-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY37.3 Bln via OMO Wednesday

MNI ASIA MARKETS OPEN: Tsy Curves Reverse Course Ahead Wed CPI

MNI EUROPEAN OPEN: Powell Underscores Inflation Focus

EXECUTIVE SUMMARY

- POWELL VOWS HIKES UNTIL ‘CLEAR AND CONVINCING’ COOLING IN PRICES (BBG)

- FED'S EVANS WANTS SMALLER U.S. RATE HIKES BY JULY OR SEPT (RTRS)

- CHINA BOND EXODUS EXTENDS INTO APRIL AS DAILY DATA GOES DARK (BBG)

- US SET TO BLOCK RUSSIAN DEBT PAYMENTS, RAISING ODDS OF DEFAULT (BBG)

- ECB'S LAGARDE GIVES NATIONAL CENTRAL BANK CHIEFS LOUDER VOICE ON POLICY (RTRS)

- EU OFFERS UK NORTHERN IRELAND PROTOCOL OLIVE BRANCH... BUT THREATENS TRADE WAR (TELEGRAPH)

- SUNAK STARTS TO MOVE THE COGS SURROUNDING NEXT LAYER OF UK FISCAL SUPPORT

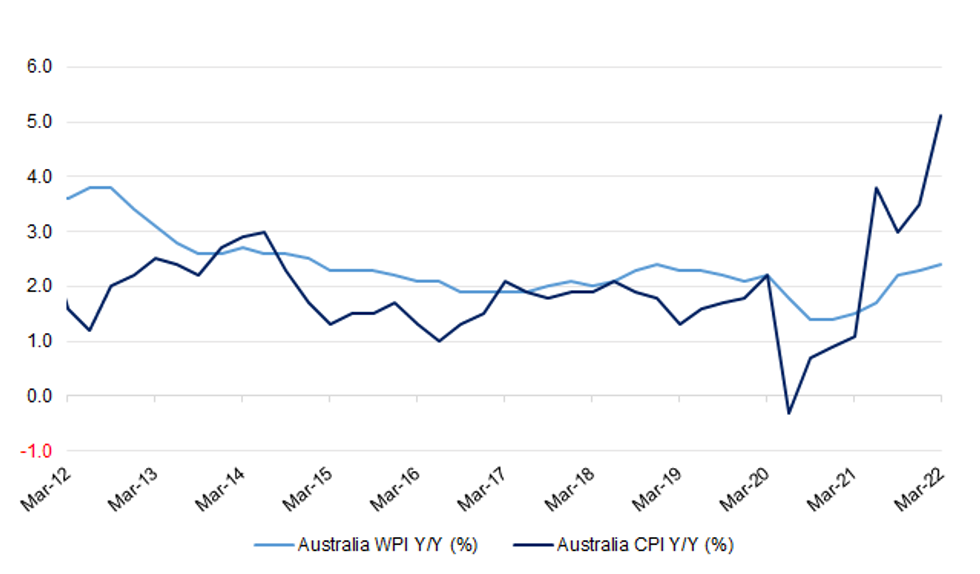

Fig. 1: Australia CPI Vs. Wage Price Index (Y/Y)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The EU will offer Britain new concessions on the Northern Ireland Protocol, but has threatened a trade war if Boris Johnson refuses to agree a compromise. The Telegraph understands that the European Commission will propose tweaking the bloc’s own laws to ease checks between mainland Britain and the province in order to end the long-running row over Brexit rules. According to sources, Maros Sefcovic, the EU’s chief negotiator, set out the olive branch in a call with Liz Truss after weeks of acrimony between the pair. (Telegraph)

BREXIT: Boris Johnson’s plans to override the controversial Northern Ireland Brexit bill could take up to a year to become law, ministers said yesterday amid warnings of a rebellion among senior Conservatives in the House of Lords. (The Times)

BREXIT: A government pledge to legislate on the Northern Ireland Protocol is "a good start", but not enough to entice the DUP to restore Stormont, its party leader Sir Jeffrey Donaldson has said. The party has blocked the establishment of the NI Assembly and the governing executive of ministers in protest against post-Brexit trade arrangements. On Monday, the UK foreign secretary outlined plans to change the protocol. However, Sinn Féin said the legislation proposal would break international law. Unionist politicians in Northern Ireland have argued the protocol, which protects free trade across the Irish land border between the UK and the EU, has undermined Northern Ireland's place in the UK. (BBC)

BREXIT: Three key UK regulators are struggling to recruit and train enough staff to implement the government’s promise to deliver Brexit benefits, a report by the spending watchdog has found. The National Audit Office found that the shortages had left the Competition and Markets Authority, the Health and Safety Executive and the Food Standards Agency facing significant challenges in standing up bespoke, post-Brexit regulatory regimes. Lawyers, veterinarians and toxicologists were among the professions the three bodies were struggling to recruit as they tried to build capacity as a result of leaving the EU’s regulatory umbrella. (FT)

BOE: Britain's worst cost of living crisis in three decades won't peak until the tail end of this year but the Bank of England will be more aggressive in raising interest rates than was thought as it battles soaring inflation, a Reuters poll found. Renewed coronavirus lockdowns in China and Russia's invasion of Ukraine have deepened supply chain issues which were only just recovering from the havoc wrought by the pandemic, sending global prices rocketing. Britons face the added headache of spiralling energy prices, higher taxes and ongoing repercussions from leaving the European Union. "Previous bouts of inflation we've had were mainly concentrated on individual items like petrol which you could try and avoid," said Paul Dales at Capital Economics. "But at the moment it is so widespread and also concentrated on things we can't avoid like electricity, gas, food." Asked when the cost of living crisis would peak, seven of 13 respondents to an additional question in the May 12-17 poll said the fourth quarter. Three said next quarter and three said by the end of next month. The government has come under increasing pressure to support household incomes and nine of 12 respondents to another question said it should do more now. All said support should be aimed at lower-income households. Prime Minister Boris Johnson said last week his government would "do things" in the short term to help Britons but did not go into any details. Official data due later on Wednesday is expected to show inflation reached a 40-year high of 9.1% last month - more than four times the BoE's 2% target. Participants in the poll saw little let up with inflation averaging 8.3% next quarter from 8.7 in the current one, an increase from the 7.9% and 8.4% in April's survey. Bank Governor Andrew Bailey said on Monday the current surge in inflation was the central bank's biggest challenge since it gained independence in 1997 and rising food prices were a major worry. Earlier this month the Bank said inflation could be more than 10% later this year. Fuel bills jumped 54% in April and the BoE now sees a further 40% increase in October. "Looking at the months ahead, the road to double-digit inflation is still firming, with services and food inflation still on the up. But we will need a few more beats - or more price pressures in the pipeline to build - to get there," said Sanjay Raja at Deutsche Bank. However, upgraded medians from last month in the latest Reuters poll still suggested inflation would gradually decline from here but wouldn't reach target until the end of next year. In December the BoE became the first major central bank to raise borrowing costs and has lifted Bank Rate in regular moves from its record low of 0.10% to 1.00%. Medians in the poll showed it rising again to 1.25% in June and to 1.50% next quarter before a pause ahead of an increase to 1.75% in the second quarter of 2023. In an April poll it wasn't expected to reach 1.25% until next quarter and 1.50% until early 2023. While a little more than two-thirds of respondents had a 1.25% forecast for end-Q2 they were more divided over where the Bank Rate would be by end-December. Fifteen saw it below 1.50%, 22 saw it at that level while 19 expected it to be higher - with the top forecasts at 2.25%. (RTRS)

BOE: The Bank of England has made "serious mistakes" in the fight against inflation and is facing a prolonged bout of painful price rises unless it acts immediately, its former Governor Lord King has warned. Officials at Threadneedle Street fuelled a surge in prices with a money printing spree during the Covid pandemic, the crossbench peer said. The idea that the current interest rate of 1pc, very low by historical standards, will have any significant impact when inflation is running at 7pc is "really very strange", he added. (Telegraph)

FISCAL: Ministers must offer immediate relief for businesses to give them the confidence to invest and create economic growth, the head of the Confederation of British Industry (CBI) is due to say today. Lord Bilimoria, president of the body which represents businesses, is to call for the government to extend the recovery loan scheme and introduce a plan to follow the super-deduction scheme, a tax cut on money invested by companies in machinery and other assets.

ECONOMY: The UK is due to become the first big European economy to reach pre-pandemic levels of corporate insolvencies as crisis support is unwound and rising inflation threatens companies’ survival prospects, according to research. Business insolvencies will rise by 37 per cent this year, Allianz Trade, a credit insurer, predicted. It cited as the main causes the withdrawal of Covid support schemes, rising commodity prices, supply chain problems, the fallout from Russia’s invasion of Ukraine and the “lagging effects” of Brexit. (The Times)

FISCAL: Rishi Sunak is drawing up plans to increase the warm home discount by hundreds of pounds before cutting taxes to help with the cost-of-living crisis. The chancellor will take a two-pronged approach: a package to help with energy bills in July followed by general tax cuts in the autumn. From October the warm home discount will give three million of the poorest households in England and Wales £150 off their bills. Treasury officials have drawn up a range of options, including a one-off increase of £300, £500 or even £600 to help households to cope with soaring energy prices. (The Times)

FISCAL: Rishi Sunak is plotting a possible early cut to income tax to help ease the cost-of-living crisis amid growing political pressure to intervene. The Chancellor is being urged by Conservative MPs to step in as soon as possible in order to reduce the burden on households, for example by imposing a windfall tax on oil and gas producers. He is planning to offer at least some support before the summer, with a comprehensive package of measures timed to coincide with the announcement of an energy price cap increase later this year. Mr Sunak told MPs that cutting taxes was his “absolute priority”, adding: “We started last autumn by cutting the tax rate for those on the lowest incomes and universal credit. (The i)

FISCAL: A windfall tax on oil and gas companies is “wildly popular” with the public, internal government polling has discovered, as ministers warm to the idea. (Telegraph)

ENERGY: Business Secretary Kwasi Kwarteng has written to the leading petrol retailers "to remind them of their responsibilities" to pass on tax cuts to motorists. The letter, sent to fuel giants on Tuesday, follows claims some retailers hiked profits following the 5p per litre fuel duty cut implemented by Chancellor Rishi Sunak in March to help motorists amid the cost of living crisis. The RAC has said retailers are taking an average profit of 2p per litre more than before the policy was introduced. It also comes as diesel prices hit a new high of 179.9p at UK forecourts on Monday, according to the Department for Business, Energy and Industrial Strategy's own figures. This was up from 178.4p a week earlier. (Sky)

POLITICS: An unnamed Conservative MP has been arrested on suspicion of rape and sexual assault. The Metropolitan Police confirmed a man was in custody over allegations dating back to between 2002 and 2009. The Conservative Party said he had been asked by the chief whip not to attend Parliament while an investigation is ongoing. The man also faces allegations of an abuse of position of trust and misconduct in a public office. (BBC)

EUROPE

ECB: European Central Bank President Christine Lagarde has given national central bank chiefs a bigger say in policy meetings, asking her own board to speak less and set aside more time for debate, sources familiar with the process said. Lagarde has told chief economist Philip Lane and fellow board member Isabel Schnabel to limit their presentations and leave more space for the central bank chiefs of the euro’s 19 countries to air their views, six sources told Reuters. Marshalling consensus among different countries has always been a tricky task for the Frankfurt-based central bank and complaints about the structure of the meetings, where a few voices typically dominate, predate Lagarde's tenure. Such criticism has grown since last summer as Lane and his staff repeatedly underestimated the size and duration of inflationary pressures. The surge in prices, which some ECB policymakers warned were persistent, eventually prompted the central bank to change tack and open the door to higher interest rates this year. Lagarde has now decided to limit board member presentations to 20 pages and told staff to wrap up seminars by lunchtime on the first day of the ECB's policy meeting, the sources said. (RTRS)

U.S.

FED: Federal Reserve Chair Jerome Powell, in his most hawkish remarks to date, said the US central bank will keep raising interest rates until there is “clear and convincing” evidence that inflation is in retreat. “What we need to see is inflation coming down in a clear and convincing way, and we’re going to keep pushing until we see that,” Powell said Tuesday during a Wall Street Journal live event. “If that involves moving past broadly understood levels of ‘neutral,’ we won’t hesitate at all to do that.” The Fed chair repeatedly stressed the need to curb the hottest inflation in decades during the roughly 35-minute interview, calling price stability “the bedrock of the economy” and acknowledging that some pain in achieving this -- including a slight rise in the unemployment rate -- was a cost worth paying in order to achieve it. (BBG)

FED: Chicago Federal Reserve Bank President Charles Evans on Tuesday said he supports moving to a shallower rate-hike path by July or September to allow the Fed time to assess inflation and the job market as it pushes borrowing costs up to neutral, and likely beyond. "I think front-loading is important to speed up the necessary tightening of financial conditions, as well as for demonstrating our commitment to restrain inflation, thus helping to keep inflationary expectations in check," Evans told the Money Marketeers in New York, noting that inflation is "much too high." (RTRS)

FED: How much higher the Federal Reserve will need to raise U.S. interest rates will depend in large part on how quickly supply chains can recover, Minneapolis Federal Reserve Bank President Neel Kashkari said on Tuesday. Russia's war in Ukraine and China's COVID-19 lockdowns are tangling supply chains that at the beginning of this year were just starting to ease, Kashkari said at Lake Superior University. The Fed has indicated it will get interest rates to a neutral level - usually estimated at around 2.5% - by the end of the year; if the Fed gets help from the supply side, the Fed "won't have to do as much" beyond that, but if not, it will need to do more, Kashkari said. (RTRS)

FED: U.S. Democratic Senator Joe Manchin, who on occasions votes against his party in the evenly split Senate, said on Tuesday he intends to support Michael Barr for Federal Reserve vice chair for supervision. (RTRS)

OTHER

BOJ: The Bank of Japan may widen its yield target band as early as this autumn if the economy is on track for a recovery from the pandemic, according to an influential former member of the central bank’s board. “The most important factor is how the real economy develops,” said Makoto Sakurai, a former member who is known for his closeness to Governor Haruhiko Kuroda. “The BOJ can consider a next phase if a recovery continues even gradually,” as long as inflation stays above 1%, he said. (BBG)

AUSTRALIA: Scott Morrison has ruled out a return to lockdowns and other restrictions to manage COVID-19 despite rising death and infection rates, while also confirming the halving of the petrol excise would end in September as petrol prices nudge past $2 a litre in large parts of the country. Mr Morrison also defended his government’s record on wages, insisting wages were growing and fighting inflation was the key economic challenge. Campaigning in the key Victorian seat of Corangamite three days out from the election, Mr Morrison met with home buyers at a newly completed house to continue to promote his super for housing policy. But with all eyes on today’s wages data – markets expect a lift in the wages price index of 0.8 per cent for the March quarter, and 2.5 per cent for the year – Mr Morrison was peppered with questions over inflation eroding workers’ pay packets. (Australian Financial Review)

AUSTRALIA: A dramatic shift in voter sentiment has tightened the race for power at the federal election by cutting primary vote support for Labor and giving the Coalition a boost that keeps it within sight of victory at the ballot box this Saturday. The election will go down to the wire after voters softened their support for Labor over the past two weeks to cut the party’s primary vote from 34 to 31 per cent, wiping away the strong gains made by Labor leader Anthony Albanese in the lead-up to the formal election campaign. With Prime Minister Scott Morrison on the offensive with an appeal to voters to back him on economic management and national security, the new survey shows a small increase in the Coalition primary vote from 33 to 34 per cent. The exclusive survey, conducted by Resolve Strategic for The Sydney Morning Herald and The Age, reveals a divided electorate with 34 per cent of all voters rejecting the major parties in favour of independents, the Greens and smaller parties. With early voting underway since Monday last week, the survey found that only 14 per cent considered themselves “uncommitted” compared to 24 per cent two weeks ago. “As we near election day, voters are naturally locking in their choice, and in many cases have already voted,” said Resolve director Jim Reed. (Sydmey Morning Herald)

AUSTRALIA: Labor maintains an advantage over the Coalition but as the 2022 election campaign enters its final days the contest has tightened in Scott Morrison’s favour, according to the latest Guardian Essential poll. Labor has a two-point lead in the poll’s two-party-preferred “plus” measure with the opposition on 48% and the Coalition on 46%. Seven per cent of respondents are undecided. A fortnight ago, Labor was ahead of the Coalition 49% to 45% with 6% undecided. The Coalition’s primary vote is on 36%, one point ahead of Labor (35%), with the Greens on 9% (down one point in a fortnight). One Nation is on 4% (up one point), with independents on 6% (up one point) and the United Australia party on 3% (down one point). All these movements are inside the poll’s margin of error which is plus or minus 3%. (Guardian)

SOUTH KOREA: The Korea Development Institute (KDI) on Wednesday lowered its 2022 growth forecast for the South Korean economy to a 2-percent range, while sharply raising its inflation outlook to over 4 percent amid heightened economic uncertainty. The state-run think tank cut its growth estimate for Asia's fourth-largest economy to 2.8 percent this year from its November estimate of 3 percent. The KDI raised its inflation outlook to 4.2 percent from 1.7 percent, as energy and food prices remain high amid the protracted war between Russia and Ukraine. The KDI's latest forecast is higher than the 2.5 percent estimate by the International Monetary Fund. In its latest projection in February, the Bank of Korea (BOK) expected 3 percent economic growth. The think tank forecast economic growth to slow to 2.3 percent next year. It expected inflation to be at 2.2 percent in 2023, close to the central bank's 2 percent target. The revised outlooks came as concerns about stagflation, a mix of slowing growth and high inflation, have mounted amid the Ukraine crisis and the Federal Reserve's aggressive rate hikes. (Yonhap)

NORTH KOREA: Kim Jong Un may be preparing to fire an intercontinental ballistic missile to coincide with US President Joe Biden’s trip to the region, CNN reported, as the North Korean leader battles a Covid-19 outbreak confronting his regime. Kim looks to be preparing to test launch an ICBM in the next two to four days, the cable news channel said, citing a US official familiar with the latest intelligence assessment. North Korea’s ICBMs are designed to deliver a nuclear warhead to the US mainland, and the country in March fired one off for the first time in more than four years -- highlighting the feat in a slickly produced video shown on state TV. (BBG)

RUSSIA: The U.S. State Department on Tuesday announced the launch of a new program to capture and analyze evidence of war crimes and other atrocities allegedly perpetrated by Russia in Ukraine, as Washington seeks to ensure Moscow is held accountable for its actions. (RTRS)

RUSSIA: Group of Seven finance ministers meeting in Bonn this week will discuss an aid package to support the immediate financial needs of Ukraine, according to government officials. While final figures have not yet been decided, the G-7 will probably consider a preliminary contribution of 5 billion euros ($5.3 billion) for the first month, said two people familiar with the matter who declined to be identified because talks are ongoing. They are looking at a possible three-month package, one of the officials said. (BBG)

RUSSIA: U.S. Senate Republican leader Mitch McConnell urged the Biden administration on Tuesday to lead an effort to ensure broad, sustained international support for Ukraine and said Washington should remain a reliable supplier of advanced weaponry for the besieged country. (RTRS)

RUSSIA: French President Emmanuel Macron told his Ukrainian counterpart on Tuesday that French arms deliveries to Ukraine would intensify in coming days and said France was ready to respond to additional demands for help, the Élysée said in a statement. "He confirmed that arms deliveries by France would continue and would increase in intensity in the days and weeks to come, the same as for the supply of humanitarian equipment," the statement said. (France 24)

RUSSIA: The United States is considering a move to block Russia’s ability to pay U.S. bondholders after a deadline expires next week, a U.S. administration official said on Tuesday. Bloomberg News said the Biden administration is poised to make the move and that it could bring Moscow closer to the brink of default. "It's under consideration but I don't have a decision to preview at this time," the official told Reuters. "We are looking at all options to increase pressure on Putin." (RTRS)

RUSSIA: Canada on Tuesday introduced a bill in the Senate that will ban Russian President Vladimir Putin and some 1,000 other members of his government and military from entering the country as it continues to ratchet up sanctions after the invasion of Ukraine. "Banning close associates and key supporters of Putin's regime, including those responsible for this unprovoked aggression, from entering our country is one of the many ways in which we're holding Russia accountable for its crimes," Public Safety Minister Marco Mendicino said in a statement. (RTRS)

RUSSIA: Russia's largest lender Sberbank, which has been hit by Western sanctions, plans to drop its listing in London after its depositary terminated an agreement with it, the bank said on Tuesday. Holders of Sberbank's depositary receipts can exchange them for Sberbank's shares by June 16, the bank said in a statement, adding that it notified the London Stock Exchange of its intention to terminate the circulation of the receipts. (RTRS)

RUSSIA: Russia is heading into a recession amid high commodity prices for the first time in recent memory, the Economy Ministry said, according to Tass, as sanctions squeeze the economy. Gross domestic product will contract by 7.8% this year and 0.7% in 2023, according to the Economy Ministry. High energy prices will keep the cash flowing in, with the current account surplus seen reaching a record of $191 billion this year. The ruble’s recent rally is likely to reverse into declines later in the year, while incomes fall and unemployment rises. The official forecast for the contraction remains milder than those seen by some economists who expect a decline of 12% or more, making this year the worst performance in a generation. (BBG)

IRAN: A U.S. State Department spokesman called on Tuesday for Iran to immediately release two French nationals, after Iranian state television showed what it described as details of the arrest of two French citizens this month, saying they were spies who had sought to stir up unrest. (RTRS)

EQUITIES: Saudi Aramco is considering an initial public offering of its trading arm amid a boom in oil prices in what could be one of the world’s biggest listings this year, according to people with knowledge of the matter. The state-controlled oil major is working with banks including Goldman Sachs Group Inc., JPMorgan Chase & Co. and Morgan Stanley as it studies a potential listing of Aramco Trading Co., the people said, asking not to be identified as the information isn’t public. (BBG)

ENERGY: The European Commission will on Wednesday unveil a 210 billion euro plan for how Europe can end its reliance on Russian fossil fuels by 2027, and use the pivot away from Moscow to quicken its shift to green energy.The invasion of Ukraine by Russia, Europe's top gas supplier, has prompted the European Union to rethink its energy policies amid sharpened concerns of supply shocks. Russia supplies 40% of the bloc's gas and 27% of its imported oil, and EU countries are struggling to agree sanctions on the latter.To wean countries off those fuels, Brussels will propose a three-pronged plan: a switch to import more non-Russian gas, a faster rollout of renewable energy, and more effort to save energy, according to draft documents seen by Reuters.The draft measures, which could change before they are published, include a mix of EU laws, non-binding schemes, and recommendations national governments could take up. (RTRS)

OIL: The European Union and Hungary are negotiating financial support to Budapest so that it lifts its veto on the bloc's planned embargo on Russian oil, but they remain split over funds for refineries, sources told Reuters on Tuesday. The EU commission this month proposed a new package of sanctions against Russia for its invasion of Ukraine, which would include a total ban on oil imports in six months' time, but the measures have not yet been adopted, with Hungary being among the most vocal critics of the plan. (RTRS)

OIL: Slovak Finance Minister Igor Matovic will propose a special tax on Russian crude processed in the country, which could bring in around 300 million euros of additional revenue to the state budget, he said on Tuesday. Matovic said that his aim is to have the tax in place for June, and that he expected to get sufficient support for the proposal from coalition parties. (RTRS)

OIL: Trading houses can decide for themselves whether commodity deals with state-controlled Russian companies meet the standard of being "strictly necessary" in order to avoid international sanctions, the Swiss agency in charge of enforcement said on Tuesday. (RTRS)

CHINA

ECONOMY: China needs to adopt more powerful policies to help the covid- hit small-and-medium sized enterprises, after economic activities showed evidence of collapses, according to a front-page commentary on the official Securities Times. Direct subsidies for smaller businesses may be more effective than tax cuts in helping them survive and restoring confidence. Measures such as shopping coupons or cash handout to low-income households should also be considered. Industrial activities are expected to pick up slowly from May or June as covid restrictions ease, but economic recovery needs more proactive policy support. Covid curbs must not go too far that hampers market recovery. (BBG)

POLICY: China is offering more financing-support tools to help private firms raise fund in the bond market, according to the official Shanghai Securities Journal. China’s dealers association, the National Association of Financial Market Institutional Investors, had a meeting on Tuesday to study more financing support, and ten major underwriters including ICBC and Bank of China were present. Overall net bond financing by China’s private enterprises contracted in the first quarter, paper said, without specifying source of data. (BBG)

PROPERTY: It should take at least a quarter for new policies and an easing of Covid-19 curbs to lift the real estate market from a bottom now, said the 21st Century Business Herald in an editorial. Housing demand will rebound when economic growth returns to a normal track and expectation stabilises, the newspaper said. There is still strong demand, the newspaper said noting that many homebuyers had lined up to wait for the approval of bank mortgages in H1 2021 amid an easing policy environment. The current housing prices in first-tier cities are still too high and any stimulation on first-tier housing markets should be avoided, the newspaper said. (MNI)

EQUITIES: Chinese stocks listed on U.S. exchanges surged on Tuesday after Vice Premier Liu He said the country supports the listing of digital companies in domestic and foreign capital markets, according to Quanshang China, a social media outlet under the Securities Times. The NASDAQ Golden Dragon China Index soared by over 7% after the market open, the newspaper said. It is necessary to balance the relationship between development and security, as well as handle the relationship between the government and the market well, the newspaper said citing officials’ speeches during the meeting. (MNI)

BONDS: Global funds offloaded Chinese government bonds for a third straight month in April, marking the longest streak of debt outflows since the aftermath of a shock currency devaluation in 2015. Overseas institutions net sold 42 billion yuan ($6 billion) of the notes in April after withdrawing a record 52 billion yuan in March. The release was published later than usual and came as China’s main bond trading platform for foreign investors quietly stopped providing data on their daily transactions after May 11, according to people familiar with the matter, spurring concern over transparency. While the pace of debt outflows has slowed, Chinese bonds are not out of the woods yet as a widening monetary policy gap with the US undermines their yield premium. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9798% at 09:42 am local time from the close of 1.5257% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Tuesday vs 49 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7421 WEDS VS 6.7854 TUES

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7421 on Wednesday, compared with 6.7854 set on Tuesday.

OVERNIGHT DATA

CHINA APR NEW HOME PRICES -0.30% M/M; MAR -0.07%

JAPAN Q1, P GDP -0.2% Q/Q; MEDIAN -0.4%; Q4 +0.9%

JAPAN Q1, P GDP ANNUALIZED -1.0% Q/Q; MEDIAN -1.8%; Q4 +3.8%

JAPAN Q1, P GDP NOMINAL +0.1% Q/Q; MEDIAN -0.3%; Q4 +0.3%

JAPAN Q1, P GDP DEFLATOR -0.4% Q/Q; MEDIAN -1.0%; Q4 -1.3%

JAPAN Q1, P GDP PRIVATE CONSUMPTION 0.0% Q/Q; MEDIAN -0.5%; Q4 +2.5%

JAPAN Q1, P GDP BUSINESS SPENDING +0.5% Q/Q; MEDIAN +0.7%; Q4 +0.4%

JAPAN Q1, P INVENTORY CONTRIBUTION % GDP +0.2%; MEDIAN +0.1%; Q4 -0.2%

JAPAN Q1, P NET EXPORTS CONTRIBUTION % GDP -0.4%; MEDIAN -0.3%; Q4 +0.1%

JAPAN MAR, F INDUSTRIAL OUTPUT -1.7% Y/Y; FLASH -1.7%

JAPAN MAR, F INDUSTRIAL OUTPUT +0.3% M/M; FLASH -0.5%

JAPAN MAR CAPACITY UTILIZATION -1.6% M/M; FEB +1.5%

AUSTRALIA Q1 WAGE PRICE INDEX +2.4% Y/Y; MEDIAN +2.5%; Q4 +2.3%

AUSTRALIA Q1 WAGE PRICE INDEX +0.7% Q/Q; MEDIAN +0.8%; Q4 +0.7%

AUSTRALIA APR WESTPAC LEADING INDEX -0.15% M/M; MAR +0.33%

Recently Westpac revised down its growth forecast for 2022 from 5.5% to 4.5%. That reflected the sharp increase in the cost of living as headline inflation lifted by 5.1% in the year to March 2022, including an increase of 2% in the March quarter and an earlier and more rapid policy tightening from the RBA That said, near term prospects are still positive. Post-COVID reopening is expected to see a further solid lift in consumer spending – as household savings normalises and more income flows through to spending. But in real terms the extent of this lift will be constrained by the higher cost of goods and services. By holding comfortably above the zero level, the Leading Index is also consistent with above trend growth in 2022 and a large boost coming in the June and September quarters. The Index growth rate has lifted from –0.02% in November 2021 – when the two major eastern states were just emerging from delta lockdowns – to 0.88% in April 2022. The 0.91ppt improvement has been mainly driven by a lift in total hours worked (contributing +0.62ppts, accounting for over two thirds of the turnaround); a widening yield spread (+0.27ppts); and a lift in commodity prices in AUD terms (+0.26ppts) with some additional support coming from dwelling approvals and US industrial production (adding +0.21pts on a combined basis). These improvements have been partially offset by a softening in consumer expectations, the Westpac-MI CSI Expectations Index and the Westpac-MI Unemployment Expectations Index taking 0.45ppts off the leading index growth rate on a combined basis. (Westpac)

MARKETS

SNAPSHOT: Powell Underscores Inflation Focus

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 169.94 points at 26827.4

- ASX 200 up 59.972 points at 7172.6

- Shanghai Comp. down 11.579 points at 3082.118

- JGB 10-Yr future up 3 ticks at 149.5, yield unch. at 0.246%

- Aussie 10-Yr future down 4.0 ticks at 96.525, yield up 3.6bp at 3.441%

- U.S. 10-Yr future -0-00+ at 118-27, yield down 1.28bp at 2.971%

- WTI crude up $0.68 at $113.08, Gold down $5.81 at $1809.33

- USD/JPY down 30 pips at Y129.08

- POWELL VOWS HIKES UNTIL ‘CLEAR AND CONVINCING’ COOLING IN PRICES (BBG)

- FED'S EVANS WANTS SMALLER U.S. RATE HIKES BY JULY OR SEPT (RTRS)

- CHINA BOND EXODUS EXTENDS INTO APRIL AS DAILY DATA GOES DARK (BBG)

- US SET TO BLOCK RUSSIAN DEBT PAYMENTS, RAISING ODDS OF DEFAULT (BBG)

- ECB'S LAGARDE GIVES NATIONAL CENTRAL BANK CHIEFS LOUDER VOICE ON POLICY (RTRS)

- EU OFFERS UK NORTHERN IRELAND PROTOCOL OLIVE BRANCH... BUT THREATENS TRADE WAR (TELEGRAPH)

- SUNAK STARTS TO MOVE THE COGS SURROUNDING NEXT LAYER OF UK FISCAL SUPPORT

US TSYS: Twisting A Little Steeper

Some light cash Tsy demand around the Asia-Pac re-open, coupled with a downtick in Chinese equites & e-minis supported Tsys during Asia-Pac dealing, although the space is back from firmest levels of the session ahead of London hours, with e-minis off lows. TYM2 last deals -0-01+ at 118-26, 0-04 off the tip of its 0-09+ overnight range, with volume just above 90K. Cash Tsys have twist steepened, with the major benchmarks running 2bp richer (led by 2s) to 0.5bp cheaper (20s & 30s). Note that the long end lagged the front end in the early rally.

- For some background, Chinese tech stocks faltered after yesterday’s rally, with caution surrounding Tencent’s impending earnings release and some concerns re: the lack of concrete assurances re: lower regulatory burden for the space in the wake of yesterday’s high level Chinese policymaker-tech executive meeting weighing. Headline index moves were relatively modest in the wider scheme of things, with the Hang Seng and CSI 300 trading down a mere 0.6% at typing. Questions surrounding the spread of COVID in the Chinese cities of Beijing, Tianjin & Sichuan still remain evident, even as the situation in Shanghai improves.

- A light, data related bid in the ACGB space provided further support to Tsys half way through Asia trade.

- Chicago Fed President Evans spoke overnight, generally underpinning the broader view of the FOMC. Post-address remarks with reporters saw Evans note that rates may have to go beyond neutral, although such a dynamic makes him nervous. As a result, he highlighted his support for moving to a shallower rate-hike path by September to allow the Fed time to assess inflation dynamics and the impact of already implemented tightening on the labour market.

- Flow was headlined by two block buys of TUM2 futures (+5.5K apiece), which underscored the outperformance of the front end of the Tsy curve.

- Wednesday’s NY session will bring the release of housing starts & building permits data, 20-Year Tsy supply and Fedspeak from Philly Fed President Harker.

JGBS: Futures Outperform On The Curve

JGB futures saw a brief and shallow look below overnight lows at the Tokyo re-open as participants reacted to Tuesday’s wider core FI market dynamics, before a slightly defensive feel and bid for wider core FI dragged the contract higher. The bid has stuck during the Tokyo afternoon, with the contract hovering around unchanged levels.

- Cash JGBS are little changed to ~1bp cheaper across the curve, with the 7- to 10-Year zone presenting the firmest point, which is likely linked to the bid in futures and the proximity of 10-Year yields to the upper limit of the BoJ’s permitted trading band (last dealing at ~0.245%).

- Note that preliminary Q1 Japanese GDP data wasn’t quite as soft as feared, with the saving grace coming as private consumption topped exp. (albeit only printing at flat levels in Q/Q terms).

- Ex-BoJ board member Sakurai spoke with BBG, suggesting that “the BoJ may widen its yield target band as early as this autumn if the economy is on track for a recovery from the pandemic… The most important factor is how the real economy develops…The BOJ can consider a next phase if a recovery continues even gradually,” as long as inflation stays above 1%.”

- The low price observed at the latest round of 5-Year JGB supply met wider expectations (as proxied by the BBG dealer poll), with the price tail holding tight. However, the cover ratio nudged lower, below the 6-auction average. The auction provided a smooth enough round of digestion.

- Looking ahead, Japan’s monthly trade and core machine orders data is due on Thursday, as are BoJ Rinban operations covering 1- to 3-, 5- to 10- & 25+-Year JGBs.

JGBS AUCTION: Japanese MOF sells Y2.0203tn 5-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.0203tn 5-Year JGBs:

- Average Yield 0.017% (prev. 0.027%)

- Average Price 99.94 (prev. 99.89)

- High Yield: 0.019% (prev. 0.029%)

- Low Price 99.93 (prev. 99.88)

- % Allotted At High Yield: 96.3432% (prev. 91.6838%)

- Bid/Cover: 3.402x (prev. 3.614x)

AUSSIE BONDS: Off Session Cheaps After WPI Provides Modest Miss

YM & XM recovered from session lows in the wake of softer than expected local WPI data, with YM -2.0 & XM -4.0 at typing.

- In terms of details, the Q/Q & Y/Y WPI prints provided 0.1ppt misses vs. their respective BBG consensus calls, hitting +0.7% in Q/Q terms and +2.4% in Y/Y terms. While this may lower the odds of a 40bp move at the RBA’s June meeting, the underlying inflation dynamics, RBA view on Australia’s economic resilience and caution surrounding inflation psychology means that a minimum of a 25p hike should be implemented next month. Add into that mix the lagged nature of the WPI release, in addition to compositional questions given recent renumeration trends and the RBA’s willingness to act on liaison programme communique.

- A quick look at RBA pricing after the dust from the latest WPI data has settled shows that the IB strip is currently pricing ~34bp of tightening come the end of the Bank’s June decision, while the strip prices a year-end cash rate of ~2.78%. These levels represent ~3bp and ~6bp moderations from the respective hawkish extremes of the session.

- The latest opinion polls continue to show the incumbent coalition chipping away at Labor’s lead ahead of Saturday’s Federal election, but will it be a case of too little, too late? Most polls indicate that will be the case, with a marginal Labor majority generally projected.

- A smooth round of ACGB Nov-32 supply saw the average weighted yield price 0.61bp through prevailing mids (per Yieldbroker), with the cover ratio printing comfortably above the 2.00x mark. A fairly bland auction all things told, with the expected smooth digestion observed.

- Thursday will see local focus turn to the latest monthly labour market report.

AUSSIE BONDS: The AOFM sells A$800mn of the 1.75% 21 Nov ‘32 Bond, issue #TB165:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 1.75% 21 November 2032 Bond, issue #TB165:

- Average Yield: 3.4942% (prev. 2.3370%)

- High Yield: 3.4975% (prev. 2.3400%)

- Bid/Cover: 2.7687x (prev. 2.1450x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 4.2% (prev. 27.6%)

- Bidders 41 (prev. 50), successful 19 (prev. 28), allocated in full 12 (prev. 18)

EQUITIES: China & Hong Kong Modestly Lower

Chinese tech stocks faltered after yesterday’s rally, with caution surrounding Tencent’s impending earnings release and some concerns re: the lack of concrete assurances re: lower regulatory burden for the space in the wake of yesterday’s high level Chinese policymaker-tech executive meeting weighing.

- Headline index moves were relatively modest in the wider scheme of things, with the Hang Seng and CSI 300 trading down a mere 0.6% at typing.

- Questions surrounding the spread of COVID in the Chinese cities of Beijing, Tianjin & Sichuan still remain evident, even as the situation in Shanghai improves.

- The downtick in Chinese equities seemed to feed through into e-minis, with the 3 major contracts sitting 0.2-0.5% lower on the day, as the NASDAQ leads the weakness.

- Elsewhere, Australia’s ASX 200 and Japan’s Nikkei 225 added less than 1.0% as participants weighed up Tuesday’s positive lead from Wall St. with the aforementioned China-specific headwinds.

OIL: A Touch Higher In Asia

WTI & Brent crude futures sit $1.00 & $0.50 above their respective settlement levels, even as Asia-Pac hours saw a marginal uptick for the USD, with broader risk trading on the backfoot.

- Crude slid into settlement on Tuesday, with talk of the U.S. reportedly tabling a global price cap on Russian oil, as an alternative to embargoes, providing one source of pressure during Tuesday trade. Elsewhere, news that Venezuela will benefit from the U.S. easing some economic sanctions also fed into price action, per several desks.

- Note that the latest API inventory estimates allowed the space to correct from Tuesday’s lows, with reports flagging a surprise drop in headline crude tocks, coupled with a larger than expected drop in gasoline stocks (higher gas prices have been a key driver of the latest uptick in oil) and a fall in stocks at the Cushing hub. Meanwhile, the same reports indicated a build in distillate stocks.

- Weekly DoE inventory data is due later on Wednesday.

GOLD: Modest Downtick In Asia

Gold has ticked lower through Asia trade, with an uptick in the DXY applying some light pressure. Spot last deals a handful of dollars lower on the day, just below $1,810/oz.

- A reminder that an uptick in wider real yields eventually resulted in a downtick for bullion on Tuesday, with hawkish central bank speak, most notably from Fed Chair Powell, in addition to firmer than expected U.S. retail sales data, weighing on bullion during NY dealing. This allowed the early bid that stemmed from a weaker USD to more than reverse.

- The technical backdrop remains unchanged, it seems that gold remains vulnerable, with familiar technical parameters remaining in play.

FOREX: Fed Inflation-Fighting Resolve & China Jitters Spoil Mood, AUD Takes Hit From WPI Data

Quarterly wage data released out of Australia disappointed RBA hawks, slightly reducing the odds of a super-sized rate hike at the Bank's June meeting. Both Y/Y & Q/Q WPI prints missed BBG consensus calls by 0.1ppt. The reaction in cash rate futures markets was noticeable but ultimately not too significant, with ~30bp worth of tightening priced for the end of the June meeting as we type. Several sell-side desks tempered their rate-hike expectations at the margin, as focus turns to Australia's monthly labour force statistics, due for release tomorrow.

- Offshore yuan went offered as the decline in China's new home prices accelerated to 0.30% M/M in April, despite measures implemented to support the troubled real estate sector. Resurfacing COVID-19 worry added pressure to the redback, as daily infections in Beijing, Tianjin and the Sichuan province continued to rise, despite further signs of improvement in Shanghai's situation.

- China jitters coupled with regional scrutiny of hawkish rhetoric from Fed Chair Powell, who flagged an "overwhelming need" to control inflation, dented risk sentiment as the Asia-Pac session progressed. Risk aversion applied pressure to Antipodean currencies and prompted participants to seek safe havens.

- The yen outperformed its G10 peers, but USD/JPY remained within yesterday's range, with risk swings stealing the show from local GDP data. The rate unwound its initial uptick as Japan's Q1 GDP contraction proved less severe than projected, even as expectations were low, the surprise could have been attributed to Q4 revisions and lack of growth momentum supported the case for continued powerful easing from the BoJ.

- Inflation data from the EZ, UK and Canada will be published later in the day, on top of U.S. housing starts & building permits. Comments from ECB's Muller and Fed's Harker are also on tap.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 18/05/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 18/05/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 18/05/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.