-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: US Budget Deficit Widens To Record In First 3Mos Of FY25

MNI BRIEF: European Commission To Decide on Austria EDP

MNI: Italy Aims At NGEU Wriggle Room Over 2026 Deadline

MNI UK Inflation Preview: December 2024

MNI EUROPEAN OPEN: Asia Prepares For Pelosi's Trip To Taiwan

EXECUTIVE SUMMARY

- THE WORLD WATCHES TAIWAN, WITH PELOSI EXPECTED TO LAND LATER TODAY

- SEVERAL CHINESE WARPLANES FLY CLOSE TO MEDIAN LINE OF TAIWAN STRAIT (RTRS SOURCE)

- BRITISH MPS PLAN VISIT TO TAIWAN AS TENSION WITH CHINA SIMMERS (GUARDIAN)

- CHINESE LEADERS SAY GDP GOAL IS GUIDANCE, NOT A HARD TARGET (BBG)

- AUSTRALIA HIKES BY HALF-POINT FOR THIRD MONTH TO COOL PRICES (BBG)

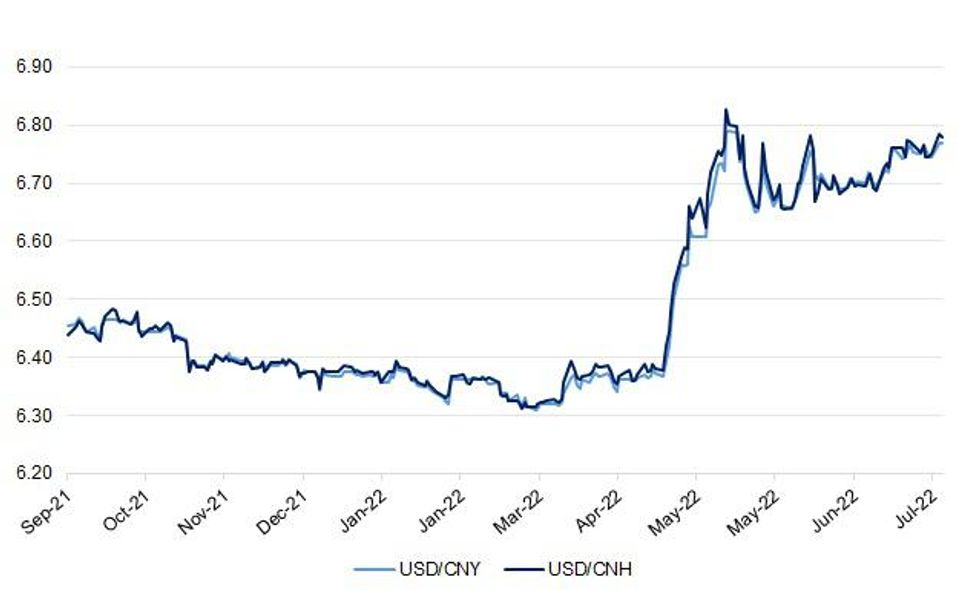

Fig. 1: USD/CNY Vs. USD/CNH

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Penny Mordaunt backed Liz Truss to become the next Conservative leader as a new poll suggested that the race to succeed Boris Johnson was tightening. (The Times)

BOE: The Bank of England should raise rates to 1.75 per cent immediately to meet the challenge of surging inflation, according to an analysis from the Institute of Economic Affairs. The think tank’s shadow monetary policy committee, a group of independent experts, has voted unanimously to raise the Bank rate. (The Times)

U.S.

FED: Economists Olivier Blanchard and Lawrence Summers said a paper by Federal Reserve Governor Christopher Waller that found a soft landing is a plausible outcome for the labor market “contains misleading conclusions, errors, and factual mistakes.” (BBG)

FISCAL: The U.S. Treasury said on Monday it expects to borrow $444 billion in the third quarter, more than the May estimate of a $182 billion, due to changes in projections of fiscal activity and the estimated impact of redemptions in the Federal Reserve System Open Market Account. The third-quarter estimate assumes an end-of-September cash balance of $650 billion. It expects to borrow $400 billion in privately held net marketable debt in the October to December quarter, assuming an end-of-December cash balance of $700 billion. The Treasury said it issued $7 billion in net debt in the second quarter, ending the three-month period with a cash balance of $782 billion. (RTRS)

OTHER

GLOBAL TRADE: Ukraine will limit grain shipments from its ports to three vessels a day for about two weeks, Infrastructure Minister Oleksandr Kubrakov said on Bloomberg Television. After safe routes are checked out during this trial mode, grain exports may reach 3 million tons a month in four or six weeks from now, he said. The next ships loaded with grain will be leaving the ports of Chornomorsk, Odesa and Pivdennyi after the first one departed Odesa on Monday en route to Lebanon. (BBG)

U.S./CHINA/TAIWAN: U.S. House of Representatives Speaker Nancy Pelosi has the right to visit Taiwan, the White House said on Monday, adding that China appeared prepared to respond in coming days, possibly with military provocations. Pelosi was set to visit Taiwan on Tuesday, three people briefed on the matter said, as China warned that its military would never "sit idly by" if she visited the self-ruled island claimed by Beijing. White House national security spokesman John Kirby told reporters at a briefing that nothing about Pelosi's possible trip changed U.S. policy toward Taiwan. (RTRS)

U.S./CHINA/TAIWAN: The White House has warned that China may respond to Nancy Pelosi's mooted visit to Taiwan with military provocations. This could include firing missiles near Taiwan, or large-scale air or naval activities, spokesman John Kirby said. (BBC)

U.S./CHINA/TAIWAN: U.S. Secretary of State Antony Blinken said on Monday that a potential visit to Taiwan by House of Representatives Speaker Nancy Pelosi would be entirely her decision, but called on China not to escalate tensions in the event of a visit. (RTRS)

U.S./CHINA/TAIWAN: President Joe Biden dispatched senior officials, including national security adviser Jake Sullivan, to lay out the risks to Pelosi, but people familiar with the situation said she had decided to press ahead with the landmark trip. (FT)

U.S./CHINA/TAIWAN: The Chinese Foreign Ministry and the People's Liberation Army (PLA) are keeping up the pressure on the US over House Speaker Nancy Pelosi's potential visit to the island of Taiwan, urging the US to honor US President Joe Biden's promise to not support "Taiwan independence," while media outlets from the US and Taiwan reported that Pelosi is expected to visit the island shortly. (Global Times)

U.S./CHINA/TAIWAN: Former editor-in-chief, and party secretary of Global Times, Hu Xijin, stated the following on his twitter on Tuesday, “Based on what I know, in response to Pelosi's possible visit to Taiwan, Beijing has formulated a series of countermeasures, including military actions.” (MNI)

U.S./CHINA/TAIWAN: Several Chinese warplanes flew close to the median line of the sensitive Taiwan Strait on Tuesday morning, a source briefed on the matter told Reuters, as tensions mounted on news U.S. House of Representatives Speaker Nancy Pelosi was set to visit Taiwan during the day. The source said several Chinese warships have stayed close to unofficial buffer in the waterway since Monday, adding that Taiwan had dispatched aircraft to monitor the situation. (RTRS)

U.S./CHINA/TAIWAN: China will conduct a military drill in some areas of South China Sea Aug. 2-6 and will ban ships from entering the areas, state broadcaster CCTV reports, citing local maritime affairs bureau. (BBG)

U.S./CHINA/TAIWAN: Taiwan’s Defense Ministry asks the military to strengthen combat readiness and preparations from 8 a.m. Tuesday to Thursday, United Daily News reports, citing announcement from the ministry. (BBG)

U.S./CHINA/TAIWAN: China’s General Administration of Customs on Monday banned food imports from more than 100 companies in Taiwan, United Daily News reports, citing the Chinese customs which said those companies have violated certain rules. (BBG)

U.K./CHINA/TAIWAN: Britain’s House of Commons foreign affairs committee is planning a visit to Taiwan later this year – probably in November or early December – despite rising tensions in the region, the Guardian has learned. (The Guardian)

JAPAN: A government panel on Monday agreed on a record hike of 31 yen in the average minimum wage for fiscal 2022 to 961 yen ($7.28) an hour, ending prolonged consultations as Japan battles accelerating inflation amid Russia's war in Ukraine. (Nikkei)

JAPAN: Japanese Finance Minister Shunichi Suzuki says that he personally feels the yen’s swing from weakness to strength has been “hectic.” Important that foreign exchange markets move in line with fundamentals in a stable manner, Suzuki tells reporters Tues. (BBG)

NEW ZEALAND: Auckland's biggest real estate agency has recorded its lowest sales volume for a July in 22 years, as midwinter lulls and rising interest rates take their toll. (NZ Herald)

BOK: South Korea's central bank said on Tuesday it expects consumer inflation to stay above 6% for the time being amid rising inflation expectations, high energy prices and increased demand-side pressures. (RTRS)

SOUTH KOREA: South Korea is considering smaller than 640t won of budget for 2023, which would be less than mid-5% increase compared to main budget of this year, Seoul Economic Daily reports, without citing anyone. (BBG)

NORTH KOREA: U.S. Secretary of State Antony Blinken highlighted the importance of the Nuclear Non-Proliferation Treaty (NPT) on Monday, citing threats posed by North Korea and Iran. "As we gather today, Pyongyang is preparing to conduct its seventh nuclear test. Iran remains on a path of nuclear escalation," he added. (Yonhap)

RUSSIA: Blinken condemned Russia’s “reckless” threats of nuclear escalation over its invasion of Ukraine, warning during the UN non-proliferation conference on Monday that such actions may prompt other nations to pursue their own nuclear weapons. “The world must reject the spread of nuclear weapons,” the top US diplomat said, beginning with compliance by states parties with the Treaty on the Non-Proliferation of Nuclear Weapons, known as the NPT. (BBG)

IRAN: Iran has begun the process of feeding gas into cascades of new centrifuges as its top diplomat proposed a new round of negotiations in Vienna to restore the country’s 2015 nuclear deal with world powers. (Al Jazeera)

IRAN: The United States on Monday imposed sanctions on Chinese and other firms it said helped to sell tens of millions of dollars' in Iranian oil and petrochemical products to East Asia as it seeks to raise pressure on Tehran to curb its nuclear program. (RTRS)

GEOPOLITICS: The United States killed al Qaeda leader Ayman al-Zawahiri in a drone strike, President Joe Biden said Monday in a speech from the White House ."I authorized a precision strike that would remove him from the battlefield, once and for all," Biden said. (CNN)

EQUITIES: Taiwan will activate its stock stabilisation fund to intervene in the market when needed, Deputy Finance Minister Juan Ching-hwa told Reuters, amid rising tensions with China as U.S. House of Representatives Speaker Nancy Pelosi was expected to arrive in Taipei later on Tuesday. (RTRS)

OIL: A Fox Business reporter tweeted the following on Monday: “A source with knowledge of the meeting between President Biden & Saudi King tells me Saudi”s will push OPEC+ to increase #oil production at their meeting on Wednesday. Source says the Saudi King made the assurance to Pres Biden during their face to face meeting July 16th.” (MNI)

CHINA

ECONOMY: China’s top leaders told government officials last week that this year’s economic growth target of “around 5.5%” should serve as guidance rather than a hard target that must be hit, according to people familiar with the matter. (BBG)

YUAN: Overseas central banks and sovereign wealth funds are expected to increase yuan assets in foreign exchange reserves correspondingly after the yuan’s weighting in the Special Drawing Rights currency basket was officially lifted to 12.28% by IMF on Monday, which will help stabilise yuan under the U.S. rate hike cycle, the 21st Century Business Herald reported citing an unnamed Wall Street asset manager. This will effectively hedge against the negative impact of overseas arbitrage capital's reduction of yuan bonds, making it more difficult to speculate on the concept of capital outflow and short-selling yuan, the newspaper said citing a FX trader in Hong Kong. (MNI)

PROPERTY: A divide in funding access is widening among Chinese developers, as most struggle to raise cash in the domestic bond market amid a deepening sector crisis while mostly state-backed builders manage to borrow at the lowest cost in 12 years. The average coupon on builders’ yuan bonds issued last month fell to 3.32%, the lowest since September 2010 when two notes were sold, according to data compiled by Bloomberg. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY3 BILLION VIA OMOS TUESDAY

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.10% on Tuesday. The operation has led to a net drain of CNY3 billion after offsetting the maturity of CNY5 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.8117% at 09:41 am local time from the close of 1.4305% on Monday.

- The CFETS-NEX money-market sentiment index closed at 44 on Monday, flat from the close of Friday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7462 TUES VS 6.7467

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7462 on Tuesday, compared with 6.7467 set on Monday.

OVERNIGHT DATA

JAPAN JUL MONETARY BASE +2.8% Y/Y; JUN +3.9%

JAPAN JUL MONETARY BASE END OF PERIOD Y666.0TN; JUN Y677.4TN

AUSTRALIA JUN BUILDING APPROVALS -0.7% M/M; MEDIAN -5.0%; MAY +11.2%

AUSTRALIA JUN PRIVATE SECTOR HOUSES +1.2% M/M; MAY -2.1%

AUSTRALIA JUN HOME LOANS VALUE -4.4% M/M; MEDIAN -3.0%; MAY +1.8%

AUSTRALIA JUN INVESTOR LOAN VALUE -6.3% M/M; MEDIAN -4.5%; MAY +0.9%

AUSTRALIA JUN OWNER-OCCUPIER LOAN VALUE -3.3% M/M; MEDIAN -3.0%; MAY +2.2%

AUSTRALIA ANZ-ROY MORGAN CONSUMER CONFIDENCE 84.1; PREV 82.4

Consumer confidence rose 2.1% last week, despite news that headline inflation exceeded 6% in the year to June. The sharp fall in petrol prices over the past three weeks may have been more important for sentiment. The drop likely explains why household inflation expectations fell 0.5ppt to 5.5%. The only confidence subindex that decreased was ‘good time to buy a major household item’ - ongoing weakness in the housing market and pressure on household budgets being likely reasons. Despite the gain in in the past three weeks, sentiment remains at a very low level and vulnerable to more tightening from the RBA. (ANZ)

SOUTH KOREA JUL CPI +6.3% Y/Y; MEDIAN +6.3%; JUN +6.0%

SOUTH KOREA JUL CPI +0.5% M/M; MEDIAN +0.4%; JUN +0.6%

SOUTH KOREA JUL CORE CPI +4.5%; MEDIAN +4.5%; JUN +4.4%

MARKETS

SNAPSHOT: Asia Prepares For Pelosi's Trip To Taiwan

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 410.84 points at 27582.51

- ASX 200 down 3.172 points at 6989.80

- Shanghai Comp. down 93.368 points at 3166.59

- JGB 10-Yr future up 15 ticks at 150.62, yield down 1bp at 0.176%

- Aussie 10-Yr future up 13.5 ticks at 97.015, yield down 9.7bp at 2.959%

- U.S. 10-Yr future +0-15 at 121-26+, yield down 2.5bp at 2.548%

- WTI crude down $0.70 at $93.19, Gold up $0.78 at $1772.95

- USD/JPY down 95 pips at Y130.66

- THE WORLD WATCHES TAIWAN, WITH PELOSI EXPECTED TO LAND LATER TODAY

- SEVERAL CHINESE WARPLANES FLY CLOSE TO MEDIAN LINE OF TAIWAN STRAIT (RTRS SOURCE)

- BRITISH MPS PLAN VISIT TO TAIWAN AS TENSION WITH CHINA SIMMERS (GUARDIAN)

- CHINESE LEADERS SAY GDP GOAL IS GUIDANCE, NOT A HARD TARGET (BBG)

- AUSTRALIA HIKES BY HALF-POINT FOR THIRD MONTH TO COOL PRICES (BBG)

US TSYS: Off Best Levels But Still Comfortably Firmer In Asia

TYU2 sits +0-17 at 121-28+ hovering a little above the middle of its 0-16+ range, operating on above average volume of ~128K. Meanwhile, cash Tsys run 3-4bp richer across the curve. The latest round of Tsy demand comes after a recent tweet from Global Times commentator Hu Xijin, which noted that “Based on what I know, in response to Pelosi's possible visit to Taiwan, Beijing has formulated a series of countermeasures, including military actions.”

- The early overnight bid in U.S. Tsys came as the Asia-Pac region geared up for what seems to be the inevitable trip to Taiwan for U.S. House Speaker Pelosi, with Sino-U.S. tensions remaining front and centre when it came to the thought process of participants.

- The early bid seemed to run out of some steam after the failure of bulls to challenge the 2.50% level in 10-Year yield terms resulted in a bit of a moderation of strength.

- On the flow side, a round of screen buying through Monday’s high in TYU2 and block lift of the same contract (+1.5K) helped the space higher during the early Asia rally.

- Note that the space looked through the bullish impulse from ACGBs in the wake of the latest RBA monetary policy decision.

- Tuesday’s NY session will see the release of JOLTS job opening data, in addition to several rounds of Fedspeak (Bullard, Evans & Mester). Pelosi’s movements will also be eyed, with reports suggesting she will land in Taiwan somewhere between 15:00-15:50 London time (10:00-10:30 NY).

JGBS: Aggressive Flattening

JGB futures haven’t been able to force a meaningful break above their overnight session high, despite a brief look above the level during the Tokyo morning.

- A fade away from best levels then occurred alongside a pullback in wider core global FI markets, with a poorly received round of 10-Year JGB supply also factoring into that dynamic.

- In terms of auction specifics, the low price saw the cover ratio tumble to levels comfortably below the recent averages, while the low price missed wider dealer expectations. The lacklustre result comes after the BoJ’s recent defence of its YCC parameters and firm insistence on holding its current policy settings as they are. The previously-flagged lack of relative value, coupled with the potential for participants being cognisant of the degree of richening away from the 0.25% yield ceiling that the BoJ permits, likely resulted in soft demand.

- Still, continued worry surrounding the impending journey of U.S. House Speaker Pelosi to Taiwan underpinned the space post-acution, facilitating a recovery in futures (the pullback was relatively shallow), with the contract last dealing +19, a little off best levels. Wider cash JGB trade has seen bull flattening of the curve, with the major benchmarks running little changed to ~6.5bp richer. 10s have underperformed surrounding tenors all day on the back of set up for and in reaction to the previously outlined supply. The bid in the super-long end has accelerated ahead of the close.

- The latest round of BoJ Rinban operations headline the domestic docket on Wednesday.

JGBS AUCTION: Japanese MOF sells Y2.1885tn 10-Year JGBs:

The Japanese Ministry of Finance (MOF) sells Y2.1885tn 10-Year JGBs:

- Average Yield: 0.168% (prev. 0.248%)

- Average Price: 100.31 (prev. 99.53)

- High Yield: 0.174% (prev. 0.250%)

- Low Price: 100.25 (prev. 99.51)

- % Allotted At High Yield: 73.0170% (prev. 26.6152%)

- Bid/Cover: 3.016x (prev. 5.046x)

AUSSIE BONDS: Firmer As RBA Tweaks Guidance Passage To Stress Optionality

The inclusion of the language surrounding the tightening cycle being on no pre-set path in the RBA’s guidance paragraph, shift higher in its inflation track and mark lower in GDP growth expectations has provided a dovish feel to the statement that accompanied the widely expected 50bp rate hike from the Bank. That has allowed the ACGB space to go bid post-decision as YM & XM surged to fresh session highs, with the former +11.0 & XM +13.5, a touch shy of best levels. Cash ACGBs are 1bp cheaper to 10bp richer across the curve, twist flattening, with an element of elongated weekend catch up evident in cash ACGB levels after the NSW holiday observed on Monday. Bills run 6-11bp richer through the reds as a result also just shy of best levels. Note that the OIS strip has unwound the best part of 10bp of tightening when it comes to the Bank’s September meeting, with a touch over 30bp of tightening priced in for that gathering. Further out, ~10bp of tightening has also been taken out of RBA December meeting-dated OIS, which now sits at ~3.00%, with pricing surrounding the terminal cash rate also pulling lower to just below 3.20% (foreseen in February).

- Swings in broader risk appetite drove price action earlier in the session, with the Asia-Pac region setting up for U.S. House Speaker Pelosi’s expected trip to Taiwan.

- Mixed local data, in the form of housing finance and building approvals, had no tangible impact on the space.

- Looking ahead to tomorrow, it will be the Q2 retail sales volumes data and A$800mn of ACGB Nov-32 supply that headlines the domestic docket.

EQUITIES: Lower In Asia; Chinese Property And Tech Underperform

Asia-Pac equity indices have mostly held on to their earlier, Pelosi-induced lows, with high-beta equities continuing to lead losses across the region despite earlier confirmation that the U.S. House Speaker had landed in Malaysia (with participants continuing to watch for confirmation of earlier Taiwanese media reports that Pelosi may arrive in Taiwan later today).

- The Hang Seng brings up the rear amongst peers, sitting 2.7% worse off, on track for a third consecutive lower daily close with virtually every constituent in the red at typing. China-based tech posed the most drag on the index, with the HSTECH dealing 3.9% weaker at writing, adding to steep sell-offs witnessed in the property (-2.4%) and finance (-2.4%) sub-gauges as well.

- The CSI300 is 2.5% worse off, a little above fresh eight-week lows made earlier in the session. The richly-valued consumer staples and healthcare sub-indices lead the way lower, while elsewhere, tech equities have struggled, with the ChiNext index operating a little above session lows at 2.7% lower as well.

- Chinese property stocks (CSI 300 Real Estate Index: -2.4%) have also extended their recent run of losses, with investors looking through a pledge by the PBOC on Monday to stabilise loan growth and facilitate financing for the country’s property sector.

- The ASX200 is 0.2% worse off, back from lows of as much as 0.7%, and narrowly on track to snap a five-session streak of higher daily closes. Losses in the materials (-1.7%) and energy (-1.0%) sub-indices were largely able to offset shallower gains across other sectors, with the major miners dealing 2.1-3.1% weaker apiece at typing.

- E-minis sit between 0.3-0.4% lower, a little above their respective session lows at typing.

OIL: Lower In Asia; Supply Optimism Rises Ahead Of OPEC+ Meeting

WTI is ~-$0.80 and Brent is ~-$1.00, with the latter sitting a little below the $100 mark after failing to break above that level earlier in the session.

- To recap, both benchmarks closed ~$4-5 lower apiece on Monday on the back of disappointing data prints out of the U.S. and Europe, worsening the energy demand outlook from some quarters amidst prior recession-related worry.

- Looking to OPEC+, a Fox Business news reporter has pointed to sources informing him that Saudi Arabia will “push OPEC+ to increase oil production at their meeting on Wednesday,” although wider news flow re: the matter on the Fox network has not been observed at writing.

- A BBG report has observed that Russian seaborne oil exports have “stabilised” and are little changed from pre-invasion levels, likely underscoring the difficulty the west faces in targeting Russian crude. This comes as FT on Monday noted that the UK continues to hold off on introducing a ban on maritime insurance to ships carrying Russian oil, a measure that was supposed to join a similar move by the EU in May.

- Brent’s prompt spread has narrowed to ~$2.00 at typing, down from over $5.00 observed just a week ago.

- Looking ahead, BP plc will report earnings later today, with the accompanying commentary potentially offering some insight into the outlook for crude supply (coming after recent high-profile earnings beats from Shell, Exxon Mobil, Chevron, and Total Energies).

GOLD: Four-Week Highs In Asia; Pelosi Visit Eyed

Gold deals ~$5/oz firmer, printing ~$1,777/oz at typing. The precious metal sits a little below fresh four-week highs ($1,780.5/oz) made after Taiwanese media offered an exact time for U.S. House Speaker Pelosi’s visit to Taiwan, adding to tailwinds from a downtick in the USD (DXY) and nominal U.S. Tsy yields.

- Immediate focus has turned to risks surrounding China’s response to Pelosi’s Taiwan trip, with U.S. Tsys catching a bid alongside defensively-oriented flows observed in the FX space, while regional cash equity indices and e-minis have gone offered.

- To recap, gold closed ~$6/oz firmer on Monday, recording a fourth straight higher daily close, coming as the USD (DXY) has simultaneously notched four consecutive lower closes. The overall move higher in gold also came amidst the backdrop of disappointing data releases out of the U.S. and Europe on Monday as well, contributing to prior recession-related worry.

- From a technical perspective, gold’s recent bounce is still seen as corrective, with focus on initial resistance at ~$1,785.3/oz (50-Day EMA), a break of which would bring $1,812.0/oz (trendline resistance) into view. On the other hand, support is seen at ~$1,745.1/oz (20-Day EMA).

FOREX: Yen Goes Ballistic Amid Taiwan Angst, Aussie Retreats On RBA Guidance Tweak

The yen had another stellar session as U.S. House Speaker Pelosi's touted trip to Taiwan stole the limelight, causing geopolitical angst to radiate across Asia. As things stand, Pelosi is expected to arrive in Taipei around 10pm local time, with Beijing threatening unspecified military response.

- USD/JPY tumbled as low as to Y130.41, bottoming out within touching distance from its 100-DMA, which was last breached in Sep 2021. The rate continued to take out key support levels, leaving with Jun 16 low/61.8% retracement of the May - Jul rally (131.50/34) in the rear-view mirror.

- Despite the yen capitalising on its safe haven allure, relative yield dynamics remained pertinent. USD/JPY moved away from session lows as U.S. Tsys pulled back from highs. Still, U.S. Tsy yields remain lower on the day, which underpins further compression of their gap with Japanese counterparts.

- The Aussie dollar took a beating from the RBA, which raised the cash rate target by the widely expected 50bp increment, but added a mention that "it is not on a pre-set path" when it comes to policy normalisation into the guidance paragraph of the statement.

- Post-RBA Aussie sales rubbed salt into the wounds of regional risk barometer AUD/JPY, sending it to worst levels since May 30. Meanwhile, AUD/NZD dropped in tandem with Australia/New Zealand 2-year swap rate spread.

- USD/CNH unwound its initial foray to the highest point since May 17 and slipped into negative territory. USD/TWD remained elevated, consolidating above the TWD30.00 mark.

- The global data docket is light going forward, while central bank speaker slate features Fed's Evans, Mester & Bullard. The market will be on the lookout for any updates on the Taiwan situation.

FX OPTIONS: Expiries for Aug02 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9900(E1.0bln), $1.0000(E1.4bln), $1.0240-45(E556mln)

- EUR/GBP: Gbp0.8647-65(E1.2bln)

- EUR/JPY: Y135.85-00(E664mln)

- AUD/USD: $0.7160(A$641mln)

- USD/CAD: C$1.2890-00($647mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2022 | 0430/1430 | *** |  | AU | RBA Rate Decision |

| 02/08/2022 | 0600/0700 | * |  | UK | Nationwide House Price Index |

| 02/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/08/2022 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/08/2022 | 1400/1000 |  | US | Chicago Fed's Charles Evans | |

| 02/08/2022 | 1400/1000 | ** |  | US | housing vacancies |

| 02/08/2022 | 1400/1000 | ** |  | US | JOLTS jobs opening level |

| 02/08/2022 | 1400/1000 | ** |  | US | JOLTS quits Rate |

| 02/08/2022 | 1700/1300 |  | US | Cleveland Fed's Loretta Mester | |

| 02/08/2022 | 2245/1845 |  | US | St. Louis Fed's James Bullard |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.