-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Markets Stuck In Pre-Fed Coil Overnight

EXECUTIVE SUMMARY

- BIDEN STILL EXPECTS TO SPEAK WITH CHINA'S XI THIS WEEK (RTRS)

- PELOSI’S TAIWAN AMBIGUITY HAS CHINA FUMING AHEAD OF BIDEN CALL (BBG)

- BANK OF ENGLAND TO RAISE RATES BY 25BPS IN AUG, BUT 50 A CLOSE CALL (RTRS POLL)

- SUNAK FAILS TO MAKE MEANINGFUL GROUND IN TORY LEADERSHIP TV DEBATE

- SIEMENS ENERGY: TRANSPORT OF NORD STREAM 1 TURBINE COULD START NOW (RTRS)

- PBOC BECOMING MORE FLEXIBLE WITH OMOS (CSJ)

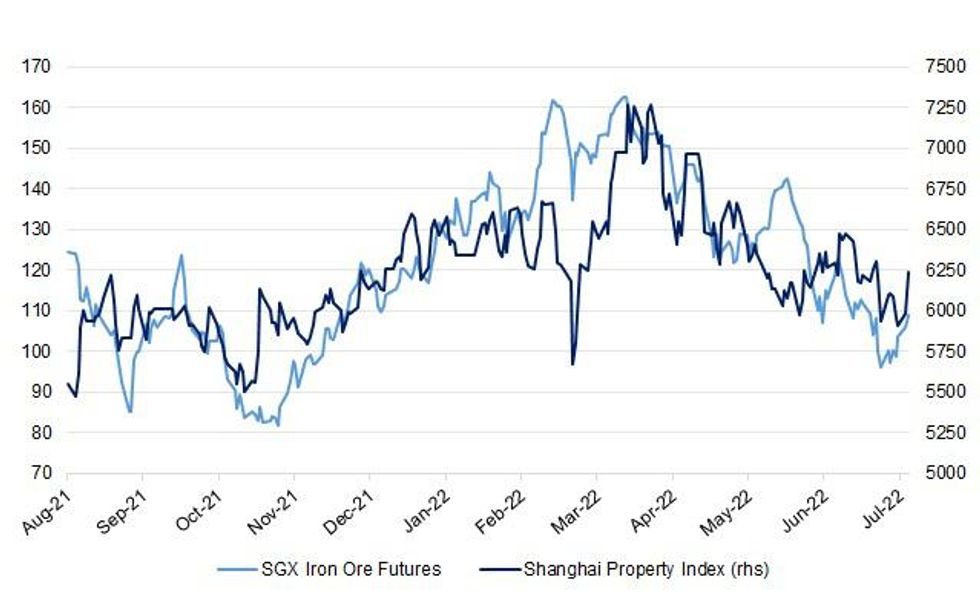

Fig. 1: SGX Iron Ore Futures Vs. Shanghai Property Index (rhs)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Rishi Sunak and Liz Truss stepped up the blue-on-blue attacks in a fiery head-to-head showdown which saw them clash over taxes, the schools they went to and their loyalty to Boris Johnson. (Sky)

POLITICS: Rishi Sunak failed to claw back ground tonight despite launching a series of attacks on Liz Truss in a brutal TV debate, according to a poll. A snap survey by Opinium found 39 per cent of viewers thought the ex-Chancellor came out on top in the BBC showdown, while 38 per cent plumped for the Foreign Secretary. However, critically among Tory voters Ms Truss was seen as having won by a margin of 47 per cent to 38 per cent. The result will be disappointing for Mr Sunak, who has tended to lead in polls of the general public - but trails among the Tory members who will decide the next leader. (Daily Mail)

POLITICS: A former Conservative Party treasurer campaigning to keep Boris Johnson in office has told The Telegraph the Prime Minister “does not want to resign”. Over lunch at Chequers on Friday, Lord Cruddas of Shoreditch claimed Mr Johnson told him he “wants to fight the next general election as leader of the party”. (Telegraph)

INFLATION: Concern about inflation reached the highest since the 1980s, a poll showed, underscoring the damage to personal finances coming from a cost-of-living crisis. The research company Ipsos said 45% of adults though inflation is one of the most troubling issue confronting the nation, the highest level recorded since the survey started in the early 1980s. (BBG)

BOE: The Bank of England (BoE) will likely shy away from a bigger interest rate rise in August and instead stick to the more modest 25 basis point increases it has been delivering, but it is a very close call, a Reuters poll of economists found. (RTRS)

BOE: The Bank of England is unlikely to provide a precise numerical estimate of the end point for quantitative tightening when it publishes its framework for running down its gilts holdings in August, but it will set a pace for combined sales and redemptions, with the counting set to start from the time active sales begin. (MNI)

FISCAL: With price cap forecasts pointing to an extremely difficult winter, MPs have called for the government to update its energy support package. (Sky)

EUROPE

GERMANY: Germany's economy ministry denied media reports saying tightened Russian gas flows through the Nord Stream 1 pipeline would spark the third level of the country's gas emergency plan, a spokesperson for the ministry told Reuters on Monday. (RTRS)

U.S.

ECONOMY: President Biden said Monday he does not think the U.S. will experience a recession despite decades-high inflation that's showing signs of easing up. "We're not going to be in a recession, in my view," Biden said. "The unemployment rate is still one of the lowest we've had in history. It's in the 3.6% area. We still find ourselves with people investing." (Axios)

ECONOMY: U.S. Treasury officials said on Monday overall income and jobs figures suggested the economy was in good health and not in a recession, even if data due this week shows gross domestic product falling for a second consecutive quarter. (RTRS)

EQUITIES: Top U.S. retailer Walmart Inc on Monday slashed its profit forecast as surging prices for food and fuel prompted customers to cut back on discretionary purchases, and its shares slid 10% in trading after the bell. (RTRS)

OTHER

GLOBAL TRADE: The first ships to export Ukraine grain from the country's Black Sea ports may move within a few days under a deal agreed on Friday by Ukraine, Russia, Turkey and the United Nations, a U.N. spokesperson said on Monday. A Joint Coordination Center will liaise with the shipping industry and will publish detailed procedures for ships in the near future, said deputy U.N. spokesperson Farhan Haq. (RTRS)

GLOBAL TRADE: Turkey's President Tayyip Erdogan said on Monday that Turkey expects Kyiv and Moscow to keep to their responsibilities under a deal they signed regarding the export of Ukrainian grains. (RTRS)

GLOBAL TRADE: Russia's attack on the Ukrainian port of Odesa casts doubt on a grain deal, the White House said Monday, adding that the United States would continue to explore options with the international community to increase Ukraine exports through overland routes. (RTRS)

GLOBAL TRADE: Severe weather will delay the Senate’s push to quickly pass funding to bolster domestic semiconductor manufacturing and boost U.S. competitiveness with China, Senate Majority Leader Chuck Schumer, D-N.Y., said Monday. (CNBC)

U.S./CHINA: U.S. President Joe Biden said on Monday that it is still his expectation that he will speak with his Chinese counterpart, Xi Jinping, this week. (RTRS)

U.S./CHINA/TAIWAN: House Speaker Nancy Pelosi’s staff and security officials aren’t ruling out plans for her to visit Taiwan in early August on a trip that has already stoked more US-China tensions. No final decision has been made about stopping in Taiwan during a trip to Asia next month, according to a person familiar with the details, but if it happens it would come within days of an expected call between President Joe Biden and Chinese leader Xi Jinping. (BBG)

BOJ: Bank of Japan policymakers saw wage hikes as key to sustainably achieve their 2% inflation target, minutes of the June meeting showed, underscoring the bank's resolve to keep interest rates ultra-low despite growing signs of price pressure. Some in the nine-member board saw price rises broadening and leading to changes in long-held public perceptions that inflation and wages would not rise much in the future, according to the minutes released on Tuesday. (RTRS)

JAPAN: Japan’s government raised its monthly economic assessment in July for the first time in three months as consumption picked up despite a surge in Covid infection cases. The Cabinet Office said the economy is picking up moderately, boosting its view of consumer spending, imports and labor conditions. (BBG)

RBA: Australia’s economy is “robust” and capable of withstanding further interest-rate increases, Reserve Bank board member Ian Harper said ahead of data predicted to show the fastest inflation in 31-1/2 years. (BBG)

AUSTRALIA: The country’s top banking regulator, Wayne Byres, is stepping down as chair of the Australian Prudential Regulation Authority (APRA) after eight years in the job, saying the time is right for a change in leadership. (The Sydney Morning Herald)

RBNZ: Criticism of the New Zealand central bank’s stimulus response to the Covid-19 pandemic is “hindsight economics,” Finance Minister Grant Robertson said Tuesday, continuing to back the RBNZ’s leadership. (MarketWatch)

RBNZ: Reserve Bank of New Zealand Governor Adrian Orrresponds to criticism of the bank’s monetary policy during the pandemic, in emailed statement. Says report released today, How Central Bank Mistakes After 2019 Led to Inflation, which was co-authored by former RBNZ governor Graeme Wheeler, “will be considered as part of our public Monetary Policy Remit review process underway”. “I acknowledge that consumer price inflation is at 7.3%, above the Remit target range of 1-3%. I also acknowledge that the Monetary Policy Committee’s decisions over recent years have influenced this outcome”. (BBG)

HONG KONG: A measure of Hong Kong’s interbank liquidity halved in the past two months, with analysts forecasting more cash drainage as the city’s de-facto central bank defends its currency. The Hong Kong Monetary Authority has bought a total HK$172 billion ($22 billion) of local currency since May 11, shrinking the aggregate balance to about HK$165 billion. (BBG)

HONG KONG: Hong Kong will “absolutely not” decouple its currency from the US dollar despite recent capital outflows and challenging China-United States ties, as the peg is aligned with the national strategy and fortifies the city’s standing as an international financial centre, the city’s finance chief has told the Post. (SCMP)

TURKEY: Recent retreat in global crude oil prices will have a direct impact on cost of transportation and indirectly slow prices elsewhere, Turkish President Recep Tayyip Erdogan tells state broadcaster TRT. “Marked” slowdown in annual inflation is expected from around February or March next year. Erdogan says Turkey is managing “cost inflation” quite well. (BBG)

BRAZIL: A former Brazil Central Bank director who helped cut interest rates to an all-time low is now advocating for more aggressive hikes than most economists expect. (BBG)

SOUTH AFRICA: South Africa will urgently add more power generation capacity to the grid and ease regulatory requirements as part of steps to address an electricity crisis, President Cyril Ramaphosa said in an address to the nation on Monday. Ramaphosa added that the National Treasury was working on a sustainable solution to struggling state utility Eskom's mammoth debt burden, saying that the finance minister would make an announcement on Eskom's debt at the October mid-term budget. (RTRS)

EQUITIES: Alibaba will apply for a primary listing in Hong Kong and keep its U.S. listing, the first big company to take advantage of a rule change allowing high-tech Chinese firms with dual class shares to seek dual primary listings in Hong Kong. Seeking a dual primary listing will also allow Alibaba to apply for the Stock Connect scheme that will permit mainland China investors to buy the company's shares more easily. (RTRS)

EQUITIES: Alibaba’s push to rival Amazon by bringing US businesses on to its ecommerce platform has struggled to meet its targets, dealing a blow to the Chinese tech giant’s global expansion plans. (FT)

ENERGY: Siemens Energy on Monday said a missing turbine that Moscow says is limiting capacity of the Nord Stream 1 pipeline could be delivered straight away, but added customs documents needed to import the equipment into Russia were missing. "The transportation of the turbine could start immediately. The German authorities provided Siemens Energy with all the necessary documents for the export of the turbine to Russia at the beginning of last week," the company said. "Gazprom is aware of this. What is missing, however, are the customs documents for import to Russia. Gazprom, as the customer, is required to provide those," the company added. (RTRS)

ENERGY: Russian gas giant Gazprom has sharply increased pressure in the pipeline that delivers Russian gas to Europe without prior notice, the Ukrainian state pipeline operator company said on Tuesday. Such pressure spikes could lead to emergencies including pipeline ruptures, and pipeline operators are obliged to inform each other about them in advance, the Ukrainian company said. Gazprom could not be immediately reached for comment. (RTRS)

ENERGY: Turkey will increase the amount of oil and natural gas it imports from Iran, President Recep Tayyip Erdogan says in interview with state-run TRT TV, without specifying a targeted amount. Erdogan says he agreed with Iranian President Ebrahim Raisi on boosting bilateral trade. (BBG)

OIL: Libya boosted oil production to more than 1 million barrels a day, a milestone for the North African country where output had more than halved since mid-April. The OPEC member, home to Africa’s largest crude reserves, ramped up its production to a “little over” a million barrels a day, Oil Minister Mohamed Oun said. (BBG)

CHINA

PBOC: The People’s Bank of China’s daily injections via reverse repos is becoming more flexible, which will better balance the supply and demand of short-term liquidity, the China Securities Journal reported citing analysts. The scale of reverse repos has been lowered to a few billion yuan from an integer multiple of 10 billion, and the frequency of changes has also increased, the newspaper said. The market should neither interpret the injection of CNY3 billion as a signal of tightening, nor should the injection of 12 billion yuan be understood as a signal of relaxation, the newspaper said citing Cheng Qiang, chief macro analyst of CITIC Securities. Compared with the scale of injections, the market should focus more on the interest rates of DR007, reverse repos and medium-term lending facilities, the newspaper said. (MNI)

INFLATION: The drastic fluctuations in international grain prices are controllable for China’s price levels, supported by its steady grain production and a bumper wheat harvest this summer, the Securities Daily reported citing analysts. Though global grain prices have recently declined, food prices still play a significant role in driving up CPI in the U.S. and euro area, the newspaper said citing analysts. China is highly self-sufficient in the three major grains and prices have a relatively low weight in the basket of CPI, the newspaper said citing analysts. (MNI)

ECONOMY: China’s economic recovery gained momentum in July as business activities resumed and confidence improved, despite disruptions from sporadic Covid outbreaks across the country. That’s the outlook based on Bloomberg’s aggregate index of eight early indicators for this month. The overall gauge was 5, a level indicating the economy is heating up. That was unchanged from June, which was revised up from the neutral level after data showed manufacturing started growing again and services expanded faster than in May. (BBG)

ECONOMY/BONDS: China securities regulator will help centrally administered state-owned enterprises sell bonds to fund science and technology innovation, Shanghai Securities News reports, citing an unidentified official from the regulator. (BBG)

PBOC/ECONOMY/BONDS: The People’s Bank of China will increase support for eligible cultural and tourism enterprises to issue bonds, so to further broaden the financing channels for the sector hit hard by the Covid-19 pandemic, the Securities Daily reported citing a statement by PBOC. Currently, the financing of many asset-light companies mainly relies on bank loans, the newspaper said citing a manager of a travel agency. The PBOC will also explore the establishment of an asset and product evaluation system to support the asset revitalization of cultural and tourism enterprises, the statement said. (MNI)

PROPERTY: China developers advance for a second day, with sentiment boosted by a match-making meeting with financial institutions taking place in Hangzhou Tuesday. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY2 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY5 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY2 billion after offsetting the maturity of CNY7 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6800% at 09:29 am local time from the close of 1.5173% on Monday.

- The CFETS-NEX money-market sentiment index closed at 43 on Monday vs 47 on Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7483 TUES VS 6.7543

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7483 on Tuesday, compared with 6.7543 set on Monday.

OVERNIGHT DATA

JAPAN JUN SERVICES PPI +2.0% Y/Y; MEDIAN +2.6%; Q1 +3.0%

AUSTRALIA ANZ ROY MORGAN WEEKLY CONSUMER CONFIDENCE 82.4; PREV 81.8

There was another small impr5ovement in consumer confidence of 0.7% last week, after the 0.2% increase the week before. Increases in the expected ‘financial situation compared to a year ago’ and whether it is a ‘good time to buy a major household item’ were the main drivers of sentiment. Confidence, however, remained very weak and at levels last seen during the early stages of the COVID-19 pandemic. Household inflation expectations rose by 0.2ppt to 6.0%. Headlines about another surge in actual inflation when the Q2 CPI is published will likely place some downward pressure on sentiment this week. (ANZ)

http://www.roymorgan.com/findings/9030-anz-roy-morgan-consumer-confidence-july-26-202207250610

SOUTH KOREA Q2, A GDP +0.7% Q/Q; MEDIAN +0.4%; Q1 +0.6%

SOUTH KOREA Q2, A GDP +2.9% Y/Y; MEDIAN +2.6%; Q1 +3.0%

MARKETS

SNAPSHOT: Markets Stuck In Pre-Fed Coil Overnight

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 21.51 points at 27675.78

- ASX 200 up 22.766 points at 6812.00

- Shanghai Comp. up 26.32 points at 3276.708

- JGB 10-Yr future up 3 ticks at 150.13, yield up 1.5bp at 0.211%

- Aussie 10-Yr future up 1.5 ticks at 96.63, yield down 1.4bp at 3.340%

- U.S. 10-Yr future +0-06 at 119-27, yield down 0.73bp at 2.789%

- WTI crude up $1.24 at $97.94, Gold up $2.56 at $1722.26

- USD/JPY down 17 pips at Y136.52

- BIDEN STILL EXPECTS TO SPEAK WITH CHINA'S XI THIS WEEK (RTRS)

- PELOSI’S TAIWAN AMBIGUITY HAS CHINA FUMING AHEAD OF BIDEN CALL (BBG)

- BANK OF ENGLAND TO RAISE RATES BY 25BPS IN AUG, BUT 50 A CLOSE CALL (RTRS POLL)

- SUNAK FAILS TO MAKE MEANINGFUL GROUND IN TORY LEADERSHIP TV DEBATE

- SIEMENS ENERGY: TRANSPORT OF NORD STREAM 1 TURBINE COULD START NOW (RTRS)

- PBOC BECOMING MORE FLEXIBLE WITH OMOS (CSJ)

US TSYS: Coiling In Asia

An early, modest Asia-Pac bid in U.S. Tsys has faded from extremes. The light bid was linked to soft guidance from U.S. retail giant Walmart, which spurred after-hours pressure for the retail sector, resulting in a small downtick for e-minis (-0.3% last). Equities have since found a bit of a base as continued focus on support for the Chinese property space provided a helping hand for broader risk appetite.

- Still, the combination of the proximity to Wednesday’s FOMC and lack of meaningful macro headlines made for generally limited Asia-Pac dealing. TYU2 deals in the middle of a 0-07 range, +0-06 at 119-27, on sub-standard volume of 43K. Meanwhile, cash Tsys run 0.5bp cheaper to 1.0bp richer, twist flattening, with a pivot around 3s.

- A 2K block sale of FVU2 113.00 calls headlined on the flow side overnight.

- Tuesday’s NY calendar includes various house price metrics, the Richmond Fed m’fing index print, Conference Board consumer confidence and 5-Year Tsy supply.

JGBS: Fierce Moves In Long End Around 40-Year Supply

JGB futures gave back their limited overnight gains at the Tokyo re-open, but have recovered a little into the Tokyo close as the longer end of the curve firms, last dealing +8

- The curve steepened in a relatively aggressive manner ahead of 40-Year JGB supply, with pre-auction concession combining with what seemed to be limited liquidity further out the curve, weighing on 10+-Year paper. The auction went well, allowing the curve to rebound from session steeps as the long end recovered from extremes. Benchmark cash JGBs run 1bp cheaper to 4bp richer as a result, twist flattening, with 30s and 40s now richer on the day, firming notably post-auction in directional dealing.

- In terms of auction specifics, the cover ratio printed above the 6-auction average, with the high yield over 2.0bp below wider dealer expectations (as proxied by the BBG dealer poll). The auction benefitted from the supportive conditions we outlined in our auction preview, which included yields operating just off cycle cheaps, the steepness of the JGB curve, the Japanese investor base’s aversion when it comes to adding to international debt holdings (as seen in Japanese weekly international security flow data) and the preference of domestic life insurers to accumulate super-long JGB holdings (per their semi-annual investment intention interviews).

- Services PPI data met expectations, ticking up to 2.0% in Y/Y terms while the stale minutes from the BoJ’s June meeting was inconsequential for markets, as expected.

- There isn’t much of note on tomorrow’s domestic docket.

JGBS AUCTION: Japanese MOF sells Y699.9bn 40-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y699.9bn 40-Year JGBs:

- High Yield: 1.345% (prev. 1.070%)

- Low Price: 89.43 (prev. 97.74)

- % Allotted At High Yield: 40.0584% (prev. 53.1502%)

- Bid/Cover: 2.705x (prev. 2.416x)

AUSSIE BONDS: Twist Flattening

Aussie bonds are off best levels, aided by U.S. Tsys backing away from their own extremes, with an initial bid in core FI (owing to Walmart’s disappointing earnings guidance after the bell) moderating throughout Sydney hours as equities in Asia received a lift from Chinese real estate and large-cap tech names. Cash ACGBs run 3.0bp cheaper to 2.0bp richer across the curve, twist flattening, pivoting around 3s, while YM and XM are -1.0 and +1.0, respectively, with the latter having briefly shown through its own overnight highs earlier in the session. Bills run 6 ticks cheaper to 2 ticks richer through the reds, twist flattening.

- Recent comments in a BBG interview from RBA Board member Harper coincided with a light cheapening in the front end of the cash ACGB curve, with the RBA board member stating that the Australian economy was “robust” enough to endure higher rates, emphasising the need to fight “broad-based” price pressures, while stating that concerns re: “overreach” on rate hikes was “overblown”.

- ACGBs looked through the release of weekly ANZ-Roy Morgan consumer confidence (the sole domestic data release due today), which saw a slight improvement to 82.4 (vs. 81.8 prev.).

EQUITIES: Mostly Higher In Asia; Chinese, Hong Kong Benchmarks Outperform

Major Asia-Pac equity indices are flat to 1.5% better off at typing, bucking a mixed lead from Wall St. that saw the tech-heavy NASDAQ close in the red.

- The Hang Seng leads the way higher, sitting 1.5% firmer on gains in the real estate (+1.6%) and finance (+1.5%) sub-indices. China-based tech ticked higher as well (HSTECH: +1.6%), led by Alibaba Group (+6.0%) after it announced plans to pursue a dual primary listing in Hong Kong and the U.S., potentially allowing the company to apply for the Stock Connect scheme as well.

- The CSI300 deals 0.9% firmer, led by gains in industrials and real estate. The CSI300 Real Estate Index trades 5.4% higher at typing, surging to two-week highs after a RTRS source report on Monday pointed to China potentially planning to launch a $44bn fund aimed at rescuing property developers. The CSI300 however trades a little above fresh six-week lows made on Monday, with the benchmark index shedding ~5.9% for July thus far.

- The Nikkei 225 sits a little below neutral levels at typing, back from trading as much as 0.6% lower as weakness in the healthcare and IT sectors neutralised a rally in energy-related equities, as well as gains from index heavyweight Softbank Group (which deals 3.5% firmer after news of Alibaba’s dual primary listing plans).

- E-minis sit 0.3% worse off apiece at writing, off session lows, with the wider fallout from Walmart’s disappointing earnings guidance seeing the contracts struggle to break above neutral levels throughout Asia-Pac dealing.

OIL: Higher In Asia On Supply Worry; WTI-Brent Spread Widens

WTI is ~+$1.60 and Brent is ~+$1.80, with the latter unwinding virtually all of last Friday’s steep, recession worry-inspired selloff in crude. Familiar debate re: tightness in crude supplies vs. demand destruction continues to do the rounds, with participants likely eyeing the upcoming FOMC over the potential impact to energy demand from the Fed’s rate hikes.

- Looking at the supply side of things, an Argus Media source report has pointed to OPEC+ producing ~2.84mn bpd below production targets for June (after the group reported falling short by ~2.7mn bpd for May), pointing to deepening production woes in the bloc.

- Brent’s prompt spread sits a little under fresh cycle highs (when discounting recent month-end, expiry-related volatility) at ~$5.05, on track to rise for a eight session in nine, reflecting rising worry re: tightness in near-term crude supplies.

- Elsewhere, Libya has announced that crude output has risen to a “little over” 1mn bpd, approaching pre-crisis levels of 1.2mn bpd.

- On the demand side of the equation, a survey by the U.S. AAA has shown over half of respondents driving less amidst higher gasoline prices (also coming after last week’s EIA inventory data showed a large, surprise build in gasoline stockpiles). The WTI-Brent spread has accordingly widened to ~$8.60, the widest since Jun ‘19, reflecting expectations of weaker U.S. oil demand.

GOLD: Higher In Asia As Dollar Softens

Gold sits $6/oz firmer to print $1,726/oz, operating a little below session highs at typing. The precious metal has caught a bid amidst a limited downtick in the USD (DXY), remaining some distance away from Monday’s peak ($1,736.3/oz).

- To recap, gold closed ~$8/oz weaker on Monday, softening as an uptick in U.S. real yields countered a marginal decline in the DXY. The move lower unwound all of the previous session’s gains, keeping gold a short distance away from multi-month lows, with the proximity to the upcoming FOMC decision perhaps sapping conviction for a sustained move in either direction, keeping in mind price movements prior to the meeting.

- To elaborate, gold has shed ~$80 so far this month (on track for a fourth consecutive lower monthly close), with the move lower coming as OIS markets have pointed to rising expectations for Fed tightening over the same period (~82bp of tightening for the Jul FOMC at typing vs. ~69bp at the beginning of July).

- From a technical perspective, short-term gains in gold appear to be corrective, following its bounce off $1,681.0/oz last Thursday, with a break above resistance at $1,745.4/oz (Jul 13 high) having the potential to strengthen a bullish set-up (and scope for a further corrective bounce). On the other hand, initial support is seen at $1,697.7 (Jul 14 low).

FOREX: Greenback Loses Ground As Early Risk-Off Impulse Dissipates

Walmart's disappointing profit outlook spooked markets, but initial defensive flows petered out as U.S. e-mini futures found a base and retraced the bulk of their early losses. This applied renewed pressure to the greenback, sending it to the bottom of the G10 pile, with the BBDXY index extending Monday's weakness.

- Decent enough performance from Chinese tech space provided reprieve to risk, with Alibaba shares doing the heavy lifting. The company said it will seek a primary listing in Hong Kong, which would make its shares directly accessible to investors from mainland China.

- The kiwi dollar remained one of the worst G10 performers alongside the USD and CHF. This comes after the kiwi lagged its commodity-tied peers on Monday. AUD/NZD retraced its earlier upswing to NZ$1.1130 but remains a handful of pips above neutral levels as we type.

- The Norwegian krone outperformed amid good demand for crude oil futures.

- Today's data highlights include U.S. new home sales & Conf. Board Consumer Confidence. Elsewhere, the FOMC will begin its two-day meeting.

FX OPTIONS: Expiries for Jul26 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0190-00(E623mln), $1.0260-65(E896mln)

- USD/JPY: Y139.00($970mln)

- EUR/JPY: Y141.00(E727mln), Y143.00(E734mln)

- USD/CAD: C$1.2750($700mln), C$1.2900($763mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2022 | 0600/0800 | ** |  | SE | PPI |

| 26/07/2022 | 0700/0900 | ** |  | ES | PPI |

| 26/07/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 26/07/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 26/07/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 26/07/2022 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 26/07/2022 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 26/07/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2022 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 26/07/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 26/07/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.