-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN OPEN: China Headlines Drive Price Action

EXECUTIVE SUMMARY

- CHINESE ECONOMIC ACTIVITY DATA FOR APRIL MISSES ALREADY SOFT EXPECTATIONS

- GRADUAL RE-OPENING OF SHANGHAI GETS UNDERWAY

- CHINA FURTHER EASES MORTGAGE LOAN RATE GUIDANCE TO SPUR DEMAND (RTRS)

- ECB'S DE COS SAYS RATES TO RISE 'VERY SOON' (RTRS)

- BORIS JOHNSON SEES ROOM FOR A DEAL ON NORTHERN IRELAND POST-BREXIT TRADE (RTRS)

- SWEDEN & FINLAND SET TO LODGE NATO MEMBERSHIP APPLICATIONS

- WHEAT SOARS IN RISK TO FOOD INFLATION AS INDIA RESTRICTS EXPORTS (BBG)

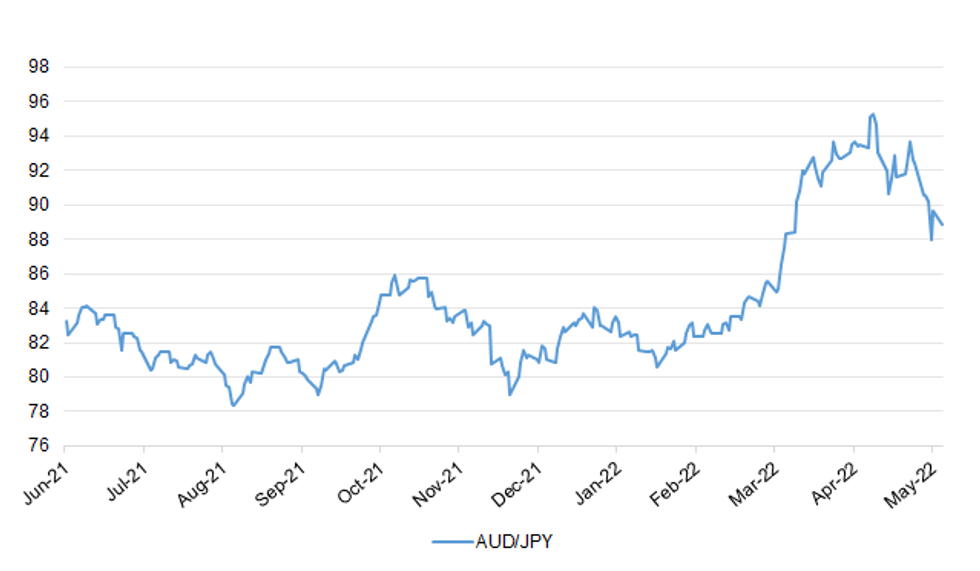

Fig. 1: AUD/JPY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: British Prime Minister Boris Johnson said he wanted to resolve a standoff with the European Union over Northern Ireland's post-Brexit trade rules, but he kept open the option of unilateral action that the EU says could start a trade war. Johnson was due to travel to Belfast on Monday to urge local political leaders to form a new power-sharing government, a key institution under the 1998 Good Friday peace agreement. After elections this month, pro-British unionists refused to join a new administration because of their opposition to the Northern Ireland Protocol which governs post-Brexit trade. Johnson, in excerpts of an article to be published by the Belfast Telegraph newspaper which were released late on Sunday, said reform of the Protocol was essential for Northern Ireland to move forward. "There is without question a sensible landing spot in which everyone's interests are protected," he said. "Our shared objective must be to the create the broadest possible cross-community support for a reformed Protocol in 2024." Johnson agreed to the Protocol in 2019 to allow Britain to leave the EU's single market and customs union without controls being re-imposed on the border between the Irish Republic and Northern Ireland, a vital part of the peace deal. But the plan effectively introduced a customs borders border between Britain and Northern Ireland, incensing many Unionists. Johnson has been trying to renegotiate the Protocol and he has threatened unilateral action if the EU does not agree to London's proposals. "I hope the EU's position changes," he said in his newspaper article. "If it does not, there will be a necessity to act." "The government has a responsibility to provide assurance that the consumers, citizens and businesses of Northern Ireland are protected in the long-term. We will set out a more detailed assessment and next steps to parliament in the coming days”. Earlier on Sunday, Ireland's foreign minister Simon Coveney urged Johnson not to introduce new trade laws that he said could undermine the peace process in Northern Ireland. Coveney said London, Dublin and Brussels could find solutions "but sabre-rattling and grand-standing in Westminster, ratcheting up tension, is not the way to do it," he told Sky News television. (RTRS)

BREXIT: Business Secretary Kwarsi Kwarteng has said it is "absolutely right" the government is ready to tear up parts of post-Brexit trading arrangements in Northern Ireland. The cabinet minister also accused Brussels of being "unreasonable" in its approach towards the Northern Ireland Protocol. But Ireland's foreign minister Simon Coveney said his country was also "frustrated" dealing with the fallout of Brexit, which he said had cost hundreds of millions of euros and threatened the peace process. Pressed on Sky News's Sophy Ridge On Sunday programme if the UK administration was prepared to ditch parts of the agreement, Mr Kwarteng said: "Absolutely right." (Sky)

BREXIT: The UK government doesn’t expect that a possible decision to override parts of its Brexit deal’s conditions for Northern Ireland will lead to a trade war with the European Union, Business Secretary Kwasi Kwarteng told the BBC. “I don’t think there will be a trade war,” Kwarteng said Sunday in a BBC television interview. “I think it would be completely self-defeating if they went into a trade war, but it’s up to them.” (BBG)

BREXIT: The UK's former Brexit minister has rejected a claim levelled by Ireland's premier that he tried to "torpedo" a proposed resolution to the Northern Ireland Protocol row. Lord Frost said Micheal Martin was "simply wrong" after the Taoiseach suggested he had attempted to deliberately undermine compromise proposals tabled by the European Commission last year. The ex-minister, who quit the cabinet late last year, also claimed the UK's position on the protocol was being "ignored or misrepresented". In those circumstances, Lord Frost said it was "hardly surprising" that the Government was considering unilateral action to address issues with the controversial post-Brexit Irish Sea trading arrangements. (BBG)

BREXIT: The government is planning to publish legislation to override the Northern Ireland Protocol, but Sky News understands the cabinet has still not agreed the wording. The Democratic Unionist Party (DUP) are demanding the trade border in the Irish Sea, created by the treaty, be removed before they restore power sharing at Stormont. Sources close to the discussion claim ministers are concerned the bill could be rendered ineffective if the government is judged to have broken international law. (Sky)

BREXIT: Labour has accused Boris Johnson of seeking to provoke a trade war with Brussels which would only exacerbate Britain’s cost-of-living crisis. Shadow foreign secretary David Lammy said Government threats to tear up the Northern Ireland Protocol have come at “the worst possible time”. (Independent)

POLITICS: The Liberal Democrats will put all their campaign efforts into only one of two crucial byelections this summer – leaving Labour to fight the Tories in the other – as pressure intensifies on leftwing parties to work more closely together to oust the Conservatives from power. The Lib Dem leader, Ed Davey, told the Observer on Saturday that his party would concentrate on the Devon seat of Tiverton and Honiton because it believes it can pull off a sensational win against the incumbent Conservatives in the south-west, where it has traditionally been strong. But with resources and money limited, the Lib Dems know they can maximise their chances there only if they limit help for their candidate in the other contest, in Wakefield, where Labour is the traditional incumbent but was pushed into second by the Tories at the 2019 general election. (Observer)

NORTHERN IRELAND: Boris Johnson is to tell Northern Ireland's leaders that any move to change post-Brexit trade rules must also restore power-sharing at Stormont. The prime minister is visiting Northern Ireland on Monday amid a political crisis sparked by tensions over the Northern Ireland Protocol. Following the 5 May election, the anti-protocol Democratic Unionist Party has refused to engage with the assembly. A new administration cannot be formed without them. A spokesperson for No 10 said Mr Johnson would hold private meetings with the parties and the UK government would "play its part to ensure political stability". The prime minister is expected to say there is "no substitute for strong local leadership". He will urge members of the Stormont assembly to "get back to work to deal with the bread-and-butter issues". (BBC)

ECONOMY: Barely a quarter of employers will offer pay rises to their workers despite difficulties in hiring talent, adding to the cost-of-living pressures facing Britons, research suggests. In a quarterly survey of 2,000 employers by the Chartered Institute of Personnel and Development, only 27 per cent of companies across all sectors said they were willing to increase pay to retain or attract labour in the second quarter of the year. This is despite nearly half - 45 per cent - of employers saying they were struggling to fill vacancies and two thirds saying that they expected hiring shortages to persist for the next six months. The worst hiring difficulties were reported in healthcare, education and the voluntary sector. (The Times)

ECONOMY: Lending to small businesses in Britain has fallen to its lowest since at least 2014 as companies and banks worry about the worsening economic outlook, according to a survey published on Monday. Only 9% of small firms sought finance in the first three months of this year, the lowest proportion since the Federation of Small Business began asking the question eight years ago. The share of firms that saw their applications approved was also at a record low of 43%, the FSB said. "Lenders pulling up the drawbridge for small firms will threaten our already faltering economic recovery," FSB National Chair Martin McTague said. The FSB surveyed 1,211 small business owners and sole traders in March and April. (RTRS)

ECONOMY: More than 50 economists warned on Monday that Britain's post-Brexit plans to boost the competitiveness of its huge finance industry risked creating the kind of problems that led to the global financial crisis. (RTRS)

BOE: Cabinet ministers have turned on the Bank of England over rising inflation, with one warning that the Bank had been failing to "get things right" and another suggesting that it had failed a "big test". In a highly unusual attack, one of the senior ministers warned: "It has one job to do – to keep inflation at around two per cent – and it's hard to remember the last time it achieved its target." The other said government figures were "now questioning its independence", suggesting Rishi Sunak, the Chancellor, should do more to hold Andrew Bailey, the Bank Governor, to account. The interventions reflect growing frustration among Conservative MPs and ministers about the Bank's approach to inflation, which currently sits at seven per cent – five percentage points above its target. (Telegraph)

BOE: The Bank of England governor, Andrew Bailey, will face a grilling from angry Conservative MPs over inflation on Monday, as cabinet sources moved to quell the incendiary remarks about the Bank’s independence. The governor’s appearance before MPs – which has been likened to the showdowns with former Bank boss Lord Mervyn King during the 2008 crash – will come amid intense work from the chancellor, Rishi Sunak, to find new measures to ease the cost of living before the summer recess. (Guardian)

FISCAL: One in five workers will be paying higher or top-rate tax by the next general election, according to an analysis based on official figures. An estimated 2.5 million more taxpayers will be dragged into rates of 40 per cent or 45 per cent due to a combination of fast-growing wages and a freeze in the point at which workers start paying higher levels of tax. Research by the pensions consultancy Lane Clark & Peacock (LCP), estimates that a record 6.78 million workers will be paying higher rates by 2024 — double the total when the Conservatives came to power in 2010 and 58 per cent higher than at the last general election in 2019. (The Times)

FISCAL: Labour will call for a vote on Tuesday to introduce a windfall tax on oil and gas companies, saying it is shameful not to introduce the measure to help tackle the rising cost of living. Shadow minister Ed Miliband told the BBC it was obscene the government had refused to bring in the policy. A windfall tax is a one off levy on companies enjoying unexpected profits. Business Secretary Kwasi Kwarteng said it was a bad idea that would deter firms from investing in the UK. But a Treasury source said the option was "not off the table". (BBC)

RATINGS: Sovereign rating reviews of note from Friday include:

- DBRS Morningstar confirmed the United Kingdom at AA (high), Stable Trend

EUROPE

ECB: The European Central Bank will likely decide at it next meeting to end its stimulus programme in July and raise interest rates "very soon" after that, ECB policymaker Pablo Hernández de Cos said on Saturday. He was speaking at a public event organised by Germany's Bundesbank. (RTRS)

ECB: The European Central Bank will raise interest rates three times this year in a bid to quell inflation, according to economists polled by Bloomberg who’re aligning their views with an increased sense of urgency among policy makers. The Governing Council will lift the deposit rate by a quarter-point in July, September and December, taking it to 0.25% by year-end, the survey showed. The main refinancing operations rate will be hiked in September and December, taking it to 0.5% from zero now. In an earlier poll, economists had only expected a single quarter-point increase this year, with the shift reflecting growing support inside the ECB for rates to start rising in July and maybe rise back above zero in 2022 following eight years below. The economy, meanwhile, is predicted to keep expanding this year even as challenges mount because of the war in Ukraine. Growth of 2.8% and 2.3% in 2022 and 2023 is now envisaged – a downgrade of 0.1 percentage point for each. (BBG)

ECB: It’s not up to the European Central Bank to tackle diverging inflation rates, Governing Council member Pablo Hernandez de Cos said. “It’s up to fiscal policy” to take care of each nation’s specific problems, he said in Frankfurt on Saturday. De Cos said the central bank’s mandate is to “exclusively focus on inflation in the euro area as a whole.” The ECB has signaled its asset purchases will likely end in July. That has traders betting on a swift series of interest-rate hikes that could tighten financial conditions prematurely for some of the region’s weakest economies, feeding concerns that fragmentation could return to the 19-nation euro zone. (BBG)

ECONOMY: The European Union cut its prediction for 2022 euro-area growth and almost doubled its estimate for inflation, according to new draft projections. In the first forecast since the outbreak of war in Ukraine, the European Commission will say gross domestic product will expand 2.7% in 2022 and 2.3% in 2023, according to a draft seen by Bloomberg. That’s down from February readings of 4% and 2.7%. On inflation, the commission predicts rates of 6.1% and 2.7% for this year and next, compared with previous forecasts of 3.5% and 1.7%, respectively. The predictions aren’t finalized and may still change before they are published by the EU executive on Monday. Russia’s invasion of Ukraine and sanctions imposed in response have darkened the outlook for the global economy by sending energy prices surging and straining supply chains that were already reeling from the pandemic. The euro area is among the worst-hit regions because of its reliance on Russian energy and proximity to the conflict. The rebound from virus restrictions is now expected to be softer than initially thought, while inflationary pressures are still on the rise. Consumer-price growth hit a fresh record last month -- reaching almost four times the European Central Bank’s 2% target. (BBG)

GERMANY: Olaf Scholz’s Social Democratic Party lost a regional election for the second straight week amid wavering support for the German chancellor’s Ukraine policy. The ballot again took place under the shadow of Russia’s war in Ukraine. Scholz’s approval rating has slumped after he was criticized for foot-dragging on supplying Kyiv with heavy weapons, and for blocking an immediate ban on Russian energy imports. (BBG)

GERMANY: The shift from Russian gas to costlier LNG could prompt some German manufacturers to relocate to the US, Michael Huether, director of the research institute IW Cologne, said in an interview with Stuttgarter Zeitung and the Stuttgarter Nachrichten. As Germany prepares to shift permanently away from cheaper Russian supplies, the US’s energy independence could make it an attractive option, Huether said. He added that Russia’s economy will be permanently damaged by its standoff with the West. “Putin is committing economic suicide,” Huether said. (BBG)

ITALY/BTPS: Market volatility may push Italy's borrowing costs slightly higher this year, to their highest since 2019, the country's head of debt said on Friday. A looming rate hike by the European Central Bank as soon as July along with the end of its asset purchase programme has inflated Italian government bond yields, pushing them to their highest since late 2018. "Our target for 2022 stands at 0.83%. It might be upwardly revised by a couple of basis points back to its 2019 levels," Davide Iacovoni told Reuters in an interview. Italy's cost of funding fell to a record low of 0.10% in 2021. Referring to the same market uncertainty, Iacovoni said that conditions are "not ideal, at the moment" for a dollar issue, but Rome still planned a U.S. denominated offer in 2022. The dollar index is hovering around its 20-year peak, benefiting from investors' risk adversion as the growth outlook worsens especially for Europe. Italy may offer a new green BTP, or sustainable government bond, in the second half of the year, probably after tapping the 2045 outstanding note via auction. It will be longer than ten- but possibly shorter than a 24-year maturity, Iacovoni said. Containing the cost of borrowing has been a persistent challenge for Rome, which expects public debt to be 147% of gross domestic product by the year end, down from 150.8% in 2021 and 155.3% in 2020. (RTRS)

SWITZERLAND: Swiss voters backed the country’s continued participation in and expansion of the European border agency known as Frontex. The measure was supported by 72% of voters, according to initial projections from national broadcaster SRF. Polls in the lead-up indicated voters would approve the plan. Final results will be published later on Sunday. Also on the ballot were changes to organ-transplant regulation and film financing. Switzerland typically holds four referendums each year on a variety of subjects. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed Malta at A+; Outlook Stable

- Fitch affirmed Switzerland at AAA; Outlook Stable

U.S.

FED: Federal Reserve Bank of Cleveland President Loretta Mester said the U.S. central bank needs to press forward with aggressive rate rises, and that by early fall it may be able to take stock of whether it can slow down or will need to speed up the process of removing support from the economy. “Given economic conditions, ongoing increases in the fed-funds rate are called for, and unless there are some big surprises, I expect it to be appropriate to raise the policy rate another 50 basis points at each of our next two meetings,” Ms. Mester said in a Friday speech text. (WSJ)

ECONOMY: Goldman Sachs Group Inc. economists cut their forecasts for US growth for this year and next to reflect the shake-out in financial markets amid the Federal Reserve’s tightening of monetary policy. In a report Sunday, the economists led by Jan Hatzius said they now expect the economy to grow 2.4% this year and 1.6% in 2023, down from 2.6% and 2.2% previously. “While this slowdown in growth should help lower job openings, it is also likely to raise the unemployment rate a bit, particularly since the job openings rate typically only falls when unemployment spikes in recessions,” the economists said. “We remain optimistic that a sharp rise in the unemployment rate can be avoided, especially since typically the job openings rate declines more and the unemployment rate increases less when the job openings rate is very elevated, like it is today.” (BBG)

ECONOMY: Goldman Sachs Senior Chairman Lloyd Blankfein urged companies and consumers to gird for a US recession, saying it’s a “very, very high risk.” “If I were running a big company, I would be very prepared for it,” Blankfein said on CBS’s “Face the Nation” on Sunday. “If I was a consumer, I’d be prepared for it.” A recession is “not baked in the cake” and there’s a “narrow path” to avoid it, he said. The Federal Reserve has “very powerful tools” to tamp down inflation and has been “responding well,” the former Goldman chief executive officer said. With high fuel prices and a shortage of baby formula tangible measures of Americans’ unease, US consumer sentiment declined in early May to the lowest level since 2011. US consumer prices rose 8.3% in April from a year ago, (BBG)

FISCAL: Senate Republican Leader Mitch McConnell predicts that a $40 billion Ukraine aid package will pass the Senate with broad bipartisan backing on Wednesday, after being delayed by GOP colleague Rand Paul. Speaking to reporters from Stockholm, McConnell said the US should back the expansion of NATO to include Sweden and Finland, and called on President Joe Biden to designate Russia as a state sponsor of terrorism. McConnell and three other Senate Republicans met in Kyiv on Saturday with Ukraine President Volodymyr Zelenskiy. They’ll travel to Helsinki on Monday for talks with Finland’s president. (BBG)

US TSYS: MNI INTERVIEW: Treasury Market Reform Efforts To Ramp Up - Liang

- The U.S. Treasury Department is bolstering its efforts this year to reform the USD23 trillion Treasury market, pushing for more transparency and data and adding that central clearing appears promising for some changes, Treasury Under Secretary for Domestic Finance Nellie Liang told MNI. "The Treasury market is an urgent area because it is important that it function well even in a stressful time," she said. "The Treasury market is the most liquid, deep market in the world and we want to keep it that way" - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

EQUITIES: Hedge funds focused on US equities are pulling back sharply on their bets after the longest stretch of sustained selling in more than a decade left many managers nursing stiff losses. The S&P 500 index has fallen for six weeks in a row in a tumultuous stretch that on Thursday left Wall Street’s benchmark share barometer down by almost a fifth from the peak it reached at the start of 2022, before a dramatic swing higher on Friday. Long-short equity funds, which pitch themselves on the ability to protect client money in down markets, have lost 18.3 per cent for the year up to and including Wednesday, according to Goldman Sachs estimates. The declines have been staggering for funds invested heavily in riskier corners of the market, including lossmaking technology companies, with traders warning that there could be a spate of large redemptions that prompt fund closures. The sharp pullback has prompted funds that trade with Goldman, Morgan Stanley and JPMorgan Chase, three of the largest prime brokers on Wall Street, to dial back their positions over the past week, according to client reports seen by the Financial Times. (FT)

OTHER

GLOBAL TRADE: G-7 agriculture ministers meeting in Stuttgart, Germany, issued a joint statement saying they’re “greatly troubled by the expected serious consequences for global food security” of Russia’s invasion of Ukraine. The impact of the war puts food supplies “under severe strain and further intensifies worldwide humanitarian needs for which President Putin and his accomplices bear the full responsibility,” according to the statement. German Agriculture Minister Cem Oezdemir said he and his G-7 counterparts had also discussed “with concern” moves toward food protectionism by some countries, including Indonesia limiting exports of palm oil and India mostly halting exports of wheat. “If we all start imposing these export limits, or even closed down markets, that just makes the crisis worse,” Oezdemir said. “It also hurts India itself and the farmers there because of course it means a rollercoaster ride for prices. (BBG)

GLOBAL TRADE: India prohibited wheat exports that the world was counting on to alleviate supply constraints sparked by the war in Ukraine, saying that the nation’s food security is under threat. Exports will still be allowed to countries that require wheat for food security needs and based on the requests of their governments, India’s Directorate General of Foreign Trade said in a notification dated May 13. All other new shipments will be banned with immediate effect. (BBG)

GLOBAL TRADE: India said it would keep a window open to export wheat to food-deficit countries at the government level despite restrictions announced two days earlier. India’s Commerce Secretary B.V.R. Subrahmanyam told reporters the government will also allow private companies to meet previous commitments to export nearly 4.3 million tons of wheat until July. India exported 1 million tons of wheat in April. India mainly exports wheat to neighboring countries like Bangladesh, Nepal and Sri Lanka. A key aim of restrictions on exports is to control rising domestic prices. Global wheat prices have risen by more than 40% since the beginning of the year. (CNBC)

GLOBAL TRADE: The UK’s Health Security Agency has been using video surveillance technology from under-fire Chinese firm Hangzhou Hikvision Digital Technology Co. at laboratories that conduct research into vaccines and deadly diseases, according to people familiar with the matter. (BBG)

GEOPOLITICS: Finland and Sweden are set to apply for membership in the NATO defense bloc after Russia’s invasion of Ukraine is ending an era of the two Nordic nations shunning military alliances. Finland’s parliament is expected in coming days to approve a formal decision to seek entry into the North Atlantic Treaty Organization that President Sauli Niinisto and Prime Minister Sanna Marin announced at a news conference in Helsinki on Sunday. Later in the day, neighboring Sweden’s ruling Social Democrats reversed their long-held opposition to such a step, removing the last obstacle to joining Finland’s bid. (BBG)

GEOPOLITICS: In a phone call with Russian President Vladimir Putin, Finland President Sauli Niinisto announced his country’s intention to see membership in NATO, saying that Russia’s invasion of Ukraine in February 2022 has “altered the security environment of Finland.” “The conversation was direct and straight-forward and it was conducted without aggravations,” President Niinistö said in a statement. “Avoiding tensions was considered important.” Niinisto said he repeated his deep concern over the human suffering caused by the war in Ukraine and called for peace. He also sought to help secure the evacuation of civilians from the war zone. Putin told Niinisto in return that abandoning neutrality and joining NATO would be a mistake that could damage relations between their two countries, Reuters reported. (CNBC)

GEOPOLITICS: Turkey said it could back Sweden and Finland's NATO bids if they stop supporting terrorists and lift export bans. Aspiring NATO bids require unanimous approval from existing members to join the alliance.Turkey's Foreign Minister Mevlut Cavusoglu on Sunday outlined demands for Finland and Sweden which seek membership in NATO in response to Russia's invasion of Ukraine. Speaking with Turkish reporters after a meeting of NATO foreign ministers in Berlin, he said that Sweden and Finland must stop supporting terrorists in their countries, provide clear security guarantees and lift export bans on Turkey. According to Cavusoglu, Turkey was not threatening anybody or seeking leverage but speaking out especially about Sweden's support for the Kurdistan Workers' Party (PKK). Ankara views the PKK as a terrorist organization. Cavusoglu echoed an earlier statement by Turkish President Recep Tayyip Erdogan two days ago, when he said Turkey did not have a "positive opinion" about Finland and Sweden's ambitions to join the military alliance. Erdogan accused both countries of harboring "terrorist organizations" in his unfavorable assessment of the membership bids. Turkey has long accused Nordic countries, especially Sweden, of harboring extremist Kurdish groups as well as supporters of Fethullah Gulen, a US-based preacher wanted over a failed 2016 coup. Sweden, in particular, has a large immigrant community that hails from Turkey. Many of the migrants are of Kurdish origin and some have been granted political asylum after decades of sporadic conflict between Kurdish groups and Turkish security forces. (Deutsche Welle)

GEOPOLITICS: “Turkey has made it clear that its intention is not to block membership” of NATO for Finland and Sweden, said Jens Stoltenberg, secretary general of the military alliance, speaking after a two-day meeting of NATO foreign ministers in Berlin. Stoltenberg said he was confident Turkey’s concerns , which came to the forefront on Friday, would be addressed without delaying the membership procedure. “A quick and swift process,” is still expected, he said. Addressing concerns about possible moves by Russia before the Nordic nations are fully ratified, Stoltenberg said “we will look into ways to provide security assurances, including by increasing NATO presence in the Baltic region, in and around Finland and Sweden.” (BBG)

GEOPOLITICS: Sweden will send a delegation of diplomats to Ankara for talks this week, after President Recep Tayyip Erdogan voiced opposition to allowing Sweden and Finland as NATO members. “We are interested in solving this situation,” Sweden’s Foreign Minister Ann Linde said. “I think you should try to find a good solution that makes both parties satisfied.” While Sweden and Finland have strong support from a large majority of NATO members, Linde acknowledged that other issues may arise. (BBG)

GEOPOLITICS: German Foreign Minister Annalena Baerbock told reporters in Berlin that Sweden and Finland would be able to join NATO “very quickly” if they decide to go ahead with applications, as is expected, and that there wouldn’t be a “grey zone” in the accession process. Her Canadian counterpart, Melanie Joly, underscored the need to move quickly, noting “disinformation campaigns that are going on in Finland and Sweden” as well. (BBG)

GEOPOLITICS: Leaders of the United States and the 10-country Association of Southeast Asian Nations (ASEAN) committed at a summit in Washington on Friday to raise their relationship to a "comprehensive strategic partnership" in November this year. In a joint "vision statement" after a two-day summit, the leaders also said in reference to Ukraine that they reaffirm "respect for sovereignty, political independence, and territorial integrity." (RTRS)

JAPAN: The Japanese government will use deficit-financing bonds to cover for 2.7 trillion yen ($20.9 billion) of extra spending to ease the blow to consumers and businesses from soaring costs, Nikkei reported. The government plans to formally decide on the spending decision on Monday and will aim to pass it in the current parliamentary session, the paper reported, without saying where it got the information from. The spending will go toward covering measures like the increase in upper limit on gasoline subsidies for oil refiners, according to the Nikkei. (BBG)

JAPAN: Japan needs a faster "third arrow" growth strategy focussing on promoting a carbon-neutral society, including by creating a financial hub in Tokyo for Asian firms aiming to go green, said Hiroshi Nakaso, considered a front-runner to be the country's next central bank chief. Massive monetary and fiscal stimulus deployed in 2013 as the first two "arrows" of then-premier Shinzo Abe's "Abenomics" policies reflated the economy. But the third, structural reform, barely took flight, failing to boost a potential growth rate stuck below 1%. Steps to encourage capital spending on green projects would help lift Japan's potential growth rate and serve as an upgraded growth strategy, said Nakaso, a former deputy governor of the Bank of Japan (BOJ). (RTRS)

AUSTRALIA: Australian Prime Minister Scott Morrison announced a housing policy on Sunday aimed at boosting home ownership and reducing prices, as his government lags the opposition Labor Party days before a general election. Australians will vote for a government on Saturday, with recent polls showing Morrison’s Liberal-National coalition on track to lose to centre-left Labor. A win by Labor, led by Anthony Albanese, would end nine years of conservative government in Australia. (RTRS)

OIL: Germany plans to stop importing Russian oil by the end of the year even if the European Union fails to agree on an EU-wide ban in its next set of sanctions, government officials said. Efforts to seal deals with alternative suppliers are progressing at the chancellery in Berlin and the government is confident it can solve remaining logistical problems within the next six to seven months, according to the officials, who spoke on condition of anonymity. With European Union foreign ministers meeting in Brussels on Monday to discuss the next round of sanctions, EU diplomats have floated a delay in the phased-in oil ban after Hungary objected, saying the step would be too damaging to its economy. (BBG)

SOUTH KOREA: South Korea's finance minister and central bank chief agreed on Monday to boost policy coordination in fighting inflation and financial markets instability, which they cited as the biggest current risks facing the economy. Finance Minister Choo Kyung-ho and Bank of Korea Governor Rhee Chang-yong also agreed that the downside risk to growth in Asia's fourth-largest economy has also increased, a joint statement from the two organisations added. The country's two most powerful economic policymakers held their first one-on-one meeting on Monday after taking office this month and in a follow-up to their attendance at a meeting on Friday hosted by President Yoon Suk-yeol. The statement did not disclose any further comments on specific asset classes or indicators. (RTRS)

BOK: South Korea's central bank chief said on Monday he may be able to say whether a 50 basis-point interest rate hike is needed only after seeing more data in around July and August. Bank of Korea Governor Rhee Chang-yong made the comment in responding to a question by reporters after his scheduled meeting with Finance Minister Choo Kyung-ho. (RTRS)

NORTH KOREA: North Korean leader Kim Jong Un blasted officials over slow medicine deliveries and ordered his military to respond to the surging but largely undiagnosed COVID-19 crisis that has left 1.2 million people ill with fever and 50 dead in a matter of days, state media said Monday. More than 564,860 people are in quarantine due to the fever that has rapidly spread among people in and around the capital, Pyongyang, since late April. Eight more deaths and 392,920 newly detected fevers were reported Monday, the North's emergency anti-virus headquarters said. State media didn’t specify how many were confirmed as COVID-19, but North Korea is believed to lack sufficient testing supplies to confirm coronavirus infections in large numbers and is mostly relying on isolating people with symptoms at shelters. (AP)

MEXICO: Mexico’s central bank is ready to tighten monetary policy at a faster pace if needed, according to Governor Victoria Rodriguez Ceja. The bank increased the key rate by half a percentage point for the fourth consecutive meeting on Thursday and said it was willing to take more “forceful measures” to tame prices. The decision wasn’t unanimous, with one board member voting for a 75 basis-point hike. Any increase bigger than 50 basis points would be the most aggressive since the current inflation targeting regime was introduced 14 years ago. “If in our evaluation it is necessary to tighten by a higher magnitude, there should be confidence that that is how we’ll react,” Rodriguez told Formula Financiero radio late Thursday. (BBG)

MEXICO: Mexico central bank Deputy Governor Jonathan Heath said in a tweet increasing the key rate by 50bps returns the monetary stance to the “neutral zone.” “I think the position consistent with the current inflation scenario should be restrictive, so there is still a long way to go,” Heath said. (BBG)

RUSSIA: Ukrainian Major General Kyrylo Budanov has said he believes his country’s war with Russia will be over by the end of the year. “The breaking point will be in the second part of August,” he said in an exclusive interview with Sky News. “Most of the active combat actions will have finished by the end of this year.” “As a result, we will renew Ukrainian power in all our territories that we have lost including Donbas and the Crimea,” he added. (CNBC)

RUSSIA: Ukraine’s deputy prime minister for European and Euro-Atlantic integration, Olga Stefanishyna, said she sees a “cautious amount of great news” in the country’s defense against Russia. In particular, she pointed to Russian troops pulling back from around Kharkiv, Ukraine’s second-largest city, in recent days. “But we are not overoptimistic in that regard,” she said in an interview on ABC’s “This Week.” “We see that Putin has readjusted his strategy, and the only possible winning scenario for him is a long-lasting war, which is not the case for us and the democratic world. ... The unconditional victory still remains the way forward.” Russia’s navy remains in “full preparedness to continue shelling,” Stefanishyna said, adding that “the bombarding of the eastern part of Ukraine, which are the major supply chains for the humanitarian and defense assistance, have been attacked over these nights.” (CNBC)

RUSSIA: Russian forces are withdrawing from the northeastern city of Kharkiv, Ukraine said in an operational update Saturday. “Russian enemy did not conduct active hostilities in the Kharkiv direction. Its main efforts were focused on ensuring the withdrawal of his troops from the city of Kharkiv, maintaining the occupied positions and supply routes,” Oleksandr Shtupun, spokesperson for the General Staff of the Armed Forces of Ukraine, said in an address on YouTube, according to an NBC News translation. (CNBC)

RUSSIA: Russia has failed to achieve substantial territorial gains in the Donbas region over the past month and during that time has sustained “consistently high levels of attrition,” the U.K. defence ministry said in an intelligence update. “Russia has now likely suffered losses of one third of the ground combat force it committed in February,” the U.K. said. “Under the current conditions, Russia is unlikely to dramatically accelerate its rate of advance over the next 30 days.” The assessment comes days after Ukrainian repelled Russian attempts to cross the Siverskyi Donets river in the Luhansk region,. (BBG)

RUSSIA: NATO allies are expected to highlight Russia’s behavior as a direct threat in an upcoming strategic document, where they’ll also address how to better support neighboring countries that are vulnerable to coercion and aggression, according to a NATO official. Allies will likely keep open the possibility of reviving relations if Moscow’s behavior changes, the official said, adding that the document will also address China and its relationship with Russia. The so-called Strategic Concept document outlines the alliance’s priorities for the coming years, and is due to be finalized at NATO’s summit in Madrid in late June. The previous version, published in 2010, referred to Russia as a partner, wording that is set to be scrapped this time. (BBG)

RUSSIA: G-7 foreign ministers said on Saturday they will continue to provide military and defense assistance to Ukraine for “as long as necessary.” (CNBC)

RUSSIA: US defence secretary Lloyd Austin called for an “immediate ceasefire” in Ukraine during his first phone call with his Russian counterpart Sergei Shoigu since the war began almost three months ago, as western allies ramped up direct talks with Moscow. Austin’s conversation with Shoigu came as German chancellor Olaf Scholz spoke with Vladimir Putin and urged the Russian president to work towards a ceasefire in Ukraine, improve the humanitarian situation and make progress towards a diplomatic solution to end the conflict. The call between Austin and Shoigu was notable because it was the first since February 18, six days before Russian forces launched their attack on Ukraine, and could help ease fears that the war will spill over into a broader fight between Nato and Russia. Contact between top US and Russian defence and military officials is considered crucial to prevent any misunderstandings or accidental escalation between the two nuclear-armed powers. “Secretary Austin urged an immediate ceasefire in Ukraine and emphasised the importance of maintaining lines of communication,” Pentagon spokesperson John Kirby said in a statement on Friday. (FT)

RUSSIA: Ukraine’s foreign minister met with Antony Blinken in Berlin, where the US Secretary of State is attending the NATO meeting. Blinken relayed details of the latest round of U.S. security assistance for Ukraine. Freeing up grain exports was among the topics of discussion as Russia’s blockade of Ukraine’s Black Sea ports prevents the breadbasket nation from shipping. The pair “committed to seeking a solution to export Ukraine’s grain to international markets,” according to a readout from the State Department. (BBG)

RUSSIA: Ukraine’s Foreign Minister Dmytro Kuleba has said additional aid from the U.S. is on its way after meeting with U.S. Secretary of State Antony Blinken in Berlin. “More weapons and other aid is on the way to Ukraine,” Kuleba tweeted. “We agreed to work closely together to ensure that Ukrainian food exports reach consumers in Africa and Asia. Grateful to Secretary Blinken and the U.S. for their leadership and unwavering support.” Blinken is in Germany for the meeting of NATO foreign ministers this weekend. (CNBC)

RUSSIA: Germany Chancellor Olaf Scholz said he detected no change of attitude in Vladimir Putin when he spoke by telephone with the Russian president for more than an hour on Friday. (BBG)

RUSSIA: Russia is responsible for the devastation in Ukraine and it’s “a matter of justice” that it should be held accountable via the seizing of frozen assets, said German Foreign Minister Annalena Baerbock. Speaking after talks with G-7 counterparts in Germany, Baerbock called seizing assets “anything but easy” in legal terms, and noted there are few precedents. If EU countries were to do so, it would have to be legally watertight and stand up at the European Court of Justice, she said, adding that her Canadian counterpart had indicated it’s legally possible there. “As Europeans we have a different legal framework, so that we always need more time for such a step,” Baerbock told reporters. “But there are indeed some good reasons why we too might choose this path.” (BBG)

RUSSIA: Group of Seven foreign ministers issued a long list of demands on Beijing’s stance toward Ukraine following their meeting in Germany, including a request “not to justify Russian action” there. The G-7 officials called on China to “resolutely urge Russia to stop its military aggression against Ukraine,” according to a joint statement. They also called on Beijing not to assist Russia, not to undermine sanctions, and “to desist from engaging in information manipulation, disinformation and other means to legitimize Russia’s war of aggression.” The G-7 is committed to “both short-and-long term-support” for Ukraine, according to the statement. “We are determined to accelerate a coordinated multilateral response to preserve global food security and stand by our most vulnerable partners in this respect,” it added. (BBG)

RUSSIA: Moscow will take adequate precautionary measures if NATO deploys nuclear forces and infrastructure closer to Russia’s border, Russian news agencies quoted Deputy Foreign Minister Alexander Grushko as saying on Saturday. “It will be necessary to respond ... by taking adequate precautionary measures that would ensure the viability of deterrence,” Interfax agency quoted Grushko as saying. Moscow has no hostile intentions towards Finland and Sweden and does not see “real” reasons for those two countries to be joining the NATO alliance, Grushko added. (CNBC)

RUSSIA: Russian diplomats in Washington are being threatened with violence and U.S. intelligence services try to make contact with them, Tass news agency cited the ambassador as saying on Saturday. Anatoly Antonov told Russian television that since Russia invaded Ukraine on Feb. 24, face-to-face meetings with U.S. officials had ended. It’s like a besieged fortress. Basically, our embassy is operating in a hostile environment ... Embassy employees are receiving threats, including threats of physical violence, Tass quoted him as saying. (RTRS)

RUSSIA: President Putin is “very ill with blood cancer”, an oligarch close to the Kremlin is reported to have said. The unnamed oligarch was recorded discussing Putin’s health with a Western venture capitalist in mid-March in a recording obtained by New Lines, a US magazine. The Russian says in the recording that Putin had surgery on his back linked to his blood cancer shortly before ordering the invasion of Ukraine. He complains that the president has gone “crazy”. He says that there is deep dissatisfaction in Moscow about the state of the economy and, appearing to speak on behalf of other oligarchs, says “we all hope” that Putin dies. “He absolutely ruined Russia’s economy, Ukraine’s economy and many other economies — ruined [them] absolutely,” the oligarch says. “The problem is with his head. One crazy guy can turn the world upside down.” There has been speculation about Putin’s health after he was seen on several occasions walking with an apparent limp. During an awkward meeting last month with Sergei Shoigu, the defence minister, Putin was seen gripping the side of a table. (The Times)

RUSSIA: Group of Seven foreign ministers vowed on Saturday to reinforce Russia's economic and political isolation, continue supplying weapons to Ukraine and tackle what Germany's foreign minister described as a "wheat war" being waged by Moscow. (RTRS)

RUSSIA: US authorities are alleging that a Russian tycoon acted as the “straw owner” of two yachts worth more than $1 billion, including the $700 million Scheherazade, a superyacht linked to Putin. Court filings in the South Pacific island of Fiji, where the US is trying to seize the $325 million yacht Amadea, reveal what US officials allege is a nest of offshore shell companies that were set up with the help of a yacht broker to conceal the true owners of both vessels — an allegation that lawyers for the listed owner and the broker dispute. A hearing is scheduled for Wednesday in Fiji on the fate of the Amadea. (BBG)

RUSSIA: UniCredit and Citigroup are exploring asset swaps with Russian financial institutions as western banks exiting the country scramble to avoid hefty writedowns on their operations, according to people with knowledge of their plans. The banks are among a small number of western lenders with a significant presence in Russia. Moscow’s invasion of Ukraine and the subsequent international sanctions have forced foreign bank executives to consider turning their backs on the country. (FT)

RUSSIA: With Putin’s invasion of Ukraine stalling, other former Soviet states are weighing prospects for pulling away from Moscow’s orbit even as they fear risks of potential border conflict. The war is sending tremors along an arc of instability stretching from Ukraine’s neighbor Moldova through the Caucasus and into Kazakhstan in central Asia. Putin’s intentions have become an urgent national security question in countries with so-called “frozen conflicts” or that have large pro-Russian minorities. (BBG)

RUSSIA: Estonia has asked NATO for command centers capable of overseeing more than 10,000 troops and the bloc's military operations in the Baltics to counter Russia amid the ongoing war in Ukraine, Estonian Defense Minister Kalle Laanet said in an exclusive interview with Nikkei. (Nikkei)

RUSSIA: Consumer inflation in Russia accelerated in April to 17.83% in year-on-year terms, its highest level since January 2002, data showed on Friday, as it got a boost from the volatile rouble and unprecedented western sanctions that disrupted logistics chains. But monthly inflation slowed to 1.56% in April from 7.61% in March when it staged the biggest month-on-month increase since January 1999, data from the federal statistics service Rosstat showed. Inflation in Russia has accelerated sharply after Russia began what it calls "a special military operation" in Ukraine on Feb. 24. The fall in the rouble to record lows in March boosted demand for a wide range of goods from food staples to cars on expectations that prices will rise even more. The rouble has recovered since and firmed to a near five-year high against the euro on Friday. (RTRS)

SOUTH AFRICA: South Africa will cut 2,000 megawatts from the country’s power grid from 5 p.m. to 10 p.m. on Sunday and will increase that to 3,000 megawatts on Monday and Tuesday evenings after a further loss of generating capacity, according to the state-owned power utility. “Since yesterday evening, breakdowns occurred on a unit each at Tutuka, Camden and Majuba power stations,” Eskom Holdings SOC Ltd. said in a statement on Sunday. Meanwhile, a generating unit at each of the company’s Hendrina and Majuba plants have returned to service, the company said. Rolling blackouts, or load-shedding as it’s known locally, is expected to be reduced to 2,000 megawatts from Wednesday for the rest of the week, Eskom said. Eskom currently has 2,094 megawatts of generating capacity on planned maintenance, while another 17,640 megawatts is unavailable due to breakdowns, the utility said. (BBG)

IRAN: The U.S. State Department said on Friday it appreciated the European Union's efforts to revive talks on restoring the 2015 Iran nuclear deal but said there was no agreement yet and no certainty that one might be reached. "At this point a deal remains far from certain. Iran needs to decide whether it insists on extraneous conditions and whether it wants to conclude a deal quickly, which we believe would serve all side's interests. We and our partners are ready, and have been for some time. It's now up to Iran," said a U.S. State Department spokesperson on condition of anonymity. (RTRS)

METALS: Major copper producers from BHP Group to Freeport-McMoRan Inc. will likely avoid drastic changes in the way they do business in Chile as writers of a new constitution wrapped up deliberations on mining proposals. In a vote on the Constitutional Convention floor on Saturday, a plan to replace the nation’s investor-friendly concession model with a system of temporary and revocable permits fell short of the two-thirds threshold needed to be included in a document that will be put to a referendum on Sept. 4. While the article had been moderated from previous iterations that required the state to have majority ownership of projects, the mining industry warned it still failed to deliver the legal certainties needed for investments that are crucial for supplying the clean-energy transition. Chile boasts the biggest deposits of the wiring metal used to electrify economies. To be sure, Saturday’s vote means the draft constitution will lack a dedicated mining statute, leaving legislation more vulnerable to changes in the future. (BBG)

METALS: Russian government is considering a Rosneft’s initiative to curb domestic metal prices, Kommersant reports, citing unidentified people with knowledge of the matter. Rosneft proposes to introduce mandatory supplies of metal products to the domestic market and a price increase ceiling of 4% per year, as well as export duties on metal and iron ore. Premier Mikhail Mishustin instructed First Deputy Prime Minister Andrey Belousov and Finance Minister Anton Siluanov to review Rosneft’s proposals. Belousov’s office has confirmed that the relevant agencies have been instructed to review and study the proposals. (BBG)

ENERGY: The European Union is set to offer its gas importers a solution to avoid a breach of sanctions when buying fuel from Russia and still effectively satisfy President Vladimir Putin’s demands over payment in rubles.In new guidance on gas payments, the European Commission plans to say that companies should make a clear statement that they consider their obligations fulfilled once they pay in euros or dollars, in line with existing contracts, according to people familiar with the matter. The EU’s executive arm told the governments that the guidance does not prevent companies from opening an account at Gazprombank and will allow them to purchase gas in accordance with EU sanctions following Russia’s invasion of Ukraine, the people added. (BBG)

ENERGY: The European Commission wants to waive EU competition rules to allow governments to cap prices for consumers in the event of a complete outage of Russian gas supplies, German newspaper Welt am Sonntag reported on Saturday, citing a commission document on “short-term energy market interventions”. According to the document, European Union member states should be allowed to regulate consumer prices for a transitional period to protect them from spiking even before an acute shortage, Welt reported. “The financing of this intervention requires significant sums,” the newspaper quoted the document as saying. (RTRS)

ENERGY: Poland’s prime minister criticized the European Commission for a plan to offer the bloc’s importers a solution to avoid a breach of sanctions when buying gas from Russia, and still satisfy President Vladimir Putin’s demands over payment in rubles. “I am disappointed to see that in the European Union there is consent to pay for gas in rubles,” Mateusz Morawiecki said on Sunday. “Poland will stick to the rules and will not yield to Putin’s blackmail.” Russia halted gas flows to neighboring Poland in late April. Bloomberg reported Saturday that the EU has developed a solution to avoid a sanctions breach. (BBG)

ENERGY: Russian state-owned utility Inter RAO will stop exporting electricity to Finland from Saturday because it has not been paid, the company's Finnish subsidiary said on Friday. (RTRS)

OIL: The EU is “very much determined” to maintain a united front against Moscow by securing unanimous support for the proposed ban on Russian oil and winning Hungary over, a top European Commission official said. Commission vice-president Maroš Šefčovič admitted that the mooted oil embargo was taking the 27 EU member states into “more and more difficult territory”, given the negative economic impact of the measures. But he added: “We are very much determined to work with Hungary and of course with the rest of the EU member states to have European unity . . . We definitely prefer the 27 going forward together.” Diplomats on Friday expressed optimism about swaying Hungarian prime minister Viktor Orbán next week as Budapest holds out for extra investment and time to make the transition away from Russian crude. (FT)

OIL: Germany plans to stop importing Russian oil by the end of the year even if the European Union fails to agree on an EU-wide ban in its next set of sanctions, government officials said. Efforts to seal deals with alternative suppliers are progressing at the chancellery in Berlin and the government is confident it can solve remaining logistical problems within the next six to seven months, according to the officials, who spoke on condition of anonymity. With European Union foreign ministers meeting in Brussels on Monday to discuss the next round of sanctions, EU diplomats have floated a delay in the phased-in oil ban after Hungary objected, saying the step would be too damaging to its economy. (BBG)

OIL: Iran has capacity to double oil exports if there’s sufficient demand, a top official said, even as a deal on the country’s nuclear program that could pave the way for the lifting of sanctions remain elusive. Iran will “exert maximum effort to recoup its crude oil market share and revive its customers,” Mohsen Khojastehmehr, managing director of the National Iranian Oil Co., told reporters Saturday in Tehran. While Iran doesn’t publish figures for oil production or exports, analysts estimate that it sells as much as 1 million barrels per day. The government’s budget plan forecasts daily sales of 1.4 million barrels for the year through March 2023. (BBG)

OIL: Iraq’s representative at OPEC said the organisation had agreed to the country increasing its output to 4.5 million barrels of oil per day (bpd) starting from June, the state news agency (INA) reported on Saturday. There will be further increases of 50,000 bpd in output in each of the months July, August and September, INA added, citing Muhammad Saadoun’s statements. Iraq pumped 4.43 million barrels per day (bpd) of oil in April, 16,000 bpd above its OPEC+ quota for that month, according to data from state-owned marketer SOMO seen by Reuters on May 11. (RTRS)

OIL: Forces from the regional Kurdish government have taken control of some oil wells in northern Kirkuk, Iraq's state-run North Oil Company said in a statement on Saturday, but the Kurdish government denied this. (RTRS)

FOREX: The International Monetary Fund has lifted the Chinese yuan's weighting in its elite basket of reserve currencies to 12.28 percent from 10.92 percent, the country's central bank said Sunday. In its first regular review of the evaluation of the IMF's special drawing rights, or SDR, since the yuan was included in the basket in 2016, the Washington-based organization has decided to raise the status of the Chinese currency, also known as the renminbi. The updated basket weights will come into effect on Aug. 1, the People's Bank of China said in a statement, adding that the next SDR review is scheduled to be concluded before the end of July 2027. Financial experts said the IMF might be trying to increase pressure on the Communist-led Chinese government to work harder to remove restrictions on transactions in the yuan. The weighting of the U.S. dollar was also raised to 43.38 percent, but that of the euro, yen and pound was decreased to 29.31 percent, 7.59 percent and 7.44 percent, respectively, according to the IMF. As of Sunday, the weights of the dollar, euro, yen and pound were 41.73 percent, 30.93 percent, 8.33 percent and 8.09 percent, respectively. (Nikkei)

CHINA

POLICY: Chinese President Xi Jinping warned of the improper accumulation of wealth and the risk it poses to a healthy economy in previously unpublished remarks by a Communist Party journal. China needs to expand the real economy and avoid a mass jobless situation, Xi said in a speech on Dec. 8 at the annual Central Economic Work Conference, and published by Qiushi magazine on Sunday. He also warned of disorderly capital expansion, and financial and property market risks. Xi highlighted that while China shouldn’t allow “capital predators” to act recklessly, it needs to ensure orderly growth of capital and not just get rid of it. It’s unclear why the journal released the remarks more than five months after the speech was made. (BBG)

POLICY: MNI BRIEF: China's Top Mission To Boost Econ-Ex-PBOC Advisor

- China should place top priority on bailing out the economy, and the central bank needs to be cautious while widely using its structural monetary tools, said Huang Yiping, a former adviser to the PBOC said on Saturday at an economy forum - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLICY: China should advance and strengthen fiscal and monetary policies, focusing on stabilising employment and prices and spurring domestic growth to offset expected weaker external demand, wrote Guan Tao, former forex official and chief economist at BOC Securities in a blog post. Monetary policy faces challenges when prices rise amid growing imported inflation driven by the Russia-Ukraine conflict, said Guan. The monetary authority should maintain the flexibility of the yuan while keeping it at a reasonable equilibrium level and absorbing internal and external shocks, said Guan. (MNI)

YUAN: MNI BRIEF: PBOC Should Act To Soothe FX Sentiment - Ex-Official

- The People's Bank of China should act to stabilise FX market expectations of a weaker yuan against a rallying dollar, said Sheng Songcheng, a former director of the PBOC's statistics department said on Saturday in an economic forum - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

PROPERTY: Chinese financial authorities on Sunday allowed a further cut in mortgage loan interest rates for some home buyers, in another push to prop up its property market and revive a flagging engine of the world's second-largest economy. For purchases of first homes, commercial banks can reduce the lower limit of interest rates on home loans by 20 basis points, based on the corresponding tenor of benchmark Loan Prime Rates (LPRs), the People's Bank of China (PBOC) and China's Banking and Insurance Regulatory Commission said in a statement. The cut aims to support demand and promote stable and healthy development of the real estate market, the statement said. (RTRS)

PROPERTY: China’s cut in the lower bound for mortgage interest rates will set mortgage rates on a downtrend and boost the property market, which has been battered by debt problems, according to the official China Securities Journal. The PBOC’s decision targets individual first home buyers and could both put pressure on rates to fall further and also help curb speculation, the newspaper said, citing market participants. In addition to the action, the LPR for 1-year and 5-year loans will likely be lowered by 5-10 basis point on Friday, because only by lowering the rate for long-term loans can the policy boost consumption and reduce buyers’ burden, according to Dong Ximiao, chief researcher of Zhaolian Finance. (BBG)

PBOC: China can cut interest rates in combination with other monetary tools to boost the real economy, even as the yuan’s drop against the dollar sparks capital outflow concerns, according to the official Economic Daily, citing academics and think tank analysts. Yuan depreciation against dollar does not mean China can’t lower rates, said Feng Xuming, director of macroeconomic think tank under Chinese Academy of Social Sciences. China does not need to follow U.S. and should focus on adding support to real economy for post-pandemic recovery, said Feng. Fed rate hikes have led to capital outflows and pressured yuan, reducing room for China to take more monetary easing, but currency depreciation will be short-lived, said Cui Fan, professor at University of Inernational Business and Economics. (BBG)

FISCAL: China could issue 2 trillion yuan ($290 billion) worth of special government bonds in the second quarter to accelerate infrastructure building, according the official Economic Information Daily. Local governments have raised up 1.3 trillion yuan by April 25, almost double last year’s level, ensuring ample spending to support front-loaded infrastructure projects for this year. (BBG)

CORONAVIRUS: Shanghai will gradually begin reopening businesses such as shopping malls and hair salons in China's financial and manufacturing hub from Monday after weeks in strict COVID-19 lockdown, while Beijing battles a small but stubborn outbreak. All but shut down for more than six weeks, Shanghai is tightening curbs in some areas that it hopes marks a final push in its campaign against the virus, which has infuriated and exhausted residents of China's largest and most cosmopolitan city. Shopping malls, department stores, and supermarkets will begin resuming in-store operations and allow customers to shop in "an orderly way", while hair salons and vegetable markets will reopen with limited capacity, Vice Mayor Chen Tong told a media briefing on Sunday. He gave no specifics on the pace or extent of such reopenings, and many residents reacted online with scepticism. "Who are you lying to? We can't even go out of our compound. You can open up, no one can go," said a user of China's Twitter-like Weibo, whose IP showed as being from Shanghai. (RTRS)

CORONAVIRUS: Shanghai aims to reopen more broadly and allow normal life to resume in the city from June 1, a city official said on Monday, after declaring that 15 out of the city's 16 districts had achieved "zero-COVID cases outside quarantined areas" status. Deputy mayor Zong Ming made the comments at a daily online news conference. (RTRS)

CORONAVIRUS: Beijing on Sunday extended guidance to work from home in four districts of the Chinese capital, including the largest, Chaoyang, as the city tries to stop a COVID-19 outbreak. Beijing found 55 new cases in the 24 hours to 3 p.m. (0700 GMT) on Sunday, 10 of which were outside areas that under quarantine, officials said. The city is scrambling to stamp out such community infections. (RTRS)

MARKETS: MNI BRIEF: PBOC To Facilitate Financial Markets Investment

- The People's Bank of China pledged to further open up its financial markets as the international Monetary Funds raised the yuan's weighting in the Special Drawing Rights currency basket, according to a statement on the PBOC's website on Sunday - on MNI Policy MainWire now, for more details please contact sales@marketnews.com..

CHINA MARKETS

PBOC NET DRAINS CNY10 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) on Monday injected CNY100 billion via one-year medium-term lending facilities and CNY10 billion via seven-day reverse repos with the rates unchanged at 2.85% and 2.10%, respectively. The operation has led to a net drain of CNY10 billion after offsetting the maturity of CNY100 billion MLF and CNY20 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9537% at 09:37 am local time from the close of 1.5496% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 41 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7871 MON VS 6.7898

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7871 on Monday, compared with 6.7898 set on Friday.

OVERNIGHT DATA

CHINA APR INDUSTRIAL OUTPUT -2.9% Y/Y; MEDIAN +0.5%; MAR +5.0%

CHINA APR INDUSTRIAL OUTPUT YTD +4.0% Y/Y; MEDIAN +5.0%; MAR +6.5%

CHINA APR RETAIL SALES -11.1% Y/Y; MEDIAN -6.6%; MAR -3.5%

CHINA APR RETAIL SALES YTD -0.2% Y/Y; MEDIAN +1.2%; MAR +3.3%

CHINA APR FIXED ASSETS EX RURAL YTD +6.8% Y/Y; MEDIAN +7.0%; MAR +9.3%

CHINA APR PROPERTY INVESTMENT YTD -2.7% Y/Y; MEDIAN -1.5%; MAR +0.7%

CHINA APR UNEMPLOYMENT RATE 6.1%; MEDIAN 6.0%; MAR 5.8%

CHINA APR RESIDENTIAL PROPERTY SALES YTD -32.2% Y/Y; MAR -25.6%

JAPAN APR PPI +10.0% Y/Y; MEDIAN +9.4%; MAR +9.7%

JAPAN APR PPI +1.2% M/M; MEDIAN +0.8%; MAR +0.9%

NEW ZEALAND APR BUSINESS NZ SERVICES PSI 51.4; MAR 51.5

The Performance of Services Index was 51.4 in April, so little changed from March’s 51.5. On the one hand, this result could be viewed as positive with it being above the breakeven 50 mark for a second consecutive month. To be sure, some parts of the PSI did lift strongly in April. Cultural, Recreational, and Personal stood out among industries, with its unadjusted PSI leaping from a truly dismal 15.6 in March to a record high of 85.8 in April, aided by a reboot of travel and events. Looking across regions, Otago/Southland’s PSI rose to a strong unadjusted 59.9 in April after a long period of underperformance. Some border reopening, and more promised, has seemingly boosted activity in the deep South by more than elsewhere. Supply chain issues remain a major headache for service sector firms – epitomised by the PSI supplier deliveries index still languishing around 40, more than 10 full index points below its historical average. (BNZ)

MARKETS

SNAPSHOT: China Headlines Drive Price Action

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 142.66 points at 26570.31

- ASX 200 up 19.087 points at 7094.2

- Shanghai Comp. down 15.806 points at 3068.478

- JGB 10-Yr future up 1 tick at 149.53, yield down 0.1bp at 0.245%

- Aussie 10-Yr future up 3.0 ticks at 96.595, yield down 2.8bp at 3.374%

- U.S. 10-Yr future +0-07+ at 119-13, yield down 1.63bp at 2.902%

- WTI crude down $2.22 at $108.28, Gold down $3.47 at $1808.22

- USD/JPY down 24 pips at Y128.98

- CHINESE ECONOMIC ACTIVITY DATA FOR APRIL MISSES ALREADY SOFT EXPECTATIONS

- GRADUAL RE-OPENING OF SHANGHAI GETS UNDERWAY

- CHINA FURTHER EASES MORTGAGE LOAN RATE GUIDANCE TO SPUR DEMAND (RTRS)

- ECB'S DE COS SAYS RATES TO RISE 'VERY SOON' (RTRS)

- BORIS JOHNSON SEES ROOM FOR A DEAL ON NORTHERN IRELAND POST-BREXIT TRADE (RTRS)

- SWEDEN & FINLAND SET TO LODGE NATO MEMBERSHIP APPLICATIONS

- WHEAT SOARS IN RISK TO FOOD INFLATION AS INDIA RESTRICTS EXPORTS (BBG)

US TSYS: Bid After Two-Way Asia Trade Ultimately Dominated By Soft Chinese Economic Data

Chinese matters were front and centre for broader risk appetite during Asia-Pac dealing, with TYM2 last +0-08+ at 119-14, 0-04 off the peak of its 0-16+ range, on relatively limited volume, given the price swings, of ~115K, with activity a little limited by the observance of the Vesak Day holiday in several Asia-Pac countries (most notably Singapore), Meanwhile, the cash Tsy curve has flattened, with the major benchmarks running 0.5-2.0bp richer on the day, led by 10s.

- The early, positive mood music that surrounded weekend news which revealed the latest move on the part of Chinese authorities re: stimulating the property market (although analysts have questioned the efficacy of a lower mortgage rate floor for first time buyers), coupled with confirmation that Shanghai will start to gradually re-open from today, quickly vanished on the back of softer than expected Chinese economic activity data, which magnified any disappointment surrounding PBoC inaction in its latest round of MLF operations (net neutral in liquidity terms and no change in the interest rate applied to use the facility).

- Note that the aforementioned weekend news flow had allowed wider markets to look through Goldman Sachs downgrading its U.S. economic growth projections and year-end target for the S&P 500 during early Asia dealing.

- Empire manufacturing data and Fedspeak from NY Fed President Williams headline the NY docket on Monday.

JGBS: Contained Tokyo Trade, Following Wider Swings In Risk Appetite

JGBs meandered through Tokyo dealing, trading with a low beta to the wider swings in the wider risk backdrop (as is the norm). As a result, JGB futures initially showed lower vs. late overnight session levels, before recovering (see other bullets for more colour on the China-driven nature of broader risk appetite), last dealing +3. Cash JGB trade has been very limited, with the major cash JGB benchmarks running -/+0.5bp vs. Friday’s closing levels.

- There hasn’t been much in the way of notable domestic headline flow to assess since the Tokyo re-open, leaving wider swings in risk appetite in the driving seat.

- Note that the weekend saw Nikkei sources report that the Japanese government will use deficit-financing bonds to cover Y2.7tn of extra spending under a supplementary budget, as it looks to shield consumers and businesses from the well-documented global inflationary pressures. The article suggested that the government plans to formally decide on the spending decision on Monday, with a view to the stimulus being passed in the current parliamentary session.

- Note that domestic PPI data topped expectations (+10.0% Y/Y vs. BBG median +9.4%) and may have fed into the early, limited downtick in the JGB space.

- 10-Year JGBi supply came and went without much fuss, passing smoothly enough, with no lasting, tangible reaction in breakevens as the cover ratio moderated a touch vs. prev. auction levels.

JGBS AUCTION: Japanese MOF sells Y199.8bn 10-Year JGBis:

The Japanese Ministry of Finance (MOF) sells Y199.8bn 10-Year JGBis:

- High Yield: -0.715% (prev. -0.388%)

- Low Price 107.60 (prev. 103.70)

- % Allotted At High Yield: 53.6842% (prev. 48.3443%)

- Bid/Cover: 3.618x (prev. 4.198x)

AUSSIE BONDS: Flatter, All Things China In The Driving Seat

Aussie bond futures were better bid than their U.S. counterparts during early Sydney dealing, even as wider risk assets benefitted from the latest supportive steps drawn up for the Chinese property market (analysts have questioned the impact that the move will have) & confirmation that Shanghai will start (gradually) easing COVID restrictions from today. That was before the wider, China- inspired defensive flows provided some fresh support for the space, with the longer end leading the bid.

- The pace has since eased back from best levels, akin to the move in U.S. Tsys, leaving YM +0.5 & XM +4.0 at typing. Cash ACGB trade sees 30s outperform, richening by ~5bp as of typing.

- The 3-/10-Year EFP box has twist flattened on the day.

- Note that the IR strip has also seen some twist flattening, with contracts running -1 to +3 through the reds. 3-month BBSW set ~3bp higher today, which helped the front end underperform.

- While the ruling coalition’s property policy proposals garnered plenty of headline interest they weren’t seen as a meaningful driver for the ACGB space. A quick reminder that the ruling coalition trailed the opposition Labor Party in the most recent opinion polls, with the Federal election set to take place on 21 May.

- Looking ahead, the minutes of the RBA’s most recent monetary policy decision are set to headline domestic matters on Tuesday. They will be combed for any guidance re: the future path of tightening after the RBA surprised markets with a 25bp hike in May, although the deluge of communique that dropped around and after the May decision may limit the scope for surprise.

EQUITIES: Easy Come, Easy Go

The early positive mood music that surrounded weekend news which revealed the latest move on the part of Chinese authorities re: stimulating the property market, coupled with confirmation that Shanghai will start to gradually re-open from today, quickly vanished on the back of softer than expected Chinese economic activity data, which magnified any disappointment surrounding PBoC inaction in its latest round of MLF operations (net neutral in liquidity terms and no change in the interest rate applied to use the facility).

- Note that the aforementioned weekend news flow had allowed wider equity markets to look through Goldman Sachs downgrading its U.S. economic growth projections and year-end target for the S&P 500 during early Asia dealing.

- A positive lead from Wall St., after the S&P 500 rose by over 2.0% on Friday, also factored into early price action.

- The above moves leave the major regional equity indices in mixed territory, with the Nikkei 225 (+0.5%) and ASX 200 (+0.3%) higher on the day, while the Hang Seng (-0.4%) & CSI 300 (-0.8%) are lower, with the China-centric nature of market drivers resulting in losses.

- E-minis are 0.4-0.6% lower, with the NASDAQ 100 contract leading losses. The S&P 500 contract is back below 4,000.

OIL: Ultimately Lower In Two-Way Asia Session

Oil swung with wider risk sentiment during Asia-Pac hours, with WTI & Brent last printing ~$1.50 softer than their respective settlement levels.

- The initial positive mood surrounding the weekend declaration of the gradual re-opening of the Chinese city of Shanghai has reversed after any disappointment surrounding PBoC inaction re: its latest round of MLF operations was magnified by much softer than expected Chinese economic activity data for the month of April, pressuring crude.

- Oil-specific weekend news flow was headlined by Iran talking up its ability to double exports, assuming there is sufficient demand, while the Iraqi government suggested that forces from the regional Kurdish government took control of some oil wells in the Kirkuk region (although the Kurdish authorities denied such a move had taken place).