-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Strong Bounce In Non-M'fing PMI Out Of China

EXECUTIVE SUMMARY

- ECB FOCUSSING ON CONDITIONS FOR NEW CRISIS TOOL (MNI SOURCES)

- OFFICIAL CHINESE PMIS MOVE BACK INTO EXPANSIONARY TERRITORY

- PUTIN: RUSSIA WILL RESPOND IF NATO SETS UP INFRASTRUCTURE IN FINLAND, SWEDEN (RTRS)

- UK BREXIT LEGISLATION IS A GUN ON THE TABLE, SAYS EU NEGOTIATOR (RTRS)

- BOJ'S PUBLIC RELATIONS CRISIS FORCES RETHINK ON INFLATION MESSAGE (RTRS)

- RBNZ CHIEF ECONOMIST WARNS HOUSING NO LONGER ONE-WAY BET (RTRS)

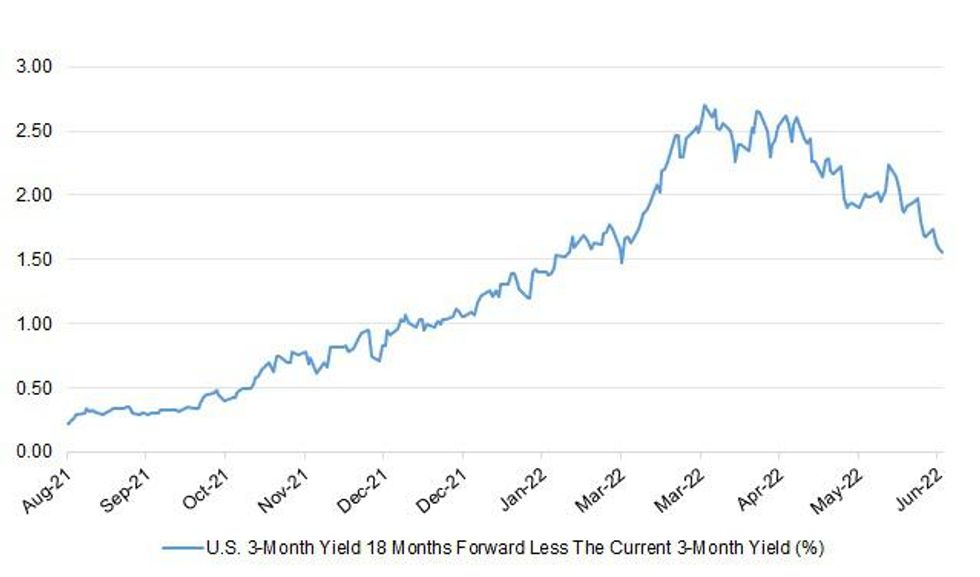

Fig. 1: U.S. 3-Month Yield 18 Months Forward Less The Current 3-Month Yield (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: The EU's chief Brexit negotiator has accused the UK of effectively putting "a gun on the table" by introducing a bill to scrap post-Brexit trade rules between Britain and Northern Ireland. Maros Šefčovič told an event in London the EU would not "negotiate on the basis of this bill". (BBC)

ECONOMY: The boss of a business lobby group will tell the government to "get its house in order" to "save the economy" as firms struggle with higher prices. Shevaun Haviland, director-general of the British Chamber of Commerce (BCC), will tell a conference that time is running out to help the economy grow. Rising material costs, supply chain issues and worker shortages is creating a "perfect storm", she will say. (BBC)

POLITICS: Boris Johnson is facing a fresh threat from Conservative rebels planning a takeover of the powerful backbench committee that could force the prime minister from office. Opponents of Johnson, including some who were loyal to him as recently as last week, have set their sights on a “clean sweep” of the 1922 Committee amid a hardening of the mood against the prime minister. (Guardian)

SCOTLAND: British Prime Minister Boris Johnson said on Wednesday that now was not the time for another vote on Scottish independence, and the United Kingdom was stronger as a single economic unit. (RTRS)

EUROPE

ECB: European Central Bank officials are likely to consider a range of possible new tools to address any blowout in eurozone spreads at its next meeting on July 21, with debate on committees now preparing the proposals focussing on how to make countries requiring assistance pledge to improve their finances and on how long bond purchases could continue, central bank sources told MNI. (MNI)

ITALY: The Italian government is planning to start work on its 2023 budget earlier than the traditional October date, in a bid to push through a less generous package than seen this year before political manoeuvring ahead of general elections next spring makes striking parliamentary agreements too difficult, a senior government official told MNI. (MNI)

SWEDEN: Robust corporate hiring plans reported together with plunging consumer confidence in the latest survey by Sweden’s National Institute of Economic Research may partly reflect problems in filling vacancies, though the discrepancy between the two measures may eventually narrow if unemployment remains contained, NIER division head Fredrik Johansson-Tormod told MNI. (MNI)

U.S.

FISCAL: Senate Democrats are working on shrinking the tax increases in President Joe Biden’s economic package as part of a bid to cut a deal with Senator Joe Manchin and get it passed in the coming weeks, according to people familiar with the talks. The changes under consideration would pare down some of the tax measures passed by the House last year, and could mean that both US corporations and wealthy households end up facing smaller tax hikes than Biden and Democrats initially envisioned, the people said. (BBG)

OTHER

GLOBAL TRADE: The US thinks efforts to free up Ukrainian grain for global markets still have a long way to go, National Security Council spokesman John Kirby said in an interview on Bloomberg Television from Madrid. “We are working very, very hard with partners all around the world to try to see what we can do to get more grain out of Ukraine,” Kirby said. “We have helped increase the flow by ground, by rail, out of Western Ukraine, but that’s not enough. We know that. And we know there’s a sense of urgency here.” (BBG)

GEOPOLITICS: China is not NATO's adversary but it does represent serious challenges, NATO Secretary-General Jens Stoltenberg said on Wednesday. "We now face an era of strategic competition ... China is substantially building up its forces, including in nuclear weapons, bullying its neighbours, including Taiwan," Stoltenberg said. "China is not our adversary but we must be clear-eyed about the serious challenges it represents." (RTRS)

BOJ: Bank of Japan Governor Haruhiko Kuroda issued an unprecedented public apology and retraction earlier this month after comments that households were more "accepting" of retail price hikes triggered a flurry of angry tweets. Once regarded for its masterful communication of complicated monetary policy to the world's largest and shrewdest investors, Kuroda's recent fumble shows the BOJ much less skilled at managing the wider public's price expectations. That could force the BOJ to rethink the way it communicates policy intentions to a population active on social media and unaccustomed to rising prices after decades of deflation or subdued price growth, three people familiar with the bank's thinking say. "The fact the governor had to take back his comment shouldn't be taken lightly," one of the sources told Reuters. "It's become harder now to speak about changing public perceptions." (RTRS)

BOJ: A rebound in automobile production hinges on an easing of supply chain disruptions that Bank of Japan officials are uncertain can recover rapidly enough to feed a manufacturing rebound in the third quarter, MNI understands. (MNI)

JAPAN: Tokyo is set to raise its coronavirus warning alert to the 2nd highest level on its 4-tier scale, FNN reports, citing an unidentified person. Move comes after finding 3,803 new cases on Wed., a jump of ~1,400 from a week earlier and just 2 weeks after lowering the alert. Panel of experts set to decide on alert on Thurs. Afternoon. (BBG)

RBNZ: New Zealand's Reserve Bank Chief Economist Paul Conway said in a speech released on Thursday that the dynamics in the New Zealand housing market are likely to change over the longer term. "For several decades, we have traded houses among ourselves at ever-increasing prices in the belief that we were creating prosperity," said Conway. "But the tide may well have turned against housing being a one-way bet for a generation of Kiwis." Conway said the central bank expects a 15% decline in house prices from their peak. (RTRS)

SOUTH KOREA: South Korea will bump up its minimum wage by 5% next year after government-appointed officials were left to make a decision closely watched by company executives, labor leaders and also policy makers concerned about the possible emergence of a wage-price spiral. The move came early Thursday morning after a vote in which all nine business representatives abstained, according to a statement from the labor ministry. Four negotiators from a labor union also skipped the vote, the ministry said. (BBG)

BRAZIL: Brazilian Treasury Secretary Paulo Valle said on Wednesday that new measures to ease fuel prices do not change the government's commitment to fiscal consolidation, and said the primary deficit forecast for this year will remain the same as it was calculated in May. Speaking at a news conference, Valle pointed out that the proposed amendment to the constitution to increase income transfers to the poorest, reduce federal taxes on fuels and create an aid to truck drivers gives legal security for benefits to bypass the constitutional spending cap. (RTRS)

RUSSIA: Britain will provide another 1 billion pounds ($1.2 billion) of military support to Ukraine, the British government said on Wednesday, as NATO branded Russia the biggest "direct threat" to Western security. The funding will go towards boosting Ukraine's defence capabilities, including air defence systems, uncrewed aerial vehicles, new electronic warfare equipment and thousands of pieces of equipment for Ukrainian soldiers. (RTRS)

RUSSIA: President Vladimir Putin said on Wednesday that Russia would respond in kind if NATO set up infrastructure in Finland and Sweden after they join the U.S.-led military alliance. Putin was quoted by Russian news agencies as saying he could not rule out that tensions would emerge in Moscow's relations with Helsinki and Stockholm over their joining NATO. (RTRS)

RUSSIA: Russian President Vladimir Putin still wants to take most of Ukraine and the picture for the war remains "pretty grim," U.S. Director of National Intelligence Avril Haines said on Tuesday. (RTRS)

RUSSIA: Russia's consumer price index was flat in the week to June 24, having declined for three weeks in a row after a massive spike in March, providing the central bank with room to cut rates to limit the economic downturn, data showed on Wednesday. So far this year, consumer prices in Russia rose 11.51%, data from the federal statistics service Rosstat showed. (RTRS)

RUSSIA: Trade through Lithuania to the Russian exclave of Kaliningrad could return to normal within days, two sources familiar with the matter said, as European officials edge towards a compromise deal with the Baltic state to defuse a row with Moscow. Kaliningrad, which is bordered by European Union states and relies on railways and roads through Lithuania for most goods, has been cut off from some freight transport from mainland Russia since June 17 under sanctions imposed by Brussels. European officials are in talks about exempting the territory from sanctions, which have hit industrial goods such as steel so far, paving the way for a deal in early July if EU member Lithuania drops its reservations, said the people, who declined to be named because the discussions are private. (RTRS)

SOUTH AFRICA: South African Reserve Bank Deputy Governor Kuben Naidoo said Wednesday that policymakers can tighten monetary policy more aggressively if needed to reach their dominant goal of returning inflation to target. (MNI)

OIL: The US hopes that the OPEC+ coalition’s pledge of extra oil supplies was a first step that will be followed by a further production increase, according to a top energy envoy. The US is currently in talks with the few OPEC countries that still have spare production capacity, Amos Hochstein, the State Department’s senior adviser for energy security, said in a Bloomberg Television interview. President Joe Biden is due to visit OPEC leader Saudi Arabia next month. (BBG)

OIL: Exports of Ecuador's flagship Oriente crude remain suspended under a force majeure declaration as the spread of anti-government protests hurts oil output, state-run Petroecuador said on Wednesday. (RTRS)

OIL: Ecuador President Guillermo Lasso issued a 30-day state of emergency covering provinces in the Amazon and Andean regions to roll back unrest that has paralyzed parts of the economy since June 13, according to a government statement sent by text message. (BBG)

CHINA

FISCAL: The sales of Chinese local government bonds in June is expected to reach a single-month record high of CNY1.93 trillion, in a bid to help stabilise the economy, the China Securities Journal reported. The weekly issuance had exceeded CNY500 billion over the past three weeks, which is rare, the newspaper said citing analysts. So far this year, a total CNY5.25 trillion of local government bonds have been issued, the newspaper said. For H2, policymakers should consider front-loading some quota of next year’s local government special bonds to this year, as Minister of Finance Liu Kun previously pledged to plan incremental policies and intensify macro policies, the newspaper said citing analysts. (MNI)

CHINA: China’s securities regulator will cut transaction, settlement and service fees for private companies’ bond sale on the Shanghai and Shenzhen stock exchanges by 160m yuan per year, according to a statement from CSRC Wednesday. Private companies will be exempted from the fee payment for bond sale on the two bourses from July 1 through June 30 2025, according to statements from the exchanges. The fee cut is aimed at helping stabilize the economy, CSRC says. (BBG)

CORONAVIRUS: China reports 39 local Covid infections for Wednesday, including 13 in Anhui, 14 in Jiangsu, four in Shenzhen and one in Beijing, according to data from the National Health Commission. (BBG)

OVERNIGHT DATA

CHINA JUN M’FING PMI 50.2; MEDIAN 50.5; MAY 49.6

CHINA JUN NON-M’FING PMI 54.7; MEDIAN 50.5; MAY 47.8

CHINA JUN COMPOSITE PMI 54.1; MAY 48.4

JAPAN MAY, P INDUSTRIAL PRODUCTION -2.8% Y/Y; MEDIAN +4.2%; APR -4.9%

JAPAN MAY, P INDUSTRIAL PRODUCTION -7.2% M/M; MEDIAN -0.3%; APR -1.5

JAPAN MAY HOUSING STARTS -4.3% Y/Y; MEDIAN +1.6%; APR +2.2%

JAPAN MAY ANNUALISED HOUSING STARTS 0.828MN; MEDIAN 0.887MN; APR 0.883MN

AUSTRALIA MAY PRIVATE SECTOR CREDIT +9.0% Y/Y; MEDIAN +8.6%; APR +8.6%

AUSTRALIA MAY PRIVATE SECTOR CREDIT +0.8% M/M; MEDIAN +0.6%; APR +0.9%

AUSTRALIA MAY JOB VACANCIES +13.8% Q/Q; APR +6.2%

NEW ZEALAND JUN ANZ BUSINESS CONFIDENCE -62.6; MAY -55.6

NEW ZEALAND JUN ANZ ACTIVITY OUTLOOK -9.1; MAY -4.7

The June ANZ Business Outlook survey showed firms are increasingly pessimistic about the outlook for activity and profitability. Investment intentions are slipping. Employment intentions are holding up pretty well, but with the profitability outlook so pessimistic, one does wonder for how long this can remain the case. But the main reason firms are so pessimistic on the outlook for profitability is not lack of demand, but rather supply-side constraints and cost pressures. Each three months we ask firms what their biggest problems are. Finding skilled labour remains #1, while non-wage cost inflation and high rates of pay continue to grow as problems. And in the “other” category, 63% of the text comments related to supply chain problems. (ANZ)

SOUTH KOREA MAY INDUSTRIAL PRODUCTION +7.3% Y/Y; MEDIAN +4.0%; APR +3.3%

SOUTH KOREA MAY INDUSTRIAL PRODUCTION +0.1% M/M; MEDIAN +0.5%; APR -3.3%

SOUTH KOREA JUL M’FING BUSINESS SURVEY 83; JUN 87

SOUTH KOREA JUL NON-M’FING BUSINESS SURVEY 81; JUL 86

SOUTH KOREA MAY CYCLICAL LEADING INDEX CHANGE +0.1; APR -0.3

UK JUN LLOYDS BUSINESS BAROMETER 28; MAY 28

CHINA MARKETS

PBOC INJECTS NET CNY70 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY80 billion via 7-day reverse repos with the rate unchanged at 2.1% on Thursday. This led to a net injection of CNY70 billion after offsetting the maturing CNY10 billion reverse repos today, according to Wind Information.

- The operation aims to keep liquidity stable at the end of mid-year, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.2103% at 9:45 am local time from the close of 2.0565% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 54 on Wednesday vs 45 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7114 THURS VS 6.7035

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7114 on Thursday, compared with 6.7035 set on Wednesday.

MARKETS

SNAPSHOT: Strong Bounce In Non-M'fing PMI Out Of China

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 365.9 points at 26440.44

- ASX 200 down 52.124 points at 6648.4

- Shanghai Comp. up 44.124 points at 3405.642

- JGB 10-Yr future down 5 ticks at 148.59, yield down 0.6bp at 0.230%

- Aussie 10-Yr future down 0.5 ticks at 96.245, yield up 0.1bp at 3.690%

- U.S. 10-Yr future -0-01 at 117-15+, yield up 1.12bp at 3.100%

- WTI crude up $0.03 at $109.81, Gold down $2.17 at $1815.6

- USD/JPY down 5 pips at Y136.54

- ECB FOCUSSING ON CONDITIONS FOR NEW CRISIS TOOL (MNI SOURCES)

- OFFICIAL CHINESE PMIS MOVE BACK INTO EXPANSIONARY TERRITORY

- PUTIN: RUSSIA WILL RESPOND IF NATO SETS UP INFRASTRUCTURE IN FINLAND, SWEDEN (RTRS)

- UK BREXIT LEGISLATION IS A GUN ON THE TABLE, SAYS EU NEGOTIATOR (RTRS)

- BOJ'S PUBLIC RELATIONS CRISIS FORCES RETHINK ON INFLATION MESSAGE (RTRS)

- RBNZ CHIEF ECONOMIST WARNS HOUSING NO LONGER ONE-WAY BET (RTRS)

US TSYS: Marginally Cheaper Ahead Of London Hours

Tsys softened as we worked our way through Asia trade, with the early, modest bid that was a result of spill over from NY dealing and/or cross-market support from rallying ACGBs fading in the wake of a much firmer than expected non-manufacturing PMI reading out of China. That leaves TYU2 -0-00+ at 117-16, 0-02 off the base of its 0-07+ range, operating on volume of ~70K lots. Meanwhile, cash Tsys run little changed to 1bp cheaper across the curve.

- In terms of the general feel of the Chinese data, the m’fing PMI provided a slight miss (50.2 vs. BBG median 50.5) while the non-m’fing PMI came in well above expectations (54.7 vs BBG median 50.5), with the NBS suggesting that the economy bottomed in May.

- There hasn’t been much in the way of major macro headlines to digest since the Chinese PMIs crossed.

- A modest round of screen buying in TYU2 futures (+2.5K) provided the highlight in a relatively limited round of Asia-Pac dealing.

- Thursday’s NY session brings the latest round of monthly PCE data, the MNI Chicago PMI print and weekly jobless claims readings. It also represents the last full session before the Independence Day weekend, with a market closure in Hong Kong also set to hamper liquidity on Friday.

AUSSIE BONDS: Paring Initial Bid

Aussie bonds backed away from best levels as we worked through the Sydney day, with the initial bid pared after the release of Australian and Chinese data. Cash ACGBs have twist steepened, running 5.0bp richer to 1.5bp cheaper across the curve, pivoting around 15s, with 30s providing the weak point. YM and XM are +4.0 and +0.5 respectively, while bills run 1-5 ticks firmer through the reds.

- In terms of details, better than expected Australian private sector credit data for May came alongside a jump in job vacancies (the latest signal of continued tightening in the labour market), while official Chinese m’fing and non-m’fing PMIs returned to expansionary territory (the non-m’fing reading provided a notable beat vs. expectations).

- It was hard to ascertain a reason for the early bid in the space, with spill over from NY Tsy trade cited. Quarter-end rebalancing may have been at play, although month-end rebalancing should have been pretty neutral based on sell-side calculations (if not marginally negative for the space).

- Friday’s domestic data docket will be headlined by final S&P Global m’fing PMI reading. Elsewhere, the AOFM will release its weekly issuance slate.

JGBS: Flatter Ahead Of Release Of BoJ Rinban Plan

JGB futures have traded off the wider impetus observed in global core fixed income markets during Tokyo hours. JGB futures sit little changed on the day ahead of the bell as a result.

- Much softer than expected domestic industrial production data (which resulted in the government lowering its assessment of the state of industrial production to “weak”) had no impact on the space.

- Cash JGBs have richened by 0.5-4.0bp, with the long end outperforming, perhaps on the back of market speculation re: the prospect of the BoJ upping the size/frequency of Rinban purchases covering JGBs with more than 10 years until maturity, in a bid to defend its existing YCC settings. The BoJ will reduce its quarterly Rinban plan after hours today.

- Looking a little further ahead, Tokyo CPI and the latest Tankan survey headline domestic matters on Friday.

EQUITIES: Mixed In Asia; Chinese Travel Catches A Bid

Major Asia-Pac equity indices are mixed at typing, with Chinese and Hong Kong stocks bucking the broader trend of losses.

- The CSI300 leads gains at +1.6%, with broad sentiment boosted by Chinese PMIs returning to expansionary territory. The consumer staples sub-index (+2.2%) contributed the most to gains on outperformance in the major Chinese liquor stocks, while travel and tourism stocks have continued to benefit from upbeat sentiment surrounding previously-flagged easing in nationwide pandemic control measures. The FTSE China A600 Travel & Leisure Index sits +3.3% firmer at typing to operate around four-month highs at typing, with index heavyweight China Tourism Group Duty Free Corp (+6.6%) leading gains.

- The Hang Seng Index is virtually unchanged at typing, having traded on either side of neutral levels throughout the session. Performance was mixed across the index, with limited gains in financials and utilities countered by weakness in China-based tech.

- The ASX200 sits 0.8% worse off at typing, on track for a second consecutive daily loss. Commodity-related names (particularly the major miners) lead the way lower, neutralising outperformance in tech equities.

- The Nikkei 225 trades 1.5% lower, shedding all of the week’s gains to date. Limited gains in smaller-cap equities did little to stem losses in >80% of the index’s constituents, with large-cap names such Tokyo Electron (-3.5%) and Fanuc Corp (-4.0%) contributing the most drag.

- U.S. e-mini equity index futures deal 0.2% to 0.3% weaker at typing, operating a little above Wednesday’s worst levels in fairly limited Asia-Pac dealing.

OIL: Higher In Asia; Supply Tightness Remains In Focus

WTI is ~+$0.40 while Brent (Sep ‘22 contract) is ~+$0.60, with WTI on track for its first monthly decline in seven months.

- The latest round of EIA inventory data released on Wednesday, saw WTI and Brent reverse course from fresh two-week highs to close $1-2 lower as a surprise build in gasoline and distillate stocks drew focus, easing worry re: tightness in domestic supply of oil products. On the other hand, a larger than expected drawdown in crude stockpiles (against BBG median) was observed, while Cushing hub stocks declined, hitting inventory levels last witnessed around Oct ‘14.

- Ecuador has declared a 30-day state of emergency including the entirety of two oil-producing provinces, drawing out ongoing production disruptions to its ~500K bpd crude output.

- Renewed, indirect Iran-U.S. nuclear talks in Doha have ended without any breakthroughs, with a U.S. official saying that talks have effectively progressed “backwards”.

- Up next, OPEC+ will end a two-day meeting later on Thursday, with headline risks appearing limited owing to previously-flagged coverage pointing to tightness in the group’s spare output capacity. RTRS source reports have also pointed to the group discussing August output policies, with seemingly little focus on discussion re: production afterwards.

GOLD: A Little Firmer In Asia; Third Straight Monthly Decline Eyed

Gold is ~$3/oz firmer to print $1,821/oz at typing, a little below best levels, but operating comfortably within Wednesday’s range. The precious metal remains on track for a third consecutive monthly decline.

- To recap Wednesday’s price action, gold whipped between two-week lows ($1,812/oz) to session highs ($1,833/oz) leading up to the release of U.S. Q1 GDP, ultimately closing ~$2/oz weaker amidst an uptick in U.S. real yields and the USD (DXY).

- Fed Chair Powell on Wednesday nodded to the possibility of Fed-led economic slowdown, calling it “challenging” to hike rates “without a hit to growth” or employment. His remark that “the bigger mistake would be to fail to restore price stability" likely drew some focus, reiterating the Fed’s focus on aggressive hikes to control inflation despite recessionary worry from some quarters.

- July FOMC dated OIS continue to price in ~70bp of tightening, pointing to an ~80% chance of a 75bp hike for that meeting, with a cumulative ~197bp priced in through calendar ‘22.

- From a technical perspective, gold’s lows made on Wednesday sees it approach initial support at $1,805.2/oz (Jun 14 low), a break of which would expose further support at $1,787.0/oz (May 16 low and bear trigger).

FOREX: China's Off'l PMIs Support Risk, Kiwi Takes Hit From Weak NZ Biz. Conditions

Demand for safe haven currencies fizzled away even as U.S. e-mini futures were heavy. Sentiment improved after the release of China's official PMI figures. The data revealed a considerably faster than expected recovery in the non-manufacturing sector coupled with a marginal miss in the manufacturing gauge.

- Some of the details of the Chinese survey were concerning, as steel PMI plunged to a record low, while accompanying commentary warned that "attention still needs to be paid to imbalances between the recoveries in supply and demand."

- Offshore yuan caught a bid upon the release of PMI data, but spot USD/CNH failed to sink through yesterday's lows. The yuan fixing offered no real impetus, with the mid-point of permitted USD/CNY trading band set just 10 pips above sell-side estimate.

- Both yen and greenback underperformed on the back of reduced demand for safe haven assets. Spot USD/JPY operated within close proximity to the Y137.00 mark, which capped gains on Wednesday. The pair's 1-month risk reversal is poised to extend its advance to three consecutive days.

- The Aussie outperformed in G10 FX space but the kiwi lagged behind owing to a dismal ANZ Business Confidence reading released out of New Zealand. Activity indicators were weak across the board, with the drop in expected profitability particularly pronounced.

- AUD/NZD climbed to its best levels in two weeks as Australia/New Zealand 2-Year swap spread tightened. Today's data showed that relative momentum in business conditions continues to support the Antipodean cross.

- On the data front, final UK GDP, German unemployment & flash French CPI take focus from here. Elsewhere, Sweden's Riksbank will announce its monetary policy decision. An overwhelming majority of analysts expect the bank to lift its policy rate by 50bp.

FX OPTIONS: Expiries for Jun30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0400(E503mln), $1.0500(E619mln), $1.0550-60(E1.2bln), $1.0750-75(E1.2bln)

- EUR/GBP: Gbp0.8650(E702mln)

- USD/CAD: C$1.2750($1.5bln), C$1.3000($585mln)

- USD/CNY: Cny6.6700($1.6bln), Cny6.70($515mln), Cny6.7500($608mln), Cny6.8000($1.4bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/06/2022 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 30/06/2022 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 30/06/2022 | 0630/0830 | ** |  | CH | retail sales |

| 30/06/2022 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/06/2022 | 0645/0845 | ** |  | FR | PPI |

| 30/06/2022 | 0645/0845 | ** |  | FR | Consumer Spending |

| 30/06/2022 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 30/06/2022 | 0730/0930 | ** |  | SE | Riksbank Interest Rate |

| 30/06/2022 | 0755/0955 | ** |  | DE | Unemployment |

| 30/06/2022 | 0900/1100 | ** |  | EU | Unemployment |

| 30/06/2022 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/06/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 30/06/2022 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 30/06/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/06/2022 | 1330/1530 |  | EU | ECB Lagarde Speech at Simone Veil Pact | |

| 30/06/2022 | 1345/0945 | ** |  | US | MNI Chicago PMI |

| 30/06/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 30/06/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 30/06/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 30/06/2022 | 1600/1200 | *** |  | US | USDA Acreage - NASS |

| 30/06/2022 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.