-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Positives Out Of China Eyed

EXECUTIVE SUMMARY

- FED'S MESTER: RATES LIKELY HEADED ABOVE NEUTRAL (MNI)

- TURKEY PUTS BRAKES ON NATO’S NORDIC EXPANSION (BBG)

- EU MINISTERS SEND THEIR OIL IMPASSE BACK TO ENVOYS (BBG)

- JOHNSON: UK MUST PROCEED WITH 'LEGISLATIVE SOLUTION' TO NI PROTOCOL AS 'INSURANCE' (SKY)

- UK FOREIGN SEC SET TO ANNOUNCE PLANS TO RIP UP NORTHERN IRELAND PROTOCOL (LBC)

- CHINESE PROPERTY PURCHASE RULES EASED IN SOME CITIES

- SHANGHAI DECLARES ‘NO COMMUNITY SPREAD’ IN ALL16 DISTRICTS (BBG)

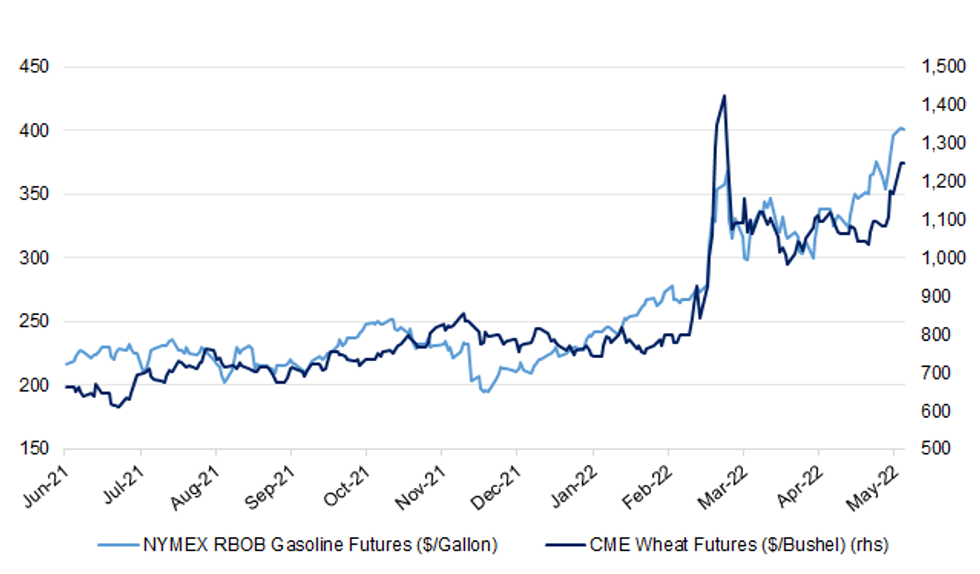

Fig. 1: NYMEX RBOB Gasoline Futures ($/Gallon) & CME Wheat Futures ($/Bushel)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson has said the UK needs to "proceed with a legislative solution" to the Northern Ireland Protocol as an "insurance" in case a deal is not reached with Brussels. Speaking on an official visit to Northern Ireland, the prime minister said he would "love" for tensions over the arrangement to be ironed out "in a consensual way with our friends and partners" in the EU. But he added that the UK also needs the "insurance" of a "legislative solution at the same time". (Sky)

BREXIT: The Foreign Secretary will on Tuesday declare her intention to bring forward legislation which rips up parts of the UK's post-Brexit trade deal on Northern Ireland. It is understood that Liz Truss will make the announcement in a statement to the Commons following a full Cabinet meeting, in an attempt to restore powersharing in the region. The row over the Northern Ireland Protocol has created an impasse in efforts to form a new Executive in Stormont, with the Democratic Unionist Party refusing to join an administration unless its concerns over the arrangements are addressed. (LBC)

BREXIT: The British government should remain in discussion with the European Union about the Northern Ireland protocol agreement, instead of unilaterally deciding to scrap it, European Council President Charles Michel said on Monday. "The only way forward on Protocol is engagement between EU an d UK", Michel said in a tweet following a discussion with Irish Prime Minister Micheal Martin. "Any unilateral action by Great Britain on Protocol - which would undermine its international legal obligations - clearly (is) not welcome, all the more so in these difficult geopolitical times." (RTRS)

BREXIT: The Minister for Foreign Affairs Simon Coveney has said the European Commission has been working hard on solutions that would distinguish goods going to Northern Ireland from Great Britain and staying there, compared to goods entering Northern Ireland but destined for the Republic. He said this was one of the main concerns of unionists around the Northern Ireland Protocol, and that a 'landing zone' could be found. However, he said the EU needed a partner to find solutions and that there hadn't been "serious engagement" from the UK side since early February. Mr Coveney was speaking after a 45-minute meeting with the EU’s chief negotiator Maros Šefčovič in Brussels. He said: "Vice-president Šefčovič’s message is - let's get back to work, let's get back to dialogue and discussion and working through the detail of how we can respond to genuine concerns that are being expressed in Northern Ireland." The UK wants much more sweeping exemptions from checks and controls for GB goods, including agri-food products, entering Northern Ireland if they are clearly staying there. (RTE)

EUROPE

ECB: The European Central Bank is expected to raise the deposit rate for the first time in over a decade in July and bring it out of negative territory at its following meeting in September, despite a 30% chance of recession within a year, a Reuters poll of economists showed. With inflation hitting a multi-decade high of 7.5% in April and almost every other major central bank having already raised interest rates, ECB President Christine Lagarde backed calls for an early rate hike by policymakers last week. The bank is now expected to end its bond purchases programme in July and follow that with a 25 basis-point deposit rate hike a few weeks later, according to a majority of economists polled from May 10 to 16. Until recently, forecasters were expecting the ECB to wait until the final quarter of the year to raise the deposit rate, currently at -0.50%. Of the 46 of 48 economists who expect the deposit rate to rise in the third quarter, 26 said rates would rise by 50 basis points by the end of the period, implying quarter-point moves at both the July and September meetings. Another 18 respondents said the deposit rate would only rise 25 basis points in Q3 and two said it would only climb 10 basis points to -0.40% by the end of the quarter. An even clearer majority expect rates to no longer be negative by the end of the year. About 90% of economists, or 43 of 48, said the deposit rate would be 0% or higher by then, with 44%, or 21 of 48, saying it would be at 0.25% by then and 8%, or 4 of 48, saying it would be at 0.50%. (RTRS)

GERMANY: German Chancellor Olaf Scholz voiced concern about the pace of price increases in his country, signaling he hasn’t ruled out further measures to cushion the effect of inflation. Scholz said he is “really worried that there are many” whose finances are stretched. His government would continue to monitor the situation and stood ready to make necessary decisions, he told broadcaster RTL on Monday. Scholz promised a swift approval by parliament of an existing relief package, which includes a one-time payment, a child supplement and a reduction in electricity costs. The relevant agencies are already prepared to pay out cash quickly, he added. (BBG)

FRANCE: French President Emmanuel Macron has chosen Elisabeth Borne to lead his new government, putting an end to weeks of speculation after the presidential election in April. Borne was named the new prime minister of France following the resignation of Jean Castex, the Elysée said Monday. Borne, whose appointment marks the second time France will be led by a female PM, will be in charge of steering through Macron’s controversial pension reform. (POLITICO)

U.S.

FED: MNI INTERVIEW: Fed's Mester: Rates Likely Headed Above Neutral

- The Federal Reserve likely needs to move monetary policy to a restrictive stance to contain inflation, Cleveland Fed President Loretta Mester told MNI Monday, warning that the Fed's estimate of the nominal longer run fed funds rate of 2% to 3% might still leave policy too accommodative - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FED: MNI INTERVIEW: Fed's Mester Sees Upside Risk to Inflation

- Cleveland Fed President Loretta Mester cautioned against concluding that U.S. inflation has peaked after CPI moderated for the first time in eight months in April, saying risks are still to the upside - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: Monday’s 81-11 procedural vote sets up Senate passage of the legislation as soon as Wednesday if all lawmakers consent to waive rules on debate. That would send it to President Joe Biden for his signature if no changes are made. The package of military has been held up by Senator Rand Paul, a Kentucky Republican. The bill includes $19.7 billion for the Defense Department, more than $3 billion above the level asked for by the Biden administration. It also includes $6 billion in direct security assistance to Ukraine that Biden sought last month and $9.05 billion to replenish weapons stocks sent from the Pentagon to Ukraine. (BBG)

CORONAVIRUS: The US government will extend the Covid-19 public-health emergency past mid-July, continuing pandemic-era policies as the nearly 2 1/2-year outbreak drags on. (BBG)

OTHER

GLOBAL TRADE: United Nations Secretary-General António Guterres is pursuing a high-stakes deal with Russia, Turkey and other nations to open up Ukrainian food exports to world markets and stave off a potential global food shortage, according to diplomats familiar with the effort. Russia has sealed off Ukraine’s Black Sea ports to weaken the country and conquer its coast. Mr. Guterres has asked Moscow to permit some Ukrainian grain shipments in exchange for moves to ease Russian and Belarusian exports of potash fertilizer. (WSJ)

GLOBAL TRADE: U.S. Agriculture Secretary Tom Vilsack said on Monday he has "deep concern" about India's wheat export ban, which spurred a rally in already elevated wheat prices. (RTRS)

GLOBAL TRADE: Taiwan Semiconductor Manufacturing Co warned clients that it plans to hike prices due to looming inflation concerns. This is the second notice from TSMC in less than a year. According to Nikkei Asian Review, TSMC plans to raise prices by single-digit percentage across mature and advance chip production technologies which will take effect beginning 2023. (FT)

GEOPOLITICS: Turkish President Recep Tayyip Erdogan said he won’t allow Sweden and Finland to join NATO because of their stances on Kurdish militants, throwing a wrench into plans to strengthen the western military alliance after Russia’s invasion of Ukraine. At a press conference in Ankara late Monday, Erdogan poured cold water on expectations that Turkish opposition to the enlargement plan could be easily resolved. The remarks were his clearest indication that he intends to block membership for the two countries, or at least extract concessions for it, since they announced their intentions to join over the weekend. (BBG)

BOJ: The Bank of Japan is steering monetary policy with the aim of creating a virtuous cycle of growth in not just prices but also corporate profits, employment and wages, its deputy governor Masayoshi Amamiya said on Tuesday. Amamiya told parliament that it was important to continue the current powerful easing to firmly back the economy. If monetary stimulus is reduced now, that would cause downward pressure on the economy, making 2% inflation even more of a distant target, Amamiya said. (RTRS)

JAPAN: Japanese Finance Minister Shunichi Suzuki kept up his warning against the yen's weakening, describing recent currency moves as "rapid" and "undesirable". Suzuki told parliament that he was communicating with U.S. and other currency authorities to respond to currency moves as appropriate, following the Group of Seven (G7) agreement on currencies. Japan holds foreign reserves worth $1.35 trillion for currency intervention in the future, Suzuki added. (RTRS)

RBA: Australia's central bank felt further increases in interest rates would be needed when hiking for the first time in more than a decade earlier this month, and considered arguments for larger moves given a spike in inflation. Minutes of its May meeting released on Tuesday, showed the Reserve Bank of Australia's (RBA) Board considered hiking by a sharper 40 basis points, but decided to move by 25 basis points to 0.35% since this would mark a return to "normal operating procedures". "Given that the Board meets monthly, it would have the opportunity to review the setting of interest rates again within a relatively short period of time, based on additional information," the minutes showed. (RTRS)

AUSTRALIA: Labor enters the final days of the campaign within reach of claiming a narrow majority but faces a fraught run home as its support falls and voters desert the major parties. An exclusive Roy Morgan poll finds Labor ahead of the Coalition after preferences by 53 to 47 per cent, a drop in its headline support of 1.5 points. This would represent a swing of 4.5 per cent toward the Opposition since the last election and its strongest share of the vote since the 1983 election. But beneath the headline figure the poll finds much shallower underlying support for Labor partly caused by voters spurning the major parties in record numbers. “There is still the prospect of Australians waking up to a hung Parliament on Sunday morning,” Roy Morgan chief executive Michele Levine said. “It is more important than ever for the ALP to finish strongly in the last few days of the campaign.” (New Daily)

NORTH KOREA: North Korea has mobilised its military to distribute COVID-19 medications and deployed more than 10,000 health workers to help trace potential patients as it fights a sweeping coronavirus wave, state media KCNA said on Tuesday (May 17). The isolated country is grappling with its first acknowledged COVID-19 outbreak, which it confirmed last week, fuelling concerns over a major crisis due to a lack of vaccines and adequate medical infrastructure. (CNA)

HONG KONG: Hong Kong will proceed with relaxing virus curbs despite recording hundreds of cases a day, as the city’s Covid policy drifts farther from Beijing’s zero-tolerance approach. Chief Executive Carrie Lam on Tuesday said the city would roll back social distancing measures on May 19 as previously announced, including opening bars and extending the hours for restaurants to serve customers. “It is reasonable to have 200 to 300 cases each day,” Lam said at a regular weekly briefing. “We don’t need to worry too much. It is also our assessment that we can safely enter the second phase of easing social distancing measures." (BBG)

BOC: MNI INTERVIEW: BOC May Need 75BP June Hike - Ex Adviser Ambler

- The Bank of Canada needs to do more to control inflation and could even find itself obliged to hike by 75 basis points on June 1 followed by more tightening to above the neutral rate, former BOC adviser Steve Ambler told MNI - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

MEXICO: The Mexican government's recently implemented plan to curb inflation is welcome and will help, but the impact on curbing rising consumer prices likely will not be very big, Jonathan Heath, a board member of the Bank of Mexico, said on Monday. (RTRS)

BRAZIL: Brazil's Economy Minister Paulo Guedes said on Monday the government will reduce payroll taxes, without giving details or deadlines for a move he has defended since taking office in 2019. Speaking at an event hosted by the Brazilian supermarket association, Guedes also said that President Jair Bolsonaro, who seeks reelection in October, will improve social programs and is planning a national reconstruction fund. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro suggested on Monday he may tinker with state-run company Petrobras' profit policy, cutting the percentage distributed to shareholders, as he looks to curb fuel price hikes ahead of the country's October elections. In a speech during an event in Sao Paulo, Bolsonaro said that all the oil companies in the world have reduced their profit margins during this economic crisis, except for Petrobras. Earlier, the President said "there is more to come on the oil issue" and the government is "looking for alternatives." (RTRS)

RUSSIA: Ukrainian artillery fire has prevent Russian troops from crossing the Donetsk River, halting their progress after Putin refocused his efforts on taking and holding territory in the eastern part of the country, according to a US defense official. The official said taking any further territory in the Donetsk region will be difficult for Russia if a river crossing can’t be undertaken successfully. In the northern part of the country, near Kharkiv, Ukrainian troops have pushed the Russians back to within a few kilometers of their border, the official said, while the Russians made some progress capturing territory west of Donetsk. (BBG)

RUSSIA: Ukrainian Deputy Defense Minister Hanna Malyar said 53 severely wounded soldiers were evacuated from Mariupol’s steel plant Azovstal to a hospital on Russian-occupied territory. Another 211 Ukrainian fighters also left the plant via a humanitarian corridor to a Russia-occupied area, and they may be part of a future exchange of prisoners, Malyar said. Ukraine’s government and security services are seeking ways to aid the remaining fighters at the plant, but “we cannot unblock Azovstal using the military,” the deputy minister said. The steel plant has an underground complex where the remaining defenders of Mariupol, a port city of 450,000 people, were trapped after a Russian siege that began on March 1. Local authorities say more than 22,000 civilians have been killed in the city. Some civilians were evacuated from Azovstal under UN auspices earlier this month. It’s not clear how many fighters remain there. (BBG)

RUSSIA: The Russian central bank on Monday said Russian residents and non-residents from friendly states will be able to channel foreign currency abroad equivalent to up to $50,000 a month, from the previous limit of $10,000. Non-residents from unfriendly countries will now be able to send foreign currency abroad to the value of their salaries or incomes from services they provide without the need to open accounts, the central bank said, scrapping the previous limit of up to $10,000 a month. (RTRS)

ENERGY: Italian energy group Eni will open bank accounts this week to pay for Russian gas after clarification that such a move will not breach sanctions, two sources said on Monday. (RTRS)

OIL: Josep Borrell, the European Union’s foreign policy chief, said the bloc’s foreign ministers decided to pass the deadlock over the proposed Russian oil ban back to ambassadors for more deliberations. Ministers meeting in Brussels sent the issue, part of a planned sixth package of sanctions, to envoys “because it was technically too complicated and it was not possible to reach a political decision today,” Borrell said. Asked about timing for a possible deal, he said he could not tell “if it going to take one week or two.” (BBG)

OIL: EU foreign ministers failed on Monday in their effort to pressure Hungary to lift its veto of a proposed oil embargo on Russia, with Lithuania saying the bloc was being “held hostage by one member state”. (RTRS)

OIL: With the world’s largest oil traders scaling back Russian crude exports, the market is trying to figure out who is going to fill the void. The answers include a medium-sized Geneva-based trader with close ties to Moscow, several smaller firms that are getting more active, and some completely new names including one called Bellatrix -- the name of a bad wizard from the world of Harry Potter. The ability of Russia to find middlemen, ships and buyers for its crude is pivotal for both the global oil market and Moscow. The fewer barrels the country exports, the greater the pressure there will be on supply, but also on the nation’s revenues. The wide spread of traders shows how -- for now -- Russia is overcoming the retreat of Trafigura Group and Glencore Plc, two of the world’s biggest commodity merchants. Vitol Group, the world’s top oil trader, has also said it won’t touch new Russian business and that its activities will decline from this quarter. (BBG)

OIL: Oil output in the Permian in Texas and New Mexico, the biggest U.S. shale oil basin, is due to rise 88,000 barrels per day (bpd) to a record 5.219 million bpd in June, the U.S. Energy Information Administration (EIA) said in its productivity report on Monday. Total output in the major U.S. shale oil basins will rise 142,000 bpd to 8.761 million bpd in June, the most since March 2020, the EIA projected. (RTRS)

OIL: The amount of crude oil in the U.S. Strategic Petroleum Reserve (SPR) dropped by 5 million barrels in the week to May 13, data from the U.S. Department of Energy showed. Stockpiles in the Strategic Petroleum Reserve (SPR) fell to 538 million barrels, the lowest since 1987. About 3.9 million barrels of sour crude was released into the market, while about 1.1 million barrels of sweet crude was issued, according to the data. (RTRS)

CHINA

PBOC: Benchmark Loan Prime Rates are expected to be slightly lowered on Friday, the 21st Century Business Herald reported citing chief analyst at Everbright Securities. Though the central bank on Monday failed to cut the medium-term lending facility rate, which is an anchor to LPR, banks may add less points to form the LPR quotation this month as they enjoy lower deposit costs after the deposit interest rate reform at the weekend, and a reserve requirement ratio cut in April, the newspaper said. A cut to the MLF rate is restrained by rising prices and it could pressure the yuan and capital outflows, the newspaper added. (MNI)

PBOC: The Chinese central bank’s decision to refrain from lowering the rate on its one-year medium-term lending facility suggests the financial system has ample liquidity, according to a report in the Shanghai Securities News that cited an analyst. See: China Keeps Key Interest Rate Unchanged Amid Yuan Pressure The PBOC’s decision to cut the RRR last month and the fact banks could borrow from the money market for less than the MLF suggested declining funding demand, said Wang Qing, an analyst at Golden Credit Rating. The decline in banks’ borrowing costs may become a main driver for them to lower the 1-year LPR, Wang said

FISCAL: China is expected to usher in a peak sales of local government special bonds between Q2 and Q3, to help boost infrastructure investment, aiming to complete the issuance of all CNY3.65 trillion special bonds by Q3, the Shanghai Securities Daily reported citing analysts. Local governments may accelerate and widen the use of special bonds to new areas such as urban gas and heating pipeline projects, the newspaper said. After the issuance of the main part of local government bonds in H1, local authorities could face certain fiscal pressure in H2 given increased anti-Covid-19 costs, which may mean higher deficits and issuing special treasury bonds, the newspaper said citing analysts. (MNI)

FISCAL: China’s fiscal spending rose 5.9% y/y in the first four months while fiscal revenue grew 5% y/y, Deputy Finance Minister Xu Hongcai says at a briefing on fiscal and taxation development in Beijing. Xu doesn’t give value of fiscal spending or revenue at the briefing. China’s macro tax burden fell to 15.1% in 2021 from 18.7% in 2012, says Wang Daoshu, vice head of the State Taxation Administration. (BBG)

PROPERTY: Chinese cities including Nanjing and Dongguan moved to relax home purchase limits on families with multiple children to buy one more home, and more cities are expected to follow suit, the China Securities Journal reported. Some cities are providing preferential mortgage rates as low as first-time buyers for these families, while some cities are subsidising such buyers as high as CNY20,000 for a single household, the newspaper said. The property market is expected to gradually pick up with major cities such as Guangzhou, Shenzhou, Suzhou and Wuhan having strong market demand, the newspaper said. (MNI)

PROPERTY: Eastern Chinese city of Hangzhou loosens requirements on social insurance payment for some residents’ purchases of existing homes, according to a local government statement. Families with three children are allowed to buy one more home in Hangzhou. (BBG)

PROPERTY: Property developer Zhongliang Holdings said on Tuesday it has gained bondholders' approval to exchange $629 million worth of 2022 bonds into new notes due next year. Zhongliang had been scrambling to secure approval for the notes due May and July 2022, totalling $729 million. For the remaining 2022 bonds where it did not gain approval, it said it did not expect to make timely repayments and urged those bondholders to agree to an exchange into new notes. (RTRS)

CORONAVIRUS: There’s “no community spread” in all of Shanghai’s 16 districts, Zhao Dandan, deputy head of the city’s health commission says at a press conference. Around 860,000 of Shanghai’s total population of about 25 million remained under the strictest form of lockdown. (BBG)

EQUITIES: Chinese Vice-Premier Liu He is scheduled to speak at a Tuesday meeting with tech executives that has been convened by the country's top political consultative body to promote the development of the digital economy, people familiar with the matter said. The meeting, currently underway, is being closely watched for remarks by Liu and others for clues as to how far Chinese authorities will go in easing a regulatory crackdown since late 2020 on the once-freewheeling tech sector. Liu has been at the forefront of efforts by the government to assure the private sector of support. (RTRS)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0455% at 09:43 am local time from the close of 1.5849% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 43 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7854 TUE VS 6.7871 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7854 on Tuesday, compared with 6.7871 set on Monday.

OVERNIGHT DATA

JAPAN MAR TERTIARY INDUSTRY INDEX +1.3% M/M; MEDIAN +1.1%; FEB -1.3%

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 89.3; PREV 90.5

Consumer confidence dropped 1.3% last week, its third consecutive weekly loss. Last week’s decline was mainly driven by drops in the subindices that capture the ‘financial situation compared to a year ago’ and whether it is a ‘good time to buy a major household item’. This suggests that cost of living concerns are front and centre for consumers. Among the respondents ‘paying off their home loan’, confidence dropped 0.6%, falling a cumulative 14.7% over the past three weeks. Confidence was 2.7% lower for people who ‘own their home’, while it rose 0.5% for people who are ‘renting’. Household inflation expectations rose 0.2ppt to 5.3% amid higher petrol prices. (ANZ)

NEW ZEALAND APR NON-RESIDENT BOND HOLDINGS 58.6%; MAR 59.0%

MARKETS

SNAPSHOT: Positives Out Of China Eyed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 71.79 points at 26618.55

- ASX 200 up 12.871 points at 7105.1

- Shanghai Comp. up 8.914 points at 3082.663

- JGB 10-Yr future up 1 tick at 149.49, yield down 0.2bp at 0.245%

- Aussie 10-Yr future down 3.0 ticks at 96.555, yield up 3.4bp at 3.415%

- U.S. 10-Yr future -0-09 at 119-12+, yield up 3.09bp at 2.913%

- WTI crude down $0.37 at $113.83, Gold up $0.03 at $1824.19

- USD/JPY up 22 pips at Y129.38

- FED'S MESTER: RATES LIKELY HEADED ABOVE NEUTRAL (MNI)

- TURKEY PUTS BRAKES ON NATO’S NORDIC EXPANSION (BBG)

- EU MINISTERS SEND THEIR OIL IMPASSE BACK TO ENVOYS (BBG)

- JOHNSON: UK MUST PROCEED WITH 'LEGISLATIVE SOLUTION' TO NI PROTOCOL AS 'INSURANCE' (SKY)

- UK FOREIGN SEC SET TO ANNOUNCE PLANS TO RIP UP NORTHERN IRELAND PROTOCOL (LBC)

- CHINESE PROPERTY PURCHASE RULES EASED IN SOME CITIES

- SHANGHAI DECLARES ‘NO COMMUNITY SPREAD’ IN ALL 16 DISTRICTS (BBG)

US TSYS: Bid In Regional Equities Helped Weigh On Tsys In Asia Trade

Tsys came under pressure during Asia-Pac hours, with the broader risk switch flicked to on. Continued positive developments surrounding the COVID situation in Shanghai, alongside the easing of rules surrounding the purchases of second homes in some Chinese cities & confirmation that Hong Kong will push ahead with its previously outlined timeframe re: the start of the wind back of its COVID-related mobility restrictions, supported wider risk appetite during Asia-Pac hours. Elsewhere, Chinese tech stocks drew support from hope surrounding a meeting between senior Chinese policymakers and tech executives, with participants speculating that the meeting may result in the easing of some of the measures implemented in the well-documented clampdown on the sector. This allowed the Hang Seng to add over 2.0% on the day, while e-minis nudged higher.

- TYM2 is -0-10+ at 119-11, just off the base of its 0-13+ overnight range, although volume isn’t particularly strong, running at ~80K. Cash Tsys run 3-4bp cheaper across the curve, with very light bear flattening in play.

- Looking ahead, Tuesday’s NY session will bring the release of retail sales data, in addition to a deluge of Fedspeak (Powell, Bullard, Mester, Harker, Kashkari & Evans are all due to speak).

JGBS: Tight Tokyo Trade

The cash JGB curve has seen some light twist steepening during Tokyo hours, with the impetus from Monday’s U.S. Tsy trade and an uptick in most of the major regional global equity indices in the driving seat.

- That leaves cash JGBs running 0.5bp richer to a little under 1bp cheaper. Futures are roughly in line with late overnight levels, +2, unwinding an early uptick, but sticking to a narrow 12 tick range during the Tokyo session.

- Local headline flow has been limited, with Finance Minister Suzuki & BoJ Deputy Governor Amamiya reaffirming the heavily discussed policymaker view re: recent FX moves, while Amamiya also reiterated the central BoJ view re: aspects of monetary policy.

- We also got confirmation of the previously outlined story re: small trial tourist groups being allowed to visit Japan later this month, as the country looks to re-open its borders.

- Prelim Q1 GDP data & 5-Year JGB supply headlines the local docket on Wednesday.

AUSSIE BONDS: Cheaper And Steeper

The previously outlined positive risk sentiment observed in wider Asia dealing seemed to be the driving factor behind the pressure on the ACGB space during Sydney trade, overriding the bull flattening seen in overnight dealing.

- Some pointed to the fact that the RBA’s May meeting minutes revealed the discussion of a 40bp rate hike as a driver of the move (the Bank also discussed a 15bp move, in addition to the 25bp hike implemented), although subsequent movements in RBA pricing seemed to be more closely linked with the broader risk-on flows, as opposed to a direct response to the meeting minutes. Note that the IB strip is currently pricing ~36bp of tightening for the June meeting and a year-end cash rate of ~2.75%, with both measures incrementally higher vs. yesterday’s closing levels.

- The RBA meeting minutes also contained discussion re: inflation psychology, with the Bank clearly cognisant of the risks surrounding de-anchored inflation expectations.

- On B/S matters the Bank noted that “in some years' time, after the Bank's balance sheet had reduced further, the Board would need to consider the broader issue of the longer-term optimal size and composition of the balance sheet, including the size of Exchange Settlement balances. In this context, it might consider the use of longer-term bond holdings, although this would be driven by the appropriate operating framework in light of evolving conditions and would not have implications for, or have a bearing on, the stance of monetary policy."

- YM & XM are hovering just above session lows, -5.0 & - 4.5, respectively. Wider cash ACGB trade sees the longer end of the curve lead the way lower, with 30s cheapening by just under 6bp. EFPs are little changed on the day.

- WPI data headlines the local docket on Wednesday, with plenty of discussion evident re: the ability of the print to tip the RBA’s hand when it comes to the level of tightening that it will deploy at the June meeting.

EQUITIES: Chinese Tech Leads Rally On Hope Of Easing Of Clampdown

Continued positive developments surrounding the COVID situation in Shanghai, alongside the easing of rules surrounding the purchases of second homes in some Chinese cities & confirmation that Hong Kong will push ahead with its previously outlined timeframe re: the start of the wind back of its COVID-related mobility restrictions, supported wider risk appetite during Asia-Pac hours.

- Elsewhere, Chinese tech names drew support from hope surrounding a meeting between senior Chinese policymakers and tech executives, with participants speculating that the meeting may result in the easing of some of the measures implemented in the well-documented clampdown on the sector.

- The Hang Seng leads gains amongst the major regional indices, running ~2.2% firmer on the session, with the Hang Seng Tech Index adding over 4.0% on the above dynamic. E-minis sit 0.3-0.7% firmer on the day, with the NASDAQ 100 outperforming.

OIL: Marginally Lower In Asia

WTI & Brent crude futures sit ~$0.40 below their respective settlement levels as we work towards the end of Asia-Pac dealing, with the modest moderation coming on the back of an impressive 4-day win streak that has seen WTI & Brent crude futures add comfortably over $10/bbl.

- This comes after the benchmarks lodged gains of ~$3 on Monday, with a surge higher in U.S. gasoline futures, optimism surrounding the Chinese COVID situation, a marginally softer USD and Libyan supply issues all feeding into the bid.

- This more than offset the impact of weaker than expected Chinese economic activity data for the month of April.

- Note that the EU continues to look to enforce an embargo of Russian crude products, although the group’s foreign policy chief, Josep Borrell, has noted that the foreign ministers of Union countries have passed the matter back over to ambassadors. Borrell pointed to technical complications and the need for time, indicating that it could take one to two weeks to get the measures over the line.

- Weekly U.S. API crude inventory estimates are due after hours on Tuesday.

GOLD: Flat In Asia After Two-Way Monday

Another tight Asia-Pac range for bullion after a relatively volatile round of Monday trade, with spot last dealing little changed around $1,825/oz.

- To recap, the wider risk-on price action observed during Monday’s Asia-Pac session allowed gold to edge lower into European hours, with the latest round of hawkish ECB speak facilitating further extension, as spot gold breached psychological support at $1,800/oz. Note that key support in the form of the Jan 28 low ($1,780.4/oz) was not tested. Wider defensive flows and a modest pull lower in U.S. real yields facilitated a recovery from worst levels of the day, with gold managing to lodge modest gains on the session come the bell.

- U.S. retail sales data and a deluge of Fedspeak, headlined by Chair Powell, provide the immediate points of focus on Tuesday.

FOREX: Sentiment Turns Positive As Shanghai Reaches Milestone In Fight Against COVID

Positive signals on China's COVID-19 outbreak underpinned a turnaround in risk appetite, reflected in G10 FX price action. Shanghai met the threshold of three consecutive days with no new infections in the community, which allows local authorities to start easing the most severe virus countermeasures.

- Risk-on flows intensified as Hong Kong confirmed it will press ahead with its planned relaxation of COVID-19 curbs, while wires reported that Hangzhou loosened requirements for second homes purchases.

- Offshore yuan caught a bid on China positives. It may have drawn additional support from the reintroduction of appreciation bias into the yuan fixing and the announcement that the PBOC will issue CNH10bn 3-Month & CNH15bn 1-Year Bills.

- The Aussie dollar paced gains in G10 FX space, tailed by its Antipodean cousin NZD. Minutes from the RBA's most recent monetary policy meeting revealed that the Board discussed three scenarios, including a 40bp hike to the cash rate target.

- Recovery in risk appetite sapped all initial strength from the yen, but USD/JPY failed to test yesterday's high.

- The global data docket features U.S. retail sales & industrial output, flash EZ GDP & UK jobs report. There is plenty of central bank speak on tap, including from Fed & ECB chiefs.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/05/2022 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 17/05/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 17/05/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 17/05/2022 | 0900/1100 | * |  | EU | Employment |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 17/05/2022 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 17/05/2022 | 1200/0800 |  | US | St. Louis Fed's James Bullard | |

| 17/05/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 17/05/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/05/2022 | 1315/0915 |  | US | Philadelphia Fed's Patrick Harker | |

| 17/05/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/05/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 17/05/2022 | 1505/1605 |  | UK | BOE Cunliffe Fireside Chat | |

| 17/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 17/05/2022 | 1630/1230 |  | US | Minneapolis Fed's Neel Kashkari | |

| 17/05/2022 | 1700/1900 |  | EU | ECB Lagarde Speech at Soroptimist International Club | |

| 17/05/2022 | 1800/1400 |  | US | Fed Chair Jerome Powell | |

| 17/05/2022 | 1830/1430 |  | US | Cleveland Fed's Loretta Mester | |

| 17/05/2022 | 2245/1845 |  | US | Chicago Fed's Charles Evans |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.