-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: BoE Upon Us, NFP Slightly Further Out

- Most of the major markets coiled during Asia-Pac dealing, awaiting impending event risk.

- Looking ahead, most sell-side analysts expect the BoE to raise the bank rate by 50bp today. Our Markets Team assigns a subjective 70% probability to a half-percentage point hike (with a 25bp hike if not).

- Elsewhere, today's data highlights include German factory orders as well as U.S. jobless claims & trade balance. Fed's Mester ('22 voter) will discuss the economic outlook.

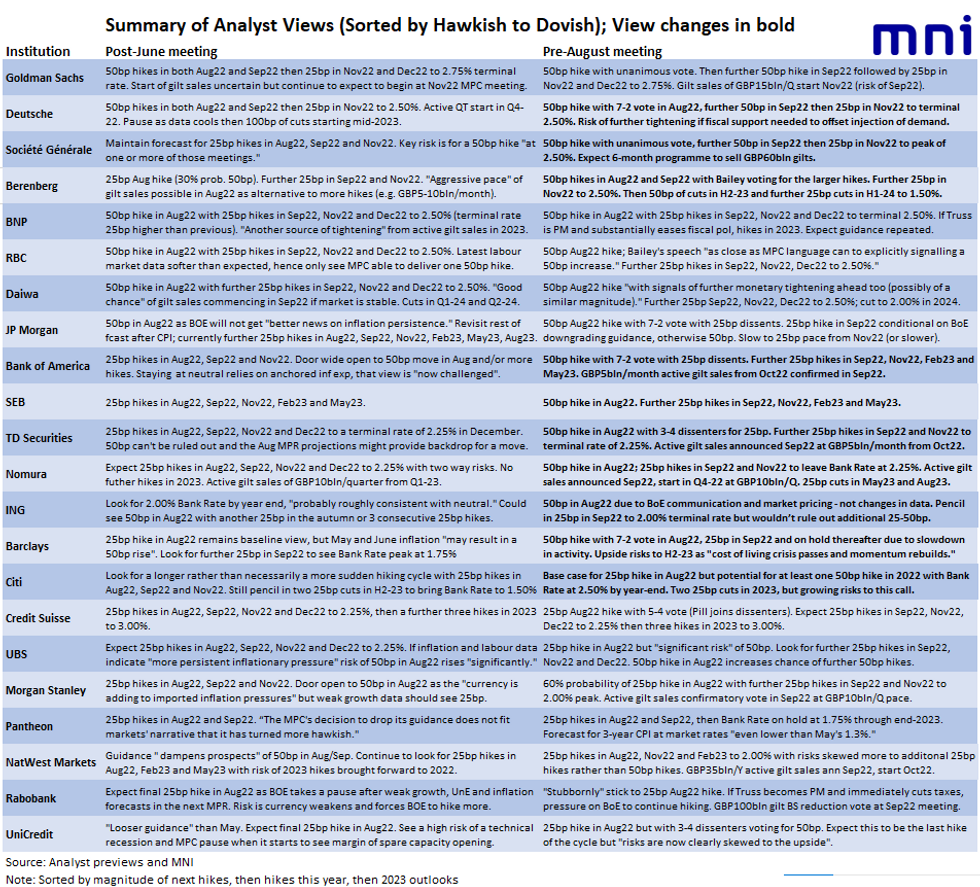

MNI BOE Preview - August 2022: 70% chance of a 50bp hike

- The MNI Markets team assigns a subjective 70% probability to a 50bp hike at this week's MPC meeting (with a 25bp hike if not).

- Inflation remains high, the PMIs have held up, other central banks have pivoted hawkishly and Bailey hinted towards a 50bp hike at his Mansion House speech.

- In addition, we will receive an update regarding balance sheet policy. It is unclear how much detail we will receive this week with the MPC expected to hold a September confirmatory vote before beginning active gilt sales.

- See the full document including MNI Instant Answers and over 20 summaries of sell side views: MNI BoE Preview - Aug22.pdf

US TSYS: Narrow Overnight

Tsys lacked anything in the way of meaningful traction overnight, operating shy of their respective Wednesday peaks. The major cash Tsy benchmarks run 1.0-2.0bp cheaper across the curve as a result, sticking to tight ranges. TYU2 is +0-06 at 120-09, 0-01+ off the base of its 0-06+ range, on sub-par volume of 60K lots.

- Given the lack of meaningful major news flow and proximity to Friday’s NFP print, we would suggest that today’s Asia-Pac session has been more of a time to reflect for regional participants. This comes after a ~33bp range for 10-Year yields over the last couple of sessions (peak to trough), with Tuesday’s move representing one of the largest intraday net swings observed over the last decade and included the failure of bulls to meaningfully test the 2.50% yield level (lows of 2.5143% were reached, representing the lowest yield level observed since early April).

- Early Asia trade saw contacts flag real money accounts’ desire to reduce duration exposure, perhaps ahead of event risk later in the week and after Pelosi’s visit to Taiwan came and went.

- Looking ahead, the latest BoE monetary policy decision will provide interest during the London-NY crossover (our full preview of that event is available here), with Challenger job cuts and weekly jobless claims data set to headline the economic releases during the NY session. We will also hear from Cleveland Fed President Mester (’22 voter).

JGBS: Curve Flattens, Futures Coil

JGB futures have been happy to consolidate during the Tokyo afternoon after failing to build on a short and limited look above their overnight high during the Tokyo morning, last dealing +9 vs. yesterday’s settlement level, a little shy of best levels. The major cash JGB benchmarks run 0.5-3.0bp richer across the curve, bull flattening. There hasn’t been much in the way of decisive news flow to digest leaving participants to react to yesterday’s flattening of the U.S. Tsy curve and limited cross-market gyrations observed since the open.

- BBG conducted an interview with “Mr. JGB,” who warned that “investors should start preparing for a return to normal Japanese bond trading as the central bank will one day step back from its debt purchases.” This hasn’t had much in the way of market impact, although the article has generated plenty of interest.

- 10-Year breakevens have moved to the narrowest levels observed since early April. Today’s 10-Year JGBi auction results were mixed. The price component was comfortably firmer than expected, although the cover ratio softened to 3.323x, below the 6-auction average of 3.48x. The pricing suggests there was decent enough demand for inflation protection given the current well-documented global inflationary picture, with some participants willing to pay up for such protection, although the limited nature of the spill over into Japanese prices likely tempered wider demand, limiting the cover ratio. It would seem the market has looked to the softer cover ratio when it comes to subsequent price action.

- Elsewhere, the latest round of Japanese weekly international security flow data suggested that the sizable covering of short JGB positions on the part of international investors resumed last week, after a one-week break, with their net purchases of Japanese bonds comfortably topping the Y1tn mark for the third time in four weeks.

- Wage and household spending data headlines the domestic docket on Friday.

AUSSIE BONDS: Bear Flattening

Aussie bonds have continued to edge lower as we have worked our way through the Sydney session, with the record Australian trade surplus print for June and marginal cheapening in U.S. Tsys helping to pull the space away from best levels. Cash ACGBs run 3.5-6.0bp cheaper across the curve, bear flattening, while YM and XM are -6.0 and -5.5, respectively operating within the lower end of their respective overnight ranges after failing to break above neutral levels earlier in early Sydney dealing.

- Note that the latest round of semi supply from TCV (a ~A$2bn tap of Sep-33 paper) may have added some pressure to XM around the time of pricing.

- Bills run flat to 7 ticks cheaper across the reds, bear steepening.

- Friday will see A$700mn of ACGB Apr-2027 on offer ahead of the RBA’s quarterly Statement on Monetary Policy (SoMP), with the AOFM's weekly issuance slate to follow soon after.

JAPAN: Foreigners Resume JGB Short Covering

The latest round of Japanese weekly international security flow data suggested that the sizable covering of short JGB positions on the part of international investors resumed last week, after a one-week break, with foreign net purchases of Japanese bonds comfortably topping the Y1tn mark for the third time in four weeks.

- The remaining net flows were fairly limited, including modest buying of foreign bonds by Japanese investors for a second consecutive week (which comes on the heels of a record 8 weeks of net sales, which was driven by elevated FX-hedging costs and market volatility), a seventh straight week of net purchases of international equities by Japanese investors and net sales of Japanese equities on the part of international investors (after 3 straight weeks of net purchases).

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | 37.1 | 112.0 | -2250.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | 336.9 | 230.3 | 1577.0 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1296.3 | -15.5 | 5092.2 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | -120.3 | 297.6 | 1178.7 |

FOREX: Yen Fluctuates, Antipodeans Gain In Quiet Asia Session

USD/JPY wavered between gains and losses, holding a 70-pip range in a catalyst-light Asia session. The pair lost some altitude over the Tokyo fix, but then recovered in sync with U.S. Tsy yields. The spot rate last deals a dozen pips shy of neutral levels, while USD/JPY risk reversal extended Wednesday's upswing.

- Worth pointing to sizeable USD/JPY option expiries coming up today. There is $1.4bn worth of options with strikes at Y133.00 due to roll off at the NY cut, with a further $2.4bn due to expire at Y134.80-00.

- Price action of USD/JPY showed strong correlation with broader greenback strength. The BBDXY index is back to virtually neutral levels and last sits at 1,272, holding yesterday's range in Tokyo trade.

- The Antipodeans took the lead, even as U.S. e-mini contracts struggled to return into positive territory. The AUD shrugged off Australia's widest trade surplus on record, underpinned by an expectation-busting growth in exports.

- The kiwi dollar outperformed at the margin, possibly supported by reflections on the state of New Zealand's labour market ahead of this month's RBNZ policy review. While data released yesterday showed an unexpected uptick in the unemployment rate, wage inflation remained hot.

- Most sell-side analysts expect the BoE to raise the bank rate by 50bp today. Our Markets Team assigns a subjective 70% probability to a half-percentage point hike (with a 25bp hike if not).

- Today's data highlights include German factory orders as well as U.S. jobless claims & trade balance. Fed's Mester will discuss the economic outlook.

FX OPTIONS: Expiries for Aug04 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0100(E691mln), $1.0150-60(E1.9bln), $1.0200-10(E1.bln), $1.0215-30(E1.7bln), $1.0295-00(E1.3bln)

- USD/JPY: Y129.35-45($2.4bln), Y132.00($863mln), Y133.00($1.4bln), Y134.25-31($590mln), Y134.80-00($2.4bln), Y135.05-10($778mln)

- AUD/USD: $0.7000(A$582mln)

- USD/CAD: C$1.2750($745mln)

- USD/CNY: Cny6.75($1.6bln)

ASIA FX: Mixed Session, Despite Higher Equities

Mixed session for USD/Asia pairs, despite a generally firmer equity tone in the region. USD/CNH range bound, while USD/TWD edges higher back above 30.00, as China military exercises kick off. USD/KRW also firmed. INR and IDR lost ground, while THB has rallied.

- CNH: USD/CNH has traded tight ranges today. Dips sub 6.7600 have been supported. The CNY fix printed in line with expectations. China equities are higher but lagging the rest of the Asia Pac region. The property sub-index continues to trend lower, now down for the 7th straight session. USD/CNH sits at 6.7615 currently.

- KRW: Firmer onshore equities haven't aided the won today. USD/KRW is back above 1310 in terms of the 1 month NDF, driving a further wedge with the recent equity bounce. Pelosi's trip to South Korea has been uneventful so far.

- TWD: Spot USD/TWD is back above 30.00, as onshore equities underperform the broader rally seen elsewhere in the region. The TWSE is off by a little over 0.8% so far today. China has commenced its military exercises around the Taiwan island.

- INR: USD/INR is up again in early trade today. The pair is back above 79.40, around +0.35% above yesterday's closing levels. This comes despite weakness in oil prices. Onshore equities are modestly higher in early trade.

- IDR: Spot USD/IDR has edged higher as well, up 17.5 figs to 14930. Indonesia's 5-year CDS premium has added 17bp his morning to last sit at 120bp. It keeps slowly retracing an earlier pullback from the Jul 15 peak of 164bp. Onshore equities are higher (+0.30%), although note there was a big outflow yesterday from offshore investors, -$479.9mn.

- PHP: The peso trades close to flat at 55.727. Wednesday saw the benchmark PSEi index cross above its 50-DMA for the first time since early March, while overseas investors were net buyers of local stocks for the second consecutive day. Reminder that Philippine inflation data will hit the wires tomorrow. It is expected that headline inflation stayed at +6.1% Y/Y in July, according to a Bloomberg survey.

- THB: Selling pressure has hit spot USD/THB, with overnight recovery in risk sentiment lending support to the Asia EM space. The pair last deals -0.10 at THB36.182. Thai officials continued to play up recovery prospects for the local tourism industry. Gov't spokesman said the authorities will roll out fresh supportive measures through 2023 to attract more overseas visitors.

CNH: China Equities Remain Underperformers, CNY NEER Stabilizes

USD/CNH tracked familiar ranges post the Asia close. Dips in the pair were supported, as USD momentum stayed positive against the likes of EUR and JPY. CNH continued to outperform against JPY though, rallying back into the 19.80/90 zone. USD/CNH is just above 6.7600 currently, with dips to the low 6.7500 region supported in recent sessions.

- Geopolitical tensions will remain the near-term focus, with the market in wait and see mode around further escalation risks, particularly with military exercises taking place around Taiwan over the next few days.

- Locally, onshore media is pointing to a 11% rise in infrastructure investment in 2022, with Q3 expected to see a strong rebound. This is likely to be a key part of the domestic recovery and may aid infrastructure related stocks today.

- Yesterday, onshore equities finished down close to 1%. The recent rebound in the Shanghai Property sub-index has also rolled over, with the index falling for the past 6 sessions. We are now back to fresh lows since mid-March.

- We continue to see China equities underperform the rest of the world, see the chart below. The CNY NEER remains off its highs, but has stabilized since the start of this week.

- On the covid front, a small Chinese city, Yiwu, plans mass testing after a recent flare up.

- In terms of data, nothing is on the calendar today, with BoP Q2 current account figures tomorrow, but this is unlikely to move market sentiment. Greater focus will be on trade figures out on Sunday for July.

Fig 1: China Equities Continue To Underperform, CNY NEER Stabilizes Somewhat

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

EQUITIES: Off Best Levels

Major Asia-Pac equity indices are broadly off best levels but remain bid as we head towards the end of Asia-Pac dealing, with tailwinds from Wall St's strongly positive lead aiding the overall move higher.

- The Nikkei 225 is 0.6% better off, back from as much as 1.0% higher. Tech and export-focused large caps contributed to the bulk of gains in the Nikkei, with the broader TOPIX trading flat at writing by comparison.

- The ASX200 deals 0.1% firmer at typing, paring initial gains of as much as 0.7% on weakness in the materials (-1.0%) and energy (-1.9%) sub-gauges, neutralising the bulk of gains in tech (S&P/ASX All Tech: +2.7%) and financials (+0.6%).

- The Hang Seng Index sits 1.5% better off at typing, back from session highs as China-based tech equities (HSTECH: +2.2%) have pared their initial bid, while initially decent showings from the financials (+1.0%) and property (+0.8%) sub-indices have moderated as well.

- The CSI300 is 0.3% better off at writing, backing away from session highs at around 1.0% higher as tech-related equities have given up their initial bid (ChiNext: +0.0%). Richly-valued consumer staples and healthcare equities nonetheless lead the way higher, with modest gains observed in utilities as well on the back of reports pointing to China’s State Grid planning to commence work on an increased amount of ultra high-voltage infrastructure in H2 ‘22.

- The Taiex trades 0.8% lower at typing, operating a shade above session lows amidst news that the Chinese military has commenced a five-day series of drills near the island.

- E-minis are flat to 0.2% weaker at writing, sitting a little below their respective U.S. earnings-induced highs made on Wednesday.

GOLD: Little Changed In Asia; Fedspeak Back In Focus

Gold sits ~$2/oz firmer to print $1,767/oz, operating within a tight ~$6/oz trading range across Asia-Pac dealing. The precious metal operates a short distance below Wednesday’s best levels at typing, extending a move off of yesterday’s troughs amidst a downtick in the USD (DXY).

- To recap Wednesday’s price action, gold closed ~$5/oz firmer, paring gains of as much as $12/oz after the marginally higher final U.S. services PMI reading and a stronger-than-expected ISM services print.

- The precious metal remains firmly below four-week highs made on Tuesday (at $1,788.1/oz), with worry surrounding Pelosi’s visit to Taiwan moderating from extremes (note that Chinese drills around Taiwan involving "long-range live ammunition shooting" will only conclude on 8 Aug), while previously-flagged Fedspeak over the past week has contained mostly hawkish undertones.

- From a technical perspective, focus is on initial resistance at ~$1,783.8/oz (50-Day EMA) following gold’s recent bounce higher, a break of which would expose further resistance at $1,807.1/oz (trendline resistance). On the other hand, support is seen at ~$1,748.9/oz (20-Day EMA).

OIL: Just Off Multi-Month Lows As U.S. Inventory Data Weighs

WTI and Brent are ~$0.30 firmer apiece, with both benchmarks treading water above their respective worst levels established on Wednesday, placing them firmly back into ranges witnessed before the Russia-Ukraine war.

- To recap, WTI and Brent closed ~$3-4 lower apiece on Wednesday, seeing WTI hit five-month lows after the latest round of U.S. EIA inventory data pointed to a large, surprise build in crude stockpiles, corroborating with prior reports on API inventories. A smaller - but surprise increase in gasoline stocks was observed as well, stoking worry from some quarters re: demand destruction amidst higher energy prices, particularly as the build comes amidst the peak of seasonal demand.

- Demand-related worry surrounding the EIA data release more than offset tailwinds from the earlier OPEC+ announcement to raise collective output targets from Sep by 100K bpd, disappointing expectations for a larger increase in a move that some have said works out to “86 seconds of global demand” on a daily basis.

- Brent’s prompt spread continues to head south, printing ~$1.55 at typing (compared to peaking at ~$2.80 earlier this week), pointing to waning worry re: tightness in global crude supplies.

- Elsewhere, the Caspian Pipeline Consortium (CPC) has reported that crude supply has been significantly reduced at the Tengiz (>600K bpd capacity) and Kashagan (~400K bpd) oilfields without citing reasons nor figures at writing.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 04/08/2022 | 0600/0800 | ** |  | DE | Manufacturing Orders |

| 04/08/2022 | 0730/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 04/08/2022 | 0800/1000 |  | EU | ECB August Economic Bulletin | |

| 04/08/2022 | 0830/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 04/08/2022 | 1100/1200 | *** |  | UK | Bank Of England Interest Rate |

| 04/08/2022 | 1130/1230 |  | UK | BOE Press Conference | |

| 04/08/2022 | 1230/0830 | * |  | CA | Building Permits |

| 04/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 04/08/2022 | 1230/0830 | ** |  | US | Trade Balance |

| 04/08/2022 | 1400/1000 | ** |  | US | WASDE Weekly Import/Export |

| 04/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 04/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 04/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 04/08/2022 | 1600/1200 |  | US | Cleveland Fed's Loretta Mester |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.