-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Hawkish RBA Bets Build, BoJ Wrestles With Markets Pre-Fed Decision

- U.S. & European equity futures creep higher as sentiment stabilises ahead of FOMC monetary policy decision.

- Hawkish RBA bets apply pressure to ACGBs. BoJ bond-buying brings brief reprieve to 10-Year JGB futures, before they take another nosedive.

- Aussie dollar tops G10 pile as greenback underperforms, correcting its rally from earlier this week.

BOND SUMMARY: JGB Nosedive Despite BoJ Bond-Buying, Hawkish RBA Bets Add Pressure To ACGBs

U.S. Tsys corrected recent sell-off ahead of the imminent monetary policy announcement from the Fed, with markets still fully pricing a 75bp rate rise. Reprieve for the space was coupled with upticks in U.S. e-mini futures, testifying to stabilisation in market sentiment. Pre-Fed musings overshadowed Chinese economic activity data, which were generally better than expected, but also fleshed out uneven recovery in Asia's largest economy.

- T-Notes extended its move away from Tuesday's low and climbed as high as to 114-28+, failing to take out that level on two attempts. TYU2 last operates +0-12+ at 114-25+, with Eurodollars running 4.5-8.0 ticks higher through the reds. Cash Tsy curve underwent bull steepening, with yields last seen 3.4-6.4bp lower. It goes without saying that the FOMC's rate decision provides the main risk event today. Just for the record, Empire Manufacturing, retail sales & terms of trade are also due.

- JGB futures staged a dynamic recovery as the BoJ specified 7-Year JGB yield for its unlimited fixed-rate bond-buying operation in a bid to prevent yield curve distortions. The Bank offered to buy Sep '29 notes (JB#356), the cheapest securities for 10-Year JGB futures, alongside the current Mar '32 debt (JB#366). The move came after 7-/10-Year JGB yield spread turned negative on Tuesday, with BoJ action pushing it back towards zero. Futures struggled to hold onto aforementioned gains and eased off into the lunch break, taking a nosedive thereafter to erase all gains. JBU2 last deals at 146.96, 63 ticks shy of previous settlement. Bull flattening hit the cash curve, but its impact has been uneven, with 10s lagging and super-longs outperforming. The BoJ is wrestling with markets ahead of its policy meeting Friday and when this is being typed, there is speculation that we can see another unscheduled bond-buying operation today.

- The addition of hawkish RBA bets exerted further pressure on ACGBs after they played catch-up with overnight U.S. Tsys' sell-off. Governor Lowe gave an interview Tuesday evening, noting that inflation could reach +7.0% Y/Y by year-end, with Goldman Sachs boosting their RBA rate-hike call after these comments. Above-forecast increase in Australia's minimum wage played into the narrative of hawkish RBA forecasters. Cash ACGB yields sit 16.3-20.0bp higher, curve runs flatter. Rate-sensitive 3-Year yield posted the largest gain, while 10-Year yield lodged new eight-year highs. Selling pressure spilled over into main futures contracts, with YMU2 last -18.4 & XMU2 -17.8, both at/near session lows. Bills trade 14-22 ticks lower through the reds. Consumer confidence data were overshadowed by aforesaid developments, despite painting a rather bleak picture.

FOREX: Greenback Falters In Corrective Pullback, Aussie Dollar Outperforms

The greenback corrected its recent rally, with BBDXY moving away from new cycle highs printed Tuesday, as Tokyo trade saw U.S. Tsy yields ease across the curve. The FOMC's monetary policy announcement provides the obvious focal point today. Markets fully price a 75bp rate hike come the end of the meeting, in the wake of steep addition of hawkish bets early this week.

- Expectations of more aggressive tightening have also been building in Australia. Goldman Sachs revised their RBA call and now expect two 50bp hikes to the cash rate target in both August and September (prev. 25bp on each occasion) after RBA Gov Lowe's latest remarks were interpreted as a hawkish sign.

- Rising perceived odds of larger rate hikes from the RBA and an above-forecast boost to the minimum wage supported the Aussie dollar, allowing it to outperform despite bleak reports on domestic consumer confidence. Monthly Westpac survey and weekly ANZ-Roy Morgan survey both showed that sentiment approached recessionary territory.

- AUD/USD climbed past the $0.6900 mark and is poised to snap a five-day sell-off. Antipodean cross AUD/NZD rose after four consecutive days of losses. AUD/JPY climbed after charting a Doji candlestick Tuesday, when its 50-DMA cushioned losses.

- USD/JPY refreshed multi-decade highs in early trade before faltering in tandem with broader greenback sales. The pair popped higher as the BoJ conducted its debt-buying operations, but that recovery attempt proved shallow. Implied volatilities remained elevated, while 1-month risk reversal showed strengthening bearish bias among options traders.

- Notable data releases include U.S. retail sales & Empire M'fing, EZ industrial output & the final reading of French CPI. The central bank speaker slate is tightly packed with ECB members, but the press conference with Fed Chair Powell will most likely steal the show.

FOREX OPTIONS: Expiries for Jun15 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500-11(E817mln)

- USD/JPY: Y131.50($550mln), Y134.00($593mln)

- GBP/USD: $1.2180-90(Gbp827mln)

- EUR/GBP: Gbp0.8515-20(E551mln), Gbp0.8600-20(E523mln)

- AUD/USD: $0.7050(A$651mln)

- USD/CNY: Cny6.6500($1.3bln)

ASIA FX: Most USD/Asia Pairs Higher, CNH Outperforms

Asian FX has mostly been on the back foot today, despite the softer USD trend against the majors. CNH has remained an outperformer though.

- CNH: USD/CNH has tracked lower for much of the day, down around 0.35% to 6.7300 at this stage. The on hold MLF rate (at 2.85%), along with better than expected activity data for May have helped sentiment. China officials stated momentum would improve further in June. China/HK equities are also higher, by at least 1.5-2.0%.

- HKD: USD/HKD remains at the top end of the 7.75-7.85 trading range. The HKMA bought a further HKD9.255bn to prop up the local currency and defend its peg to the U.S. dollar, after earlier purchasing HK4.396bn. HK rates continue to climb with 12mth Hibor climbing to its highest level since 2008 (2.85%).

- KRW: The won has underperformed. Spot USD/KRW is close to 1293, slightly above mid-May highs. Onshore equities have fallen sharply today, off more than 2%. This reflects domestic rather than offshore drivers, still foreign investors have sold $450mln in equities so far today, bringing week-to-date outflows to over $1bn.

- INR: USD/INR remains above 78.00, not getting much benefit from the dip in oil prices. Yesterday's WPI came in slightly stronger than expected at 15.88% YoY, versus 15.30% expected. The 1 month USD/INR NDF sits just below 78.30

- IDR: Spot USD/IDR has pushed to fresh highs for the year, currently tracking just under 14750. Earlier, the trade data was slightly weaker than expected. The surplus dipped under $3bn. Jokowi is set to announce cabinet changes later today.

- PHP: Fresh gains for spot USD/PHP allowed the pair to lodge fresh cycle highs at PHP53.403. We are back slightly now from these levels at 53.370. There is a sense of concern about rising COVID-19 cases in Metro Manila. OCTA Research warned on Tuesday that daily infections could reach up to 500 by the month-end and called for reconsideration of flexible work arrangements.

EQUITIES: Mixed Performances Ahead Of FOMC

Asia Pacific equity markets are mixed today. China/HK higher, while the rest of the region struggles for the most part. US equity futures are higher, which is likely helping to cap losses.

- China related markets had a positive lead from the Dragon index overnight, which rebounded close to 7% in US trading. Better than expected activity data for May has added to the positive mood. IP, retail sales and FAI all came in stronger than expected and China officials stated economic momentum should improve further in June.

- The CSI 300 is up around 1.5%, the Shanghai composite +1.30%, while in Hong Kong the HSI is +1.5% higher, with the tech sub-index up close to 2.30%.

- Korean equities remain laggards, with onshore tech sentiment weighing. The Kospi is down 1.5%, the Kosdaq over 2%. Foreign investors have shed another $426mn in local equities today. This brings week to date net outflows close to $1bn.

- Japan markets are also lower, but losses are a more modest 0.6-0.7% at this stage. Yen and onshore bond market volatility continues in the lead up to this Friday's BoJ decision.

- US equity futures are positive at this stage. S&P500 around +0.50%, while Nasdaq tracking closer to +0.75%.

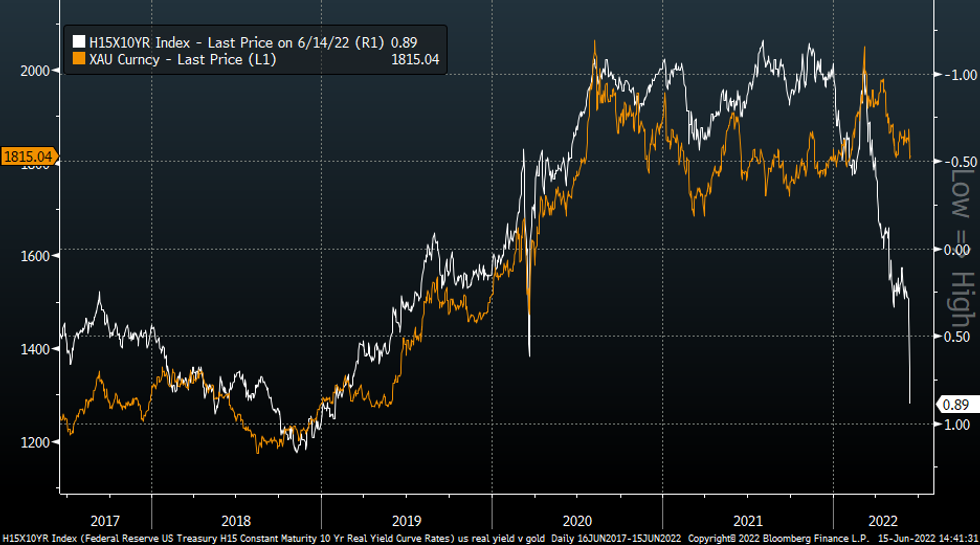

GOLD: Up From 4 Week Lows

Gold has once again recovered some ground following the overnight sell-off. We are back to $1815, after dipping sub $1810 late in NY trading.

- Today's moves are line with broader USD weakness, with the DXY around 0.2% lower though the session, back to 105.30, from a high of +105.50.

- US yields have also seen somewhat of a reversal, with the 2yr and 10yr off around 6bps and 5bps respectively at this stage. This has likely helped the precious metal at the margin.

- This follows very sharp moves higher in recent session though. The US real 10yr jumped a further 20bps overnight to 0.89%. This time last week we were still sub 0.30%.

- The chart below plots gold versus the real US 10yr, which is inverted on the chart. Such a backdrop may see gold struggle in the near term, or at least until we have greater clarity around the Fed outlook. Note the mid-May lows in gold were just below $1790.

- Goldman's has nudged down its gold forecast for the next 3-6 months, but they still sit higher than current spot levels. The bank expects gold to be back at $2100 in 3 months’ time, $2300 in 6 months. The 12 month target of $2500 was unchanged. Emerging market gold demand is expected to rebound in H2 the bank stated.

Fig 1: Gold & US Real 10yr Yield

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

OIL: Steady Ahead Of FOMC

Brent Crude is holding above $121.00, barely changed on the day, following the sharp dip through NY trading overnight. WTI is close to $119, also little changed on the day.

- Market sentiment still remains a little nervous following overnight reports the US may consider taxing the profits on energy companies. US gasoline prices continue to push higher in the US, raising political pressure around the issue.

- Gasoline inventories reportedly fell by 2.16 barrels in the US last week, while crude stockpiles rose nationally by 736k barrels but fell at the Cushing hub.

- China data was better than expected, with IP moving back into expansion territory (+0.7%, versus -2.9% previously), while retail spending fell by less than expected. China electricity production was -3.3%, versus -4.3% in April. Crude oil processed was still -10.9% in YoY, a slight deterioration from the previous month's -10.5% reading.

- The data didn't impact oil sentiment to any great extent though.

- A slowing global backdrop is expected to cool global oil demand, according to OPEC. The organization is forecasting world oil consumption to rise 1.8mln barrels a day next year, down from the 3.4mln projected this year.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/06/2022 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/06/2022 | 0900/1100 | ** |  | EU | industrial production |

| 15/06/2022 | 0900/1100 | * |  | EU | Trade Balance |

| 15/06/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 15/06/2022 | 1215/0815 | ** |  | CA | CMHC Housing Starts |

| 15/06/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 15/06/2022 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/06/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/06/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/06/2022 | 1315/1515 |  | EU | ECB Panetta Intro Statement on Digital Euro at ECON | |

| 15/06/2022 | 1400/1000 | * |  | US | Business Inventories |

| 15/06/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/06/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 15/06/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 15/06/2022 | 1620/1820 |  | EU | ECB Lagarde in conversation with Jose Vinals at LSE | |

| 15/06/2022 | 1800/1400 | *** |  | US | FOMC Statement |

| 15/06/2022 | 2000/1600 | ** |  | US | TICS |

| 16/06/2022 | 2245/1045 | *** |  | NZ | GDP |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.