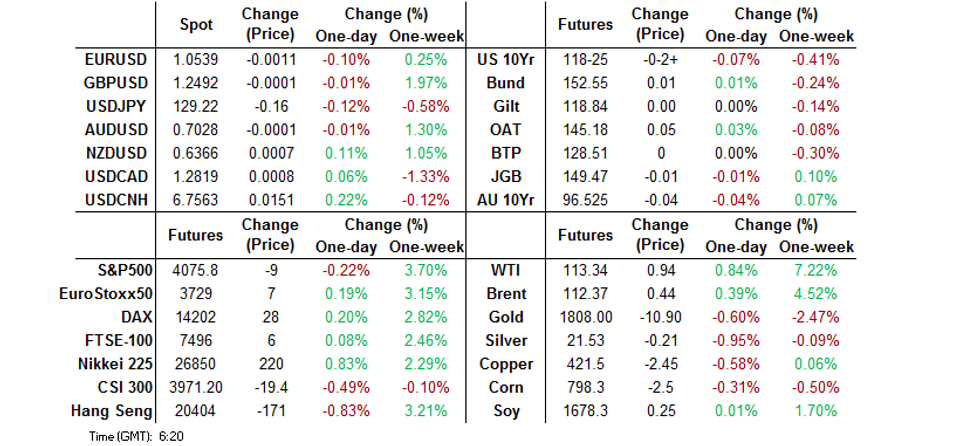

-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: A More Tentative Asia Session

- Chinese tech stocks faltered after yesterday’s rally, with caution surrounding Tencent’s impending earnings release and some concerns re: the lack of concrete assurances re: lower regulatory burden for the space in the wake of yesterday’s high level Chinese policymaker-tech executive meeting weighing. Headline index moves were relatively modest in the wider scheme of things. Questions surrounding the spread of COVID in the Chinese cities of Beijing, Tianjin & Sichuan still remain evident, even as the situation in Shanghai improves.

- JPY outperformed in G10 FX trade as e-minis nudged lower.

- Inflation data from the Eurozone, UK and Canada will be published later in the day, on top of U.S. housing starts & building permits. Comments from ECB's Muller and Fed's Harker are also on tap.

US TSYS: Twisting A Little Steeper

Some light cash Tsy demand around the Asia-Pac re-open, coupled with a downtick in Chinese equites & e-minis supported Tsys during Asia-Pac dealing, although the space is back from firmest levels of the session ahead of London hours, with e-minis off lows. TYM2 last deals -0-01+ at 118-26, 0-04 off the tip of its 0-09+ overnight range, with volume just above 90K. Cash Tsys have twist steepened, with the major benchmarks running 2bp richer (led by 2s) to 0.5bp cheaper (20s & 30s). Note that the long end lagged the front end in the early rally.

- For some background, Chinese tech stocks faltered after yesterday’s rally, with caution surrounding Tencent’s impending earnings release and some concerns re: the lack of concrete assurances re: lower regulatory burden for the space in the wake of yesterday’s high level Chinese policymaker-tech executive meeting weighing. Headline index moves were relatively modest in the wider scheme of things, with the Hang Seng and CSI 300 trading down a mere 0.6% at typing. Questions surrounding the spread of COVID in the Chinese cities of Beijing, Tianjin & Sichuan still remain evident, even as the situation in Shanghai improves.

- A light, data related bid in the ACGB space provided further support to Tsys half way through Asia trade.

- Chicago Fed President Evans spoke overnight, generally underpinning the broader view of the FOMC. Post-address remarks with reporters saw Evans note that rates may have to go beyond neutral, although such a dynamic makes him nervous. As a result, he highlighted his support for moving to a shallower rate-hike path by September to allow the Fed time to assess inflation dynamics and the impact of already implemented tightening on the labour market.

- Flow was headlined by two block buys of TUM2 futures (+5.5K apiece), which underscored the outperformance of the front end of the Tsy curve.

- Wednesday’s NY session will bring the release of housing starts & building permits data, 20-Year Tsy supply and Fedspeak from Philly Fed President Harker.

JGBS: Futures Outperform On The Curve

JGB futures saw a brief and shallow look below overnight lows at the Tokyo re-open as participants reacted to Tuesday’s wider core FI market dynamics, before a slightly defensive feel and bid for wider core FI dragged the contract higher. The bid has stuck during the Tokyo afternoon, with the contract hovering around unchanged levels.

- Cash JGBS are little changed to ~1bp cheaper across the curve, with the 7- to 10-Year zone presenting the firmest point, which is likely linked to the bid in futures and the proximity of 10-Year yields to the upper limit of the BoJ’s permitted trading band (last dealing at ~0.245%).

- Note that preliminary Q1 Japanese GDP data wasn’t quite as soft as feared, with the saving grace coming as private consumption topped exp. (albeit only printing at flat levels in Q/Q terms).

- Ex-BoJ board member Sakurai spoke with BBG, suggesting that “the BoJ may widen its yield target band as early as this autumn if the economy is on track for a recovery from the pandemic… The most important factor is how the real economy develops…The BOJ can consider a next phase if a recovery continues even gradually,” as long as inflation stays above 1%.”

- The low price observed at the latest round of 5-Year JGB supply met wider expectations (as proxied by the BBG dealer poll), with the price tail holding tight. However, the cover ratio nudged lower, below the 6-auction average. The auction provided a smooth enough round of digestion.

- Looking ahead, Japan’s monthly trade and core machine orders data is due on Thursday, as are BoJ Rinban operations covering 1- to 3-, 5- to 10- & 25+-Year JGBs.

AUSSIE BONDS: Off Session Cheaps After WPI Provides Modest Miss

YM & XM recovered from session lows in the wake of softer than expected local WPI data, with YM -2.0 & XM -4.0 at typing.

- In terms of details, the Q/Q & Y/Y WPI prints provided 0.1ppt misses vs. their respective BBG consensus calls, hitting +0.7% in Q/Q terms and +2.4% in Y/Y terms. While this may lower the odds of a 40bp move at the RBA’s June meeting, the underlying inflation dynamics, RBA view on Australia’s economic resilience and caution surrounding inflation psychology means that a minimum of a 25p hike should be implemented next month. Add into that mix the lagged nature of the WPI release, in addition to compositional questions given recent renumeration trends and the RBA’s willingness to act on liaison programme communique.

- A quick look at RBA pricing after the dust from the latest WPI data has settled shows that the IB strip is currently pricing ~34bp of tightening come the end of the Bank’s June decision, while the strip prices a year-end cash rate of ~2.78%. These levels represent ~3bp and ~6bp moderations from the respective hawkish extremes of the session.

- The latest opinion polls continue to show the incumbent coalition chipping away at Labor’s lead ahead of Saturday’s Federal election, but will it be a case of too little, too late? Most polls indicate that will be the case, with a marginal Labor majority generally projected.

- A smooth round of ACGB Nov-32 supply saw the average weighted yield price 0.61bp through prevailing mids (per Yieldbroker), with the cover ratio printing comfortably above the 2.00x mark. A fairly bland auction all things told, with the expected smooth digestion observed.

- Thursday will see local focus turn to the latest monthly labour market report.

FOREX: Fed Inflation-Fighting Resolve & China Jitters Spoil Mood, AUD Takes Hit From WPI Data

Quarterly wage data released out of Australia disappointed RBA hawks, slightly reducing the odds of a super-sized rate hike at the Bank's June meeting. Both Y/Y & Q/Q WPI prints missed BBG consensus calls by 0.1ppt. The reaction in cash rate futures markets was noticeable but ultimately not too significant, with ~30bp worth of tightening priced for the end of the June meeting as we type. Several sell-side desks tempered their rate-hike expectations at the margin, as focus turns to Australia's monthly labour force statistics, due for release tomorrow.

- Offshore yuan went offered as the decline in China's new home prices accelerated to 0.30% M/M in April, despite measures implemented to support the troubled real estate sector. Resurfacing COVID-19 worry added pressure to the redback, as daily infections in Beijing, Tianjin and the Sichuan province continued to rise, despite further signs of improvement in Shanghai's situation.

- China jitters coupled with regional scrutiny of hawkish rhetoric from Fed Chair Powell, who flagged an "overwhelming need" to control inflation, dented risk sentiment as the Asia-Pac session progressed. Risk aversion applied pressure to Antipodean currencies and prompted participants to seek safe havens.

- The yen outperformed its G10 peers, but USD/JPY remained within yesterday's range, with risk swings stealing the show from local GDP data. The rate unwound its initial uptick as Japan's Q1 GDP contraction proved less severe than projected, even as expectations were low, the surprise could have been attributed to Q4 revisions and lack of growth momentum supported the case for continued powerful easing from the BoJ.

- Inflation data from the EZ, UK and Canada will be published later in the day, on top of U.S. housing starts & building permits. Comments from ECB's Muller and Fed's Harker are also on tap.

ASIA FX: China Negatives Spill Over, Countering Initial Risk-On Impulse

China headline flow provided a mix of negative signals, countering the initial risk-on impetus, carried over from Tuesday's Wall Street session. Although Shanghai extended its run without community transmission of COVID-19, daily case tallies rose in Beijing, Tianjin and Sichuan, fuelling concerns about virus flare-ups. Elsewhere, China's new home prices fell for the eight straight month in April, with the pace of decline accelerating to 0.30% M/M, signalling continued distress in the local property sector despite support measures proposed to date.

- CNH: Spot USD/CNH went bid carried by local headline flow, with the upswing facilitated by the reintroduction of weak bias into the PBOC's yuan fixing. The mid-point of permitted USD/CNY trading band was set at CNY6.7421, 21 pips above sell-side estimate. USD/CNH is on track to snap a three-day losing streak.

- KRW: The won led gains in the Asia EM basket as spot USD/KRW failed to claw back the entirety of its opening losses, even as 1-month NDF pushed higher. Broader risk dynamics were in the driving seat.

- IDR: Spot USD/IDR soared to its highest point since early Oct 2020.

- MYR: The ringgit slipped but spot USD/MYR failed to re-test yesterday's high.

- PHP: Spot USD/PHP crept higher ahead of tomorrow's BSP monetary policy decision, but key resistance from PHP52.500 remained intact.

- THB: The baht weakened from the off as participants assessed yesterday's GDP data & downgrade to the 2022 growth outlook by Thailand's main economic forecaster.

- INR: Spot USD/INR extended its pullback from an all-time high, in the wake of Tuesday's wholesale prices beat & suspected RBI intervention.

IDR: Rupiah Buffeted By Internal And External Headwinds

In the past 5 trading sessions, IDR is down 0.80% against the USD, the worst performer within the major EM Asia FX bloc.

- Spot USD/IDR is looking to break above 14700, while the 1 month NDF is already through this level. This is the highest level observed since late 2020.

- Yesterday's much better than expected trade figures, a surplus of $7560mn, versus $4000mn expected, provided little relief.

- The market is likely looking forward, with May data to be more heavily impacted by the palm oil export ban and softer China demand for commodities.

- In any event, the bumper trade surplus in April did little to arrest the slide in BI's FX reserves in the month. Valuation effects were no doubt in play during the month but headline FX reserves have now declined by more than $10bn since last November. Headline FX reserves are now back to $135.7bn, which represents the lowest level seen since November 2020.

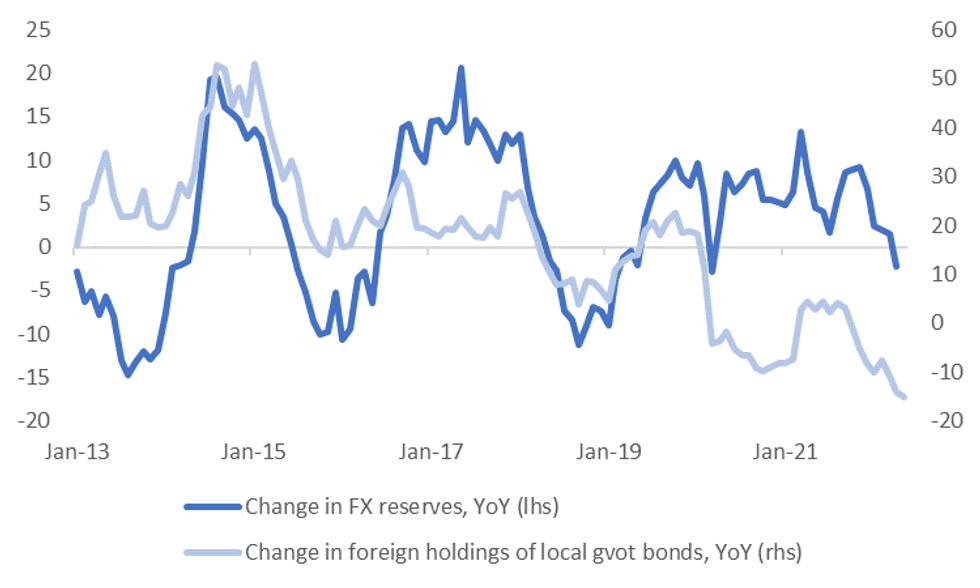

- The directional correlation between FX reserve changes and change in foreign holdings of local bonds remains strong, see the first chart below. Foreign investors continue to reduce holdings of local bonds, down 7 out of the past 8 months and are on track to fall further in May.

Fig 1: Change In BI FX Reserves And Change In Foreign Holdings Of Local Bonds

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

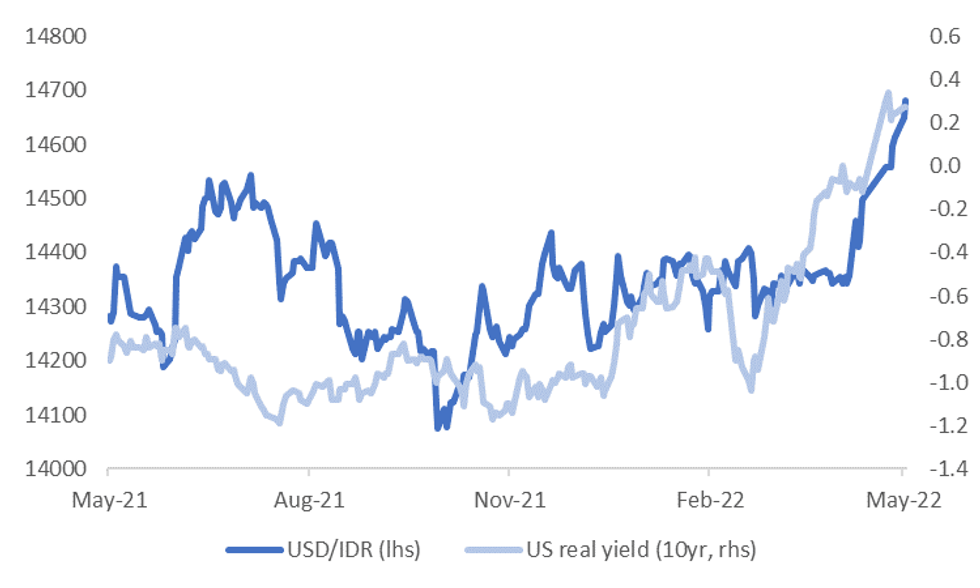

- The correlation between USD/IDR and US real yields has also been rising, see the second chart below. If anything US real yield moves tend to lead IDR moves, particularly since the start of the year.

- Historically, IDR has been very sensitive to US monetary policy shifts, as the country has relied on external funding for its current account deficit position. However, booming commodity prices and weaker imports (as domestic demand still recovers from the Covid shock) has seen Indonesia enjoy a current account surplus for much of the past 2 years.

- This provides some buffer to rising Fed rates and capital outflow pressures. However, the market consensus is for the current account position to slip back into modest deficit in 2022. Hence it could provide less support as we move further into the year.

Fig 2: USD/IDR And U.S. Real 10yr yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: China & Hong Kong Modestly Lower

Chinese tech stocks faltered after yesterday’s rally, with caution surrounding Tencent’s impending earnings release and some concerns re: the lack of concrete assurances re: lower regulatory burden for the space in the wake of yesterday’s high level Chinese policymaker-tech executive meeting weighing.

- Headline index moves were relatively modest in the wider scheme of things, with the Hang Seng and CSI 300 trading down a mere 0.6% at typing.

- Questions surrounding the spread of COVID in the Chinese cities of Beijing, Tianjin & Sichuan still remain evident, even as the situation in Shanghai improves.

- The downtick in Chinese equities seemed to feed through into e-minis, with the 3 major contracts sitting 0.2-0.5% lower on the day, as the NASDAQ leads the weakness.

- Elsewhere, Australia’s ASX 200 and Japan’s Nikkei 225 added less than 1.0% as participants weighed up Tuesday’s positive lead from Wall St. with the aforementioned China-specific headwinds.

GOLD: Modest Downtick In Asia

Gold has ticked lower through Asia trade, with an uptick in the DXY applying some light pressure. Spot last deals a handful of dollars lower on the day, just below $1,810/oz.

- A reminder that an uptick in wider real yields eventually resulted in a downtick for bullion on Tuesday, with hawkish central bank speak, most notably from Fed Chair Powell, in addition to firmer than expected U.S. retail sales data, weighing on bullion during NY dealing. This allowed the early bid that stemmed from a weaker USD to more than reverse.

- The technical backdrop remains unchanged, it seems that gold remains vulnerable, with familiar technical parameters remaining in play.

OIL: A Touch Higher In Asia

WTI & Brent crude futures sit $1.00 & $0.50 above their respective settlement levels, even as Asia-Pac hours saw a marginal uptick for the USD, with broader risk trading on the backfoot.

- Crude slid into settlement on Tuesday, with talk of the U.S. reportedly tabling a global price cap on Russian oil, as an alternative to embargoes, providing one source of pressure during Tuesday trade. Elsewhere, news that Venezuela will benefit from the U.S. easing some economic sanctions also fed into price action, per several desks.

- Note that the latest API inventory estimates allowed the space to correct from Tuesday’s lows, with reports flagging a surprise drop in headline crude tocks, coupled with a larger than expected drop in gasoline stocks (higher gas prices have been a key driver of the latest uptick in oil) and a fall in stocks at the Cushing hub. Meanwhile, the same reports indicated a build in distillate stocks.

- Weekly DoE inventory data is due later on Wednesday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/05/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 18/05/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 18/05/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 18/05/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 18/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 18/05/2022 | - |  | EU | ECB Lagarde & Panetta in G7 Meeting | |

| 18/05/2022 | 1230/0830 | *** |  | CA | CPI |

| 18/05/2022 | 1230/0830 | *** |  | US | Housing Starts |

| 18/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 18/05/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 18/05/2022 | 2000/1600 |  | US | Philadelphia Fed's Patrick Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.