-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

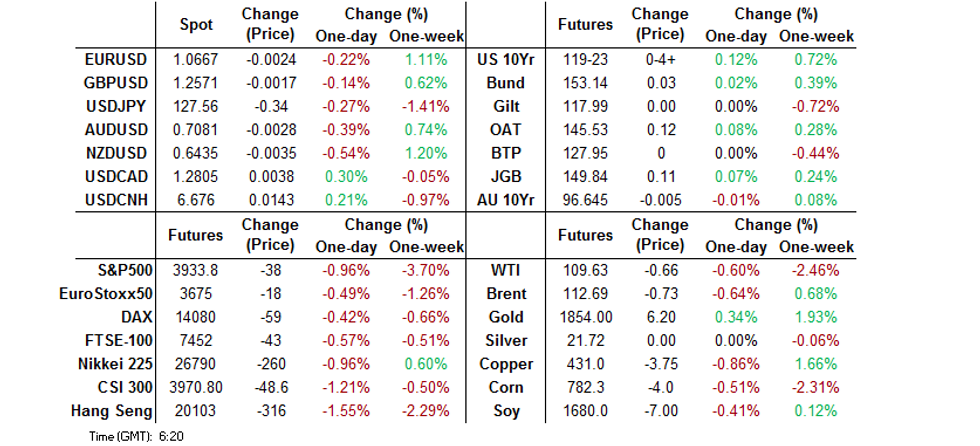

Free AccessMNI EUROPEAN MARKETS ANALYSIS: U.S. Tech SNAPs Lower

- Disappointing guidance from Snapchat set the tone for wider Asia-Pac trade, with the tech name shedding ~30% in after hours dealing, dragging other social media names with it. This resulted in underperformance for the NASDAQ 100 (-1.5%) amongst the 3 major e-mini futures contracts. Losses in the S&P 500 (-0.9%) & DJIA (-0.5%) contracts were a little more limited, owing to tech sector weightings within those indices.

- Continued worry re: Chinese economic growth, despite Monday’s (limited) fiscal stimulus announcement, combined with Hong Kong playing down the likelihood of an imminent relaxation of COVID-related border controls, weighed on Hong Kong & Chinese equities. The Hang Seng & CSI 300 both shed over 1.0% during their respective morning sessions.

- Flash PMI readings from across the globe will hit the wires through Tuesday. Fed's Powell headlines the central bank speaker slate, which also features ECB's Villeroy & Riksbank's Breman.

US TSYS: Light Bid Seen In Asia

TYM2 stuck to a relatively narrow 0-07 range in Asia-Pac hours, with Tsys ultimately drawing support from Snapchat guidance-inspired weakness in e-minis (with the NASDAQ 100 contract down ~1.5% at typing), worry re: Chinese growth and Hong Kong’s leadership playing down the prospect of an imminent unwind of COVID-related border restrictions. Elsewhere, U.S. President Biden flagged no changed in U.S. policy re: Taiwan after his Monday comms mishap, while the Taiwanese press noted that the two countries will speak about U.S. arms sale policy during an upcoming round of “Monterey Talks” in Washington D.C. The latter points had little ultimate impact on markets.

- TYM2 last trades +0-04+ at 119-23, 0-02 off best levels, on volume of ~120K. Cash Tsys run 0.5-1.5bp richer across the curve, with 7s outperforming.

- Fedspeak from George (’22 voter) & Daly (’24 voter) failed to shift the narrative, with the former flagging a need to monitor market reaction during the early days of the Fed’s QT scheme, while the later noted that she didn’t foresee a recession in the wake of Fed tightening.

- Looking ahead, NY hours will bring the release of the latest batch of flash PMIs, new home sales data and the latest Richmond Fed m’fing survey. We will also get Fedspeak from Chair Powell & 2-Year Tsy supply.

US TSYS: On The MOVE Again?

A quick note just to flag that the ICE-Bank of America MOVE index has pulled back from the peak of the latest foray higher after U.S. 10-Year Tsy yields failed to break through their ’18 peak. The MOVE index failed to challenge its YtD peak during the latest push higher, meaning that it got nowhere near challenging its Mar ’20 COVID-related peak.

Fig. 1: ICE-Bank of America Move Index Vs. U.S. 10-Year Tsy Yield (rhs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

JGBS: Firmer On Tuesday

JGBs benefitted from the wider defensive tone observed during Asia-Pac trade, in addition to the smooth passage of off-the run JGB supply. These factors combined to leave futures +12 late in the Tokyo day. The wider cash JGB curve bull flattened, with the major benchmark JGBs running 0.5-2.0bp richer on the day. Note that 7s managed to outperform surrounding lines owing to the bid in futures.

- In terms of details, the latest liquidity enhancement auction covering off-the-run 5- to 15.5-Year JGBs saw smooth enough digestion with nothing in the way of notable change in spread dynamics and the cover ratio only seeing a slight moderation, holding comfortably above 4.00x.

- Japanese Finance Minister Suzuki noted that he plans to submit an extra budget to parliament tomorrow, while highlighting the government aim of firmly responding to price rises, given the threat that such a dynamic poses to consumption.

- Elsewhere, a senior BoJ official reiterated the Bank’s core mantra, noting that it will patiently continue with its powerful monetary easing to firmly underpin the economy, as the Bank looks to foster an improvement in wage growth.

- BoJ Rinban operations and an after market address from BoJ Governor Kuroda headline the domestic docket on Wednesday.

AUSSIE BONDS: Tight Ranges Observed

A particularly rangebound session for the ACGB space saw the early session boundaries prevail for both YM & XM, with a modest uptick in the latest round of domestic weekly consumer confidence data and softer than expected NZ retail sales print from across the Tasman failing to provide any meaningful impetus for the space.

- That leaves YM -1.5 and XM at unchanged levels as of typing. Wider cash ACGB trade sees the longer end of the curve outperform, with 30s richening by ~1bp on the session.

- EFPs are incrementally wider on the day, with the 3-/10-Year box flattening.

- The IR strip runs -2bp to +1bp through the reds.

- Q1 completed construction work, an address from RBA Assistant Governor (Economics) Ellis on “Housing in the Endemic Phase” & A$300mn of ACGB Jun-51 supply headline domestically on Wednesday.

FOREX: Tech Equity Weakness Dents Risk, Retail Sales Miss Adds Pressure To Kiwi

Risk-off flows swept across G10 FX space on a negative lead from the equity space, where NASDAQ 100 futures lost ground following disappointing guidance from Snapchat owner. In addition, participants appeared to prefer to err on the side of caution while assessing China's latest package of measures to support the economy.

- Antipodean currencies paced losses as the broader commodity-tied FX space came under pressure. The kiwi dollar underperformed after New Zealand's retail sales unexpectedly shrank in Q1, defying expectations of a 0.3% quarterly expansion.

- NZD/USD extended its pullback from yesterday's high of $0.6492. The rate failed to test the $0.6500 figure on Monday, with NZ$785mn worth of options with strikes at that level set to roll off at the NY cut today.

- Participants sought shelter in safe haven currencies. Demand for safety lifted the yen to the top of the G10 scoreboard.

- PMI readings from across the globe will keep hitting the wires through the day. Fed's Powell headlines the central bank speaker slate, which also features ECB's Villeroy & Riksbank's Breman.

ASIX FX: Weaker Equities Weigh

Asian FX has generally moved away from recent highs today, as regional equities have traded weaker as the session progressed. Lower US futures have outweighed further China fiscal support measures.

- CNH: The USD/CNY fix came in below expectations again, but only modestly. USD/CNH has crept back above 6.6700, with the currency losing some impetus as there has been no follow up to Biden's comments on reviewing tariffs. China equities are off by than 1%, with modest fresh fiscal stimulus unable to aid sentiment. UBS and J.P. Morgan downgraded their 2022 GDP forecasts for China.

- KRW: 1 month USD/KRW is +0.40% above the NY close, putting us back above 1264 . This is in line with regional equity weakness, with Kospi losses rising as the session progressed. Net equity outflows accelerated today to -$238.5mn. Earlier, consumer sentiment dipped to 102.6 from 103.8 last month.

- IDR: USD/IDR 1 month is 0.25% higher, tracking back to 14670. The main focus is on the BI decision due later today. No change is expected, but tightening risks are growing (see this link).

- SGD: USD/SGD is higher but only modestly above NY closing levels. We remain sub 1.3750, with SGD outperforming G10 weakness against the USD (except for JPY). We noted yesterday the SGD NEER continues to lag Singapore inflation trends.

- INR: Spot USD/INR is up slightly in early trade, pushing up towards the 77.60 level. Watch intervention risk above 77.70 if seen. Local bond yields have moved away from yesterday's highs though .

EQUITIES: Snapping Lower

Disappointing guidance from Snapchat set the tone for wider Asia-Pac trade, with the tech name shedding ~30% in after hours dealing, dragging other social media names with it. This resulted in underperformance for the NASDAQ 100 (-1.5%) amongst the 3 major e-mini futures contracts. Losses in the S&P 500 (-0.9%) & DJIA (-0.5%) contracts were a little more limited, owing to tech sector weightings within those indices.

- Continued worry re: Chinese economic growth, despite Monday’s (limited) fiscal stimulus announcement, combined with Hong Kong playing down the likelihood of an imminent relaxation of COVID-related border controls, weighed on Hong Kong & Chinese equities. The Hang Seng & CSI 300 both shed over 1.0% during their respective morning sessions.

GOLD: Dips Supported In Asia

Gold is modestly higher, recovering from an earlier dip to $1850. We are now back above $1856, +0.15% above the NY close.

- Today's recovery in gold coincided with a trough in EUR, although the rebound in the precious metal has outperformed FX moves. This may owe to the general softening tone seen throughout regional equity markets as today's session has progressed, which has likely aided safe haven demand.

- US equity futures remain in negative territory (albeit off worse levels), while UST yields have drifted lower.

- If gold can continue to recover, the post-Asia close from yesterday around $1865 will be eyed. Gold ran out of steam overnight as equity sentiment improved and US real yields edged higher. These factors outweighed continued softer USD sentiment.

OIL: A Touch Softer In Asia

Oil traded defensively during Asia-Pac hours, with WTI & Brent crude futures running ~$0.50 below their respective settlement levels at typing, off worst levels of Asia dealing.

- Wider risk generally traded on the defensive during Asia-Pac hours, with the NASDAQ 100 leading the U.S. e-mini complex lower in the wake of soft earnings guidance from a U.S. tech name. The soft tone for wider risk assets ultimately weighed on crude.

- A resultant, modest uptick in the DXY would also have applied some pressure to oil.

- Focus continues to fall on EU strategy re: Russian oil exports, with Dutch PM Rutte flagging the potential for agreement on the matter during the next week, while the German Economy Minister pointed to an agreement “within days,” while noting the potential for oil price caps on Russian exports (a method that has been touted as an alternative to a blanket embargo).

- Elsewhere, Beijing’s new COVID case count moderated from the levels observed yesterday, but this failed to provide any real impetus for oil.

- Weekly U.S. API inventory estimates will cross after hours on Tuesday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/05/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 24/05/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 24/05/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 24/05/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 24/05/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 24/05/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 24/05/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 24/05/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 24/05/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 24/05/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 24/05/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 24/05/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 24/05/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 24/05/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 24/05/2022 | 1620/1220 |  | US | Fed Chair Jerome Powell | |

| 24/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

| 24/05/2022 | 1800/2000 |  | EU | ECB Lagarde Opens World Economic Forum Dinner |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.