-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Rolls Out “Unusually Large” Rate Hike To Combat Inflation

EXECUTIVE SUMMARY

- FED HIKES KEY RATE BY 75BP IN “UNUSUALLY LARGE” MOVE

- ECB BOND-BUYING SCHEME LIKELY TO HAVE LOOSE CONDITIONS (RTRS)

- BOE, SNB RATE DECISIONS DUE TODAY, BOJ ON TAP FRIDAY

- AUSTRALIA EMPLOYMENT GROWTH TOPS FORECASTS, PARTICIPATION WIDENS

- NEW ZEALAND REPORTS SURPRISE GDP CONTRACTION FOR Q1

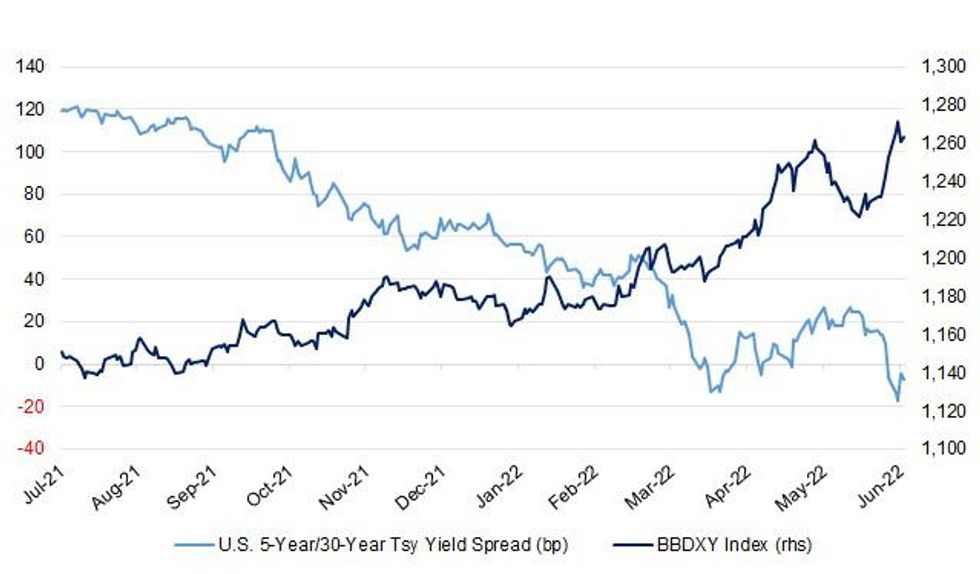

Fig. 1: U.S. 5-Year/30-Year Tsy Yield Spread (bp) & BBDXY Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Rishi Sunak would save up to £57bn for taxpayers over the next three years if he stopped the Bank of England paying interest on money held by commercial banks at the central bank, according to a new report seen by the Financial Times. The report by the New Economics Foundation, a left of centre think-tank, recommends the BoE reforms the way that its interest rate underpins the financial system — by no longer paying interest on most of the nearly £1tn reserves held by commercial banks overnight. (FT)

ECONOMY: Entire towns and cities will be cut off from the train network next week as strike action closes half of Britain's rail lines. Huge swathes of Britain will be without any rail services on Tuesday, Thursday and Saturday when 40,000 RMT members walk out in a dispute over pay and jobs. Network Rail confirmed on Wednesday that about 80 per cent of services would have to be scrapped. Major transport hubs in Cornwall, Wales, Dorset, Cheshire, Lancashire and Scotland will have no rail links. (Telegraph)

ECONOMY: Food price rises in the UK could hit 15% this summer – the highest level in more than 20 years – with inflation lasting into the middle of next year, according to a report. Meat, cereals, dairy, fruit and vegetables are likely to be the worst affected as the war in Ukraine combines with production lockdowns in China and export bans on key food stuffs such as palm oil from Indonesia and wheat from India, the grocery trade body IGD warns. (Guardian)

ECONOMY: More than half of us are reducing our energy use because of the cost-of-living crisis, new research suggests. Figures from the Building Societies Association also reveal that 31% are planning to cut back on essentials such as food and clothing. Stark figures also suggest that close to 50% of workers have been forced to borrow money from banks, payday lenders or their family and friends to make ends meet. The GMB union surveyed 2,300 workers - with some saying they cannot afford to have the heating on and feed their families, and others revealing they are only eating every other day. (Sky)

ECONOMY: MPs have warned the UK government against putting “undue pressure” on regulators to “inappropriately weaken” standards for banks, insurers and other financial services firms. The call by the Treasury select committee is an indication of its concerns about the risks of a post-Brexit shift to light touch financial regulation. (FT)

POLITICS: Lord Christopher Geidt on Wednesday became the second ethics adviser to quit under Boris Johnson’s premiership, a day after expressing his “frustration” over the “partygate” affair. Geidt’s resignation caught Downing Street by surprise and his departure will raise further questions over Johnson’s conduct and overall standards in his administration. (FT)

EUROPE

EU: Poland is close to agreeing to a European Union directive that would implement a minimum corporate tax after the country won guarantees on another part of the global deal. The government in Warsaw is ready to drop its objections as early as at the meeting of EU finance minister in Luxembourg on Friday, according to people familiar with negotiations. In return, Poland can expect to be granted a additional commitment on the implementation of the other part of the global deal that would make multinational companies pay more tax in the countries where they do business, the people said. (BBG)

EU: EU leaders next week are set to discuss — but not endorse — a French proposal for a “European Political Community,” which President Emmanuel Macron first floated in May as a middle-ground EU membership option for Ukraine. The discussion will come during a European Council summit late next week, according to draft conclusions obtained by POLITICO. While EU leaders will outline the plan’s vision, they will simply agree to revisit the subject at a later date, the document says. At the meeting, EU leaders will also discuss whether to grant Ukraine EU candidate status — a major step on the road to joining the bloc. But they have not yet reached a conclusion on the topic, according to the document. (Politico)

ECB: The European Central Bank is likely to attach some loose conditions to an upcoming scheme designed to cap borrowing costs for the euro zone's most indebted states in a bid to win support for it, sources told Reuters. The ECB stepped in to stem a rout in bond markets on Wednesday by announcing plans to devise a new purchase scheme aimed at fighting "fragmentation", or a widening gap between the yields paid by Germany and those of lower-rated countries such as Italy. (RTRS)

UKRAINE: The head of Ukraine's military on Wednesday said Russia had concentrated its main strike forces in the north of Luhansk region and were trying to attack simultaneously in nine directions. "The fierce struggle for Luhansk region continues," Valeriy Zaluzhny, commander-in-chief of the armed forces, said in an online message. The Russians were using aircraft, rocket-propelled grenades, and artillery, he added. (RTRS)

UKRAINE: President Joe Biden on Wednesday announced a fresh U.S. infusion of $1 billion in weapons for Ukraine that includes anti-ship rocket systems, artillery rockets, howitzers and ammunition. In a phone call with Ukraine President Volodymyr Zelenskiy, Biden said he told the embattled leader about the new weaponry. (RTRS)

UKRAINE: The leaders of the European Union's three biggest countries, Germany, France and Italy, are expected in Kyiv on Thursday to show their backing for Ukraine as it struggles to withstand a relentless Russian assault. (RTRS)

GAS: Israel and Egypt will boost gas deliveries to the EU after the three parties signed a new energy agreement in Cairo on Wednesday as Brussels seeks to cut energy dependence on Russia. (FT)

U.S.

FED: MNI STATE OF PLAY: Fed Lays Path To Restrictive Stance Near 4%

- Federal Reserve Chair Jerome Powell Wednesday said another 0.75-percentage-point rate increase is possible in July as the central bank refreshed its projections showing its path to a restrictive stance that could reach nearly 4% in 2023 - on MNI Policy MainWire now, for more details please contact sales@marketnews.com.

POLITICS: Republican former Alaska Gov. Sarah Palin, Republican Nick Begich and independent Al Gross have advanced to the August special election for the state’s only U.S. House seat. (AP)

ECONOMY: Top executives of General Motors Co (GM.N) and Ford Motor Co (F.N) said on Wednesday U.S. consumer demand for cars and trucks remains strong, despite rising interest rates and record high gas prices. "We have not seen signs of weakening demand," GM Chief Financial Officer Paul Jacobson told investors at a conference sponsored by Deutsche Bank. New vehicle prices are high, and inventories of unsold cars and trucks remain low, he said. (RTRS)

ENERGY: The White House is scrambling to help solve a massive surge in gas prices that increasingly is seen as a weight that could leave Democrats suffering a rout in this fall’s midterm elections. Energy Secretary Jennifer Granholm is expected to convene an emergency meeting in the coming days. Meanwhile on Wednesday, President Biden’s economics team gathered alongside outside advisers to discuss various options. More meetings are expected again on Thursday. (Hill)

TSYS: China's holdings of U.S Treasuries tumbled in April to their lowest since May 2010, data showed on Wednesday, with Chinese investors likely cutting losses as Treasury prices fell after Federal Reserve officials signaled sizable rate hikes to temper soaring inflation. Japan's holdings of U.S. Treasuries fell further in April to their lowest since January 2020, amid a persistent decline in the yen versus the dollar, which may have prompted Japanese investors to sell U.S. assets to benefit from the exchange rate. Overall, foreign holdings of Treasuries slid to 7.455 trillion, the lowest since April 2021, from $7.613 trillion in March. (RTRS)

OTHER

WTO: A global bid to deliver a package of World Trade Organization agreements on issues ranging from food security to tariff-free digital commerce headed into an extended session with hopes fading that a final push for compromise will yield 11th-hour breakthroughs. On the final full day of the WTO’s 12th ministerial conference in Geneva, officials from the world’s largest economies were only a few words away from an agreement to waive intellectual-property rights for Covid-19 vaccines. But India remained a key holdout in negotiations expected to end by mid-afternoon on Thursday. (BBG)

WTO: The global technology industry is pressing the World Trade Organization to exempt data flows from cross-border tariffs, saying a failure to do so would undermine a global recovery already threatened by spiralling prices. The WTO agreed in 1998 to a moratorium on e-commerce tariffs and repeatedly extended it at ministerial conferences, which the Geneva-based trade body normally holds every two years. Now India, Indonesia, Sri Lanka, Pakistan and South Africa were threatening to block an extension, trade sources close to WTO talks said. This raises the prospect that tariffs could be imposed on such data flows as music streaming and financial transactions. (RTRS)

NATO: President of Ukraine Volodymyr Zelensky has confirmed that he will take part in the NATO summit in late June. He did not specify in what format he will take part in the event. (Pravda)

NATO: Prime Minister Fumio Kishida said Wednesday he will attend a summit meeting of the North Atlantic Treaty Organization this month as the first Japanese leader to attend the gathering of the Western security alliance. (Kyodo)

U.S./CHINA: U.S. President Joe Biden will keep an open mind when considering relaxing tariffs on Chinese goods, White House spokesman John Kirby said on Wednesday. (RTRS)

AUSTRALIA: Australia's energy minister on Thursday urged households in Sydney to switch off lights in the evening to avert blackouts, as the country's power market remained suspended with more than a quarter of its coal-fired capacity knocked out. (RTRS)

AUSTRALIA: Australia, under a new Labor government, on Thursday raised its 2030 target for cutting carbon emissions, bringing the country more in line with other developed economies' Paris climate accord commitments. (RTRS)

NEW ZEALAND: Travelers to New Zealand will no longer need to provide a negative Covid-19 test before they arrive in the country from next week. The requirement will be lifted from 11:59 p.m. on June 20, according to a statement from Covid-19 Response Minister Ayesha Verrall on Thursday. The government had previously signaled the need for the test would stop in late July. (BBG)

SOUTH KOREA: South Korea’s economic chiefs stressed the need to remain focused on reining in inflation that’s threatening the nation’s outlook, after the Federal Reserve took aggressive policy action to tackle surging US prices. Bank of Korea Governor Rhee Chang-yong, Finance Minister Choo Kyung-ho and several other senior policy makers met Thursday, just hours after the Fed raised its interest rate by 75 basis points in response to US inflation accelerating to a 40-year high. (BBG)

SOUTH KOREA: South Korea’s government downgraded its economic growth forecast for this year to less than the central bank’s outlook and raised its inflation estimate higher, underscoring mounting challenges for policy makers. The Finance Ministry now sees gross domestic product advancing 2.6% and consumer prices rising 4.7% in 2022, a deterioration from 3.1% and 2.2% previously, according to a statement. That compares with the Bank of Korea’s forecasts last month of a 2.7% expansion and 4.5% inflation. (BBG)

SOUTH KOREA: Capital gains tax will be levied only on individuals holding publicly traded shares worth 10b won or more, South Korea’s finance ministry says in its economic policy direction. The statement didn’t say when the change will be implemented. (BBG)

SOUTH KOREA: South Korean President Yoon Suk-yeol promised on Thursday to remove outdated regulations hindering new businesses while calling for an immediate start to reforming labour practices, the education system and pension programmes. Yoon, in his second month in office, also said at an event introducing his government's economic policy framework that his government would lower the living cost by helping reduce private sector production costs. (RTRS)

NORTH KOREA: North Korea appears to be expanding restoration work at its nuclear test site to include a second tunnel, a U.S.-based think tank said on Thursday, as South Korean and U.S. officials say a new nuclear test could happen any day. (RTRS)

NORTH KOREA: North Korea reported an outbreak of an unidentified intestinal epidemic in a farming region on Thursday, putting further strain on the isolated country as it battles chronic food shortages and an unprecedented wave of COVID-19 infections. (RTRS)

HONG KONG: The Hong Kong Monetary Authority (HKMA) has increased the city’s cost of money in lockstep with the Federal Reserve’s biggest one-time increase in 28 years, taking a step to follow global central banks in tamping down on inflationary pressure. (SCMP)

CANADA: Justin Trudeau’s finance minister will use a keynote speech to make the case that Canada’s government is ready to tackle affordability issues as consumer prices soar and borrowing costs rise sharply. Chrystia Freeland, in midday remarks Thursday to the Empire Club in Toronto, will examine the state of Canada’s economy as the Covid-19 pandemic subsides, according to a person familiar with the speech. She’ll focus on the global challenge of inflation and steps the government is taking to counter the rising cost of living. However, it will not lay out any new spending, instead pointing to programs that are already within the fiscal framework, the person said. (BBG)

BRAZIL: Brazil's central bank on Wednesday raised interest rates by 50 basis points, in line with prevailing market expectations, and signaled another increase coming in the world's most aggressive rate-hiking cycle. The bank's rate-setting committee, known as Copom, raised its benchmark Selic interest rate to 13.25%, the highest level since the beginning of 2017 and up sharply from a record low of 2% in March 2021. (RTRS)

MEXICO: The United States and Mexico are working through disputes involving American companies in the Mexican energy sector worth more than an estimated $30 billion in investment, the U.S. ambassador to the country said on Wednesday. (RTRS)

RUSSIA: Russia on Wednesday said it has offered "safe passage" for Ukraine grain shipments from Black Sea ports but is not responsible for establishing the corridors and Turkey suggested that ships could be guided around sea mines. (RTRS)

RUSSIA: The authorities are discussing the replacement of the expected price of Russian Urals oil when compiling the macro forecast of the Ministry of Economy, two sources close to the government, as well as a federal official who participated in the discussion of this issue, told Vedomosti. (Vedomosti)

RUSSIA: Russian First Deputy Prime Minister Andrei Belousov says the rouble is overvalued and industry would be more comfortable if it fell to between 70 to 80 against the U.S. dollar from the current 57, Tass news agency reported on Wednesday. Belousov said in an interview with Tass that year-on-year Russian inflation by the end of the year would be somewhere around 15%. (RTRS)

RUSSIA: Russia and the United States must discuss the extension of the START nuclear arms reduction treaty, Kremlin spokesman Dmitry Peskov told the RIA news agency in an interview on Thursday. The matter was important for global security and Russia's military operation in Ukraine was no reason to avoid its discussion, Peskov added. (RTRS)

RUSSIA: The U.S. government has pushed new, increased funding into three technology companies since the start of the Ukraine conflict to help Russians sidestep censors and access Western media, according to five people familiar with the situation. The financing effort is focused on three firms that build Virtual Private Networks (VPN) - nthLink, Psiphon and Lantern – and is designed to support a recent surge in their Russian users, the sources said. (RTRS)

MIDDLE EAST: The US administration has been pushing Israel to avoid taking unilateral steps that would further damage ties with the Palestinians in the lead-up to President Joe Biden’s trip to Israel and the West Bank next month, two Israeli and Palestinian officials told The Times of Israel Wednesday. (Times of Israel)

MIDDLE EAST: Most Gulf central banks followed the U.S. Federal Reserve on Wednesday, lifting their key interest rates by three-quarters of a percentage point, while Saudi Arabia made a smaller hike after the latest data showed inflation there slowing slightly. (RTRS)

TURKEY: Foreign Minister Mevlut Cavusoglu spoke at the joint press conference held after his meeting with Norwegian Foreign Minister Anniken Huitfeldt and Irish Foreign and Defense Minister Simon Coveney. When asked about how long Turkey will continue to oppose Sweden and Finland's NATO membership, Cavusoglu said that it depends on the response of these two countries to Turkey. "We have told both NATO and these countries that these documents sent to us are far from meeting our expectations. Now we will compile and collect them and send our own answer. (Anadolu Agency)

METALS: Mexico's national union of mining and metallurgical workers launched a strike on Wednesday at an ArcelorMittal plant after labor representatives failed to reach agreement with the steelmaker over profit-sharing, the two sides said. The union said the Luxembourg-based firm was refusing to share 10% of profits from the 2021 fiscal year among over 3,500 direct employees of the plant in the western state of Michoacan. (RTRS)

METALS: Bolivia's government on Wednesday declined to name which of six short-listed companies it would select to help mine its untapped lithium riches, with the chief of the country's state-run lithium company saying more than one could be eventually selected. (RTRS)

ENERGY: BHP Group will scrap a plan to exit from thermal coal and instead aim to shutter its final mine by mid-2030 after prices surged and with investor attitudes shifting on the sale of fossil-fuel assets. The world’s top miner, which has been reviewing its options for the Mt Arthur mine in Australia’s New South Wales-state for about two years, didn’t attract a suitable offer for the asset, according to a Thursday statement. (BBG)

OIL: According to the forecasts of the International Energy Agency (IEA), the decline in oil production in Russia in 2022 will amount to 3 million barrels per day, according to the report of the organization dated June 15. By the end of the year, production in the country will amount to about 8.7 million barrels per day. It will remain at this level throughout 2023, IEA experts believe. “Russia recognizes that the search for new markets will become increasingly difficult, and mining projects may be delayed,” the report says. IEA analysts note that some Russian manufacturers are "struggling to secure equipment supplies and financing" as Western investors, service companies and lenders plan to leave the country. (Vedomosti)

CHINA

PBOC: The People’s Bank of China is likely to keep the benchmark Loan Prime Rate unchanged next Monday, after it skipped moving the anchored rate of the medium-term lending facility this week, the Shanghai Securities Journal reported citing analysts. Also, policymakers are observing stimulus effects after making the largest ever 15 bps cut to the five-year LPR last month, the newspaper cited analysts as saying. The room for MLF rate cut will be limited in the future amid the rapid tightening of monetary policy by the Federal Reserve, and the PBOC may resort to lowering LPR to stimulate loan demand in the next stage, the newspaper said citing analysts.

ECONOMY: Hong Kong’s highly touted wealth link with the Chinese mainland is being hampered by travel curbs that make it hard for new customers to meet bankers. As of April, the program had attracted only 940 million yuan ($140 million), or about 0.3% of the total quota, since its inception in October. Marketing is restricted on the Wealth Management Connect scheme and strict quarantine measures make it difficult for bankers to travel in person in search of new business. (BBG)

ECONOMY: China will seize the current window to increase pro-growth policy intensity without resorting to excessive money supply, focusing on ensuring employment and stable prices, according to a statement on the gov website following the State Council executive meeting late on Wednesday. China will step up efforts to support private investment, which accounts for more than half of the total investment, and measures will include selecting a batch of major construction projects to attract private capital, the statement said. (MNI)

ECONOMY: China’s balance of payments is resilient to any capital flow shocks as the outflows under securities investment was offset by the surplus in foreign trade in goods and direct investment, the 21st Century Business Herald reported citing Guan Tao, a former forex official. There was a net outflow of USD21.6 billion under securities investment in May, the slowest pace since February, the newspaper said citing data by State Administration of Foreign Exchange. Foreign goods trading registered a surplus of USD38.3 billion in May, an increase of 97% y/y, while the surplus in direct investment maintained basically the same level as last May at USD5.5 billion, the newspaper said. (MNI)

ECONOMY: China saw an uptick in new construction sites in May, according to satellite data, suggesting infrastructure investment is poised to accelerate from its currently sluggish pace. The area of new construction sites in China’s three largest urban areas -- around the cities of Beijing, Shanghai and Guangzhou -- increased by 110% in May from the same month in 2021, according to Four Squares Technology Ltd., which analyzes satellite images. However, that increase was from a low base - the area around Guangzhou saw zero areas of new construction in May 2021. (BBG)

CORONAVIRUS: Many of Shanghai’s restaurants and retail stores remain closed amid sporadic lockdowns to deal with a Covid-19 outbreak that refuses to abate, marring authorities’ vows to return China’s commercial hub to full normalcy by June 30. Half-opened restaurants, shopping centres and entertainment venues are spoiling the facade of normalcy that Shanghai’s authorities are trying to project to buttress their argument that their dogged pursuit of the zero-Covid policy was a tentative success at containing the Omicron’s spread. (SCMP)

CHINA MARKETS

PBOC INJECTS CNY10 BILLION VIA OMOS, LIQUIDITY UNCHANGED

- The People's Bank of China (PBOC) injected CNY10 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY10 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.9826% at 9:35 am local time from the close of 1.6162% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 48 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7099 THURS VS 6.7518

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7099 on Thursday, compared with 6.7518 set on Wednesday.

OVERNIGHT DATA

CHINA MAY NEW HOME PRICES -0.17%; APR -0.30%

JAPAN MAY TRADE BALANCE -Y2,384.7BN; MEDIAN -Y2,040.4BN; APR -Y842.8BN

JAPAN MAY TRADE BALANCE ADJUSTED -Y1,931.4BN; MEDIAN -Y1,704.5BN; APR -Y1,618.9BN

JAPAN MAY EXPORTS +15.8% Y/Y; MEDIAN +16.1%; APR +12.5%

JAPAN MAY IMPORTS +48.9% Y/Y; MEDIAN +44.0%; APR +28.3%

AUSTRALIA MAY EMPLOYMENT CHANGE +60.6K; MEDIAN +25.0K; APR +4.0K

AUSTRALIA MAY UNEMPLOYMENT RATE 3.9%; MEDIAN 3.8%; APR 3.9%

AUSTRALIA MAY PARTICIPATION RATE 66.7%; MEDIAN 66.4%; APR 66.4%

AUSTRALIA MAY FULL TIME EMPLOYMENT CHANGE +69.4K; APR +93.4K

AUSTRALIA MAY PART TIME EMPLOYMENT CHANGE -8.7K; APR -88.9K

AUSTRALIA JUN CONSUMER INFLATION EXPECTATIONS +6.7%; MAY +5.0%

AUSTRALIA MAY RBA FX TRANSACTIONS MARKET +A846$MN; APR +A$872MN

AUSTRALIA MAY RBA FX TRANSACTIONS GOVERNMENT -A$847MN; APR -A$882MN

AUSTRALIA MAY RBA FX TRANSACTIONS OTHER -A$840.8MN; APR -A$878MN

NEW ZEALAND Q1 GDP +1.2% Y/Y; MEDIAN +2.4%; Q4 +3.1%

NEW ZEALAND Q1 GDP SA -0.2% Q/Q; MEDIAN +0.6%; Q4 +3.0%

SOUTH KOREA MAY EXPORT PRICE INDEX +23.5% Y/Y; APR +22.0%

SOUTH KOREA MAY EXPORT PRICE INDEX +3.1% M/M; APR +1.5%

SOUTH KOREA MAY IMPORT PRICE INDEX +36.3% Y/Y; APR +35.4%

SOUTH KOREA MAY IMPORT PRICE INDEX +3.6% M/M; APR -0.6%

MARKETS

SNAPSHOT: Fed Rolls Out “Unusually Large” Rate Hike To Combat Inflation

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 249.63 points at 26575.79

- ASX 200 up 3.77 points at 6604.8

- Shanghai Comp. up 8.127 points at 3313.533

- JGB 10-Yr future up 136 ticks at 146.94, yield down 0.5bp at 0.251%

- Aussie 10-Yr future up 8 ticks at 95.8, yield down 8bp at 4.120%

- US 10-Yr future +0-14 at 115-19, yield up 3.8bp at 3.322%

- WTI crude up $0.69 at $116, Gold down $2.43 at $1831.39

- USD/JPY up 55 pips at Y134.39

- FED HIKES KEY RATE BY 75BP IN “UNUSUALLY LARGE” MOVE

- ECB BOND-BUYING SCHEME LIKELY TO HAVE LOOSE CONDITIONS (RTRS)

- BOE, SNB RATE DECISIONS DUE TODAY, BOJ ON TAP FRIDAY

- AUSTRALIA EMPLOYMENT GROWTH TOPS FORECASTS, PARTICIPATION WIDENS

- NEW ZEALAND REPORTS SURPRISE GDP CONTRACTION FOR Q1

BOND SUMMARY: Post-Fed Musings In Play, Strong Aussie Data Signals Keep Lid On ACGBs

Post-FOMC impetus carried over into Asia, lending support to JGBs and ACGBs as local markets re-opened, as T-Notes started correcting their relief rally, which gradually spilled over elsewhere. The initial impetus petered out as the session progressed, with core FI markets staging more or less coordinated recovery, even as ACGBs struggled to shake off data-induced weakness.

- T-Notes pulled back from post-Fed highs (115-30+) but the dip was supported at 115-05 and the contract trimmed losses. TYU2 sits +0-14+ at 115-19+ as we type, amid continued assessment of Fed policy outlook. Eurodollar futures run -1.5 to +5.5 ticks through the reds. Cash Tsy curve bear flattened, although yields now sit off highs & flats, last +1.0-6.7bp. The 5-/30-Year sector re-inverted after a brief foray into positive territory on Wednesday, while the 2-/10-Year bit of the curve trimmed yesterday's gains without testing zero. U.S. data docket for today includes housing starts, building permits, Philadelphia Fed Biz. Outlook & weekly jobless claims.

- JGB futures struggled to punch through overnight highs (147.34) and eased off ahead of the Tokyo lunch break before finding poise again. This leaves JBU2 at 146.97, 139 ticks above Wednesday's settlement and near re-opening levels. Cash JGB yields have faltered across the curve amid continued bond-buying by the BoJ. As a reminder, Japan's central bank will conclude its monetary policy meeting on Friday.

- Domestic data fuelled hawkish RBA bets, amplifying Fed-inspired pressure to ACGBs. The labour market remained tight, with above-forecast employment growth driven exclusively by full-time positions and coupled with an uptick in participation; consumer inflation expectations continued to soar. Futures extended losses to fresh session lows as the data hit the wires, before finding poise and trimming losses in sync with T-Notes. YM last +16.3 & XM +10.5, with bills running 3-12 ticks higher through the reds. Cash ACGB curve remains steeper, with yields last 7.0-13.5bp

JGBS AUCTION: Japanese MOF sells Y4.52898tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.52898tn 3-Month Bills:

- Average Yield: -0.1479% (prev. -0.0942%)

- Average Price: 100.0373 (prev. 100.0235)

- High Yield: -0.1308% (prev. -0.0882%)

- Low Price: 100.0330 (prev. 100.0220)

- % Allotted At High Yield: 36.3204% (prev. 54.5268%)

- Bid/Cover: 3.536x (prev. 3.841x)

EQUITIES: Mostly Higher In Asia On Light Post-FOMC Tailwinds

Major regional equity indices are mostly higher at typing, tracking a positive lead from Wall St. Most benchmarks nonetheless trade below their best levels for the session, having pared opening gains as earlier optimism surrounding the Fed’s rate hike decision on Wednesday moderated throughout Asia-Pac dealing.

- Sentiment in high-beta equities across the region was markedly more positive in the wake of the Fed’s 75bp hike on Wednesday, with focus swirling around Fed Chair Powell saying that “unusually large” hikes would likely be rare going forward.

- The Nikkei 225 leads regional peers to trade 1.2% higher at typing, on track to snap four straight sessions of declines, with ~200 of the index’s 225 constituents in the green. Major exporters and large-cap names such as Fast Retailing Co. lead gains, aided by continued weakness in the JPY, and optimism from Japanese export data outperforming expectations earlier in the session. Elsewhere, the energy and material sub-sectors notably lagged peers amidst weakness in major energy and commodity benchmarks,

- China’s CSI300 sits 0.4% better off at writing, with richly-valued consumer staples (particularly large-cap Kweichow Moutai) and healthcare equities leading gains.

- The Hang Seng Index is 0.4% worse off at typing, bucking the broader trend of gains after reversing an earlier, higher open on weakness in China-based tech names and property-related equities. On the latter, the Hang Seng Properties Index trades 1.1% lower, with evident investor worry re: a rise in borrowing costs impacting property sales, following the Fed’s move to raise rates on Wednesday.

- The ASX200 trades 0.3% firmer, led by gains in tech names and the major miners. The S&P/ASX All Technology Index is 1.3% better off, having pared gains from as much as 1.9% earlier in the session. Large-caps Block Inc, Xero Ltd, and REA Group lead gains, with a limited recovery in the cryptocurrency space from its own lows likely lending support to some of the index’s constituents as well.

- U.S. e-mini equity index futures deal 0.3% firmer at typing apiece, backing away from session highs at ~1.0% heading into European hours. The contracts nonetheless sit a little below their respective best levels made on Wednesday, holding on to much of their post-FOMC gains.

OIL: Higher In Asia As Supply Worry Weighed Against Stagflation Risk

WTI is +$0.90 and Brent is +$0.70 at writing, continuing a limited recovery from their respective two-week lows made on Wednesday as the USD (DXY) has extended a pullback from fresh 20-year highs as well.

- To recap, WTI and Brent closed ~$3.60 and ~$2.70 weaker respectively on Wednesday for a second straight day of losses. Both benchmarks were initially sent lower after the release of U.S. EIA crude inventory data, while the Fed’s 75bp rate hike later in the session saw crude hit fresh session lows, with worry re: declining energy demand from reduced economic activity evident.

- To elaborate on the former, the latest round of weekly EIA data pointed to a large, surprise build in U.S. crude inventories (based on WSJ estimates), alleviating some supply worry, while distillate inventories increased. Gasoline inventories saw a surprise drawdown (keeping in mind the ongoing “summer driving season”, while Cushing hub stockpiles declined.

- Keeping within the country, U.S. oil production has topped 12mn bpd according to EIA data, the most since Apr ‘20. Expectations re: the possibility of further, significant ramping up of crude production and refining remains evidently muted however, given well-documented difficulties flagged by prominent U.S. producers, with some outlining issues with supplying operations/expansion amidst supply chain disruptions.

- Elsewhere, the International Energy Agency (IEA) published their monthly report on Wednesday, further pointing to tightness in global crude supplies in the near-term. World demand for crude is forecast to surpass pre-pandemic levels in ‘23 (thus rising to record levels), while the IEA highlighted that global crude supplies are unlikely to keep up amidst Russian output decreases, and various oil producers continuing to hit production caps. A note that this comes after OPEC on Tuesday projected global crude demand to surpass pre-pandemic levels in ‘22.

GOLD: Edges Away From Overnight Highs

Gold has edged down slightly during today's Asia session. We are just above $1830, versus late NY highs of +$1840.

- We are only down 0.20% from NY closing levels, with fairly tight ranges prevailing overall.

- The USD is slightly firmer against the majors in terms of EUR, JPY and GBP, so Gold's pullback from overnight highs is in line. Contributing to this move was an earlier spike in US yields, although we have moved away from the day's highs.

- Equity sentiment has been fairly positive throughout the region, which has likely reduced safe haven demand at the margin.

- The CEO of Newmont, the world's largest gold producer, stated the precious metal's floor price is getting higher ($1500-$1600). This is up from the previous floor around $1200 and owes to surge in global inflation pressures.

FOREX: Risk-On Flows Dominate, Yen Resumes Losses

Regional reaction to the Fed's 75bp rate rise, dubbed by Chair Powell as an "unusually large" move, dominated early price action before petering out. Riskier currencies still comfortably outperform traditional safe havens, but the BBDXY recovered from initial lows as cash U.S. Tsy curve bear flattened in Tokyo trade.

- Higher U.S. Tsy yields resulted in fresh demand for USD/JPY, with BoJ bond-buying operations keeping JGB yields in check. The cross crept higher despite technical signals and options markets dynamics suggesting that correction might be in store. Wednesday's post-Fed dip in USD/JPY saw its RSI return from overbought territory, while 1-month risk reversal extended its slump to the lowest point (largest bearish bias) since Mar 9.

- The Aussie dollar topped the G10 scoreboard, despite showing little reaction to domestic data, which fanned hawkish RBA bets. Monthly jobs report testified to acute tightness in the labour market, while consumer inflation expectations soared to the highest level since 2008. Market pricing of July cash rate target hikes stabilised at 56bp after the release vs. ~51bp prior.

- AUD/NZD crept higher but the recent cycle high (NZ$1.1174) remained intact. The upswing was facilitated by weak GDP data released out of New Zealand, whose economy unexpectedly contracted in the three months through end-March. That said, NZD fared well against other G10 currencies amid better risk sentiment.

- Key data releases today include U.S. weekly jobless claims & housing starts. Central bank activity stays in high gear on Thursday, with the BoE & SNB due to announce their rate decisions. Several ECB members are set to speak, while the BoJ begins its two-day monetary policy meeting.

FOREX OPTIONS: Expiries for Jun16 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0540-60(E576mln), $1.0743-50(E513mln)

- EUR/GBP: Gbp0.8750(E873mln)

- NZD/USD: $0.6200(N$818mln), $0.6300(N$654mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/06/2022 | 0730/0930 |  | CH | SNB interest rate decision | |

| 16/06/2022 | 0730/0930 | *** |  | CH | SNB policy decision |

| 16/06/2022 | 0750/0950 |  | EU | ECB Panetta Speech & Q&A at European Payments Council | |

| 16/06/2022 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 16/06/2022 | 0830/1030 |  | EU | ECB de Guindos at Osservatorio Giovani-Editori Conference | |

| 16/06/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 16/06/2022 | - |  | EU | ECB Lagarde & Panetta at Eurogroup Meeting | |

| 16/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 16/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 16/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 16/06/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 16/06/2022 | 1400/1000 | *** |  | US | Housing Starts |

| 16/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 16/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 16/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 17/06/2022 | 0830/0930 |  | UK | BOE Tenreyro Opens BOE Household Finance Workshop | |

| 17/06/2022 | 0900/1100 | ** |  | EU | Construction Production |

| 17/06/2022 | 0900/1100 | *** |  | EU | HICP (f) |

| 17/06/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 17/06/2022 | - |  | JP | Bank of Japan policy meeting | |

| 17/06/2022 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/06/2022 | 1315/0915 | *** |  | US | Industrial Production |

| 17/06/2022 | 1430/1530 |  | UK | BOE Pill Panels BOE Household Finance Workshop |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.