-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Chinese Equities Play Game Of Two Halves

EXECUTIVE SUMMARY

- JOHNSON PLANS LAW TO OVERRIDE BREXIT DEAL IN TEST OF STRENGTH (BBG)

- POLLS SHOW MACRON CANNOT BE SURE OF WINNING ABSOLUTE MAJORITY IN LEGISLATIVE ELECTION

- U.S. TSY SEC YELLEN: INFLATION TO STAY HIGH, BIDEN LIKELY TO UP FORECAST (RTRS)

- NORTH KOREA MAY CONDUCT NUCLEAR TEST ON FRIDAY OR BY JUNE 20 (SBS)

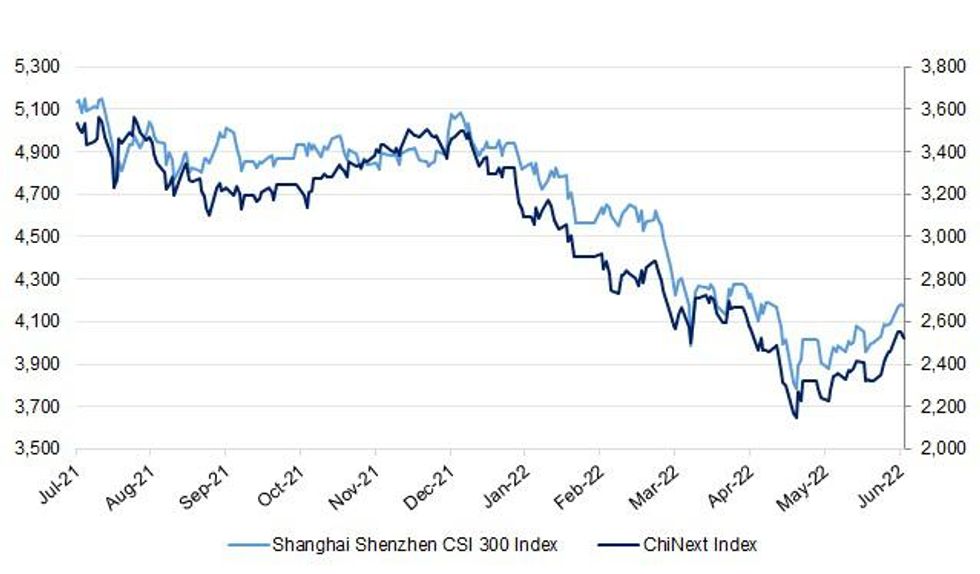

- CHINA EQUITIES LOSE STEAM, UNWIND INITIAL UPSWING

Fig. 1: Shanghai Shenzhen CSI300 Index (CSI300) & ChiNext Index (CNT)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson plans to press ahead with legislation to override parts of the Brexit deal, three people familiar with the matter said, a move that risks inflaming tensions with some of his MPs and with the European Union. The draft bill may be presented to the House of Commons as soon as Thursday, though the timing may slip, the people said on condition of anonymity. Officials signaled last month the government was eyeing the fortnight following June 6 to introduce the legislation. (BBG)

POLITICS/ECONOMY: Senior Conservatives from across the party have renewed calls for Boris Johnson to implement urgent tax cuts as Downing Street played down the prospects of a shift in policy. A string of high-profile MPs, from Steve Baker on the party’s right wing to Damian Green on its left, have backed a fresh demand from the Adam Smith Institute for the government to reduce the tax burden. (Guardian)

TRANSPORT: Strike action by rail workers on three days later this month will lead to a complete shut-down of Britain's train network, their union said on Tuesday in what it billed as the biggest industrial action in the rail sector in more than 30 years. The Rail, Maritime and Transport Workers union said more than 50,000 workers would walk out on June 21, 23 and 25 in a row over pay freezes and job cuts. It said London Underground workers would also strike on June 21 as part of a separate dispute over pensions and job losses. (RTRS)

EUROPE

EU: European Parliament lawmakers vote Wednesday on whether to mandate an end to the sale of new gasoline and diesel cars and vans from 2035. The revision of car and van CO2 standards legislation is a critical part of the Commission’s Fit for 55 package and aims to put the industry, which accounts for a fifth of the bloc's greenhouse gas emissions, on track to meet the EU's long-term 2050 climate targets. But industry and MEPs from some carmaking countries are pushing for a stay of execution for combustion engines, arguing that's needed to keep plug-in hybrid models alive. On Wednesday, lawmakers can either vote with the European Commission — and the Parliament's agreed draft report from the environment committee — that mandates all new cars and vans sold from 2035 must be zero emissions. Or they can support a counter proposal from the center-right European People's Party to amend that reduction down to 90 percent with no fixed phaseout date. In a chamber of 705 deputies, officials agree the winning margin is likely to be no more than 15 votes. (Politico)

GERMANY: Germany's economy and climate ministry will present a package of measures to speed up the expansion of wind energy, documents reviewed by Reuters showed on Wednesday, as the country turns to renewables to cut its use of Russian fossil fuels. The new law will impose binding area targets for onshore wind energy expansion on the federal states and will open landscape protection areas for wind energy "to an appropriate extent" in each state. (RTRS)

FRANCE: The centrist camp of French President Emmanuel Macron is not guaranteed to win an absolute majority in this month's legislative elections, two polls showed on Tuesday. (RTRS)

FRANCE: Health workers demonstrated in cities across France on Tuesday to demand higher pay and more staff for services stretched to breaking point, just days before the country votes in parliamentary elections. Although recently re-elected, President Emmanuel Macron has ordered a probe into which emergency units need immediate help with people in the sector warning there is no time to lose. (France24)

CZECHIA: On Wednesday, President Miloš Zeman will appoint three new members of the Czech National Bank's policy board at Prague Castle. The ČTK agency received notification of the date of appointment from the presidential office. According to HN sources, economists Eva Zamrazilová, Karina Kubelková and Jan Frait will join the central bank's top management. (HN)

UKRAINE: The European Parliament will recommend that the EU heads of state and government, who meet at the summit on June 23-24, grant Ukraine the status of a candidate country for EU membership and purchase weapons for Ukraine to repel Russian aggression. (Ukrinform)

UKRAINE: The World Bank's executive board approved $1.49 billion of additional financing for Ukraine on Tuesday to help pay wages for government and social workers, expanding the bank's total pledged support to over $4 billion. The World Bank said in a statement that the latest funding is supported by financing guarantees from Britain, the Netherlands, Lithuania and Latvia. The project is also being supported by parallel financing from Italy and contributions from a new Multi-Donor Trust Fund. (RTRS)

UKRAINE: Ukraine is launching a "Book of Executioners", a system to collate evidence of war crimes Kyiv says were committed during Russia's occupation, President Volodymyr Zelenskiy said on Tuesday. Ukrainian prosecutors say they have registered more than 12,000 alleged war crimes involving more than 600 suspects since the Kremlin started its offensive on Feb. 24. (RTRS)

UKRAINE: Radiation detectors in the Exclusion Zone around Ukraine's defunct Chornobyl nuclear power plant are back online for the first time since Russia seized the area on Feb. 24, and radiation levels are normal, the U.N. nuclear watchdog said on Tuesday. (RTRS)

UKRAINE: Russia drew closer to its goal of fully capturing Ukraine’s eastern industrial heartland of coal mines and factories as the Kremlin claimed to have taken control of 97% of one of the two provinces that make up the Donbas region. Russian Defense Minister Sergei Shoigu said Tuesday that Moscow’s forces hold nearly all of Luhansk province. And it appears that Russia now occupies roughly half of Donetsk province, according to Ukrainian officials and military analysts. (AP)

U.S.

FED: President Joe Biden’s nomination of Michael Barr as vice chair for supervision at the Federal Reserve has won bipartisan backing, assuring that he will be quickly confirmed by the full Senate. Three GOP members of the Senate Banking Committee -- Pat Toomey of Pennsylvania, Mike Rounds of South Dakota and Cynthia Lummis of Wyoming -- said Tuesday they would back Barr when the panel meets Wednesday to vote on the nomination. (BBG)

ECONOMY: U.S. Treasury Secretary Janet Yellen said it is "virtually impossible" for the United States to insulate itself from oil market shocks such as those caused by Russia's invasion of Ukraine, so it is important to shift toward renewable energy sources. Yellen told the Senate Finance Committee that U.S. oil producers failed to anticipate the recovery in demand and prices following the COVID-19 pandemic, but they now have incentives to increase production. (RTRS)

ECONOMY: U.S. Treasury Secretary Janet Yellen told senators on Tuesday that she expected inflation to remain high and the Biden administration would likely increase the 4.7% inflation forecast for this year in its budget proposal. During a Senate Finance Committee hearing, Yellen said that the United States was dealing with "unacceptable levels of inflation," but that she hoped price hikes would soon begin to subside. Yellen repeatedly rejected Republican assertions that inflation was being fueled by Biden's $1.9 trillion American Rescue Plan (ARP) COVID-19 spending legislation last year. "We're seeing high inflation in almost all of the developed countries around the world. And they have very different fiscal policies," Yellen said. "So it can't be the case that the bulk of the inflation that we're experiencing reflects the impact of the ARP." (RTRS)

FISCAL: U.S. Treasury Secretary Janet Yellen on Tuesday urged Congress to approve $80 billion in funding for the Internal Revenue Service to help the agency reduce a huge backlog of tax returns and allow it to go after $600 billion in unpaid tax bills. "The IRS is under siege. It is suffering from huge underinvestment," Yellen told a Senate Finance Committee hearing on Treasury's budget request for fiscal 2023. Yellen said the agency was dealing with massive problems, including a "huge backlog" in working through tax returns, and lacked the personnel needed to carry out complicated audits of higher-earning taxpayers. (RTRS)

POLITICS: The U.S. House of Representatives' Oversight Committee said on Tuesday it had opened an investigation into what it called former President Donald Trump's failure to account for gifts received from foreign government officials. (RTRS)

ENERGY: U.S. power consumption was on track to rise to record highs in 2022 and 2023 as the economy grows, the U.S. Energy Information Administration (EIA) said in its Short Term Energy Outlook (STEO) on Tuesday. The EIA projected power demand will climb to 4,010 billion kilowatt-hours (kWh) in 2022 and 4,019 billion kWh in 2023 from 3,930 billion kWh in 2021. That compares with an eight-year low of 3,856 billion kWh in 2020, depressed by the pandemic, and an all-time high of 4,003 billion kWh in 2018. (RTRS)

EQUITIES: Elon Musk's efforts to arrange new financing that will limit his cash contribution to his $44 billion acquisition of Twitter Inc have been put on hold because of the uncertainty surrounding the deal, people familiar with the matter said. Musk has been in discussions to arrange $2 billion to $3 billion in preferred equity financing from a group of private equity firms led by Apollo Global Management Inc that would further reduce his cash contribution, according to the sources. These conversations are now on hold until there is clarity about the future of the acquisition, one of the sources said. (RTRS)

OTHER

WORLD BANK: The World Bank on Tuesday slashed its global growth forecast by nearly a third to 2.9% for 2022, warning that Russia's invasion of Ukraine has compounded the damage from the COVID-19 pandemic, and many countries now faced recession. The war in Ukraine had magnified the slowdown in the global economy, which was now entering what could become "a protracted period of feeble growth and elevated inflation," the World Bank said in its Global Economic Prospects report, warning that the outlook could still grow worse. (RTRS)

AUSTRALIA: Australian Prime Minister Anthony Albanese said his government would consider new policies to combat pressures from rising inflation and interest rates, after the country’s Reserve Bank announced its biggest rate rise since 2000 on Tuesday. Speaking at a press conference in Darwin, Albanese said while the interest rate rise had been expected for some time, it would still be a “blow for families.” “We know that people are suffering from a cost-of-living crisis with everything going up except for their wages,” he said. Albanese said he believed his policies to make childcare more affordable and to lift productivity would help Australians cope. (BBG)

ASIA-PACIFIC: President Joe Biden's special envoy for talks with three tiny but strategically important Pacific island nations will lead a delegation to the Marshall Islands next week amid growing U.S. worries about China's efforts to expand its influence in the region. Joseph Yun, a veteran diplomat appointed by Biden in March, told Reuters he and his team would be in the Marshall Islands from June 14-16. A spokesperson for the U.S. State Department said Yun would hold talks on the Compact of Free Association (COFA) that governs U.S. economic assistance for the Republic of the Marshall Islands (RMI), which is due to expire next year. (RTRS)

JAPAN: Japanese investors sold US Treasuries for the sixth consecutive month in April, underscoring waning appetite for the securities as the Federal Reserve sticks to its aggressive monetary tightening path. The Japanese -- the biggest foreign holder of Treasuries -- sold a net 2.4 trillion yen ($18.1 billion) of the securities in April, in the sixth month of outflows. The last time there was such a long selling stretch by Japan’s funds was in the six months to March 2018, according to the Ministry of Finance data released Wednesday. (BBG)

SOUTH KOREA: Thousands of truck drivers in South Korea have gone on strike at some ports and container depots in the country, threatening to slow the export of goods from the Asian nation, according to the International Transport Workers’ Federation. “The impact of the strike is already being felt at ports, petrochemical complexes, and other logistics hubs,” the ITF said in the statement. (BBG)

SOUTH KOREA: South Korea on Wednesday lifted the mandatory seven-day self-isolation period for all international arrivals in the latest move to return to pre-pandemic normalcy amid a downtrend in COVID-19 cases. (Yonhap)

NORTH KOREA: South Korea assesses North Korea is highly likely to conduct a nuclear test Friday or by no later than June 20 when the rainy season begins, SBS TV reported, citing a South Korean government source. South Korea’s assessment is based on information such as signs of preparation, the weather at Punggye-ri test site and internal circumstances in North Korea. (BBG)

NORTH KOREA: Defense leaders from South Korea, the United States and Japan meet in Singapore amid heightened tensions on the Korean Peninsula due to signs that North Korea's seventh nuclear test is imminent. Defense Minister Lee Jong-seop will attend the 19th Asian Security Conference ('Shangri-La Dialogue') to be held in Singapore for three days starting the day after tomorrow (10th). It is said that they have prepared an agenda and message in case North Korea conducts its 7th nuclear test during this meeting. (SBS)

AMERICAS: U.S. Vice President Kamala Harris has pooled $3.2 billion in corporate pledges aimed at addressing some of the economic factors driving migration from Central America, her office said on Tuesday, lending impetus to measures to be discussed at the Summit of the Americas this week. The latest round of corporate investments announced by Harris are intended to create jobs, expand access to the internet and bring more people into the formal banking system. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro on Tuesday cast doubt on the 2020 election victory of U.S. President Joe Biden, just two days before they are due to meet for the first time during the Summit of the Americas. Bolsonaro, an outspoken admirer of former President Donald Trump, said in a TV interview that he still harbors suspicions about Biden's victory and he again praised Trump's government. "The American people are the ones who talk about it (election fraud). I will not discuss the sovereignty of another country. But Trump was doing really well," Bolsonaro said. "We don't want that to happen in Brazil," he added. (RTRS)

BRAZIL: Former Brazilian President Luiz Inacio Lula da Silva, the leftist frontrunner ahead of an October election, is looking at ways to reverse President Jair Bolsonaro's planned privatization of state-run electricity company Eletrobras, his advisers say. Lula's aides said the transaction shifting majority control of the power company to private investors, scheduled for Thursday, will be short-lived if he has his way. But many legal and financial experts said the privatization deal has many built-in safeguards that will make it hard to unwind once it goes through. (RTRS)

BRAZIL: Brazilian President Jair Bolsonaro said on Tuesday that Supreme Court Justice Edson Fachin, the country's top electoral authority, committed "rape against Brazilian democracy" by meeting with foreign diplomats to brief them on upcoming elections in the country. Last month, Fachin, head of Brazil's Electoral Court (TSE), invited international organizations to send observers to monitor the October elections, which Bolsonaro has criticized, asserting that the electronic voting machines are not reliable. His government opposed the invitation of European Union observers. (RTRS)

CHILE: Chile’s central bank slowed the pace of monetary tightening for the second consecutive meeting and said it would lower the magnitude of hikes ahead to bring inflation back to target. The bank board, led by Rosanna Costa, lifted the overnight rate by 75 basis points to 9% Tuesday, as forecast by nine of 15 economists in a Bloomberg survey. Six other analysts projected a hike of a full percentage point. Policy makers have now raised borrowing costs by a total of 850 basis points since July. (BBG)

RUSSIA: The U.S. Treasury Department has banned U.S. money managers from buying any Russian debt or stocks in secondary markets, on top of its existing ban on new-issue purchases, in its latest sanctions on Moscow over its invasion of Ukraine. Despite Washington's sweeping sanctions in recent months, Americans were still allowed to trade hundreds of billions of dollars worth of assets already in circulation on secondary markets. (RTRS)

RUSSIA: Russian Ambassador to the United States Anatoly Antonov warned of Moscow 's retaliatory measures against possible American deliveries of long-range missiles to Ukraine. “If the Americans decide to supply long-range missiles [to Ukraine ], then I have no doubt that the Russian side will take adequate steps to protect our territory from a possible attack,” the ambassador said on Channel One. (Izvestia)

RUSSIA: Russia's only aircraft carrier, the Admiral Kuznetsov, has suffered another repair delay and will not reenter service until 2024 at the earliest, Tass quoted a defence source as saying on Tuesday. (RTRS)

RUSSIA: Russian Foreign Minister Sergei Lavrov will meet in Ankara with his Turkish counterpart Mevlut Cavusoglu on Wednesday. And although the main topic of negotiations will be the unblocking of supplies of Ukrainian wheat through the ports on the Black Sea, it will not do without the traditional regional agenda. The meeting will take place against the backdrop of Ankara's statements about the preparation of a Turkish military operation in northern Syria. But if earlier Moscow was sharply opposed to Turkey's similar intentions, now its reaction looks surprisingly calm. Perhaps this is partly due to the fact that the balance of power in this Syrian province may change. (Kommersant)

RUSSIA: The air forces of Russia and Syria conducted a joint drill over the war-torn country Tuesday, the first since Russia’s invasion of Ukraine began more than three months ago, Syria’s Defense Ministry said. (AP)

TURKEY: Turkish Defence Minister Hulusi Akar told Russian counterpart Sergei Shoigu in a call on Tuesday that Turkey would respond to moves aimed at disrupting stability in northern Syria, his office said, as Ankara gears for talks with Moscow ahead of an expected offensive in the region. (RTRS)

IRAN: The United States on Tuesday blamed Iran for both sides' failure so far to reach an agreement on reviving the 2015 Iran nuclear deal, saying Iran's demands on sanctions-lifting were preventing progress. "What we need is a willing partner in Iran. In particular, Iran would need to drop demands for sanctions lifting that clearly go beyond the JCPOA and that are now preventing us from concluding a deal," a U.S. statement to a meeting of the U.N. nuclear watchdog's Board of Governors said, referring to the 2015 deal by its name, the Joint Comprehensive Plan of Action. (RTRS)

METALS: Bolivia has narrowed to six from eight the list of competing foreign firms vying to tap its vast lithium resources, energy minister Franklin Molina said on Tuesday, part of the country's most ambitious effort yet to extract the metal. Bolivia has the world's largest resources of lithium, the ultra-light metal key to making batteries for electric vehicles, but has struggled for decades to mine them commercially. (RTRS)

ENERGY: Qatar has picked Exxon Mobil Corp, TotalEnergies SE, Royal Dutch Shell and ConocoPhillips as partners in the expansion of the world's largest liquefied natural gas (LNG) project, people with knowledge of the matter said on Tuesday. The North Field expansion will boost Qatar's LNG output by 64% by 2027, strengthening its position as the world's top LNG exporter and help to guarantee long term supply of gas to Europe. (RTRS)

OIL: The European Union’s ban on seaborne imports of Russian oil will lead to an 18% drop in the country’s fuel output by the end of next year, according to the Energy Information Administration. Production of liquid fuels will drop to 9.3 million barrels a day in the fourth quarter of 2023 from 11.3 million in the first quarter of this year, the US government agency said in a monthly report. (BBG)

CHINA

ECONOMY: China’s southern tech hub of Shenzhen wants to double the value of its existing chip sector within three years as part of a broader push to improve the country’s self-sufficiency in core technologies. Shenzhen, known as China’s Silicon Valley, announced a plan to build “an influential cluster” for the semiconductor industry by 2025, including the development of leading national capabilities in manufacturing, packaging and testing of chips. By 2025, Shenzhen aims to develop a semiconductor industry that can bring in 250 billion yuan (US$37.5 billion) in annual sales, compared to the 110 billion yuan in revenue last year, according to an action plan jointly issued on Monday by the Shenzhen Development and Reform Commission and other local authorities. (SCMP)

ECONOMY: China’s entertainment regulator released its second batch of game approvals this year following a seven-month freeze, in a step toward normalization in China’s internet sector. The approval of 60 new titles by the National Press and Publication Administration marks an acceleration from April’s 45 and includes entries from studios like Genshin Impact creator MiHoYo Co. China’s two powerhouse games publishers, Tencent Holdings Ltd. and NetEase Inc., were notably absent from both lists, but analysts see their prospects for approval improving as well. (BBG)

ECONOMY: China’s Ministry of Commerce will “do its best” to help exporters secure orders, ministry official Li Xingqian says at a briefing. Number of foreign orders that Chinese exporters lost is manageable; impact is limited. (BBG)

FISCAL: China will extend value-added tax refunds to seven new sectors including wholesale and retail sales, agriculture, accommodation and catering to facilitate the cash flow of enterprises and help stabilise employment, Yicai.com reported citing a statement by the Ministry of Finance on Monday. This new round of tax refunds will total CNY142 billion, starting July 1 and aims to be completed by end-July, Yicai said. China's value-added tax refunds are expected to total CNY1.64 trillion this year. (MNI)

POLITICS: China is offering rewards of more than US$15,000 for citizens who report actions deemed a threat to national security, as the ruling Communist Party ramps up law enforcement ahead of its twice-a-decade national congress. The Ministry of State Security on Monday said a new regulation setting out criteria for the rewards had been introduced with immediate effect. Anyone who reports a clear target or verifiable lead for actions not already known to the state and considered damaging to national security will be eligible for a reward once it is confirmed by investigators. (SCMP)

ENERGY: China has issued 4.5 million tonnes of quotas for refined fuel exports, sources told Reuters on Tuesday, a top-up to the first issue for 2022 to ease high domestic inventories as demand was dented by COVID-19 lockdowns. Beijing wants to discourage refiners from pumping surplus fuel, an act seen by the government as derailing its long-term emission battle, by slashing quotas for export.But the widespread COVID-19 lockdown, starting in March across several Chinese cities, has hammered Chinese fuel consumption and forced refiners to scale back production amid swelling product inventory. (RTRS)

FOREX: China’s foreign exchange reserves are likely to remain stable with less yuan depreciation pressure as supply and demand in the forex market are basically balanced, the China Securities Journal reported citing analysts. China’s forex reserves rose by USD8.1 billion month on month to amount USD3.13 trillion by end-May, the newspaper said citing data by the State Administration of Foreign Exchange. The stability of the forex market and reserves will be supported by a relatively high trade surplus, the recent resumption in net capital inflows as well as a likely falling U.S. dollar index and U.S. Treasury yields in the near term, the newspaper said citing analysts. (MNI)

FOREX: China will extend trading hours of interbank forex market as part of measures to further open up its financial market, Zhou Yu, an official with PBOC’s International Department, says at a briefing. Zhou didn’t give details about the planned trading hour extension. China will also simplify procedures for overseas investors to access Chinese market, Zhou says. (BBG)

FIXED INCOME: China should consider issuing special treasury bonds or front-load next year’s local government special bond quota in the second half of this year to help fund infrastructure investment, the China Securities Journal reported citing analysts. China aims to issue all CNY3.65 trillion of this year’s special bonds by end-June to help accelerate infrastructure construction, leaving a funding gap in H2, the newspaper said. Other potential policies to fill the gap include increasing the credit lines of policy banks, lowering the reserve requirement ratio, or putting forward pledged supplementary lending (PSL), the newspaper said citing Xiong Yuan, chief economist of Guosheng Securities. (MNI)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8161% at 9:48 am local time from the close of 1.6225% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 42 on Tuesday vs 41 on Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.6634 WEDS VS 6.6649

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.6634 on Wednesday, compared with 6.6649 set on Tuesday.

OVERNIGHT DATA

JAPAN Q1, F GDP ANNUALISED SA -0.5% Q/Q; MEDIAN -1.1%; FLASH -1.0%

JAPAN Q1, F GDP SA -0.1% Q/Q; MEDIAN -0.3%; FLASH -0.2%

JAPAN Q1, F GDP DEFLATOR -0.5% Y/Y; MEDIAN -0.4%; FLASH -0.4%

JAPAN Q1, F GDP PRIVATE CONSUMPTION +0.1% Q.Q; MEDIAN +0.0%; FLASH +0.0%

JAPAN Q1, F BUSINESS SPENDING -0.7% Q/Q; MEDIAN +0.3%; FLASH +0.5%

JAPAN Q1, F INVENTORY CONTRIBUTION % GDP 0.5%; MEDIAN 0.2%; FLASH 0.2%

JAPAN Q1, F NET EXPORTS CONTRIBUTION % GDP -0.4%; MEDIAN -0.4%; FLASH -0.4%

JAPAN APR BOP CURRENT ACCOUNT BALANCE Y501.1BN; MEDIAN Y524.5BN; MAR Y2,549.3BN

JAPAN APR BOP CURRENT ACCOUNT ADJUSTED Y511.5BN; MEDIAN Y399.2BN; MAR Y1,555.9BN

JAPAN APR TRADE BALANCE BOP BASIS -Y688.4BN; MEDIAN -Y737.4BN; MAR -Y166.1BN

JAPAN MAY BANK LENDING INCL TRUSTS +0.7% Y/Y; APR +0.9%

JAPAN MAY BANK LENDING EX-TRUSTS +0.9% Y/Y; APR +1.0%

JAPAN MAY BANKRUPTCIES +11.01% Y/Y; APR +1.88%

JAPAN MAY ECO WATCHERS SURVEY CURRENT 54; MEDIAN 52.0; APR 50.4

JAPAN MAY ECO WATCHERS SURVEY OUTLOOK 52.5; MEDIAN 51.5; APR 50.3

SOUTH KOREA Q1, P GDP +3.0% Y/Y; MEDIAN +3.1%; Q4 +3.1%

SOUTH KOREA Q1, P GDP SA +0.6% Q/Q; MEDIAN +0.7%; Q4 +0.7%

MARKETS

SNAPSHOT: Chinese Equities Play Game Of Two Halves

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 240.08 points at 28184.81

- ASX 200 up 25.36 points at 7121.1

- Shanghai Comp. down 22.617 points at 3219.146

- JGB 10-Yr future up 6 ticks at 149.57, yield down 0.3bp at 0.245%

- Aussie 10-Yr future up 3 ticks at 96.465, yield down 3.4bp at 3.523%

- U.S. 10-Yr future -0-07+ at 118-06, yield up 2.94bp at 3.003%

- WTI crude up $0.4 at $119.81, Gold down $4.15 at $1848.21

- USD/JPY up 58 pips at Y133.17

- JOHNSON PLANS LAW TO OVERRIDE BREXIT DEAL IN TEST OF STRENGTH (BBG)

- POLLS SHOW MACRON CANNOT BE SURE OF WINNING ABSOLUTE MAJORITY IN LEGISLATIVE ELECTION

- U.S. TSY SEC YELLEN: INFLATION TO STAY HIGH, BIDEN LIKELY TO UP FORECAST (RTRS)

- NORTH KOREA MAY CONDUCT NUCLEAR TEST ON FRIDAY OR BY JUNE 20 (SBS)

- CHINA EQUITIES LOSE STEAM, UNWIND INITIAL UPSWING

BOND SUMMARY: Overhang U.S. Tsy Impetus, Correction Of Post-RBA Slide Underpin ACGB Resilience

Wednesday brought a rebound in ACGBs which appeared keen to recoup some of their post-RBA losses. Headline flow was limited, offering little in the way of notable catalysts to nudge core FI space in any definite direction.

- Cash ACGBs turned bid as correction of their post-RBA sell-off was facilitated by the initial catch-up with overnight strength in U.S. Tsys. When this is being typed, ACGB yields sit 4.5-7.3bp lower in cash Sydney trade, with the curve running steeper. Futures contracts firmed, with YM last +7.0 & XM +4.5, both slightly off session highs. Bills trade 2-13 ticks higher through the reds. There was no reaction to an auction for A$800mn of ACGB Sep '26, which drew a bid/cover ratio of 3.28x (prev. 4.64x).

- T-Notes came under light pressure, grinding further away from their best levesl from Tuesday. TYU2 changes hands -0-06 at 118-07+ at typing, printing fresh session lows. Eurodollar futures run 0.5-2.0 ticks lower through the reds. Cash U.S. Tsy yields firmed a tad and last sit 1.4-2.2bp higher across the curve, with 10-Year yield within touching distance from the 3.0% level.

- JGB futures went offered in tandem with T-Notes. They last trade at 149.56, 5 ticks above previous settlement and close to session lows. Cash JGB yields are generally lower across the curve, but only marginally. Data released out of Japan failed to provoke any response, even as Q1 GDP figures were revised to reflect a smaller contraction. The BoJ conducted its Rinban operations covering 1-3, 3-5, 5-10 & 10-25 Year baskets, which saw the following offer/cover ratios:

- 1- to 3-Year: 2.57x (prev. 2.47x)

- 3- to 5-Year: 1.98x (prev. 2.23x)

- 5- to 10-Year: 2.23x (prev. 2.67x)

- 10- to 25-Year: 2.98x (prev. 4.27x)

AUSSIE BONDS: The AOFM sells A$800mn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 0.50% 21 Sep ‘26 Bond, issue #TB164:

- Average Yield: 3.2491% (prev. 2.9040%)

- High Yield: 3.2550% (prev. 2.9100%)

- Bid/Cover: 3.2812x (prev. 4.6350x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 26.3% (prev. 9.2%)

- Bidders 42 (prev. 40), successful 12 (prev. 10), allocated in full 6 (prev. 5)

EQUITIES: Chinese Tech Pares Gains; Australian Financials Founder Post-RBA

Major Asia-Pac equity indices are mostly higher at typing, mirroring a lead from Wall St. An initial region-wide equity rally led by Hong Kong and Chinese stocks was later reduced on a reversal in the latter, taking most regional benchmarks off of their session highs in the process.

- The Hang Seng Index sits 1.5% firmer at typing, backing away from session highs as initial strength in China-based tech and financials moderated through Asia-Pac dealing. The Hang Seng Tech Index is 2.7% better off (back from session highs at +4.3%), with well-known tech large-caps catching a bid on as worry re: regulatory crackdowns on the sector have continued to ease. To elaborate, authorities on Tuesday approved a second, larger batch of video games for ‘22, lifting sentiment in the tech sector (keeping in mind the crackdown on the sector that began in ‘21), and adding to positive sentiment after previously-flagged reports that regulators were looking to wrap up investigations in Didi Global and other tech companies.

- The CSI300 is 0.4% worse off at typing, sharply flipping from gains of as much as 1.1% to losses on a broad market-wide retreat, and underperformance in the industrials sub-index (-2.5%), led by weakness in major battery manufacturer CATL (-6.8%).

- Equity trading volumes for Chinese stocks crossed CNY1.0tn on two consecutive days this week (Mon and Tue) - the first time this has happened since mid-March, and before the most recent in-country COVID flare-up.

- The Nikkei 225 sits 0.9% higher at writing with some optimism evident, aided by the release of better-than-expected final Q1 GDP figures earlier in the session. Broader JPY weakness again provided a tailwind to Japanese equities as well, with real estate and export-related names leading gains.

- The ASX200 is 0.4% better off at typing, operating a little above worst levels after paring gains from best levels near the open(~+0.9%) . Gains in energy, materials, and technology names were able to offset steep losses in the “Big 4” Australian banks, which each sit 2.6% to 5.6% lower apiece at writing. A note that the underperformance in the latter four comes after the RBA’s surprise 50bp hike on Tuesday, with the ASX200 Financials sub-index now on track for a third-consecutive day of losses, down ~5.3% for the week so far.

- U.S. e-mini equity index futures trade 0.3% to 0.4% lower at typing, operating a little below their respective best levels made late in Tuesday's NY session.

OIL: WTI Holds Near Recent 13-Week Highs; U.S. Inventories Eyed

WTI and Brent deal ~$0.40 firmer apiece at typing, putting them narrowly on track to close higher for the fourth session in five.

- To recap, both benchmarks whipped between gains and losses on Tuesday to ultimately close ~$1 firmer, with WTI struggling to make headway above the $120 handle after backing away from 13-week highs ($120.99) made on Monday.

- Prevailing worry re: tightness in global crude supplies has continued to mix with expectations for a rise in global fuel demand for the remainder of ‘22, helping crude to catch a bid in recent sessions. Adding to the debate, the U.S. EIA has forecast Russian fuel exports to decline by ~18% come end-’23 (~2mn bpd decline in supply), mainly on the EU’s incoming, phased ban on Russian crude.

- Production at Libya’s recently-restarted Sharara oilfield (~280K bpd capacity) has been reportedly halted since late Monday, while ~10% of Norway’s offshore oil and gas workers are due to strike later on Sunday should relevant negotiations fail.

- The latest round of U.S. API crude inventory estimates crossed late on Tuesday, with reports pointing to a surprise build in crude inventories and an increase in gasoline and distillate stockpiles, while Cushing hub stocks declined.

- Looking ahead, U.S. EIA inventory data is due later on Wednesday (1530 BST), with WSJ and BBG estimates pointing to expectations for a drawdown in crude inventories.

GOLD: Weaker In Asia Trading

Gold is edging lower today, down around 0.30% from the NY close, to be back on a $1846 handle.

- Today's weakness is mainly reflective of the rebound in USD sentiment. The DXY is up around 0.25% on the day.

- Firmer US yields haven't helped either, with the 10yr almost back above 3.00% (+2bps since the open).

- Equities have been mixed, opening firmer, but have lost ground as the session progressed. US equity futures are lower.

- Overnight, gold got close to $1856, as the USD weakened and US yields came off. The World Bank lowered its 2022 global growth forecasts, which also reportedly helped demand.

- Note support should still be seen just below $1840 and around the low $1830 level.

FOREX: Yen Weakness Persists, Pullback In Chinese Equities Weighs On Yuan

The initial reprieve provided to Chinese tech space by a suite of new game approvals issued by Beijing did not last long as local equity benchmarks swung into losses, sending reverberations across financial markets. There were no obvious headline drivers behind the turnaround in Chinese stocks, stoking speculation of possible profit-taking. Offshore yuan dropped to fresh session lows in sync with the equity move, creating a drag on the Antipodeans. Spot USD/CNH remained comfortably within the confines of yesterday's range.

- The PBOC pledged to extend trading hours of China's onshore FX market as part of the broader push to open up domestic financial markets.

- Yen weakness remained a key theme amid firm conviction that the BoJ's ultra-loose monetary policy settings are here to stay. EUR/JPY breached the prior day's high ahead of the Tokyo open, resulting in broader yen weakness and facilitating the eventual upswing in USD/JPY to new two-decade highs. Spot USD/JPY last trades ~50 pips better off, with its 1-month risk reversal consolidating near the highest point since May 10.

- Gains vs. the yuan and yen helped the greenback to cement its position as the best G10 performer, with BBDXY rising steadily as the session progressed.

- Final EZ GDP, German industrial output & U.S. wholesale inventories take focus from here.

FOREX OPTIONS: Expiries for Jun08 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0600(E606mln), $1.0650(E658mln), $1.0680-85(E510mln), $1.0750-60(E880mln), $1.0800(E880mln)

- USD/JPY: Y130.00-15($709mln)

- GBP/USD: $1.2450(Gbp702mln)

- EUR/GBP: Gbp0.8585-95(E662mln)

- NZD/USD: $0.6315(A$1.1bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/06/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/06/2022 | 0600/0800 | ** |  | DE | Industrial Production |

| 08/06/2022 | 0600/0700 | * |  | UK | Halifax House Price Index |

| 08/06/2022 | 0645/0845 | * |  | FR | Foreign Trade |

| 08/06/2022 | 0645/0845 | * |  | FR | Current Account |

| 08/06/2022 | 0800/1000 | * |  | IT | Retail Sales |

| 08/06/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 08/06/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 08/06/2022 | 0900/1100 | *** |  | EU | GDP (2nd est.) |

| 08/06/2022 | 0900/1100 | * |  | EU | Employment |

| 08/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 08/06/2022 | 1400/1000 | ** |  | US | Wholesale Trade |

| 08/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 08/06/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.