-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI POLITICAL RISK - Trump Announces Raft Of Key Nominations

BRIEF: EU-Mercosur Deal In Final Negotiations - EC

MNI EUROPEAN MARKETS ANALYSIS: Oil Lower On Saudi Production Rumours, OPEC+ Eyed

- WTI & Brent cheapened overnight, as both crude benchmarks came under pressure after an FT source report pointed to the potential for an immediate increase in crude production by OPEC heavyweight Saudi Arabia, possibly announced at an OPEC+ meeting later on Thursday.

- Wider markets were a little more limited, with a long UK weekend and impending holidays in both China & Hong Kong seemingly limiting willingness re: amassing fresh risk, particularly with U.S. NFPs due on Friday.

- U.S. ADP employment data, the aforementioned OPEC+ gathering and central bank speak from Fed's Logan & Mester, ECB's Villeroy & de Cos, as well as BoC's Beaudry, provide the highlights on Thursday.

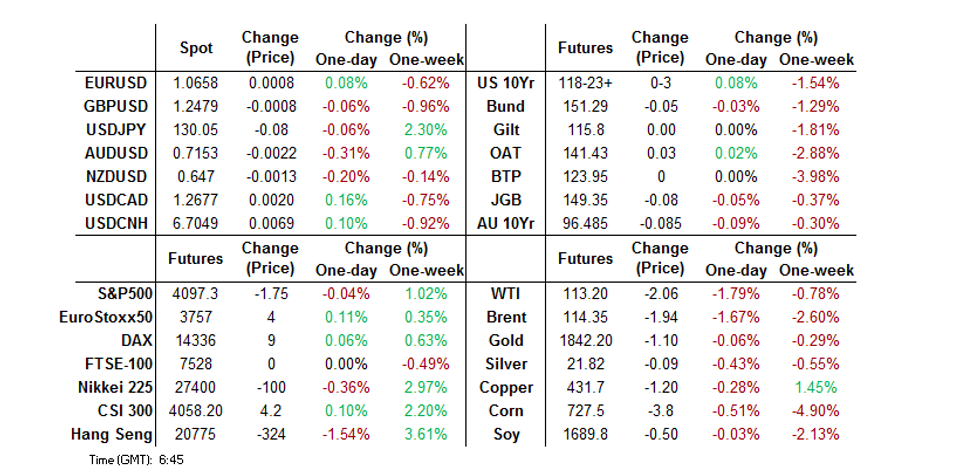

US TSYS: Limited Overnight, Block Flow Headlines, ADP Eyed

TYU2 futures coiled in overnight trading, briefing looking higher at the re-open before settling into a 0-09 range, last dealing +0-04 at 118-24+ on ~110K lots. Cash Tsys run 1.5bp cheaper to marginally richer on the curve, twist flattening, with a pivot around 20s.

- An FT source report which suggested that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions,” had no meaningful impact on Tsys, even with WTI futures trading over $3 softer vs. settlement at one point.

- Elsewhere, there wasn’t anything in the way of meaningful macro headline flow to digest.

- A quick reminder that Hong Kong & Chinese markets will be closed on Friday, owing to the observance of national holidays. This, coupled with the lack of macro headline flow and a 4-day weekend in the UK (Starting today), may be limiting the appetite of investors when it comes to taking on fresh risk, especially with NFPs due to be released on Friday.

- Flow of note include slightly misweighted FV/TY block flatteners (-8K/+5K x2 and -4K/+2K) along with a block buyer of FVN2 112.00 puts (+5K) and seller of TYN2 119.00 puts (-2.5K), with those options crossing at the same time (pointing to some form of conditional flattener trade).

- Looking ahead, ADP employment data headlines the NY docket on Thursday, with weekly jobless claims, challenger job cuts, factory orders and final durable goods readings also on tap. Fedspeak will come from NY Fed’s Logan (soon to be Dallas Fed President) and Cleveland Fed President Mester (’22 voter).

JGBS: Tight Session, 10s Go Smoothly

Futures coiled during Tokyo dealing, failing to move notably away from late overnight levels, last -5 a touch above late overnight session levels. The JGB curve saw some modest steepening pressure, with the major benchmarks running little changed to ~1bp cheaper on the day. The 20+-Year zone provided the weakest point on the curve, aided by the overnight cheapening in core FI markets, while the lack of relative BoJ control in this area of the curve promoted underperformance vs. shorter dated paper.

- 10-Year JGB supply saw smooth digestion, with the low price matching wider expectations (as proxied by the BBG dealer poll), tail holding tight and cover ratio holding comfortably above the auction average (which stood at 3.75x), albeit back from last month’s multi-year high. BoJ assurances were seemingly enough to result in healthy demand when it comes to 10-Year JGB supply (it also prevented anything in the way of pre-auction concession, with 10-Year JGB yields 1bp of the upper limit of the -/+0.25% band, limiting weakness in paper out to 10s).

- On the wider issuance front, Indonesia priced Y81bn of samurai bonds, with maturities of 3-, 5-, 7- & 10-Years.

- Japanese Chief Cabinet Secretary Matsuno confirmed the desire of the government to lift the Japanese average wage to Y1,000 per hour, as was reported in the local press pre-market.

- BoJ board member Adachi failed to unveil anything in the way of meaningful fresh information in his latest address.

- The latest round of BoJ Rinban operations headline the domestic docket on Friday.

AUSSIE BONDS: A Touch Flatter On The Day

The ACGB space found a bit of a base around the previously outlined pull back in oil markets, owing to an FT source report which suggested that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions.” The subsequent dip in crude oil prices initially took some of the stagflation worry out of wider markets, at least on a very incremental basis. Still futures have coiled during the remainder of the session, operating a touch above the early session lows, after initially showing through their respective overnight troughs in early Sydney trade.

- That leaves YM -9.0 and XM -7.0 at typing, with the bear flattening on the wider cash ACGB curve a little more pronounced, as 30s run ~5.5bp cheaper on the day. EFPs are wider again today, with the 3-/10-Year box bull flattening (3s +~4.0bp, 10s +~3.0bp). Meanwhile, bills run 3-15bp cheaper through the reds.

- We also got A$4.4bn of semi supply from TCV, across ’28 & ’30 floating rate lines.

- Local news flow has been fairly inconsequential for markets, with Energy Minister Bowen flagging the difficulties that Australia faces in the energy sphere at present, ahead of a state ministerial level meeting re: the matter, scheduled for next week. Bowen stressed that the government will do what it must to ensure the reliability and affordability of the domestic energy markets.

- Elsewhere, the latest Australian monthly trade balance reading provided a slightly wider than expected surplus in the month of April, with imports moderating a touch in M/M terms.

- Housing finance data and the release of the weekly AOFM issuance slate headline the domestic docket on Friday.

JAPAN: Japanese Investors Revert To Selling Of Foreign Bonds

The latest round of Japanese weekly international security flow data revealed that Japanese investors more than reversed the net buying of foreign bonds observed over the 2 weeks that came before the latest release, registering the fifth week of net selling in seven (as well as a fourteenth week of net selling in eighteen).

- Elsewhere, international investors were marginal net sellers of Japanese bonds in the latest week, after two straight weeks of net purchases.

- Equity flows were limited, with Japanese investors being small net sellers of foreign equities, while foreign investor flows surrounding Japanese equities were virtually neutral in net terms.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -1138.9 | 628.6 | -959.3 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -274.4 | 330.1 | 403.1 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | -26.2 | 1281.8 | 1417.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 0.9 | 4.2 | -261.5 |

FOREX: USD Dips Supported Amidst Range Bound Day

The USD has stayed on the front foot today, but overall moves have been modest. US yields have edged up, despite lower oil prices. Safe havens have outperformed the commodity FX bloc though.

- USD/JPY has dipped below 130.00 on a number of occasions but has seen demand below this level. The BoJ's Adachi reiterated the central bank's dovish outlook, noting it is too early to tighten monetary policy.

- EUR/USD is close to unchanged on the day at 1.0650/55, up moves capped by the uptick in US yields.

- AUD hasn't received much support from the stronger than expected trade surplus figures, coming in at just under A$10.5bn, versus A$9bn expected. This owed to lower than expected import growth (-1% versus +1% estimated), while exports rose as forecast (+1%). Weaker equity market sentiment in Asia Pacific markets has weighed.

- NZ's terms of trade rose by 0.5%, but this was less than the market forecast (+1.3%). NZD/USD has drifted a little lower to 0.6475.

- CAD and NOK have underperformed the safe havens, down 0.13% and 0.25% respectively against the USD from NY closing levels. Oil prices have remained under water today, following reports that Saudi Arabia could bring forward production increases scheduled for later in the year. Crude is up from its lows though.

- USD/CNH has pushed higher again, but found offers above 6.7100. USD/KRW spot is up over 1% to be back above 1250. This reflects some catch up from yesterday, where onshore markets were closed. Most other USD/Asia pairs are higher.

FOREX OPTIONS: Expiries for Jun02 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.8bln), $1.0555(E767mln), $1.0650-60(E723mln), $1.0700(E939mln), $1.0725-45(E3.9bln), $1.0800(E683mln)

- USD/JPY: Y129.50-60($565mln), Y132.00($1.1bln)

- AUD/USD: $0.7300(A$507mln)

- USD/CAD: C$1.2595($540mln)

- USD/CNY: Cny6.6900($600mln)

ASIA FX: KRW & TWD Underperform, IDR Rebounds

USD/Asia pairs are tracking higher, with KRW and TWD underperformers, while IDR has bucked the regional trend today and rebounded strongly against the USD.

- CNH: USD/CNH has pushed higher today, but only modestly, with offers still above 6.7100 for now. The fixing bias remains neutral, while the PBoC stated it would step up implementing prudent monetary policy. China equities have outperformed broader weakness seen throughout the region.

- KRW: USD/KRW has surged higher today, spot is back above 1253, +1.25% versus the previous close. This reflects some catch up given onshore markets were closed yesterday. The 1 month NDF is also 0.50% higher. The Kopsi is off by 1%, while the May PMI eased to 51.8 from 52.1 last month.

- TWD: USD/TWD has continued to recover after getting close to the 29.00 level recently. Spot is back to 29.38, around +0.38% on the day. Local equities are down a further 0.50%. Note yesterday offshore investors sold $372 of local equities.

- IDR: The rupiah has bucked the broader trend of a stronger USD. Spot USD/IDR is down to 14500, about 0.50% lower on the day. Positive headlines around palm oil exports, recovering tourism inflows and reported inflows into local bonds, have all seemingly helped.

- MYR: USD/MYR is back close to 4.4000 (last at 4.3942). Lower oil hasn't helped today, but we would be mindful of official rhetoric this close to the 4.4000 region. The authorities stated they will maintain existing price controls on chicken and chicken eggs. They also reaffirmed the live chicken export ban to Singapore.

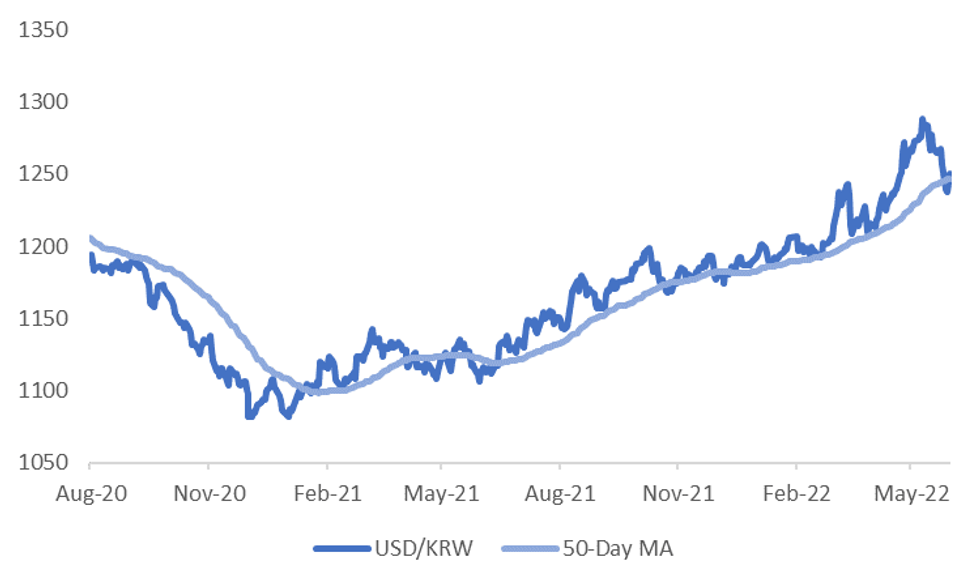

USD/KRW - Another False Break Of The 50-Day MA?

Spot USD/KRW has rebounded sharply today to 1250, +1% on the day, which puts it back above the 50-day MA of 1246.8. Dips below the 50-day MA have proven to be good buying opportunities in USD/KRW over the past 18 months.

- The first chart below plots spot USD/KRW against the 50-day MA. Since the beginning of 2021, spot moves below this level have proven to be false breaks.

- The broad uptrend in the USD over this period is obviously a key catalyst, but Korea-specific factors have been important as well, as we outline below.

Fig 1: USD/KRW Versus the 50-Day MA

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

- The move into trade deficit territory has not helped the external position. The May trade deficit printed better than expected, but an onshore think-tank, the Korea Institute for Industrial Economics & Trade, expects a deficit of -$15.8bn for 2022, which would be the largest in 26 years. This mainly owes to stronger commodity prices boosting the import bill.

- The consensus forecast for the current account position is a surplus of 3.3% of GDP this year. However, this surplus is largely being recycled back offshore to overseas investments.

- At the end of last week, the National Pension Service stated it would increase its offshore equity allocation to 30.3% by end 2023, up from 27.8% this year. By 2027 this is expected to be 40.3%.

- Export growth also surprised on the upside in May. It will be interesting to observe how much impetus external demand China brings going forward though.

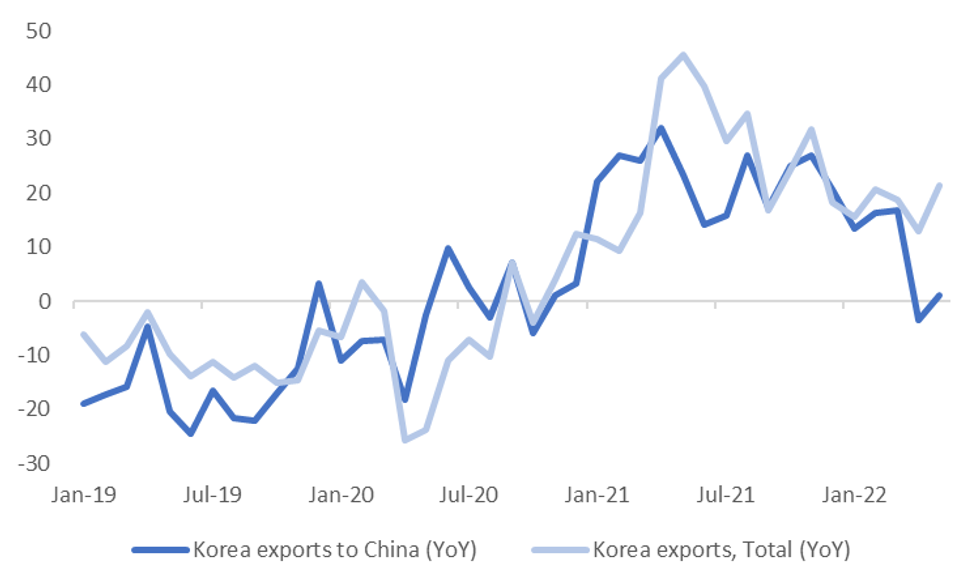

- The second chart plots total export growth for Korea and that to China, both in YoY terms. Export growth to China has lagged the broader trend in the past 18 months. Will this persist given China's on-going Covid-zero strategy, which will weigh on domestic demand, all else equal.

- The BoK, in its latest update, also expected a slower export growth picture in 2022.

- FX stability remains a strong focus point for the authorities, which can act as a buffer against these supportive USD/KRW factors outlined above.

Fig 2: Korea Export Growth - Total & China In YoY Terms

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

EQUITIES: Lower In Asia As Growth Worry Rises; China Defeats COVID Wave (Again)

Virtually all Asia-Pac equity indices are lower at typing, tracking a negative performance from Wall St. High-beta equities across the region largely underperformed, with a decline in major crude benchmarks during the session proving unable to lift wider worry re: stagflation.

- The Hang Seng Index leads losses amongst regional peers, trading 1.6% lower and operating around session lows at typing. Nearly all constituents are in the red, with China-based tech names such as Meituan and Tencent again leading losses. The Hang Seng Tech is similarly 1.7% worse off at writing, tracking a 1.6% decline in the NASDAQ Golden Dragon China Index in Wednesday’s NY session.

- The Chinese CSI300 has fared a little better, sitting a little below neutral levels at typing. Gains in Chinese tech names (as seen in the ChiNext and STAR50 dealing 0.7% and 1.9% higher respectively) were largely neutralised by losses in high-valuation consumer staples and healthcare stocks for another day. Industrials outperformed as well, boosted by Chinese authorities declaring victory over Shanghai’s COVID outbreak, with new daily infections nationwide falling to 61 on Wednesday (vs. 68 the day before).

- The ASX200 deals 1.0% softer at writing, with gains in energy and utility names countered by weakness in technology and healthcare stocks. The S&P/ASX All Technology Index sits 2.0% worse off at typing, led by losses in large-caps REA Group, Xero Ltd, and Block Inc (-6.4%), with the latter tracking a large sell-off in the cryptocurrency space overnight.

- U.S. e-mini equity index futures are either side of neutral, trading a little above their respective troughs made on Wednesday at typing.

GOLD: $1,850/oz Eyed; Rise In Dollar, Real Yields Cap Gains

Gold is $1/oz worse off, printing $1,845/oz at typing. The precious metal operates a little off Wednesday’s best levels ($1,849.98/oz), having traded on either side of neutral levels in fairly directionless Asia-Pac dealing, facilitated by light macro headline flow.

- To recap Wednesday’s price action, gold caught a bid after hitting two-week lows earlier in that session (at $1,828.6/oz), ultimately closing ~$9/oz higher on the day after failing to rise above the $1,850/oz handle amidst an uptick in the USD (DXY) and U.S. real yields.

- A round of comments from the Fed’s Daly and Bullard on Wednesday voicing support for 50bp hikes come the June FOMC saw little reaction in gold and U.S. real yields, although Fed-dated OIS pricing now points to a Fed Funds rate of ~2.94% after the Dec FOMC, compared to ~2.64% at the end of last week.

- Looking ahead, the NY Fed’s Logan (‘23 voter) and the Cleveland Fed’s Mester (voter) will speak later on Thursday at 17:00 and 18:00 respectively, noting that the former will be making closing remarks at an event on MonPol implementation and digital innovation.

- Looking to technical levels, previously identified support and resistance levels remain intact, at $1,807.5/oz (May 18 low) and $1,869.7/oz (May 24 high) respectively.

OIL: Lower In Asia; OPEC Production Commitments In Focus Ahead Of Meeting

WTI and Brent are ~$2.40 softer apiece at typing, off one-week lows made earlier in the session. Both benchmarks came under pressure after a previously flagged FT source report pointed to the potential for an immediate increase in crude production by OPEC heavyweight Saudi Arabia, possibly announced at an OPEC+ meeting later on Thursday.

- To elaborate, the source report outlined that production increases scheduled for Sept ‘22 could be brought forward to Jul and Aug, while highlighting that “Saudi Arabia has indicated to western allies that it is prepared to raise oil production should Russia’s output fall substantially under the weight of sanctions”.

- On previously flagged WSJ source reports re: the exemption of Russia from OPEC+ output targets, RTRS source reports have since suggested that the group is not actively discussing the measure in recent meetings, likely unwinding some of the downward pressure on major crude benchmarks.

- Keeping within the Middle East, BBG source reports have said that U.S. President Joe Biden would “likely” visit Saudi Arabia (among other Gulf Cooperation Council countries) later this month, driving debate re: OPEC-centred efforts to increase crude production.

- Elsewhere, the latest round of U.S. API inventory estimates crossed late on Wednesday, with reports pointing to a larger than expected drawdown in crude stocks, reversing a small build reported last week (although little movement was observed in major crude benchmarks). A decline in gasoline stockpiles was reported as well, while there was a build in distillate and Cushing hub inventories.

- Looking ahead, U.S. EIA inventory data is due later on Thursday (1600 BST), with WSJ estimates calling for a decline in crude and gasoline stockpiles as well.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/06/2022 | 0630/0830 | *** |  | CH | CPI |

| 02/06/2022 | 0900/1100 | ** |  | EU | PPI |

| 02/06/2022 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/06/2022 | 1230/0830 | * |  | CA | Building Permits |

| 02/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 02/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 02/06/2022 | 1230/0830 | ** |  | US | Non-Farm Productivity (f) |

| 02/06/2022 | 1400/1000 | ** |  | US | factory new orders |

| 02/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 02/06/2022 | 1445/1045 |  | CA | BOC Deputy Beaudry Economic Progress Report Speech | |

| 02/06/2022 | 1500/1100 | ** |  | US | DOE weekly crude oil stocks |

| 02/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 02/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 02/06/2022 | 1600/1200 |  | US | New York Fed's Lorie Logan | |

| 02/06/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.