-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Market Flows Dominate In Final Asia-Pac Session Of The Week

EXECUTIVE SUMMARY

- POWELL SAYS HE CAN’T GUARANTEE A ‘SOFT LANDING’ AS THE FED LOOKS TO CONTROL INFLATION (CNBC)

- KURODA SAYS IMPORTANT FOR BOJ TO SUPPORT ECONOMY WITH EASING NOW (BBG)

- MNI INSIGHT: RBA COMFORTABLE WITH STRONGER WAGES GROWTH

- CHINA PRESS: FOREX TRADERS EXPECT A YUAN REBOUND IN THE NEAR TERM (HERALD)

- RUSSIA COULD CUT GAS SUPPLY TO FINLAND ON FRIDAY (RTRS)

- EU STARTS TO MULL DELAY IN OIL SANCTIONS AS HUNGARY DIGS IN (BBG)

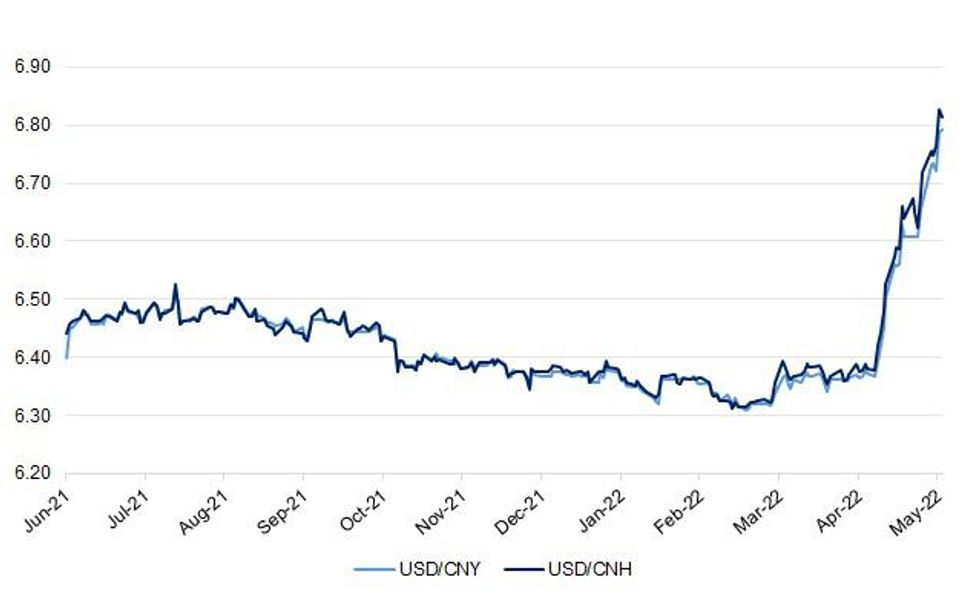

Fig. 1: USD/CNY vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson must show the same leadership over Northern Ireland as he has on Ukraine by ripping up the Northern Ireland Protocol, Lord Frost has said. The former Brexit minister, the architect of the 2019 withdrawal deal, said efforts to broker an agreement had "reached the end of the road". He urged the Prime Minister to act now to save the Union even if that meant "confrontation" with the EU. Writing for The Telegraph, he said Sinn Fein's victory in last week's Stormont elections and the refusal of the DUP to enter a power-sharing agreement had "forced the Government's hand". "The Government has no option now other than to act unilaterally to disapply part or all of the Protocol. The Belfast Good Friday Agreement, which the Protocol is supposed to protect, is on life support," he wrote. "Sometimes governments and their leaders must just do the right thing. Fortunately, doing the right thing is usually also the best thing for our country. (Telegraph)

BREXIT: A delegation of influential US congress representatives will fly to London within days amid growing concern in the White House about spiralling tensions over the Northern Ireland protocol, the Guardian can reveal. With the UK government poised to table legislation next week which could revoke parts of the protocol, arrangements are being made for at least half a dozen representatives from the US Congress to fly to Europe for a series of meetings in Brussels, Dublin, London and Belfast. The delegation will be headed by the influential chair of the ways and means committee, Richie Neal, which has significant power over future trade deals. Antony Blinken, the US secretary of state, has previously said the US intends to appoint its own envoy to Northern Ireland. (Guardian)

POLITICS: Boris Johnson has a “big mountain to climb” if he is to lead the Tories to victory at the next election, the former foreign secretary Jeremy Hunt has warned as he refuses to rule out a leadership bid. In his starkest criticism of the government to date, Hunt said that the Tories’ loss of nearly 500 seats in last week’s local elections was not just “mid-term blues” but reflected deep concerns of voters about the cost of living. He warned that the “very, very low growth” of the economy risked undermining the NHS as it faced “ever increasing bills” and shortages of doctors. (The Times)

POLITICS: Swing voters in Tiverton & Honiton have said that they will not vote for the Conservatives until the “lying buffoon” Boris Johnson has quit, boosting the Liberal Democrats’ hopes in an impending by-election. A focus group for Times Radio found that voters in the Devon constituency who supported the Tories in the last election were swinging towards the Lib Dems as they lost faith in the prime minister. Some said that they would never vote for the party until it had a different leader despite a lukewarm reception for Labour’s Sir Keir Starmer, who was described as bland. The findings will boost Lib Dem hopes of overturning a 24,239 Tory majority in a by-election prompted by the resignation of Neil Parish. (The Times)

BOE: Senior Conservative MPs have turned on the Bank of England over its handling of inflation, in a rare outbreak of political criticism of the central bank in the way it is doing its core job. Liam Fox, a former cabinet minister, told the Commons that the BoE had “consistently underestimated the threat” of rising inflation, which the BoE fears could top 10 per cent later this year. “The BoE persisted beyond any rational interpretation of the data to tell us that inflation was transient, then that it would peak at 5 per cent,” he said. Fox said the Commons Treasury select committee should launch an investigation into the central bank’s handling of inflation. One member of the government said that the BoE had “got it completely wrong at every single moment of this crisis” and it should have “obviously” tightened monetary policy sooner. (FT)

FISCAL/ECONOMY: Boris Johnson and Rishi Sunak have discussed dramatically reducing the number of civil servants further than previously planned to pre-Brexit levels, with one source saying the headcount was around 90,000 lower then, ITV News understands. They revealed the prime minister and chancellor drew up a plan to start with a recruitment freeze and a new rule banning vacancies being filled without special permission from ministers at a meeting on Monday. However, to get anywhere close to 2015/16 levels will raise the prospect of significant job cuts, likely heightening tensions between ministers and civil servants who have already clashed over the question of people working from home. Unions dismissed the latest discussions as either a "headline-grabbing stunt" or something that would mean government cutting back on delivering key services in areas like health, on borders or in the passport office. At the meeting, the prime minister, his chancellor and Chief of Staff Steve Barclay, talked about a 25% cut to return Whitehall to its size before numbers were increased to deal with Brexit and then Covid, according to those familiar with discussions. (ITV)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- DBRS Morningstar on the United Kingdom (current rating: AA (high), Stable Trend)

EUROPE

ECB: There is no need at the moment for relief measures from the European Central Bank in response to the war in Ukraine, the bank's top supervisor Andrea Enria said, adding that the bank was not planning 'one-size-fits-all' restrictions of banks' dividends. "We will discuss with each and every bank their capital trajectory and their plans to pay dividends," Enria said in a interview with Greek state ERT TV published on Thursday. (RTRS)

GERMANY: “The warning of a wage-price spiral is very justified,” Finance Minister Christian Lindner tells ZDF Thursday night. “This warning must not be misunderstood by the unions,” Lindner says, adding that he’s not suggesting that workers bear the loss of purchasing power. Instead, “the state is attempting to counteract this loss in purchasing power via relief packages.” This should allow “trade unions not to have to fight inflation solely through collective-bargaining demands at the expense of companies and their competitiveness,” Lindner says. “The state is trying to dampen inflation expectations for wage negotiations a bit so that we don’t get into” automatic wage increases. (BBG)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Malta (current rating: A+; Outlook Stable) & Switzerland (current rating: AAA; Outlook Stable)

- Moody’s on Latvia (current rating: A3; Outlook Stable)

U.S.

FED: Federal Reserve Chairman Jerome Powell warned Thursday that getting inflation under control could cause some economic pain but remains his top priority. Powell said he couldn’t promise a so-called soft landing for the economy as the Fed raises interest rates to tamp down price increases running near their fastest pace in more than 40 years. “So a soft landing is, is really just getting back to 2% inflation while keeping the labor market strong. And it’s quite challenging to accomplish that right now, for a couple of reasons,” the central bank chief said in an interview with Marketplace. (CNBC)

FED: Federal Reserve Bank of San Francisco President Mary Daly backed raising interest rates by a half-percentage point at each of the central bank’s next two meetings, adding that she’d like to see financial conditions tighten further. “Going up in 50-basis-point increments to me makes quite a bit of sense and there’s no reason right now that I see in the economy to pause on doing that in the next couple of meetings,” Daly said in an interview Thursday with Bloomberg News. She added that a 75-basis-point increase, which has been the subject of speculation as an option to curb surging inflation, is “not a primary consideration.” Daly is not a voter this year on the policy-setting Federal Open Market Committee. (BBG)

FED: The U.S. Senate on Thursday confirmed Jerome Powell to a second four-year term as head of the Federal Reserve, paving the way for the former investment banker to continue leading the central bank as it confronts the highest inflation in 40 years. Powell, who was renominated by U.S. President Joe Biden, drew bipartisan backing in the divided Senate, with a final tally of 80 senators in favor of his confirmation and only 19 opposed. (RTRS)

FED: Senate Banking Chair Sherrod Brown said his committee plans to hold a hearing on another Biden Fed nominee, Michael Barr as the Fed’s vice chair for supervision, on May 19. Brown pledged a confirmation vote within a few weeks. (BBG)

FISCAL: The US Senate was forced to postpone final passage of a $40 billion Ukraine support package after Rand Paul refused to allow the vote unless a provision to appoint an official with oversight powers for the aid was included. Paul, a Kentucky Republican, said that US deficit-spending in order to support Ukraine could further stoke soaring inflation. The Senate, where work can be slowed by objections from one senator, is now expected to vote on the legislation and send it to President Joe Biden’s desk for his signature next week. (BBG)

TREASURIES: The Financial Stability Oversight Council is concerned about the functioning of the Treasury market, Treasury Secretary Janet Yellen told lawmakers on the House Financial Services Committee. “We have had episodes in which liquidity has dried up and we are working very hard -- coordinating with the inter-agency Treasury working group -- to look at reforms to make sure this critically important market for the United States and the globe functions well, has the liquidity that it needs,” she said.

OTHER

GLOBAL TRADE: “Twenty-five million tons of grain are blocked in Ukrainian ports, especially in Odesa,” German Foreign Minister Annalena Baerbock said at the opening of the G7 foreign ministers’ meeting in Weissenhaus in Northern Germany. “This is grain which is urgently needed as food in African countries and the Middle East.” Accusing Russian President Vladimir Putin of using grain to further divide the global community, Baerbock said, “We must stand together in the face of this food crisis.” Wheat futures in Chicago rose after a US Department of Agriculture report said production in Ukraine, one of the world’s biggest growers, will drop by one-third compared to last season. (BBG)

GLOBAL TRADE: U.S. Commerce Secretary Gina Raimondo said on Thursday that the United States was looking to deepen resilience of supply chains with Southeast Asian partners. Raimondo made the comment at an event with U.S. businesses and leaders from the Association of Southeast Asian Nations (ASEAN) who are visiting Washington for a two-day summit. (RTRS)

U.S/CHINA: Shein, the Chinese fast fashion giant that’s quickly become the third-most valuable startup in the world, is seeing a reality check with sales growth slowing from the lofty heights of the pandemic, just as it faces mounting pressure to live up to a $100 billion valuation. As part of its latest $1 billion fundraising round, Shein told existing investors including Tiger Global Management, IDG Capital and Sequoia Capital China that it’s looking to list on a US bourse in as soon as two years, people familiar with the company’s thinking said. Shein is considering a shift of corporate domicile to Singapore to pave the way for a US IPO, the people said. (BBG)

GEOPOLITICS: The White House has said it would support any move by Finland and Sweden to join NATO in reaction to Russia’s invasion of Ukraine. “We would support a NATO application by Finland and/or Sweden should they apply. We would respect any decision they make,” White House press secretary Jen Psaki told reporters. (Al Jazeera)

GEOPOLITICS: U.S. President Joe Biden opened a gathering of Southeast Asian leaders with a promise to spend $150 million on their infrastructure, security, pandemic preparedness and other efforts aimed at countering the influence of rival China. On Thursday, Biden started a two-day summit with the 10-nation Association of Southeast Asian Nations (ASEAN) in Washington with a dinner for the leaders at the White House ahead of talks at the State Department on Friday. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda says monetary easing must stay in place to support an economy still in the middle of recovering from the pandemic. While the bank hasn’t yet achieved its price target after years of easing, a rate hike would worsen the economy and banks’ profitability might fall due to a drop in lending, Kuroda says in response to questions in parliament. It’s “extremely important” for foreign exchange rates to move in a stable manner and reflect economic fundamentals. Recent rapid weakening of yen adds to uncertainties. Impact of moves in currency differs among economic entities; will carefully monitor. Inappropriate to consider an exit from easing in the context of my term as governor. (BBG)

JAPAN: A weaker yen helps exports while boosting import costs, Japan’s Finance Minister Shunichi Suzuki tells parliament Friday. An abrupt decline in the yen is not desirable, but that’s different from saying a weaker yen is always fine as long as the move isn’t rapid. Authorities are watching the foreign exchange market and impact on the Japanese economy closely; the government will act appropriately if needed. (BBG)

RBA: MNI INSIGHT: RBA Comfortable With Stronger Wages Growth

- The Reserve Bank of Australia is comfortable with wages growth exceeding the rate of inflation and sees this as a return to normal conditions and unlikely to drive higher prices and create more pressure for interest rate hikes, MNI understands - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

AUSTRALIA: Federal Treasurer Josh Frydenberg has pledged to save the vast majority of an expected more than $30 billion revenue windfall from high commodity prices and low unemployment, under a budget consolidation commitment. As inflation climbs higher than the government and the Reserve Bank of Australia expected, Mr Frydenberg said in an interview that he believed Treasury could advise the elected government after the poll to focus on continued budget repair to help reduce inflation pressures. (Australian Financial Review)

NORTH KOREA: The Biden administration says North Korea could be preparing for a nuclear test as U.S. President Joe Biden gets set to visit Asia later this month, White House spokesperson Jen Psaki said on Thursday. Biden is expected to visit South Korea and Japan from May 20-24 and hold talks with his Korean and Japanese counterparts. Psaki said North Korea could launch a missile test as early as this month. Psaki said Biden was also considering a visit to the Korean Demilitarized Zone, but no final decision has been made. (RTRS)

NORTH KOREA: North Korea on Friday revealed a widespread outbreak of an unknown fever that spread “explosively” across the country since the end of April, resulting in 350,000 cases and six deaths -- including one that tested positive for Covid-19. Kim Jong Un, who locked down the country on Thursday after confirming the country’s first Covid case, called for more stringent measures to stop the virus, according to state-run Korean Central News Agency. On Thursday alone, North Korea had 18,000 new cases of fever and as many as 187,800 people are being isolated and treated, it said. (BBG)

HONG KONG: The Hong Kong Monetary Authority further purchases HK$2.865 billion to support the local currency, according to the de facto central bank’s page on Bloomberg. HKMA had earlier bought HK$4.082 billion for the May 16 settlement. Aggregate balance will decrease to about HK$329.06 billion on May 16. (BBG)

BOC: Bank of Canada Deputy Governor Toni Gravelle said borrowing costs need to rise quickly to more normal levels to bring inflation back to target, and that the current policy interest rate of 1% is “too stimulative.” In a speech Thursday entitled “The Perfect Storm,” Gravelle reiterated that rates need to rise further into the neutral range of 2 to 3% in order to cool domestic inflation and bring the economy back to balance. Gravelle said the central bank may pause increases to interest rates at the neutral range if price pressures begin to reverse course, or if heavily indebted Canadian households reduce their spending by more than expected. Conversely, the deputy governor also made the case for hiking borrowing costs above the neutral range if global supply chain issues persist, or parts of the domestic economy end up being less sensitive to higher interest rates than expected. “We are not on a pre-set path of policy rate increases aimed at getting to a specific ‘terminal’ rate,” Gravelle said. “Our decisions are not on autopilot.” (BBG)

TURKEY: Turkey amends articles of association of the country’s central bank to ensure that its possession of money, receivables, assets and rights belonging to foreign central banks cannot be seized and/or subject to precautionary injunctions, according to a presidential decree published in Official Gazette on Friday. (BBG)

BRAZIL: Brazil central bank has announced changes that ease its capital requirements for credit risk, with the new rules expected to free up to 3.8 billion reais. New rules introduce differences in risk weighting for different operations which will translate into smaller capital requirements for less risky exposures, said central bank in a statement. New rules should free up to 3.8 billion reais for financial institutions, though individual impacts will be in line to each institution credit portfolio. New regulation follows best practices recommendations by the Basel Committee on banking supervision and are part of the structure of “Basel III”. (BBG)

MEXICO: Mexico’s central bank boosted borrowing costs by half a percentage point in a widely-anticipated move to tame inflation that’s at two-decade highs, adding that it could consider increasing the pace of hikes going forward. Banxico, as the bank is known, raised the key rate to 7% on Thursday, as expected by 23 of 24 economists surveyed by Bloomberg. The increase matched that of the Federal Reserve, which Mexican policy makers traditionally follow to avert abrupt capital outflows. “Given the growing complexity in the environment for inflation and its expectations, taking more forceful measures to attain the inflation target may be considered,” the board wrote in a statement accompanying the decision. (BBG)

MEXICO: Mexico will publish a presidential decree modifying import and export tax law tariffs on Friday, according to the Finance Ministry. Decree to be published in the daily gazette. (BBG)

RUSSIA: Russia’s ambassador to the EU Vladimir Chizhov said plans by Finland and Sweden to join NATO will “necessitate certain military-technical measures, like improving or raising the degree of defense preparations along the Russian-Finnish Border.” Joining NATO “has never made any country more secure,” Chizhov said in an interview with the UK’s Sky News. He also said he was “sure” there would be a negotiated solution to the war in Ukraine that would see the country become a neutral state and recognize the Donbas republics and Russia’s annexation of Crimea. Ukraine says it’s open to neutrality but won’t concede any territory. (BBG)

RUSSIA: The US will soon begin a “major initiative” alongside the EU and the UK to help Ukraine document potential war crimes and human rights abuses committed during Russia’s invasion, Beth Van Schaack, the State Department’s ambassador-at-large for global criminal justice, told the Senate Foreign Relations Committee. Van Schaack appeared remotely from a conference in the German city of Nuremberg, where Nazi leaders were tried after World War II. “This is another Nuremberg moment,” she told senators. “There’s a global consensus that Russia’s conduct is intolerable and that those responsible for atrocities must be held accountable.” (BBG)

RUSSIA: The U.N. Human Rights Council passed a resolution on Thursday to set up an investigation into possible war crimes by Russian troops in the Kyiv area and beyond, a move that Russia said amounted to political score-settling. Members passed by an overwhelming majority (33 for, 2 against) a resolution to order a Commission of Inquiry to investigate events in the regions around Kyiv and other areas such as Sumy that were temporarily held by Russian troops. (RTRS)

PERU: Peru raised interest rates to the highest level in 13 years to curb soaring inflation that triggered mass disorder last month. The central bank boosted its key rate by half a percentage point to 5%, in line with the forecasts of all eight economists surveyed by Bloomberg. “The significant increase in world prices of energy and food since the second half of last year, accentuated recently by international conflict, has created a large increase in global inflation to levels not seen in many years in advanced economies and in the region,” the bank said in its statement. (BBG)

ARGENTINA: Argentina’s central bank raised interest rates for the fifth time this year on Thursday in an attempt to halt an inflationary spike. BCRA, as the Argentine monetary authority is known, increased its benchmark Leliq rate by 200 basis points to 49%, according to a statement. The rate hike also boosts the effective annual rate to 62%, up from slightly above 55% previously. The rate increase comes after Argentina’s statistics agency earlier on Thursday released data showing consumer prices rose 6% in April, bringing it to the highest annual level since 1992. (BBG)

BONDS: Combined unrealized losses on foreign bond holdings at Japan’s three largest banks are expected to grow to ~1.5t yen as of the end of March, Yomiuri reports without saying where it obtained the information. Market value of foreign debt held by Mitsubishi UFJ Financial Group, Sumitomo Mitsui Financial Group and Mizuho Financial Group pushed down by rise in US and European interest rates. Unrealized losses at each bank range from ~400b yen to ~800b yen; to be disclosed along with full-year earnings. (BBG)

ENERGY: “The order of magnitude of the reduction in gas from Russia that is at stake today has an impact on the price development, but not on the security of supply,” Finance Minister Christian Lindner tells ZDF Thursday night. Germany “must continue to work with great effort to become independent from Russia as quickly as possible and not susceptible to blackmail” over gas, Lindner says. (BBG)

ENERGY: Italy’s energy giant Eni SpA is set to pay Gazprom PJSC for gas supplies in May even if the initial euro payment is converted to rubles, according to people familiar with the matter. The move comes after Gazprom tried to reassure European buyers including Eni that the payment wouldn’t violate EU sanctions since Russia’s central bank wouldn’t be directly involved, said the people, who asked not to be identified because the talks are private. Eni hasn’t set up a ruble account yet, the people said, but is doing the legal work in preparation of setting one up if needed. (BBG)

ENERGY: Key Finnish politicians have been warned that Russia could halt its gas supplies to neighbouring Finland on Friday, local newspaper Iltalehti reported on Thursday, citing unnamed sources. (RTRS)

ENERGY: Daily nominations for Russian gas deliveries to Slovakia via Ukraine rose on Thursday, data from Slovakian operator TSO Eustream showed. Nominations via the Velke Kapusany border point were around 856,922 megawatt hours (MWh) per day on Thursday, versus about 732,837 MWh per day on Wednesday, the data showed. (RTRS)

ENERGY: Austria will requisition depot from Gazprom if it’s not storing gas going into next winter season, Chancellor Karl Nehammer tells Kronen Zeitung in interview. Says discussion ongoing at European level on decoupling gas and power prices. (BBG)

OIL: Some European Union nations are saying it may be time to consider delaying a push to ban Russian oil so they can proceed with the rest of a proposed sanctions package if the bloc can’t persuade Hungary to back the embargo. Governments are still aiming for a deal on the full package, including a phased-in oil ban, by Monday, when EU foreign ministers meet in Brussels, according to EU diplomats. The idea of pushing off the move against Russian oil, which Hungary has said would be too damaging to its economy, is gaining support, the diplomats added. But other countries are worried that removing it now would be a sign of weakness, another diplomat said. Hungary’s Viktor Orban has suggested before that any oil ban would need to be discussed by EU leaders at a summit. The next one is scheduled for the end of May. (BBG)

CHINA

PROPERTY: Most Chinese banks saw the ratio of non-performing real estate loans rise to varying degrees in 2021, the China Securities Journal reported citing annual reports from listed banks. The rate of non-performing real estate loans in ICBC, one of the big four state-owned banks, rose by 2.47 percentage points to 4.79% from 2020 to 2021, while that of smaller banks such as Bank of Suzhou had rose by 5 pps to above 5%, the newspaper said. Though the risk is generally controllable, banks will respond by conducting stress tests, strengthening list management, and increasing credit loss reserves, while meeting reasonable financing needs in real estate, the Journal said. (MNI)

YUAN: A yuan dip may be temporary, as the forex market generally expects Chinese regulators have sufficient tools to stabilise the currency, the 21st Century Business Herald reported citing an unnamed FX trader at a large state-owned bank. Some large asset management institutions have established long positions in the yuan between 6.81 and 6.83 against the U.S. dollar, looking for trading opportunities, the newspaper cited the trader as saying. After the yuan weakened by more than 5% in the past three weeks, institutions have begun to buy, as they believe speculation has driven the yuan below the equilibrium level. But the currency will soon usher in a return of value as the Chinese economy resumes steady growth, the newspaper said citing another unnamed trader at a large European asset management institution. (MNI)

ECONOMY: The Chinese economy is expected to move to an economic recovery inflection point with the Covid-19 outbreaks effectively controlled in Shanghai and Jilin province, with some leading indicators such as electricity consumption showing positive changes, the China News Service reported citing Sheng Laiyun, deputy director of the National Bureau of Statistics. China will stick to its dynamic zero- Covid policy, while expanding infrastructure investment, stablising employment and ensuring supply and price stability in food and energy, the newspaper said citing Sheng. (MNI)

ECONOMY: Calls are growing for China’s government to sell more bonds to pay for extra stimulus to boost an economy facing its greatest challenges since the initial few months of the pandemic in 2020. The central government should start issuing “special sovereign bonds” again, according to analysts including Yuekai Securities Co.’s Luo Zhiheng. The government sold 1 trillion yuan ($147 billion) of the bonds in 2020 to pay for measures to fight the pandemic, but didn’t sell any last year or include them in the bond plan for this year as the economy was recovering and the virus was under control. The situation looks very different now compared to earlier in the year when the 2021 budget was decided. China’s financial hub of Shanghai is locked down, logistics have been snarled, factories have been shut, and now outbreaks in other cities are likely to keep causing disruptions and restrictions for as long as China sticks to its Covid Zero policy. Governments at all levels need more money to pay for the lockdowns and testing, but revenue from land sales is falling rapidly due to the housing market crash. (BBG)

CORONAVIRUS: Shanghai aims to achieve no community Covid spread in mid-May, the city’s Vice Mayor Wu Qing says at a presser Friday. The city will implement “orderly opening-up, limited movement, effective control and classified management” after achieving no community spread. The municipal government is considering allowing more companies to resume production and restoring commercial operations and school classes in an orderly manner, Wu says, without giving a time frame. The city will also work to resume traffic and medical services based on developments of Covid control. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0454% at 09:34 am local time from the close of 1.5735% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 41 on Thursday vs 43 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7898 FRI VS 6.7292

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher for the sixth trading day at 6.7898 on Friday, compared with 6.7292 set on Thursday.

OVERNIGHT DATA

JAPAN APR M2 MONEY STOCK +3.6% Y/Y; MEDIAN +3.4%; MAR +3.5%

JAPAN APR M3 MONEY STOCK +3.2% Y/Y; MEDIAN +3.0%; MAR +3.1%

NEW ZEALAND APR BUSINESSNZ M’FING PMI 51.2; MAR 53.7

While the Performance of Manufacturing Index (PMI) remained expansive in April, it also had a tinge of struggle about it. For a start, its seasonally adjusted reading, of 51.2, was slower than the 53.7 in posted in March and, in the process, dipped below its long-term norm, of 53.1. Then there was the PMI’s production index. This slipped marginally into contraction territory, with a result of 49.1, after hanging on by its fingertips in March, with 50.3. The employment index also slipped to the wrong side of the 50 breakeven mark, with 49.8, from 52.2 the previous month. Also, there was a very mixed picture via other lenses on the PMI. By industry, for example, there were the extremes of Printing, Publishing and Recorded Media (95.0) playing off against Other Manufacturing (29.0, from 51.3 in March) and Petroleum, Coal, Chemical & Associated Products (37.8) – all in unadjusted terms. By firm size, the best performers were micro firms (56.6) but with the very next size up, small-medium firms, the clear laggard in April, with 41.9. Geographically, only Otago/Southland was positive, with 55.4, while Northern, Central and Canterbury/Westland all slipped below 50. Having said this, there was also the strong message that what’s holding manufacturing back, in general, is more about ongoing supply constraints, than a weakening in demand. This was reflected in Deliveries of Raw Materials subsiding to 49.5 in April, while New Orders, at 56.0, remained a smidge above their long-term average. Supply problems certainly featured extensively in respondents’ comments, including inferences that COVID, and related absenteeism, remains a big issue, even with recorded case numbers having peaked back in March. This provides valuable context to the negativity in the PMI’s jobs index. (BNZ)

SOUTH KOREA APR EXPORT PRICE INDEX +21.4% Y/Y; MAR +23.4%

SOUTH KOREA APR EXPORT PRICE INDEX +1.0% M/M; MAR +6.2%

SOUTH KOREA APR IMPORT PRICE INDEX +35.0% Y/Y; MAR +35.9%

SOUTH KOREA APR IMPORT PRICE INDEX -0.9% M/M; MAR +7.6%

MARKETS

SNAPSHOT: Market Flows Dominate In Final Asia-Pac Session Of The Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 659.95 points at 26409.42

- ASX 200 up 123.97 points at 7064.8

- Shanghai Comp. up 17.82 points at 3072.771

- JGB 10-Yr future up 6.0 ticks at 149.53, yield down 0.8bp at 0.240%

- Aussie 10-Yr future up 2.5 ticks at 96.57, yield down 2.1bp at 3.405%

- US 10-Yr future -0-17+ at 119-14+, yield up 3.98bp at 2.888%

- WTI crude up $1.60 at $107.73, Gold up $5.97 at $1827.81

- USD/JPY up 57 pips at Y128.91

- POWELL SAYS HE CAN’T GUARANTEE A ‘SOFT LANDING’ AS THE FED LOOKS TO CONTROL INFLATION (CNBC)

- KURODA SAYS IMPORTANT FOR BOJ TO SUPPORT ECONOMY WITH EASING NOW (BBG)

- MNI INSIGHT: RBA COMFORTABLE WITH STRONGER WAGES GROWTH

- CHINA PRESS: FOREX TRADERS EXPECT A YUAN REBOUND IN THE NEAR TERM (HERALD)

- RUSSIA COULD CUT GAS SUPPLY TO FINLAND ON FRIDAY (RTRS)

- EU STARTS TO MULL DELAY IN OIL SANCTIONS AS HUNGARY DIGS IN (BBG)

US TSYS: Bear Steepening In Asia

Tsy trade lacked an overt catalyst during Asia hours, with the late NY bounce in equities extending, allowing Tsys to move further away from Thursday’s best levels, with bear steepening in play. This comes after Thursday’s bull steepening was driven by general recession fears and worry re: COVID in China.

- The S&P 500 e-mini is +1.0%, aided by a tech-led rally in both Hong Kong & the U.S.

- That leaves the major cash Tsy benchmarks 2.5-5.0bp cheaper on the day, with TYM2 last printing -0-16+ at 119-15+, 0-05+ off the base of the contract’s 0-13+ session range, on volume of ~105K.

- A lack of meaningful headline flow meant sporadic bursts of activity were in the driving seat during Asia-Pac hours.

- Late NY rhetoric from Fed Chair Powell had nothing in the way of meaningful impact on the space, as he reiterated his preference for 50bp hikes at the next couple of meetings, while indicating two-way risks around wider tightening i.e. an ability to do more or less dependent on the evolution of economic matters, as he stressed that inflation is “way too high.” Powell also noted that the Fed’s ability to engineer a soft landing may be based on factors that are outside of its control. Earlier Thursday saw U.S. Tsy Sec Yellen reiterated her hope that the Fed will be able to fight off inflation without causing a recession.

- U.S. hours will bring terms of trade data, in addition to the latest UoM sentiment reading and Fedspeak from Mester (’22 voter) & Kashkari (’23 voter).

JGBS: Flatter Finish To The Week, Potentially Aided By Lifers

JGB futures traded either side of late overnight levels during early Tokyo dealing, with wider swings in risk appetite at the fore and a lack of notable market moving headline flow evident. A 2.5% rally in the Nikkei 225 likely capped the early bid in JGBs, with futures back below late overnight levels as a result, last +7.

- The wider JGB curve bull flattened, with the major benchmarks running little changed to 2bp richer. This was a product of Thursday’s firming across wider core FI markets, which has perhaps facilitated some lifer-based demand in the longer end of the curve.

- Rhetoric from BoJ Governor Kuroda reaffirmed the need for monetary easing, even as he noted that market functioning may be impaired by the BoJ’s actions. He also noted that it is inappropriate to link an exit from the Bank’s ultra-loose policy settings with his term as Governor.

- Elsewhere, comments from Japanese FinMin Suzuki reaffirmed well-known views re: wider currency market dynamics.

- BoJ RInban operations covering 1- to 10-Year JGBs saw a modest uptick in offer/cover ratios, but this had little impact on the space.

JGBS AUCTION: Japanese MOF sells Y723.4bn 30-Year JGBs:

Japanese MOF sells Y723.4bn 30-Year JGBs:

- Average Yield 1.015% (prev. 0.989%)

- Average Price 99.64 (prev. 100.25)

- High Yield: 1.026% (prev. 0.993%)

- Low Price 99.40 (prev. 100.15)

- % Allotted At High Yield: 97.1524% (prev. 13.0925%)

- Bid/Cover: 3.079x (prev. 3.049x)

AUSSIE BONDS: Back From Best Levels On Bid In Equities

An uptick in e-minis & Hong Kong tech stocks pressured Aussie bond futures away from their overnight peaks ahead of the weekend, with YM +9.0 & XM +2.5 at typing. The longer end of the cash ACGB is curve now running little changed to marginally cheaper on the day.

- Note that there hasn’t been much in the way of obvious short cover in YM to trigger the move away from cycle cheaps during recent sessions, with open interest little changed vs. levels observed at the time where the contract printed its current cycle low. There has been a modest down tick in XM open interest (2%) in recent days, although this isn’t particularly large in the grander scheme of things.

- The 3-/10-Year EFP box has twist flattened.

- The latest round of ACGB May-32 supply saw firm enough pricing, with the weighted average yield printing 0.65bp through prevailing mids, although the cover ratio wasn’t particularly firm, printing at 2.32x. Note that the auction was still comfortably covered, albeit with cover shy of that which was witnessed during RBA QE times.

- Next week will bring wage price data (our policy team’s latest insight piece flagged their understanding that the Reserve Bank of Australia is comfortable with wages growth exceeding the rate of inflation and sees this as a return to normal conditions and unlikely to drive higher prices and create more pressure for interest rate hikes) and the Bank’s May meeting minutes. Market pricing re: RBA tightening is back from recent extremes, but still aggressive, with a year-end cash rate of ~2.70% priced in the IB strip, per BBG WIRP. Elsewhere, there will be focus on the run in to the Federal Election (21 May), with the opposition Labor Party leading the opinion polls, and the latest monthly labour market report.

AUSSIE BONDS: The AOFM sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

The AOFM sells A$1.0bn of the 1.25% 21 May ‘32 Bond, issue #TB158:

- Average Yield: 3.3588% (prev. 2.4911%)

- High Yield: 3.3600% (prev. 2.4925%)

- Bid/Cover: 2.3200x (prev. 3.3550x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 66.9% (prev. 94.9%)

- Bidders 39 (prev. 45), successful 13 (prev. 14), allocated in full 5 (prev. 6)

AUSSIE BONDS: AOFM Weekly Issuance Slate

The AOFM has released its weekly issuance slate:

- On Wednesday 18 May it plans to sell A$800mn of the 1.75% 21 November 2032 Bond.

- On Thursday 19 May it plans to sell A$1.0bn of the 12 August 2022 Note & A$500mn of the 26 August 2022 note.

- On Friday 20 May it plans to sell A$700mn of the 4.75% 21 April 2027 Bond.

EQUITIES: Strong Finish To A Losing Week

Virtually all Asia-Pac equity indices are higher at typing, bucking a mixed lead from Wall St. on Thursday. High-beta equities across geographies caught a bid, with reduced appetite for havens evident in Asia-Pac dealing. Broader gauges of regional equities however still point to heavy losses, with the MSCI AC Asia Pacific Index down ~4.1% for the week prior to today’s rally.

- The Nikkei 225 sits 2.5% better off at typing, extending a rise from two-month lows made on Thursday. The move higher comes as sentiment in large caps firmed amidst positive earnings calls from some constituents, mixing with tail-winds from another bout of JPY weakness during the session. On the former, Softbank Group (+11.1%) led large-cap peers higher after reporting earnings, largely unwinding this week’s losses after hitting two-month lows on Thursday.

- The Hang Seng Index deals 2.0% firmer at typing, recording gains in virtually all sub-indices. China-based tech companies outperformed, with the Hang Seng Tech Index sitting 3.9% higher on gains in familiar large-cap names for another day (Tencent, JD.com etc.). Looking ahead, participants will be keeping a close eye on Baidu, Bilibili, and other Chinese internet technology giants this month, with debate re: their possible inclusion in the main Hang Seng Index during the latter’s quarterly reshuffle doing the rounds, ahead of the decision later this month (20 May).

- The ASX200 trades 1.7% higher at typing, pulling away from 15-week lows made on Thursday. High-beta tech led gains, with the S&P/ASX All Technology Index rising from two-year lows on Thursday to deal 5.1% firmer at writing, led by a ~13% rise in index heavyweight Block Inc (with the latter unwinding approx. half of Thursday’s loss, initially sparked by the implosion of the third-largest stablecoin in the cryptocurrency space).

- U.S. e-mini equity indices are 0.8% to 1.3% better off at typing, extending a move off of their respective troughs on Thursday amidst the previously flagged improvement in risk appetite.

OIL: Higher In Asia; IEA Revises Crude Shortfall Projections For ‘22

WTI is ~+$1.20 and Brent is ~+$1.40, extending a move higher from their respective best levels on Thursday, and operating a little off session highs at typing. Both benchmarks are nonetheless on track for their first weekly loss in three, with worry re: reduced economic growth and energy demand remaining front and centre.

- EU lawmakers may delay potential Russian energy sanctions over well-documented Hungarian resistance, with a previously flagged video call between parties remaining unscheduled. Looking ahead, the next round of discussions between EU leaders re: the matter will likely happen in end-May.

- Turning to China, Shanghai reported six COVID cases “in the community” for Thursday, (increase from Wednesday’s two cases), keeping in mind that Chinese officials have placed the lifting of lockdowns to be conditional on three days of zero community spread. Elsewhere, city authorities in Beijing have denied rumours of an impending city-wide lockdown with some media reports of stockpiling behaviour doing the rounds on Thursday, keeping in mind that Shanghai’s current lockdown was similarly preceded by authorities declaring two days prior that no such measures would be taken. Beijing recorded 50 new cases on Thursday, against 46 on Wednesday.

- Elsewhere, the International Energy Agency’s (IEA) monthly Oil Market Report crossed on Thursday. The group revised supply shortfall projections for ‘22 downwards, pointing to a fall in Chinese energy demand and demand destruction from higher oil prices mixing with output increases elsewhere, suggesting that the impact on global supplies from sanctions on Russian energy may be less severe than initially feared.

GOLD: Back From Fresh 3-Month Lows; Dollar Rally Saps Strength

Gold is ~$3/oz firmer to print $1,825/oz at writing, extending a move higher after briefly dipping to three-month lows early in the session (at $1,811.7/oz).

- The precious metal is on track to see a fourth consecutive weekly close, potentially recording its largest weekly decline since end-Mar at current prices.

- To recap Thursday’s price action, gold closed ~$30/oz lower, facilitated by downward pressure from a broad uptick in U.S. real yields, and the USD (DXY) hitting fresh cycle highs. On the latter, the DXY is firmly on track to record a sixth consecutive higher weekly close, currently trading at levels last witnessed in Dec ‘02.

- Looking back, a note that nonfarm payrolls, CPI, and PPI readings for Apr previously came in above expectations, reinforcing the narrative for recent Fed hawkishness, and exacerbating recent gloom surrounding non-yielding precious metals.

- Nonetheless, June and July FOMC dated OIS are continuing to price in a cumulative ~105bp of tightening by the July meeting, suggesting little change in expectations for 2 x 50bp hikes at both meetings for now, in line with recent Fedspeak.

- From a technical perspective, the downtrend remains intact. Gold has broken initial support at $1,832.1/oz (May 11 low), exposing further support at $1,821.1 (Feb 11 low) and $1,780.4 (Jan 28 low and key support. On the upside, initial resistance is situated at $1,865.4/oz.

FOREX: Yen Turns Tail As Risk Regains Poise

Risk sentiment found poise towards the end of the week in Asia as U.S. e-mini futures crept higher. Headline flow offered little to add to the familiar narrative, leaving participants to reflect on familiar dynamics. Some positivity may have been linked to reassuring comments from Shanghai authorities on the local COVID-19 outbreak, as they expected to achieve zero community transmission in mid-May.

- The yen went offered amid reduced appetite for safe haven assets. Japan's economic officials reiterated their usual comments. FinMin Suzuki pointed to two-way impact of a weaker yen and noted that the government is watching the FX market closely, while BoJ Gov Kuroda stressed the importance of FX stability but also backed continued powerful monetary easing.

- Firmer crude oil prices lent support to commodity-tied currencies. The Aussie dollar paced gains in the space, despite the absence of notable domestic catalysts.

- The PBOC extended a streak of firmer than expected yuan fixings to nine days, while the deviation from the expected level widened to 69 pips. Offshore yuan showed little in the way of immediate reaction to the fixing and rose to a fresh cycle high of CNH6.8380, before reversing gains later in the session.

- The HKMA stepped up HKD purchases in defence of its currency peg, bringing their total value to HKD6.947bn.

- The flash reading of U.S. Uni. of Mich. Sentiment, Norwegian GDP, EZ industrial output & final French CPI take focus on the data front today. Comments are due from Fed's Mester & Kashkari as well as ECB's Guindos, Centeno, Nagel & Schnabel.

FOREX OPTIONS: Expiries for May13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0835-50(E865mln)

- GBP/USD: $1.2100(Gbp647mln), $1.2200(Gbp674mln)

- USD/JPY: Y129.95-00($520mln)

- AUD/USD: $0.6725(A$1.3bln), $0.7200-05(A$946mln), $0.7400(A$1.1bln)

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.