-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Pyrrhic Victory

EXECUTIVE SUMMARY

- WEAKENED JOHNSON SCRAPES THROUGH AFTER DAMAGING CONFIDENCE VOTE (FT)

- SWEDEN’S INDEPENDENT MP KAKABAVEH TO ABSTAIN IN KEY NO-CONFIDENCE VOTE

- RBA RAISES CASH RATE TARGET BY 50BP, PROVIDING HAWKISH SURPRISE

- BOJ’S KURODA: ECONOMY ISN’T IN A PLACE APPROPRIATE FOR TIGHTENING (BBG)

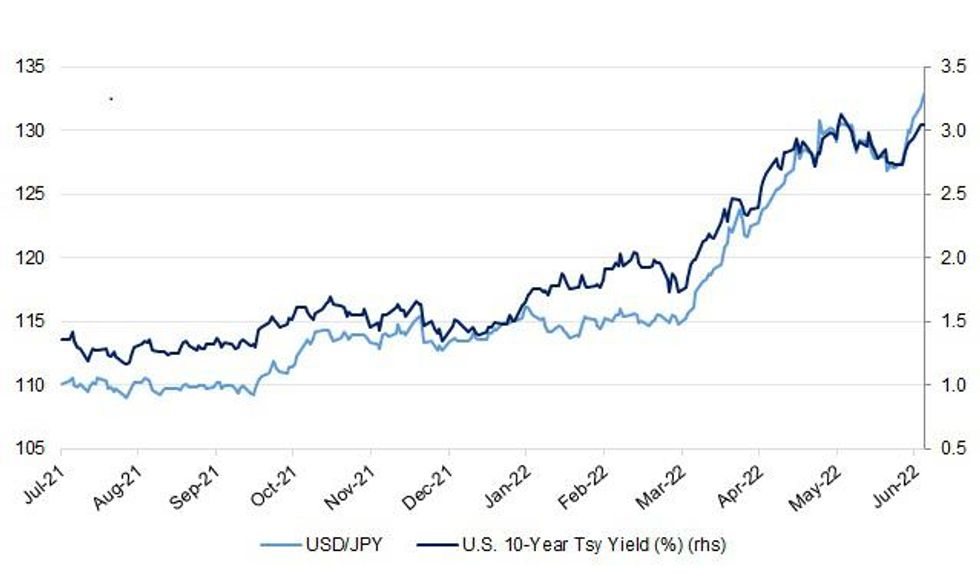

Fig. 1: USD/JPY vs. U.S. 10-Year Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Boris Johnson on Monday night survived a bruising confidence vote, but his victory by 211 to 148 in a ballot of Tory MPs left him badly damaged and exposed the scale of the division and animosity in his party. The result means that 41 per cent of Johnson’s MPs wanted to oust the prime minister. The revolt was more serious than Downing Street had expected and leaves his authority badly damaged. Johnson told MPs his victory would end months of speculation about his future and he would now be able to focus fully on policy delivery, holding out the prospect of future tax cuts. But the confidence vote, triggered after more than 15 per cent of his MPs withdrew their support from him, was accompanied by rancour and withering criticism of the prime minister from his colleagues. (FT)

POLITICS: Tory rebels have vowed to keep trying to force Boris Johnson from office, as the prime minister’s allies admitted he was reaching “the beginning of the end” after a devastating result in Monday night’s confidence vote. Several rebel MPs boasted the government whipping operation had been “appalling” and appeared to collapse under the weight of Monday night’s rebellion, meaning Johnson was now on “borrowed time”. The divide between those backing and opposing Johnson threatens to derail Downing Street’s attempts to draw a line under the humiliating episode. (Guardian)

EUROPE

SWEDEN: Amineh Kakabaveh will abstain in today's no-confidence vote in the Riksdag, she told SVT News. This means that Morgan Johansson (S) will be able to remain as Minister of the Interior and Justice, as there will then not be the 175 mandates required to overthrow him. (SVT)

SWEDEN: On Tuesday at noon, the Swedish parliament is scheduled to decide the fate of Justice Minister Morgan Johansson after the far-right Sweden Democrats, backed by three other opposition parties, called for his removal, citing his record tackling violent crime. The deciding vote looks set to fall to independent lawmaker Amineh Kakabaveh, whose vote last year also secured Andersson’s appointment as prime minister. (Politico)

UKRAINE: President Volodymyr Zelenskyi said that Western politicians and the media were beginning to push Ukraine to end the war with a result that was not beneficial for Ukraine, but Zelensky assured that he was not holding such talks with anyone. (Pravda)

UKRAINE: The President of Ukraine Volodymyr Zelenskyi stated that neither he nor Foreign Minister Dmytro Kuleba had been invited to a meeting in Ankara on June 8, at which, in particular, the issues of Black Sea shipping will be considered. (Pravda)

UKRAINE: The Ukrainian government is working on legislation that would designate English as the language of business communication, Prime Minister Denys Shmyhal said late on Monday. "English is now used in business communication throughout the civilized world, so giving it such a status in Ukraine will promote business development, attract investment and accelerate Ukraine's European integration," Shmyhal wrote on the Telegram messaging app without detailing what the law would entail. (RTRS)

U.S.

ECONOMY: U.S. Treasury Secretary Janet Yellen faces a gauntlet of tough questions about how the Biden administration has handled the economy in Congress this week, after admitting she was "wrong" about the path inflation would take. Yellen testifies to the Senate Finance Committee Tuesday and the House of Representatives Ways and Means Committee on Wednesday, thrusting one of the most experienced, yet least political of Joe Biden's advisers into the hot seat as Republicans hammer the president over inflation that has reached 40-year highs. (RTRS)

POLITICS: State police in Michigan have obtained warrants to seize voting equipment and election-related records in at least three towns and one county in the past six weeks, police records show, widening the largest known investigation into unauthorized attempts by allies of former President Donald Trump to access voting systems. The previously unreported records include search warrants and investigators' memos obtained by Reuters through public records requests. The documents reveal a flurry of efforts by state authorities to secure voting machines, poll books, data-storage devices and phone records as evidence in a probe launched in mid-February. (RTRS)

POLITICS: Sen. Joe Manchin (D-W.Va.) told CNN on Monday that he would support raising the age to 21 for gun purchases and "wouldn't have a problem on looking at" a ban on AR-15 style weapons. (Axios)

EQUITIES: The US Securities and Exchange Commission is weighing changes to stock-market rules that could force trading firms to directly compete to execute trades from retail investors, according to people familiar with the matter. A move by the SEC to press major wholesale brokerages to win auctions for orders by mom-and-pop investors would be a major change for the stock market. While nothing has been announced, the change is among those being considered by staff at Wall Street’s main regulator, said the people who asked not to be named discussing the plans which remain private. (BBG)

ENERGY: Power demand in Texas is set to break its all-time record this week, testing the resilience of the grid after generation issues this year and a days-long blackout during a deep freeze in 2021. Extreme weather is increasingly straining power grids across the United States, and regulators are predicting record heat and drought this summer could cause rotating blackouts in several regions. (RTRS)

ENERGY: Just under half of Americans support nuclear power to generate electricity, a waning industry the Biden administration has been trying to revitalize with billions of dollars in public spending as part of a plan to cut U.S. greenhouse gas emissions, a new Reuters/Ipsos poll showed. The poll, conducted last week, found 45% of Americans support nuclear power, 33% oppose it, and 22% are not sure how they feel about it. Of those supporting it, 48% cited energy reliability, 43% cited lower overall pollution, and only 39% said they favor it as a low-carbon energy source. (RTRS)

OTHER

U.S./CHINA: U.S. Trade Representative Katherine Tai on Monday said fighting inflation is a more complicated issue than can be addressed with a "singular focus" on China tariffs, and that it was important to bring a "thoughtful, strategic, deliberate" approach to the U.S.-Chinese trade relationship. Tai, in remarks to the Washington International Trade Association, said inflation was "scary" and hurting Americans' pocketbooks but was a complicated issue with many causes. "The economy is large and there are a lot of pressure points and levers in that economy," Tai said. "If we're going to take on an issue like inflation, and given the seriousness that it requires, then our approach to tools for mitigating and addressing that inflation need to respect that it is a more complicated issue than just tariffs at the border." (RTRS)

U.S./CHINA: President Biden is facing public pressure from America's leading unions on an issue that has divided his top advisers: extending former President Trump's China tariffs on approximately $300 billion worth of Chinese goods. By filing an official comment with the Office of the U.S. Trade Representative Monday evening, union leaders are going public with what they've been saying in private: they expect Biden to keep all of Trump's tariffs in place. "Our government must act in the national interest to strengthen our economy for the future," writes Thomas Conway, the president of the United Steel Workers, in a comment filed on behalf of the Labor Advisory Committee for Trade Negotiations and Trade Policy. (AXIOS)

U.S./CHINA/TAIWAN: A senior Chinese economist at a government-run research group called on authorities to seize Taiwan Semiconductor Manufacturing Co. if the US hits China with sanctions on par with those leveled against Russia. “If the US and the West impose destructive sanctions on China like sanctions against Russia, we must recover Taiwan,” said Chen Wenling, chief economist at the China Center for International Economic Exchanges. The research group is overseen by the National Development and Reform Commission, China’s top economic planning agency. “Especially in the reconstruction of the industrial chain and supply chain, we must seize TSMC.” (BBG)

BOJ: Bank of Japan Governor Haruhiko Kuroda said on Tuesday a weak yen is beneficial for Japan's economy if the currency's moves are not too sharp. But he told parliament that policymakers must be mindful that the yen's declines could have a negative impact on households and smaller firms. (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda says Japan’s economy is still in the middle of a recovery from the pandemic and facing downward pressure from rising commodity prices. “In this situation, monetary tightening is not at all a suitable measure,” Kuroda says in a speech. Top priority is to continue with monetary easing persistently. Necessary to create a virtuous economic cycle between wage increases and price rises. See a rise in inflation expectations and tolerance for price gains, making wage growth a key factor. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki declined on Tuesday to comment on a remark by the Bank of Japan's governor the previous day that households were becoming accepting of price hikes. Suzuki, speaking to reporters after a cabinet meeting, kept up warnings against renewed yen weakening beyond 132 yen to the dollar. (RTRS)

JAPAN: Japan’s prefecture of Hokkaido joined a growing list of entities to pull planned yen bond sales after a jump in borrowing costs. At least seven borrowers have either canceled or tweaked plans to issue yen bonds since a Bank of Japan policy meeting in late April. Spreads on yen notes spiked to the highest in more than a year last week. (BBG)

TAIWAN: It is wrong to label Taiwan's main opposition party the Kuomintang (KMT) as being pro-China as it has always been pro-U.S. and is dedicated to defending the island though also to talking to Beijing, its chairman said in Washington. (RTRS)

NORTH KOREA: Senior government officials of South Korea and the United States had talks here Tuesday on North Korea and pending alliance issues, two weeks after their presidents agreed during a Seoul summit to upgrade Seoul-Washington ties to a “Global Comprehensive Strategic Alliance”. (Yonhap)

NORTH KOREA: The US warned North Korea of a strong punishment if it conducts a nuclear test, as Washington and a United Nations’ watchdog agency have said signs indicate Pyongyang could soon set off its first atomic device since 2017. “There would be a swift and forceful response to such a test,” Deputy Secretary of State Wendy Sherman said in Seoul in a Tuesday meeting with her South Korean counterpart. (BBG)

AMERICAS: The United States believes Mexico is fully committed to the migration initiative that will be rolled out at the Summit of the Americas this week, a senior Biden administration official said on Monday, even though the Mexican President said he was not attending. The Mexican government will be represented at the summit by foreign minister Marcelo Ebrard. In a call with reporters, the official said the participation level at the summit will not be an obstacle in "getting significant business done" at the gathering. (RTRS)

AMERICAS: The United States "understands" Mexico's position on the Summit of the Americas, State Department spokesperson Ned Price said on Monday after Mexico's president made good on a threat to skip the event because all countries in the Western Hemisphere were not invited. Price also defended Washington's decision to exclude Cuba, Venezuela and Nicaragua from the meeting in Los Angeles this week, saying those countries "are not exemplars of democratic governance." (RTRS)

BRAZIL: Brazilian government will offset states that accept to cut ICMS tax on diesel and cooking gas to zero, President Jair Bolsonaro announced in a speech at Presidential Palace. President also proposed to cut PIS/Cofins and Cide taxes on gasoline and ethanol to zero. Measures depend on the Congress approval of a Constitutional Amendment. Exemption and reimbursement to states are temporary and set to be valid until December 31, Economy Minister Paulo Guedes said during the same event. Government did not disclose proposal’s fiscal impact. Govt to use extraordinary revenues that have not yet been included in the budget to pay the subsidies, Guedes said. Bolsonaro also said that federal government proposals depend on state support for a bill that limits to 17% or 18% the ICMS tax to be charged on items such as fuel, public transport and telecommunications.

ARGENTINA: Argentina's government proposed a bill Monday to tax companies that earn "extraordinary income" from the war in Ukraine, a measure that would particularly affect the country's grains industry. The bill aims to levy an additional 15% tax on companies with profits of over 1 billion pesos (about $8.3 million) in 2022 whose profit margin is either more than 10% in real terms or is 20% higher than in 2021. Analysts say sectors like food, energy and agriculture would be most affected, given that Argentina is one of the largest suppliers of grains and meat in the world. (RTRS)

RUSSIA: Russia has imposed personal sanctions on 61 U.S. officials including Treasury Secretary Janet Yellen and Energy Secretary Jennifer Granholm and leading defence and media executives, the Russian foreign ministry said on Monday. (RTRS)

RUSSIA: Russia should not close the U.S. embassy despite the crisis triggered by the war in Ukraine because the world's two biggest nuclear powers must continue to talk, the U.S. ambassador to Moscow was quoted as saying on Monday. (RTRS)

RUSSIA: Russia warned U.S. news organisations on Monday they risked being stripped of their accreditation unless the treatment of Russian journalists in the United States improves, according to three sources with knowledge of the matter. (RTRS)

RUSSIA/IRAN: Russia will not associate itself with the resolution on Iran if it is adopted at the current session of the IAEA Board of Governors. Mikhail Ulyanov, Permanent Representative of Russia to International Organizations in Vienna, announced this on Monday in his Telegram channel . "It is becoming more and more obvious that the intention of the Western participants in the Vienna talks to adopt a resolution on Iran at the current session of the IAEA Board of Governors is very counterproductive for the JCPOA," Ulyanov wrote. "Russia will by no means associate itself with such a resolution." (TASS)

METALS: Peru Justice Minister Felix Chero said a high-level govt commission and church members will travel Tuesday to Las Bambas mine area to restart dialogue between the company and communities. Las Bambas managers to participate in the talks, which should start Thursday, Chero said. (BBG)

METALS: U.S.-based Jane Street Global Trading has sued the London Metal Exchange for $15.3 million following the cancellation of nickel trades on the platform owned by Hong Kong Exchanges and Clearing in March, the Hong Kong bourse said on Tuesday. (RTRS)

CHINA

ECONOMY: China’s economic growth is expected to return to above 5% in the second half of the year, with pro-growth policies kicking in to fill the gap from March to mid-May, the China Securities Journal reported citing analysts from HUAXI Securities. Recent high-frequency data, such as a narrowing decline in crude steel output, rebounding power generation and the vehicle logistics index, show that the resumption of production is accelerating in May, the newspaper said. Growth will recover significantly in Q3, mainly driven by accelerated infrastructure investment, the newspaper said citing analysts. (MNI)

YUAN: The yuan will remain basically stable, supported by the adjustment of the U.S. dollar index, easing of pandemic curbs and growing confidence in China's economic growth, the China Securities Journal reported citing analysts. The Fed's continued tightening of monetary policy has been priced in the market, and U.S. growth is likely to slow gradually, which may weigh on the dollar index, the newspaper said citing analysts from Shanxi Securities. The large trade surplus, net inflow of direct investment, and increase in private forex asset holdings will help keep the yuan at a balanced level, the newspaper said citing Guan Tao, a former forex official. On Monday, the onshore yuan rose above 6.64 against the dollar to hit a nearly month high, the newspaper said. (MNI)

CORONAVIRUS: Shanghai port’s daily container throughput rebounds to over 95% of the normal level, Shanghai Securities News reports, without saying where it got the information. Shanghai’s Pudong airport reported more than 4,400 inbound and outbound cargo flights in May, 74.9% more than April, the report cites the customs as saying. (BBG)

CORONAVIRUS: Beijing inched closer to zero Covid cases Monday as the capital rolled back virus restrictions. The city reported 2 cases, down from 6 on Sunday and the lowest tally since April 22. Life started to return to normal Monday, with public transport resuming in most districts, allowing workers to return to the office. Entertainment facilities like cinemas opened in most areas, with capacity capped at 75%, while restaurants were allowed to offer dining in. Residents are allowed to move about freely as long as they have a negative Covid test result within the past 72 hours. The previous requirement was 48 hours. (BBG)

CORONAVIRUS: The Universal Beijing Resort said on Tuesday it will reopen on June 15 after being closed more than a month to comply with China's COVID-19 prevention measures, but it will cap the number of visitors at no more than 75% of capacity. The resort, which includes a retail district, two hotels and the Universal Studios theme park, was shut on May 1. After it reopens, all visitors must show a negative PCR test taken within the past 72 hours and wear masks at all times, in line with city-wide measures. The resort will also test its employees daily and carry out regular disinfection, it added. (RTRS)

FISCAL/INFRASTRUCTURE: China should accelerate fiscal spending on infrastructure projects, and relax restrictive policies on real estate for homebuyers and developers to help release potential credit demand, wrote Lian Ping, dean of Zhixin Investment Research Institute in an article published by Yicai.com. The launch of infrastructure projects requires matching funds, mainly medium and long-term borrowing by enterprises, said Lian. Local authorities should lift home purchase limits and increase mortgage quotas to boost home sales, as the real estate downturn has greatly restrained consumption and investment and led to shrinking financing needs of various sectors, said Lian. (MNI)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.1000% at 9:42 am local time from the close of 1.6479% on Monday.

- The CFETS-NEX money-market sentiment index closed at 41 on Monday vs 42 on June 2.

PBOC SETS YUAN CENTRAL PARITY AT 6.6649 TUES VS 6.6691

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.6649 on Tuesday, compared with 6.6691 set on Monday.

OVERNIGHT DATA

JAPAN APR HOUSEHOLD SPENDING -1.7% Y/Y; MEDIAN -0.6%; MAR -2.3%

JAPAN APR, P LEADING INDEX CI 102.9; MEDIAN 102.5; MAR 100.8

JAPAN APR, P COINCIDENT INDEX 96.8; MEDIAN 97.4; MAR 96.8

JAPAN APR LABOUR CASH EARNINGS +1.7% Y/Y; MEDIAN +1.5%; MAR +2.0%

JAPAN APR REAL CASH EARNINGS -1.2% Y/Y; MEDIAN -1.6%; MAR +0.6%

AUSTRALIA ROY MORGAN WEEKLY CONSUMER CONFIDENCE 87; PREV 90.7

Consumer confidence dropped 4.1% last week, most likely on cost-of-living concerns as inflation expectations rose to 5.7%, its highest weekly reading since early April. Consumers are especially pessimistic about the current economic outlook and their current financial circumstances. Confidence dropped a similar amount for both consumers paying off their home loan as well as for those who own their home: 6.2% and 6.5%, respectively. Among the major states, confidence dropped sharply in NSW and Queensland by 7.5% and 7.2%, respectively. Confidence dropped 1.0% in Victoria and 0.5% in WA but increased 7.9% in SA. (ANZ)

NEW ZEALAND MAY ANZ COMMODITY PRICE -2.8% M/M; APR -1.9%

SOUTH KOREA MAY FOREIGN RESERVES $447.71BN; APR $449.30BN

UK MAY BRC SALES LIKE-FOR-LIKE -1.5%; APR -1.7%

MARKETS

SNAPSHOT: Pyrrhic Victory

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 67.6 points at 27983.49

- ASX 200 down 104.974 points at 7101.3

- Shanghai Comp. up 15.629 points at 3252.001

- JGB 10-Yr future down 23 ticks at 149.47, yield unch. at 0.245%

- Aussie 10-Yr future down 5 ticks at 96.46, yield up 4.9bp at 3.533%

- U.S. 10-Yr future -0-02 at 117-27+, yield up 0.74bp at 3.047%

- WTI crude up $0.81 at $119.31, Gold up $0.42 at $1841.84

- USD/JPY up 98 pips at Y132.87

- WEAKENED JOHNSON SCRAPES THROUGH AFTER DAMAGING CONFIDENCE VOTE (FT)

- SWEDEN’S INDEPENDENT MP KAKABAVEH TO ABSTAIN IN KEY NO-CONFIDENCE VOTE

- RBA RAISES CASH RATE TARGET BY 50BP, PROVIDING HAWKISH SURPRISE

- BOJ’S KURODA: ECONOMY ISN’T IN A PLACE APPROPRIATE FOR TIGHTENING (BBG)

BOND SUMMARY: ACGBs Take Beating From Hawkish RBA Hike, Curve Flattens

Cross-asset impetus and the RBA provided the main driving forces of Tuesday's Asia-Pac session. Core FI came under light pressure in early trade, as USD/JPY renewed two-decade highs with BoJ Gov Kuroda beating the drum for continued powerful monetary easing, which weighed on Tsy futures (typically strongly inversely correlated with USD/JPY). The RBA then jumped into the driving seat, providing a hawkish surprise with a 50bp hike to the cash rate target, which was predicted by just three out of 29 economists in the Bloomberg survey (most were looking for a 25bp hike, some for a 40bp move). Market pricing based on meeting-dated OIS was also leaning towards a 25bp move.

- Cash ACGBs ground lower from the off, catching up with overnight moves in U.S. Tsys and following the broader trend in core FI, before the RBA decision inspired a fresh round of aggressive sales. Yields soared as the curve bear flattened, they last sit 5.8-16.8bp higher, with 3-year yield stabilising just shy of the 3.16% session high. Futures sank in reaction to the outsized cash rate target hike, YM trades -16.5 & XM -7.5. Bills run 19-37 ticks lower through the reds.

- Aforementioned fallout from yen sales saw T-Notes lose some altitude, with the RBA announcement capping subsequent recovery attempt. When this is being typed, TYU2 changes hands -0-03 at 117-26+, off post-RBA low of 117-22+. Eurodollar futures trade 0.25-2.0 ticks lower through the reds. The yield curve runs flatter in cash trade, driven by short-end weakness. Monthly trade balance & 3-Year debt supply will take focus in NY hours.

- JGB futures followed their core FI peers lower and last deal at 149.46, 24 pips south from previous settlement. Cash curve is tad steeper as 30s remain on the back foot after an auction for that tenor, even as the low price matched expectations (98.75). Dovish comments from Kuroda-san may have countered the impact of RBA matters. Local data failed to move the needle for JGBs, as earnings growth topped forecasts but the contraction in spending proved deeper than expected.

JGBS AUCTION: Japanese MOF sells Y726.5bn 30-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y726.5bn 30-Year JGBs:

- Average Yield: 1.049 % (prev. 1.015%)

- Average Price: 98.88 (prev. 99.64)

- High Yield: 1.055% (prev. 1.026%)

- Low Price: 98.75 (prev. 99.40)

- % Allotted At High Yield: 49.1048% (prev. 97.1524%)

- Bid/Cover: 3.112x (prev. 3.079x)

EQUITIES: Mixed In Asia; Yen Weakness, RBA Hike In Focus

Major Asia-Pac equity indices are mostly higher at typing, broadly tracking a positive lead from Wall St. JPY weakness earlier in the session coincided with selling in Tsy futures after BOJ governor Kuroda pledged to continue with an ultra-easy MonPol stance, with the overall move precipitating sell-offs in Australian, Japanese, and South Korean stocks, as well as U.S. equity index futures.

- The Hang Seng Index sits 0.1% worse off at writing, backing away from fresh nine-week highs made earlier in the session. China-based tech stocks outperformed for a change, with the Hang Seng Tech Index dealing 0.5% firmer at typing - notably less than the NASDAQ Golden Dragon China Index (+5.4%) in Monday’s NY session. Sentiment in China-based tech has been shored up this week by a slew of positive developments, from the re-opening of major Chinese cities, to regulators seemingly ending their crackdown on the sector (taking reference to WSJ reports on Monday re: the apps of Didi Global and two other companies potentially having their apps reinstated to domestic app stores later this week).

- The Nikkei 225 deals 0.6% firmer at typing, with a majority of the index’s constituents registering gains amidst the latest bout of JPY weakness (with USD/JPY hitting 20-year highs).

- The ASX200 deals 1.7% lower at typing, falling by ~0.7% after the RBA raised the cash rate target by 50bp (BBG median 25bp). Minor gains materials and energy-related stocks were unable to offset losses in high-beta technology and healthcare stocks, with the S&P/ASX All Technology Index sitting 2.9% lower at writing, led lower by large-caps Block Inc, REA Group, and Xero Ltd. The “Big 4” banks were all sharply lower following the RBA’s MonPol decision as well, and trade between 1.4% to 2.8% lower at typing.

- U.S. e-mini equity index futures operate a shade above session lows, sitting 0.4% to 0.6% worse off at writing.

OIL: Higher In Asia As China Re-Opening Rolls On; WTI Eyes $120

WTI and Brent are ~$0.60 higher, operating around session highs at typing. Both benchmarks operate a little under highs seen on Monday, with China’s continued lifting of COVID-induced lockdowns helping to boost optimism re: increased energy demand in the coming weeks.

- To elaborate, the easing of COVID-related measures in Beijing and Shanghai have continued, with the latter reporting that its container port is now operating at ~95% of “normal levels”. Traffic bans within both cities have been lifted - as have dining-in restrictions, while nationwide, travel restrictions (such as on “non-essential” overseas travel) are also widely expected to be lifted at some point, However, focus has shifted to rising case counts in other areas - particularly in China’s Inner Mongolia (69 cases for Monday out of 124 nationwide) and Dandang City (32 cases).

- Several banks have upgraded their forecast for major oil benchmarks, with many citing expectations for Russian crude output to decline further in the coming months, mixing with a rebound in the outlook for Chinese oil demand.

- Turning to the U.S., debate re: demand destruction continues to run hot as an estimated (by the AAA) >20% of gas stations nationwide are charging >$5/gallon for gasoline (the pre-’22 record was $4.11/gallon).

- Fuel subsidies/tax cuts across several countries (such as South Africa, Indonesia, and Mexico) are however helping to tamp down wider demand destruction worry, although the fiscal cost of such measures have raised questions over their sustainability.

GOLD: Struggling To Stay Above $1840

Gold is struggling to stay above $1840, as cross asset signals weigh.

- To recap, Gold broke back below $1850 post yesterday's Asia close. We found support just above $1840, but we have been below this level today.

- Broadly stronger USD sentiment, driven by higher yields, is weighing on gold sentiment.

- Notably, real US yields have bounced nicely over the past 10 days or so. We are now back to +28bps up from the recent low +11bps.

- The precious metal hasn't received much support from weaker US equity futures today.

- Note if we see further downside the market may look at early June lows, just under $1830.

FOREX: Kuroda Adds Fuel To Yen Sell-Off, Stealing Show From Hawkish RBA

There was already good demand for USD/JPY ahead of the Tokyo open, with BBDXY climbing past yesterday's high in tandem with the pair. BoJ Gov Kuroda then rubbed salt into the yen's wounds as he reaffirmed commitment to ultra-loose monetary policy centred around the YCC framework and noted that tightening remains a distant prospect. A barrage of comments from Japanese financial officials stressing the importance of stability in FX markets did little to help the yen.

- Spot USD/JYP refreshed its two-decade highs, running as high as to Y132.75 at one point, as the Japanese currency cemented its position as the worst G10 performer. With the spot rate creeping higher, further topside momentum emerged behind USD/JPY 1-month risk reversal, which swung above parity on Monday. Demand for calls has been building anew since mid-May, when that risk reversal reached its most bearish levels since March.

- Yen weakness stole the limelight from the much awaited RBA monetary policy decision. Australian policymakers wrongfooted markets with a half-point hike to the cash rate target, even as sell-side consensus called for a 25bp move. The resultant bid in AUD was generally rather short-lived. Both AUD/USD and AUD/JPY promptly unwound their post-RBA gains, although AUD/NZD remained on the front foot after lodging a new four-year high.

- U.S. trade balance & German factory orders as well as comments from Riksbank's Ingves & ECB's Wunsch take focus from here.

FOREX OPTIONS: Expiries for Jun07 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0525-45(E1.3bln), $1.0600(E1.4bln), $1.0700(E612mln), $1.0730-35(E1.4bln), $1.0780-00(E731mln)

- USD/JPY: Y127.50($1.2bln), Y128.90-00($567mln), Y129.95-15($686mln), Y131.00($531mln)

- GBP/USD: $1.2600-15(Gbp537mln)

- EUR/GBP: Gbp0.8650(E501mln)

- EUR/JPY: Y136.80-00(E581mln)

- AUD/USD: $0.7220-25(A$561mln)

- NZD/USD: $0.6445(N$546mln)

- USD/CAD: C$1.2695(C$610mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 07/06/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 07/06/2022 | 0700/0900 | ** |  | ES | Industrial Production |

| 07/06/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 07/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Services PMI (Final) |

| 07/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/06/2022 | 1230/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/06/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 07/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 07/06/2022 | 1400/1000 | * |  | CA | Ivey PMI |

| 07/06/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

| 07/06/2022 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.