-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Meandering Through The Night

- Weakness in regional tech equities provided some support for core FI markets during Asia-Pac hours.

- G10 FX trade was limited, with very modest outperformance seen in the JPY.

- Today's data highlights include U.S. Conf. Board Consumer Confidence & flash wholesale inventories. Multiple ECB policymakers will speak at the Forum on Central Banking in Sintra. Also coming up are comments from Fed's Daly & Riksbank's Skingsley

US TSYS: Firmer In Asia

Weakness for some of the major regional Asia-Pac tech equity indices (which later moderated) coupled with spill over from a bid in the ACGB space allowed Tsys to richen a touch overnight, leaving TYU2 +0-05 at 116-31, 0-02 off the peak of the 0-11 range, on sub-par volume of ~70K. Meanwhile, cash Tsys run 1.5-3.0bp richer across the curve.

- There wasn’t much in the way of meaningful headline flow to digest.

- Market flow was headlined by what seemed to be a block buy of the TYU2 116/114 put spread, hedged with a block buy of the TYU2 119.50 calls (+5K vs. +2K).

- Looking ahead, Tuesday’s NY session will bring the release of trade balance data, various house price metrics, the consumer confidence reading and Richmond Fed m’fing index. We will also get 7-Year Tsy supply (hot on the tail of Monday’s particularly week 5-Year auction) and Fedspeak from San Francisco Fed President Daly (’24 voter).

JGBS: Lacklustre Tokyo Trade

JGB futures operated below unchanged levels during Tokyo dealing and were seemingly a little more hesitant to go bid when compared to their global FI counterparts (liquidity/market function/BoJ recalibration worry, or perhaps a combination of the 3, remaining evident), even as some of the major Asia-Pac tech equity indices faltered.

- That leaves the contract -9 ahead of the close with the space off worst levels, while the major cash JGB benchmarks sit little changed to 1bp cheaper as the curve comes under some light steepening pressure.

- There hasn’t been anything in the way of meaningful domestic headline flow to drive the space.

- Today’s sale of 2-Year JGBs saw the cover ratio decline to 3.81x from 5.43x at the previous auction, moving below the six-auction average of 4.65x. The price tail widened a little, although the low price matched dealer expectations (100.100 as per the BBG dealer poll). As we suggested in our preview, this auction was likely supported by domestic investors with capital to deploy, while the wider international investment community would likely stay away on the back of worry re: some form of BoJ recalibration.

- Looking ahead, retail sales data and BoJ Rinban operations headline domestic matters on Wednesday.

AUSSIE BONDS: Richening Aided By AOFM Shelving 20-Year Supply Plan

Aussie bonds more than unwound the overnight cheapening observed in futures, with the initial firming coming on the back of a softening for Chinese tech equities (which later pulled back from extremes). The space then caught a further bid as a speech from AOFM CEO Nicholl (link here) saw the Agency shelve a plan to establish new ACGB ‘43 or ‘44 maturities. The space has backed away from best levels since Nicholl stopped speaking.

- That leaves cash ACGBs running 3.0 to 5.5bp richer across the curve with 2s outperforming, while YM and XM deal +3.0 and +3.5, respectively. EFPs are essentially unchanged on the day.

- Bills sit -1 to +3 through the reds, twist flattening. Retail sales data headlines Wednesday’s domestic docket.

FOREX: Yen Regains Poise, Market Mood Sours

The yen caught a bid over the Tokyo fix and jumped onto the top of the G10 pile as U.S. e-mini futures reversed their initial gains. Marginal narrowing in U.S./Japan 10-Year yield spread applied some pressure to spot USD/JPY, putting the rate on track to snap a two-day winning streak. Meanwhile, the pair's 1-month risk reversal edged higher for the first time in five days.

- Continued advance in crude oil prices lent support to commodity-linked CAD & NOK, but Antipodean currencies failed to benefit from that trend. AUD/USD 1-week implied volatility jumped as it now covers the next RBA monetary policy meeting, with the Reserve Bank expected to raise the cash rate target by 50bp.

- The greenback meandered, with the U.S. dollar index (BBDXY) respecting the confines of yesterday's range.

- Today's data highlights include U.S. Conf. Board Consumer Confidence & flash wholesale inventories.

- Multiple ECB policymakers will speak at the Forum on Central Banking in Sintra. Also coming up are comments from Fed's Daly & Riksbank's Skingsley.

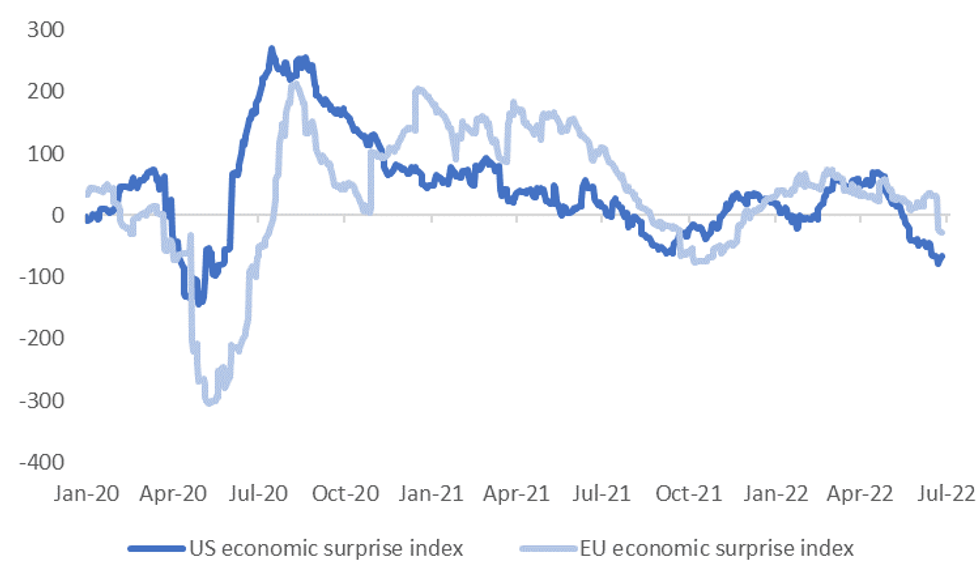

USD: US Data Momentum Up From Recent Lows

US data momentum is showing some signs of stabilizing, with better than expected durable goods and home sales printing on Monday, although some offset came from the weaker than expected Dallas Fed manufacturing survey.

- The US Citi EASI has risen in the early part of this week, see the chart below. The latest reading is -67%, versus a low of -79% late last week. We are still well off the positive levels recorded back in mid May, but the gap with the EU EASI has closed somewhat.

- The Atlanta Fed nowcaster for GDP growth is also back in positive territory. The latest print is just under +0.26%, which is pointing to very modest growth, but compares with a mid-June low of -0.002%.

Fig 1: Citi US EASI Up Off Recent Lows

Source: Citi, MNI - Market News/Bloomberg

- Whether this is the start of an improved period of data momentum remains to be seen. US financial conditions are off their recent highs, according to the Goldman Sachs Index, but remain well up on Q1 levels.

- Also the weaker than expected Dallas Fed survey continues a poor run for regional Fed surveys in June, meaning that downside risks to this Friday's US ISM print arguably still prevail.

- Current market estimates are at 54.5 versus 56.1 in May. Tonight the Richmond Fed index prints, with the market looking for a -5 headline outcome, following the -9 print last month.

- Still, the USD has received some benefit to the extent that better data outcomes have helped US yields recover some ground. This is most evident in higher USD/JPY levels.

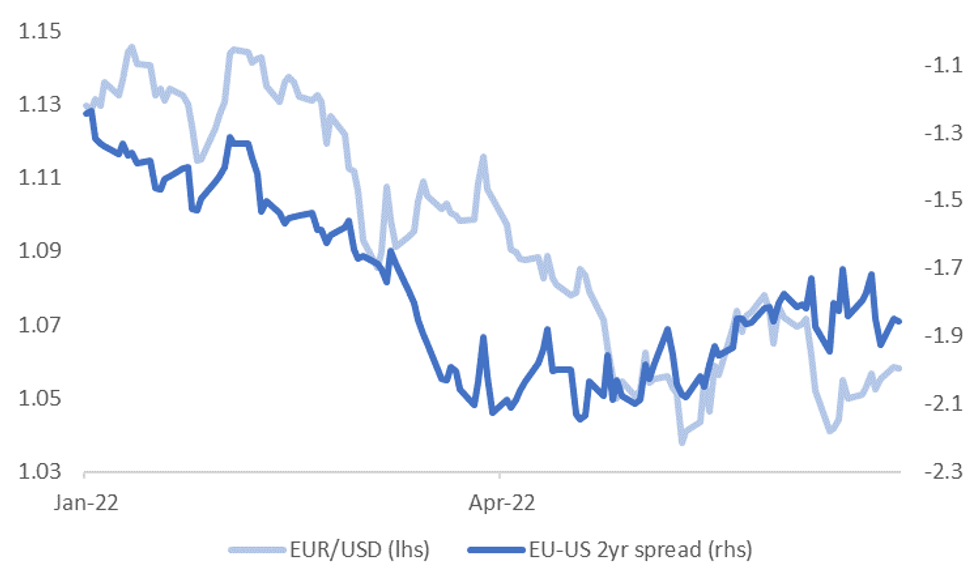

- However, EUR has outperformed since the start of the week. EUR/USD is trying to get a foothold above 1.0600, with EU yields generally outperforming front-end US yields in recent sessions. We remain below recent highs though, see the second chart below.

Fig 2: EUR/USD & 2yr Spreads

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

FOREX OPTIONS: Expiries for Jun28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0450(E1.5bln), $1.0585-00(E1.2bln)

- USD/JPY: Y132.00-15($1.2bln), Y135.00($780mln)

ASIA FX: Won Outperforms, INR To Record Lows

Most USD/Asia pairs are higher today, albeit to varying degrees, as equity sentiment has turned less supportive. The won has outperformed by a modest margin, as has MYR. INR has fallen to a record low, while IDR has also weakened.

- CNH: USD/CNH has tracked a tight range today, wedged between 6.6900 and 6.7000 for most of the session. The CNY fixing came in slightly weaker than expected, while the 5-day rolling sum of the error terms is leaning modestly against CNY strength. China/HK were weaker, although have moved away from worst levels.

- KRW: USD/KRW tried to go lower in early trade but found support at 1283, as equity sentiment softened. The Kospi is still higher at this stage, while onshore tech shares are lower though. The 1 month NDF last traded above 1285. We have seen modest won outperformance on the day.

- INR: USD/INR has risen to fresh record highs today. In the first chunk of onshore trading, the pair is up 0.4% to 78.64. The rebound in oil prices is clearly not helping. Onshore equities are weaker (-0.60%), while longer tenor bond yields are picking up.

- IDR: Spot USD/IDR last trades +42.5 figs at IDR14,845, with domestic headline flow providing little of real note. Onshore equities are lower, while firmer core US/EU yields from overnight have probably weighed at the margin as well. Looking ahead, the main point of note this week is the CPI report, due for release on Friday.

- MYR: USD/MYR is back below 4.4000, higher oil prices helping. S&P affirmed Malaysia's sovereign credit ratings but raised the outlook to stable (from negative), citing expectations that the nation's "steady growth momentum and strong external position will hold over the next two years."

- THB: USD/THB is slightly higher today, currently back above 35.35. Monday's comments from the BoT analyst meeting have had little follow-through in terms of baht price action today, even as the Bank reaffirmed its messaging pointing to an imminent rate rise. The Customs Department is expected to release monthly trade figures this week, the data may hit the wires at any point from now.

EQUITIES: Mixed In Asia; Tech Goes Offered

Major Asia-Pac equity indices are mixed at typing, with tech-related equities across the region broadly softer on a negative lead from Wall St. Elsewhere, limited debate re: economic slowdown worry did the rounds on a rally in major crude benchmarks.

- The Hang Seng Index trades 0.9% lower at writing, on track to snap a three-day streak of gains that had taken it to 12-week highs on Monday. Tencent Holdings (-4.7%) contributed the most to losses for a second day on prior news of a major shareholder announcing intent to reduce its stake, facilitating wider weakness in China-based tech, with the Hang Seng Tech Index sitting 1.7% worse off at typing.

- The CSI300 deals 0.1% weaker, halting its own three-day streak of gains. Outperformance in richly-valued consumer staple equities was neutralised by losses in real estate and tech-related equities, with the CSI300 Real Estate Index and the ChiNext Index sitting 1.7% and 1.1% worse off respectively.

- The ASX200 trades 0.6% firmer at typing, operating a little below two-week highs made earlier in the session. Major miners contributed the most to gains in the index, with a rally in major commodity benchmarks (BCOM: +0.4%) facilitating outperformance in the materials and energy sub-indices. On the other hand, tech names provided the most drag, with the S&P/ASX All Technology Index sitting 1.3% worse off at typing.

- U.S. e-mini equity index futures deal 0.1% to 0.2% weaker off at typing, reversing an initial, limited bid near the open.

GOLD: Little Changed In Asia; G7 Matters Eyed

Gold sits $1/oz firmer to print $1,824/oz at typing, operating a little above Monday’s worst levels in fairly limited Asia-Pac dealing.

- To recap, the precious metal reversed an early bid on Monday to close ~$4/oz weaker, with the move lower facilitated by an uptick in U.S. real yields. Initial support stemming from news over the weekend of an upcoming G7 ban on Russian gold imports has receded entirely, with gold trading below last Friday’s close at typing.

- The ongoing G7 meeting should nonetheless provide a potential source of headline risk for bullion, with leaders expected to formally announce the gold import ban later on Tuesday, while negotiations over a plan to impose price caps on Russian oil and gas continue to play out.

- Up next, San Francisco Fed Pres Daly (‘24 voter) participates in an interview with LinkedIn’s Chief Economist later on Tuesday (1730 BST), with U.S. Conf. Board Consumer Confidence and flash Wholesale Inventories headlining the U.S. data docket.

- Looking to technical levels, well-documented support and resistance levels remain intact at $1,787.0/oz (May 16 low) and $1,889.1/oz (trendline resistance from Mar 8 high) respectively.

OIL: Fresh One-Week Highs In Asia; Supply Worry Remains At The Fore

WTI is ~+$1.30 and Brent is ~+$1.50, operating a little below their respective one-week highs at writing, with both benchmarks on track for a third straight day of gains.

- Brent’s prompt spread is continuing to notch fresh highs (~$4.30 at writing), reflecting elevated worry re: near-term tightness in crude supplies. The measure operates above levels last seen around early-March, when Russia’s invasion of Ukraine had pushed major benchmarks to cycle highs.

- Looking to wider supply-related issues, Libya’s state oil company is continuing to consider declaring force majeure in major oil-loading ports amidst well-documented political unrest, while Ecuador remains at risk of halting oil production entirely over previously-flagged anti-government protests.

- French President Macron stated on Monday that the UAE and Saudi Arabia were effectively able to increase crude production by a maximum of ~150K bpd, citing an exchange with UAE President Sheikh Mohammed, potentially sinking already-scant hopes from some quarters for additional OPEC-sourced oil supply.

- Looking ahead, the U.S. EIA’s Petroleum Status report that was scheduled to cross last week is yet to be re-scheduled. Delayed reports will likely be released before new ones however, raising the prospect of a data release later today (keeping in mind the regular report usually crosses on Wednesdays).

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/06/2022 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 28/06/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/06/2022 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 28/06/2022 | 0800/1000 |  | EU | ECB Lagarde Intro at ECB Forum | |

| 28/06/2022 | 0830/1030 |  | EU | ECB Lane on Globalisation & Labour Markets at ECB Forum | |

| 28/06/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 28/06/2022 | 0930/1130 |  | EU | ECB Elderson on Energy Prices & Sources at ECB Forum | |

| 28/06/2022 | 1100/1300 |  | EU | ECB Panetta on Digital Currencies at ECB Forum | |

| 28/06/2022 | 1100/1200 |  | UK | BOE Cunliffe Panels ECB Forum | |

| 28/06/2022 | 1200/0800 |  | US | Richmond Fed President Tom Barkin | |

| 28/06/2022 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 28/06/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 28/06/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 28/06/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 28/06/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 28/06/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 28/06/2022 | 1630/1230 |  | US | San Francisco Fed's Mary Daly | |

| 28/06/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.