-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Fed Hike Size, Taiwan Drills & Italian Unrest Dominate Weekend News

#anchor-5EXECUTIVE SUMMARY

- FED'S BOWMAN: MORE 75 BASIS-POINT HIKES SHOULD BE ON THE TABLE (RTRS)

- DALY SAYS FED IS ‘FAR FROM DONE YET’ ON BRINGING INFLATION DOWN (BBG)

- BTPS EYED AFTER ITALY’S CENTRE-LEFT COALITION COLLAPSES & MOODY’S SWITCH ITALY’S OUTLOOK TO NEGATIVE

- TRUSSONOMICS REMAINS UNDER THE MICROSCOPE IN UK TORY LEADERSHIP RACE

- TAIWAN VOWS TO RESIST PRESSURE AS CHINA ANNOUNCES MORE DRILLS (BBG)

- CHINA’S HAINAN STARTS MASS COVID TESTING, IMPOSES MORE LOCKDOWNS (BBG)

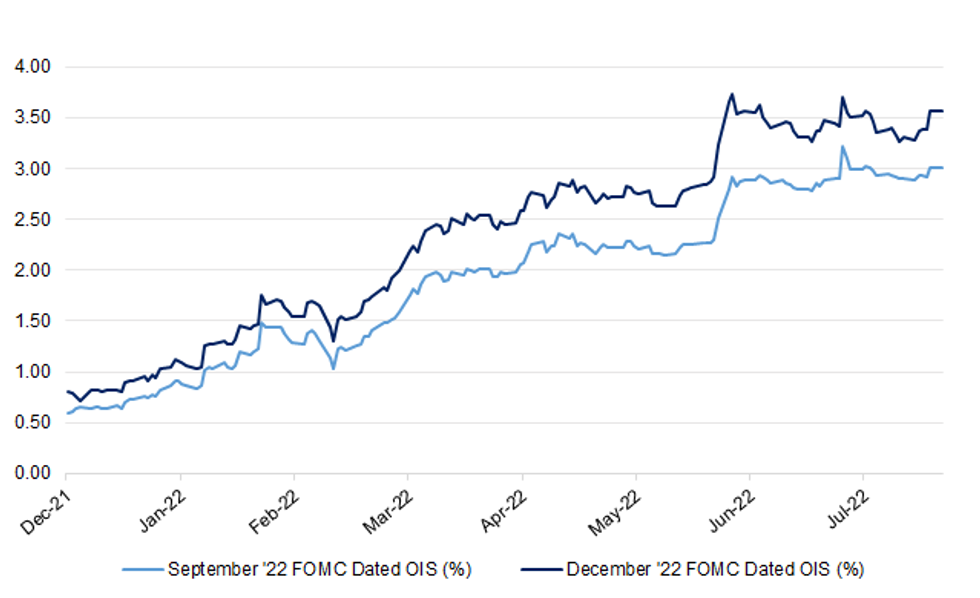

Fig. 1: September & December '22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS/FISCAL: Liz Truss, the Tory leadership frontrunner, has rejected “handouts” as the best way to help households through the worst income squeeze in 60 years, promising instead tax cuts and radical economic reform. (FT)

POLITICS/FISCAL: Liz Truss’s comments about not using “handouts” to ease the cost of living crisis have been “misinterpreted”, Penny Mordaunt has claimed. (Telegraph)

POLITICS/FISCAL: Two thirds of voters believe the government would be wrong to prioritise tax cuts over tackling the cost of living, a poll has found, as the rivals for the Tory leadership again clashed over their economic plans. In a warning to Liz Truss, the YouGov poll for The Times indicated that 64 per cent of voters thought the next prime minister should concentrate on inflation, with 17 per cent favouring tax cuts. (The Times)

POLITICS/FISCAL: Liz Truss would seek to immediately reverse the rise in National Insurance contributions if she were to become prime minister. Her team said it had been thought the plan could not be implemented until April 2023, but now they believed it would be within weeks. (BBC)

POLITICS/FISCAL: Rishi Sunak has pledged to introduce another multibillion-pound package to help ease the cost of living crisis, saying the country faces a stark choice between “clear-eyed realism and starry-eyed boosterism”. The former chancellor said it was “wrong” of his leadership rival Liz Truss to rule out further direct support for households this winter when nightmare forecasts suggest the price cap on energy bills could reach £4,400 in January. (The Times)

BOE: Andrew Bailey would be told to abandon the Bank of England’s 2pc inflation target under a radical plan to reform its mandate and boost the economy. Mr Bailey, the Bank's Governor, may be ordered to target nominal GDP in future - the size of the economy in cash terms - instead of seeking to keep inflation at 2pc, under plans being floated by allies of the Tory leadership frontrunner Liz Truss. This would be a significant departure from current rules. The proposals are thought to be one of several options being considered, with talks at a very early stage. (Telegraph)

BOE: A former mandarin with “no economic experience” is on course to be appointed to the Bank of England’s board after civil servants told the Chancellor she would “make a strong contribution to improving diversity and inclusion”. Dame Clare Moriarty, a former permanent secretary of the environment department, has been selected by Nadhim Zahawi, having been lined up by Rishi Sunak before his resignation last month. A source close to Mr Sunak denied that any of his special advisers carried out due diligence checks on Dame Clare. (Telegraph)

BREXIT: European officials are pessimistic about a reset in post-Brexit relations with the UK, whoever becomes Britain’s next prime minister in September. (Guardian)

EUROPE

GERMANY: People in Germany have to save at least 20% of their energy consumption to avoid a gas shortage by December due to falling Russian gas flows, Germany’s network regulator head Klaus Mueller said. (RTRS)

ITALY: An Italian centrist party quit its alliance with the Democrats, days after agreeing to join forces in a bid to prevent a right-wing landslide in September elections triggered by the fall of Prime Minister Mario Draghi’s government. (BBG)

RATINGS: Sovereign rating reviews of note from Friday include:

- Fitch affirmed France at AA; Outlook Negative

- Fitch affirmed Latvia at A-; Outlook Stable

- Moody's affirmed the Czech Republic at Aa3, outlook changed to negative from stable

- Moody's affirmed Italy at Baa3, outlook changed to negative from stable

- Moody's affirmed Slovakia at A2, outlook changed to negative from stable

- DBRS Morningstar confirmed Sweden at AAA, Stable Trend

U.S.

FED: The U.S. Federal Reserve should consider more 75 basis-point interest rate hikes at coming meetings in order to bring high inflation back down to the central bank's goal, Fed Governor Michelle Bowman said on Saturday. (RTRS)

FED: San Francisco Fed President Mary Daly suggested a 50 basis-point rate increase isn’t locked in at the US central bank’s next policy meeting, saying the Federal Reserve is “far from done yet” in bringing down inflation. “Absolutely -- and we need to be data-dependent,” Daly said on CBS’s “Face the Nation” when asked about the likelihood of a half percentage-point increase by the Fed in September. “We need to leave our minds open. We have two more inflation reports coming out, another jobs report.” (BBG)

ECONOMY/POLITICS: With the midterm elections three months away, Americans maintain a sour view on the state of the economy and are pessimistic about its future course, with President Joe Biden’s approval rating across a range of issue areas continuing to suffer, according to a new ABC News/Ipsos poll. More than two-thirds (69%) of Americans think the nation’s economy is getting worse -- the highest that measure has reached since 2008, when it was 82% in an ABC News/Washington Post poll. Currently, only 12% think the economy is getting better and 18% think it is essentially staying the same. (ABC)

FISCAL: The U.S. Senate on Sunday passed a sweeping $430 billion bill intended to fight climate change, lower drug prices and raise some corporate taxes, a major victory for President Joe Biden that Democrats hope will aid their chances of keeping control of Congress in this year's elections. (RTRS)

EQUITIES: Warren Buffett’s Berkshire Hathaway Inc. is following an age-old strategy -- buy the dip -- but doing it cautiously. The conglomerate was a net buyer of equities in the quarter, reporting $3.8 billion in purchases, according to results released Saturday. It was a net seller in the second quarter of last year. (BBG)

OTHER

GLOBAL TRADE: Four more ships carrying almost 170,000 metric tons of corn and other foodstuffs sailed from Ukrainian Black Sea ports on Sunday under a deal to unblock the country’s exports after Russia’s invasion, Ukrainian and Turkish officials said. (CNBC)

CHINA/TAIWAN: The Chinese military will from now on conduct "regular" drills on the eastern side of the median line of the Taiwan Strait, Chinese state television reported on Sunday, citing a commentator. (RTRS)

CHINA/TAIWAN: Taiwan reiterated it won’t succumb to pressure from China after days of military drills in the air and seas surrounding the island, with hostilities set to continue even as world leaders urge an end to the strife. (BBG)

U.S./CHINA/TAIWAN: Chinese foreign minister Wang Yi said on Sunday that Taiwan is not part of the United States but Chinese territory, in the latest diplomatic invective against U.S. policy since a visit to Taiwan by U.S. House of Representatives Speaker Nancy Pelosi. (RTRS)

U.S./CHINA/TAIWAN: The White House said on Saturday that China's actions in and around the Taiwan Strait were provocative and irresponsible after Taiwan officials said Chinese aircraft and warships rehearsed an attack on the island. "These activities are a significant escalation in China's efforts to change the status quo. They are provocative, irresponsible, and raise the risk of miscalculation," a White House spokesperson said. (RTRS)

U.S./CHINA/TAIWAN: U.S. Secretary of State Antony Blinken accused China of "irresponsible steps" on Saturday by halting key communication channels with Washington, and said its Taiwan actions showed a move from prioritising peaceful resolution towards use of force. (RTRS)

GEOPOLITICS: United Nations Secretary-General Antonio Guterres said on Monday that the risk of nuclear confrontation had returned after decades, calling on nuclear states to commit to no first use of the weapons. (RTRS)

BOJ: Japan needs bolder monetary and fiscal stimulus to seize “a once-in-a-lifetime opportunity” from global inflationary pressures to end its war on deflation, according to a Bank of Japan board member who recently left the central bank. The BoJ has come under market pressure in recent months to reassess its ultra-easy monetary policy as central banks globally race to raise interest rates to tame increasing food and commodity prices. (FT)

JAPAN: Prime Minister Fumio Kishida is expected to replace Defense Minister Nobuo Kishi while retaining ruling Liberal Democratic Party Secretary-General Toshimitsu Motegi in a cabinet and party leadership reshuffle slated for Wednesday, Nikkei has learned. (Nikkei)

SOUTH KOREA: South Korea will unveil additional measures to tame inflation, and a package of housing supply plans, this week in an effort to help stabilize people's livelihoods, the finance minister said Monday. (Yonhap)

SOUTH KOREA: South Korea is looking to buy more liquefied natural gas to replenish stockpiles before winter. (BBG)

NORTH KOREA: U.N. experts report that North Korea is testing “nuclear triggering devices” and that its preparations for another nuclear test were at a final stage in June, quoting information from unnamed countries. (AP)

HONG KONG: Hong Kong is easing Covid-19 entry rules for international arrivals from Friday, requiring them to remain in a hotel for three days before undergoing four days of “home medical surveillance” that will allow limited movement into areas where vaccine pass checks are not mandatory. (SCMP)

BRAZIL: An oil and gas industry study commissioned by the campaign of former President Luiz Inacio Lula da Silva for the October elections will recommend bolstering Petrobras' refining capacity, including through the reversal of refinery privatizations, one of the study's authors told Reuters. (RTRS)

RUSSIA: Ukrainian President Volodymyr Zelenskiy called on Sunday for a stronger international response to what he described as Russian "nuclear terror" after shelling at the Zaporizhzhia nuclear power plant, the biggest in Europe. (RTRS)

RUSSIA: The head of the U.N.’s atomic agency warned on Saturday about the "very real risk of a nuclear disaster" due to the shelling at the Zaporizhzhia nuclear power plant in Ukraine. (POLITICO)

RUSSIA/TURKEY: Western capitals are increasingly alarmed at the deepening ties between Turkey’s president Recep Tayyip Erdoğan and Vladimir Putin, raising the prospect of punitive retaliation against the Nato member if it helps Russia avoid sanctions. Six western officials told the Financial Times they were concerned about the pledge made by Turkish and Russian leaders to expand co-operation on trade and energy after the two had four-hour meeting in Sochi on Friday. (FT)

SOUTH AFRICA: South African power utility Eskom Holdings SOC Ltd. has lifted the current round of power production curbs, partly due to low weekend demand. The current round of blackouts, known locally as loadshedding, started on Aug. 3 after 11 days without interruptions. Loadshedding has been suspended, Eskom said in a statement on Sunday. (BBG)

IRAN: Negotiations between Iran and the U.S. on reviving the 2015 nuclear deal are close to completion, the European Union’s senior negotiator at the talks said Sunday evening, but it remained unclear whether Tehran will accept the final deal. (WSJ)

IRAN: Iran's foreign minister called on Saturday for a "realistic response" from the United States to Iranian proposals at indirect talks in Vienna aimed at reviving Tehran's 2015 nuclear deal with world powers, state media reported. (RTRS)

ISRAEL: Israel and the Palestinian Islamic Jihad militant group declared a truce late on Sunday, raising hopes of an end to the most serious flare-up on the Gaza frontier in more than a year. (RTRS)

COLOMBIA: Gustavo Petro on Sunday became Colombia's first leftist president, pledging to unite the polarized country in the fight against inequality and climate change and achieve peace with leftist rebels and crime gangs. (RTRS)

ENERGY: America’s largest oil and gas producers are keeping a lid on supply, defying calls from the Biden administration to lift output even as soaring fuel prices driven by Russia’s war in Ukraine deliver bumper profits. (FT)

GAS: Canadian Prime Minister Justin Trudeau’s top energy official defended his country’s decision to release a sanctioned turbine for the key Nord Stream 1 gas pipeline, saying the government was not convinced by Ukraine’s arguments there were alternative options. (BBG)

OIL: Russia’s idled primary oil refining capacity was revised up to 3.196 million tonnes in August, up 23% from the previous estimate, according to Reuters calculations based on Refinitiv Eikon data. (RTRS)

CHINA

ECONOMY: China’s exports are expected to maintain a high rate of growth in Q3, while Chinese imports are expected to experience a further recovery, the China Securities Journal reported following July's trade data. China’s low-priced industrial products are seizing a greater global market share, with high inflation overseas putting the wider global manufacturing sector under pressure. The significant increase in exports to the EU, influenced by tight energy supply, provided a key boost to exports in July, the newspaper said, citing Wang Qing, chief macro analyst of Golden Credit Rating. External demand is still robust, especially when it comes to automobiles and clothing, and the adverse impact of overseas interest rate hikes is not yet obvious in the data, the newspaper said, citing analysts. (MNI)

YUAN: China’s foreign exchange reserves will remain stable, supported by the steady recovery of the Chinese economy and a likely rise in the U.S. dollar index, alongside a move higher in U.S. and European bond prices, the China Securities Journal reported, citing analysts. China’s FX reserves rose by USD32.8 billion to USD3.1 trillion at the end of July, marking the largest monthly increase since January 2021. Bond yields across the major economies fell in July amid a further weakening of expectations surrounding broader economic growth, while major stock markets rebounded from previous lows. These factors combined to push up China’s FX reserves, the newspaper said, citing Wen Bin, chief economist of Minsheng Bank. China's balance of payments surplus also drove up reserves slightly, Wen added. (MNI)

CORONAVIRUS: China’s Hainan started mass Covid-19 testing from Sunday and imposed more lockdowns as infections rise in the southern island province. (BBG)

CREDIT: China’s riskiest borrowers are sliding to record lows in global credit markets as a debt crisis in the country’s property sector spreads, fueling defaults and effectively blocking developer refinancing just as more bond deadlines loom. (BBG)

CREDIT: Chinese builder Logan Group Co. said it will “suspend” coupons on five dollar bonds and warned of creditors potentially seeking repayment acceleration as a result, as developers continue to struggle with debt obligations amid slumping home sales. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.1% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 2.0200% at 9:41 am local time from the close of 1.2963% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 44 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7695 MON VS. 6.7405 FRI

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.7695 on Monday, compared with 6.7405 set on Friday.

OVERNIGHT DATA

CHINA JUL TRADE BALANCE $101.26BN; MEDIAN $89.04BN; JUN $97.94BN

CHINA JUL USD EXPORTS +18.0% Y/Y; MEDIAN +14.1%; JUN +17.9%

CHINA JUL USD IMPORTS +2.3% Y/Y; MEDIAN +4.0%; JUN +1.0%

CHINA JUL TRADE BALANCE CNY682.69BN; MEDIAN CNY600.00BN; JUN CNY650.11BN

CHINA JUL CNY EXPORTS +23.9%; MEDIAN +19.6%; JUN +22.0%

CHINA JUL CNY IMPORTS +7.4%; MEDIAN +5.7%; JUN +4.8%

CHINA JUL FOREIGN RESERVES $3.10407TN; MEDIAN $3.05065TN; JUNE $3.07127TN

JAPAN JUN BOP CURRENT ACCOUNT BALANCE -JPY132.4BN; MEDIAN -JPY706.2BN; MAY +JPY128.4BN

JAPAN JUN ADJUSTED BOP CURRENT ACCOUNT BALANCE +JPY838.3BN; MEDIAN -JPY27.6BN; MAY +JPY8.2BN

JAPAN JUL BANK LENDING INCLUDING TRUSTS +1.8% Y/Y; JUN +1.2%

JAPAN JUL BANK LENDING EXCLUDING TRUSTS +2.1% Y/Y; JUN +1.5%

NEW ZEALAND Q3 RBNZ 2-YEAR INFLATION EXPECTATIONS +3.07%; Q2 +3.29%

MARKETS

SNAPSHOT: Fed Hike Size, Taiwan Drills & Italian Unrest Dominate Weekend News

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 73.9 points at 28250.08

- ASX 200 down 2.662 points at 7012.9

- Shanghai Comp. up 6.046 points at 3233.073

- JGB 10-Yr future down 18 ticks at 150.52, yield up 0.7bp at 0.175%

- Aussie 10-Yr future down 13.0 ticks at 96.765, yield up 12.4bp at 3.210%

- U.S. 10-Yr future +0-05+ at 119-17+, yield down 1.1bp at 2.816%

- WTI crude up $0.18 at $89.18, Gold down $3.01 at $1772.51

- USD/JPY up 17 pips at Y135.18

- FED'S BOWMAN: MORE 75 BASIS-POINT HIKES SHOULD BE ON THE TABLE (RTRS)

- DALY SAYS FED IS ‘FAR FROM DONE YET’ ON BRINGING INFLATION DOWN (BBG)

- BTPS EYED AFTER ITALY’S CENTRE-LEFT COALITION COLLAPSES & MOODY’S SWITCH ITALY’S OUTLOOK TO NEGATIVE

- TRUSSONOMICS REMAINS UNDER THE MICROSCOPE IN UK TORY LEADERSHIP RACE

- TAIWAN VOWS TO RESIST PRESSURE AS CHINA ANNOUNCES MORE DRILLS (BBG)

- CHINA’S HAINAN STARTS MASS COVID TESTING, IMPOSES MORE LOCKDOWNS (BBG)

US TSYS: Richer At The Margins In Asia

TYU2 operates just shy of best levels as we head towards London hours, last +0-03+ at 119-15+, -0-03 off the peak of its overnight high, dealing in a 0-10 range on limited volume of ~68K. Cash Tsys print little changed to 1bp richer across the curve.

- Post-NFP spill over and weekend Fedspeak applied pressure to the space in early Asia-Pac dealing, but bears failed to force a break below Friday’s lows in the major futures contracts (only TU experienced an actual test of its Friday trough). That was before geopolitics and a nudge lower in New Zealand inflation expectation provided some modest support for the space.

- In terms of details, the weekend saw Fed Governor Bowman indicate that similar sized rate hikes to the 75bp steps deployed recently should be on the table until inflation meaningfully decreases. Elsewhere, San Francisco Fed President Daly (’24 voter) reiterated her view that the Fed is “far from done yet” when it comes to its fight to bring down inflation, stressing the data dependence of the central bank (perhaps seeming a little more open to a larger than 50bp hike in the process).

- Elsewhere, the weekend saw Chinese trade data for July reveal a wider than expected surplus aided by much firmer than expected exports. Meanwhile, continued tension surrounding Taiwan also generated plenty of headlines, with China announcing its intentions to conduct “regular” drills near the island.

- Looking ahead, NY hours will see the release of the NFIB small business optimism index and unit labour cost data.

JGBS: Futures Lead Weakness In Belly, Steepening Gives Way To Twist Flattening

JGB futures pulled lower at the open, as Tokyo reacted to Friday’s post-NFP cheapening in U.S. Tsys, allowing the contract to take out its overnight session base. Since then, a recovery for U.S. Tsys from worst levels has facilitated a similar move in JGBs.

- That leaves the benchmark futures contract -17 at typing, a little shy of its Tokyo peak after failing to get anywhere near recouping the losses observed since Friday’s settlement. Meanwhile, the early bear steepening impulse witnessed on the JGB curve has given way to twist flattening, with the major benchmarks running 1.5bp cheaper to 0.5bp richer. 7s present the weakest point on the curve, owing to the aforementioned move lower in futures, while 30s are the firmest point on the curve, with the pivot seen at the 20-Year point.

- Lower tier local data and news flow hasn’t impacted the space, with wider cross-asset flows at the fore. Note that the Nikkei has flagged the likelihood of an announcement re: a government cabinet reshuffle on Wednesday.

- Flash machine tool orders data and 30-Year JGB supply headline the domestic docket on Tuesday.

AUSSIE BONDS: Off Of Extremes Into The Bell

Aussie bonds operate off of cheapest levels as we move towards the Sydney close, with U.S. Tsys trading in a similar manner. That leaves YM -14.5 & XM -13.5, with much of the overnight/early Sydney bear flattening in YM/XM unwound after YM failed to breach its overnight lows. Wider cash ACGB trade sees the major benchmarks print 10-14bp cheaper across the curve, with the belly leading the weakness.

- EFPs are a little narrower on the day, with the 3-/10-Year box flattening.

- Bills run 9-17bp cheaper through the reds.

- The space saw a modest, short-lived bid on the back of a moderation in NZ 2- & 5-Year inflation expectations from across the Tasman, before backing off from best levels alongside U.S. Tsys.

- The latest round of (infrequent) ACGB Apr-37 supply saw the weighted average yield print 0.51bp through prevailing mids (per Yieldbroker), while the cover ratio came in comfortably below the 2.50x benchmark. The auction was probably a bit softer than we expected on the whole, with the lack of clear micro relative value, flatness of the 5-/15- & 10-/15-Year yield curves and Monday timing of supply (the most illiquid time of the global trading week) the major negatives that we would point to.

- Moving forwards, the latest Westpac consumer and NAB business confidence surveys headline domestically on Tuesday. Elsewhere, the AOFM is set to come to market with A$100mn of index linked paper.

AUSSIE BONDS: ACGB Apr-37 Auction Results

The AOFM sells A$300mn of the 3.75% 21 Apr 2037 Bond, issue #TB144:

- Average Yield: 3.3974% (prev. 2.5517%)

- High Yield: 3.4000% (prev. 2.5550%)

- Bid/Cover: 2.2167x (prev. 2.6000x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 81.0% (prev. 100.0%)

- Bidders 37 (prev. 50), successful 14 (prev. 21), allocated in full 7 (prev. 21)

EQUITIES: Little Changed, With Conflicting Forces Observed

The major regional equity indices trade either side of unchanged in the first Asia-Pac session of the week, with deeper COVID restrictions in the Chinese province of Hainan, the post-NFP uptick in FOMC tightening premium, continued Chinese drills surrounding Taiwan and a shortening of Hong Kong’s quarantine period for international travellers at the fore on the headline front. The matters largely offset, although the net bearish skew to the major headline flow applied light pressure to the majority of the regional equity benchmarks. The Nikkei 225 was the outperformer amongst the major regional indices, last sitting 0.2% higher, benefitting from the post-NFP move lower in the yen. Elsewhere, the major regional indices run 0.2-0.8% below their respective Friday closes, while e-minis are 0.1% below Friday’s settlement levels.

GOLD: Can't Sustain Gains Above 50-Day MA

Gold is a little lower from Friday closing levels in NY. The precious metal last traded at $1773, off by a further 0.15%. After failing to close back above the 50-day MA on Friday (which comes in at $1787.40), the near term focus may shift to a more consolidative tone in gold.

- This is also in line with renewed Fed hawkishness last week and the bumper Friday payrolls report. With US real yields are on the march higher again, which is likely to present a near term headwind to gold. The real 10yr is back to +37bps, from a recent low of +9bps at the start of the month.

- The correlation between gold and US real yields remains a reasonable one. Note US nominal yields are down a touch today, with both the 2yr and 10yr down by 1.5 to 2bps. This hasn’t aided gold sentiment though.

- Other cross asset drivers haven’t had a huge influence on trends today either. Equities are mixed in Asia Pac markets, but generally away from worse levels. The same goes for US equity futures. The USD has tried to rally against the majors today, but hasn't made much in the way of fresh inroads.

- Elsewhere, the Czech central bank stated over the weekend it wants to increase the shares of its FX reserves that are held in gold. Note total FX reserves for the central bank are $157bn.

OIL: Modest Upside, Tentative Signs Of Improving China Demand

Oil prices have steadily recovered after early weakness at the open. Brent is back at $95/bbl, while WTI is a touch over $89/bbl. These are very small gains, but build on modest positive momentum from Friday's session.

- Yesterday's China import data showed some recovery in oil demand, around 4.2% higher compared to June levels in terms of import volumes. We are still down 4% on a year-to-date basis though.

- The demand outlook also improved at the margin as Hong Kong cut the hotel quarantine period from 7 days to 3 days for intervention travellers (effective this Friday). China also eased rules around international flights where covid cases are detected, although restrictions still remain in place.

- These benefits to demand could also be offset by a fresh lockdown in Sanya, a holiday destination, while Hainan will conduct mass testing as case numbers continue to climb.

- Spec positions continued to move lower, with net longs in Nymex now back to fresh lows from April 2020.

- Goldman Sachs cut its near term forecast for oil. The Bank lowered its Q3 forecast to $110/bbl from $140/bbl, and the Q4 forecast to $125/bbl, from $130/bbl. The 2023 outlook was unchanged at $125/bbl and the Bank maintained a constructive view over the medium term.

- The market focus will also be on a number of official reports this week. The US EIA prints its short-term outlook on Tuesday. Monthly snapshots are also out from OPEC and the International Energy Agency on Thursday.

- Note for Brent the 200 day MA comes in $98.60/bbl. Brent is down further 13.6% since the start of August, after a 4.2% drop in July.

FOREX: Yen Stays On Back Foot, Kiwi Trims Gains As NZ Inflation Expectations Cool

Regional reaction to the most recent U.S. nonfarm payroll report released after Asia hours last Friday inspired some fresh demand for USD/JPY but the pair struggled to make much headway beyond the prior trading day's high. It topped out at Y135.58 and trimmed gains into the Tokyo fix as U.S. Tsy yields slipped into negative territory. The yen continues to underperform its G10 peers at the margin, mostly due to the absence of other notable catalysts.

- USD/JPY risk reversal crept higher, printing new multi-week highs across the curve, indicating stronger bullish sentiment among options traders.

- The BBDXY index retraced its initial uptick but managed to consolidate its post-NFP gains. The expectation-busting jobs report fanned hawkish Fed expectations.

- Antipodean currencies garnered some mild strength, albeit the kiwi dollar pared advance upon the release of the RBNZ's Q3 Survey of Expectations, which showed the first decline in 2-year out inflation expectations since mid-2020.

- The global economic docket is particularly thin today.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 08/08/2022 | 0545/0745 | ** |  | CH | unemployment |

| 08/08/2022 | 1500/1100 | ** |  | US | NY Fed survey of consumer expectations |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 08/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 09/08/2022 | 2301/0001 | * |  | UK | BRC-KPMG Shop Sales Monitor |

| 09/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 09/08/2022 | 1000/0600 | ** |  | US | NFIB Small Business Optimism Index |

| 09/08/2022 | 1230/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 09/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 09/08/2022 | 1400/1000 | ** |  | US | IBD/TIPP Optimism Index |

| 09/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 09/08/2022 | 1700/1300 | *** |  | US | US Note 03 Year Treasury Auction Result |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.