-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: U.S. Stocks Find Poise, Beijing COVID Cases Climb

EXECUTIVE SUMMARY

- ECB’S LAGARDE SIGNALS THAT JULY IS LIKELY LIFTOFF DATE FOR ECB RATES (BBG)

- PENTAGON WEIGHS DEPLOYING SPECIAL FORCES TO GUARD KYIV EMBASSY (WSJ)

- TURKEY’S ERDOGAN DISCUSSES CONCERNS WITH NATO HOPEFULS SWEDEN AND FINLAND (RTRS)

- BEIJING SEES MOST CASES THIS OUTBREAK, LOCKDOWN ANGST RENEWS (BBG)

- ANTHONY ALBANESE SWORN IN AS AUSTRALIAN PRIME MINISTER AFTER LABOR WINS ELECTION

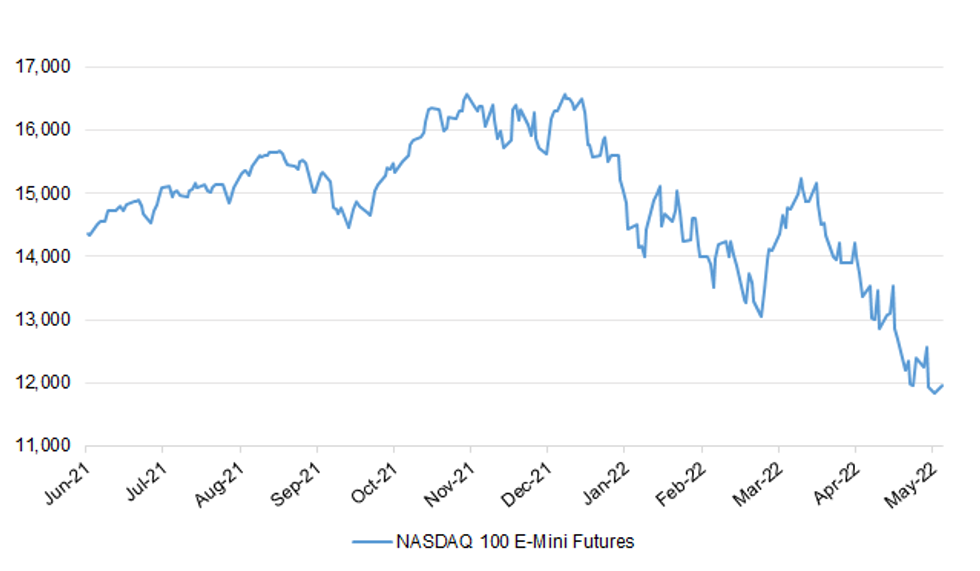

Fig. 1: NASDAQ 100 E-Mini Futures

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: The UK is unprepared for huge food price hikes and shortages of essential goods that will be triggered by the Ukraine war, the head of a government advisory body fears. Ian Wright has told The Independent of growing concerns that there is no proper plan for a “scary” future of disrupted food supplies, warning: “This is a bigger crisis than energy.” (Independent)

ECONOMY/POLITICS: The Liberal Democrats have urged Downing Street to clarify whether Boris Johnson — who is resisting the idea of an energy windfall tax — has discussed the issue with his informal political adviser Sir Lynton Crosby, whose companies represent various clients in the oil and gas industry. The UK prime minister has been holding off calls from Labour MPs, prominent business leaders and some Conservative MPs to impose a windfall tax on North Sea operators to reflect their recent multibillion-pound profits. (FT)

PUBLIC HEALTH: Public health officials are to announce more UK monkeypox cases on Monday, as efforts ramp up to contain the first multinational outbreak of the virus that has led to cases in at least 14 countries. (Guardian)

EUROPE

ECB: European Central Bank President Christine Lagarde said the first increase in interest rates in more than a decade may come in July but downplayed the idea of a half-point move amid concerns about economic expansion. With a growing contingent on the Governing Council honing in on the summer for liftoff, Lagarde told Dutch television that a hike may be delivered “weeks” after net bond-buying ends early next quarter -- in line with ECB guidance. “We are going to follow the path of stopping net asset purchases,” she said. “Then, sometime after that -- which could be a few weeks -- hike interest rates.” (BBG)

ECB: European Central Bank President Christine Lagarde said crypto-currencies are “based on nothing” and should be regulated to steer people away from speculating on them with their life savings. Lagarde told Dutch television that she’s concerned about people “who have no understanding of the risks, who will lose it all and who will be terribly disappointed, which is why I believe that that should be regulated.” (BBG)

EU: The EU’s decision to suspend its deficit and debt rules for an extra year is not an excuse for member states to persist with loose spending policies, Germany’s finance minister Christian Lindner has said, in a call for more fiscal discipline. “The fact that member states are now able to deviate from the Stability and Growth pact doesn’t mean they actually should do that,” Lindner told the Financial Times. (FT)

GERMANY: Germany wants to intensively pursue gas and renewable energy projects with Senegal, Chancellor Olaf Scholz said on Sunday during his first trip to Africa, against the backdrop of the war in Ukraine and its impact on energy and food prices. Scholz kicked off the three-day tour in Senegal, which has billions of cubic metres of gas reserves and is expected to become a major gas producer in the region. (RTRS)

BELGIUM: Belgium has become the first country to introduce a compulsory 21-day quarantine for monkeypox patients after reporting four cases of the disease in the last week. Belgian health authorities took the decision on Friday, according to Belgian media. Monkeypox contact cases are not required to self-isolate but should remain vigilant particularly if they are in contact with vulnerable people. (Politico)

PORTUGAL: Portugal’s finance minister has vowed to remove his country from the “podium” of the three most indebted economies in Europe to protect families and businesses from the impact of higher interest rates. Fernando Medina said it was vital to reduce more quickly the country’s public debt - the highest in the eurozone after Greece and Italy - to prevent higher government borrowing costs hitting the wider economy. (FT)

UKRAINE: Ukraine and Poland agreed on Sunday to establish a joint border customs control and work on a shared railway company to ease the movement of people and increase Ukraine's export potential. Ukrainian President Volodymyr Zelenskiy and Polish President Andrzej Duda touted the increased cooperation between the countries during a meeting in Kyiv on Sunday, with Duda offering Warsaw's backing for the embattled neighbour. "The Polish-Ukrainian border should unite not divide," Duda told lawmakers as he became the first foreign leader to give a speech in person to the Ukrainian parliament since Russia's Feb. 24 invasion. (RTRS)

UKRAINE: Ukraine ruled out a ceasefire or any territorial concessions to Moscow as Russia stepped up its attack in the country's east and south, pounding the Donbas and Mykolaiv regions with air strikes and artillery fire. Kyiv's stance has become increasingly uncompromising in recent weeks as Russia experienced military setbacks while Ukrainian officials grew worried they might be pressured to sacrifice land for a peace deal. (RTRS)

UKRAINE: U.S. military and diplomatic officials are weighing plans to send special forces troops to Kyiv to guard the newly reopened embassy there, proposals that would force the Biden administration to balance a desire to avoid escalating the U.S. military presence in the war zone against fears for the safety of American diplomats, U.S. officials said. President Biden has yet to be presented with the proposal. But if he approves it, troops would be deployed only for the defense and security of the embassy, which lies within range of Russian missiles, U.S. officials said. Their presence inside Ukraine would mark an escalation from Mr. Biden’s initial pledge that no American troops will be sent into the country. (WSJ)

UKRAINE: France’s European affairs minister said that any bid for Ukraine to join the European Union would take at least 15 to 20 years to complete, putting a damper on Ukrainian President Volodymyr Zelenskiy's hopes of gaining a quick entry into the bloc. "We have to be honest. If you say Ukraine is going to join the EU in six months, or a year or two, you're lying," Clement Beaune told France’s Radio J on May 22. "It's probably in 15 or 20 years -- it takes a long time." (Radio Free Europe)

UKRAINE: The Russian-appointed head of the occupied Ukrainian town next to Europe's largest nuclear power plant was injured in an explosion on Sunday, a Ukrainian official and a Russian news agency said. Andrei Shevchik, who was named mayor of Enerhodar by Russia following its occupation of the town, was in intensive care following the blast, Russia's RIA news agency said, citing a source in the emergency services. (RTRS)

MOLDOVA: Liz Truss has revealed that she wants to send modern weaponry to Moldova to protect it from the threat of invasion by Russia. In an interview with The Telegraph, the Foreign Secretary said Vladimir Putin was determined to create a “greater Russia” despite defeat in Kyiv, Ukraine’s capital. Moldova, to the south-west of Ukraine, is not a Nato member and there are fears it could be Putin’s next target after Ukraine as he seeks territorial expansion. (Telegraph)

NAGORNO-KARABAKH: The leaders of Azerbaijan and Armenia met on Sunday in Brussels to discuss a peace plan for Nagorno-Karabakh that has stoked a wave of protests in Yerevan over opposition claims that Armenian Prime Minister Nikol Pashinyan is being too soft. (RTRS)

U.S.

ECONOMY: National Economic Council Director Brian Deese said Sunday that the high inflation rates across the country are a result of the economy’s “period of transition” in recovering from the pandemic. “We’re moving from the strongest economic recovery in modern history to what can be a period of more stable and resilient growth,” he said on “Fox News Sunday.” (Politico)

POLITICS: At least 357 sitting Republican legislators in closely contested battleground states have used the power of their office to discredit or try to overturn the results of the 2020 presidential election, according to a review of legislative votes, records and official statements by The New York Times. The tally accounts for 44 percent of the Republican legislators in the nine states where the presidential race was most narrowly decided. In each of those states, the election was conducted without any evidence of widespread fraud, leaving election officials from both parties in agreement on the victory of Joseph R. Biden Jr. (NYT)

OTHER

IMF: The International Monetary Fund warned against global economic fragmentation as a consequence of Russia’s invasion of Ukraine, saying that undoing decades of integration will make the world poorer and more dangerous. Nations should lower trade barriers to alleviate shortages and lower prices, after more than 30 countries restricted trade in food, energy and other key commodities, IMF Managing Director Kristalina Georgieva said. (BBG)

DAVOS: The three-decade era of globalisation risks going into reverse according to company executives and investors, as world leaders prepare to meet in the Swiss town of Davos for the first time since the coronavirus pandemic began. The geopolitical fallout from Russia’s war in Ukraine, combined with the disruption to global supply chains caused by the virus, recent market turmoil and the rapidly worsening economic outlook leave corporate leaders and investors grappling with vital strategic decisions, several told the Financial Times in interviews. (FT)

NATO: Turkish President Tayyip Erdogan, who has objected to Sweden and Finland joining NATO, held phone calls with the leaders of the two countries on Saturday and discussed his concerns about terrorist organisations. Erdogan told Sweden's Prime Minister Magdalena Andersson that Ankara expected concrete steps to address its concerns, according to the Turkish presidency. He also said an arms exports embargo imposed on Turkey after its Syria incursion in 2019 should be lifted, it added. In another call, Erdogan told Finnish President Sauli Niinisto that failing to deal with terrorist organisations that posed a threat to a NATO ally would not suit the spirit of alliance, Ankara said. (RTRS)

U.S./CHINA: The US-Indo Pacific strategy is causing more and more vigilance and concern in the world, especially among the countries in the Asia-Pacific region, said Chinese State Councilor and Foreign Minister Wang Yi on Sunday. He made the remarks during a joint press conference with Pakistani Foreign Minister Bilawal Bhutto-Zardari in Guangzhou City, south China’s Guangdong Province. (Pakistan Times)

U.S./ASIA: President Joe Biden on Monday promised “concrete benefits” for the people of the Indo-Pacific region from a new trade pact he was set to launch, designed to signal U.S. dedication to the contested economic sphere and address the need for stability in commerce after disruptions caused by the pandemic and Russia’s invasion of Ukraine. Meeting with Japanese Prime Minister Fumio Kishida, Biden said the new Indo-Pacific Economic Framework would also increase U.S. cooperation with other nations in the region. (AP)

JAPAN: President Joe Biden assured his "good friend" Prime Minister Fumio Kishida of Japan on Monday that the United States is fully committed to Japan's defence, amid simmering tension with China and the ramifications of Russia's invasion of Ukraine. (RTRS)

RBA: Reserve Bank of Australia Assistant Governor Christopher Kent, who oversees the nation’s financial markets, comments in response to questions following a speech in Sydney on Monday. “On the neutral cash rate, it’s very uncertain, changes over time, depends very much on potential growth, people’s willingness to take risks. (...) Model estimates have it somewhere between two and three at the moment.” (BBG)

AUSTRALIA: Anthony Albanese has been sworn in as Australia’s 31st Prime Minister alongside senior Labor frontbenchers before he heads to Tokyo for talks with the US, India and Japan. Labor secured an historic victory on Saturday night but has not yet been delivered a majority with the party so far holding 72 electorates with 14 seats in doubt. Mr Albanese’s frontbench team including Treasurer Jim Chalmers, Finance Minister Katy Gallagher, Foreign Minister Penny Wong and Deputy Prime Minister Richard Marles were also sworn in before the leader's Quad meeting overseas. (Sky)

AUSTRALIA: Peter Dutton has emerged as the frontrunner to replace Scott Morrison as the leader of the Liberal Party. However, a new opposition leader cannot be appointed until the Liberal Party room is finalised. (SMH)

NEW ZEALAND: Prime Minister Jacinda Arden could be travelling to the White House to meet US President Joe Biden as part of a trade trip to promote New Zealand. The Government announced the visit on Monday morning, with Ardern expected to depart on Monday afternoon. Because of US Covid travel rules, the prime minister, who was originally meant to depart on Saturday, had to delay her flight until 10 days after testing positive. (Stuff)

NEW ZEALAND: Ardern said Cabinet had confirmed New Zealand will send a further 30 NZ Defence Force personnel to the UK until the end of July. They will be there to help train Ukrainian soldiers in using the L119 light artillery gun, which was only used by a handful of countries, Ardern said. (RNZ)

SOUTH KOREA: The United States is not considering adding South Korea to the Washington-led Quad security forum seen by many as a partnership to counter an assertive China, a senior U.S. official reportedly said Sunday. (Yonhap)

SOUTH KOREA: Prime Minister Han Duck-soo said Monday he will make utmost efforts for national unity, while pledging swift implementation of an extra budget aimed at compensating small merchants hit by losses caused by stricter virus curbs. (Yonhap)

HONG KONG: Hong Kong Exchanges and Clearing (HKEX), which operates Asia’s third-largest stock market, will establish two international offices over the next year to reach out to more overseas investors and market the city as a fundraising destination, according to its chief executive. One of the offices will be in Europe and the other in the US, Nicolas Aguzin told the Post in an exclusive interview from Davos, Switzerland, where he is attending the World Economic Forum. The exact locations will be announced at a later date, and they will be the first HKEX offices outside Asia. It currently has a presence in Singapore, Beijing and Shanghai. (SCMP)

ASEAN: Representatives of the United States and several other nations walked out of an Asia-Pacific trade ministers meeting in Bangkok on Saturday to protest Russia's invasion of Ukraine, officials said. The walkout was "an expression of disapproval at Russia's illegal war of aggression in Ukraine and its economic impact in the APEC region," one diplomat said. A diplomat said the five countries that staged the protest wanted "stronger language on Russia's war" in the group's final statement to be issued on Sunday. (RTRS)

SOUTHEAST ASIA: Global private equity firm General Atlantic plans to plough $2 billion into India and Southeast Asia over the next two years after falling valuations made the region's startups more attractive, a senior executive told Reuters. General Atlantic is in early-stage investment talks with about 15 companies in sectors including technology, financial services, retail and consumer, Sandeep Naik, the head of its business in India and Southeast Asia, said in an interview. (RTRS)

INDIA: India unveiled inflation-fighting fiscal measures estimated to be worth $26 billion, including cuts to fuel taxes and import duties, adding pressure on government borrowing and bonds while joining efforts by the central bank to tame price pressures. The steps announced over the weekend by Prime Minister Narendra Modi’s administration come as inflation climbed to an eight-year high on commodities and supply-chain shocks and the central bank began raising interest rates for the first time in almost four years. “The new measures could play a key role in easing price pressures,” Rahul Bajoria and Sri Virinchi Kadiyala at Barclays Plc wrote in a report to clients Sunday, adding that the central bank will likely still maintain its path toward tighter monetary policy. (BBG)

PAKISTAN: Recently ousted Pakistani Prime Minister Imran Khan asked his supporters to march on Islamabad, the nation’s capital, for a sit-in on May 25 as a way to press the government to quit and call new elections. Khan’s move is likely to fuel further political instability in a country already facing an economic crisis from rising inflation. (BBG)

PHILIPPINES: The administration of presumptive president Ferdinand “Bongbong” Marcos Jr. may not have funds it will need for its proposed stimulus package as the outgoing Duterte administration has already disbursed 90 percent of the 2022 national budget, a lawmaker said. (CNN)

THAILAND: Chadchart Sittipunt has won the election for Bangkok governor, pending the official announcement from the Election Commission. Mr Chadchart was the transport minister under the Pheu Thai Party before then army chief Gen Prayut Chan-o-cha led the coup. (Bangkok Post)

RUSSIA: The Central Bank returned to foreign currency purchases to keep the ruble from uncontrolled strengthening, two sources close to the government told Vedomosti and confirmed a source close to the Central Bank. According to them, the Bank of Russia acquires exclusively foreign exchange earnings from exporters. At the same time, the regulator conducts purchases not directly, but with the help of other participants in the financial market. The interlocutors of Vedomosti did not name the specific mechanism and players. (Vedomosti)

RUSSIA: Russia is likely experiencing a shortage of appropriate reconnaissance Uncrewed Aerial Vehicles (UAVs), which it has attempted to use to identify targets to be struck by combat jets or artillery, British Defence ministry said on Saturday. (RTRS)

RUSSIA: Russia is ready to continue negotiations with Ukraine, the initiative to freeze them comes from Kyiv. Vladimir Medinsky, aide to the president of the Russian Federation, stated this on Sunday in an interview with the Belarusian TV channel ONT. (TASS)

PERU: Peru's President Pedro Castillo shuffled his Cabinet on Sunday, including replacing the interior minister and the important mining minister amid rising tensions over protests in the world's second largest copper producing country. (RTRS)

TURKEY: Turkey’s foreign relations ministry summoned Ambassador Jeff Flake after the US embassy posted a warning that police might respond violently to an opposition rally in Istanbul. The ministry told Flake, a former Republican senator from Arizona, that the warning contained unfounded allegations about actions taken in the past. (BBG)

IRAN: Qatar's foreign minister said in remarks cited on Saturday by al Jazeera TV that Qatar had been informed by Iran that matters were "under review" regarding reviving a nuclear deal between Iran and world powers. The Qatari-based TV broadcaster quoted Foreign Minister Sheikh Mohammed bin Abdulrahman Al-Thani as saying that reaching common ground will boost stability in the Gulf region and help oil markets. (RTRS)

IRAN: Iran’s foreign ministry has rejected reports of the country’s willingness to “compromise” its stance in ongoing indirect negotiations with the United States to restore its 2015 nuclear deal with world powers. Foreign ministry spokesman Saeed Khatibzadeh said late Saturday that Iran’s supreme leader, Ayatollah Ali Khamenei, made no mention of compromise to Qatar’s emir, Sheikh Tamim bin Hamad Al Thani, when they met in Tehran earlier this month. (Al Jazeera)

IRAN: Iran’s elite Islamic Revolutionary Guard Corps (IRGC) says one of its officers has been assassinated in the capital Tehran by gunmen riding on two motorcycles, according to the state news agency IRNA. (Al Jazeera)

IRAN: A senior member of Iran’s Islamic Revolutionary Guards Corps who was killed in Tehran on Sunday had planned kidnappings and other attempts to attack Israeli and Jewish targets worldwide, according to unsourced reports in Hebrew media. (Times of Israel)

ISRAEL: Meretz lawmaker Ghaida Rinawie Zoabi will return to Israel's coalition, just three days after her resignation threatened to send the country into its fifth election in four years. (Haaretz)

EGYPT: Egypt’s finance minister has warned that “millions” could die globally because of the food price crisis triggered by the Ukraine war, echoing warnings made by the UN and G7 countries as worries about a worldwide wheat shortage intensify. In an interview during a visit to London, Mohamed Maait warned of “food insecurity” around the world. However, he insisted Egypt had enough wheat to last until the end of the year. (FT)

OIL: Saudi Arabia has signalled it will stand by Russia as a member of the Opec+ group of oil producers despite tightening western sanctions on Moscow and a potential EU ban on Russian oil imports. Prince Abdulaziz bin Salman, the energy minister, told the Financial Times that Riyadh was hoping “to work out an agreement with Opec+ . . . which includes Russia”, insisting the “world should appreciate the value” of the alliance of producers. (FT)

OIL: The former head of Russia’s second-biggest oil group has warned that a European ban on the country’s “impossible to replace” crude would be “the most negative scenario” for all parties as EU discussions on an embargo intensify. Vagit Alekperov, who stepped down as chief executive of Lukoil last month after he was hit by western sanctions, told the Financial Times that any EU move to cut off Russian oil imports would be “a shock for everyone”. (FT)

CHINA

PBOC: China’s mortgage interest rates are likely to be further lowered nationwide after the central bank cut the long-term lending reference rate, the five-year Loan Prime Rate by 15 bps to 4.45% on Friday, Beijing Business Today reported citing analysts. The minimum mortgage rate for first-time homebuyers could drop to as low as 4.25% as the central bank earlier lowered the floor of the rate to 20 bps below the five-year LPR, the newspaper said. Currently, newly issued housing mortgages in Tianjin and Zhengzhou have followed the minimum 4.25%, while many banks in Beijing have lowered the first-time mortgage rate moderately to 5% from the previous 5.15%, the newspaper said. (MNI)

ECONOMY: China's economic growth track has decelerated too fast, and the country should restore the normal life and production as soon as possible to stabilise employment, said China Economic Weekly citing Yu Yongding, former advisor to the PBOC. China should boost consumption and investment through expansionary fiscal and monetary policies, while repairing the supply chain, said Yu. Getting back to normal orders is the top priority, and higher prices can be tolerated as long as inflation is within a reasonable range, Yu was cited as saying. (MNI)

ECONOMY: China will speed up funds to safeguard employment, develop new jobs and cut and defer taxes for companies, Shanghai Securities News reported. The current difficulty lies in promoting the employment of young people, as the number of graduates hits a record high of 10.76 million but only 11 million urban new jobs are expected to be added this year, the newspaper said citing analysts. Meanwhile, young migrant workers going to cities for work continues to rise, the newspaper said noting the unemployment rate of the population aged 16 to 24 rose to 18.2% in April from 16.0%. (MNI)

CORONAVIRUS: Beijing is considering relaxing its quarantine requirements for international arrivals to a 7+7 policy, which would consist of seven days in a hotel and then seven days of health monitoring at home, reducing the hotel stay from 10 days, in response to appeals from investors, according to two sources briefed on the discussions. If it becomes official policy this month, it would mark the second reduction in May from the Chinese capital’s initial 14+7 quarantine rule for people arriving from overseas, including Hong Kong. (SCMP)

GEOPOLITICS: China is intensifying its drive for influence in the Pacific by negotiating security deals with two additional island nations following a pact with the Solomon Islands, according to officials in the US and allied countries. Beijing’s talks with Kiribati, a Pacific island nation 3,000km from Hawaii where US Indo-Pacific Command is based, are the most advanced, the officials said. (FT)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9628% at 09:29 am local time from the close of 1.5839% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 46 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6756 MON VS 6.7487

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6756 on Monday, compared with 6.7487 set on Friday.

OVERNIGHT DATA

JAPAN APR TOKYO CONDOMINIUMS FOR SALE +16.1% y/y; mar -19.7%

SOUTH KOREA MAY 1-20 TRADE BALANCE -$4.8270BN; APR 1-20 -$5.1990BN

SOUTH KOREA MAY 1-20 EXPORTS +24.1% Y/Y; APR 1-20 +16.9%

SOUTH KOREA MAY 1-20 IMPORTS +37.8% Y/Y; APR 1-20 +25.5%

UK MAY RIGHTMOVE HOUSE PRICES+10.2% Y/Y; APR +9.9%

UK MAY RIGHTMOVE HOUSE PRICES +2.1% M/M; APR +1.6%

MARKETS

SNAPSHOT: U.S. Stocks Find Poise, Beijing COVID Cases Climb

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 179.24 points at 26918.27

- ASX 200 up 3.055 points at 7148.7

- Shanghai Comp. down 14.768 points at 3131.799

- JGB 10-Yr future up 4 ticks at 149.82, yield down 0.6bp at 0.236%

- Aussie 10-Yr future up 0.5 ticks at 96.67, yield down 1.1bp at 3.303%

- U.S. 10-Yr future -0-08 at 119-28, US 10-Yr yield up 3.6bp at 2.817%

- WTI crude up $0.62 at $110.9, Gold up $7.78 at $1854.28

- USD/JPY down 51 pips at Y127.37

- ECB’S LAGARDE SIGNALS THAT JULY IS LIKELY LIFTOFF DATE FOR ECB RATES (BBG)

- PENTAGON WEIGHS DEPLOYING SPECIAL FORCES TO GUARD KYIV EMBASSY (WSJ)

- TURKEY’S ERDOGAN DISCUSSES CONCERNS WITH NATO HOPEFULS SWEDEN AND FINLAND (RTRS)

- BEIJING SEES MOST CASES THIS OUTBREAK, LOCKDOWN ANGST RENEWS (BBG)

- ANTHONY ALBANESE SWORN IN AS AUSTRALIAN PRIME MINISTER AFTER LABOR WINS ELECTION

BOND SUMMARY: Core FI Lose Altitude Amid Uptick In E-Minis, Despite China COVID Worry

Core FI came under pressure in Asia as an uptick in U.S. e-minis supported market sentiment. That said, uncertain outlook for China's COVID-19 outbreak kept a lid on risk, preventing a deeper bond sell-off.

- T-Notes extended their pullback from Friday's peak (120-08+) before stabilising. TYM2 changes hands -0-06 at 119-30 as we type, while Eurodollars run 1.0-4.0 ticks lower through the reds. Cash Tsy yields sit 2.4-3.5bp higher, curve is tad flatter. Fed's Bostic will discuss the economic outlook later today.

- JGB futures quickly gave away their opening gains. JBM2 trades at 149.80, up 2 ticks versus last settlement. Cash JGB curve has slightly flattened, with the super-long end leading gains. Local headline flow was fairly light, centred around U.S. Pres Biden's ongoing visit to Tokyo.

- Aussie bonds went offered as weekend federal election brought a decisive victory for Labor, with Anthony Albanese swiftly sworn in as new Prime Minister. While votes are still being counted, the risk of a hung parliament has narrowed. YM last -0.5 & XM +1.0, both near session lows. Bills trade unch. to +2 ticks through the reds. Cash ACGB curve twist flattened, with yields last seen +0.8bp to -2.3bp. RBA's Kent said the Reserve Bank is now in QT phase, adding that models estimate the neutral level of cash rate at around 2-3%.

EQUITIES: Firmer E-Minis Support Sentiment But China's COVID-19 Situation Weighs

U.S. e-minis found poise after S&P 500 avoided a bear market close on Friday, despite extending its losing streak (on a weekly basis) to the worst rout in two decades. While the uptick in U.S. equity-index futures supported risk sentiment, murky outlook for China's COVID-19 outbreak complicated the overall picture, as Beijing reported a record number of new infections during the current outbreak.

- Major regional indices (ex-China) trade flat or in the green, trimming initial gains as the session progressed.

- China's equity benchmarks provided a notable exception and retreated from the off amid weakness in the local tech space.

- E-minis are 0.7-1.2% better off at typing, with the NASDAQ 100 leading.

OIL: Crude Tad Firmer, WTI Shows Above $111/bbl

WTI & Brent have edged higher as the new week got under way with the risk switch flicked to on.

- WTI briefly showed above the $111 mark and last trades at $110.70/bbl, up ~$0.40 from its previous settlement level. Brent last seen at $113.20/bbl, up ~$0.65 versus last settlement.

- Weekend headline flow centred around Russia's participation in the OPEC+ framework. Saudi Arabia's energy minister told the FT that Riyadh wanted "to work out an agreement with OPEC+ ... which includes Russia," frustrating U.S.-led efforts to isolate Moscow over its invasion of Ukraine and undermine its critically important oil industry used to fund the war machine.

- Latest COVID-19 headlines out of China failed to shed much light on the outlook. Shanghai reported no community infections, but Beijing's daily cases rose to a new high since the current outbreak started.

GOLD: Building On Last Week's Gains

Gold is up a further 0.40% today, building on last week's gains of 1.92%, which was the strongest weekly performance for the metal since the start of March.

- Gold is trading back through $1850, its highest levels since May 12th.

- Concerns around the global growth backdrop, particularly last week with China growth downgrades and US business survey misses, has no doubt aided the safe haven appeal of the metal.

- The fact that growth concerns are creeping into US sentiment, which has been a headwind for USD performance, has also likely aided the turnaround. The DXY was down 1.35% last week, its first drop in 7 weeks.

- USD weakness has continued today (DXY off a further -0.44%).

- US real yields are unlikely to have been a key driver of gold sentiment, but stability in yields has also likely helped at the margin.

FOREX: USD Weaker; NZD Outperforms

USD sentiment remains on the back foot, sitting weaker against all the majors, while NZD and AUD are seeing outperformance.

- NZD/USD rose more than 1% today, getting close to 0.6470 before settling back at 0.6450. Higher US equity futures has improved risk appetite, with mixed readings in Asian markets not impacting sentiment at this stage.

- The RBNZ is main event risk this week in NZ, with the market expecting a 50bps hike, which supported by the RBNZ Shadow Board view. NZ 2yr swap rates are around 5bps higher on the day. A 50bps hike is close to fully priced for this week's meeting.

- The AUD has been dragged higher by NZD performance, although has unperformed modestly. AUD/USD is back at 0.7090, +0.70% higher on the day, while the AUD/NZD cross is back sub 1.1000. With the election now behind us and solid chance of Labor holding a small outright majority, tail risk around political uncertainty has been removed for the AUD.

- Elsewhere, the USD remains on the backfoot. US yields are higher on the day, but the differentials with the majors fell sharply last week. EUR/USD is back close to the 1.0600 handle, while USD/JPY is down through 1.2750. GBP/USD back towards 1.2550.

- On the data front, German Ifo Survey will take focus after Asia hours. Comments from ECB's de Cos, Holzmann, Nagel & Villeroy, Fed's Bostic & BoE's Bailey are on tap.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/05/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 23/05/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 23/05/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 23/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/05/2022 | 1600/1200 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/05/2022 | 1615/1715 |  | UK | BOE Governor Bailey Panels Discussion |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.