-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: RBA Catches Market Off Guard

EXECUTIVE SUMMARY

- RBA CATCHES MARKET OFF GUARD WITH 25BP RATE HIKE

- U.S. SAYS RUSSIA'S PROGRESS IN DONBAS HAS BEEN "MINIMAL AT BEST" (AXIOS)

- TORIES SET TO LOSE 550 SEATS IN WORST LOCAL ELECTION PERFORMANCE IN A GENERATION (TELEGRAPH)

- CITI SAYS TRADER MADE ERROR BEHIND FLASH CRASH IN EUROPE STOCKS (BBG)

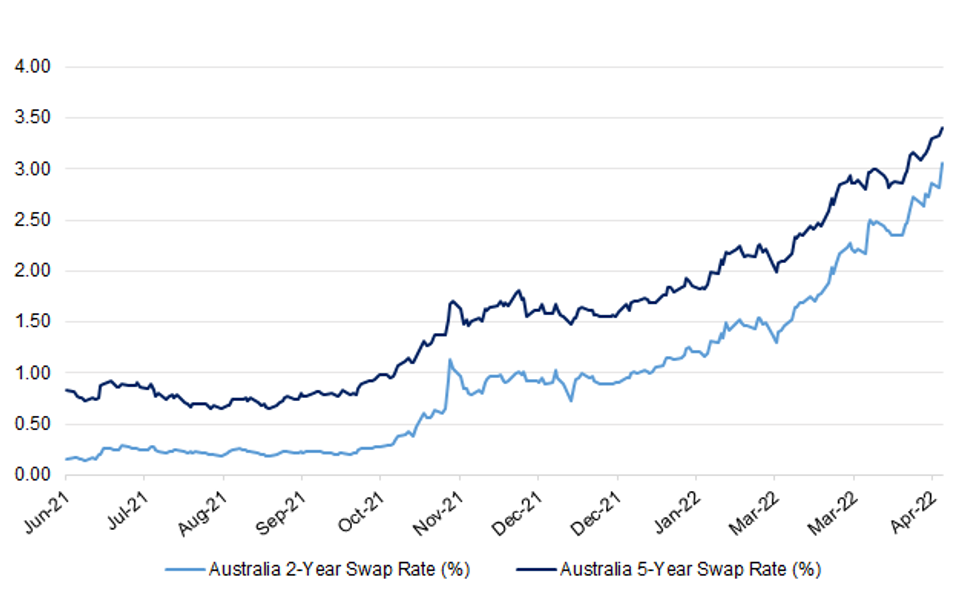

Fig. 1: Australia 2-Year & 5-Year Swap Rates (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: The Conservatives are on track to lose nearly 550 seats in the local elections in the worst performance since Sir Tony Blair led the Labour party in the Nineties, a survey predicted. Labour will hold 3,500 council seats, a gain of more than 800, whilst the Tories will retain just under 980, a fall of 548, according to the survey of 1,749 adults in the 201 councils going to the polls on Thursday. The Tories could lose control of its flagship councils of Wandsworth and Westminster, as well as Barnet, Southampton, Newcastle-under-Lyme and Thurrock. Labour, however, could gain 16 councils in a six per cent swing to the party away from the Conservatives. The findings, if replicated on Thursday, will be seen as a backlash by voters over “partygate.” (Telegraph)

EUROPE

FISCAL: MNI BRIEF: Ukraine-Hit States To Get Higher RRF

- The impact of the war in Ukraine will have an impact on the final share-out of Recovery Fund grants among member states, EU Economic Commissioner Paolo Gentiloni said Monday. In comments to the European Parliament, Gentiloni said the Commission was working to identify "additional reforms and investments" which could be undertaken by states to reduce their dependence on fossil fuels and diversify sources of fossil fuel imports - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ESM: MNI BRIEF: Eurogroup Head Reveals New ESM Head Shortlist

- Eurogroup Chair Paschal Donohoe has revealed the shortlist of candidates to succeed Klaus Regling as head of the European Stability Mechanism. The list includes: Italy's Marco Buti, a senior EU Commission official and currently Commissioner Paolo Gentiloni's chief of staff, Luxembourg's Pierre Gramegna, a former finance minister of Luxembourg. The Netherlands proposed Menno Snel, a former state secretary for finance, and Portugal put forward Joao Leao, another former finance minister. EU finance ministers will make a decision on which of the four will take over the role at their meeting on May 23 - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

ITALY: Italy on Monday approved a new stimulus package worth 14 billion euros ($14.71 billion) to shield firms and families from the economic impact of the war in Ukraine, Prime Minister Mario Draghi said. The measures will not push up the country's budget deficit this year and will partly be financed by increasing a windfall tax on energy companies, Draghi told reporters after cabinet approved the government decree. (RTRS)

EQUITIES: Citigroup Inc. said its London trading desk was behind a flash crash in Europe, which had sent shares across the continent tumbling after a sudden 8% decline in Swedish stocks. “This morning one of our traders made an error when inputting a transaction,” the New York-based bank said late Monday in an emailed statement. “Within minutes, we identified the error and corrected it.” Citigroup is in talks with regulators and exchanges about the incident, according to a person familiar with the matter who asked not to be named discussing non-public information. A knee-jerk selloff in OMX Stockholm 30 Index in five minutes wreaked havoc in bourses stretching from Paris to Warsaw toppling the main European index by as much as 3% and wiping out 300 billion euros ($315 billion) at one point. (BBG)

U.S.

FED: Federal Reserve officials have time before they need to agree on what constitutes a neutral level for monetary policy, but neutral may well be a lot higher than central bankers currently expect, Bill Nelson, chief economist at the Bank Policy Institute, writes in a note to clients. The former top Fed staffer writes that while officials appear to see something around 2.5% as neutral, inflation expectations data suggests neutral could be much higher, like 5% if the data is accurate. (WSJ)

ECONOMY: MNI INTERVIEW: ISM Miss Doesn't Signal Recession - Mfg Chief

- U.S. manufacturers are experiencing weaker business growth in the face of global disruptions but the sector will likely sustain moderate growth levels through 2023, and renewed supply troubles may actually lengthen the expansion as demand persists, Institute for Supply Management chair Timothy Fiore told MNI Monday. "If you look at the headline number you could say that there's indication that it would" lead to recession fears, Fiore said. "But, no, absolutely not. There's no end to demand here. We're still seeing 3-to-1 positive comments on demand" from manufacturers - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: MNI BRIEF: US Treasury Expects $26B In Pay Downs In Q2

- The U.S. Treasury Department on Monday announced it expects to pay down USD26 billion in privately-held net marketable debt in the second quarter, USD92 billion lower than announced in January, and the first pay down since the second quarter of 2016. The Treasury also announced it is assuming a higher end-of-quarter cash balance of USD800 billion, a hundred billion more than just a quarter ago, and higher because expected outflows as well as the timing of receipts. For the third quarter, Treasury plans to borrow USD182 billion, assuming an end-of-September cash balance of USD650 billion - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: U.S. Senate Majority Leader Chuck Schumer said on Monday he hoped the U.S. Senate would take up President Joe Biden's request for $33 billion in emergency aid for Ukraine as soon as next week. "It is my hope that a bipartisan agreement can be reached very soon and that the Senate can begin processing this aid package on the floor as early as next week," the Democratic leader said in remarks opening the Senate. (RTRS)

OTHER

GLOBAL TRADE: All tools are on the table to address rising inflation, including reductions of tariffs on Chinese imports, U.S. Trade Representative Katherine Tai said on Monday, but she stressed that any policy shift needed to keep medium-term goals in mind. "Sure we can look at those tariffs, but I'm giving you the ... strategic lens through which we need to be looking at," Tai told a conference hosted by the Milken Institute in Los Angeles. "The question is what do we do with them." Tai said whatever tools were deployed to tackle inflation should not undermine medium-term goals of building a more resilient, durable global economy that looked at people not just as consumers, but also as workers. (RTRS)

RBA: Australia’s central bank increased interest rates by more than economists had anticipated and signaled further hikes to come. The move aligns the country with the global fight against inflation in a year when at least 50monetary policy institutions that have already hiked rates. Later this week, central bankers in the U.S., Brazil, U.K., Czech Republic, Poland and Chile are predicted to raise borrowing costs again. (BBG)

AUSTRALIA: The heads of two of Australia’s biggest listed companies have revealed what’s top of their wish-list for the country’s economy in the run-up to the May 21 election: more people. Australia urgently needs to ramp up migration levels after the pandemic virtually stopped the influx of skilled workers that are vital to the country’s growth, according to Scott Charlton, chief executive officer of toll-road giant Transurban Group. To deliver large pipelines across the east coast of Australia including the 2032 Brisbane Olympics “we need development skills, we need construction skills and we need to increase that skilled migration,” he said in an interview with Bloomberg Television at the Macquarie Australia Conference. His comments were echoed soon after by Susan Lloyd-Hurwitz, CEO of Mirvac, the country’s largest diversified property group. (BBG)

AUSTRALIA: Transurban Group Chief Executive Officer Scott Charlton said toll-road traffic has fully rebounded in Australia and is almost at normal levels in the U.S. as businesses and consumers emerge from the pandemic. Traffic in Australia returned to pre-Covid levels for the first time in the past two weeks, and volumes in the U.S. are just 10% below, Charlton said in an interview on Bloomberg Television Tuesday. Freight traffic is 7% higher than it was before the pandemic, he said. “We’re really pleased to see the recovery flowing through to our major cities, particularly in Australia,” he said. Transurban operates 21 roads in Australia and North America, including Sydney’s Eastern Distributor and 95 Express Lanes in Greater Washington, according to its website. (BBG)

NEW ZEALAND: New Zealand’s government will set a target for budget surpluses and introduce a new cap on debt that’s higher than previous limits, allowing greater investment in infrastructure. Surpluses will be kept within a band of 0-2% of gross domestic product over time, Finance Minister Grant Robertson said in a pre-budget speech Tuesday in Wellington. A new measure of net debt will be introduced to bring New Zealand more in line with other countries, with a ceiling of 30% of GDP, he said. Under the previous measure, that equates to 50% of GDP. “It is a limit rather than a target, and again is flexible enough to allow a buffer against short-term shocks, while providing greater room for productive investment,” Robertson said. “The interaction of the two fiscal rules means that the additional debt cannot be used for day-to-day spending as that is limited by the surplus rule. This leaves the debt ceiling to guide capital investments needed in infrastructure to keep our economy moving.” (BBG)

NEW ZEALAND: Auckland's largest real estate agency experienced a dramatic decline in sales volumes in April, with selling prices also dropping. Barfoot & Thompson sold just 615 residential properties in April, down from 1107 in April last year. That's a fall of 44%. It was the lowest number of properties the agency has sold in the month of April since 2008, apart from April 2020 when New Zealand was in a Covid-19 lockdown. Conversely, the agency's stock levels are rising. At the end of April it had 4845 residential properties available for sale, up 45% compared to April last year. That meant the amount of properties available for sale on the agency's books was at its highest level for the month of April since 2011. Selling prices have also begun to fall. Barfoot's average selling price was $1,212,376 in April, down from $1,234,572 in March. The average selling price is now $66,271 lower than its December 2021 peak of $1,278,647. April's median selling price was $1,141,000, down by $99,000 compared to December's peak of $1,240,000. (Interest NZ)

NEW ZEALAND: Tourism Minister Stuart Nash wants to target “high quality” visitors going forward rather than the mass tourism market, he said in an interview with Bloomberg Television Tuesday in Wellington. Says high quality tourists are not high necessarily high net-worth -- they engage with local culture, they sample cuisine, they undertake adventure tourism. Wants to embrace regenerative tourism where visitors add value to communities and the eco-system. There are things to do in New Zealand where people will pay for the experience as they do all round the world but very rarely is there a differential payment for international tourists over domestic travelers. Will take 3-5 years to get back to the 3.9m annual visitor arrivals seen before the pandemic. (BBG)

BOK: A senior South Korean central bank official said on Tuesday the country's consumer inflation would likely stay above 4.0% for a while and stressed the need to manage inflation expectations. A Bank of Korea statement quoted Lee Hwan-seok, a deputy governor, as making the remarks at a meeting with other senior officials at the bank soon after data showed the country's consumer inflation hit a more than 13-year high in April. (RTRS)

SOUTH KOREA: South Korean President-elect Yoon Suk Yeol’s transition team is considering allowing banks to offer extended mortgage loans to support housing purchases of youth, Korea Economic Daily reports, citing unidentified people in the team and financial regulator. Currently 40-yr is longest term for mortgage in South Korea. (BBG)

NORTH KOREA: The chief nuclear envoys of South Korea and China are set to have discussions in Seoul on the Korean Peninsula security situations amid concerns about the Kim Jong-un regime's growing nuclear threats, according to officials Tuesday. The secretive North has even shown indications of preparing for another nuclear test. Liu Xiaoming, Beijing's special representative on Korean Peninsula affairs, arrived in Seoul on Sunday for his first trip to South Korea since assuming the post in April last year. He is scheduled to hold talks with his South Korean counterpart, Noh Kyu-duk, on Tuesday morning to share their assessments of the regional security situation and discuss ways for "managing it with stability," officials said. It would mark their first in-person meeting in their capacities as top nuclear envoys. (Yonhap)

HONG KONG: Hong Kong will further ease COVID-19 restrictions, allowing bars to open until 2 a.m. and raising the number of diners permitted at a table to eight from four, as cases in the global financial hub continue to ease, leader Carrie Lam said on Tuesday. Beaches and swimming pools would reopen from Thursday, when restaurants could also cater to four more people at each table, Lam said at a regular news briefing. The extended hours for bars, as well as the reopening of karaoke rooms and some other venues, would take effect from May 19. Hong Kong health authorities reported 283 cases of COVID-19 on Monday, the first time the daily tally has dropped below 300 in nearly three months. The city has recorded more than 1.2 million infections and over 9,300 deaths since the start of the pandemic. (RTRS)

MEXICO: Mexican national oil company Pemex on Monday reported a $6.17 billion first-quarter net profit, reversing a nearly $2 billion loss in the year-ago period, driven by foreign exchange gains, growing output and higher crude prices. (RTRS)

RUSSIA: The Pentagon assesses that Russia's progress in Ukraine's eastern Donbas region has been "minimal at best," with Russian forces continuing to suffer from "poor" command and control, low morale and recurring logistical problems, a senior U.S. defense official told reporters Monday. (Axios)

RUSSIA: The sanctions imposed on Russia in response to its invasion of Ukraine will not be lifted until Moscow reaches a peace agreement with Ukraine, German Chancellor Olaf Scholz said, adding that it was for Ukraine to determine the peace terms. (RTRS)

RUSSIA: A fresh European Union sanctions package over Russia's invasion of Ukraine is set to include "more Russian banks" being pushed out of the global SWIFT network, the bloc's top diplomat Josep Borrell said Monday. "In the banking sector, there will be more Russian banks that will leave SWIFT," the global banking communications system, Borrell said during a visit to Panama. (AFP)

EQUITIES: A brief bout of concern about the status of Alibaba Group Holding Ltd. co-founder Jack Ma triggered wild swings in shares of the e-commerce company on Tuesday, underscoring continued investor anxiety toward China’s tech sector after a year-long crackdown. Alibaba plunged as much as 9.4% in Hong Kong, erasing about $26 billion of market value, after state broadcaster CCTV reported that authorities in the company’s home base of Hangzhou had imposed curbs on an individual surnamed Ma. The stock rebounded after a statement from Hangzhou police indicated the accused person’s name covered three characters. CCTV also updated its report to show a third character. Jack Ma’s Chinese name is the two-character Ma Yun. (BBG)

ENERGY: Physical gas flows via the Yamal-Europe pipeline, which brings gas from Russia by way of Poland to Germany, stopped again after a brief resumption on Monday, data from the Gascade pipeline operator showed. Physical flows at the Mallnow metering point on the German border dropped to 0 after gas flows resumed westward from Poland to Germany at 82,233 kWh/h for a brief period, data from operator Gascade showed. Physical flows had earlier dropped to 0 shortly before resuming westward. The Yamal pipeline has mostly worked in a reverse mode since last December, sending gas eastward from Germany to Poland. However, Russian gas giant Gazprom has not booked any gas transit capacity via the Yamal-Europe pipeline for the third quarter, Interfax news agency reported on Monday, citing the latest auction results on the GSA Platform. (RTRS)

ENERGY: The European Union warned member states Monday to prepare for a possible complete breakdown in gas supplies from Russia, insisting it would not cede to Moscow's demand that imports be paid for in rubles. The European Commission will on Tuesday propose to member states a new package of sanctions to punish President Vladimir Putin's Kremlin for its invasion of Ukraine, including an embargo on Russian oil, officials said. But energy and environment ministers meeting in Brussels on Monday addressed the larger and potentially more complicated issue of Russia's natural gas, upon which several countries -- including EU top economy Germany -- depend for much of their power generation. Moscow has demanded clients from "unfriendly countries" -- including EU member states -- pay for gas in rubles, a way to sidestep Western financial sanctions against its central bank. It has cut off Bulgaria and Poland after their firms refused to comply. After the talks, the French chair of the meeting, ecological transition minister Barbara Pompili, and the European commissioner for energy, Kadri Simson, said the 27 member states were united with Poland and Bulgaria and would stockpile (AFP)

ENERGY: Hungary will not vote for any measures prepared by the European Union that could endanger the security of its oil or gas supply, Foreign Minister Peter Szijjarto said, reiterating the country's position on Monday to RTL television. (RTRS)

OIL: Record fuel exports from the U.S. Gulf Coast are eating into domestic supplies, leaving gasoline and diesel tanks on the East Coast emptier than they have been in decades. As much as 2.09 million barrels a day of gasoline, diesel and jet fuel shipped out of the refining hub in April, the highest level since oil analytics firm Vortexa began tracking the data in 2016. The bulk of the exports went to Latin America. The strong pull from overseas shows the world needs U.S. Gulf Coast refiners more than ever. But producers there will have to balance lucrative exports with domestic demand heading into the peak travel season this summer, with pump prices already at record highs for diesel and hovering just shy of peak for gasoline. (BBG)

OVERNIGHT DATA

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 90.7; 96.5

Consumer confidence plunged 6.0% last week, its sharpest fall since the 7.6% drop in mid-January due to the Omicron surge. The strong inflation result of 5.1% y/y was likely the primary driver of the drop in confidence as it increases the prospect of interest rate hikes by the RBA in the near future. This is supported by the fact confidence dropped 9.6% amongst people ‘paying off their home loan’, while for people who already own their home or are renting confidence dropped by 4.7% and 4.2% respectively. Inflation expectations increased 0.2ppt to 5.3% last week as average petrol prices rose nationally. This is the lowest level for consumer confidence at the start of a tightening cycle since the inflation targeting regime began in the early 1990s. This may see the RBA tighten more slowly than the market is pricing. (ANZ)

NEW ZEALAND MAR BUILDING PERMITS +5.8% M/M; FEB +12.2%

SOUTH KOREA APR CPI +4.8% Y/Y; MEDIAN +4.4%; MAR +4.1%

SOUTH KOREA APR CPI +0.7% Y/Y; MEDIAN +0.4%; MAR +0.7%

SOUTH KOREA APR CORE CPI +3.6% Y/Y; MAR +3.3%

MARKETS

SNAPSHOT: RBA Catches Market Off Guard

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 is closed

- ASX 200 down 20.99 points at 7326

- Shanghai Comp. is closed

- JGBs are closed

- Aussie 10-Yr future down 9.5 ticks at 96.6, Aussie 10-Yr yield up 9.2bp at 3.352%

- U.S. 10-Yr future unch. at 118-11, cash Tsys are closed

- WTI crude up $0.03 at $105.21, Gold down $3.66 at $1859.32

- USD/JPY down 5 pips at Y130.11

- RBA CATCHES MARKET OFF GUARD WITH 25BP RATE HIKE

- U.S. SAYS RUSSIA'S PROGRESS IN DONBAS HAS BEEN "MINIMAL AT BEST" (AXIOS)

- TORIES SET TO LOSE 550 SEATS IN WORST LOCAL ELECTION PERFORMANCE IN A GENERATION (TELEGRAPH)

- CITI SAYS TRADER MADE ERROR BEHIND FLASH CRASH IN EUROPE STOCKS (BBG)

US TSYS: Pressured BY RBA After Quiet Asia Session

The hawkish RBA decision has applied pressure to Tsy futures into London hours, allowing the Asia-Pac session range in TYM2 to extend to a still narrow 0-07 band. The contract last sits +0-00+ at 118-11+, operating on a lowly ~45K lots.

- A reminder that cash Tsys are closed until London hours owing to a Japanese holiday, while holidays in both Singapore and China are further limiting liquidity.

- A brief Alibaba-related sell off in the Hang Seng provided the most modest of bids during early Asia dealing, although that faded and allowed Tsys to move back from best levels pre-RBA.

- There wasn’t anything in the way of meaningful macro headline news flow to digest, leaving participants sidelined ahead of this week’s impending even risk (FOMC {& NFPs).

- Wednesday’s NY docket will see the release of factory orders, final durable goods readings and JOLTS job openings.

AUSSIE BONDS: Fresh Cycle Lows As RBA Surprises With 25bp Hike

Fresh cycle lows for both YM & XM as the RBA provides a larger than expected 25bp cash rate, while marking its near-term inflation forecast notably higher, indicating that both headline and underlying inflation will only fall back to the upper end of its target band by around mid-24.

- This provided a very hawkish tinge to the statement, with the Bank noting that the inflation outlook “will require a further lift in interest rates over the period ahead. The Board will continue to closely monitor the incoming information and evolving balance of risks as it determines the timing and extent of future interest rate increases.”

- A markdown in GDP expectations and a slight mark lower for the unemployment track were also indicated.

- It is had to get a handle on why the RBA chose to deploy a 25bp rate hike, did it view 40bp as too aggressive with the risk of destabilising bond/funding markets? Or did it want to show that it was willing to think outside of the box?

- YM last prints 15.5 ticks lower on the day, with XM -9.0 as the curve bear flattens. Note that both contracts hover a touch above session lows.

- Bills run 10-22 ticks lower through the reds with IRU2 & IRZ2 underperforming.

- Governor Lowe will speak ahead of the Sydney session close (16:00 Sydney/07:00 London).

EQUITIES: Alibaba Headlines Dominate In Asia

Hong Kong equity trade provided one of the focal points of a holiday-constrained Asia-Pac session.

- The Hang Seng Tech Index shed over 4.0% in early dealing as participants returned from their elongated weekend. Softer than expected Chinese PMI data released over the weekend applied some pressure, but there was also some idiosyncratic news to factor in. Alibaba shares tumbled by nearly 10% after CCTV reported that China imposed “compulsory measures” on an individual with the surname of Ma, with the matter tied to national security. Speculation did the rounds that the individual involved could be Alibaba founder Jack Ma. We then saw some reprieve for both the tech sector and the wider Hang Seng as it became apparent that Jack Ma was not the individual in question. That, coupled with news of the next stage of relaxation of COVID curbs in Hong Kong, allowed the Hang Seng to recover. The Hang Seng Tech is now 0.5% lower on the day, comfortably above its early session trough, with Alibaba shares now in positive territory. The benchmark Hang Seng index is +0.3%.

- The ASX 200 unwound early losses and is little changed on the session.

- E-mini futures are 0.3-0.5% higher on the day, after the major Wall St. indices recovered Monday’s early losses ahead of the NY close, before pushing higher.

- Elsewhere, it is worth noting that Citi confirmed that its trading desk was behind Monday’s flash crash in Swedish equities. The bank noted that one of its traders “made an error when inputting a transaction. Within minutes, we identified the error and corrected it.”

OIL: Marginally Higher In Asia After Monday’s Recovery

WTI & Brent crude futures sit ~$0.25 above their respective settlement levels at typing, with participants having little to trade off in overnight dealing.

- A reminder that Monday saw the early Chinese-inspired weakness, stemming from worry re: the COVID situation in Beijing & soft PMI data, countered by demand for refined products. This allowed the early losses in crude to be reversed, as the two major benchmarks finished with modest gains, aided by the continued global distaste (in general, not absolute terms) for Russian fuel.

- Weekly API inventory data is due late in the NY day on Tuesday.

GOLD: U.S. Real Yields Weigh Early In The Week

Gold has stuck to a narrow range in Asia-Pac dealing, last sitting just above $1,860/oz, little changed on the day. Monday’s shunt higher in U.S. real yields, which saw 10-Year real yields register a fresh cycle high and the first close in positive territory during the current cycle, allowed bears to force bullion below last week’s low. They now look to the 76.4% retracement of the Jan 28-Mar 8 rally ($1,848.8/oz) as the next area of meaningful technical support as the bearish threat intensifies

FOREX: Hawkish RBA Rate Decision Boosts Aussie Dollar

Risk-on flows took hold in a partial reversal of Monday's price action, while hawkish surprises provided by the RBA’s monetary policy decision boosted the Aussie dollar.

- Australia's central bank raised the cash rate target by 25bp and signalled that meeting its inflation target “will require a further lift in interest rates over the period ahead”. Consensus was looking for a 15bp hike, while the swaps market was pricing just shy of that amount.

- It was a live meeting and ahead of the rate decision announcement, AUD/USD overnight implied volatility reached its highest point since the eve of the RBA's monetary policy decision delivered on Mar 2, 2021.

- Post-RBA impetus allowed AUD/USD to surged above the $0.7100 mark, which kept a lid on gains earlier in the Asia-Pac session. AUD/NZD took out resistance from the psychologically significant NZ$1.1000 figure, which limited gains on Apr 21, and attacked next resistance from Aug 18, 2020 high of NZ$1.1044.

- The greenback dropped back after yesterday's rally. Reminder that the FOMC also holds a policy meeting this week, with the outcome due to be announced on Wednesday.

- Offshore yuan reversed its initial gains after CCTV reported that the authorities in Hangzhou slapped curbs on an individual surnamed "Ma", even as Alibaba's shares rebounded as a statement from local police suggested that the tech giant’s co-founder could not be the person in question.

- Activity in Asia was limited by holiday closures in some major regional financial centres including mainland China, Japan and Singapore.

- Later in the day, focus will turn to U.S. factory orders & final durable goods orders, EZ jobs data as well as comments from BoC's Rogers.

FX OPTIONS: Expiries for May03 NY cut 1000ET (Source DTCC)

- USD/JPY: Y127.00($860mln), Y129.75($550mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 03/05/2022 | 0755/0955 | ** |  | DE | unemployment |

| 03/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Manufacturing PMI (Final) |

| 03/05/2022 | 0900/1100 | ** |  | EU | PPI |

| 03/05/2022 | 0900/1100 | ** |  | EU | unemployment |

| 03/05/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 03/05/2022 | - |  | EU | ECB Lagarde & Panetta in Eurogroup Meeting | |

| 03/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 03/05/2022 | 1300/1500 |  | EU | ECB Lagarde High School Q&A | |

| 03/05/2022 | 1400/1000 | ** |  | US | factory new orders |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 03/05/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 03/05/2022 | 1515/1615 |  | UK | BOE Mutton Panellist at Bankers Association | |

| 03/05/2022 | 1630/1230 |  | CA | BOC Sr Deputy Rogers speaks on operational independence |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.