-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

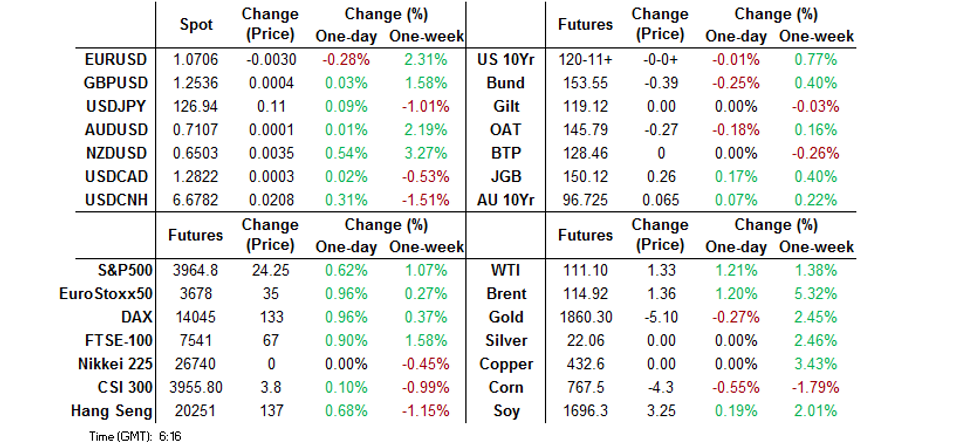

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Kiwi Soars On RBNZ OCR Track

- The kiwi dollar bounced off session lows to become the best G10 FX performer after the RBNZ raised the OCR by half a percentage point and reaffirmed the need to front-load tightening as inflation-fighting takes priority. In line with the "stitch in time" logic outlined in the previous monetary policy review, the Reserve Bank suggested it will need to remove heat from the economy sooner and faster, before eventually returning the key interest rate to more neutral settings. Accordingly, the Committee charted a steeper OCR track, with a higher peak of 3.95%, easing off only in the second half of 2024 once the Reserve Bank achieves its goals.

- Tsys never strayed too far from neutral during Asia-Pac dealing, even with e-minis gradually moving higher as we worked through overnight trade.

- Minutes from the latest FOMC meeting, final German GDP & flash U.S. durable goods orders will take focus later in the day. The central bank speaker slate is tightly packed and dominated by ECB members.

US TSYS: Coiling In Asia

Tsys never strayed too far from neutral during Asia-Pac dealing, even with e-minis gradually moving higher as we worked through overnight trade.

- The latest round of missile launches from North Korea failed to impact wider macro sentiment, with a subsequent show of joint military force on the part of the U.S. & South Korea having equally limited impact. A hawkish RBNZ monetary policy decision also failed to feed into Tsy price action. Recent headline flow has revealed that China has conducted military drills near Taiwan to “warn the U.S.” Once again, this has failed to impact wider risk sentiment.

- TYM2 trades -0-01 at 120-11 as a result, sticking to a narrow 0-05+ range on volume of ~170K. Note that futures roll activity supported volume. Cash Tsys run 0.5-2.0bp cheaper across the curve, with 5s leading the sell off.

- Block lifts in TYM2 (+5.0K & +2.0K) provided the highlights on the flow side.

- Wednesday’s NY session will see the release of the minutes from the most recent FOMC decision, durable goods and MBA mortgage apps data, 5-Year Tsy & 2-Year FRN supply and Fedspeak from Vice Chair Brainard.

JGBS: Mundane Session, Light Richening Seen

Cash JGBS bull flattened this morning, with the major benchmarks running 0.5-2.5bp richer, aided by Tuesday’s bid in U.S. Tsys (although the U.S. curve bull steepened on Tuesday). Futures managed to add to the overnight bid, last +24.

- Note that the Japanese government maintained its assessment of the Japanese economy in its latest monthly observation. This comes after an upgrade of its overall economic view in April.

- BoJ Rinban operations covering 1- to 25-Year JGBs provided little impetus for market, although there may have been some incremental support derived from the latest round of BoJ purchases.

- There wasn’t any meaningful macro reaction to the latest round of North Korean missile launches, which drew the usual rounds of condemnation from Japanese officials, as well as fresh warnings re: the potential for nuclear tests on the Korean peninsula.

- Services PPI data and 40-Year JGB supply headline domestically on Thursday.

AUSSIE BONDS: RBNZ Allows Space To Move Off Best Levels

Aussie bond futures ticked away from highs on the back of the trans-Tasman impetus observed post-RBNZ. This came after early trade saw both YM & XM extend on their respective overnight highs as domestic participants reacted to offshore market gyrations.

- To recap, the RBNZ delivered the widely expected 50bp OCR hike. The Bank was not afraid of flagging brisk tightening intentions via its updated OCR projection track, as it looks to return inflation to the target band. The fight against inflation remains paramount in the near-term. Further out, the Bank noted that “once aggregate supply and demand are more in balance, the OCR can then return to a lower, more neutral, level.” The post-meeting RBNZ press conference didn’t contain much in the way of notable dovish offset, as Governor Orr reaffirmed the hawkish rhetoric deployed in the post-meeting statement and accounts of the gathering. That leaves YM +7.5 & XM +6.0 at typing, with the Australia/New Zealand 2-Year swap spread tightening by ~20bp on the day. BBG’s WIRP function shows year-end RBA cash rate expectations as little changed on the day, hovering just above 2.50%. This comes after the spill over from the latest RBNZ decision managed to offset the early Fed repricing-driven move.

- An unexpected Q/Q fall in domestic completed construction work during Q1 (-0.9% Vs. BBG median +1.0%) did little for the space pre-RBNZ.

- RBA Assistant Governor (Economics) Ellis noted that it is not sensible to predict where the cash rate will peak in the current tightening cycle during a Q&A session. She pointed to a need to carefully watch the incoming economic data, tipping her hat to broadening inflationary pressures, while highlighting the differences in the challenges faced by the Australian & U.S. economies.

- The latest round of ACGB Jun-51 supply was smoothly digested, after dealer liaison likely unearthed some demand for the line. Semi and corporate issuance failed to impact the space.

- Private CapEx data headlines domestically on Thursday, providing the latest round of GDP partial data.

FOREX: Kiwi Emboldened As RBNZ Opens Door To More Aggressive Policy Tightening

The kiwi dollar bounced off session lows to become the best G10 performer after the RBNZ raised the OCR by half a percentage point and reaffirmed the need to front-load tightening as inflation-fighting takes priority. In line with the "stitch in time" logic outlined in the previous monetary policy review, the Reserve Bank suggested it will need to remove heat from the economy sooner and faster, before eventually returning the key interest rate to more neutral settings. Accordingly, the Committee charted a steeper OCR track, with a higher peak of 3.95%, easing off only in the second half of 2024 once the Reserve Bank achieves its goals.

- NZD strength spilled over into its Antipodean cousin AUD, to some degree. AUD/USD re-tested session highs post-RBNZ, while AUD/JPY rose to a fresh intraday peak.

- AUD/NZD retreated to a new monthly low in sync with a sharp decline in AU/NZ 2-year swap spread. The pair bottomed out within touching distance from its 50-DMA, which has remained intact since March.

- The broader commodity-tied FX space found poise as crude oil prices firmed, while an uptick in U.S. e-mini futures indicated improvement in risk appetite. Better sentiment dampened demand for traditional safe havens JPY & CHF, which outperformed on Tuesday.

- Offshore yuan is on track to snap its four-day rally as worrying COVID-19 developments in Beijing and Tianjin pulled the rug from under the redback.

- Final German GDP & flash U.S. durable goods orders will take focus later in the day. The central bank speaker slate is tightly packed and dominated by ECB members.

ASIA FX: Mixed Performances On Divergent Drivers

Asian FX has been mixed, with firmer equity sentiment but a slightly stronger USD against the majors, providing offsetting influences for the region.

- CNH: USD/CNH has spent much of the day with a firmer trend, we currently sit around 6.6750, versus opening levels closer to 6.6600. The fixing bias remains skewed towards limiting CNY depreciation pressures, while equity market sentiment has been better for both China and HK markets. The USD is slightly higher against EUR and JPY, which has likely weighed.

- KRW: 1 month USD/KRW pushed back to 1265 in early trade, as North Korea ramped up missile tests and overnight tech equity weakness weighed. However, we are back to a 1263 handle, as equity market sentiment has recovered. The Kospi is up 0.80%, but net equity outflows have still been evident today (-$95mn).

- IDR: The rupiah is slightly firmer, with USD/IDR drifting down to 14640. This comes after Indonesia chose to stand pat on the 7-Day Reverse Repo Rate on Tuesday, while raising the reserve requirement rate.

- SGD: USD/SGD has edged up from the low 1.3700 region (last 1.3730), as the USD has recovered some ground against the majors. The Ministry of Trade & Industry reaffirmed its +3%-5% Y/Y growth forecast for this year, but said the actual outturn will likely be in the lower half of this range and warned that "the external demand outlook for the Singapore economy has weakened compared to three months ago."

- MYR: USD/MYR is down a touch to 4.3920. The government will not implement restrictions on cooking oil exports amid ample domestic supplies, Plantation Industries and Commodities Minister Zuraida Kamaruddin told Bloomberg on Tuesday.

- THB: USD/THB is slightly higher, pushing up to 34.20, likely following the USD lead against EUR and JPY. Thai FinMin Arkhom said the government is waiting for the "appropriate time" to impose a tax on stocks trading. He added that the economic recovery is still progressing at a slow pace and the government wants to see stronger rebound. The Cabinet gave a nod to the extension of hotel subsidy scheme to assist the ailing tourism sector until September. The previous expiry date of the programme was May 31.

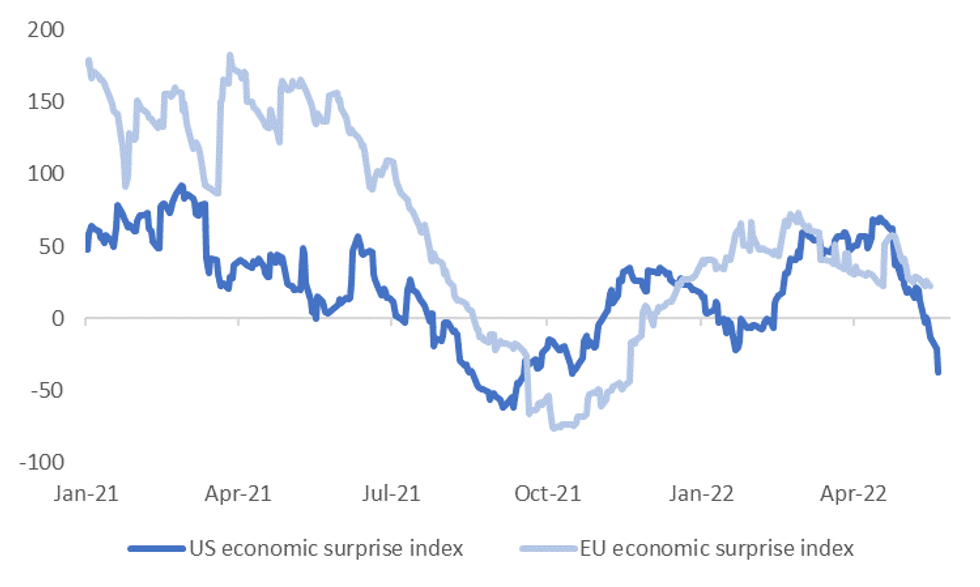

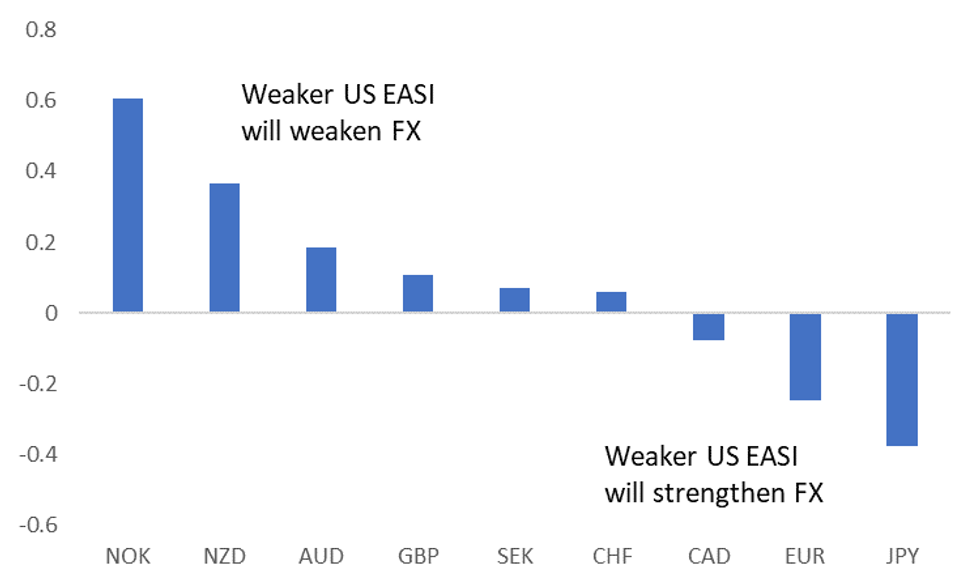

USD: US Data Still Disappointing

US data continues to surprise on the downside, weighing on USD performance. However, as we highlight in this short update, current correlations between the Citi EASI and G10 FX are quite divergent.

- The first chart below updates the Citi US and EU Economic Surprise Index readings. The US reading, post the weaker business survey and housing data released overnight, is now back to lows last seen in October 2021. The wedge between the US and EU readings is significant.

- This is hurting USD sentiment via lower yields and some softening in Fed tightening expectations. Growth expectations are also starting to be revised lower.

- More hawkish rhetoric from the ECB has also clearly benefited EUR.

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- If we continue to see downside US data surprises, current correlations suggest the EUR and JPY should benefit the most within the G10 FX space, see the second chart below.

- Interestingly, all other G10 FX (except CAD) have a positive correlation with the EASI for the past month. This may well reflect the risk channel, whereby downside surprises in US data weighs on broader risk appetite, and supports the USD against higher beta currencies, all else equal.

- Such a scenario could unfold over the coming period, particularly if recession fears heighten further. This could limit the benefit to higher beta currencies from any further shift lower in US Fed expectations if data continues to disappoint.

Fig 2: Citi US EASI & G10 FX Correlations - Past Month

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

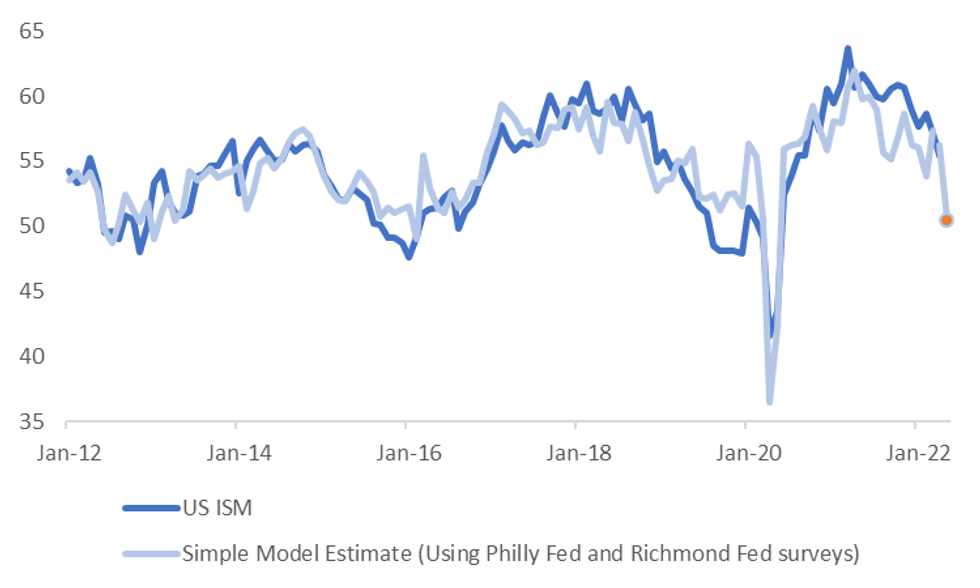

US: Will US ISM Break 50 In May?

Recent weakness in regional Fed surveys is pointing to downside risks for the upcoming ISM manufacturing print.

- The very soft print for the Richmond Fed index (-9 versus +10 consensus), caps off a poor run for Fed US business surveys in recent weeks. The Empire manufacturing survey fell to -11.6 versus 15 expected, while the Philly Fed survey fell to 2.6 versus 15.0 forecast.

- These readings come ahead of the closely watched ISM manufacturing print for May, due for release on June 1.

- A simple model for the ISM, using the Philly Fed and Richmond Fed survey readings as inputs, is presented in the chart below. The model fit is around 70% using the past decade of data.

- Interestingly, using the latest Philly Fed and Richmond Fed readings gives an ISM estimate for May of 50.4, which would be the lowest rate of headline expansion lodged since early 2020.

- There are some important caveats. As the chart below highlights, the regional Fed survey estimate for the ISM has generally been underestimating the ISM print in the past 18 months.

- Still, a fresh downside surprise for the ISM reading would only add to concerns surrounding the US/global economic outlook.

Fig 1: US Manufacturing ISM & Regional Fed Surveys

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Upticks In E-minis Underpins Regional Equities Overnight

A recovery from lows during the NY afternoon, and a subsequent rally during overnight dealing, leaves the 3 major e-mini contracts 0.4-0.8% firmer at typing, with the NASDAQ 100 outperforming after yesterday’s earnings guidance-related underperformance.

- This allowed the major Asia-Pac equity indices to move away from their early session lows, lodging modest gains in the process.

- Chinese equities hover around neutral levels, with the latest rounds of policymaker support for the Chinese economy offset by the localised COVID clusters observed in tier 1 cities, which have been accompanied by the well-documented social mobility restrictions.

GOLD: Moves Off Recent Highs

Gold has slipped modestly today, down 0.2% or $4 lower compared to NY closing levels. We remain above $1862 at this stage.

- Today's pullback is in line with a reduced safe haven bid as equity markets have traded on the front foot throughout Asia Pac, shrugging off a negative lead from US/EU markets overnight.

- Higher US equity futures are also helping.

- The USD is mixed, but has gained ground against EUR and JPY, to push the DXY slightly higher. This has also helped gold edge off recent highs.

- US yields are up modestly, but not too far away from overnight lows. US real yields did dip 5bp overnight (in the 10yr), which supported the post-Asia move through $1860.

- If we can break above $1870, the market is next likely to target $1885.

OIL: U.S. Product Drawdowns In Latest API Estimates Support Crude

WTI & Brent added over $1.00 vs. their respective settlement levels during Asia-Pac dealing, seemingly benefitting from reports flagging a larger than expected drawdown in gasoline stocks in the latest round of weekly API U.S. inventory estimates, with the same reports flagging a surprise (albeit modest) drop in distillate stocks. Elsewhere, the reports pointed to a surprise, small build in headline crude stocks and modest drawdown in stocks at the Cushing hub. Tight U.S. product markets continue to dominate when it comes to this particular release.

- Meanwhile, focus continues to fall on the deliberations re: the latest EU response to the Russia-Ukraine conflict, with a unanimous decision on further sanctions seemingly not on the table at the upcoming EU summit.

- On the Russian supply front, RTRS sources have noted that “Russian Urals crude exports and transit from its Baltic ports in May are expected match the initial plan, despite Western sanctions that have hit demand in Europe. Official sanctions and self-sanctioning by European buyers have hammered demand for Urals in its traditional market, but Asian buyers have stepped in to keep export flows unaffected. The ports of Primorsk and Ust-Luga will load a total of 7 million tonnes of Urals in May, in line with the initial plan, traders said.”

- Looking ahead, the weekly DoE inventory data will cross later on Wednesday.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/05/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 25/05/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/05/2022 | 0600/0800 | ** |  | SE | PPI |

| 25/05/2022 | 0600/0800 | ** |  | SE | Unemployment |

| 25/05/2022 | 0600/1400 | ** |  | CN | MNI China Liquidity Suvey |

| 25/05/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 25/05/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/05/2022 | 0700/0900 |  | EU | ECB Panetta Speaks at Goethe University | |

| 25/05/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 25/05/2022 | 0730/0930 |  | SE | Riksbank Financial Stability Report | |

| 25/05/2022 | 0800/1000 |  | EU | ECB Lagarde in Stakeholder Dialogue | |

| 25/05/2022 | 0945/1145 |  | EU | ECB Lane Speaks at German Bernacer Prize | |

| 25/05/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/05/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 25/05/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 25/05/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 25/05/2022 | 1515/1615 |  | UK | BOE Tenreyro Panels Discussion | |

| 25/05/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/05/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/05/2022 | 1615/1215 |  | US | Fed Vice Chair Lael Brainard | |

| 25/05/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.