distrust among Kyiv's supporters. Sergei Naryshkin, the chief of Russia's Foreign Intelligence Service (SVR), cited unpublished intelligence that he said showed the United States and Poland, NATO allies, were plotting to restore Polish control over part of western Ukraine. "According to the intelligence received by Russia's Foreign Intelligence Service, Washington and Warsaw are working on plans to establish Poland's tight military and political control over its historical possessions in Ukraine," Naryshkin said in a rare statement released by the SVR. Poland denied the claim and said it was disinformation spread by Moscow.

U.S.

ECONOMY: President Biden said Thursday that his administration is looking at ways to reduce "some" federal student loan debt. Why it matters: However, he said specifically his administration is not planning to forgive up to $50,000 per borrower, a figure repeatedly proposed by Senate Majority Leader Chuck Schumer (D-N.Y.) and other Democrats. (Axios)

EQUITIES: Elon Musk sold about $4 billion worth of Tesla Inc. shares after announcing a blockbuster $44 billion deal to buy Twitter Inc. Tesla’s chief executive officer offloaded about 4.4 million shares on April 26 and April 27, filings showed late Thursday. Wall Street analysts and investors in the electric carmaker suspected that Musk may need to sell some stock to cover the $21 billion equity portion of the transaction that he’s personally guaranteed. Musk tweeted shortly after the filings were made public that he has “no further Tesla sales planned after today.” (BBG)

EQUITIES: Elon Musk told banks that agreed to help fund his $44 billion acquisition of Twitter Inc. that he could crack down on executive and board pay at the social media company in a push to slash costs, and would develop new ways to monetize tweets, three people familiar with the matter said. Musk made the pitch to the lenders as he tried to secure debt for the buyout days after submitting his offer to Twitter on April 14, the sources said. His submission of bank commitments on April 21 were key to Twitter's board accepting his "best and final" offer. (RTRS)

OTHER

U.S./CHINA: Beijing is discussing with American regulators the logistics of allowing on-site audit inspections of Chinese companies listed in New York, according to people familiar with the matter, a sign of progress in talks to keep U.S. stock markets open to issuers from Asia’s largest economy. Regulators on both sides are negotiating how to let a team of inspectors from the Public Company Accounting Oversight Board visit China so they can scrutinize auditing procedures and access the reports of a majority of 261 U.S.-listed firms, the people said, requesting not to be named because the matter is private. The talks, aimed at preserving these listings and reviving fresh public offerings, include hammering out issues such as quarantine requirements, the people added. The two countries have yet to reach a conclusive agreement on moving forward with the checks, the people said. (BBG)

U.S./CHINA: Biden administration officials are debating how — and even whether — to lower some of former President Trump’s tariffs against China to help ease inflation, people familiar with the matter tell Axios. Why it matters: The administration has limited options to lower prices for American consumers but knows it will be punished in this fall's midterms if higher prices persist throughout the year. Providing so-called “exclusions” for some goods — not subjecting them to the Section 301 tariffs imposed by Trump — is one tool the current president has at his disposal. But Biden, like his predecessor, has pursued a confrontational approach toward China, and officials have been reluctant to relax the tariffs without extracting something in return. Between the lines: The debate is pitting economists at Treasury, including Secretary Janet Yellen, against China hawks on the National Security Council. They want to keep pressure on China. (Axios)

JAPAN: Japanese Prime Minister Fumio Kishida sets off on Friday for an extended visit to Southeast Asia, aiming to marshal regional responses to the Ukraine crisis as well as counter China's growing assertiveness in the region. Kishida will first visit Indonesia, which is this year's chair of the Group of 20 major economies, of which Russia is also a member, and a major economic power in the region. He will then go to Vietnam, chair of the Asia-Pacific Economic Forum (APEC), followed by Thailand, before proceeding to Europe. (RTRS)

JAPAN/SOUTH KOREA: Japan Prime Minister Fumio Kishida is arranging to skip the inauguration of South Korea's President-elect Yoon Suk-yeol on May 10 due to unresolved bilateral diplomatic tensions, government sources told Sankei. (MNI)

SOUTH KOREA: South Korea will lift an outdoor face mask mandate starting next week, Yonhap news agency reported on Friday, in the country's latest step to ease COVID-19 restrictions as the Omicron variant recedes. The move would come two weeks after South Korea scrapped most of its pandemic-related precautions, including a midnight curfew on restaurants and other businesses, on April 18. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un called on the country's military to "bolster up their strength in every way to annihilate the enemy", state media reported on Friday, as new satellite imagery showed increased preparations for a possible nuclear test. Last month North Korea resumed testing its largest ICBMs, and there are signs it could soon test a nuclear weapon for the first time since 2017. "Current satellite imagery indicates that preparations are well underway and should not be discounted as insignificant activity," the U.S.-based Center for Strategic and International Studies (CSIS) said in a report on Thursday. (RTRS)

HONG KONG: Hong Kong-listed firms that have not submitted audited annual results have until mid-May before they risk a trading suspension, with the deadline likely to put pressure on real estate developers. (BBG)

BRAZIL: Former Brazilian President Luiz Inacio Lula da Silva told allies on Thursday he aims to represent a seven-party center-left coalition in his challenge to incumbent Jair Bolsonaro in this October's election. Lula, a former union organizer leading the presidential race, has stacked his agenda with party congresses to cement that coalition, including Thursday rallies with the Brazilian Socialist Party and Sustainability Network (REDE). (RTRS)

RUSSIA: The U.S.-led response to Russia’s invasion of Ukraine won’t be enough to deter future acts of aggression by Russia and China, and the NATO alliance isn’t as united as its leaders suggest, former National Security Advisor John Bolton said. U.S. and NATO support for Ukraine won’t “be sufficient to achieve an outcome that will deter the Russians in the future and deter others.” (BBG)

RUSSIA: Russian President Vladimir Putin in a telephone conversation with Indonesian President Joko Widodo discussed the work of the G20 and the situation in Ukraine, the Kremlin press service reports. It is noted that the conversation took place at the initiative of the Indonesian side. (RIA Novosti)

METALS: Two top executives at United Co. Rusal International PJSC agreed to buy out the U.S. unit of the Russian aluminum giant and plan to rename the company. Brian Hesse, former chief executive officer and president of Rusal America, and Andrey Donets, a former senior vice president, will purchase the unit, Hesse confirmed in an email. All Rusal America contracts will transfer to the new company, to be called PerenniAL. Researcher Harbor Intelligence first reported the move in a note seen by Bloomberg. The new company will continue to selling Rusal’s metal. (BBG)

OIL: After driving up prices for everything from steel pipes to frack sand to labor, inflation has finally the ensnared the centerpiece of oilfield equipment: the drilling rig. Rig prices are spiking in the U.S. compared to the rest of the world, promising profits at multiyear high for oilfield contractors. Three of the world’s biggest operators told investors Thursday that they’ve been able to rapidly raise prices in the U.S. compared to overseas, where contracts are generally lengthier and therefore take longer to reprice. Helmerich & Payne, the biggest supplier of rigs in the shale patch, said the higher pricing means it now has the chance to reap profits unseen since the heady days of 2014, when their margins on rigs was 50%. (BBG)

CHINA

ECONOMY: China’s top leaders pledged to meet economic targets, a sign it may step up stimulus to support growth during the country’s worst Covid outbreak since 2020. Authorities should “strengthen macro adjustments, strive to achieve full year economic and social development goals, and keep the economy running within a reasonable range,” the Communist Party’s Politburo said Friday, according to a report by state broadcaster China Central Television, citing a statement from the Politburo meeting. It also vowed to support the healthy growth of platform companies, reiterating remarks from the State Council earlier this week. The Politburo, led by President Xi Jinping, reiterated support for its “dynamic Covid Zero policy.” It added that efforts will be made to boost domestic consumption and help the stable and healthy development of the property market. (BBG)

CORONAVIRUS: Shanghai reported its first increase in Covid-19 cases in six days, a setback for a city still in the midst of an unprecedented lockdown. The financial hub reported 9,970 infections and 52 deaths for Thursday, slightly up from 9,764 cases on Wednesday. In addition, it also reclassified 5,062 previously counted asymptomatic patients as symptomatic, the highest such number in the past week. (BBG)

CORONAVIRUS: As many as 12.38 million Shanghai residents, nearly half the population of China's financial hub, are now in lower-risk areas, meaning they can leave their homes, the government said on Friday. (RTRS)

ECONOMY: China’s passenger traffic is expected to slump by 62 per cent during the May Day holiday period, as the country battles the latest wave of Covid-19 cases with draconian lockdowns and quarantine measures. Ministry of Transport forecasts say a total of 100 million trips will be made over the five-day holiday, which starts on Saturday and runs until next Wednesday – a 62 per cent drop compared with the previous year. Major cities, including Shanghai, Beijing and Guangzhou, are currently battling outbreaks that have seen restrictions being placed on people’s movements. Authorities in other parts of the country are also trying to discourage people from travelling. (SCMP)

ECONOMY: Smartphone sales in China saw the worst-performing quarter since the country was first swept by Covid-19 two years ago, according to data from Counterpoint Research, which cited weaker consumer sentiment amid economic headwinds and ongoing disruption due to coronavirus outbreaks. China’s smartphone sales slid 14 per cent in the first quarter of 2022 to 74.2 million units, according to a report published by Counterpoint on Thursday. Consumer demand was already waning before the recent wave of Covid-19 infections, and combined with slowing economic growth, a decline in retail sales growth and record-high unemployment rates in big cities, the impact on the sector has been significant, said research analyst Mengmeng Zhang. (SCMP)

ECONOMY/PROPERTY: Caterpillar Inc on Thursday warned that demand for excavators in China, one of its largest markets, could slip below pre-pandemic levels in 2022, as construction activity takes a hit in the country from strict pandemic lockdowns. "The 10-ton and above excavator market in China was very strong in 2020 and 2021. We now anticipate this market will be slightly lower than 2019 levels (this year)," Caterpillar Chief Executive Officer Jim Umpleby said on a post-earnings call. (RTRS)

PROPERTY: Embattled China Evergrande Group is targeting sales of 1 billion yuan ($152.26 million) during China's Golden Week holiday, a person with knowledge of the matter said, as the property developer offers apartments at discounts nationwide. It is offering special discounts on 10,000 apartments across 413 projects to push sales in the holiday period, its Pearl River Delta business unit said in a WeChat post last week, without elaborating. (RTRS)

PROPERTY: The southern Chinese province vowed to ensure stable development of the property market and boost financial support for small companies hit by Covid, according to a notification Thursday. The local administration has called on banks to set reasonable down-payment ratios and mortgage rates for home buyers. The local government also encouraged financial institutions to boost support for quality property projects and ensure timely deliveries. The province will push distressed developers to “actively conduct self-rescue and defuse risks.” (BBG)

OVERNIGHT DATA

AUSTRALIA Q1 PPI +4.0% Y/Y; Q4 +3.7%

AUSTRALIA Q1 PPI +1.6% Q/Q; Q4 +1.3%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +7.8% Y/Y; MEDIAN +8.0%; FEB +7.9%

AUSTRALIA MAR PRIVATE SECTOR CREDIT +0.4% M/M; MEDIAN +0.6%; FEB +0.6%

NEW ZEALAND APR CONSUMER CONFIDENCE 84.4; MAR 77.9

NEW ZEALAND APR CONSUMER CONFIDENCE +8.3% M/M; MAR -4.7%

SOUTH KOREA MAR INDUSTRIAL PRODUCTION +3.7% Y/Y; MEDIAN +4.0%; FEB +6.3%

SOUTH KOREA MAR INDUSTRIAL PRODUCTION SA +1.3% M/M; MEDIAN -0.5%; FEB +0.3%

SOUTH KOREA MAR CYCLICAL LEADING INDEX CHANGE 0.3; FEB -0.3

UK APR LLOYDS BUSINESS BAROMETER 33; MAR 33

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1058% at 09:32 am local time from the close of 1.9023% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Thursday vs 48 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6177 FRI VS 6.5628

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6177 on Friday, compared with 6.5628 set on Wednesday.

MARKETS

SNAPSHOT: China Sticks To Covid-Zero, Tech Equities Take Focus

Below gives key levels of markets in the second half of the Asia-Pac session:

- The Nikkei 225 is closed today.

- ASX 200 up 65.216 points at 7422.1

- Shanghai Comp. up 11.05 points at 2986.535

- JGBs are closed today.

- Aussie 10-Yr future down 9 ticks at 96.785, yield up 9.1bp at 3.172%

- US 10-Yr future up 14.0625 ticks at 119.5, cash Tsys are closed.

- WTI crude up $0.56 at $105.92, Gold up $12.22 at $1906.7

- USD/JPY down 35 pips at Y130.5

- RUSSIAN ATTACK TARGETS UKRAINIAN CAPITAL AMID UN CHIEF’S VISIT TO KYIV (AP)

- CHINA AND U.S. NEGOTIATE ON-SITE AUDIT CHECKS AS DELISTINGS LOOM (BBG)

- CHINA WON’T WAIVER ON COVID ZERO, WILL OPTIMIZE RESPONSE (BBG)

- CHINA POLITBURO URGES EFFORTS TO MEET ECONOMIC GROWTH TARGETS (BBG)

- APPLE & AMAZON FORECASTS, LEAKED DETAILS OF MUSK’S TWITTER PITCH CAUSE FRET

BOND SUMMARY: Core FI Under Pressure, Japan Markets Closed

T-Notes and Aussie bond futures came under pressure amid little appetite for haven assets, with Japanese financial markets closed in observance of a public holiday. Reports of progress in talks aiming to keep U.S. equity markets open to Chinese issuers helped buoy market sentiment.

- Aussie bond futures came under pressure amid recovery in risk sentiment and expectations that the RBA will raise the cash rate come the end of its monetary policy meeting next week. Above-forecast inflation data released Wednesday put pressure on policymakers to take action, with the OIS strip fully pricing a 15bp hike. YM last deals -7.0 & XM -10.0, with bills sitting 2-9 ticks lower through the reds. Cash ACGBs extended their opening gains, with yields on 10-Year & 3-Year ACGBs printing best levels since 2014. When this is being typed, cash ACGB yields trade 6.7bp-9.7bp higher across the curve. The auction for A$1.0bn of ACGB 0.50% 21 Sep '26 & light AOFM issuance slate for next week provoked little if any market response.

- T-Notes quickly gave away opening gains and continued to lose altitude, as U.S. e-mini futures were trimming losses. TYM2 changes hands +0-02+ at 119-14, hovering just above session lows, with Eurodollars running +1.0 tick to -0.5 tick through the reds. Cash Tsys were closed until London hours due to a market closure in Tokyo. Focus in the U.S. turns to PCE data, MNI Chicago PMI & U. of Mich. Sentiment, with FOMC members already in their blackout period ahead of next week's monetary policy meeting.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$1.0bn of the 0.50% 21 September 2026 Bond, issue #TB164:

- Average Yield: 2.9040% (prev. 1.5720%)

- High Yield: 2.9100% (prev. 1.5750%)

- Bid/Cover: 4.6350x (prev. 4.0900x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 9.2% (prev. 48.4%)

- Bidders 40 (prev. 40), successful 10 (prev. 14), allocated in full 5 (prev. 8)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Friday 6 May it plans to sell A$1.0bn of the 2.75% 21 November 2027 Bond.

EQUITIES: Mostly Higher As Chinese Equities Catch A Bid On Politburo Pledge

Asia-Pac equity indices are mostly higher at typing, bucking negative reception from an after-market earnings beat from mega-caps Amazon and Apple. Chinese stocks are in the midst of a broad surge on an announcement from the Politburo pledging support to meet the country’s 5.5% growth target for ‘22, with high-beta stocks outperforming.

- The Chinese CSI300 is 1.5% firmer at typing, rising above neutral levels after aforementioned reports re: the Politburo’s vows to support economic growth. Notably, underperformance in a gauge of real estate equities was broadly reversed, with the government specifically voicing support for the industry.

- The Hang Seng Tech Index was sharply bid towards the tail-end of the morning session and currently sits >10% firmer at typing. Large-caps such as Tencent, Alibaba, and JD.com contributed outsize gains to the index, building on gains made before the break.

- Focusing on the Politburo meeting, policymakers doubled down on their commitment to China’s 5.5% growth target for ‘22 through stronger “macro adjustments”, while pledging support to boost domestic consumption as well, likely again feeding into speculation for policy easing in the coming weeks.

- On the topic of Chinese consumption, several cities/regions have issued at least several hundred million yuan in coupons, vouchers, and digital “red envelopes” to residents, in an attempt to spur spending over the upcoming May Day holidays.

- U.S. e-mini equity index sit flat to 0.9% weaker at typing, with the NASDAQ leading losses. All contracts however operate clear of Thursday’s troughs, and have continued to move higher from cycle lows made on Tuesday.

OIL: WTI Reclaims $100 On Possible EU Sanctions; China Vows Quicker Action On COVID

WTI and Brent are flat to a little higher at typing, operating a shade below their respective two-week and one-week highs made on Thursday.

- To recap, major oil benchmarks caught a bid on Thursday after BBG source reports suggested that Germany plans to back a phased ban in Russian crude. Sources also pointed to a sixth EU sanctions package on Russian goods likely being put up for approval by next week, although the “precise mechanics” of an embargo on Russian oil is reportedly still in the works.

- Looking to China, fresh COVID case counts in Shanghai for Thursday surged to ~15.6K cases, reversing five consecutive days of declines after reporting ~10.7K cases for Wednesday. Authorities however pointed out on Friday that the city has continued to ease restrictions, with only around ~5mn of the city’s >25mn population currently under full lockdown. Zooming out, case counts in Beijing have also crept upwards, although overall cases in China have encouragingly remained below 20K.

- Turning to pandemic control measures, Chinese regulators on Friday re-affirmed the country’s COVID-zero strategy, but stressed that they may not reach for massed city-wide lockdowns in the future. Elsewhere, Jilin province (pop. ~24mn)in the country’s northeast reported a 7.9% Y/Y decline in GDP on Thursday, coming after the province had been put under lockdown since Mar 11.

- Up next, participants may be on the lookout for COVID-related progress in the e-commerce hub of Hangzhou (pop. ~10mn), after the city started a mass testing drive earlier in the week.

GOLD: Hovering Around $1,900/oz As May FOMC Draws Closer

Gold sits ~$6/oz higher, printing ~$1,900/oz at typing. The precious metal is back from session highs at (~$1,905.9/oz), but operates clear of Thursday’s best levels.

- The precious metal builds on a ~$8/oz higher close on Thursday, after rising off session lows at $1,872.2/oz on support from a downtick in U.S. real yields despite a fresh cycle high in the USD (DXY).

- Gold is on track to close ~$40/oz lower for the month, possibly representing its worst month in over half a year, with headwinds evident above the $2,000/oz price level. The DXY has continued to make fresh successive cycle highs throughout April while U.S. real yields have pushed higher as well, with 10-Year real yields hovering a touch below neutral levels (after briefly breaking into positive territory for the first time in over two years on Apr 20).

- Looking ahead, U.S. PCE data is expected to draw some focus, with MNI Chicago PMI and U. of Michigan Consumer Sentiment headlining data releases as well.

- From a technical perspective, gold has formed initial support at Thursday’s low of $1,872.2/oz, while resistance remains some distance away at around ~$1,941.3/oz (20-Day EMA).

FOREX: AUD Outperforms, USD Falters Ahead Of Next Week's Central Bank Meetings

The U.S. dollar index (DXY) traded on a heavier footing, moving away from a multi-year high printed on Thursday. The greenback was the worst performer among major currencies, with participants preparing for next week's FOMC meeting.

- Greenback weakness may have been exacerbated by reduced demand for safe havens, with U.S. e-mini futures chewing into their opening losses. This train of thought is supported by observed CHF weakness.

- The yen got some reprieve in the wake of Thursday's post-BoJ rout as Japan observed a public holiday. Liquidity over the next few days will be limited amid "Golden Week" market closures.

- The yuan was unfazed by the second consecutive firmer-than-expected PBOC fix. While spot USD/CNH weakened in initial reaction, it staged a strong rebound, facilitated by China's pledge to maintain its Covid-Zero policy.

- The Aussie dollar outperformed ahead of next week's RBA MonPol meet. Data released on Wednesday provided evidence of runaway inflation, raising pressure on policymakers to take action despite ongoing election campaign.

- On the data front, preliminary EZ GDP & CPI data will take focus in European hours. Moving into the NY session, focus will turn to U.S. PCE, MNI Chicago PMI & U. of Mich. Sentiment as well as Canadian GDP.

- The central bank speaker slate includes ECB's de Cos and SNB's Jordan, with Russia's central bank set to announce its rate decision.

FOREX OPTIONS: Expiries for Apr29 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0565-75(E2.0bln), $1.0600(E838mln), $1.0650(E288mln), $1.0700(E2.9bln), $1.0785-90(E587mln)

- USD/JPY: Y124.00($1.4bln), Y126.75($500mln)

- EUR/GBP: Gbp0.8475(E751mln)

- USD/CAD: C$1.2850($690mln)

- USD/CNY: Cny6.5400($500mln), Cny6.5500($570mln), Cny6.6500($560mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 29/04/2022 | 0530/0730 | ** |  | FR | Consumer Spending |

| 29/04/2022 | 0530/0730 | *** |  | FR | GDP (p) |

| 29/04/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 29/04/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/04/2022 | 0645/0845 | ** |  | FR | PPI |

| 29/04/2022 | 0700/0900 | *** |  | ES | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | DE | GDP (p) |

| 29/04/2022 | 0800/1000 | *** |  | IT | GDP (p) |

| 29/04/2022 | 0800/1000 | ** |  | EU | M3 |

| 29/04/2022 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/04/2022 | 0900/1100 | *** |  | EU | GDP preliminary flash est. |

| 29/04/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/04/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/04/2022 | 1230/0830 | ** |  | US | Employment Cost Index |

| 29/04/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 29/04/2022 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 29/04/2022 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.