-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NFP Day

- Core FI markets moved away from worst levels after 10-Year U.S. Tsy yields failed to breach their cycle peaks, with NFPs eyed.

- Offshore yuan went offered despite the PBOC's continued efforts to push back against its depreciation via the daily USD/CNY fixing. Spot USD/CNH ripped through the CNH6.7000 figure for the first time since Nov 2020, which generated an incremental tailwind for USD crosses across the board, keeping the DXY close to its recent cycle highs. Gains for USD/CNH were capped at CNH7339 and the pair eased off from there, while consolidating above CNH6.7000.

- The aforementioned U.S. NFP report headlines the global data docket on Friday, with Canada also due to report its labour market figures. Elsewhere, There is plenty of central bank speak coming up today, from a diverse cohort of Fed, ECB, BoE & Riksbank members. Finally, the fallout from the UK local elections will be worth watching.

US DATA PREVIEW: MNI US Payrolls Preview: Labor Supply Seen Limiting Jobs Gains

EXECUTIVE SUMMARY

- Nonfarm paryolls are expected to have risen by 380k in April according to the Bloomberg survey median or 400k with the primary dealer median with relatively even dispersion.

- Average hourly earnings growth is seen unchanged at +0.4% M/M whist the unemployment rate is forecast to fall another tenth to joint pre-pandemic lows of 3.5%.

- Fresh on the tail of the FOMC, a high bar for non-50bp hikes has been set and there’s still another payrolls report on Jun 3 ahead of the next FOMC on Jun 15, but nuances remain.

- Click the following link for full document:USNFPMay2022Preview.pdf

US DATA PREVIEW: Primary Dealer NFP Estimates

| Dealer | Estimate | Dealer | Estimate |

|---|---|---|---|

| Daiwa | +500K | J.P.Morgan | +475K |

| Jefferies | +475K | Morgan Stanley | +475K |

| Societe Generale | +475K | BNP Paribas | +460K |

| Barclays | +450K | Bank of America | +450K |

| Amherst Pierpoint | +440K | RBC | +420K |

| HSBC | +405K | NatWest | +400K |

| Scotiabank | +400K | TD Securities | +400K |

| BMO | +380K | Citi | +360K |

| Credit Suisse | +350K | Mizuho | +350K |

| Nomura | +340K | Deutsche Bank | +300K |

| Goldman Sachs | +300K | UBS | +300K |

| Wells Fargo | +300K | ||

| Dealer Median | +400K | BBG Whisper | +325K |

US TSYS: Back From Early Cheaps, NFPs Eyed

TYM2 is +0-02+ at 118-04+ ahead of London hours, trading closer to the top than the base of its 0-15 overnight range, on volume of ~150K. Cash Tsys sit 0.5-1.5bp cheaper on the day.

- Asia-Pac participants were happy to sell Tsys in early dealing, although there was a lack of overt headline catalysts apparent. This meant that most pointed to Japanese reaction after the three-day Tokyo holiday, while a fresh leg higher in USD/CNH wouldn’t have harmed the early Tsy dynamic.

- Still, a bid has come back into the space, with the failure of 10-Year yields and TY futures when it came to cracking below their respective cycle cheaps allowing the space to correct from worst levels.

- Swap and invoice spreads are back from their Thursday tights, which suggests that cash Tsys at least when compared to futures, and payside swap flow helped the early cheapening move, at least incrementally (a reversal of what was observed during Thursday’s NY session, when the cheapening seemed to be futures driven).

- All in, it was quiet when it came to macro headline flow during Asia-Pacific hours, with participants awaiting the monthly NFP print (see our full preview of that release here).

- Elsewhere, there will be a deluge of Fedspeak on Friday, with Williams, Waller, Bullard, Kashkari, Daly & Bostic (Bullard & Daly will speak after market) all due up.

JGBS: Cheaper After The Holiday, But Off Lows

JGB futures are a touch above worst levels, last -19 on the day. Meanwhile, cash JGBs sit 0.5-2.5bp cheaper across the curve, bear steepening.

- Tokyo participants played catch up after their three-day holiday, with firmer than expected Tokyo CPI data (largely driven by a waning impact of lower mobile phone costs and the well documented jump in energy prices) also factoring into the weakness that was observed. Re: the latter, this will not impact BoJ policy, given the Bank’s continue focus on a lack of demand-pull inflation.

- Payside flows in swaps also seemed to help the weakness, with 5+-Year swap spreads wider on the day.

- The BoJ continues to offer fixed rate operations on a daily basis as it looks to hammer home its commitment to enforcing the upper end of its permitted 10-Year JGB yield trading band. Note that 10-Year JGB yields sit at ~0.24%, 1bp shy of the BoJ’s YCC upper limit.

- Off-the-run supply saw the spreads widen a touch via the prior 1- to 5-Year liquidity enhancement auction, while the cover ratio ticked higher. There was nothing in the way of meaningful reaction post-supply, with the stabilisation away from lows in wider core FI markets helping JGBs find a bit of a base after the Tokyo lunch break.

- Domestic news flow focused on the further wind back of COVID-related border restrictions.

- Looking ahead, wage data headlines the domestic docket on Monday, with the latest round of BoJ Rinban operations and outdated meeting minutes from the Bank’s March MPM also slated.

AUSSIE BONDS: Off Lows, Largely Being Driven By U.S. Tsy Flows

Flows surrounding U.S. Tys were a dominant factor for the space during Sydney dealing. Meanwhile, the removal of any hedging pressure after A$500mn of 2030-32 NSW TCorp issuance priced further played into the move away from worst levels of the Sydney session.

- YM -6.0 and XM & XM -7.0 at typing, after both failed to get anywhere near challenging their respective cycle lows earlier in the session.

- ACGB Nov-27 supply saw the weighted average yield print 1.19bp through prevailing mids, although cover came in at ~2.50x. As we flagged in our preview, it would seem that market vol. and the hawkish RBA market pricing is keeping many prospective bidders sidelined, while the lack of liquidity means that those that want to guarantee access to the line are having to pay up at auction.

- Elsewhere, the formal release of the RBA’s SoMP provided little impetus for markets as the RBA’s post-meeting statement and Governor Lowe’s subsequent press conference had already fleshed out the shift in the Bank’s inflation forecasts. Wage growth expectations were marked higher, with such a move also flagged in the Bank’s post-decision rhetoric. There was nothing in the way of further discussion when it came to terminal & neutral rate assumptions.

- Next week’s AOFM issuance slate is a little busier, with some Note supply, a couple of ACGB auctions (including A$400mn of ACGB Jun-51) and indexed issuance all due.

FOREX: Yuan In Retreat Despite Appreciation Bias In PBOC Fix, Yen Goes Offered After Holiday

Offshore yuan went offered despite the PBOC's continued efforts to push back against its depreciation via the daily USD/CNY fixing. Spot USD/CNH ripped through the CNH6.7000 figure for the first time since Nov 2020, which generated an incremental tailwind for USD crosses across the board, keeping the DXY close to its recent cycle highs. Gains for USD/CNH were capped at CNH7339 and the pair eased off from there, while consolidating above CNH6.7000.

- The yen went offered as Japanese financial markets re-opened after a three-day hiatus. USD/JPY extended its rally after yesterday's swing into a weekly gain. This puts the rate on track for a ninth consecutive week of gains, the longest uninterrupted winning streak since 2013.

- Sterling regained poise with BoE monetary policy decision & accompanying gloomy economic forecasts already in the rear-view mirror. Vote counting began overnight after the UK held local elections on Thursday.

- U.S. NFP repot headlines the global data docket on Friday, with Canada also due to report its labour market figures.

- There is plenty of central bank speak coming up today, from a diverse cohort of Fed, ECB, BoE & Riksbank members.

FOREX OPTIONS: Expiries for May06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0425-30(E550mln), $1.0570-75(E523mln), $1.0600(E581mln), $1.0650(E782mln), $1.0700(E569mln)

- GBPUSD: $1.2450(Gbp542mln)

- EUR/GBP: Gbp0.8500-10(E551mln), Gbp0.8575(E755mln)

- USD/JPY: Y128.50($1.1bln)

- AUD/USD: $0.7100(A$765mln), $0.7200(A$931mln), $0.7300(A$2.1bln)

- AUD/NZD: N$1.1000(A$509mln), N$1.1050(A$507mln)

- USD/CAD: C$1.2700($639mln), C$1.2750-60($934mln), C$1.2800($991mln), C$1.2840($1.4bln), C$1.3055($1.7bln)

- USD/CNY: Cny6.6500($630mln), Cny6.7000($1.5bln)

ASIA FX: Asia EM FX Under Pressure, Firmer Than Expected PBOC Fix Ignored

USD/Asia crosses traded on a firmer footing as onshore markets across the region reacted to the overnight risk-off impulse. The PBOC continued to lean against redback weakness via its yuan fixing, but to no avail.

- CNH: Spot USD/CNH shot higher, piercing the CNH6.70 mark for the first time since Nov 2020. Offshore yuan was unfazed by the fact that the PBOC set the USD/CNY reference rate 47 pips below the sell-side estimate, displaying appreciation bias for the fourth time in a row. Worth noting that during Thursday's meeting of Politburo Standing Committee, China's top brass reaffirmed their adherence to Covid-Zero strategy and warned critics against questioning harsh disease-fighting methods.

- KRW: Spot USD/KRW rallied to a fresh cycle high as trading in South Korea resumed after a public holiday. Vice FinMin Lee warned that officials are monitoring markets and stand ready to take stabilisation steps if needed.

- MYR: Spot USD/MYR turned bid, printing its best levels in more than two years, after resistance from Apr 28 high of MYR4.3687 gave way.

- PHP: Spot USD/PHP remained within touching distance from key PHP52.500 resistance level. Local data releases provided no meaningful impetus, amid continued tightening in the labour market coupled with a larger than expected deepening in monthly trade deficit. Reminder that on Monday Philippine voters will cast their ballots in national and local elections.

- THB: The baht went offered, albeit USD/THB failed to attack recent cycle highs. PM Prayuth was scheduled to chair a meeting of the nation's energy policy committee, which could see officials discuss the recently lifted diesel price cap.

- INR: The rupee lost ground in line with regional trend. Participants assessed a BBG source report released after hours Thursday, which noted that the Reserve Bank of India "may extend interest-rate hikes amid worries inflation would exceed its mandated target (...), although a three-quarter point increase is unlikely in the June meeting."

- Financial markets in Indonesia remained closed for holidays.

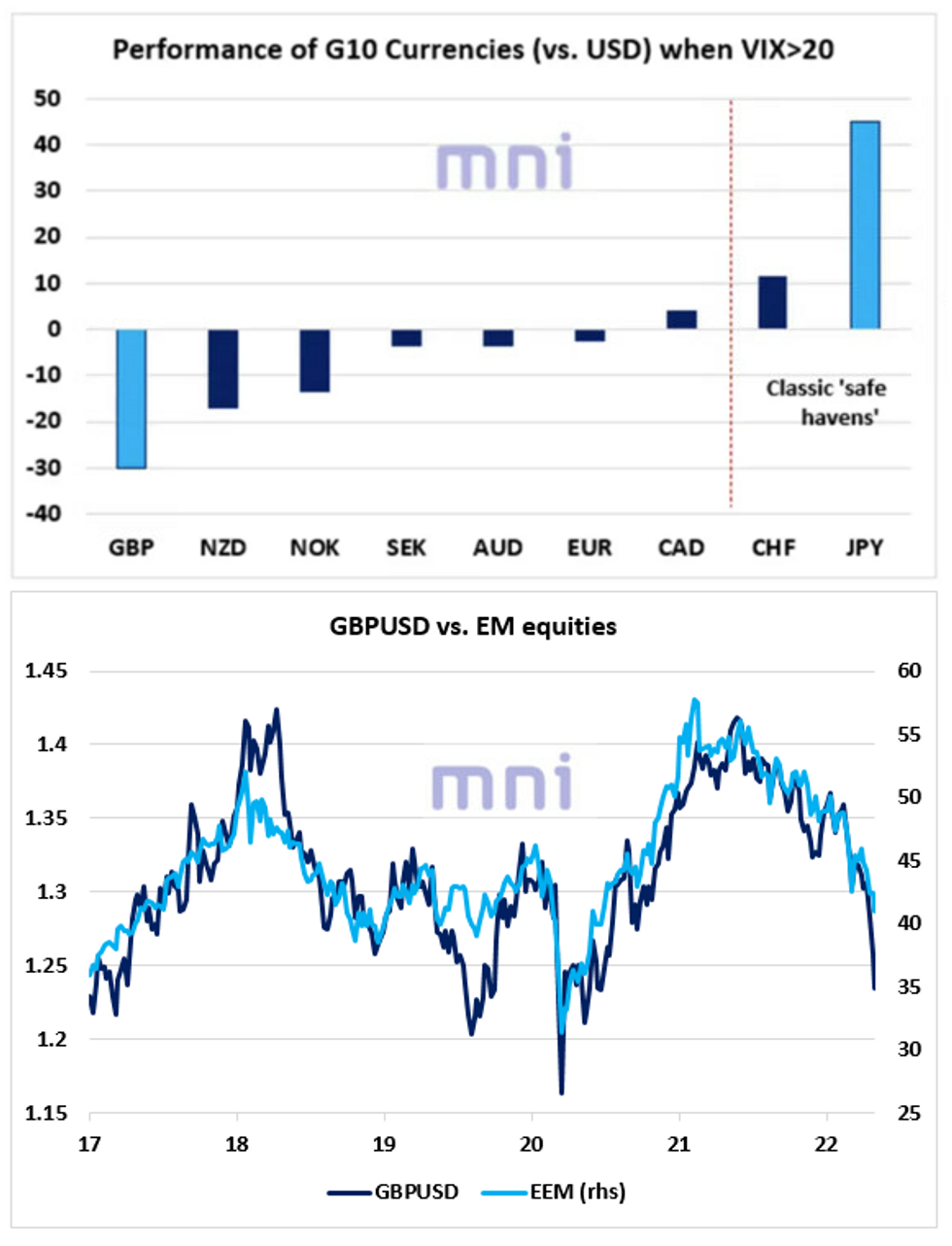

FOREX: GBP Confirms Status as EM Currency

- Global risk off environment combined with renewed geopolitical risk have been weighing on 'risk-on' assets, including GBP.

- Historically, the British pound has been the weakest performing currency in high-volatility regime among the G10 world, averaging -30bps in monthly returns when VIX is trading above 20.

- The top chart shows the average monthly performance of the G9 currencies (vs. USD) when the VIX rises above 20 since January 1990 (VIX inception); the choice is arbitrary but a VIX higher than 20 has generally been defined as a 'high-volatility regime'.

- In addition, we have seen that GBP/USD has shown a strong co-movement with EM equities since the EU referendum in June 2016 (bottom chart).

- Therefore, the underperformance of theUK economy (relative to the US), rising recession risks (BoE raised flag today that UK is heading for a recession), vulnerable EM equities and persistent USD strength could continue to weigh on Sterling in the near to medium term.

- Cable broke back below its 1.25 support in today's trading session, which corresponds to the 61.8% Fibo retracement of the 1.1410 - 1.4250 range.

- Next support to watch on the downside stands at 1.2260 (June 2020 low).

Source: Bloomberg/MNI.

EQUITIES: Lower In Asia; JPY Weakness Helps Japan Avoid Peer Rout

Most Asia-Pac equity indices are lower at writing, largely tracking Wall St.’s rout on Thursday. Richly valued names across sectors and geographies broadly led losses, with spillover debate from the NY session re: highly-valued equities in a time of rising rates, doing the rounds in Asia.

- The Hang Seng brought up the rear amongst index peers, trading 3.6% lower at typing. Investors are continuing to shrug off multiple specifically-worded pledges from Chinese authorities and state media to support the development of “internet platform companies”, with the Hang Seng Tech Index sitting 5.0% worse off at typing, led by losses in Tencent (-4.5%), JD.com (-6.7%), and Bilbili (-9.0%). The selloff in China-based tech largely tracks a decline in the NASDAQ Golden Dragon China Index (-7.7%) on Thursday, with the move in the latter coming amidst notable weakness in tech and software-related names during the NY session.

- The Nikkei 225 bucked the broader negative trend, outperforming major equity index peers on its first day back from a three-day holiday, sitting 0.9% better off and operating at session highs at typing. Energy and utility equities saw the most gains, tracking gains in major energy benchmarks over the holiday period. Export-related names (such as automakers) caught a broad bid as well, with large-caps such as Fast Retailing (+1.6%) rising amidst another bout of JPY weakness. Overall, ~200 of the index’s 225 constituents are in the green at typing.

- U.S. e-mini equity index futures are virtually unchanged at writing, belying a 3.1% to 5.0% lower daily close on Thursday, led by losses in NASDAQ contracts. The overall move lower has erased virtually all post-FOMC gains, seeing the e-minis operate at ranges seen earlier in the week.

GOLD: Headed For Pre-FOMC Range As Dollar, Nominal Tsy Yields Surge

Gold sits ~$5/oz lower, printing $1,872/oz at typing. The move lower extends Thursday’s losses and sees the precious metal give up virtually all post-FOMC gains, with the weakness facilitated by an uptick in nominal U.S. Tsy yields and the USD (DXY) during the session.

- To recap, gold closed ~$11/oz lower on Thursday as U.S. real yields and the USD (DXY) broadly surged to/above pre-FOMC levels, facilitating a sharp decline in the NY session after hitting one-week highs at $1,909.8/oz.

- Zooming out, the yellow metal trades in a range just above 11-week lows made earlier this week, with the geopolitical risk premium re: the Russia-Ukraine conflict almost entirely countered by evident worry re: rising rates and Dollar strength.

- Looking ahead, U.S. labour data (NFPs, AHE, Hours Worked etc.) crosses later on Friday at 1230 GMT. A note that this comes after the ADP employment data miss and ISM Services employment sub-component decline earlier in the week, while also keeping in mind debate re: the long-term correlation between ADP and NFP data.

- From a technical perspective, resistance for bullion is situated around $1,913.9.oz (20-Day EMA), while support is eyed at $1,850.5/oz (May 3 low).

OIL: Higher In Asia; WTI Holding Below Multi-Week Highs

WTI and Brent are ~$0.50 firmer apiece at writing to print $108.80 and $111.40 respectively, having risen above neutral levels to extend a move off of Thursday’s trough.

- To recap, WTI and Brent pared gains after hitting nine-week ($111.37) and three-week ($114.00) highs respectively on Thursday, both ultimately closing little changed on the day. Worry over stagflation and Dollar strength has continued to take centre stage against well-documented fears over disruptions to global supplies, with downward pressure from issues such as Chinese energy demand destruction receding as the country shows signs of bringing the current COVID outbreak under control.

- To elaborate on the latter, COVID cases in China have continued their steady downtrend, with officials in Shanghai declaring that community spread there has been “effectively contained”. The matter may bear watching however, with surveys of Japanese factories in Shanghai reportedly pointing to a majority still being shut, with those opening reporting reduced output as well. Cases in Beijing have continued edging upwards as well (count for May 5 stands at 72 vs 50 for May 4), coming as China’s Politburo doubled down on their COVID-Zero strategy on Thursday.

- Elsewhere, the U.S. govt fuelled some concern re: tight fuel supplies, announcing a plan to buy up to 60mn bbls of crude for strategic reserves by end-2022, with delivery to happen sometime “after FY23”. The move was tipped as part of an effort to replenish the planned 180mn bbl drawdown announced earlier this year, potentially paving the way for similar announcements in the future.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/05/2022 | 0545/0745 | ** |  | CH | Unemployment |

| 06/05/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 06/05/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 06/05/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 06/05/2022 | 0730/0930 |  | SE | Riksbank Minutes April meet | |

| 06/05/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 06/05/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/05/2022 | 1115/1215 |  | UK | BOE Pill Monetary Policy Report National Agency briefing | |

| 06/05/2022 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 06/05/2022 | 1230/0830 | *** |  | US | Employment Report |

| 06/05/2022 | 1315/0915 |  | US | New York Fed's John Williams | |

| 06/05/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 06/05/2022 | 1500/1600 |  | UK | BOE Tenreyro Lecture at Irish Economic Association | |

| 06/05/2022 | 1500/1100 |  | US | Minneapolis Fed's Neel Kashkari | |

| 06/05/2022 | 1900/1500 | * |  | US | Consumer Credit |

| 06/05/2022 | 1920/1520 |  | US | Atlanta Fed's Raphael Bostic |

To read the full story

Sign up now for free trial access to this content.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.