-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Assess Known Risks At Start Of FOMC Week

EXECUTIVE SUMMARY

- CHINA STRENGTHENS WARNING TO US ABOUT PELOSI’S PLANNED TAIWAN TRIP (FT)

- RUSSIAN ODESA MISSILE STRIKE TESTS UKRAINE GRAIN EXPORT DEAL (BBG)

- U.S. ECONOMY SLOWING, BUT RECESSION NOT INEVITABLE, YELLEN SAYS (RTRS)

- ECB WILL RAISE RATES UNTIL INFLATION FALLS BACK TO 2%, LAGARDE SAYS (RTRS)

- ECB MAY ENDURE MODERATE RECESSION TO HALT PRICES, HOLZMANN SAYS (BBG)

- CONSERVATIVE PARTY MEMBERS STILL LOOK TO LIZ TRUSS (THE TIMES)

- SIEMENS GIVES GAZPROM NORD STREAM 1 TURBINE DOCUMENT (KOMMERSANT)

- CHINA PLANS REAL ESTATE FUND TO HELP SUPPORT DEVELOPERS (REDD)

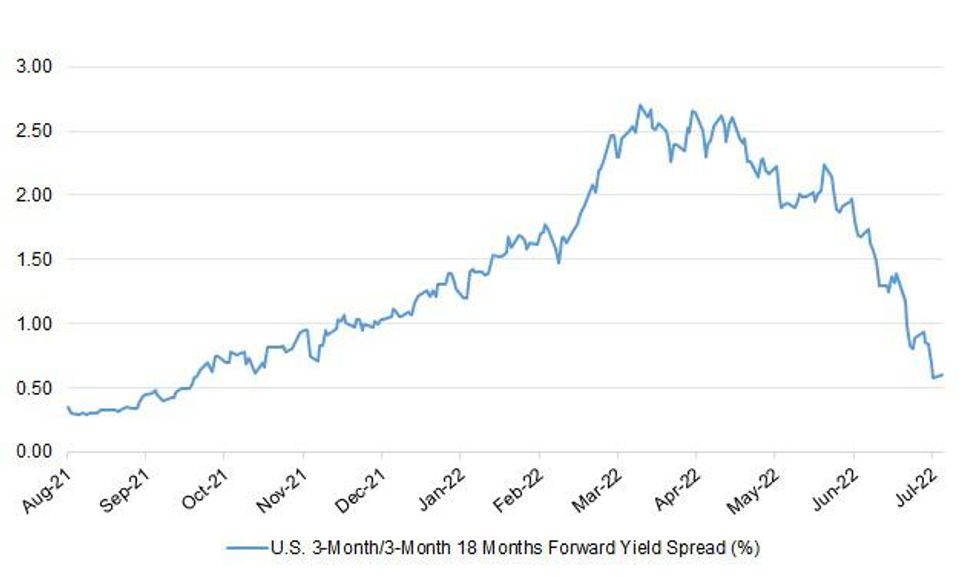

Fig. 1: U.S. 3-Month/3-Month 18 Months Forward Yield Spread (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak is still trailing Liz Truss among Tory voters, even though most prefer to prioritise getting inflation under control over cutting taxes, a YouGov poll suggests. (The Times)

POLITICS: Boris Johnson privately believes he will be back in office next year, despite announcing his resignation after MPs rose up against his leadership two weeks ago. (Telegraph)

POLITICS/BOE: Liz Truss’s economic plan would fuel inflation and prompt quicker interest rate increases from the Bank of England than if Rishi Sunak led the nation, a poll of economists showed. Eight of the nine economists surveyed by Bloomberg said Sunak, the former chancellor of the exchequer, would handle the economy better than Truss, with one preferring the foreign secretary. (BBG)

EUROPE

ECB: The European Central bank will raise its interest rates until inflation falls back to its 2% target, the ECB's President Christine Lagarde said in an interview with Germany's Funke Mediengruppe published on Friday. (RTRS)

ECB: European Central Bank Governing Council member Joachim Nagel said he was pleased with Thursday’s decision to raise interest rates by 50 basis points as it minimizes the risk of having to act more strongly later on. “In my view it’s better to start with a bigger increase in interest rates,” Nagel said in an interview with Handelsblatt published Friday. “The times of negative interest rates are over.” (BBG)

ECB: The European Central Bank may have to accept a moderate recession to stem price pressures if it sees signals that inflation expectations are rising, Governing Council member Robert Holzmann said. “We hope that won’t become necessary,” Holzmann told the Austrian public broadcaster ORF late Sunday. Holzmann, who is also the governor of the Austrian National Bank, said the size of a next tightening step in September will depend on developments in the economic outlook. That will determine whether the next move is another 50 basis-point hike, a larger or a smaller one, he said. (BBG)

ECONOMY: A number of industrial companies in Germany are cutting production in reaction to soaring energy prices, a survey by the country’s Chambers of Industry and Commerce (DIHK) showed on Sunday. (RTRS)

FRANCE: The French government is doubling down on calls to save energy amid rising prices and the war in Ukraine. (BBG)

FRANCE: The French finance minister said Saturday he would consider increasing a subsidy on fuel prices to 30 euro cents per liter from 18 cents, sending a message of compromise to conservatives in the lower house of parliament. (BBG)

ITALY: Italy’s Democrats are weighing possible alliances for the country’s national elections in September and will decide in the coming days and weeks on the makeup of any new coalitions, party leader Enrico Letta said in an interview with la Repubblica published Sunday. (BBG)

RATINGS: Rating reviews of note from after hours on Friday include:

- Fitch affirmed Hungary at BBB; Outlook Stable

- Fitch affirmed Ireland at AA-; Outlook Stable

- Fitch affirmed Poland at A-; Outlook Stable

- DBRS Morningstar confirmed the European Financial Stability Facility at AAA, Stable Trend

- DBRS Morningstar confirmed the European Stability Mechanism at AAA, Stable Trend

- DBRS Morningstar confirmed Switzerland at AAA, Stable Trend

U.S.

ECONOMY: U.S. Treasury Secretary Janet Yellen said on Sunday that U.S. economic growth is slowing and acknowledged there was the risk of a recession, but she said a downturn was not inevitable. (RTRS)

INFLATION/ENERGY: U.S. President Biden tweeted the following on Saturday: "Americans have seen gas prices drop by about 60 cents a gallon in the last month, saving the average driver about $30/month. An extra 60 cents a gallon back in your pocket is meaningful. It's breathing room. And we're not done working to lower costs for families." (MNI)

POLITICS: President Biden's coronavirus symptoms "continue to improve significantly" as he has completed three full days of taking Pfizer's antiviral pill, Paxlovid, according to a letter from the White House physician on Sunday. (Axios)

OTHER

GLOBAL TRADE: Russia attacked Odesa’s sea port with cruise missiles hours after signing a deal to unblock Ukrainian grain exports from three Black Sea ports, including Odesa, that was hailed as a vital step toward alleviating a global food crisis. (BBG)

GLOBAL TRADE: Ukraine could export 60 million tonnes of grain in eight to nine months if its ports were not blockaded, but Russia's strike on the port of Odesa showed it will definitely not be that easy, an economic adviser to the Ukrainian president said on Saturday. Ukraine could earn $10 billion by exporting 20 million tonnes of grain in silos in addition to 40 million tonnes from its new harvest, economic adviser Oleh Ustenko said on television. Ukraine will need 20 to 24 months to export those volumes if its ports are not functioning properly, he said. (RTRS)

GLOBAL TRADE: Russia’s foreign minister said Moscow is counting on the UN to help resolve sanctions-related issues hampering Russian food and fertilizer exports. (BBG)

GLOBAL TRADE: A number of insurance underwriters are interested in providing cover for grain shipments from Ukraine after an agreement was reached to re-open Black Sea ports, although the first shipments are expected to be weeks away, industry sources said on Friday. (RTRS)

GEOPOLITICS: The United States will host a virtual meeting on Tuesday of officials representing the 14 countries that have joined the Indo-Pacific Economic Framework, as Washington seeks to expand its engagement with Asia. (RTRS)

U.S./CHINA/TAIWAN: China has issued stark private warnings to the Biden administration about the upcoming trip to Taiwan by Nancy Pelosi, Speaker of the US House of Representatives, triggering alarm bells among White House officials who oppose her visit. (FT)

U.S./CHINA/TAIWAN: White House National Security Adviser Jake Sullivan reiterated on Friday that US President Joe Biden was committed to a policy of “strategic ambiguity” regarding Taiwan despite earlier comments that suggested a change in policy. (SCMP)

U.S./CHINA/TAIWAN: China's Foreign Minister Wang Yi said on Monday that the South China Sea is not a "safari park" for countries outside the region or a "fighting arena" for major powers to compete in. The South China Sea issue should be handled by countries in the region themselves, Wang said. (RTRS)

U.S./CHINA/TAIWAN: After the US government received an unprecedentedly strong message from the Chinese side regarding US House Speaker Nancy Pelosi's planned visit to the island of Taiwan, the Biden administration appears to be increasingly concerned that the visit could lead to catastrophic consequences for China-US relations. (Global Times)

U.S./CHINA: China’s securities regulator told CNBC in a statement it has not researched a plan for a three-tiered system to help Chinese companies avoid U.S. delisting. The Financial Times reported, citing sources, that China is preparing a system to separate U.S.-listed Chinese companies into three groups based on their level of data sensitivity. The report said that system would help some Chinese companies come into compliance with U.S. demands to be able to inspect audit papers. The regulator said other information about ongoing discussions with U.S. regulators should come from official announcements. (CNBC)

BOJ: Fresh off a robust victory in upper house elections, the government of Fumio Kishida has started a process that could replace five slots on the nine-member Bank of Japan Board by April of next year, including Governor Haruhiko Kuroda and two deputies, Masayoshi Amamiya and Masazumi Wakatabe. (MNI)

RBA: The Reserve Bank of Australia is not expecting a domestic recession as the economy heads to lower growth later this year on weaker consumer spending as part of the cost of controlling inflation, MNI understands. The RBA's view is that the economy is currently running hot largely due to strong employment, and while wages are increasing, they are still likely to be lagging inflation which is expected to reach around 7% this year. (MNI)

AUSTRALIA/CHINA: Prime Minister Anthony Albanese says it is in China’s interest to lift all sanctions against Australia amid rumblings it may turf a long-held ban on coal imports. There are suggestions China is proposing to end an almost two year ban on Australian coal as tensions between the two countries begin to ease. Mr Albanese said there were “no justifications” for the China sanctions against Aussie goods. (The Australian)

BRAZIL: Brazilian President Jair Bolsonaro said on Sunday that a cash welfare program that provides 600 reais ($109) in monthly payments to low-income Brazilians will continue next year if he is re-elected. The right-wing leader, who has increasingly relied on social spending to boost his campaign, made the announcement at an event announcing the official beginning of his candidacy. (RTRS)

BRAZIL: Brazil's Economy Ministry projected on Friday a primary budget deficit of 59.354 billion reais ($10.80 billion) for the central government this year, according to its latest bi-monthly revenue and expenditure report. The forecast came in better than the 65.5 billion reais deficit seen in May. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelensky said a ceasefire with Russia without reclaiming lost territories would only prolong the war, according to an interview with the Wall Street Journal on Friday. (Jerusalem Post)

RUSSIA: The United States is exploring whether it can send U.S.-made fighter jets to Ukraine, a White House spokesman told reporters on Friday, as the conflict with Russia is about to enter its sixth month and fighting rages in eastern Ukraine. (RTRS)

RUSSIA: U.S. Deputy Treasury Secretary Wally Adeyemo will travel to Paris and Brussels next week to meet with counterparts and discuss ways to step up sanctions imposed on Russia in response to its invasion of Ukraine, the Treasury said in a statement on Friday. (RTRS)

RUSSIA: The European Union needs a new strategy on the war in Ukraine as sanctions against Moscow have not worked, Hungarian Prime Minister Viktor Orban said on Saturday. (RTRS)

RUSSIA: Russian state-owned companies Rosneft and Gazprom will be able to ship oil to third countries under an adjustment of European Union sanctions agreed by member states this week aimed at limiting the risks to global energy security. (RTRS)

RUSSIA: The Russian central bank said on Friday that automatic conversion of depositary receipts in shares of companies in Russian depositories will begin on Aug. 15. Moscow is de-listing Russian company depositary receipts from foreign exchanges and converting them into local Russian securities in a bid to reduce foreigners' control over these companies amid Western sanctions. (RTRS)

SOUTH AFRICA: South African President Cyril Ramaphosa said the government is making progress on a plan to boost economic growth, after he was criticized by one of the nation’s former leaders for failing to deliver the plan. (BBG)

IRAN: French President Emmanuel Macron told his Iranian counterpart Ebrahim Raisi during a call Saturday that a nuclear deal was still possible but had to happen fast. (BBG)

METALS: Chile's state-owned Codelco, the world's top copper miner, expects to gradually restart operations at some of its mining projects on Monday, following the death of two workers earlier this month, the company said in a statement on Sunday. Codelco had halted all its mining construction projects pending a safety review last week, due to the two deaths, which took place at different mining sites. The resumption of operations will start with infrastructure work, the company said, and then move on in the next few days to include underground mines. (RTRS)

METALS: The London Metal Exchange has told some of its committee members it will not ban Nornickel's metal from its system as the company is not under UK sanctions even though Chief Executive Vladimir Potanin is, three sources familiar with the matter said. (RTRS)

ENERGY: Siemens Energy AG on Sunday transferred a Canadian export license to Gazprom PJSC that allows turbines for the Nord Stream 1 pipeline to be repaired and transported, Kommersant said, citing people it didn’t identify. (BBG)

ENERGY: European governments are attempting to water down Brussels’ plans to push the bloc into cutting gas demand to better weather a shortage of Russian supplies this winter. (FT)

ENERGY: Austria will connect to its local grid a gas storage tank that has in the past delivered fuel exclusively to Germany, as Europe’s energy crisis continues. The facility, near Salzburg, supplies households and industrial companies in the southern German state of Bavaria, home to BMW AG and Siemens AG. Austria expects the storage site to be connected to local supply lines this year, Sueddeutsche Zeitung reported, citing Climate and Energy Minister Leonore Gewessler. (BBG)

ENERGY: Algeria’s gas supply to Spain has been temporarily disrupted after an incident on the European side of the Medgaz pipeline on Sunday morning, state news agency APS reported. (BBG)

ENERGY: The European Union is seeking additional gas supplies from Nigeria as the bloc prepares for potential Russian supply cuts, Matthew Baldwin, deputy director general of the European Commission's energy department, said on Saturday. (RTRS)

OIL: Iraq has the capacity to increase its oil production by 200,000 barrel per day (bpd) this year if asked, an executive of Iraq’s Basra Oil Co. (BOC) told Reuters on Friday. (RTRS)

OIL: The Keystone oil pipeline network resumed normal operations July 23 after a nearly weeklong reduction in capacity triggered by damage at a third-party electric substation, operator TC Energy said. (Platts)

CHINA

FISCAL: China is likely to front-load next year’s local government special bond quota in the second half of the year to help boost infrastructure investment, as monetary policy is difficult to ease significantly amid rising inflation and the rate hikes overseas, Yicai.com reported citing analysts. CPI may be pushed above the 3% ceiling in some months in H2, with pork prices entering an upward cycle, though weak consumption and the recent correction in oil prices may help to ease some upward pressure, the newspaper said citing analysts. There is discussion in the markets that the Ministry of Finance may be considering bringing forward the issuance of CNY1.5 trillion of next year’s special bonds to this year, Yicai added. (MNI)

FISCAL: Beijing has turned down requests from three local governments to lift their debt quotas, amid rising economic pressure and financial risk driven by a slump in the property sector and zero-Covid measures. (SCMP)

FISCAL: China’s total debt as a percentage of gross domestic product climbed to an all-time high of 271% in the second quarter, surpassing the previous record of 270.3% reached in the third quarter of 2020, according to data compiled by Bloomberg. (MNI)

ECONOMY: China’s exports are expected to maintain growth in the second half of the year, following the double-digital increases in H1, the China Securities Journal reported in the front-page citing analysts. By mid-July, the foreign trade cargo throughput of key ports monitored by China Ports increased by 5.9% y/y, 4.8 percentage points faster than the previous period, the newspaper said. At present, the U.S.’s domestic consumer demand is relatively good, with low inventories for automobile and auto parts as well as apparel, and demand from ASEAN countries, will drive up demand for Chinese upstream products, such as electromechanical intermediates, the newspaper said citing analysts. (MNI)

DIGITAL YUAN: China’s e-CNY is legal tender in digital form and can be exchanged 1:1 with physical yuan, so it can be used to buy gold and foreign exchange, the Shanghai Securities News reported citing Mu Changchun, director of the Digital Currency Research Institute at the People's Bank of China, in responding to recent misunderstandings of e-CNY. The digital yuan is positioned at M0 and will meet the needs of personal anonymous payment, and the authority can inquire about user information only when suspected illegal transactions are triggered, the newspaper said citing Mu. (MNI)

CORONAVIRUS: Shanghai ordered residents across nine of the city's districts and some smaller areas to do COVID-19 tests over July 26-28, the city government said on Monday, as sporadic local cases kept emerging in the Chinese commercial hub. (RTRS)

PROPERTY: China’s State Council approved a plan late last week to set up a real estate fund to provide financial support to 12 developers and a few new distressed developers that were recently nominated by local authorities, REDD reported. The fund secured 50 billion yuan ($7.4 billion) from China Construction Bank and a 30 billion yuan re-lending facility from People’s Bank of China; It can be upsized to between 200 billion yuan and 300 billion yuan. (BBG)

PROPERTY: China Evergrande Group’s Chief Executive Officer Xia Haijun was forced to resign as the embattled property developer tries to strike a restructuring deal to resolve $300 billion of liabilities that have roiled the nation’s real estate market. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY7 BILLION VIA OMOS MONDAY

The People's Bank of China (PBOC) injected CNY5 billion via 7-day reverse repos with the rate unchanged at 2.10% on Monday. The operation has led to a net drain of CNY7 billion after offsetting the maturity of CNY12 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.7472% at 09:41 am local time from the close of 1.4826% on Friday.

- The CFETS-NEX money-market sentiment index closed at 47 on Friday vs 45 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7543 MON VS 6.7522

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7543 on Monday, compared with 6.7522 set on Friday.

OVERNIGHT DATA

JAPAN JUN NATIONWIDE DEPT STORE SALES +11.7% Y/Y; MAY +57.8%

JAPAN JUN TOKYO DEPT STORE SALES +13.8% Y/Y; MAY +80.6%

MARKETS

SNAPSHOT: Markets Assess Known Risks At Start Of FOMC Week

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 213.65 points at 27701.01

- ASX 200 up 1.301 points at 6792.80

- Shanghai Comp. down 23.272 points at 3246.702

- JGB 10-Yr future up 51 ticks at 150.26, yield down 3.1bp at 0.184%

- Aussie 10-Yr future up 10.5 ticks at 96.625, yield down 10bp at 3.340%

- U.S. 10-Yr future -0-00+ at 119-28, yield up 3.27bp at 2.783%

- WTI crude down $0.67 at $94.03, Gold down $1.06 at $1726.57

- USD/JPY up 8 pips at Y136.20

- CHINA STRENGTHENS WARNING TO US ABOUT PELOSI’S PLANNED TAIWAN TRIP (FT)

- RUSSIAN ODESA MISSILE STRIKE TESTS UKRAINE GRAIN EXPORT DEAL (BBG)

- U.S. ECONOMY SLOWING, BUT RECESSION NOT INEVITABLE, YELLEN SAYS (RTRS)

- ECB WILL RAISE RATES UNTIL INFLATION FALLS BACK TO 2%, LAGARDE SAYS (RTRS)

- ECB MAY ENDURE MODERATE RECESSION TO HALT PRICES, HOLZMANN SAYS (BBG)

- CONSERVATIVE PARTY MEMBERS STILL LOOK TO LIZ TRUSS (THE TIMES)

- SIEMENS GIVES GAZPROM NORD STREAM 1 TURBINE DOCUMENT (KOMMERSANT)

- CHINA PLANS REAL ESTATE FUND TO HELP SUPPORT DEVELOPERS (REDD)

US TSYS: A Little Cheaper In Asia

TYU2 hovers around the middle of its 0-11 overnight range, last dealing -0-00+ at 119-28, on sub-par volume of ~75K, while cash Tsys run 2.0-3.5bp cheaper across the curve.

- Early Asia trade saw regional participants sell Tsys on the back of a rally in European/NY hours for a second consecutive session, which could suggest that the regional impulse has been dominated by profit taking on existing long positions over the past couple of sessions, as opposed to an attempt to fade the richening, given the degree of the pull lower in yields in pre-Asia trade.

- Modest losses for crude oil futures (which more than reversed the early uptick), coupled with a downtick for equities and continued focus on the recession-related risks (which drove Friday’s bid in core global FI markets, in lieu of soft European and U.S. PMI data) then took the edge off the initial cheapening, even with the White House continuing to play down any such fears. Meanwhile, subsequent talk of potential support for the Chinese property sector limited the downtick in wider equity indices.

- Elsewhere, weekend headline flow focused on simmering Sino-U.S. tensions surrounding Taiwan and a Russian missile attack on the port of Odesa, which came hours after the two countries agreed a pact to allow Ukraine to export grain (note that this particular attack wouldn’t breach that pact, if Russia’s suggestion that it was targeting naval hardware prove to be true).

- Overnight flow was dominated by a block buyer of TY futures (+3.3K).

- Looking ahead, the NY calendar is headlined by regional Fed activity indices from Chicago & Dallas, along with 2-Year Tsy supply.

JGBS: Off Best Levels, New BoJ Board Members Set To Speak

JGBs operate shy of best levels, after JGB futures failed to force a break of the overnight session high.

- Local headline flow has been light thus far, leaving wider core FI dynamics since Friday’s Tokyo close and the unwind of an early uptick in crude futures at the fore.

- Futures sit +45 vs. Friday’s settlement, ~20 off their Tokyo peak. Cash JGBs run little changed to ~3.5bp richer on the day, after playing catch up to Friday’s richening in wider core global FI markets, with swaps lagging across the curve, resulting in a widening of swap spreads.

- The details of BoJ Rinban operations covering 1- to 25-Year JGBs may have provided some pressure on the 10- to 25-Year zone of the curve, given the uptick in offer/cover in that bucket.

- 10-Year JGB yields briefly showed below 0.18%, hitting the lowest level observed since March in the process, given the BoJ’s YCC parameters a little more breathing room.

- The BoJ has flagged an impending address from new board members Takata & Tamura (17:00 Tokyo/09:00 London). As noted by our policy team in their most recent insight piece, Takata, most recently an economist at brokerage Okasan Securities, has previously voiced concern over side-effects of powerful monetary easing, although he is expected to side with current policy settings at the upcoming BoJ decisions. Meanwhile, Tamura, most recently a senior adviser at Sumitomo Mitsui Banking Corp, has reportedly voiced concern on the BoJ’s bond market operations distorting markets, but is also likely to support Kuroda when it comes to maintaining easy policy through the end of the Governor’s term.

AUSSIE BONDS: Richer, But Off Best Levels

Aussie bonds deal shy of best levels, with a modest downtick in U.S. Tsys applying some pressure, although ACGBs have held on to the bulk of gains made after catching up to Friday’s recession worry-driven richening in core global FI markets. Cash ACGBs run 7-11bp richer across the curve, with the belly leading the bid. YM and XM are +9.5 & +11.0, respectively, after failing to challenge their overnight session peaks. Bills run 6 to 11 tick richer through the reds, bull flattening.

- The latest round of ACGB-47 supply went smoothly, with the weighted average yield printing 2.22bp through prevailing mids (per Yieldbroker). The cover ratio improved to 2.46x (from 2.09x prev.), although the low frequency at which the line is issued (last auction in Dec ‘19) may limit the usefulness of comparisons to past results. The earlier-flagged, easily-digestible DV01 and inversion in the ACGB Mar-47/Jun-51 spread likely contributed to the smooth auction, adding to tailwinds from the broader stabilisation in Aussie bonds from outright cycle cheaps.

- The domestic data docket and RBA speaker slate is empty on Tuesday, with Q2 CPI expected to provide the first point of interest for the week when it crosses on Wednesday.

AUSSIE BONDS: ACGB-47 Supply Goes Very Well

Today’s ACGB Mar-47 supply was absorbed smoothly, with the weighted average yield printing 2.22bp through prevailing mids (per Yieldbroker). The cover ratio came in at 2.46x, above the previous auction result of 2.09x, although the low frequency at which the line is issued (last auction in Dec ‘19) may limit the usefulness of comparisons to past auction results.

- The easily-digestible DV01 and previously-flagged inversion in the ACGB Mar-47/Jun-51 spread likely contributed to today’s smooth auction, adding to tailwinds from the broader stabilisation in Aussie bonds from outright cycle cheaps.

EQUITIES: Lower In Asia On Underperformance In Tech; U.S. Large-Cap Earnings Eyed

Major Asia-Pac equity indices sit flat to 0.8% lower at typing amidst underperformance from high-beta equities region wide, tracking a similar performance on Wall St. (particularly tech and advertising after Snap’s 39% plunge on Friday).

- The CSI300 sits 0.8% weaker, hitting fresh six-week lows at typing. The overall move lower comes despite a bid in the real estate sector, with the CSI300 Real Estate Index adding 1.9% at writing, with the richly-valued consumer staples and healthcare sub-indices leading the way lower.

- The Hang Seng deals 0.8% worse off, with gains in the property sub-gauge (+1.5%) unable to offset weakness in China-based tech. The Hang Seng Tech Index sits 2.2% weaker, dragged lower by Chinese EV stocks and tech large-caps, with the selloff coming despite FT source reports pointing to China planning a three-tiered strategy to avoid U.S. de-listings.

- The Nikkei 225 deals 0.7% lower at typing, on track to snap a six-session streak of higher daily closes. Major exporters and the IT sector struggled, with the negative lead from U.S. tech weighing on sentiment.

- The ASX200 trades virtually unchanged at typing in a relatively tepid session (perhaps ahead of Wednesday’s Q2 CPI print), seeing steep losses in tech (S&P/ASX All Tech Index:-1.4%) offset gains in the materials sub-gauge.

- E-minis sit flat to 0.1% worse off at typing, a little off their respective lows made on Friday.

- A busy week beckons for equities - 175 companies on the S&P500 will report earnings, headlined by large-caps including Apple, Amazon, and Microsoft. The Fed’s FOMC decision is due on Wed, while U.S. Q2 Advanced GDP will cross on Thu, followed by PCE data on Friday.

OIL: Lower In Asia As Demand Outlook In Focus

WTI and Brent are ~-$0.70 worse off apiece, with the former operating a shade below its Friday trough at typing. The move lower comes as participants in Asia react to the mix of disappointing PMIs out of Europe and the U.S., with the latter’s flash services PMI dipping into contractionary territory for the first time in nearly two years, exacerbating recession fears from some quarters ahead of this week’s FOMC, where a 75bp hike (or larger) may heighten expectations of reduced economic activity and energy demand.

- Daily COVID case counts in China have ticked lower (680 cases for Sun vs. 869 for Sat, with major cities continuing to report low case counts.

- Turning to oil supply concerns, the Canada-U.S. Keystone pipeline resumed normal operations over the weekend, restoring previously-reduced supply to the crude storage hub of Cushing.

- Elsewhere, Libya’s state oil operator reported on Friday that crude output has hit ~860K bpd, while pledging that “full” oil production (~1.2mn bpd) would be achieved within two weeks. Keeping within the country, deadly militia-led clashes were reported in the capital over the weekend and may be worth monitoring given the political bent of previous disruptions to crude production.

- Crude remains steeply backwardated, pointing to worsening tightness in near-term supply, with Brent’s prompt spread sitting at ~$4.97 at typing.

GOLD: A Little Lower In Asia

Gold sits ~$2/oz weaker at typing to print ~$1,725/oz, rising off session lows as nominal U.S. Tsy yields have come off of their earlier highs. The precious metal has struggled to rise above neutral levels in Asia after closing firmer for the first week in six last Friday, with that move higher aided by a pullback in Fed rate hike expectations from their mid-July, U.S. CPI-inspired extremes.

- To recap, gold initially surged to one-week highs on Friday (at $1,739.3/oz) after the U.S. services flash PMI printed below expectations (while also entering contractionary territory), before paring gains to close ~$10/oz higher.

- Gold however remains on track for a fourth straight monthly loss, with well-documented recession-related worry (particularly in the U.S. and Europe) countered by expectations of Fed hawkishness amidst persistently high inflation, and the USD (DXY) continuing to operate at historically elevated levels.

- July FOMC dated OIS now price in ~82bp of tightening for that meeting (off its mid-July peak ~93bp), pointing to ~30% odds of a 100bp move, while a cumulative ~181bp is priced in through to Dec ‘22 (against >210bp on Jul 14).

- From a technical perspective, gold’s move higher on Friday approached initial resistance at $1,745.4/oz (Jul 13 high). A breach of that level would expose further resistance at ~$1,764.0/oz (20-Day EMA), while on the downside, initial support is situated at $1,697.7 (Jul 14 low).

FOREX: Antipodeans Sag In Cautious Asia-Pac Trade

The week in Asia started on a cautious note, as lingering recession fears and geopolitical backdrop dented sentiment, with U.S. e-mini futures operating in negative territory.

- The greenback outperformed as U.S. Tsy yields firmed. That said, the U.S. dollar index (BBDXY) pared most of its initial gains.

- USD/JPY gave away the bulk of its initial gains after the Tokyo fix but managed to stay in positive territory. U.S./Japan 10-year yield spread widened by ~6bp, moving away from one-month narrows touched last Friday.

- The Antipodeans went offered amid broader aversion to risk. AUD/USD staged a brief foray below the $0.6900 mark before trimming losses. AUD/NZD crept higher in tandem with Australia/New Zealand 2-year swap rate gap.

- The European FX bloc traded on a slightly firmer footing, with sterling lagging its regional peers.

- German Ifo Survey will take focus after the data-light Asia session.

FX OPTIONS: Expiries for Jul25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0200(E641mln), $1.0250(E1.8bln)

- USD/JPY: Y134.20($550mln)

- AUD/USD: $0.6750(A$1.1bln), $0.6950-55(A$910mln), $0.7000(A$1.1bln)

- NZD/USD: $0.6100(N$651mln)

- USD/CAD: C$1.3010($700mln), C$1.3100($530mln)

- USD/CNY: Cny6.7500($2.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2022 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/07/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.