-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fear And Trembling

EXECUTIVE SUMMARY

- FRENCH, GERMAN AND ITALIAN LEADERS TO MEET WITH ZELENSKY IN KYIV (WSJ)

- MACRON PARTY, LEFT-WING ALLIANCE NECK AND NECK IN FIRST ROUND OF LEGISLATIVE ELECTION

- TORY MPS ATTACK BORIS JOHNSON OVER PLAN TO RIP UP N. IRELAND BREXIT DEAL (FT)

- CHINA IS WALKING BACK VIRUS LOOSENING JUST WEEKS AFTER REOPENING (BBG)

- LDP POLICY CHIEF TAKAICHI: “NOW IS NOT THE TIME” FOR FX INTERVENTION (Nikkei)

- USD/JPY BREAKS ABOVE Y135, 10-YEAR JGB YIELD BREACHES BOJ'S 0.25% CAP

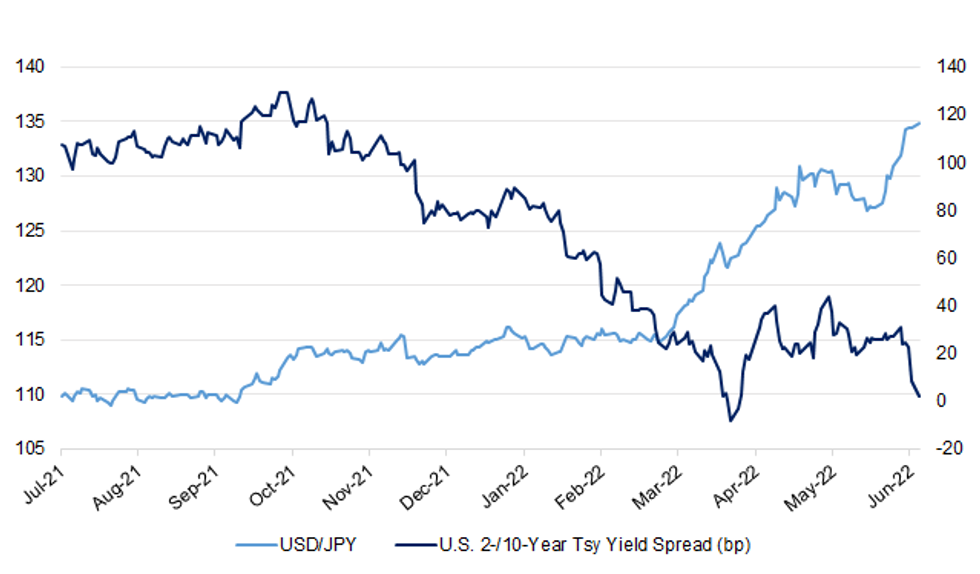

Fig. 1: USD/JPY vs. U.S. 2-Year/10-Year Tsy Yield Spread (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: Boris Johnson has been accused by Tory MPs of “damaging the UK and everything the Conservatives stand for” as he prepares to publish a bill to rip up his 2020 Brexit deal with the EU covering trade with Northern Ireland. The legislation, to be published on Monday, will bring Johnson into conflict with many of his own Tory MPs, the House of Lords, the EU, lawmakers in Washington and even some business groups in Northern Ireland. An internal note circulating among Tory MPs opposing the bill and seen by the Financial Times says the measure “breaks international law and no shopping around for rent-a-quote lawyers can hide that”. The legislation would expunge key elements of the so-called Northern Ireland protocol, part of an international treaty with the EU. It would also give ministers sweeping powers — government officials insist they are just an “insurance policy” — to change almost every aspect of the text. (FT)

BREXIT: The UK’s foremost business lobby group has warned the government that its threat to override the Northern Ireland protocol is forcing companies to think again about investing in Britain and dragging down the economy. The Confederation of British Industry (CBI) said immediate talks with the EU, rather than political grandstanding, were needed to resolve the impasse over the protocol, which governs post-Brexit trade between the EU, Northern Ireland and Great Britain. (Guardian)

ECONOMY: Brandon Lewis has become the latest Cabinet minister to call for planned income tax cuts to be brought forward "when we can afford to do it". The Northern Ireland Secretary made the comments a day after similar remarks by Health Secretary Sajid Javid. (Sky)

ECONOMY: The head of a landmark review of England’s food system has called for “much bolder” action to address climate change and obesity after government proposals focused on production were attacked by campaign groups. “We’re moving forward but it’s not radical enough,” said Henry Dimbleby, the founder of the Leon restaurant chain who has produced two government-commissioned independent reports. (FT)

EUROPE

GERMANY: The Chancellor has admitted mistakes in dealing with the energy supply from Russia. "The old equation that Russia is a reliable economic partner even in crises no longer applies (...)", Scholz said on Sunday evening in his opening speech at the East German Economic Forum. The goal is therefore clear: Germany must become independent of Russian energy imports - "as quickly as possible, but also as safely as necessary.” (Handelsblatt)

FRANCE: French President Emmanuel Macron was in danger of falling short of a parliamentary majority after a first round of voting in parliamentary elections on Sunday that saw his centrist camp tied with a left-wing coalition led by Jean-Luc Mélenchon. Estimates by Ipsos put Mélenchon's Nupes bloc on 25.6 percent, just ahead of Macron's alliance on 25.2 percent, casting doubt on the president's ability to hold on to his majority in France's National Assembly. Turnout was on course to reach a record low of 47.7 percent. Voters will return to the polls next Sunday for a second and final round of voting, with Marine Le Pen's far-right National Rally also hoping to bolster its presence in parliament after coming third with around 19 percent of votes cast. (France24)

ITALY: Right-wing candidates look set to triumph in critical regional capitals across Italy after the country voted Sunday for mayors in almost 1,000 towns and cities. The votes mark the last major litmus test before a national parliamentary election early next year, offering right-wing parties an opportunity to prove they can convert their lead in the polls into real votes. Candidates on the right looked on track to win in the first round in Genoa and Palermo, respectively Italy’s fifth and sixth largest cities, exit polls published Sunday suggested. The right-wing candidate in a third regional capital, L’Aquila, was also close to clinching a first-round win. (Politico)

UKRAINE: The leaders of France, Germany and Italy plan to meet with Ukrainian President Volodymyr Zelensky in Kyiv this week, officials said, as reports showed Russia making gains in the country’s east and Ukrainian officials urgently sought arms from Western nations to hold Russian forces at bay. French President Emmanuel Macron, German Chancellor Olaf Scholz and Italian Prime Minister Mario Draghi were planning to visit the Ukrainian capital on Thursday, said two European officials, who cautioned that plans could yet change. The trip would be the first to Ukraine since the beginning of the war for the three Western leaders. (WSJ)

UKRAINE: The Ukrainian Ambassador Andriy Melnyk expects Chancellor Olaf Scholz to promise the delivery of German tanks to Ukraine during a visit to Kiev. "Unfortunately, without German heavy weapons, we will not be able to break Russia's massive military superiority and save the lives of soldiers and civilians," Melnyk told the German Press Agency. "The Ukrainians expect that Chancellor Olaf Scholz will announce a new aid package for German armaments during his visit to Kyiv, which should definitely include Leopard 1 main battle tanks and Marder infantry fighting vehicles that can be delivered immediately." (Handelsblatt)

UKRAINE: European Commission President Ursula von der Leyen told President Volodymyr Zelenskiy during a visit to Kyiv that the EU executive's opinion on Ukraine's request to join the European Union would be ready by the end of next week. (RTRS)

UKRAINE: Failure to grant Ukraine EU candidate status later this month would signal to Russia Europe’s weakness and could plunge the country into the perpetual enlargement waiting room, Ukrainian President Zelenskyy’s foreign policy adviser, Ihor Zhovkva, told EURACTIV. “We’re not asking for membership, we’re asking for the first step,” Zhovkva said, speaking to EURACTIV shortly after European Commission President Ursula von der Leyen’s second surprise visit to Kyiv on Saturday. (EURACTIV)

UKRAINE: Ukraine has established two routes through Poland and Romania to export grain and avert a global food crisis although bottlenecks have slowed the supply chain, Kyiv's deputy foreign minister said on Sunday. (RTRS)

UKRAINE: Russian forces have blown up a bridge linking the embattled Ukrainian city of Sievierodonetsk to another city across the river, cutting off a possible evacuation route for civilians, local officials said on Sunday. (RTRS)

U.S.

POLITICS: Senate negotiators said Sunday they reached a bipartisan framework on measures intended to limit some access to firearms, paving the way for the broadest federal legislation on guns in decades. The proposal, after weeks of push and pull in the wake of mass shootings last month at a Buffalo, N.Y., supermarket and a Uvalde, Texas, elementary school, is narrower than what many Democrats had sought. It aims to go after illegal sales of guns and to fund mental-health programs and school security. It also provides incentives for states to implement and maintain so-called red-flag laws and includes juvenile records in background checks for people buying guns who are under 21 years of age. (WSJ)

POLITICS: A former Trump campaign director and a U.S. attorney the then-president weighed firing are among those who will testify Monday as the Jan. 6 committee works to show how Trump forged ahead with plans to remain in power despite being “told again and again that he didn’t have [the] numbers to win.” (Hill)

GASOLINE: The average price for a gallon of unleaded gasoline rose above $5 nationally for the first time due to increased demand from the economy reopening from the pandemic and depleted oil supplies stemming in part from the war in Ukraine. (CNBC)

OTHER

GEOPOLITICS: The global nuclear arsenal is expected to grow in the coming years for the first time since the Cold War while the risk of such weapons being used is the greatest in decades, a leading conflict and armaments think-tank said on Monday. (RTRS)

NATO: Security concerns raised by Turkey in its opposition to Finland's and Sweden's NATO membership applications are legitimate, NATO Secretary General Jens Stoltenberg said on Sunday during a visit to Finland. "These are legitimate concerns. This is about terrorism, it's about weapons exports," Stoltenberg told a joint news conference with Finnish President Sauli Niinisto while visiting him at his summer residence in Naantali, Finland. (RTRS)

NATO: Finland will not join NATO if Sweden's problems with Turkey mean that Swedish membership is postponed. This was stated by Finnish President Sauli Niinisto at a press conference with NATO Secretary General Jens Stoltenberg on Sunday. “I say that Sweden's case is ours. That means we go further hand in hand,” Niinisto said. (NRT)

U.S./CHINA: China’s defence minister has strongly pushed back against US accusations of aggression, and sought to present Beijing as a responsible power and western countries as outsiders undermining stability in Asia. The stance came as Beijing tried to avoid a further escalation in tensions over Taiwan, after a meeting between General Wei Fenghe and US defence secretary Lloyd Austin on Friday that was dominated by discussions about the island that were described as “frank, positive and constructive”. In his own address on Sunday, Wei said China aimed to be “a builder of world peace, a contributor to global development, a protector of the international order and a provider of public goods”, using a keynote phrase coined by Chinese president Xi Jinping. (FT)

U.S./CHINA: The US sought to bolster its support in Asia this weekend by reassuring nations they don’t need to join a coalition against China, drawing a stark contrast with Beijing’s threats to defend its interests with military force. Defense Secretary Lloyd Austin told Asia’s biggest security forum Saturday that the US was taking “ wise counsel” from smaller countries, saying they should be “free to choose, free to prosper and free to chart their own course.” (BBG)

BOJ: The Bank of Japan announces an addition to its bond purchase schedule for tomorrow after benchmark 10-Year JGB yield breached the upper end of its permitted -/+0.25% trading range. The BoJ will conduct additional purchases of Y500bn 5- to 10-Year JGBs on Tuesday, stepping up defence of its yield target. "The Bank will make changes in the auction schedule and amounts of outright purchases of JGBs as needed, taking account of market conditions." (MNI)

JAPAN: Sanae Takaichi, head of the Policy Research Council at the Liberal Democratic Party, said in a Fuji TV programme on Sunday that now was “not the right time” for the government and the Bank of Japan to intervene in foreign exchange markets. She explained that the depreciation of the yen is an opportunity to increase the number of foreign visitors to Japan and improve the export competitiveness of exported agricultural products. (Nikkei)

JAPAN: Japan’s top government spokesman reiterated “concern” over the recent rapid weakening of the yen, after the currency fell to a fresh 20-year low of 135 to the dollar. Foreign exchange rates should move stably and in line with economic fundamentals, Chief Cabinet Secretary Hirokazu Matsuno says in a press briefing. Will watch forex moves and their impact on the economy with a heightened sense of urgency while coordinating closely with the Bank of Japan. (BBG)

NEW ZEALAND: The latest NZIER Consensus Forecasts show a downward revision to the growth outlook over the coming years, despite the stronger starting point. The revisions reflect expectations of weaker activity across most sectors from 2023. Although the recovery in demand was stronger than initially expected as lockdown restrictions were relaxed, there are increasing headwinds for the New Zealand economy. These headwinds include continued global supply chain disruptions as countries continue to grapple with COVID-19, the war in Ukraine and rising interest rates. (NZIER)

NEW ZEALAND: Immigration Minister Kris Faafoi will step down from Parliament, as will speaker of the house Trevor Mallard, sparking a major Cabinet reshuffle. Prime Minister Jacinda Ardern announced changes to a number of portfolios, including taking the police portfolio off Poto Williams, and handing it to Chris Hipkins. (Stuff)

SOUTH KOREA: South Korean authorities are monitoring the won’s “excessive volatility” with special cautiousness, according to a text message from officials at the finance ministry and the central bank. Government and the Bank of Korea will work so that the herd behavior doesn’t become more serious in the FX market. (BBG)

NORTH KOREA: North Korea fired artillery shots Sunday, presumably from multiple rocket launchers, South Korea's military said, in what would be yet another show of force by the reclusive regime. (Yonhap)

THAILAND: Bank of Thailand Governor Sethaput Suthiwartnarueput said that he prefers to raise interest rates sooner rather than later as risks rise that inflation will hurt the economy. Sethaput in a speech Monday said that “too slow a rate hike is not good” and that raising the policy rate earlier could avert steep increases down the road. While the danger to the country’s economic recovery from the pandemic has declined, inflation risks have risen and the central bank sees the “need to think about rate normalization” and to scale down from a “very accommodative” policy, he said. (BBG)

PHILIPPINES: Bangko Sentral ng Pilipinas will scale down its daily purchases of government securities as it normalizes its monetary operations, Governor Benjamin Diokno says. Reconfiguring the GS window into a regular liquidity facility ensures consistency with overall monetary settings, he says in a briefing. (BBG)

PHILIPPINES: The Philippine economy will likely expand 6% this year, incoming Economic Planning Secretary Arsenio Balisacan said, lower than the government’s target as inflation tempers the outlook for growth. “The inflation that we are seeing is very much imported and it obviously will temper a bit our growth,” Balisacan said in an interview with Bloomberg Television’s Rishaad Salamat and Yvonne Man. The outlook “already takes into account the current problems in global and domestic markets,” he said. (BBG)

HONG KONG: Hong Kong will continue to see volatile ebbs and flows of capital in the foreseeable future, as rival geopolitical forces buffet its open economy, the city’s de facto central bank chief said in a rare interview. “We have already seen some capital outflow from the Hong Kong dollar market after the [US] Federal Reserve raised interest rates,” said Eddie Yue Wai-man, chief executive of the Hong Kong Monetary Authority (HKMA). “The trend will continue, as we are just at the beginning of the interest rate rise cycle.” (SCMP)

BRAZIL: Brazilian President Jair Bolsonaro asked US President Joe Biden for help in his re-election bid during a private meeting on the sidelines of a regional summit this week, portraying his leftist opponent as a danger to US interests, according to people familiar with the matter. During the meeting on Thursday, Biden underlined the importance of preserving the integrity of Brazil’s democratic electoral process, and when Bolsonaro asked for help, Biden moved to change the subject, one of the people said. Bolsonaro’s comments to Biden about his rival, Luiz Inacio Lula da Silva , echoed his public warnings about the two term former president, according to the people, who requested anonymity to discuss a private conversation. (BBG)

CHILE: Chile’s central bank needs to continue monetary tightening but at a slower pace to bring inflation to target, bank president Rosanna Costa told newspaper La Tercera. Accelerating inflation represents the biggest challenge for policy makers, Costa said, adding that most of the factors behind price increases come from external pressures. Policy makers last week pointed to the impact of Russia’s invasion of Ukraine on commodity prices, especially energy and food. (BBG)

RUSSIA: The leader of the Russian-backed separatist Donetsk region of Ukraine said on Sunday there was no reason to pardon two British nationals who were sentenced to death last week after being captured while fighting for Ukraine. A court in the self-proclaimed Donetsk People's Republic on Thursday found Aiden Aslin and Shaun Pinner - and Moroccan Brahim Saadoun - guilty of "mercenary activities" seeking to overthrow the republic. (RTRS)

RUSSIA: Kremlin-installed officials in occupied southern Ukraine celebrated Russia Day on Sunday and began issuing Russian passports to residents in one city who requested them, as Moscow sought to solidify its rule over captured parts of the country. At one of the central squares in the city of Kherson, Russian bands played a concert to celebrate Russia Day, the holiday that marks Russia’s emergence as a sovereign state after the collapse of the Soviet Union, according to Russia’s state news agency RIA Novosti. In the neighboring Zaporizhzhia region, Moscow-installed officials raised a Russian flag in Melitopol’s city center. (AP)

TURKEY: At a meeting with young people in the eastern province of Van, Recep Tayyip Erdogan said on Sunday he would discuss the issue of a grain export corridor with Russian President Vladimir Putin and Ukrainian President Volodymyr Zelenskyy. (TRT World)

MIDDLE EAST: President Biden plans to visit Israel and Saudi Arabia in July, the White House confirmed to Axios on Sunday. Details: Three Israeli officials told Axios Biden is expected to visit Israel and the Palestinian Authority on July 14 and 15 before traveling on to Saudi Arabia. The White House has not confirmed those dates, and the Israeli officials all warned that the timing had shifted several times and could change again. (Axios)

MIDDLE EAST: U.S. President Joe Biden said Sunday that Israeli national security would be a major issue during his possible visit to Saudi Arabia, denying that the trip had to do with attempts to cap oil prices that have topped $5 a gallon in the United States. “The commitments from the Saudis don’t relate to anything having to do with energy,” Biden said outside Air Force One. “It happens to be a larger meeting taking place in Saudi Arabia. That’s the reason I’m going. And it has to do with national security for them – for Israelis.” (Haaretz)

ISRAEL: In the latest crisis to hit the beleaguered coalition, Blue and White MK Michael Biton’s office said Sunday that he plans to stop voting for the majority of the coalition’s legislative agenda, compounding the government’s growing difficulties in passing laws. Starting Monday, Biton will only support the coalition against no-confidence motions and to renew politically sensitive legislation that applies parts of Israeli law to settlers in the West Bank. He is expected to be absent from the plenum for other government votes. (Times of Israel)

CHINA

CORONAVIRUS: China is starting to re-impose Covid-19 restrictions just weeks after major easing in key cities, raising concern the country may once again employ strict lockdowns to control its outbreak. Beijing reported 51 new local cases for Sunday, after having single digit cases on most days last week. The city’s local government said an outbreak linked to a popular bar is proving more difficult to control than previous clusters, in a weekend that saw mass testing and rising infections both in the capital and Shanghai. A total of 37 cases were reported for Shanghai, with five new cases detected in the community. Authorities delayed the reopening for most schools in Beijing that was planned for Monday, while most districts in Shanghai suspended dine-in services at restaurants. China reported 143 cases nationwide for Sunday as the number of new infections crept up. Daily cases fell below 100 last month for the first time since early March after strict curbs. (BBG)

CORONAVIRUS: Beijing will suspend all offline sports events starting from June 13 citing high transmission risks of a recent COVID-19 outbreak linked to a bar in the city, Beijing Municipal Bureau of Sports said in a statement on Monday. (RTRS)

ECONOMY: The Chinese economy likely rebounded in May as declines in industrial output and consumption narrowed, Yicai.com reported citing economists. Economists surveyed by Yicai expected industrial output fell 0.49% y/y in May, compared to the 2.9% decline in April, as power consumption by industrial enterprises in Shanghai recovered to 80.5% of the level same period last year while logistics also improved. A decline in consumption likely narrowed to a 7% y/y dip from the previous 11.1% decline, said Yicai citing economists. Fixed-asset investment may remain upbeat, growing about 7.2% amid policy pushes to boost the economy, the newspaper said citing economists. China is set to release its May economic indicators on Wednesday. (MNI)

ECONOMY: Chinese savings deposits have increased significantly since the start of the pandemic more than two years ago, Yicai.com reported. In the first five months of this year, resident deposits increased by CNY7.86 trillion, up 50.6% y/y, compared to the CNY6.15 trillion in the same period of 2020, said Yicai citing data by the central bank. Corporate savings deposits are also rising with funds in their current accounts growing slower than those in their time deposits, as willingness to expand investment has not yet recovered amid high energy and raw material costs and weak demand, the newspaper said citing Wang Yunjin, senior researcher of Zhixin Investment Research Institute. (MNI)

ECONOMY: Leading indicators signal that the resumption of work and production in Shanghai and the whole Yangtze River Delta Economic Zone has accelerated after a two-month Covid-19 lockdown, CCTV news reported. An estimated 96% of 9,472 industrial enterprises in Shanghai have reopened so far, with their production capacity reaching 69%, CCTV said. The production capacity of key integrated circuit companies in Shanghai is above 90%, while the production of automobiles reached 70,000 units in May, more than tripling from April, CCTV said. (MNI)

ECONOMY: One after another, the big names in global finance were summoned by Chinese officialdom. On the agenda: pay—specifically, telling Credit Suisse Group AG, Goldman Sachs Group Inc. and UBS Group AG to report details on how they compensate their top bankers. Don’t reward your top people too lavishly, Chinese regulators warned the banks this year in meetings in Shanghai and Beijing, or you might run afoul of the Communist Party, according to people familiar with the matter. (BBG)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.000% at 9:43 am local time from the close of 1.5728% on Friday.

- The CFETS-NEX money-market sentiment index closed at 43 on Friday vs 44 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 67182 MON VS 6.6994

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7182 on Monday, compared with 6.6994 set on Friday.

OVERNIGHT DATA

JAPAN Q2 BSI LARGE ALL INDUSTRY -0.9 Q/Q; Q1 -7.5

JAPAN Q2 BSI LARGE MANUFACTURING -9.9 Q/Q; Q1 -7.6

NEW ZEALAND APR NET MIGRATION -80; MAR +926

SOUTH KOREA JUN 1-10 EXPORTS -12.7% Y/Y; MAY +28.7%

SOUTH KOREA JUN 1-10 IMPORTS +17.5% Y/Y; MAY +34.7%

MARKETS

SNAPSHOT: Fear And Trembling

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 836.35 points at 26987.94

- ASX 200 is closed

- Shanghai Comp. down 36.325 points at 3248.509

- JGB 10-Yr future down 54 ticks at 148.47, yield up 0.4bp at 0.257%

- Aussie bonds are closed

- U.S. 10-Yr future -0-11+ at 116-14+, yield up 2.81bp at 3.184%

- WTI crude down $1.81 at $118.85, Gold down $8.89 at $1862.6

- USD/JPY up 59 pips at Y135.01

- FRENCH, GERMAN AND ITALIAN LEADERS TO MEET WITH ZELENSKY IN KYIV (WSJ)

- MACRON PARTY, LEFT-WING ALLIANCE NECK AND NECK IN FIRST ROUND OF LEGISLATIVE ELECTION

- TORY MPS ATTACK BORIS JOHNSON OVER PLAN TO RIP UP N. IRELAND BREXIT DEAL (FT)

- CHINA IS WALKING BACK VIRUS LOOSENING JUST WEEKS AFTER REOPENING (BBG)

- LDP POLICY CHIEF TAKAICHI: “NOW IS NOT THE TIME” FOR FX INTERVENTION (Nikkei)

- USD/JPY BREAKS ABOVE Y135, 10-YEAR JGB YIELD SHOWS ABOVE BOJ’S 0.25% CAP

BOND SUMMARY: U.S. 2-/10-Yr Tsy Yield Spread Nears Zero, Super-Long End Leads JGB Curve Steepening

Regional reaction to above-forecast U.S. CPI figures released after hours Friday applied further pressure to core FI space, with participants adding hawkish FOMC bets. Benchmark futures contracts extended losses despite risk-negative COVID-19 headlines out of China, where Beijing and Shanghai unwound some of their recent re-opening on the back of rising case counts.

- T-Notes extended their post-CPI sell-off and last trade -0-11+ at 116-14+, hovering near session lows, with Eurodollar futures running 3.0-19.5 ticks lower through the reds. Cash Tsy curve bear flattened, with 2-Year yield last 10bp higher. U.S. 2-Year/10-Year Tsy yield spread faltered towards zero, raising the prospect of an imminent yield curve inversion. Comments from Fed's Brainard (she will speak on the Community Reinvestment Act) take focus from here, while Wednesday's FOMC monetary policy decision headlines the local docket for the week.

- JGB futures softened as regional players caught up with U.S. consumer inflation data published after Asia hours Friday. JBU2 last changes hands at 148.51, down 50 ticks from previous settlement, close to session lows. Cash curve bear steepened, with the super-long end leading declines. Cheapening impetus is putting the BoJ's YCC framework to a test, with 10-Year yield trading close to the 0.25% ceiling. With the 10-Year/30-Year spread widening to multi-year highs, some are suggesting that the BoJ could buy longer-dated debt to step up enforcement of the YCC. The Bank is due to wrap up its monetary policy meeting on Friday.

- Australian financial markets were closed in observance of a public holiday.

JGBS: Futures Rebound On BoJ Stepped Up YCC Enforcement, Pull Back As Kuroda Sticks To Usual Script

Benchmark JGB futures have bounced from session lows (148.42) as the BoJ stepped up efforts to enforce its 0.25% ceiling on 10-Year yield, offering to buy an additional Y500bn of 5- to 10-Year JGBs on Tuesday.

- The announcement came as 10-Year JGB yield breached 0.25%, rising to its highest levels since January 2016.

- JGB futures last trades at 148.52, 49 ticks below previous settlement, pulling back from post-BoJ highs as BoJ Gov Kuroda reiterated the intention to stick with powerful monetary easing.

- Cash JGB yields sit higher, curve runs steeper as speculation that the central bank may eventually have to buy longer-dated debt has weighed on the super-long end. 10-Year JGB yield remains above 0.25% as we type.

FOREX: Yen Tumbles Past Another Round Figure Despite Risk Aversion

The psychologically important Y135.00 level gave way to rallying USD/JPY as (1) U.S. Tsy yields advanced after the release of firmer-than-expected U.S. CPI figures on Friday, (2) participants showed confidence in the dovish resolve of Mr Kuroda et al. ahead of this week's FOMC/BoJ monetary policy meetings, and (3) a senior lawmaker from Japan's ruling LDP helped reduce the credibility of verbal interventions by top financial officials.

- Spot USD/JPY struggled to break above Y135.00 for the better part of the Tokyo session, some suggested that topside was limited by the shrinking U.S. 2-/10-Year yield gap. The pair topped out at Y135.19, its highest level since 1998. Implied volatilities climbed across the curve, while 1-month 25 delta risk reversal snapped a two-day losing streak.

- Sales of U.S. Tsys resumed in cash Tokyo trade after CPI report published on Friday fanned hawkish FOMC bets. The greenback turned bid at the start to the new week, easily outperforming its major peers.

- The FOMC will deliver its monetary policy decision on Wednesday, just two days ahead of the BoJ's announcement. Japanese policymakers are increasingly isolated in their ultra-loose policy stance, which they are expected to reaffirm on Friday.

- Over the weekend, head of the LDP's Policy Research Council Sanae Takaichi said now was not the right time for an FX intervention, as yen weakness can help attract foreign tourists and increase export competitiveness. Her comments exposed cracks in the government's united front on yen weakness, cushioning the impact of official rhetoric signalling a sense of concern with rapid yen depreciation.

- AUD/JPY recouped initial losses amid fresh demand seen on the back of USD/JPY breaching Y135.00. The rate struggled for any further gains, with the Aussie dollar and its commodity-tied peers pressured by risk-off reaction to COVID-19 headlines out of China. Australian markets were shut for a holiday.

- Shanghai and Beijing reported upticks in COVID-19 case tallies and walked back on some of their recent re-opening measures. Offshore yuan went offered even as the PBOC set the mid-point of permitted USD/CNY trading band below the expected level for the third day in a row.

- UK economic activity indicators are about the only notable data release today. Comments are due from ECB's de Guindos, Holzmann & Simkus as well as Fed's Brainard.

FOREX OPTIONS: Expiries for Jun13 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0575(E651mln), $1.0625-35(E567mln), $1.0675(E630mln), $1.0745-50(E1.9bln)

- EUR/JPY: Y143.00(E1.6bln)

- USD/CNY: Cny6.85(2.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 13/06/2022 | 0600/0700 | ** |  | UK | Index of Services |

| 13/06/2022 | 0600/0700 | ** |  | UK | UK Monthly GDP |

| 13/06/2022 | 0600/0700 | *** |  | UK | Index of Production |

| 13/06/2022 | 0600/0700 | ** |  | UK | Output in the Construction Industry |

| 13/06/2022 | 0600/0700 | ** |  | UK | Trade Balance |

| 13/06/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 13/06/2022 | 1100/1300 |  | EU | ECB de Guindos at Arab Central Banks & Monetary Authorities' Meeting | |

| 13/06/2022 | 1230/0830 | * |  | CA | Household debt-to-disposable income |

| 13/06/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 13/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.