-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Powell Stresses Data Dependence, Focus Moves To U.S. GDP

EXECUTIVE SUMMARY

- FED DELIVERS 75BP HIKE, HIGHLIGHTS DATA DEPENDENCE

- MANCHIN AND SCHUMER ANNOUNCE DEAL FOR ENERGY AND HEALTH CARE BILL (CNN)

- ITALY'S CONSERVATIVES STRIKE DEAL OVER CANDIDATE FOR PM (RTRS)

- CHINA’S CENTRAL BANK SEEKS TO MOBILISE $148BN BAILOUT FOR DEVELOPERS (FT)

- LOW CHANCE OF FURTHER DROP IN CHINESE SHORT-TERM RATES (SEC. TIMES)

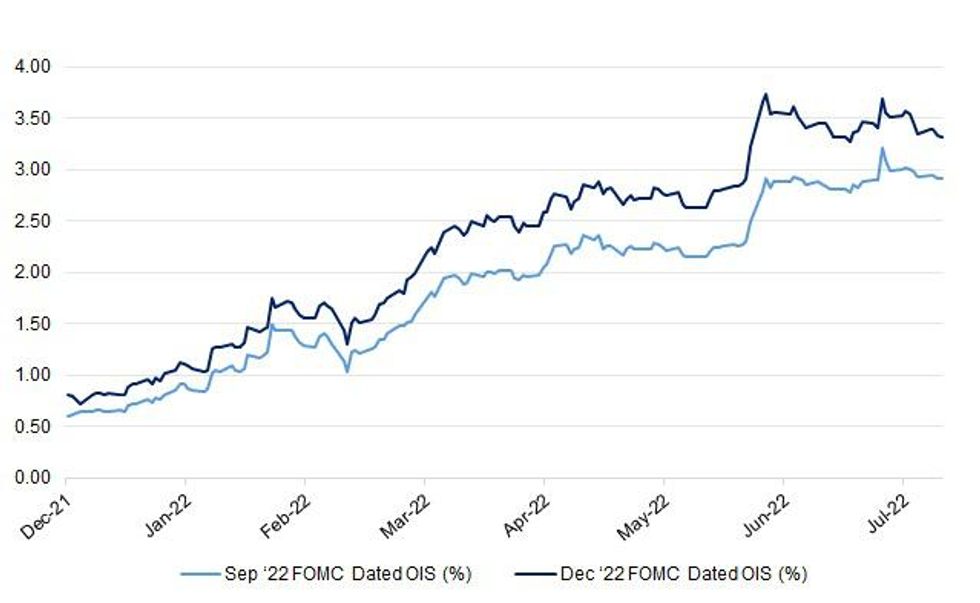

Fig. 1: Sep ‘22 & Dec ‘22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

ECONOMY: British companies say exports have stagnated for more than a year due a surge in inflation and friction following the departure from the European Union. The portion of businesses reporting increased sales abroad remains at 29%, little changed for a fifth consecutive quarter, according to a survey of 2,600 companies by the British Chambers of Commerce. A quarter of respondents said sales declined. (BBG)

PROPERTY: Britain's commercial real estate sector is entering or might already be in a downturn, according to an industry survey, as higher interest rates push up investors' financing costs and weaker consumer sentiment hurts demand for retail space. (RTRS)

EUROPE

ITALY: The party with the most votes in Italy's centre-right coalition will choose the prime minister if the bloc wins the coming election, the alliance said on Wednesday, putting far-right leader Giorgia Meloni in pole position for the top job. (RTRS)

ITALY: Italy can get through next winter with only minor cuts to its gas consumption even if Russia completely halts flows, Ecological Transition Minister Roberto Cingolani said. (BBG)

U.S.

FED: Jerome Powell said the Federal Reserve will press on with the steepest tightening in a generation to curb inflation while giving officials more flexibility on coming moves amid signs of a broadening economic slowdown. Policy makers raised the benchmark lending rate 75 basis points on Wednesday to a range of 2.25% to 2.5% and said they anticipate “ongoing increases” will be appropriate. Just how much depends on the data, the central bank chief said, stepping away from the specific guidance he gave at the June meeting, though he didn’t take another similar-sized move off the table. (BBG)

ECONOMY: The United States is not currently in a recession or in a "pre-recession," the White House said on Wednesday as the Federal Reserve Board raised interest rates to try to fight inflation. White House press secretary Karine Jean-Pierre declined to comment on Fed monetary policy after the Fed raised rates by three quarters of a percentage point. (RTRS)

FISCAL: Senate Majority Leader Chuck Schumer and Sen. Joe Manchin on Wednesday announced a deal on an energy and health care bill, representing a breakthrough after more than a year of negotiations that have collapsed time and again. (CNN)

FISCAL: U.S. President Joe Biden said he spoke on Wednesday with Democratic senators Chuck Schumer and Joe Manchin to offer his support for a bill that would reduce the national debt, invest in energy technologies and lower the cost of prescription drugs. (RTRS)

FISCAL: The U.S. federal debt burden will reach 185% of economic output in 2052, the Congressional Budget Office projected on Wednesday, an improvement over last year's long-term estimate but a projection driven by exponentially higher interest costs. The CBO in 2021 had projected federal debt in 2051 at 202% of U.S. GDP output, with this year's improvement due to a strong recovery from the COVID-19 pandemic. The estimates assume current tax and spending laws remain in place over the next 30 years. The CBO estimated U.S. net interest outlays as a percentage of GDP to rise to 7.2% in 2052 versus 1.6% this year. (RTRS)

EQUITIES: Meta Platforms Inc., the social media giant that includes Facebook and Instagram, reported its first-ever quarterly sales decline, citing advertisers’ shrinking budgets. (BBG)

OTHER

GLOBAL TRADE: The U.S. Senate on Wednesday passed sweeping legislation to subsidize the domestic semiconductor industry, hoping to boost companies as they compete with China and alleviate a persistent shortage that has affected everything from cars, weapons, washing machines and video games. The House of Representatives plans to vote on Thursday on the long-awaited bill after the Senate passed it on a 64 to 33 bipartisan vote. (RTRS)

U.S./CHINA: US and China officials must reach an agreement “very soon” over access to audit work papers for Chinese companies to avoid being kicked off American stock exchanges, Securities and Exchange Commission Chair Gary Gensler said Wednesday. (BBG)

BOJ: Bank of Japan Deputy Governor Masayoshi Amamiya on Thursday stressed the need to keep monetary policy ultra-loose due to uncertainty on whether wages will increase enough to compensate households for the rising cost of living. (RTRS)

AUSTRALIA: Australian inflation is seen peaking at 7.75% by December, underlining the challenges to an economy where rising interest rates are already weighing on the property market and household spending. Consumer prices are expected to moderate to 5.5% in June 2023, then return inside the Reserve Bank of Australia’s 2-3% target in 2024, Treasurer Jim Chalmers said in an economic statement on Thursday. He highlighted the deteriorating international backdrop to his nation’s open, trading economy. (BBG)

RBNZ: New Zealand’s central bank reiterated its pledge to continue its Funding for Lending Program until the end of 2022 as planned, saying this will ensure its credibility as a policy tool if it were to be needed again. (BBG)

SOUTH KOREA: South Korea's finance minister said Thursday the U.S. Federal Reserve's latest rate hike is expected to have a limited impact on the domestic financial market as the outcome is in line with market expectations. (Yonhap)

SOUTH KOREA: South Korea’s National Pension Service is “tactically hedging” some of overseas investment at above a certain level of FX rate, to respond to currency market fluctuation, the nation’s largest investor says in a statement. (BBG)

NORTH KOREA: North Korean leader Kim Jong Un has ordered his military to set up their forces to allow them to promptly mobilise their nuclear war deterrent, saying his country was prepared for any military clash with the United States, Yonhap news agency reported on Thursday. (RTRS)

HONG KONG: Hong Kong’s monetary authority has raised the city’s borrowing cost by 75 basis points for the second consecutive month, in lockstep with an increase of the same amount overnight by the Federal Reserve. (SCMP)

BRAZIL: Brazil on Wednesday assured U.S. Defense Secretary Lloyd Austin that its armed forces were focused on providing security to ensure a safe, secure and transparent election in October, Austin said. (RTRS)

RUSSIA: Russian forces have taken over Ukraine's second-biggest power plant in eastern Donetsk region and are undertaking a "massive redeployment" of troops to three southern regions, a Ukrainian presidential adviser said. (RTRS)

RUSSIA: Russia has not been approached formally by Washington about a phone call between U.S. Secretary of State Antony Blinken and Foreign Minister Sergei Lavrov, Tass news agency said on Wednesday. "We are guided by normal diplomatic practice, not doing things by megaphone," it quoted a foreign ministry spokesperson as saying. Blinken earlier told reporters that he would speak to Lavrov in the coming days. (RTRS)

RUSSIA: The Russian economy declined by 4.0% year-on-year in the second quarter of 2022 after a 3.5% rise in the previous three months, the economy ministry said on Wednesday. (RTRS)

RUSSIA: Consumer prices in Russia declined 0.08% in the week to July 22 after sliding 0.17% a week earlier, data showed on Wednesday, vindicating the central bank's decision to cut interest rates more sharply than expected last week. The rouble's strengthening and a drop in consumer demand have helped Russia rein in inflation, which soared to 20-year highs in annual terms after Moscow sent tens of thousands of troops into Ukraine in February. So far this year, consumer prices have risen 11.32% compared with a 4.51% increase in the same period of 2021, data from the Federal Statistics Service Rosstat showed. (RTRS)

SOUTH AFRICA: South Africa’s government sought a series of commitments by labor unions and business, ranging from lower entry-level wages to an agreement to boost investment, as part of a plan to revive the nation’s struggling economy. (BBG)

IRAN: White House Middle East coordinator Brett McGurk told a group of think tank experts last week it's “highly unlikely” that the 2015 nuclear deal with Iran will be revived in the near future, according to three U.S. sources who were on the call. (Axios)

IRAN: Iran welcomes diplomatic efforts to resolve its nuclear dispute with world powers, state media quoted Foreign Minister Hossein Amirabdollahian as saying on Wednesday, a day after the EU's top diplomat proposed a new draft text to revive a 2015 nuclear deal with Tehran. "Iran welcomes the continuation of diplomacy and negotiations," Amirabdollahian told the European Union's Josep Borrell by telephone, adding that the United States should now show that it also seeks a deal. "The United States always states that it wants an agreement, so this approach should be seen in the agreement and in practice," he said. (RTRS)

IRAQ: Hundreds of Iraqi demonstrators, most of them followers of the Iraqi Shia leader Muqtada al-Sadr, have stormed the parliament building in Baghdad to protest against the nomination for prime minister by Iran-backed parties. (Al Jazeera)

ARGENTINA: Argentina raised by 600 basis points the rate on the short-term local note it uses to mark the ceiling of the benchmark monetary policy rate. The rate marks the upper bound of the interest rate reference range set by the central bank July 14 to determine its monetary policy rate. Argentina’s benchmark Leliq rate stands at 52%, trailing inflation that’s above 60%. (BBG)

EQUITIES: Samsung Electronics Co.’s second-quarter profit missed analyst estimates on cooling demand for consumer gadgets, along with the chips and displays they use. (BBG)

METALS: Rio Tinto Group said it’s formed a joint venture with the Guinea government and Winning Consortium Simandou to develop infrastructure including a railway and port, in a breakthrough that should help unlock the world’s biggest untapped iron ore deposit. (BBG)

ENERGY: Siemens Energy on Wednesday said it had not received any damage reports regarding the turbines of Nord Stream 1 gas pipeline from Russia's Gazprom so far, adding it did not have access to the turbines on site. (RTRS)

ENERGY: The European Union is now closer than ever to overhauling a power market that’s buckling under the weight of a once-in-a-generation energy crisis exacerbated by Russia’s invasion of Ukraine, according to Spain’s top energy official. (BBG)

CHINA

POLICY: China’s leaders will have the chance to revisit this year’s ambitious official economic growth target during a meeting of key policy makers expected this week. The Politburo -- the country’s top decision-making body -- usually holds its July meeting at the end of the month, when its 25 members assess the economy’s performance during the first half and set priorities for the remainder of the year. (BBG)

ECONOMY: China’s economic recovery is not a smooth path as consumption will continue to be under pressure with anti-pandemic measures becoming more stringent, and the real estate sector is still in a negative cycle with record-high developers’ default risks and low appetite for home purchases, wrote Wu Ge, chief economist of Changjiang Securities. Infrastructure investment, seen as the main growth driver this year, may play a weaker role without the help of a robust housing market, as the substantial reduction in land sales revenues has dampened the source of infrastructure funds, said Wu. (MNI)

YUAN: China should allow the yuan to make adequate adjustments in response to changes in a basket of currencies including the euro, the yen and the Korean won to maintain its export competitiveness, according to an article published by China Finance 40 Forum citing Sun Mingchun, chief economist of Haitong International. Currently, the yuan only weakens limitedly against the U.S. dollar when many non-U.S. currencies are depreciating sharply against the dollar, said Sun. This could pose challenges to Chinese exporters should the euro depreciate further amid possible recession in the euro zone in the next six months to a year, Sun was cited as saying. (MNI)

MONEY MARKETS: The probability of further decline in China’s short-term interest rates is low as the domestic economy is improving, and bond investors should take precaution, the official Securities Times says in a front-page commentary Thursday. (BBG)

PROPERTY: Beijing is seeking to mobilise up to Rmb1tn ($148bn) of loans for stalled property developments, in its most ambitious attempt to revive the debt-stricken sector and mollify home buyers who are boycotting mortgage repayments after lengthy construction delays. (FT)

PROPERTY: A group of offshore creditors to China Evergrande Group are demanding additional information about the seizure of nearly $2 billion by local banks that could explain how the troubled property developer pledged the funds without investors’ knowledge, according to people familiar with the matter. (WSJ)

CHINA MARKETS

PBOC NET DRAINS CNY1 BILLION VIA OMOS THURSDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Thursday. The operation has led to a net drain of CNY1 billion after offsetting the maturity of CNY3 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) fell to 1.5198% at 09:54 am local time from the close of 1.5498% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 43 on Wednesday vs 42 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7411 THURS VS 6.7731

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7411 on Thursday, compared with 6.7731 set on Wednesday.

OVERNIGHT DATA

AUSTRALIA JUN RETAIL SALES +0.2% M/M; MEDIAN +0.5%; MAY +0.9%

AUSTRALIA Q2 EXPORT PRICE INDEX +10.1% Q/Q; MEDIAN +8.4%; Q1 +18.0%

AUSTRALIA Q2 IMPORT PRICE INDEX +4.3% Q/Q; MEDIAN +4.5%; Q1 +5.1%

NEW ZEALAND JUL ANZ BUSINESS CONFIDENCE -56.7; JUN -62.6

NEW ZEALAND JUL ANZ ACTIVITY OUTLOOK -8.7; JUN -9.1

The key themes of the July survey were: Activity indicators were fairly steady (though late-month responses were weaker, on the whole – particularly for employment and investment intentions). Inflation pressures remain intense but are not obviously worsening. The outlook for house-building has hit a brick wall. (ANZ)

SOUTH KOREA AUG BUSINESS SURVEY M’FING 78; JUL 83

SOUTH KOREA AUG BUSINESS SURVEY NON-M’FING 80; JUL 81

SOUTH KOREA JUN RETAIL SALES +9.2% Y/Y; MAY +10.1%

SOUTH KOREA JUN DEPT STORE SALES +18.2% Y/Y; MAY +19.9%

SOUTH KOREA JUN DISCOUNT STORE SALES +2.3% Y/Y; MAY -3.0%

GERMANY JUN NRW CPI +7.8% Y/Y; JUN +7.5%

GERMANY JUN NRW CPI +1.1% M/M; JUN -0.1%

MARKETS

SNAPSHOT: Powell Stresses Data Dependence, Focus Moves To U.S. GDP

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 61.5 points at 27778.71

- ASX 200 up 60.664 points at 6884.00

- Shanghai Comp. up 18.67 points at 3294.425

- JGB 10-Yr future up 3 ticks at 150.32, yield up 0.1bp at 0.201%

- Aussie 10-Yr future up 6 ticks at 96.785, yield down 5.9bp at 3.190%

- U.S. 10-Yr future -0-13 at 120-00+, yield down 0.18bp at 2.785%

- WTI crude up $1.04 at $98.26, Gold up $2.12 at $1736.32

- USD/JPY down 115 pips at Y135.41

- FED DELIVERS 75BP HIKE, HIGHLIGHTS DATA DEPENDENCE

- MANCHIN AND SCHUMER ANNOUNCE DEAL FOR ENERGY AND HEALTH CARE BILL (CNN)

- ITALY'S CONSERVATIVES STRIKE DEAL OVER CANDIDATE FOR PM (RTRS)

- CHINA’S CENTRAL BANK SEEKS TO MOBILISE $148BN BAILOUT FOR DEVELOPERS (FT)

- LOW CHANCE OF FURTHER DROP IN CHINESE SHORT-TERM RATES (SEC. TIMES)

US TSYS: Bund Weakness Unwinds Early Richening

Initial Asia-Pac trade saw regional participants lift Tsys as they looked towards the prospect of a slower round of data-dependent Fed hikes post-FOMC. That was before a pre-NRW CPI dip in German Bund futures pulled the space away from best levels (with the data release itself promoting some short-term vol. in Bunds). TYU2 printed a fresh session low on the back of that data release, and now operates -0-01 off the base of its 0-10+ range, -0-14+ at 119-31, with volume running at a fairly non-descript ~85K. Cash Tsys are marginally mixed across the curve, last dealing -/+0.5bp vs. Wednesday’s closing levels.

- Macro headline flow remains light and the move in Tsys is quite muted when you consider that USD/JPY has shed over 100 pips as Tokyo FX dealers react to the potential for a slower, data-driven round of hikes from the Federal Reserve, with that particular move perhaps being exacerbated by short JPY positioning.

- Looking ahead, German CPI data (on the regional and national levels) will generate interest. Meanwhile, the initial Q2 GDP reading provides the highlight of Thursday’s NY docket (with median estimates looking for the U.S. to escape a technical recession). Weekly jobless claims data and the Kansas City Fed m’fing activity reading are also due, as is 7-Year Tsy supply.

- Participants will also be on the lookout for comments surrounding the latest phone call between U.S. President Biden & Chinese counterpart Xi.

JGBS: Two-Way Session, Curve Twist Steepens

JGB futures have been dragged around by the wider impetus observed in the core global FI space, with the initial uptick reversed by some spill over from the previously outlined weakness in German Bunds. That leaves the contract -5 ahead of the Tokyo close.

- The wider spread downtick in core global FI markets has promoted a further steepening of the JGB curve during the Tokyo afternoon, building on the morning theme, with the major cash benchmarks running 1bp richer to 3bp cheaper, pivoting around 7s. Payside flows in super-long swaps seemed to have helped the long end to cheapen after a couple of days of aggressive flattening of the JGB curve (aided by a well-received round of 40-Year JGB supply)

- Note that the modest bid in the short-end of the curve (2s represent the strongest point) comes in lieu of a well-received round of 2-Year JGB supply. In terms of auction specifics, the low price printed above broader expectations, while the price tail narrowed. The cover ratio came in a little below the six-auction average, but bettered the level observed at the previous auction. The BoJ’s on-hold monetary policy stance likely contributed to the smooth takedown, adding to demand from offshore investors on the lookout for attractive FX-hedged yield pickups on offer, countering negatives from a move away from cycle cheaps (on the BoJ’s decision to stand pat), as well as the steepness of the JGB curve.

- A sidenote that JPY strength was the most notable theme in Tokyo FX trade, as participants reacted to the potential for a slower round of data-dependent Fed hikes in the coming months. Existing short positioning in JPY may have accelerated the move.

- Domestic headline flow has been non-existent, outside of the previously flagged weekly international security flow data which seemingly saw an end of the recent streak of short covering in JGBs on the part of international investors.

- Looking ahead, Friday’s domestic docket will be headlined by Tokyo CPI, retail sales, industrial production and the labour market report. The BoJ will also conduct its latest round of Rinban operations, in addition to releasing the summary of opinions from its most recent monetary policy meeting.

JGBS AUCTION: Japanese MOF sells Y2.2642tn 2-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.2642tn 2-Year JGBs:

- Average Yield: -0.074% (prev. -0.049%)

- Average Price: 100.159 (prev. 100.109)

- High Yield: -0.072% (prev. -0.044%)

- Low Price: 100.155 (prev. 100.100)

- % Allotted At High Yield: 62.1910% (prev. 59.1854%)

- Bid/Cover: 4.332x (prev. 3.814x)

AUSSIE BONDS: Back From Best Levels

Aussie bonds have steadily backed away from best levels as we have worked our way through the Sydney day, mirroring a similar pullback in U.S. Tsys alongside weakness in German Bunds. Cash ACGBs run flat to 6.5bp richer across the curve, bull steepening, with 3s sitting 6bp richer at typing, back from as much as 14bp richer earlier. YM and XM are +8.0 and +4.5, respectively, with the former sliding back below its overnight high. Bills run 8 to 11 ticks richer through the reds, bull flattening. EFPs have narrowed, with a notable steepening of the 3-/10-Year box in play.

- ACGBs were little changed on the domestic retail sales data miss (+0.2% M/M vs. BBG median +0.5%) after quickly reversing an initial blip lower. Elsewhere, Australian Treasurer Chalmers’ state of the economy address did little to rock the Aussie bond space, delivering a cut to GDP growth outlook, while forecasting that inflation will hit 32-year highs at 7.75% by end-22.

- Friday will see Q2 PPI and Jun private sector credit headline the data docket, while A$1.0bn of ACGB Nov-33 will be on offer, followed by the release of the AOFM’s weekly issuance slate

EQUITIES: Off Best Levels; Tech Leads Gains Post-FOMC

Asia-Pac equity indices are broadly off best levels seen earlier in the session, as spillover from the FOMC-inspired bid in U.S. equities on Wednesday (that saw the NASDAQ lead peers at +4.1%) has faded from its extremes. High-beta equities region-wide nonetheless lead the way higher, with energy-related stocks outperforming amidst a rally in major crude benchmarks as well.

- The Hang Seng lags peers at -0.6%, operating a little above session lows at typing. The property (-1.3%) and financials (-0.9%) sub-indices again lead losses amidst the latest round of worry in China’s property sector, with real estate giant Country Garden Holdings’ (-2.5%) stock hitting 1-year lows at typing. The HSTECH is back from best levels of as much as +1.4% higher, sitting 0.3% better off at typing amidst a weak showing from Chinese tech large-caps.

- The Nikkei 225 is off best levels after briefly breaching the 28’000 mark for the first time in seven weeks, dealing 0.2% higher at writing. The utilities and energy sectors lead gains in the index, countering losses in financials and consumer staples.

- The ASX200 trades 0.9% higher at typing, on track for a third straight higher close, with gains in tech (S&P/ASX All Tech Index: +2.3%) and the materials sub-index (+1.8%) easily offsetting shallow losses in utilities and healthcare.

- U.S. e-minis sit 0.1-0.4% weaker at typing, but are nonetheless off worst levels, and holding on to the bulk of their post-FOMC gains as we head into European hours.

OIL: Higher In Asia As Demand Worry Eases

WTI and Brent are ~$1.60 firmer apiece, building on their respective ~$2 higher closes on Wednesday, with Brent sitting just shy of fresh one-week highs.

- To recap Wednesday’s price action, crude hit session highs after the EIA data pointed to a significantly larger-than-expected drawdown in crude stockpiles, corroborating with the decline reported through API estimates on Tuesday. Gasoline stockpiles fell by more than expected while there was a surprise drawdown in distillate stockpiles, with a build observed in Cushing hub stocks.

- The large draw in crude inventories comes amidst record high U.S. exports, aided by the previously-flagged widening of the WTI-Brent spread. Domestic gasoline demand was also reported to have surged by 8.5% after two weeks of declines, likely easing recent expectations of demand destruction.

- Wednesday’s FOMC also provided some relief to crude as the prospect of a slower rate hike path suggested by Fed Chair Powell eased wider worry re: a Fed-led slowdown, with a bid in equities observed as well.

- Looking ahead, U.S. Q2 Advance GDP later will take focus, with the BBG median currently looking for a 0.5% expansion. Note that several individual forecast upgrades were made on Wednesday on the back of fresh economic data, with the Atlanta Fed’s Q2 GDPNow real GDP estimate moderating to -1.2% as well (from -1.8% on Jul 26).

GOLD: Back From Fresh Two-Week Highs In Asia

Gold sits ~$1/oz firmer to print $1,735/oz at typing, back from two-week highs made earlier in the session ($1,741.8/oz). The precious metal has held on to the bulk of its post-FOMC gains amidst a downtick in the USD, with the DXY operating around session lows at typing after briefly showing through its post-FOMC trough.

- To recap, gold closed ~$17/oz higher on Wednesday mainly on the back of a ~$20 post-FOMC rally as participants in some quarters have interpreted comments from Fed Chair Powell’s presser as raising the possibility of less-aggressive tightening in the coming meetings (mainly over the emphasis on the Fed offering “less clear” guidance on rate hikes, as well as the flagging of data dependence for September’s decision).

- Sep FOMC dated OIS now price in ~54bp of tightening for that meeting, pointing to the removal of ~8bp of tightening premium in the wake of Wednesday’s FOMC decision.

- From a technical perspective, gold’s rally on Wednesday failed to breach initial resistance at $1,745.4/oz (Jul 13 high), keeping in mind that short-term gains still appear to be corrective, following its bounce off $1,681.0/oz last Thursday. On the other hand, initial support is seen at $1,697.7/oz (Jul 14 low).

FOREX: Post-FOMC Aftershocks Test Limits Of Shorting Yen

Initially modest USD/JPY sales accelerated over the Tokyo fix, sending the pair toward the Y135.00 mark as bears forced their way through Jul 22 low of Y135.72. Regional players digested the Fed's monetary policy decision and the subsequent press conference with Fed Chair Powell, who raised the prospect of a slower, more data-dependent rate hike path.

- The discrepancy between the Fed's aggressively hawkish posturing and the BoJ's dovish resolve has been a key driver of the dramatic rally in USD/JPY over the past few months.

- Post-FOMC musings lent some support to U.S. Tsys in Asia hours, promoting some light narrowing in the yield gap with Japan. This was partly unwound with Tsys paring gains as the session progressed.

- Bloomberg trader sources flagged liquidation of long USD/JPY positions and said large sell stops were triggered around Jul 22 low of Y135.57, with offers seen toward the Y136.20/25 option strikes due to roll off later today.

- USD/JPY 1-month risk reversal turned its tail, roughly halving yesterday's advance and moving away from a new weekly high printed in the Tokyo morning.

- Demand for the yen was broad based, making the currency a clear G10 outperformer. Regional risk barometer AUD/JPY shed ~87 pips & EUR/JPY dropped more than 1 full figure to a two-week low.

- The BBDXY index gave up and sank to its lowest point in more than three weeks, even as U.S. e-mini futures traded in the red.

- A weak domestic retail sales print applied some light pressure to the Aussie dollar, but the impact was fairly short-lived.

- Focus turns to German CPI as well as U.S. weekly jobless claims & advance GDP/PCE data. Comments are due form ECB Governing Council member Visco.

FX OPTIONS: Expiries for Jul27 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E1.5bln), $1.0125(E650mln), $1.0197-10(E1.7bln), $1.0250-55(E1.2bln), $1.0270(E533mln), $1.0300(E1.1bln)

- EUR/JPY: Y142.40(E1.4bln)

- USD/CAD: C$1.2750($590mln), C$1.2850-55($850mln), C$1.2910-25($648mln)

- USD/CNY: Cny6.7000($1.2bln), Cny6.7500($617mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/07/2022 | 0600/0800 | *** |  | SE | GDP |

| 28/07/2022 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/07/2022 | 0645/0845 | ** |  | FR | PPI |

| 28/07/2022 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 28/07/2022 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/07/2022 | 0800/1000 | *** |  | DE | Hesse CPI |

| 28/07/2022 | 0900/1100 | ** |  | EU | Economic Sentiment Indicator |

| 28/07/2022 | 0900/1100 | * |  | EU | Consumer Confidence, Industrial Sentiment |

| 28/07/2022 | 0900/1100 | * |  | EU | Business Climate Indicator |

| 28/07/2022 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/07/2022 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/07/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 28/07/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 28/07/2022 | 1230/0830 | *** |  | US | GDP (adv) |

| 28/07/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 28/07/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 28/07/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 28/07/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 28/07/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 28/07/2022 | 1730/1330 |  | US | Treasury Secretary Janet Yellen |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.