-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: China COVID Worry Dominates In Asia

EXECUTIVE SUMMARY

- WHITE HOUSE EXPECTS ‘ELEVATED’ BUT ‘OUT OF DATE’ INFLATION NUMBERS FOR JUNE (THE HILL)

- NEXT CONSERVATIVE LEADER AND PM TO BE UNVEILED BY 5 SEPTEMBER (BBC)

- UK INFLATION STILL LIKELY TO FALL SHARPLY NEXT YEAR, BOE'S BAILEY SAYS

- LABOUR ENJOYS WIDEST LEAD OVER TORIES SINCE ’13 IN LATEST OPINION POLL

- MONITORING FX CLOSELY WITH STRONG SENSE OF URGENCY, SUZUKI SAYS (BBG)

- CHINA LOCKS DOWN WUGANG CITY FOR THREE DAYS ON ONE COVID CASE (BBG)

- U.S. WILL DISCUSS ENERGY SECURITY WITH OPEC LEADERS ON MIDDLE EAST TRIP, WHITE HOUSE OFFICIAL SAYS (RTRS)

- IEA: THIS IS THE ‘FIRST GLOBAL ENERGY CRISIS’ AND IT WILL GET WORSE (AFR)

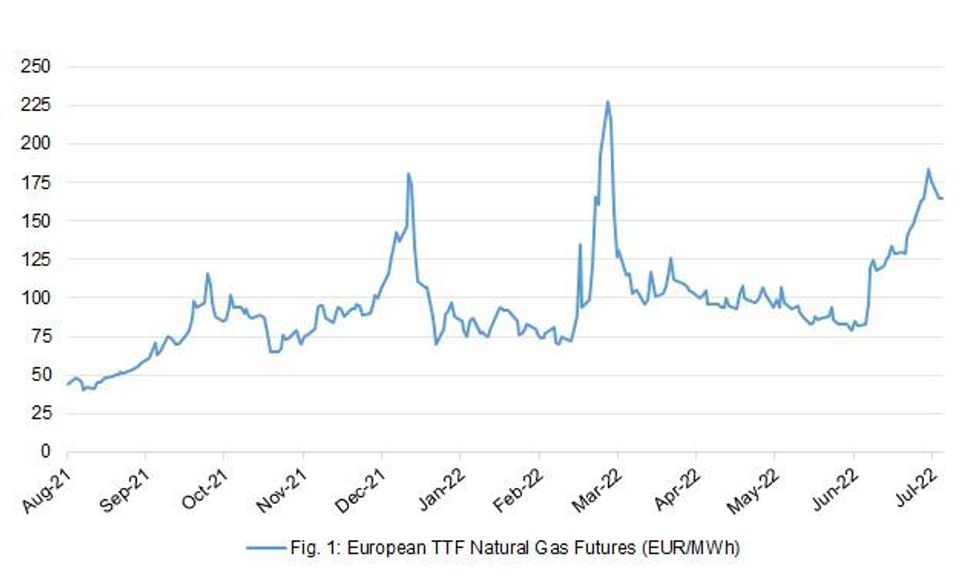

Fig. 1: European TTF Natural Gas Futures (EUR/MWh)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: The next Conservative leader and UK prime minister will be announced on 5 September, party bosses have announced. In a bid to rapidly eliminate fringe candidates, they have also decided to make it harder to enter into and progress in the contest. Tory MPs will whittle the field down to two final candidates before the end of next week, in successive rounds of voting. (BBC)

POLITICS: Penny Mordaunt is the new favourite to become Conservative leader among grassroots activists, the latest polling has shown. (Telegraph)

POLITICS: The new leader will also have to reverse evaporating support for the Conservatives. A survey by Savanta ComRes on Monday put the opposition Labour Party at 43% compared with 28% for the Conservatives, its biggest poll lead since 2013. (RTRS)

BOE: Bank of England Governor Andrew Bailey said on Monday that he thought the BoE's most recent forecast for inflation, showing it was likely to fall sharply next year, remained valid. "I always go into forecasts with an open mind, and that's critical, but I think the basic fundamentals of that profile remain in place today," Bailey told lawmakers. Inflation was likely to be back at its 2% target in around two years' time, he added. (RTRS)

BOE: The Bank of England should get on with shrinking its balance sheet, even if quantitative tightening is more likely to prompt market volatility than some at the BOE had hoped, the Bank’s former technical head of division, David Aikman, told MNI. (MNI)

ECONOMY: Consumer spending data tracked by payments company Barclaycard, which monitors almost half of all UK credit and debit card transactions, showed that household bills have continued to mount. Household spending on utilities jumped by an annual rate of about 40 per cent in June with car fuel spending up by about 25 per cent, laying bare the squeeze on households’ income as energy prices rise. In contrast, spending on household goods fell 5.1 per cent in June compared with May, while spending on home improvements and in furniture stores dropped 7.4 per cent and 2.7 per cent, respectively. (FT)

EQUITIES: Ministers are poised to back the next wave of post-Brexit reforms to the City of London that will make it easier for listed companies to raise money in the UK and encourage retail investors to back them. (FT)

EUROPE

ECB: The high level of uncertainty about inflation prospects will complicate the task of the European Central Bank as it seeks to rein in prices in the euro area without derailing economic growth, according to the outgoing finance minister of Croatia. (BBG)

FRANCE: The French government is poised to pay more than 8 billion euros ($8.05 billion) to bring power giant EDF back under full state control, two sources with knowledge of the matter said, adding the aim is to complete the transaction in the autumn. (RTRS)

U.S.

FED: The U.S. economy is healthy and shows little sign of an imminent recession, and can withstand higher interest rates, St. Louis Federal Reserve president James Bullard said Monday. (AP)

FED: Atlanta Fed President Raphael Bostic said Monday he's confident the U.S. economy can withstand another 75 basis point interest-rate increase later this month, but policymakers should wait to see how the economy fares before judging future hikes. (MNI)

INFLATION: The White House is bracing for “highly elevated” inflation numbers when the Labor Department on Wednesday releases its consumer price index (CPI), a key gauge of inflation for the month of June. But the administration argued the data will not reflect recent progress that has brought down down gas prices. (The Hill)

INFLATION: Commerce Secretary Gina Raimondo said Monday that she's not worried about the strength of the foreign exchange value of the U.S. dollar. "I am not concerned about the dollar being as strong as it is," Raimondo said, during an interview on Bloomberg Television. Raimondo said she was more focused on easing supply-chain bottlenecks to ease inflation pressures. (MarketWatch)

CORONAVIRUS: The US government will once again extend the Covid-19 public health emergency, continuing measures that have given millions of Americans special access to health insurance and telehealth services. (BBG)

OTHER

GLOBAL TRADE: Ukrainian President Volodymyr Zelenskiy said on Monday he had held talks with Turkish leader Tayyip Erdogan on the need to unblock Ukraine's ports and resume its grain exports. "We appreciate (Turkish) support. Discussed the importance of unblocking (Ukrainian) ports and resuming grain exports. We must also prevent Russia from taking our grain from (occupied territories)," he tweeted. (RTRS)

GLOBAL TRADE: US lawmakers are playing politics with national security by delaying the passage of legislation that will liberate billions of dollars for chipmakers to build more manufacturing facilities in the US amid a global shortage, Commerce Secretary Gina Raimondo said. (BBG)

GLOBAL TRADE: Dutch ratification of the trade deal between Canada and the European Union hangs in the balance with a possible rejection by the upper chamber likely forcing a revision of the entire agreement. (BBG)

JAPAN: Japanese Finance Minister Shunichi Suzuki says he’s monitoring foreign exchange markets with a strong sense of urgency. (BBG)

BOJ: U.S. Treasury Secretary Janet Yellen met with Bank of Japan Governor Haruhiko Kuroda on Tuesday, the Treasury Department said, as both countries grapple with mounting economic challenges exacerbated by Russia's war in Ukraine. (RTRS)

MEXICO/RATINGS: Petroleos Mexicanos had its debt rating cut by Moody’s Investors Service, citing Mexico’s recent downgrade and the company’s upcoming maturities. (BBG)

RUSSIA: The European Union plans to propose a new package of sanctions against Russia over its war in Ukraine in the coming weeks, according to people familiar with the matter. (BBG)

RUSSIA: EU companies hurt by sanctions imposed on Russia over Ukraine may see a 25% rise in state aid to 500,000 euros ($504,050) to help them cope with the invasion's impact and resulting energy crunch, a European Commission document seen by Reuters showed. (RTRS)

RUSSIA/IRAN: The United States believes Iran is preparing to provide Russia with up to several hundred drones, including some that are weapons capable, U.S. national security adviser Jake Sullivan told reporters on Monday. Sullivan also said the United States has information that shows Iran is preparing to train Russian forces to use these drones. (RTRS)

CHILE: Chile’s central bank doesn’t see a foreign exchange intervention as necessary at the moment with markets able to absorb shocks adequately, the bank said in a statement. (BBG)

ENERGY: The global energy crisis has not yet reached its peak and is likely to worsen as the northern hemisphere winter approaches, the head of the International Energy Agency has warned, while voicing confidence that clean energy will help resolve the crunch. (Australian Financial Review)

ENERGY: Russian Finance Ministry “totally” supports Gazprom’s idea to sell liquefied natural gas for rubles, minister Anton Siluanov says in Vedomosti interview. (BBG)

OIL: American officials will discuss energy security with OPEC leaders during U.S. President Joe Biden's travel to the Middle East this week, U.S. national security advisor Jake Sullivan told reporters on Monday. "We will have the opportunity among this very broad agenda to talk about energy security with the leaders of the OPEC nations in the Middle East," Sullivan said. (RTRS)

OIL: The global price of oil could surge by 40% to around $140 per barrel if a proposed price cap on Russian oil is not adopted, along with sanction exemptions that would allow shipments below that price, a senior U.S. Treasury official said on Tuesday. U.S. Treasury Secretary Janet Yellen will discuss implementation of the proposed oil price cap with Japanese Finance Minister Shunichi Suzuki when they meet later on Tuesday, the official said. The goal was to set the price at a level that covered Russia's margin cost of production so Moscow is incentivized to continue exporting oil, but not high enough to allow it to fund its war against Ukraine, the official said. Japanese officials had expressed concern about the price cap being set too low, but had not rejected a potential price range of $40 to $60 per barrel outright, the official said. (RTRS)

OIL: The United States on Monday said 14 companies had been awarded contracts for the latest sale of oil from the Strategic Petroleum Reserve as part of the Biden administration's efforts to ease oil prices boosted by reactions to Russia's invasion of Ukraine. (RTRS)

CHINA

PBOC: The benchmark Loan Prime Rate may remain unchanged in July, as the central bank is unlikely to lower the rate of Medium-term Lending Facility, an anchor of the LPR, with the economy entering a period of recovery, the Securities Daily reported. The current financing environment remains loose with actual loan interest rates at a low level, while credit demand is also recovering, the newspaper said citing analysts. Though there is a possibility of further lowering LPR in the second half of the year, especially for the five-year and above maturity, which is dependent on the pace of economic recovery in H2, the newspaper said citing analysts. LPR is released on the 20th of every month. (MNI)

ECONOMY: Large state-owned banks are required to tilt resources to manufacturing enterprises and promote the continued rapid growth of medium and long-term loans to the manufacturing industry, Securities Times reported citing a document by the China Banking and Insurance Regulatory Commission released on Monday. For key automobile and home appliance manufacturers, it is necessary to optimise the foreign trade financial services to support their overseas expansion, the newspaper said. For manufacturers with good credit but temporarily in distress due to the pandemic, banks should avoid blindly withdrawing or suspending loans, the Daily said. (MNI)

BANKING/CREDIT: The continued recovery of new loans and aggregate financing in June indicate improved financing demand of companies and residents, as both figures hit record highs for the same period, China Securities Journal reported citing analysts. June new loans rose CNY2.81 trillion, adding CNY686.7 billion from a year earlier, supported by the rebound of medium- and long-term credit as business confidence picks up and home sales recover, the newspaper said citing analysts. Aggregate financing rose CNY5.17 trillion in June, CNY1.47 trillion more than the same period last year, driven by the large-scale issuance of local government bonds, increased loans to the real economy and off-balance sheet bill financing, the newspaper said citing analysts. (MNI)

CORONAVIRUS: A city in one of China’s steel hubs is being shut down for three days after a single Covid-19 infection was found there. Wugang in Henan Province announced a citywide lockdown starting July 11, making it the latest Chinese city to enact strict mobility curbs amid the country’s ongoing Covid flareup. (BBG)

CHINA MARKETS

PBOC INJECTS CNY3 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY3 billion via 7-day reverse repos with the rate unchanged at 2.1% on Tuesday. This keeps the liquidity unchanged after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7248% at 9:36 am local time from the close of 1.5504% on Monday.

- The CFETS-NEX money-market sentiment index closed at 49 on Monday vs 44 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7287 TUE VS 6.6960 MON

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7287 on Tuesday, compared with 6.6960 set on Monday.

OVERNIGHT DATA

AUSTRALIA JUN NAB BUSINESS CONFIDENCE +1; MAY +6

AUSTRALIA JUN NAB BUSINESS CONDITIONS +13; MAY +15

Business confidence fell to a below-average +1 index point in June as global uncertainty, looming interest rate hikes and inflation continued to cloud the outlook. Fears over these impacts on household consumption were particularly evident with confidence in the retail sector taking a significant hit. Business conditions declined by a more modest 2pts to +13 index points but remained well above average. Conditions have remained strong across the states and across most industries – including retail. Soft conditions in construction remain an outlier as building costs continue to rise, squeezing profits despite a large ongoing pipeline of work in the sector. While confidence eased, forward orders remain elevated, as does capacity utilisation, suggesting that conditions will likely remain healthy in the near-term. The supply side remains a challenge, with survey measures of both input and labour costs growth reaching new records in June at 3.6% and 4.8% respectively in quarterly terms. Product (output) price growth also strengthened and retail price inflation remained elevated at 2.9%. Bringing together retail and services industry price data from the survey suggests a very high print for underlying inflation when the Q2 CPI is released later in July. (NAB)

AUSTRALIA JUL WESTPAC CONSUMER CONFIDENCE INDEX 83.8; JUN 86.4

This marks the seventh consecutive monthly fall. Last month we noted the Index was already around levels that, since the beginning of the survey in 1974, had only been seen during periods of major disruption in the Australian economy including: the COVID pandemic; the Global Financial Crisis; the recession in the early 1990s; the slowdown in the mid–1980s and the recession of the early 1980s. (Westpac)

AUSTRALIA JUN CBA HOUSEHOLD SPENDING INTENTIONS +0.9% M/M; MAY +3.0%

AUSTRALIA JUN CBA HOUSEHOLD SPENDING INTENTIONS +11.9% Y/Y; MAY +8.1%

Welcome to the June 2022 edition of the CommBank Household Spending Intentions (HSI) Index. For June the HSI Index rose by a modest 0.9%/mth, taking the index back to an equal record-high of 117.3. On an annual basis the HSI index is up 11.9% relative to June 2021. However, it’s important to note that the gains in the HSI Index for June were relatively narrowly based. Big gains were seen for Transport (including higher petrol prices), Education and Household services. The more interest rate sensitive sectors of the economy are clearly starting to show the impact of the RBA’s monetary policy tightening cycle, with Entertainment, Home buying and Retail all declining on the month. With the RBA lifting interest rates by 50bp in July and with further increases expected in the months ahead, to a peak of 2.1% in the cash rate by November, we would expect to see the interest rate sensitive components of the HSI Index weaken further in coming months. (CBA)

AUSTRALIA ANZ-ROY MORGAN WEEKLY CONSUMER CONFIDENCE INDEX 81.6; PREV. 83.7

Consumer confidence declined for a second straight week, driven by concerns about both the economic outlook and household finances. The RBA’s 50bp rate hike last week weighed on sentiment, with confidence falling for those people paying off a mortgage by a sharp 5.4%. This continues the trend in place since late April when the high March quarter inflation report brought forward rate hike expectations. Since then, confidence amongst mortgage holders has fallen 25%, while confidence for renters is down just 4%. Inflation expectations lifted as petrol prices hover near record highs. Global oil prices dropped last week, boding well for Australia’s retail petrol prices over the coming weeks. (ANZ)

NEW ZEALAND MAY NET MIGRATION SA -828; APR +64

SOUTH KOREA MAY ADJUSTED M2 MONEY SUPPLY +0.8% M/M; APR +0.2%

SOUTH KOREA MAY ADJUSTED L MONEY SUPPLY +1.0% M/M; APR +0.5%

SOUTH KOREA JUNE HOUSEHOLD LENDING RISES TO KRW1,060.8TN; MAY KRW1,060.5TN

UK JUN BRC SALES LIKE-FOR-LIKE -1.3% Y/Y; MAY -1.5%

MARKETS

SNAPSHOT: China COVID Worry Dominates In Asia

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 515.13 points at 26297.17

- ASX 200 up 11.143 points at 6613.3

- Shanghai Comp. down 33.383 points at 3280.201

- JGB 10-Yr future up 27 ticks at 149.28, yield down 0.6bp at 0.239%

- Aussie 10-Yr future up 11.0 ticks at 96.555, yield down 11.2bp at 3.398%

- U.S. 10-Yr future +0-07+ at 118-19+, yield down 3.34bp at 2.959%

- WTI crude down $1.72 at $102.37, Gold down $4.67 at $1729.29

- USD/JPY down 16 pips at Y137.28

- WHITE HOUSE EXPECTS ‘ELEVATED’ BUT ‘OUT OF DATE’ INFLATION NUMBERS FOR JUNE (THE HILL)

- NEXT CONSERVATIVE LEADER AND PM TO BE UNVEILED BY 5 SEPTEMBER (BBC)

- UK INFLATION STILL LIKELY TO FALL SHARPLY NEXT YEAR, BOE'S BAILEY SAYS

- LABOUR ENJOYS WIDEST LEAD OVER TORIES SINCE ’13 IN LATEST OPINION POLL

- MONITORING FX CLOSELY WITH STRONG SENSE OF URGENCY, SUZUKI SAYS (BBG)

- CHINA LOCKS DOWN WUGANG CITY FOR THREE DAYS ON ONE COVID CASE (BBG)

- U.S. WILL DISCUSS ENERGY SECURITY WITH OPEC LEADERS ON MIDDLE EAST TRIP, WHITE HOUSE OFFICIAL SAYS (RTRS)

- IEA: THIS IS THE ‘FIRST GLOBAL ENERGY CRISIS’ AND IT WILL GET WORSE (AFR)

US TSYS: Richer Overnight

Continued worry surrounding the COVID situation in China (another city went into a 3-day lockdown on the discovery of 1 case, while fears surrounding a Shanghai lockdown remained evident, with 3 COVID cases detected outside of quarantine) allowed Tsys to rally overnight, with weakness in e-minis and Chinese stocks noted.

- TYU2 showed through its Monday & Friday highs, although there was a lack of notable upside extension beyond that, with gains pared back into London hours. The contract last deals +0-05 at 118-17, 0-07 off of the peak of its 0-14+ range, operating on solid volume of ~115K. Cash Tsys run 1.5-3.5bp richer across the curve, with bull steepening in play.

- Asia-Pac flow was dominated by a couple of bloc buys in TY futures (+1.5K & +2.3K).

- Tuesday’s NY docket will provide the latest NFIB small business optimism reading, along with Fedspeak from Barkin (’24 voter) & 10-Year Tsy supply. A quick reminder that Wednesday will bring the CPI reading for June, with the Biden administration already warning of “highly elevated” readings, noting the prints will not reflect the recent lowering of gas prices

JGBS: Curve Twist Steepens, Futures Bid

JGB futures have held on to their morning bid, last printing +26, with the early uptick holding. Wider cash JGBs run 2.5bp richer to 1.5bp cheaper across the curve. 7s lead the rally in paper out to 20s, outperforming on the back of the bid in futures, while the curve has pivoted around 30s.

- A reminder that weakness in domestic equities and the wider defensive flows observed since Monday’s Tokyo close seemed to be the major supportive factors for the space throughout the session, although the super-long end softened as we moved through the day.

- The most notable round of domestic headline flow came from Finance Minister Suzuki, who seemingly showed greater outward worry re: the recent run of JPY weakness, at least when compared to previous communique on the matter. Suzuki is currently meeting with his U.S> counterpart, Yellen.

- A firm round of 5-Year supply would have helped the wider bid, as it saw the low price top wider dealer expectations (which stood at 99.81, per the BBG dealer pol), while the tail vanished as the cover ratio moved away from the multi-year low that was observed at the prior 5-Year auction, topping the 6-auction average (3.37x) in the process. The recent cheapening vs. swaps and allure of new paper likely facilitated demand.

- BoJ Rinban operations headline the domestic docket on Wednesday.

JGBS AUCTION: 5-Year JGB Auction Results

The Japanese Ministry of Finance (MOF) sells Y2.0210tn 5-Year JGBs:

- Average Yield: 0.039% (prev. 0.083%)

- Average Price: 99.83 (prev. 100.08)

- High Yield: 0.039% (prev. 0.089%)

- Low Price: 99.83 (prev. 100.05)

- % Allotted At High Yield: 97.0236% (prev. 70.9981%)

- Bid/Cover: 3.917x (prev. 3.165x)

AUSSIE BONDS: Surveys Reiterate Consumer Woes & Tight Labour Market, ACGBs Bid

The defensive tone observed in wider markets (spill over from Monday trade & continued worry re: China COVID matters) coupled with soft domestic business and consumer survey prints (with the picture painted by consumers still far more dire than that given by businesses, at least in headline terms) has supported the ACGB space during Tuesday trade, leaving YM and XM 11.5 and 10.5 ticks above their respective settlement levels, a touch shy of best levels of the session. Cash ACGBs see the major benchmarks running 8.5-11.5bp richer across the curve, with 5s leading the bid. EFPs have actually broken the recent trend and sit a little narrower on the day, although the velocity and scale of the recent widening is notable. Bills run 5-19bp richer through the reds, bull flattening. Note that broader volume remains on the lighter side.

- Outside of the headline readings, we note that the NAB business survey revealed that “the supply side remains a challenge, with survey measures of both input and labour costs growth reaching new records in June at 3.6% and 4.8% respectively in quarterly terms.” This will have caught the RBA’s attention given its focus on softer survey and liaison programme findings when it comes to wage growth.

- A$800mn of ACGB Nov-32 supply headlines local matters tomorrow.

- In the semi space, SAFA’s May ’36 tap is set to price today after being launched earlier.

EQUITIES: Generally Lower In Asia

Monday’s defensive tone spilled over into Asia-Pac hours, with the latest localised COVID-related lockdown in a Chinese city & the detection of a handful of cases outside of quarantine in Shanghai applying further pressure to wider sentiment.

- Headline flow was limited, with cross-market related moves front and centre. The weaker start for the likes of the Nikkei 225 and the KOSPI dragged e-minis through Monday’s lows, with the weakness in e-minis then extending further as Chinese equities moved lower.

- In terms of outright performance, the Nikkei 225 is 1.5% lower on the day at typing, with the CSI 300 printing 1.0% worse off. E-mini futures are 0.5 to 0.7% below settlement levels, with the NASDAQ 100 contract leading the weakness.

- The ASX 200 bucked the broader trend, sitting 0.3% higher on the day ahead of the close, benefitting from buoyant consumer staples and healthcare sectors, which outweighed the downtick in the heavyweight materials sector.

GOLD: Still Losing Ground

Gold saw a brief dip sub $1730 (low was a $1723 handle), but we are now back above this level, last tracking at $1732. This is down slightly from NY closing levels. The broader trend for the precious metal still looks skewed to the downside given ongoing USD strength.

- Gold's fortunes look tied to broader USD sentiment in the near term. The earlier dip came as EUR/USD almost fell through parity against the USD.

- Overnight moves in gold also tracked USD swings. The precious metals lost 0.5% yesterday and we are now at lows going back to late September last year. This low had a $1722 handle, which was close to levels we saw earlier today (~$1723). Beyond that is sub $1700 recorded in August last year.

- Lower back end US yields didn't help gold much overnight, although real 10yr yields are only marginally off recent highs, which is arguably a more important driver.

- Weaker equities also haven't generated much safe have support during today’s session.

OIL: Drifting Lower As Broader Risk Appetite Softens

Brent crude is down slightly from NY closing levels, last tracking sub $106/bbl, but has respected recent ranges since the start of this week. It's been a similar pattern for WTI, sitting close to $102.50/bbl currently. Cross asset signals have been negative, with equities lower and the USD gaining further ground.

- Broader energy commodity trends continue to outperform the metals complex, with supply pressures clearly holding up energy prices relative to metals.

- Today in Sydney, IEA Executive Director Fatih Birol stated that we may not have seen the worst of the energy crisis. He also stated this winter in the EU will be very difficult.

- The US is also trying to garner fresh support for its proposal to cap Russian oil export prices at $40-$60. This comes as US Treasury Secretary Yellen kicks off a 10 day trip to Asia, starting in Japan. Japan officials have already reportedly stated the cap could be too low, although haven’t rejected the proposal. US officials have stated failure to implement a cap could result in oil prices rising to $140/bbl. Clearly, there still needs to be lots of detail worked out with this plan.

- Elsewhere, US National Security Advisor Sullivan stated the US does believe OPEC has more oil capacity. This comes ahead of Biden's trip to Saudi Arabia this week.

- China Covid developments remain negative at the margin, onshore equities continue to weaken, while the city of Wugang was placed into a 3 day lockdown after 1 covid case was discovered. Close to 30 million people in China are currently in lockdown.

FOREX: Risk-Off Impulse Lingers On But Moderates, EUR/USD Flirts With Parity

Participants were reluctant to take more risk ahead of this week's company earnings reports & U.S. CPI data. Overnight headline flow did not provide much in the way of fresh insights, failing to assuage familiar fears related to China's COVID-19 situation and other well-documented headwinds to global growth. That said, initial risk-off impetus moderated as the session progressed.

- The yen still sits atop the G10 pile, with other traditional safe havens (USD, CHF) also showing strength. USD/JPY slipped into the Tokyo open and extended losses to Y137.03, before trimming initial losses.

- The dollar index (BBDXY) ripped through yesterday's best levels on its way to fresh cyclical highs, even as U.S. Tsys richened across the curve. All three main U.S. e-mini contracts sank.

- Spot USD/CNH added ~215 pips on a flight to safety, with the move likely facilitated by a slightly weaker than expected PBOC fix. The mid-point of permitted USD/CNY trading band was set 18 pips above expectations.

- Greenback strength drove EUR/USD to its lowest point since 2002, with the pair bottoming out at $1.0006. The rate sits within touching distance from parity, owing to the Eurozone's exposure to the fallout from Russia's war on Ukraine.

- The kiwi dollar showed resilience despite its commodity-tied peers coming under pressure. Reminder that the RBNZ will announce its rate decision on Wednesday, it is expected to hike the OCR by 50bp.

- On the radar today we have German ZEW Survey and remarks from Fed's Barkin, ECB's Villeroy & BoE's Bailey.

FOREX OPTIONS: Expiries for Jul12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0175-85(E521mln), $1.0260-70(E1.2bln)

- USD/JPY: Y135.55-60($1.0bln), Y137.60-65($1.2bln)

- NZD/USD: $0.6250(N$1.2bln)

- USD/CNY: Cny6.7000($1.3bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/07/2022 | 0800/0900 |  | UK | BOE Cunliffe on Crypto Markets | |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 12/07/2022 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 12/07/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 12/07/2022 | 0900/1000 |  | UK | BOE Bailey Speaks at OMFIF | |

| 12/07/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 12/07/2022 | - |  | EU | ECB de Guindos at ECOFIN Meeting | |

| 12/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 12/07/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 12/07/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 12/07/2022 | 1600/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/07/2022 | 1630/1230 |  | US | Richmond Fed's Tom Barkin | |

| 12/07/2022 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.