-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI EUROPEAN OPEN: RBNZ Continues To Lead G10 Hawkish Charge

EXECUTIVE SUMMARY

- RBNZ STEPS UP INFLATION FIGHT WITH SECOND HALF-POINT HIKE (BBG)

- RBA’S ELLIS AVOIDS DISCUSSION ON TERMINAL RATES (MNI)

- EUROPE LOOKS TO BEEF UP ITS POWERS TO SEIZE RUSSIAN ASSETS (BBG)

- RUSSIA EDGES CLOSER TO DEFAULT AS US LETS KEY WAIVER LAPSE (BBG)

- UK GOVERNMENT PLAN TO HELP HOUSEHOLDS COULD COME WITHIN DAYS (BBC)

- NORTH KOREA LAUNCHES 3 MISSILES

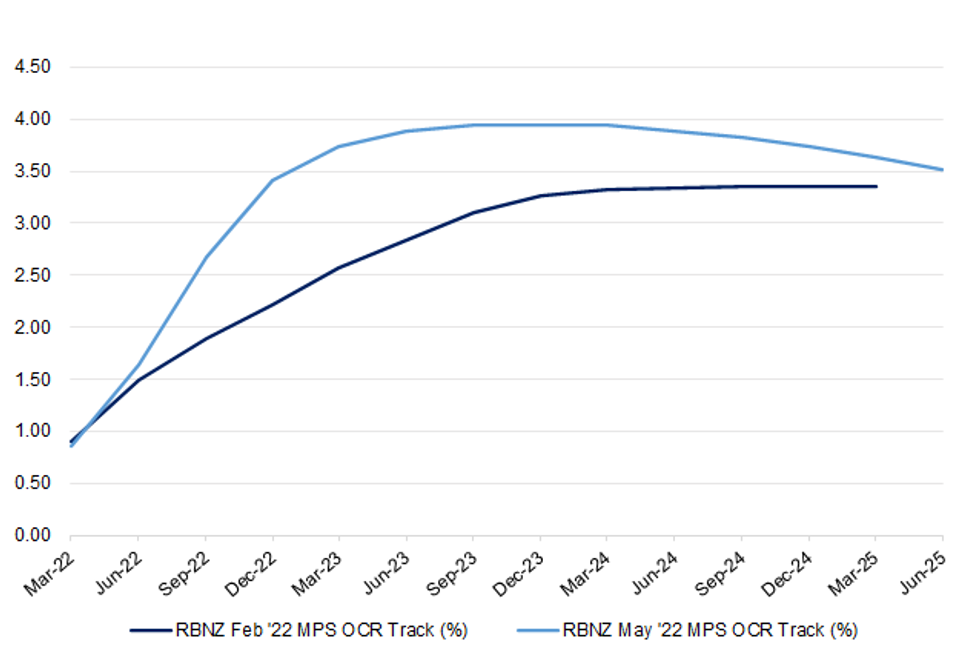

Fig. 1: RBNZ Feb '22 OCR Track Vs. May '22 OCR Track

Source: MNI - Market News/RBNZ

Source: MNI - Market News/RBNZ

UK

FISCAL: A government plan to help support people with the rising cost of living could come as soon as Thursday, the BBC understands. The PM and chancellor have been under growing pressure to act as prices for fuel, food and energy continue to soar. But BBC political editor Chris Mason said the government was also desperate to shift the agenda on from Partygate. Downing Street denied the announcement was timed to distract from Sue Gray's report into lockdown gatherings. The senior civil servant's report into events held in Downing Street is expected to be sent to No 10 on Wednesday. (BBC)

FISCAL: Civil servants have voted to back national strike action that would hit airports, ports, courts and other key infrastructure. Britain’s largest civil-service union today voted in favour of national strike action after taking issue with a 2 per cent pay offer from the government and plans to cut 91,000 jobs. (The Times)

POLITICS: Boris Johnson is likely to face demands to provide details of his secret meeting with Sue Gray to a powerful Commons committee. The privileges committee will soon begin an investigation into whether the prime minister knowingly misled MPs over parties held in Downing Street during lockdowns. As part of the inquiry, the committee is likely to take evidence on the meeting between Gray and Johnson, sources said. (The Times)

EUROPE

NORWAY: Norway’s public-sector workers clinched a wage agreement with the state in overtime talks, averting a strike as the Nordic nation’s government seeks to keep the economy from overheating. Talks with the state mediator produced a deal on a pay increase of 3.84%, the Norwegian Confederation of Trade Unions said Tuesday. That exceeds a 3.7% hike secured by industry unions last month, an accord that functioned as a starting point for negotiations in other sectors. Labor shortages and wage pressures in the richest Nordic country on a per capita basis have been growing after stimulus backed by its sovereign wealth fund -- the world’s largest -- helped its economy rebound from the pandemic faster than most developed peers. (BBG)

EQUITIES: Central bank policy tightening, fears of a recession and the economic impact of the war in Ukraine are all expected to keep a lid on any significant advance in European stocks for the remainder of 2022, a Reuters poll found. The poll of 21 fund managers, strategists and analysts, surveyed over the past two weeks, forecast the pan-European STOXX 600 index would reach 450 points by the end of the year, a 3.1% gain from Monday's close. European shares have sunk over 10% so far this year, suffering their worst start to a year since the COVID outbreak in 2020 and their second-worst start since 2008. (RTRS)

U.S.

FED: Federal Reserve Bank of Atlanta President Raphael Bostic said Tuesday he believes the central bank can raise rates to deal with overly high inflation without sending the economy into recession. “The Federal Open Market Committee’s overarching goal is to return inflation to our target range without triggering significant economic dislocation,” Mr. Bostic said in an essay posted on the Atlanta Fed’s website. (WSJ)

POLITICS: Georgia’s Republican Gov. Brian Kemp was projected on Tuesday to win his party’s nomination for reelection, batting away a primary challenge from ex-President Donald Trump’s preferred candidate, former Sen. David Perdue. Kemp will face Democrat Stacey Abrams in a rematch of the gubernatorial contest she narrowly lost to him in 2018, NBC News projected. (CNBC)

EQUITIES: Wall Street strategists expect U.S. stocks to end 2022 above current beaten-down levels but some warned of turbulence on concerns inflation and aggressive interest rate rises crimps economic growth and unnerves investors, a Reuters poll found. The benchmark S&P 500 will end this year at 4,400, based on the median forecast of 43 strategists polled by Reuters over roughly the last two weeks. That would be a 10.7% gain from Monday's close. But strategists have been revising down their year-end forecasts after the recent sharp sell-off, including Credit Suisse Securities, which cut its year-end S&P 500 target to 4,900 from 5,200 earlier this month. (RTRS)

OTHER

U.S./CHINA: U.S. Secretary of State Antony Blinken will deliver a speech on Thursday outlining U.S. policy toward China, the State Department said. Blinken will deliver the speech at 10 a.m. EDT (1400 GMT) at George Washington University, in Washington, D.C., at an event hosted by the Asia Society think tank, the State Department said in a statement on Tuesday. Blinken had planned to give the speech three weeks earlier, on May 5, but postponed it after testing positive for COVID-19. (RTRS)

U.S./CHINA: An official at the U.S. Securities and Exchange Commission said on Tuesday that "significant issues remain" in reaching a deal with China over a long-running dispute around auditing compliance of Wall Street-listed firms based in Beijing. The SEC's international affairs chief, YJ Fischer, told an audience that the agency's accounting body, the U.S. Public Company Accounting Oversight Board, would need to complete China audit inspections by Nov. 22 to meet a Chinese company 2023 delisting deadline. Fischer added that Chinese authorities should consider delisting from U.S. exchanges a "subset of issuers" that it deems "too sensitive to comply" with U.S. rules. (RTRS)

GEOPOLITICS: A joint patrol by Russian and Chinese warplanes near Japan's airspace during a visit by U.S. President Joe Biden on Tuesday demonstrates that a partnership between the two countries is "quite alive and well," U.S. State Department spokesperson Ned Price said. The exercise was likely planned well in advance by both countries, Price added in a press briefing on Tuesday. (RTRS)

JAPAN: Japan’s government maintained its monthly economic assessment in May after upgrading it in April, as the impact of the omicron variant continues to fade. The Cabinet Office said the economy is showing signs of picking up, simplifying the wording of its assessment from the previous month. It boosted its view of housing construction and said labor conditions are showing signs of improvement. It cut its evaluation of imports as raw material prices continued to increase. More than two months after Japan lifted quasi-emergency virus restrictions, new Covid-19 case counts have fallen further. Infections have declined from a peak of more than 100,000 daily cases in early February to around a third of that now as the omicron wave subsides. (BBG)

AUSTRALIA: Federal Treasurer Jim Chalmers appears to have walked away from a promise that a Labor government would formally advocate for workers on the minimum wage to get a pay rise. The Fair Work Commission is reviewing the minimum wage and during the election campaign, now Prime Minister Anthony Albanese repeatedly stated his party would make a formal submission if elected. But when asked today, Dr Chalmers would not answer questions about when the government would make that submission to the independent umpire. "The Fair Work Commission already knows our view," he said. (ABC)

RBA: RBA Assistant Governor (Economics) Ellis notes that it is not sensible to predict where the cash rate will peak in the current tightening cycle during a post-address Q&A session. She pointed to a need to carefully watch the incoming economic data, tipping her hat to broadening inflationary pressures, while highlighting the differences in the challenges faced by the Australian & U.S. economies. (MNI)

RBNZ: New Zealand’s central bank raised interest rates by half a percentage point for a second straight meeting and forecast more aggressive hikes to come to tame inflation. The Reserve Bank’s Monetary Policy Committee lifted the Official Cash Rate to 2% from 1.5% Wednesday in Wellington, as expected by 19 of 22 economists in a Bloomberg survey. It projected the OCR will rise to at least 3.25% this year and peak at close to 4% in 2023, higher than previously forecast. “It remains appropriate to continue to tighten monetary conditions at pace to maintain price stability and support maximum sustainable employment,” the RBNZ said. “The Committee is resolute in its commitment to ensure consumer price inflation returns to within the 1-3% target.” (BBG)

NORTH KOREA: North Korea fired three ballistic missiles toward the East Sea on Wednesday, South Korea's military said, just a day after U.S. President Joe Biden wrapped up his Asia trip highlighting America's security commitment to Seoul and Tokyo. The Joint Chiefs of Staff (JCS) said it detected the launches from the Sunan area in Pyongyang at around 6 a.m., 6:37 a.m. and 6:42 a.m., respectively, which marked the North's 17th show of force this year. "While reinforcing monitoring and vigilance activities, our military, in close cooperation with the United States, is maintaining a full readiness posture," the JCS said in a text message sent to reporters. The launches followed speculation that the North could conduct an intercontinental ballistic missile (ICBM) or nuclear test to bolster its military presence and tighten national unity amid COVID-19 outbreaks and economic woes. (Yonhap)

NORTH KOREA: In response, the United States and South Korea held combined live-fire drills, including surface-to-surface missile tests involving the Army Tactical Missile System (ATACMS) of the U.S. and the South's Hyunmoo-2 SRBM, both militaries said. (RTRS)

NORTH KOREA: South Korea convened a National Security Council (NSC) meeting over North Korea's missile launch on Wednesday and "strongly condemned" the North's latest weapons test as a "grave provocation", the presidential office said. Yoon Suk-yeol, South Korea's new president, presided over the meeting and ordered officials to take agreed steps to strengthen U.S. deterrence, according to his office. In a separate government statement, South Korea also said it had "strong and effective" responses ready to deal with any North Korea provocations. (RTRS)

MEXICO: President Andres Manuel Lopez Obrador’s price pact with big Mexican firms is seen slowing inflation by as much as 1.5 percentage points by year-end, the Finance Ministry projects. (BBG)

MEXICO: Mexico’s central bank may need additional interest rate hikes of two to three percentage points to reach the needed degree of monetary tightening, Deputy Governor Jonathan Heath said Tuesday. The bank, known as Banxico, has already boosted rates by 300 basis points to 7% since June but may need to double that increase to tame cost of living rises, Heath said at a Chatham House conference in Mexico City. Borrowing costs need to go past the “neutral zone” to restrictive, he said, at which point they slow both economic growth and consumer prices. “We are only just entering the lower end of the neutral zone, which means I would say we need to increase maybe two, maybe three points further at least to be clearly in the restrictive zone,” Heath said. That would give Mexico a stance “consistent with the inflationary phenomenon we have at the moment.” (BBG)

BRAZIL: Bill establishing a 17% ceiling for ICMS tax on products such as fuel and electricity shall be voted on Wednesday, the proposal’s rapporteur in the Lower House, lawmaker Elmar Nascimento, said in an interview. (BBG)

BRAZIL: Government’s statement on the CEO change at Petrobras -- citing its commitment to the company’s governance -- “sounds like something dissociated from the reality of the facts,” Brazilian shareholders association Amec says in a statement. Management changes aren’t related to the company’s operating performance. Amec also cites arbitrariness in recent decisions. (BBG)

BRAZIL: Brazilian President Jair Bolsonaro signed a decree on Tuesday to step up fines for environmental crimes, according to the official government gazette, in a move to allow more aggressive protection of the Amazon rainforest. The decree raises the potential value of fines for falsifying documents to cover up illegal logging, clarifies heavier consequences for repeat environmental offenders and aims to reduce the backlog of fines pending collection. (RTRS)

RUSSIA: Russian forces have taken control of three Donetsk region towns including Svitlodarsk, regional governor Pavlo Kyrylenko told a local affiliate of Radio Free Europe/Radio Liberty. Earlier on Tuesday, the Russian-backed Donetsk People's Republic said in a post on the Telegram messaging service that its forces had taken control of the town and replaced the Ukrainian flag with a Russian flag. Svitlodarsk is 80 kilometers southwest of Sievierodonetsk, the focus of Russian attacks in recent days. (RTRS)

RUSSIA: Russian troops may have withdrawn from northern Ukraine, but the land mines they scattered pose a significant obstacle to a semblance of normal life resuming, according to Kyiv’s mayor. Vitali Klitschko said the unexploded ordnance is mostly on the outskirts of Kyiv, the capital, and in smaller towns and on farmland. But, he said, it adds to the concern in the capital that “our city is not safe. Not everyone can feel safe here.” Klitschko spoke in an interview on the sidelines of the World Economic Forum in Davos with his brother and fellow world boxing champion Wladimir. (BBG)

RUSSIA: US banks and individuals will be barred from accepting bond payments from Russia’s government after 12:01 a.m. New York time on Wednesday, when a license that has so-far allowed the cash to flow ends, Treasury said in a statement on Tuesday. The decision to go forward ending the waiver indicates that the US would rather force Russia -- under a slew of punishing sanctions over its war in Ukraine -- into default than allow the nation to drain its coffers to the benefit of US investors. (BBG)

RUSSIA: The European Union will propose new laws that would give member states more power to seize criminal assets, potentially including those of sanctioned Russian individuals and entities. The EU proposal, aimed at strengthening the bloc’s tools against organized crime, would expand the ability of member states to trace, freeze and investigate certain assets and will set out the conditions under which those assets could be confiscated if criminal activity is involved, according to people familiar with the matter and documents seen by Bloomberg. The plan would task EU nations with setting up asset recovery strategies and offices, and a centralized registry containing information on frozen, managed and confiscated assets, said the people, who asked not to be identified because the discussions are private. (BBG)

RUSSIA: Nike will exit Russia after not extending a franchise agreement with Inventive Retail Group, which runs the US company’s largest branded retail chain in the country, Vedomosti reports, citing a letter from IRG to its personnel. (BBG)

RUSSIA: Russian authorities agreed to raise pensions, minimum wages and the official poverty threshold by 10%, Vedomosti reported, citing two unidentified people close to the government. President Vladimir Putin will make the final decision, the newspaper reported. A Putin aide previously said the president may announce increase in social payments during a meeting of the State Council presidium on welfare programs, which is planned for May 25. (BBG)

RUSSIA: Russian banks' corporate lending portfolio eased by 0.03% in April compared with March, the central bank said on Tuesday, adding it expected the portfolio to recover as it cuts the key rate. Retail deposits at banks rose by 3.8%, or by 1.3 trillion roubles ($23.8 billion,) in April as some Russians brought back the money they had withdrawn from their accounts in March, the central bank said. It did not disclose banks' profit or loss for April. (RTRS)

PERU: Peru opposition lawmaker Norma Yarrow filed an accusation in Congress to oust Vice President Dina Boluarte from office, RPP TV reported. (BBG)

METALS: Peru President Pedro Castillo and six indigenous communities are advancing to reach an agreement on a conflict with MMG’s Las Bambas copper mine, Fuerabamba leader, Edison Vargas said to RPP radio. “We are advancing for the good of our country and the mining project that is currently paralyzed,” Vargas said after meeting with Castillo at the Presidential Palace. Vargas said talks with ministers to continue Wednesday at 10am local time. Las Bambas to join dialogue Wednesday, Justice Minister, Felix Chero said to journalists. Six communities asked to review payment contracts and the company to return lands where the mining operation ended. (BBG)

ENERGY: Qatar is willing to help the UK with its cost of living crisis, the country's energy minister has said - but he also criticised western countries who spent years "demonising oil and gas companies". In an exclusive interview, Saad Sherida Al-Kaabi said that years of pushing for a rapid end to fossil fuel production and calling producers the "bad guys" had contributed to the current crisis. (Sky)

ENERGY: Billionaire George Soros said he believes that Europe is in a stronger position than it thinks when it comes to dealing with Putin. Speaking at a dinner on Tuesday on the sidelines of the World Economic Forum in Davos, Soros said he wrote Italy’s Prime Minister Mario Draghi that for Putin and gas, “Europe is his only market.” “If he doesn’t supply Europe, he must shut down the wells in Siberia from where the gas comes,” Soros wrote in a copy provided after his dinner remarks. “It takes time to shut them down, and once they are shut down, they are difficult to reopen because of the age of equipment.” (BBG)

ENERGY: U.S. President Joe Biden has not ruled out using export restrictions to ease soaring domestic fuel prices, U.S. Energy Secretary Jennifer Granholm said on Tuesday. (RTRS)

OIL: The U.S. Department of Energy on Tuesday said it was selling up to 40.1 million barrels of crude oil from the U.S. Strategic Petroleum Reserve as part of a previous announcement by the administration. The sale is part of President Joe Biden's March 31 announcement to release crude oil from the reserve to combat rising energy prices, the department said in a statement. (RTRS)

OIL: Russian Urals crude exports and transit from its Baltic ports in May are expected match the initial plan, despite Western sanctions that have hit demand in Europe, according to three traders and Reuters calculations based on shipping data. Official sanctions and self-sanctioning by European buyers have hammered demand for Urals in its traditional market, but Asian buyers have stepped in to keep export flows unaffected. The ports of Primorsk and Ust-Luga will load a total of 7 million tonnes of Urals in May, in line with the initial plan, traders said and the data showed. (RTRS)

CHINA

YUAN: More foreign investment institutions set yuan equilibrium levels at CNY6.5 to CNY6.6 against the U.S. dollar, over 2,000 basis points higher than that at end-April, the 21st Century Business Herald reported citing traders. The falling dollar index has driven the yuan rally in the past week, but more importantly, overseas investors are correcting previous mispricing following China’s proactive moves to stabilise growth and resume production from Covid-19 lockdowns. Overseas institutions prefer the relatively stable economic fundamentals of China, as the Fed’s continuous rate hikes increases the risk of U.S. recession, the newspaper said citing an unnamed hedge fund manager. (MNI)

CORONAVIRUS: Huangpu district, home to Shanghai's busiest shopping streets like Nanjing Road and Huaihai Road, announced on Wednesday morning that it would conduct three rounds of mass testing on all the 630,000 residents through Friday, aiming to entirely contain the pandemic. (BBG)

EQUITIES: The A share market is still grinding at the bottom with the Shanghai Composite Index likely to fluctuate between 2,900 to 3,200 points, though better than the risk aversion and panic environment in the first four months, the National Business Daily reported citing Fang Yi, chief strategy officer of Guotai Junan. A total of 2,934 A shares fell by more than 4% on Tuesday, accounting for 62.8% of all A shares still trading, and the Shanghai Composite Index saw the biggest drop since May to 3,070.93, the newspaper said. The decline was led by emerging tech stocks, and any rebounds may depend on how global inflation and China-U.S. relations go, the newspaper said citing analysts. (MNI)

CHINA MARKETS

PBOC INJECTS CNY10BN VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8452% at 09:56 am local time from the close of 1.5435% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 50 on Tuesday vs 45 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6550 WEDS VS 6.6566

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6550 on Wednesday, compared with 6.6566 set on Tuesday.

OVERNIGHT DATA

JAPAN MAR, F LEADING INDEX 100.8; FLASH 101.0JAPAN MAR, F COINCIDENT INDEX 97.5; FLASH 97.0

AUSTRALIA Q1 CONSTRUCTION WORK DONE -0.9% Q/Q; MEDIAN +1.0%; Q4 +0.6%

SOUTH KOREA Q1 SHORT-TERM EXTERNAL DEBT $174.9BN; Q4 $164.7BN

SOUTH KOREA JUN BUSINESS SURVEY MANUFACTURING 87; MAY 88

SOUTH KOREA JUN BUSINESS SURVEY NON-MANUFACTURING 86; MAY 85

MARKETS

SNAPSHOT: RBNZ Continues To Lead G10 Hawkish Charge

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 21.49 points at 26727.45

- ASX 200 up 47.469 points at 7176.3

- Shanghai Comp. up 17.735 points at 3088.662

- JGB 10-Yr future up 25 ticks at 150.11, yield down 2.7bp at 0.210%

- Aussie 10-Yr future up 7 ticks at 96.725, yield down 6.5bp at 3.253%

- U.S. 10-Yr future -0-00+ at 120-11+, yield up 1.43bp at 2.765%

- WTI crude up $1.32 at $111.1, Gold down $3.91 at $1862.54

- USD/JPY up 15 pips at Y126.99

- RBNZ STEPS UP INFLATION FIGHT WITH SECOND HALF-POINT HIKE (BBG)

- RBA’S ELLIS AVOIDS DISCUSSION ON TERMINAL RATES (MNI)

- EUROPE LOOKS TO BEEF UP ITS POWERS TO SEIZE RUSSIAN ASSETS (BBG)

- RUSSIA EDGES CLOSER TO DEFAULT AS US LETS KEY WAIVER LAPSE (BBG)

- NORTH KOREA LAUNCHES 3 MISSILES

- UK GOVERNMENT PLAN TO HELP HOUSEHOLDS COULD COME WITHIN DAYS (BBC)

US TSYS: Coiling In Asia

Tsys never strayed too far from neutral during Asia-Pac dealing, even with e-minis gradually moving higher as we worked through overnight trade.

- The latest round of missile launches from North Korea failed to impact wider macro sentiment, with a subsequent show of joint military force on the part of the U.S. & South Korea having equally limited impact. A hawkish RBNZ monetary policy decision also failed to feed into Tsy price action. Recent headline flow has revealed that China has conducted military drills near Taiwan to “warn the U.S.” Once again, this has failed to impact wider risk sentiment.

- TYM2 trades -0-01 at 120-11 as a result, sticking to a narrow 0-05+ range on volume of ~170K. Note that futures roll activity supported volume. Cash Tsys run 0.5-2.0bp cheaper across the curve, with 5s leading the sell off.

- Block lifts in TYM2 (+5.0K & +2.0K) provided the highlights on the flow side.

- Wednesday’s NY session will see the release of the minutes from the most recent FOMC decision, durable goods and MBA mortgage apps data, 5-Year Tsy & 2-Year FRN supply and Fedspeak from Vice Chair Brainard.

JGBS: Mundane Session, Light Richening Seen

Cash JGBS bull flattened this morning, with the major benchmarks running 0.5-2.5bp richer, aided by Tuesday’s bid in U.S. Tsys (although the U.S. curve bull steepened on Tuesday). Futures managed to add to the overnight bid, last +24.

- Note that the Japanese government maintained its assessment of the Japanese economy in its latest monthly observation. This comes after an upgrade of its overall economic view in April.

- BoJ Rinban operations covering 1- to 25-Year JGBs provided little impetus for market, although there may have been some incremental support derived from the latest round of BoJ purchases.

- There wasn’t any meaningful macro reaction to the latest round of North Korean missile launches, which drew the usual rounds of condemnation from Japanese officials, as well as fresh warnings re: the potential for nuclear tests on the Korean peninsula.

- Services PPI data and 40-Year JGB supply headline domestically on Thursday.

AUSSIE BONDS: RBNZ Allows Space To Move Off Best Levels

Aussie bond futures ticked away from highs on the back of the trans-Tasman impetus observed post-RBNZ. This came after early trade saw both YM & XM extend on their respective overnight highs as domestic participants reacted to offshore market gyrations.

- To recap, the RBNZ delivered the widely expected 50bp OCR hike. The Bank was not afraid of flagging brisk tightening intentions via its updated OCR projection track, as it looks to return inflation to the target band. The fight against inflation remains paramount in the near-term. Further out, the Bank noted that “once aggregate supply and demand are more in balance, the OCR can then return to a lower, more neutral, level.” The post-meeting RBNZ press conference didn’t contain much in the way of notable dovish offset, as Governor Orr reaffirmed the hawkish rhetoric deployed in the post-meeting statement and accounts of the gathering. That leaves YM +7.5 & XM +6.0 at typing, with the Australia/New Zealand 2-Year swap spread tightening by ~20bp on the day. BBG’s WIRP function shows year-end RBA cash rate expectations as little changed on the day, hovering just above 2.50%. This comes after the spill over from the latest RBNZ decision managed to offset the early Fed repricing-driven move.

- An unexpected Q/Q fall in domestic completed construction work during Q1 (-0.9% Vs. BBG median +1.0%) did little for the space pre-RBNZ.

- RBA Assistant Governor (Economics) Ellis noted that it is not sensible to predict where the cash rate will peak in the current tightening cycle during a Q&A session. She pointed to a need to carefully watch the incoming economic data, tipping her hat to broadening inflationary pressures, while highlighting the differences in the challenges faced by the Australian & U.S. economies.

- The latest round of ACGB Jun-51 supply was smoothly digested, after dealer liaison likely unearthed some demand for the line. Semi and corporate issuance failed to impact the space.

- Private CapEx data headlines domestically on Thursday, providing the latest round of GDP partial data.

AUSSIE BONDS: The AOFM sells A$300mn of the 1.75% 21 Jun ‘51 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 3.5857% (prev. 3.8326%)

- High Yield: 3.5900% (prev. 3.8350%)

- Bid/Cover: 2.7667x (prev. 2.0775x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield 23.5% (prev. 74.4%)

- Bidders 48 (prev. 54), successful 19 (prev. 27), allocated in full 14 (prev. 18)

EQUITIES: Upticks In E-minis Underpins Regional Equities Overnight

A recovery from lows during the NY afternoon, and a subsequent rally during overnight dealing, leaves the 3 major e-mini contracts 0.4-0.8% firmer at typing, with the NASDAQ 100 outperforming after yesterday’s earnings guidance-related underperformance.

- This allowed the major Asia-Pac equity indices to move away from their early session lows, lodging modest gains in the process.

- Chinese equities hover around neutral levels, with the latest rounds of policymaker support for the Chinese economy offset by the localised COVID clusters observed in tier 1 cities, which have been accompanied by the well-documented social mobility restrictions.

OIL: U.S. Product Drawdowns In Latest API Estimates Support Crude

WTI & Brent added over $1.00 vs. their respective settlement levels during Asia-Pac dealing, seemingly benefitting from reports flagging a larger than expected drawdown in gasoline stocks in the latest round of weekly API U.S. inventory estimates, with the same reports flagging a surprise (albeit modest) drop in distillate stocks. Elsewhere, the reports pointed to a surprise, small build in headline crude stocks and modest drawdown in stocks at the Cushing hub. Tight U.S. product markets continue to dominate when it comes to this particular release.

- Meanwhile, focus continues to fall on the deliberations re: the latest EU response to the Russia-Ukraine conflict, with a unanimous decision on further sanctions seemingly not on the table at the upcoming EU summit.

- On the Russian supply front, RTRS sources have noted that “Russian Urals crude exports and transit from its Baltic ports in May are expected match the initial plan, despite Western sanctions that have hit demand in Europe. Official sanctions and self-sanctioning by European buyers have hammered demand for Urals in its traditional market, but Asian buyers have stepped in to keep export flows unaffected. The ports of Primorsk and Ust-Luga will load a total of 7 million tonnes of Urals in May, in line with the initial plan, traders said.”

- Looking ahead, the weekly DoE inventory data will cross later on Wednesday.

GOLD: Moves Off Recent Highs

Gold has slipped modestly today, down 0.2% or $4 lower compared to NY closing levels. We remain above $1862 at this stage.

- Today's pullback is in line with a reduced safe haven bid as equity markets have traded on the front foot throughout Asia Pac, shrugging off a negative lead from US/EU markets overnight.

- Higher US equity futures are also helping.

- The USD is mixed, but has gained ground against EUR and JPY, to push the DXY slightly higher. This has also helped gold edge off recent highs.

- US yields are up modestly, but not too far away from overnight lows. US real yields did dip 5bp overnight (in the 10yr), which supported the post-Asia move through $1860.

- If we can break above $1870, the market is next likely to target $1885.

FOREX: Kiwi Emboldened As RBNZ Opens Door To More Aggressive Policy Tightening

The kiwi dollar bounced off session lows to become the best G10 performer after the RBNZ raised the OCR by half a percentage point and reaffirmed the need to front-load tightening as inflation-fighting takes priority. In line with the "stitch in time" logic outlined in the previous monetary policy review, the Reserve Bank suggested it will need to remove heat from the economy sooner and faster, before eventually returning the key interest rate to more neutral settings. Accordingly, the Committee charted a steeper OCR track, with a higher peak of 3.95%, easing off only in the second half of 2024 once the Reserve Bank achieves its goals.

- NZD strength spilled over into its Antipodean cousin AUD, to some degree. AUD/USD re-tested session highs post-RBNZ, while AUD/JPY rose to a fresh intraday peak.

- AUD/NZD retreated to a new monthly low in sync with a sharp decline in AU/NZ 2-year swap spread. The pair bottomed out within touching distance from its 50-DMA, which has remained intact since March.

- The broader commodity-tied FX space found poise as crude oil prices firmed, while an uptick in U.S. e-mini futures indicated improvement in risk appetite. Better sentiment dampened demand for traditional safe havens JPY & CHF, which outperformed on Tuesday.

- Offshore yuan is on track to snap its four-day rally as worrying COVID-19 developments in Beijing and Tianjin pulled the rug from under the redback.

- Final German GDP & flash U.S. durable goods orders will take focus later in the day. The central bank speaker slate is tightly packed and dominated by ECB members.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/05/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 25/05/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 25/05/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2022 | 0700/0900 |  | EU | ECB Panetta Speaks at Goethe University | |

| 25/05/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/05/2022 | 0730/0930 |  | SE | Riksbank Financial Stability Report | |

| 25/05/2022 | 0800/1000 |  | EU | ECB Lagarde in Stakeholder Dialogue | |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.