-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessECB Data Watch

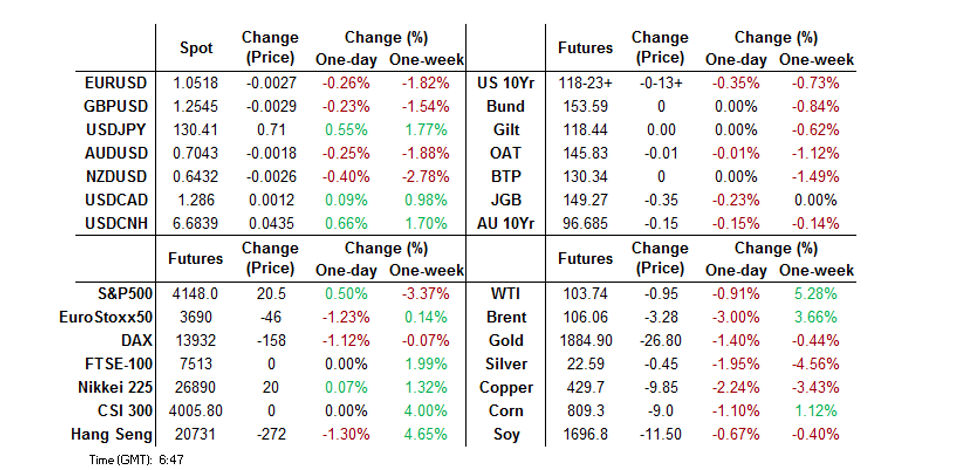

MNI EUROPEAN MARKETS ANALYSIS: USD Bid, Tsys Hold Friday's Losses

- The USD firmed in Asia-Pac dealing, while Tsys consolidated Friday's losses.

- CNH traded on the defensive, with some China-specific factors weighing on the redback.

- Broader liquidity has been limited by holidays in Hong Kong, Singapore & China, while the observance of a holiday in London will hamper liquidity during European hours. Tier 1 headline flow has been relatively non-existent since the Asia open owing to the widespread holidays across the region. The latest U.S. ISM manufacturing survey headlines the broader docket on Monday, with final Eurozone m’fing PMI data also due.

US TSYS: Little Changed To Cheaper In Light Asia Trade

The cash Tsy curve has bear flattened in early dealing this week, with the front end of the curve likely showing some regional Asia-Pac reaction when it comes to Friday’s front end/belly-led cheapening, while the 7+-Year zone of the curve was a little better bid on the risk negative factors we have outlined in the weekend news (namely softer than expected Chinese PMIs & worry re: various areas of geopolitical tension), before that impulse faded. That leaves cash Tsys little changed to ~1.5bp cheaper across the curve. TYM2 is -0-13 at 118-24, 0-01+ off the base of the contract’s 0-07 Asia range, operating on volume of ~85K.

- Eurodollar futures sit 1.5 to 5.5 ticks softer through the reds.

- Note that the OIS strip currently prices a ~50% chance of a 75bp hike at the Fed’s June meeting, in line with market pricing observed on Friday (a 50bp hike at this week’s FOMC meeting is fully priced).

- Market and headline flow has been limited by the observance of holidays across China, Hong Kong & Singapore.

- Looking ahead, ISM manufacturing data headlines the NY docket on Monday, although more focus will be placed on Wednesday’s FOMC decision and Friday’s NFP print.

- Note that the observance of a UK holiday during London hours will limit wider liquidity and result in a halt of cash trade until NY hours commence.

JGBS: One-Way Traffic

Friday’s weakness in U.S. Tsys seeped through into JGBs, with JGB futures opening lower and moving in a downward direction for the bulk of the Tokyo session. The contract sits 35 ticks below Thursday’s settlement levels at typing, after Japanese participants returned from their elongated weekend.

- Meanwhile, cash JGBs sit little changed to ~3bp cheaper across the curve. 10s provide the firmest point on the JGB curve (aided by the presence of the BoJ’s fixed rate operations), while 7s and 30+-Year paper provide the weakest points, the former on the weakness in futures and the latter on the relative lack of BoJ control in that area of the curve.

- Domestic headline flow has been light, with wider affairs driving price action.

- This has left little to counter the offshore-driven weakness, as Tokyo participants prepare for a three-day break, which will be observed from Tuesday through Thursday.

AUSSIE BONDS: Curve A Touch Steeper With RBA Expectations Capping Early Bid

YM was happy to operate in the bottom half of its overnight session range during the first Sydney session of the week, while XM extended on post-settlement losses as we moved through the day. That leaves YM -12.0 & XM -14.0 as we move towards the bell, with the 10- to 15-Year sector of the ACGB curve providing the weakest point in wider cash trade. 10-Year ACGB yields tagged a fresh cycle high, breaching 3.25%.

- The wider tone was set by Friday’s U.S. Tsy-driven post-Sydney losses, with expectations re: RBA lift off at Tuesday’s meeting capping the early uptick.

- Both the 3- & 10-Year EFPs have tightened by ~2bp as of typing.

- There was no reaction in the space to the M/M dip in Melbourne Institute inflation expectations (-0.1%), while the Y/Y reading cooled a little (to 3.4% from the multi-year high of 4.0% observed in March). The space was back from best levels ahead of the prints, with no subsequent bid emerging.

- ANZ Job Ads dropped by 0.5% in April, although the measure remains 57.3% above the pre-pandemic level, with the data collator noting that “labour market conditions are very tight.”

- Focus is squarely on Tuesday’s RBA decision (the MNI markets team leans towards a 15bp rate hike come the end of tomorrow’s meeting, expect our full preview of the event to be released during the London morning).

FOREX: USD Firmer In Asia

A firmer USD became apparent after a fairly non-committal start to Asia-Pac dealing, with the greenback moving to the top of the G10 FX table, although the DXY operates a little shy of its recent cycle peak.

- No doubt the early moves higher in USD/CNH (linked to soft Chinese PMI data, angst surrounding Sino-U.S. relations & COVID worry, as Beijing deepened COVID limitations, while the case situation improved in Shanghai) & USD/JPY have played into the broader USD uptick. Note that both crosses remain comfortably within the recently observed ranges, with USD/CNH last +400 pips or so, just above CNH6.6800, while USD/JPY is ~65 pips firmer on the day, hovering around Y130.35.

- More broadly, the likely 50bp hike from the Fed on Wednesday, coupled with global recession fears and the expectation for further Fed tightening is playing into the USD bid at the start of a new week.

- Broader liquidity has been limited by holidays in Hong Kong, Singapore & China, while the observance of a holiday in London will hamper liquidity during European hours.

- Tier 1 headline flow has been relatively non-existent since the Asia open owing to widespread holidays across the region.

- The latest U.S. ISM manufacturing survey headlines the wider docket on Monday, with final Eurozone m’fing PMI data also due.

FX OPTIONS: Expiries for May02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E684mln), $1.0700-15(E1.1bln), $1.0800(E1.6bln)

EQUITIES: E-Minis Nudge Higher After Friday’s Weakness

Friday’s negative lead from Wall St. (which was seemingly based on guidance from tech giants Apple & Amazon, in addition to the impending spectre of further Fed tightening & higher U.S. Tsy yields, at least from a fundamental perspective) applied pressure to the major Asia-Pac equity indices that were open for trade on Monday. That leaves the Nikkei 225 -0.1% and the ASX 200 -1.2% at typing.

- Meanwhile, e-minis managed to recover some ground after the S&P 500 & NASDAQ 100 lost over 3.0% & 4.0%, respectively, during Friday’s cash trade. The 3 major e-mini contracts have managed to add 0.5-0.8% to their respective Friday settlement levels after non-committal, two-way dealing during early Asia hours. This came despite a more risk-negative feel to weekend headline flow.

GOLD: Bullion Starts The Week On The Defensive

A firmer USD has weighed on bullion during Asia-Pac dealing, with spot gold last down the best part of $10/oz, just below $1,890/oz. Gold continues to hold within the confines of the recently observed range, with our technical analyst noting that the precious metal remains vulnerable despite the recovery from Thursday’s low. That same Thursday low ($1,872.2/oz) provides the initial point of technical support, with any sustained breach there set to expose the 76.4% retracement of the Jan 28-Mar 8 rally ($1,848.8/oz). Bulls need to retake firm resistance in the form of the 20-day EMA to start turning the technical tide back in their favour.

- Known ETF holdings of gold seem to have found a bit of a short-term plateau after rising by 10% from the late December trough. Note that the metric currently operates ~4% below the record peak observed in ’20.

- Participants will be attuned to all things U.S. in the coming week, with the ISM manufacturing report (Monday), FOMC meeting (Wednesday) & NFP release (Friday) providing the major macro reference points over the coming days.

OIL: A Touch Lower To Start The Week

WTI & Brent crude futures have started the week on the backfoot, sitting ~$1.00 below their respective settlement levels at typing.

- A combination of a firmer USD and worries re: the COVID situation in China, after Beijing introduced stricter mobility restrictions (while the situation in Shanghai has improved), has weighed on crude prices.

- Elsewhere, Sunday saw Libya’s National Oil Corporation announce the “temporary” lifting of force majeure and resumption of operations at the Zueitina oil terminal to drawdown stock and free up storage space. This came after the NOC warned of “imminent environmental disaster” at the facility unless tanks were emptied. This could be providing an incremental amount of pressure to crude futures.

- Finally, a BBG source report re: the EU looking for an embargo of Russian oil by year end has failed to impact the space, with the NYT running a similar story on Friday and after Hungary expressed its willingness to veto such a move on the EU stage.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/05/2022 | 0600/0800 | ** |  | DE | retail sales |

| 02/05/2022 | 0715/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0745/0945 | ** |  | IT | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0750/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0755/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 02/05/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 02/05/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 02/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 02/05/2022 | 1400/1000 | *** |  | US | ISM Manufacturing Index |

| 02/05/2022 | 1400/1000 | * |  | US | Construction Spending |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 02/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.