-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN OPEN: Saudi To Start Lifting Oil Output Further To Fill Russian Gap?

EXECUTIVE SUMMARY

- FED'S BULLARD: HIGH INFLATION 'STRAINING' CREDIBILITY (RTRS)

- FED’S BARKIN SEES NO SIGN OF US RECESSION THE DATA (BBG)

- ECB'S LANE: FIRST NORMALISATION STEPS WILL VALIDATE MARKET TIGHTENING (RTRS)

- SAUDI ARABIA READY TO PUMP MORE OIL IF RUSSIAN OUTPUT SINKS UNDER BAN (FT)

- EU PUSH FOR PARTIAL RUSSIAN OIL BAN DELAYED BY HUNGARIAN DEMANDS (BBG)

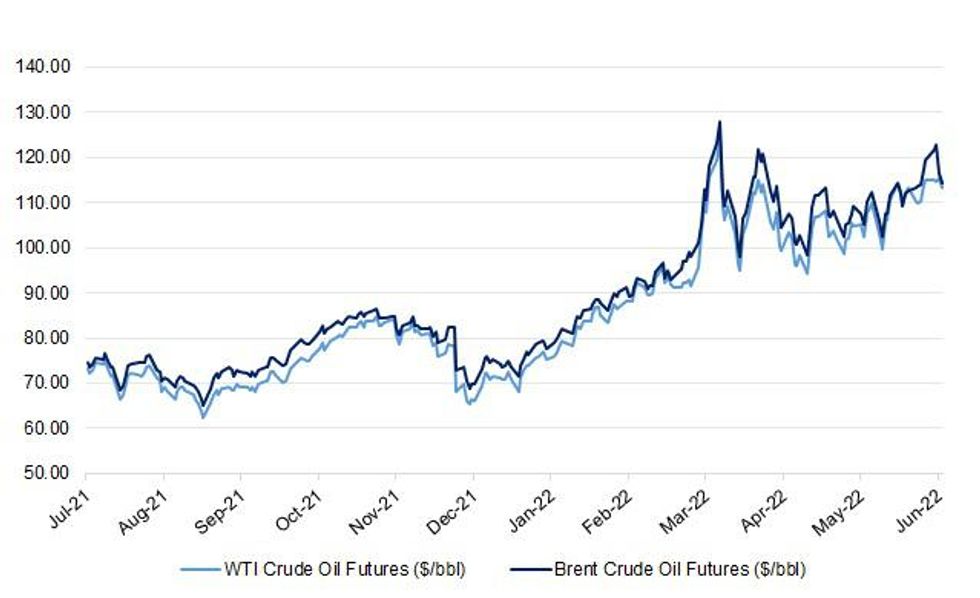

Fig. 1: WTI & Brent Crude Oil Futures ($/bbl)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Bank of England Deputy Governor Jon Cunliffe said on Wednesday the central bank was seeing evidence of a slowdown in the housing market. House prices have been increasing at double-digit rates annually but there have been signs of a potential slowdown, with Bank of England data on Tuesday showing a sharp drop in mortgage approvals in April. British consumer price inflation hit a 40-year high of 9.0% in April, and financial markets expect the BoE to raise interest rates to at least 2% by the end of the year from 1% now. Asked if the era of cheap borrowing had come to an end, Cunliffe said: "We have to ensure that the inflation we are seeing in the economy now ... doesn’t become the new normal." "So interest rates may well have to rise further," he said, adding that he did not think Britain was heading back to the interest rates of the 1990s, when the bank rate ranged between 5% and 14.88%. (RTRS)

POLITICS: Boris Johnson has delayed plans for a summer Cabinet reshuffle as he battles a growing Tory backbench revolt and seeks to keep ministers onside. The Prime Minister had told colleagues he was planning a shake-up after the May local elections, which saw Labour and the Liberal Democrats take scores of council seats from the Tories. However, the plans are on hold after the publication of Sue Gray’s partygate report and fresh calls for his resignation from around a dozen Tory MPs. One member of Mr Johnson’s inner circle told The Telegraph that July was now the earliest point at which a reshuffle would take place. “We are focused on the what, not the who”, said the source. Talking about partygate, the source added: “We are only just sweeping the debris off the deck.” (Telegraph)

POLITICS: Tory MPs including a junior minister are holding back from submitting letters of no confidence in Boris Johnson over fears their names will leak and they will face reprisals from the whips. Rebel Conservatives trying to orchestrate enough names to oust the prime minister say many MPs, particularly newer ones, are concerned about the privacy of the process. They worry that the Tory whips will be spying outside the office of Sir Graham Brady, the 1922 Committee chair who gathers the letters, and do not trust emails not to be accidentally shared or viewed by staff who have access to the accounts. (Guardian)

POLITICS: Boris Johnson’s allies have accused those plotting to oust him of being “self-indulgent, narcissistic and contemptuous” amid growing concern in government about the risk of a confidence vote in the prime minister. Johnson is said to be increasingly frustrated with Tory MPs who are openly plotting to remove him after a critical report into Downing Street parties. A total of 30 Tory MPs have now called for him to go and a further 18 have publicly criticised him. (The Times)

POLITICS: One of Boris Johnson's strongest cabinet allies has hit out out Tory MPs trying to oust him, accusing them of doing "the opposition's work". Culture Secretary Nadine Dorries claimed growing calls for the PM to resign were the result of a "co-ordinated campaign" by backbenchers. Criticism of Mr Johnson among Tory MPs has increased since Sue Gray's Partygate report last week. But Ms Dorries said the "overwhelming" majority still backed him. Twelve Conservative MPs have called on Mr Johnson to quit since the release of Ms Gray's report laid bare the scale of Covid rule-breaking in No 10. It takes the number now openly calling on him to resign to 28. Most of have written letters of no confidence in him, although the total number formally calling for a contest may be higher. (BBC)

NORTHERN IRELAND: Tony Blair has warned that the problems “at the heart” of the Northern Ireland Protocol could put the Good Friday Agreement at risk unless the EU makes a “significant” shift from its hardline stance on border checks. (Telegraph)

EUROPE

ECB: The European Central Bank's steps towards normalising monetary policy will bring it in line with market conditions, ECB chief economist Philip Lane said on Wednesday. "It's robust to make the initial steps in normalisation to validate the tightening that has already happened in many financial markets," Lane told an economics conference in Paris. (RTRS)

FISCAL: Brussels has backed Poland’s long-delayed economic recovery plan, potentially unlocking billions of euros for Warsaw, despite doubts within the European Commission over its commitment to legal reforms. Warsaw submitted its pitch for a share of the €800bn NextGenerationEU Covid-19 recovery fund in May last year, proposing to tap as much as €36bn of EU grants and loans. Its bid has been held up by a protracted dispute with the commission over Polish rules that Brussels believes undermine the independence of its judiciary. Gentiloni, economics commissioner, confirmed the plan had been adopted in a commissioners’ vote in Brussels on Wednesday. However, Vestager and Timmermans voted against the decision, according to people with knowledge of the matter. Their high-level opposition underlines concerns within Brussels over Poland’s willingness to uphold EU standards on the rule of law. (FT)

U.S.

FED: Inflation at levels last seen in the 1970s and early 1980s is putting the U.S. central bank's credibility at risk, St. Louis Federal Reserve Bank President James Bullard said on Wednesday, reiterating his call for the Fed to follow through on promised rate hikes to bring down inflation, and inflation expectations. "The current U.S. macroeconomic situation is straining the Fed's credibility with respect to its inflation target," Bullard said in slides prepared for a presentation to the Economic Club of Memphis. Though U.S. labor markets remain robust and the U.S. economy on track to grow in the quarters ahead, Bullard said, Russia's invasion of Ukraine and the possibility of a sharp slowdown in China after its COVID-19 lockdowns mean that risks remain substantial. Bullard has said he wants to get rates to 3.5% by the end of the year. (RTRS)

FED: Federal Reserve Bank of Richmond President Thomas Barkin says the US consumer is holding up and he doesn’t see evidence that the economy is slipping into a recession. “Right now what I’m hearing is people investing, consumers spending. You can’t find a recession in the data, and you can’t find it in the actions of executives”. Barkin speaks in interview on Fox Business. “I do think it’s time, both on rates and the balance sheet, to normalize where we are”. “With inflation this elevated and the economy still this strong, it just makes perfect sense to do that”. (BBG)

FED: The Federal Reserve should tighten policy until inflation begins trending down toward its 2% goal, San Francisco Federal Reserve Bank President Mary Daly said, adding officials should remain data-dependent and temper rate increases once price growth moderates. “I certainly am comfortable to do what it takes to get inflation trending down to the level we need it to be,” Daly said Wednesday in an interview on CNBC. “What the Fed needs to do -- and this is how I am thinking about the economy -- is remove the accommodation, but then be open to the data, be data-dependent.” Daly said she supports 50-basis-point rate increases at the central bank’s June and July meetings, but doesn’t want to forecast policy moves beyond that. She favors pushing the fed funds rate to neutral, which she estimates around 2.5%, by the end of the year. Daly does not vote on policy this year. (BBG)

FED: US economic growth looks to have downshifted in recent weeks in the face of headwinds that include rising interest rates and inflation, the Federal Reserve said. Expansion and price gains may be moderating in parts of the country as households and businesses navigate higher rates, the Russian invasion of Ukraine and ongoing disruptions from Covid-19 infections, the central bank said in its Beige Book report Wednesday. “Four districts explicitly noted that the pace of growth had slowed since the prior period,” it said. Business contacts in several districts reported becoming more cautious as their outlooks grew more pessimistic. (BBG)

INFLATION: President Joe Biden said on Wednesday bringing down high gasoline prices will take some time and that he will announce steps on Thursday aimed at reducing prices for Americans in other areas. "We can't take immediate action that I'm aware of yet to bring down the price of gasoilne. ... But we can compensate by providing for other necessary costs for families by bringing those down," Biden told reporters after an event about the baby formula shortage he is grappling with. (RTRS)

INFLATION: High inflation is being driven by global phenomena that could not be anticipated, including Russia's invasion of Ukraine, U.S. Deputy Secretary of the Treasury Wally Adeyemo said on Wednesday, adding that U.S. demand remains strong. "I don't think anyone saw the invasion - Russia's invasion of Ukraine - coming, which is driving the high energy prices that we see today," Adeyemo told MSNBC a day after U.S. Treasury Secretary Janet Yellen said she was "wrong" last year about the path inflation would take. "The best way to compare what's happening here in the United States is to look around the world, because inflation isn't only happening here in the United States. It's happening around the globe," Adeyemo said. (RTRS)

ECONOMY: MNI INTERVIEW: No Recession In Sight As ISM Poised For Gains

- ISM's gauge of U.S. manufacturing activity will likely take another step up in June and July as China reopens, Institute for Supply Management chair Timothy Fiore told MNI Wednesday, noting continued strong consumer demand and rebuffing fears of a possible recession - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

FISCAL: The Biden administration plans to cancel all outstanding student loans for those who attended Corinthian Colleges, formerly one of the largest for-profit education companies, the U.S. Department of Education announced on Wednesday. The schools have been accused of predatory and unlawful practices, and faced lawsuits from the Consumer Financial Protection Bureau as well as Vice President Kamala Harris when she was attorney general of California. The company filed for Chapter 11 bankruptcy in 2015. Around 560,000 borrowers stand to benefit from the debt cancellation, which will come out to around $5.8 billion. That’s the largest single debt forgiveness action taken by the government to date. (CNBC)

POLITICS: U.S. President Joe Biden's public approval rating rose six percentage points this week to 42%, rebounding from a week earlier when it sank to the lowest level of his presidency, a Reuters/Ipsos opinion poll completed on Wednesday found. The two-day national poll found that 52% of Americans disapprove of Biden's job performance. Biden's approval rating has been below 50% since August, raising alarms that his Democratic Party is on track to lose control of at least one chamber of Congress in the Nov. 8 midterm election. (RTRS)

ENERGY: The Biden administration is likely to raise ethanol blending mandates for 2021 above the figure it proposed in December to align with actual U.S. consumption levels, according to two sources briefed on the decision. In December, the U.S. Environmental Protection Agency proposed that refiners blend 13.32 billion gallons of ethanol into the fuel pool, a move that angered Farm Belt lawmakers and biofuel producers who said it was too low. But recent federal figures show U.S. consumption of ethanol at about 13.94 billion gallons. The administration is now considering lifting the 2021 mandate to around that level, the sources said. (RTRS)

OTHER

GLOBAL TRADE: The Biden administration is working to get temporary storage containers for Ukrainian grain into the country, a stopgap measure as it seeks to mitigate a growing food crisis caused by Russia's months-long blockade of Ukrainian ports, administration officials told CNN. These storage containers -- such as bags or boxes -- could help salvage some of the more than 20 million tons of grain that are currently stuck inside Ukraine. They could also help Ukraine load the grain onto trains or trucks out of the country once overland routes are established, a senior administration official explained. (CNN)

U.S./CHINA: U.S. authorities are ready to implement a ban on imports from China's Xinjiang region when a law requiring it becomes enforceable later in June, a U.S. Customs official said on Wednesday, adding that a "very high" level of evidence would be required for an exemption. U.S. President Joe Biden in December signed into law the Uyghur Forced Labor Prevention Act (UFLPA) in an effort to safeguard the U.S. market from products potentially tainted by human rights abuses in Xinjiang, where the U.S. government says China is committing genocide against Uyghur Muslims. The law includes a "rebuttable presumption" that all goods from Xinjiang, where Chinese authorities established detention camps for Uyghurs and other Muslim groups, are made with forced labor, and bars their import unless it can be proven otherwise. (RTRS)

GEOPOLITICS: President Recep Tayyip Erdogan replaced Turkey’s ambassadors to Sweden and Finland on Thursday in a new diplomatic push against their memberships in the NATO over their alleged support to separatist Kurdish militants. Erdogan appointed Yonet Can Tezel to Sweden and Deniz Cakar to Finland as he replaced dozens of Turkish ambassadors around the world, according to a decree published by Official Gazette. (BBG)

GEOPOLITICS: NATO chief Jens Stoltenberg said he would convene a meeting with senior officials from Sweden, Finland and Turkey in Brussels in the coming days to address Ankara’s concerns over the Nordic countries’ application to join the alliance. Stoltenberg said he intends to sort out the issues before a summit in Madrid in late June. “I’m confident we’ll find a way forward, I’m confident because all allies agree NATO enlargement has been a great success,” he said at a news conference with US Secretary of State Antony Blinken in Washington, D.C. Finnish President Sauli Niinisto, meanwhile, pushed back against Turkey’s objections, saying his nation already fulfills the bloc’s conditions regarding the fight against terrorism. (BBG)

GEOPOLITICS: Denmark will join the EU’s defence policy in the latest shake-up of Europe’s security architecture following Russia’s full-scale war against Ukraine. In the largest ever pro-EU vote in the traditionally Eurosceptic Scandinavian country, 67% of Danes voted in favour of ending the opt-out in a historic referendum. It is the first time in three attempts that Denmark has voted to end one of its hard won opt-outs after it rejected the Maastricht treaty in 1992, and comes two weeks after Finland and Sweden submitted applications to join Nato. (FT)

GEOPOLITICS: U.S. officials are planning a trip for President Joe Biden to the Middle East later this month to meet Gulf allies, which could put him in the same room with Saudi Crown Prince Mohammed bin Salman, sources said on Wednesday. No final decisions have been made about the trip, according to sources inside and outside the United States familiar with the planning, who spoke on condition of anonymity. The trip, tentatively being planned after a G7 summit in Germany and a NATO meeting in Spain, would include a visit to Israel, in which Biden would meet Israeli Prime Minister Naftali Bennett, the sources said. Asked about the possibility of Biden going to Saudi Arabia, White House Press Secretary Karine Jean-Pierre told reporters Wednesday she had no trips to preview, and that Biden stood by his earlier opinions of the crown prince. (RTRS)

BOJ: Bank of Japan board member Seiji Adachi said on Thursday it was premature to tighten monetary policy now as inflation remains short of the bank's 2% target and the economy has yet to fully recover from the COVID-19 pandemic. In a speech, however, Adachi said he expected Japan's inflationary pressure to heighten going forward as more companies pass on higher costs to consumers. (RTRS)

JAPAN: Japan’s government is considering raising the ceiling on international arrivals to 30,000 people per day as early as next month, further rolling back Covid-19 border controls, Yomiuri reports, citing unidentified officials. Daily cap was doubled to 20,000 and a limited number of tourists are being allowed into the country from this month. Will make a final decision after considering airport quarantine measures and infection numbers. Jiji separately reported Wed. that another option under consideration is removing the ceiling entirely. (BBG)

AUSTRALIA: Australia's new energy minister, Chris Bowen, said on Thursday he would take whatever action necessary to ensure reliable and affordable energy supply amid a crisis that has sent domestic wholesale power and gas prices soaring. Australia's energy market operator this week imposed a price cap on wholesale gas prices and has activated a mechanism to call on more supply amid a spike in demand for heating due to a cold snap and gas-fired generation to cover coal plant outages. There is a more drastic policy, called the Australian Domestic Gas Security Mechanism, available to the government that would require liquefied natural gas (LNG) suppliers on the east coast to hold back some exports for the domestic market. However, Bowen said the gas security trigger would not help the current shortage of gas supply, as it involves an annual review which would not take effect until Jan. 1. "It's not an easy trigger to pull," Bowen told reporters at his first media conference since being sworn in on Wednesday. (RTRS)

RBNZ: New Zealand's central bank said it will remove dividend payment restrictions on banks that were imposed early in the pandemic, as underlying strength remains in the economy despite headwinds. The restrictions will come to a complete end on July 1, the Reserve Bank of New Zealand said Thursday. Removal of the restrictions was subject to no significant worsening in economic conditions. Banks were initially prevented from making any dividend payments, which was reduced to a 50% restriction in March last year. "Underlying strength remains in the economy, supported by a strong labor market, sound household balance sheets, continued fiscal support and strong terms of trade," Deputy Gov. Christian Hawkesby said in a statement. "However, the economy is still facing headwinds, including heightened global economic uncertainty, cost pressures and low consumer confidence." (BBG)

BOK: Central banks need to do more than their obligation of maintaining price stability as calls for them taking more social responsibility will continue to rise in the post-pandemic era, Seoul's top central banker said Thursday. At an international conference in Seoul, Rhee Chang-yong, head of the Bank of Korea (BOK), said South Korea and other emerging countries are facing a likelihood of returning to a "very low inflation" and "very low growth environment" after current high inflation cools off, due to their "rapid aging problem." "Calls for the social responsibility of central banks are also likely to continue. This is because the shock from the pandemic and the subsequent recovery turned out to be uneven across income groups and industrial sectors," Rhee told the conference held to discuss central banks' role. (Yonhap)

AMERICAS: The United States is still hammering out a final guest list ahead of next week's Summit of the Americas in Los Angeles, senior U.S. officials said on Wednesday, after weeks of tension around several countries expected to be excluded. Summit preparations have been clouded by the threat of an embarrassing boycott by some regional leaders, including Mexican President Andres Manuel Lopez Obrador, if Cuba, Venezuela and Nicaragua are not invited. "We still have some final considerations, but we will, I think, inform people publicly soon," White House Latin America adviser Juan Gonzalez said in a call with reporters. Lopez Obrador, who received an invitation last week, has yet to say whether he will attend. (RTRS)

AMERICAS: U.S. President Joe Biden's first formal talks with Brazilian counterpart Jair Bolsonaro will cover a wide range of issues when they meet at the Summit of the Americas next week, including food insecurity, climate change and pandemic recovery, the White House said on Wednesday. Biden's top Latin America adviser, Juan Gonzalez, confirmed the two would meet in Los Angeles. Asked if Biden would raise concerns about Bolsonaro's questioning of Brazil's voting system, he said only that the United States "does have confidence in Brazil's electoral institutions which have proven robust." After signaling he might skip the summit, Bolsonaro said last week he would attend and meet Biden on the sidelines, despite what he called a "freeze" in Brazil-U.S. ties since Biden took office in January 2021. (RTRS)

MEXICO: Mexico's central bank said on Wednesday it expects annual headline inflation to have reached its peak in the second quarter of 2022, but added that the balance of risks to inflation are biased to the upside. The Bank of Mexico, in its quarterly report, underscored it is willing to act more forcefully on monetary policy if needed in order to bring inflation to the bank's 3% target, plus or minus 1 percentage point. (BBG)

MEXICO: A faster key rate hike is on the table to fight inflation, Mexico’s central bank governor Victoria Rodriguez Ceja said during the bank’s quarterly inflation report presentation. (BBG)

MEXICO: Mexico central bank Deputy Governor Irene Espinosa said larger rate increases are needed due to upward inflation revisions. Inflation expectations could de-anchor, Espinosa said during Banxico’s quarterly report presentation. The bank’s current rate isn’t consistent with easing CPI, she said. (BBG)

MEXICO: Mexico’s inflation would be above 9% without the government subsidizing gasoline and diesel costs, a central banker said on Wednesday, a sign of support for one of the administration’s flagship policies to clamp down on inflation. The federal government absorbed the additional cost of gasoline and diesel as international prices soar to avoid them being passed on to consumers, which it estimates have cost it $4.4 billion this year, and it has paid for with crude oil income. Banco de Mexico Deputy Governor Jonathan Heath said that he expected the government would keep the subsidies in place, if it can afford them them, as an extra tool to contain price gains. If it had not been for the government’s subsidies and caps on gasoline prices, “instead of inflation being above 7%, it would be above 9%, possible more,” Heath told reporters during a press conference on Wednesday. (BBG)

MEXICO: Petroleos Mexicanos has received billions of dollars more than it expected so far this year for crude oil exports due to the international price rally, giving it more breathing room to pay down its debts. The state-owned oil company known as Pemex received more than $13 billion between January and May for the crude oil it sold on international markets, which is some $5.4 billion above the amount it had budgeted for the period, according to a person familiar with the situation. The excess revenue is attributable to the year-to-date rally in crude prices, and the amount does not take taxes into account. (BBG)

RUSSIA: A number of civilians are sheltering from Russian shelling under a chemical plant in the Ukrainian city of Sievierodonetsk and it is possible there are still stocks of dangerous chemicals at the facility, the regional governor told Reuters on Wednesday. "There are civilians there in bomb shelters, there are quite a few of them, but it will not be a second Azovstal as that (plant) had a huge underground city … which isn’t there at Azot," Luhansk regional governor Serhiy Gaidai said, referring to the prolonged siege of a steel plant in Mariupol. (RTRS)

RUSSIA: The US will send four HIMARS missile systems in an initial shipment of advanced weaponry to Ukraine as the country’s forces defend their territory, according to a senior Pentagon official. The system, which can fire missiles as far as 80 kilometers away, will take three weeks of training to operate and an additional two weeks of training to maintain, said Colin Kahl, the under secretary of defense for policy. Training will be conducted at an undisclosed location outside of Ukraine before the systems are brought to the front lines, Kahl said. The missiles are part of a package of weaponry the White House announced on Tuesday. Moscow has warned that they may be used for attacks inside Russian territory. Ukraine’s government has assured the US that they won’t be. (BBG)

RUSSIA: The Biden administration plans to sell Ukraine four MQ-1C Gray Eagle drones that can be armed with Hellfire missiles for battlefield use against Russia, three people familiar with the situation said. The sale of the General Atomics-made drones could still be blocked by Congress, the sources said, adding that there is also a risk of a last minute policy reversal that could scuttle the plan, which has been under review at the Pentagon for several weeks. (RTRS)

RUSSIA: The White House said on Wednesday that any offensive cyber activity against Russia would not be a violation of U.S. policy of avoiding direct military conflict with Russia over its invasion of Ukraine. White House press secretary Karine Jean-Pierre commented on statements from U.S. cyber command chief General Paul Nakasone, who told Sky News on Wednesday the United States has conducted a series of digital operations in support of Ukraine. (RTRS)

RUSSIA: Russia recorded a zero increase in consumer prices after modest deflation the week before, data showed on Wednesday, ahead of the central bank's rate-setting meeting scheduled for June 10. Weekly inflation spiked to 2.22% in early March, soon after Russia started what it calls a "special military operation" in Ukraine on Feb. 24, but has been slowing since then, capped by a rapid recovery in the rouble. In the week to May 27, the consumer price index (CPI) was unchanged after declining 0.02% in the previous week for the first time since August 2021, data from statistics service Rosstat showed. Inflation is slowing even after the central bank lowered its key interest rate to 11% in May and said it saw room for more cuts this year, as it tries to manage a shrinking economy and high inflation. So far this year, consumer prices in Russia have risen 11.82%, Rosstat said. Prices for nearly everything, from vegetables and sugar to clothes and smartphones, have risen sharply in recent weeks as Russia encountered logistics disruptions and increased volatility in the rouble. Annual inflation has slowed to 17.51% as of May 20 from 17.83% in April, which was its highest since January 2002. The central bank expects inflation to reach its 4% target in 2024. Russian President Vladimir Putin said last week that inflation won't exceed 15% this year. (RTRS)

RUSSIA: Russia's economy shrank by 3% in April after growing by a downwardly revised 1.3% in March, the economy ministry said on Wednesday, due to Western sanctions over Ukraine and sluggish consumer demand. The ministry had initially put the March increase at 1.6%. (RTRS)

RUSSIA: Russia's capital investment rose 12.8% year-on-year in the first quarter to 3.995 trillion roubles ($64.96 billion), after a 3.3% increase in the same period a year ago, the Federal Statistics Service said on Wednesday. Russia's decision to send tens of thousands of troops into Ukraine on Feb. 24 and subsequent sanctions from the West have raised fears of an imminent economic crisis, but official data on Wednesday painted a mixed picture. (RTRS)

IRAN: U.S. and Israeli officials committed to coordinating efforts to prevent Iran from acquiring nuclear weapons in a meeting of senior officials, the White House said in a statement on Wednesday. The officials also discussed economic and diplomatic steps to achieve their goals and reviewed ongoing cooperation between the U.S. and Israeli militaries in Tuesday's meeting, the White House said. (RTRS)

ENERGY: The state-appointed trustee for Gazprom Germania has been empowered to fill the northern German Rehden natural gas storage site up from its current 2% level to help ensure energy supply security, the economy ministry said in a statement on Wednesday. The Gazprom Germania assets, including the Astora storage unit that operates Rehden and other sites in Germany and Austria, were abandoned by Gazprom in the course of Russia's invasion of Ukraine and energy embargo measures in the European Union. The measure, based on a gas storage law, will come into effect on June 2. (RTRS)

ENERGY: The Netherlands and Germany will jointly develop and exploit a new gas field in the North Sea to help secure gas supply as Europe tries to wean itself off Russian fossil fuels, the Dutch government said on Wednesday. Production at the field some 19 kilometres (12 miles) off the north coast of both countries is expected to start by the end of 2024, the government said. (RTRS)

OIL: Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions, according to five people familiar with the discussions. The kingdom has so far resisted calls from the White House to accelerate production increases despite oil prices trading near $120 a barrel, the highest level in a decade, arguing that it fears the energy crunch could get significantly worse later this year. Saudi Arabia believes it needs to keep spare production capacity in reserve. “Saudi Arabia is aware of the risks and that it is not in their interests to lose control of oil prices,” said one person briefed on the kingdom’s thinking. Saudi Arabia’s view is that while the oil market is undoubtedly tight, which has buoyed the rise in prices, there are not yet genuine shortages, according to diplomats and industry sources briefed on the discussions, which come ahead of a monthly meeting of the Opec+ oil producer alliance on Thursday. (FT)

OIL: European Union efforts to approve a partial ban on Russian oil imports hit an obstacle after Hungary raised new or already rejected demands, sinking a push to clinch a deal Wednesday, according to people familiar with the negotiations. EU ambassadors may meet again on Thursday in Luxembourg to try to green light the bloc’s sixth sanctions package that would target Russia for its invasion of Ukraine, said the people, who asked not to be identified because the discussions are private. (BBG)

FOREX: The U.S. dollar is set to clear its recent weak period unscathed and remain dominant because the number of reasons supporting it, including its safe-haven status, still strongly outweigh any reason to sell, according to a Reuters poll. Risk assets, which had their worst start to the year since the COVID-19 outbreak in 2020, pushed the dollar to a nearly two-decade high last month. A minor rebound in stocks last week partly held the dollar back from retaking those levels and got many talking about a snap in the trend. But most say it's too soon to discuss that. Indeed, a near two-thirds majority of strategists, 28 of 44, said the dollar's recent pullback would last less than three months. Among those, 16 said it would die down as early as end-June. Six said three to six months, three said six to 12 months. The remaining seven chose over a year. Nearly a two-thirds majority of analysts, 25 of 39, who answered an additional question said strategies of going long the dollar and shorting either emerging or major currencies would dominate trading over the next three months. But the wider poll of nearly 60 currency strategists reiterated the view the dollar will weaken marginally over the 12-month horizon. While the euro, the Japanese yen, the British pound and the Swiss franc were forecast to gain against the dollar over the next 12 months none were expected to recoup their year-to-date losses. (RTRS)

FOREX: Battered emerging market currencies will struggle to hold on to recent gains towards year-end as U.S. Federal Reserve interest rate hikes and inflation concerns keep the dollar in the forefront, a Reuters poll found. Barely recovering from a nearly two-year bear run, positive sentiment in emerging market currencies has already been soured by higher U.S. Treasury yields. (RTRS)

CHINA

PBOC/CREDIT: Chinese local governments are likely to sell so many bonds in June that the central bank will be compelled to feed extra liquidity into the economy to avert a cash crunch. Citic Securities Co. predicts local governments will sell at least 1.5 trillion yuan ($224 billion) of debt this month following calls from authorities to boost issuance to support the Covid-stricken economy. That’s more than the record monthly issuance of 1.3 trillion yuan seen in May 2020. “The PBOC will need to step up liquidity support in response to the coming fluctuations in cash conditions,” said Ming Ming, chief economist at Citic Securities in Beijing. It may even cut the reserve requirement ratio to shore up the economy, he said.

CAPITAL FLOW: Net outflows from the Chinese bond market may decelerate to less than CNY100 billion per month in May and June, as short-term investors have priced in the inversion of China-U.S. government-bond yield and the yuan trend should stabilise in the coming months, Yicai.com reported citing Liu Linan, managing director of Deutsche Bank. The U.S. 10-year Treasury bond yield may rise to 3.3% in Q3 while that of 10-year China Government Bond may fluctuate between 2.7-3%, Liu was cited as saying. There is no need to worry about the yuan, as it is traded at the midpoint of the fluctuation range in the past four years, reflecting rational market sentiment, Liu was cited as saying. (MNI)

CORONAVIRUS: China declared victory over Shanghai’s coronavirus outbreak as the nation reported its fewest new cases in more than three months, vindicating Covid Zero in the eyes of Beijing despite the policy’s rising economic and social toll. A report on the front page of the People’s Daily newspaper Thursday headlined “Great Achievements Have Been Made in the Defense of Shanghai” claimed victory in the fight against the virus in the city of 25 million. In a separate commentary, the chief mouthpiece of the Communist Party said it proved yet again that Covid Zero is the strategy most suited for China because of the country’s aging population, relatively low vaccination rate among the elderly and children, and inadequate medical resources. New infections fell to 61 across China on Wednesday, from 68 on Tuesday and the lowest since Feb. 17. (BBG)

ENERGY: China plans to double its wind and solar power generation by 2025, with renewable energy generating about 3.3 trillion kWh annually, the Shanghai Securities News reported citing the 14th Five-Year Plan for Renewable Energy Development released Wednesday. Current available funds with low interest rates are far from enough, while the government is expected to further increase support for green bonds and green credits for eligible new energy projects, the newspaper said. (MNI)

RATINGS: Fitch affirmed China at A+; Outlook Stable

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7935% at 9:22 am local time from the close of 1.5889% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7095 THU VS 6.6651

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7095 on Thursday, compared with 6.6651 set on Wednesday.

OVERNIGHT DATA

JAPAN MAY MONETARY BASE +4.6% Y/Y; APR +6.6%

JAPAN MAY MONETARY BASE END OF PERIOD Y673.4BN; APR Y688.4BN

AUSTRALIA APR TRADE BALANCE +A$10,495MN; MEDIAN +A$9,000MN; MAR +A$9,314MN

AUSTRALIA APR EXPORTS +1% M/M; MEDIAN +1%; MAR +0%

AUSTRALIA APR IMPORTS -1% M/M; MEDIAN +1%; MAR -5%

NEW ZEALAND Q1 TERMS OF TRADE INDEX +0.5% Q/Q; MEDIAN +1.3%; Q4 -0.9%

SOUTH KOREA MAY S&P GLOBAL M’FING PMI 51.8; APR 52.1

South Korean manufacturers signalled a softer improvement in operating conditions midway through the second quarter, according to the latest PMI data. The lower reading of the Manufacturing PMI came as firms reported a renewed reduction in output that was the quickest for five months. Positively, new order inflows remained in expansion territory and rose at the fastest pace for three months, though this was largely led by domestic sales as foreign demand remained subdued. Supply chain disruption continued to hinder growth in activity and demand in the manufacturing sector. Material shortages and rising input costs were exacerbated by delays in sourcing and receiving inputs, especially following the reimposition of strict COVID-19 measures in China as firms reported the sharpest deterioration in vendor performance since last December. Moreover, the latest rise in input costs pushed firms to raise output charges at a record pace in an effort to protect margins. Goods producers remained confident that output would rise over the coming 12 months, with firms citing a stronger degree of optimism in comparison to April. Positive sentiment was underpinned by hopes that the latest wave of the pandemic would end swiftly, while the disruption caused by the Russia-Ukraine conflict would also settle and in turn provide a boost to global supply chains and economic activity. (S&P Global)

MARKETS

SNAPSHOT: Saudi To Start Lifting Oil Output Further To Fill Russian Gap?

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 26.38 points at 27431.51

- ASX 200 down 72.276 points at 7161.7

- Shanghai Comp. up 3.368 points at 3185.524

- JGB 10-Yr future down 7 ticks at 149.69, yield up 0.3bp at 0.241%

- Aussie 10-Yr future down 8.5 ticks at 96.485, yield up 8bp at 3.499%

- U.S. 10-Yr future up 0-03 at 118-23+, yield up 0.91bp at 2.9149%

- WTI crude down $2.34 at $112.92, Gold down $0.70 at $1845.90

- USD/JPY down 8 pips at Y130.05

- FED'S BULLARD: HIGH INFLATION 'STRAINING' CREDIBILITY (RTRS)

- FED’S BARKIN SEES NO SIGN OF US RECESSION THE DATA (BBG)

- ECB'S LANE: FIRST NORMALISATION STEPS WILL VALIDATE MARKET TIGHTENING (RTRS)

- SAUDI ARABIA READY TO PUMP MORE OIL IF RUSSIAN OUTPUT SINKS UNDER BAN (FT)

- EU PUSH FOR PARTIAL RUSSIAN OIL BAN DELAYED BY HUNGARIAN DEMANDS (BBG)

US TSYS: Limited Overnight, Block Flow Headlines, ADP Eyed

TYU2 futures coiled in overnight trading, briefing looking higher at the re-open before settling into a 0-09 range, last dealing +0-04 at 118-24+ on ~110K lots. Cash Tsys run 1.5bp cheaper to marginally richer on the curve, twist flattening, with a pivot around 20s.

- An FT source report which suggested that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions,” had no meaningful impact on Tsys, even with WTI futures trading over $3 softer vs. settlement at one point.

- Elsewhere, there wasn’t anything in the way of meaningful macro headline flow to digest.

- A quick reminder that Hong Kong & Chinese markets will be closed on Friday, owing to the observance of national holidays. This, coupled with the lack of macro headline flow and a 4-day weekend in the UK (Starting today), may be limiting the appetite of investors when it comes to taking on fresh risk, especially with NFPs due to be released on Friday.

- Flow of note include slightly misweighted FV/TY block flatteners (-8K/+5K x2 and -4K/+2K) along with a block buyer of FVN2 112.00 puts (+5K) and seller of TYN2 119.00 puts (-2.5K), with those options crossing at the same time (pointing to some form of conditional flattener trade).

- Looking ahead, ADP employment data headlines the NY docket on Thursday, with weekly jobless claims, challenger job cuts, factory orders and final durable goods readings also on tap. Fedspeak will come from NY Fed’s Logan (soon to be Dallas Fed President) and Cleveland Fed President Mester (’22 voter).

JGBS: Tight Session, 10s Go Smoothly

Futures coiled during Tokyo dealing, failing to move notably away from late overnight levels, last -5 a touch above late overnight session levels. The JGB curve saw some modest steepening pressure, with the major benchmarks running little changed to ~1bp cheaper on the day. The 20+-Year zone provided the weakest point on the curve, aided by the overnight cheapening in core FI markets, while the lack of relative BoJ control in this area of the curve promoted underperformance vs. shorter dated paper.

- 10-Year JGB supply saw smooth digestion, with the low price matching wider expectations (as proxied by the BBG dealer poll), tail holding tight and cover ratio holding comfortably above the auction average (which stood at 3.75x), albeit back from last month’s multi-year high. BoJ assurances were seemingly enough to result in healthy demand when it comes to 10-Year JGB supply (it also prevented anything in the way of pre-auction concession, with 10-Year JGB yields 1bp of the upper limit of the -/+0.25% band, limiting weakness in paper out to 10s).

- On the wider issuance front, Indonesia priced Y81bn of samurai bonds, with maturities of 3-, 5-, 7- & 10-Years.

- Japanese Chief Cabinet Secretary Matsuno confirmed the desire of the government to lift the Japanese average wage to Y1,000 per hour, as was reported in the local press pre-market.

- BoJ board member Adachi failed to unveil anything in the way of meaningful fresh information in his latest address.

- The latest round of BoJ Rinban operations headline the domestic docket on Friday.

JGBS AUCTION: Japanese MOF sells Y2.1951tn 10-Year JGBs

The Japanese Ministry of Finance (MOF) sells Y2.1951tn 10-Year JGBs:

- Average Yield 0.239% (prev. 0.245%)

- Average Price 99.62 (prev. 99.56)

- High Yield: 0.241% (prev. 0.248%)

- Low Price 99.60 (prev. 99.53)

- % Allotted At High Yield: 7.2951% (prev. 25.2561%)

- Bid/Cover: 4.860x (prev. 5.742x)

AUSSIE BONDS: A Touch Flatter On The Day

The ACGB space found a bit of a base around the previously outlined pull back in oil markets, owing to an FT source report which suggested that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions.” The subsequent dip in crude oil prices initially took some of the stagflation worry out of wider markets, at least on a very incremental basis. Still futures have coiled during the remainder of the session, operating a touch above the early session lows, after initially showing through their respective overnight troughs in early Sydney trade.

- That leaves YM -9.0 and XM -7.0 at typing, with the bear flattening on the wider cash ACGB curve a little more pronounced, as 30s run ~5.5bp cheaper on the day. EFPs are wider again today, with the 3-/10-Year box bull flattening (3s +~4.0bp, 10s +~3.0bp). Meanwhile, bills run 3-15bp cheaper through the reds.

- We also got A$4.4bn of semi supply from TCV, across ’28 & ’30 floating rate lines.

- Local news flow has been fairly inconsequential for markets, with Energy Minister Bowen flagging the difficulties that Australia faces in the energy sphere at present, ahead of a state ministerial level meeting re: the matter, scheduled for next week. Bowen stressed that the government will do what it must to ensure the reliability and affordability of the domestic energy markets.

- Elsewhere, the latest Australian monthly trade balance reading provided a slightly wider than expected surplus in the month of April, with imports moderating a touch in M/M terms.

- Housing finance data and the release of the weekly AOFM issuance slate headline the domestic docket on Friday.

EQUITIES: Lower In Asia As Growth Worry Rises; China Defeats COVID Wave (Again)

Virtually all Asia-Pac equity indices are lower at typing, tracking a negative performance from Wall St. High-beta equities across the region largely underperformed, with a decline in major crude benchmarks during the session proving unable to lift wider worry re: stagflation.

- The Hang Seng Index leads losses amongst regional peers, trading 1.6% lower and operating around session lows at typing. Nearly all constituents are in the red, with China-based tech names such as Meituan and Tencent again leading losses. The Hang Seng Tech is similarly 1.7% worse off at writing, tracking a 1.6% decline in the NASDAQ Golden Dragon China Index in Wednesday’s NY session.

- The Chinese CSI300 has fared a little better, sitting a little below neutral levels at typing. Gains in Chinese tech names (as seen in the ChiNext and STAR50 dealing 0.7% and 1.9% higher respectively) were largely neutralised by losses in high-valuation consumer staples and healthcare stocks for another day. Industrials outperformed as well, boosted by Chinese authorities declaring victory over Shanghai’s COVID outbreak, with new daily infections nationwide falling to 61 on Wednesday (vs. 68 the day before).

- The ASX200 deals 1.0% softer at writing, with gains in energy and utility names countered by weakness in technology and healthcare stocks. The S&P/ASX All Technology Index sits 2.0% worse off at typing, led by losses in large-caps REA Group, Xero Ltd, and Block Inc (-6.4%), with the latter tracking a large sell-off in the cryptocurrency space overnight.

- U.S. e-mini equity index futures are either side of neutral, trading a little above their respective troughs made on Wednesday at typing.

OIL: Lower In Asia; OPEC Production Commitments In Focus Ahead Of Meeting

WTI and Brent are ~$2.40 softer apiece at typing, off one-week lows made earlier in the session. Both benchmarks came under pressure after a previously flagged FT source report pointed to the potential for an immediate increase in crude production by OPEC heavyweight Saudi Arabia, possibly announced at an OPEC+ meeting later on Thursday.

- To elaborate, the source report outlined that production increases scheduled for Sept ‘22 could be brought forward to Jul and Aug, while highlighting that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions”.

- On previously flagged WSJ source reports re: the exemption of Russia from OPEC+ output targets, RTRS source reports have since suggested that the group is not actively discussing the measure in recent meetings, likely unwinding some of the downward pressure on major crude benchmarks.

- Keeping within the Middle East, BBG source reports have said that U.S. President Joe Biden would “likely” visit Saudi Arabia (among other Gulf Cooperation Council countries) later this month, driving debate re: OPEC-centred efforts to increase crude production.

- Elsewhere, the latest round of U.S. API inventory estimates crossed late on Wednesday, with reports pointing to a larger than expected drawdown in crude stocks, reversing a small build reported last week (although little movement was observed in major crude benchmarks). A decline in gasoline stockpiles was reported as well, while there was a build in distillate and Cushing hub inventories.

- Looking ahead, U.S. EIA inventory data is due later on Thursday (1600 BST), with WSJ estimates calling for a decline in crude and gasoline stockpiles as well.

GOLD: $1,850/oz Eyed; Rise In Dollar, Real Yields Cap Gains

Gold is $1/oz worse off, printing $1,845/oz at typing. The precious metal operates a little off Wednesday’s best levels ($1,849.98/oz), having traded on either side of neutral levels in fairly directionless Asia-Pac dealing, facilitated by light macro headline flow.

- To recap Wednesday’s price action, gold caught a bid after hitting two-week lows earlier in that session (at $1,828.6/oz), ultimately closing ~$9/oz higher on the day after failing to rise above the $1,850/oz handle amidst an uptick in the USD (DXY) and U.S. real yields.

- A round of comments from the Fed’s Daly and Bullard on Wednesday voicing support for 50bp hikes come the June FOMC saw little reaction in gold and U.S. real yields, although Fed-dated OIS pricing now points to a Fed Funds rate of ~2.94% after the Dec FOMC, compared to ~2.64% at the end of last week.

- Looking ahead, the NY Fed’s Logan (‘23 voter) and the Cleveland Fed’s Mester (voter) will speak later on Thursday at 17:00 and 18:00 respectively, noting that the former will be making closing remarks at an event on MonPol implementation and digital innovation.

- Looking to technical levels, previously identified support and resistance levels remain intact, at $1,807.5/oz (May 18 low) and $1,869.7/oz (May 24 high) respectively.

FOREX: USD Dips Supported Amidst Range Bound Day

The USD has stayed on the front foot today, but overall moves have been modest. US yields have edged up, despite lower oil prices. Safe havens have outperformed the commodity FX bloc though.

- USD/JPY has dipped below 130.00 on a number of occasions but has seen demand below this level. The BoJ's Adachi reiterated the central bank's dovish outlook, noting it is too early to tighten monetary policy.

- EUR/USD is close to unchanged on the day at 1.0650/55, up moves capped by the uptick in US yields.

- AUD hasn't received much support from the stronger than expected trade surplus figures, coming in at just under A$10.5bn, versus A$9bn expected. This owed to lower than expected import growth (-1% versus +1% estimated), while exports rose as forecast (+1%). Weaker equity market sentiment in Asia Pacific markets has weighed.

- NZ's terms of trade rose by 0.5%, but this was less than the market forecast (+1.3%). NZD/USD has drifted a little lower to 0.6475.

- CAD and NOK have underperformed the safe havens, down 0.13% and 0.25% respectively against the USD from NY closing levels. Oil prices have remained under water today, following reports that Saudi Arabia could bring forward production increases scheduled for later in the year. Crude is up from its lows though.

- USD/CNH has pushed higher again, but found offers above 6.7100. USD/KRW spot is up over 1% to be back above 1250. This reflects some catch up from yesterday, where onshore markets were closed. Most other USD/Asia pairs are higher.

FOREX OPTIONS: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.8bln), $1.0555(E767mln), $1.0650-60(E723mln), $1.0700(E939mln), $1.0725-45(E3.9bln), $1.0800(E683mln)

- USD/JPY: Y129.50-60($565mln), Y132.00($1.1bln)

- AUD/USD: $0.7300(A$507mln)

- USD/CAD: C$1.2595($540mln)

- USD/CNY: Cny6.6900($600mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2022 | 0630/0830 | *** |  | CH | CPI |

| 02/06/2022 | 0900/1100 | ** |  | EU | PPI |

| 02/06/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/06/2022 | 1230/0830 | * |  | CA | Building Permits |

| 02/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 02/06/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/06/2022 | 1400/1000 | ** |  | US | factory new orders |

| 02/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/06/2022 | 1445/1045 |  | CA | BOC Deputy Beaudry Economic Progress Report Speech | |

| 02/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 02/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/06/2022 | 1600/1200 |  | US | New York Fed's Lorie Logan | |

| 02/06/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.