-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Soft Data Pushes PBoC Into Rate Cuts

EXECUTIVE SUMMARY

- CHINA’S XI JINPING PLANS TO MEET WITH BIDEN IN FIRST FOREIGN TRIP IN NEARLY THREE YEARS (WSJ)

- MORE U.S. LAWMAKERS VISITING TAIWAN 12 DAYS AFTER PELOSI TRIP (POLITICO)

- PBOC CUTS RATES, DRAINS MEDIUM-TERM LIQUIDITY, WHILE CHINESE DATA DISAPPOINTS

- GOVERNOR 'OPEN TO REVIEW' OF BANK OF ENGLAND'S MANDATE AFTER CRITICISM FROM LIZ TRUSS (TELEGRAPH)

- WALL STREET REVIVES RUSSIAN BOND TRADING AFTER U.S. GO-AHEAD (RTRS)

- RUSSIAN OIL FLOWS TO CZECH REPUBLIC HAVE RESUMED, PIPELINE OPERATOR SAYS (RTRS)

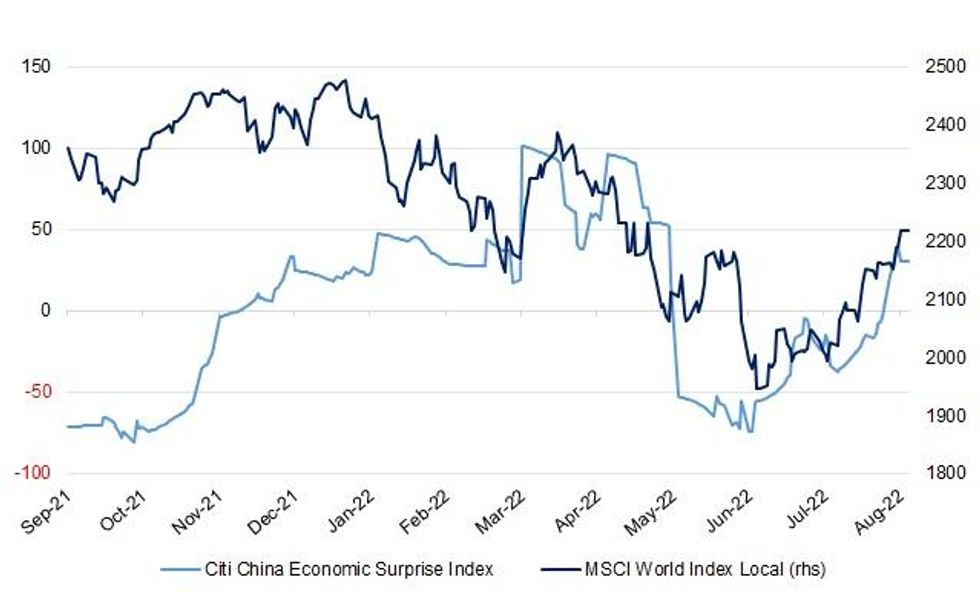

Fig. 1: Citi China Economic Surprise Index Vs. MSCI World Index Local

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Liz Truss holds a commanding 22-point lead over Rishi Sunak in the race to become the next Tory leader and prime minister, according to an exclusive poll of party members for the Observer. (Observer)

FISCAL: The winner of the Conservative party leadership contest will face huge additional costs of servicing the nation’s debt and paying social security benefits as a result of rising inflation and interest rates, according to Financial Times calculations. (FT)

FISCAL/POLITICS: Liz Truss could pull the UK out of a deal agreed by Rishi Sunak to “stitch-up” global corporation tax rates at 15 per cent, it has emerged, as two of her most prominent supporters criticised the agreement. (Telegraph)

FISCAL/ENERGY: Households would see their energy bills cut by an extra £400 this winter under Treasury proposals for a government-backed lending scheme for suppliers. (Sunday Times)

FISCAL/ENERGY: Two of the biggest energy suppliers are calling for the creation of a special fund that would allow the industry to freeze customers’ bills for two years and spread the cost of the gas-price crisis over a decade or more. (Sunday Times)

POLITICS/ENERGY: The Labour leader, Keir Starmer, is to call for a ban on crippling energy price rises this autumn in a move that would save the average household more than £2,000 a year on gas and electricity bills, the Observer can reveal. (Observer)

BOE: Andrew Bailey has told the Chancellor that he would be "open to a review" of the Bank of England's mandate, following Liz Truss's criticism of its approach to inflation, The Telegraph can disclose. (Telegraph)

BOE: The Bank of England will deliver another bumper 50 basis points (bps) increase to borrowing costs next month but then slow the pace to a more regular 25 basis point rise in November before pausing, a Reuters poll forecast. (RTRS)

EUROPE

GERMANY: Germany must cut its gas use by a fifth to avoid a crippling shortage this winter, its top network regulator said, as businesses and households brace themselves for Europe’s biggest energy crisis in a generation. (FT)

GERMANY: German gas storage facilities were slightly more than 75% full last Friday, a couple of weeks ahead of target, data from European operators group GIE showed on Sunday. (RTRS)

GERMANY: Germany plans to give the transportation of materials and equipment essential for energy production priority on the country's rail networks should water levels on the Rhine fall further and hamper shipping by river, a draft decree shows. (RTRS)

GERMANY: Germany should not tax "excessive" company profits earned amid an economic and energy crisis as that would interfere with market forces, the finance minister said in an interview on Sunday when asked about the windfall levies imposed elsewhere in Europe. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- S&P affirmed Hungary at BBB: Outlook revised to Negative from Stable

- DBRS Morningstar downgraded Belgium to AA, Trend Changed to Stable

U.S.

FISCAL: The Democratic-led U.S. House of Representatives approved a $430 billion bill on Friday that is seen as the biggest climate package in U.S. history, delivering a major legislative victory for President Joe Biden ahead of the Nov. 8 midterm elections. (RTRS)

POLITICS: FBI agents who searched former President Donald Trump’s Mar-a-Lago home Monday removed 11 sets of classified documents, including some marked as top secret and meant to be only available in special government facilities, according to documents reviewed by The Wall Street Journal. (WSJ)

ENERGY: US Energy Secretary Jennifer Granholm said US gasoline prices should fall further after dropping to less than $4 a gallon for the first time since March. (BBG)

OTHER

U.S./CHINA: Chinese officials are making plans for Xi Jinping to visit Southeast Asia and meet face-to-face with President Biden in November, according to people familiar with the preparations, in what would mark the Chinese leader’s first international trip in nearly three years and his first in-person meeting with Mr. Biden since the American leader’s inauguration. (WSJ)

U.S./CHINA: The US and China displayed their military strength in Indonesia and Thailand by holding war games over the weekend, as the rival superpowers worked to strengthen their influence in south-east Asia. (FT)

U.S./CHINA/TAIWAN: A delegation of American lawmakers arrived in Taiwan on Sunday, just 12 days after a visit by U.S. House Speaker Nancy Pelosi that prompted China to launch days of threatening military drills around the self-governing island that Beijing says must come under its control. (POLITICO)

U.S./CHINA/TAIWAN: U.S. Indo-Pacific coordinator Kurt Campbell said on Friday that China overreacted to U.S. House of Representatives Speaker Nancy Pelosi's visit to Taiwan and used it as a pretext to try to change the status quo in the Taiwan Strait. The American response would be patient and effective, and the U.S. presence and posture in the region would account for China's more destabilizing behavior, Campbell told reporters in a call. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida on Monday instructed his cabinet ministers to come up with additional steps to cushion the economic blow from rising living costs. In a meeting to discuss measures to cope with raw material costs, Kishida said he has instructed the trade minister to come up with details on plans to deal with rising energy costs. (RTRS)

JAPAN: At least 20 Japanese lawmakers appointed as deputies for cabinet members confirmed Friday that they had links to a controversial religious group, after Prime Minister Fumio Kishida called for a self-check and review to appease a wary public. (Nikkei)

AUSTRALIA: Tens of thousands more skilled migrants will arrive in Australia from next year, as the Albanese government moves to fill chronic labour shortages by recognising trades and qualifications from more countries. The government wants to increase the migration intake to between 180,000 and 200,000 a year, which would bring in more skilled migrants including tradies, IT specialists and aged care workers. (Sydney Morning Herald)

RBNZ: There was a range of views amongst the Shadow Board members on what the Reserve Bank of New Zealand should do with the Official Cash Rate (OCR) over the coming year. However, the majority view was that a 50 basis points OCR increase in the August meeting is warranted, with only two members recommending a different quantum of tightening (25 basis points and 75 basis points each). (NZIER)

SOUTH KOREA: South Korea will cut its national budget for the first time in 13 years in 2023, as the Asian nation seeks to tighten spending amid rising interest rates globally. (BBG)

TURKEY/RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Moody's downgraded Turkey to B3, Outlook to changed Stable

MEXICO: Mexico's state-oil company Pemex requested this week almost $6.5 billion in additional funding from the government to pay for works at the 'Dos Bocas' refinery this year, according to a document and two sources familiar with the matter. (RTRS)

BRAZIL: Brazil President Jair Bolsonaro and challenger Luiz Inacio Lula da Silva both pledged to preserve 600 reais ($118) in monthly government aid to poor families while campaigning for election in October. (BBG)

RUSSIA: President Vladimir Putin’s invasion of Ukraine set Russia’s economy back four years in the first full quarter after the attack, putting it on track for one of the longest downturns on record even if less sharply than initially feared. (BBG)

RUSSIA: Any possible seizure of Russian assets by the United States will completely destroy Moscow's bilateral relations with Washington, TASS quoted the head of the North American Department at the Russian foreign ministry as saying on Saturday. (RTRS)

RUSSIA: Several major Wall Street banks have begun offering to facilitate trades in Russian debt in recent days, according to bank documents seen by Reuters, giving investors another chance to dispose of assets widely seen in the West as toxic. (RTRS)

SOUTH AFRICA: South African Finance Minister Enoch Godongwana denied an allegation of sexual harassment, after being informed that a case was opened against him. (BBG)

IRAN: Europe’s proposal to resuscitate Tehran’s nuclear deal with world powers would blunt American sanctions against Iran’s Revolutionary Guards and pave the way for Tehran to avoid further scrutiny of suspected atomic sites, according to excerpts of a draft of the text reviewed by POLITICO. (POLITICO)

IRAN: However, the U.S. special envoy for the Iran talks, Rob Malley, in a statement to POLITICO after this story was first published, denied that the United States was changing its standards or rules when it comes to enforcing sanctions. (POLITICO)

GAS: Russian gas giant Gazprom PJSC has started providing Hungary with additional volumes requested by Prime Minister Viktor Orban’s government to address winter energy supply concerns, according to a Foreign Ministry official in Budapest. (BBG)

OIL: Russian oil flows to the Czech Republic through the Druzhba pipeline resumed after more than a week on Friday evening, Czech pipeline operator MERO said, as transit fee payments were unblocked. (RTRS)

OIL: Russia's Rosneft said on Friday that fuel prices in Germany will likely jump if the PCK Schwedt refinery it owns alongside Shell and Eni replaces Russian pipeline oil supplies with more expensive, seaborne non-Russian barrels. (RTRS)

OIL: Saudi Aramco plans to raise its sustainable production capacity to 12.3 million b/d by 2025 as the world's largest oil-exporting company accelerates plans to bring additional output to market to meet the needs of global consumers, its chief executive told reporters during an earnings call Aug. 14. (Platts)

OIL: Shell is ramping up three of its oil and gas fields in the Gulf of Mexico after completing repairs to a station in Fourchon, Louisiana, that allowed key pipes to resume flows. (BBG)

OIL: The US expressed concern that an Indian company hid the origin of Russian oil, processed it and shipped some products to New York, according to a deputy governor of India’s central bank. (BBG)

OIL: United Arab Emirates’ crude oil and condensate exports are lower so far in August after a complete halt in flows from Fujairah’s offshore terminals because of widespread flooding. (BBG)

OIL: Venezuela has suspended new crude shipments to Europe under an oil-for-debt deal and has asked Italy's Eni and Spain's Repsol to provide it with fuel in exchange for future cargoes, three people familiar with the matter said. (RTRS)

CHINA

PBOC: China’s benchmark Loan Prime Rates may decline further, with a particular focus on the five-year measure, the China Securities Journal reported, citing analysts. Among the newly issued loans in June, the proportion of loans with interest rates lower than the LPRs has increased, which may drive down the latest quotation of the LPRs, the newspaper wrote, citing Xie Yunliang, chief macro analyst of Cinda Securities. The weighted average interest rate of newly issued loans in June hit a new low, the newspaper noted, citing the PBOC’s Q2 Monetary Policy Report. The central bank updates LPR quotations on the 20th of every month (or the soonest day afterwards if the 20th falls on a weekend), and the current 1-year and 5-year LPR fixings sit at 3.70% and 4.45%, respectively. (MNI)

CORONAVIRUS: Hainan reported more than 1,000 Covid-19 cases for Sunday, as tourists stranded in the popular holiday destination protested over the weekend. (BBG)

CORONAVIRUS: China's financial hub Shanghai said on Sunday it would reopen all schools including kindergartens, primary and middle schools on Sept. 1 after months of COVID-19 closures. (RTRS)

PROPERTY: Chinese developers have suffered a meltdown of at least $90 billion in stocks and dollar bonds this year, with a bursting housing bubble and an intensifying debt crisis threatening to inflict even more pain. (BBG)

CHINA MARKETS

PBOC NET DRAINS CNY200 BILLION VIA MLF, NET NEUTRAL ON OMOS ONMONDAY

The PBOC cut the rate applied to the one-year medium-term lending facility by 10 bps to 2.75%, while it injected CNY400 billion in gross liquidity via the instrument. Meanwhile, it also lowered the rate applied to 7-day reverse repos by 10 bps to 2.00% while injecting CNY2 billion in gross liquidity via the instrument. This resulted in a net drain of CNY200 billion given today's maturity of CNY600 billion of MLFs and CNY2 billion of reverse repos, according to Wind Information.

- The operations aim to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6395% at 9:51 am local time from the close of 1.3486% on Friday.

- The CFETS-NEX money-market sentiment index closed at 42 on Friday vs 40 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.7410 MON VS 6.7413

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.7410 on Monday, compared with 6.7413 set on Friday.

OVERNIGHT DATA

CHINA JUL INDUSTRIAL PRODUCTION +3.8% Y/Y; MEDIAN +4.3%; JUN +3.9%

CHINA JUL INDUSTRIAL PRODUCTION YTD +3.5% Y/Y; MEDIAN +3.5%; JUN +3.4%

CHINA JUL RETAIL SALES +2.7% Y/Y; MEDIAN +4.9%; JUN +3.1%

CHINA JUL RETAIL SALES YTD -0.2% Y/Y; MEDIAN +0.1%; JUN -0.7%

CHINA JUL FIXED ASSETS EX RURAL YTD +5.7% Y/Y; MEDIAN +6.2%; JUN +6.1%

CHINA JUL PROPERTY INVESTMENT YTD -6.4% Y/Y; MEDIAN -5.7%; JUN -5.4%

CHINA JUL SURVEYED JOBLESS RATE 5.4%; MEDIAN 5.5%; JUN 5.5%

CHINA JUL NEW HOME PRICES -0.11% M/M; MEDIAN -0.10%; JUN -0.10%

JAPAN Q2, P GDP ANNUALISED SA +2.2% Q/Q; MEDIAN +2.6%; Q1 -0.1%

JAPAN Q2, P GDP SA +0.5% Q/Q; MEDIAN +0.7%; Q1 +0.0%

JAPAN Q2, P GDP NOMINAL SA +0.3% Q/Q; MEDIAN +0.6%; Q1 +0.4%

JAPAN Q2, P GDP DEFLATOR -0.4% Y/Y; MEDIAN -0.8%; Q1 -0.5%

JAPAN Q2, P GDP PRIVATE CONSUMPTION +1.1% Q/Q; MEDIAN +1.3%; Q1 +0.3%

JAPAN Q2, P GDP BUSINESS SPENDING +1.4% Q/Q; MEDIAN +1.3%; Q1 -0.3%

JAPAN Q2, P INVENTORY CONTRIBUTION % GDP -0.4%; MEDIAN -0.3%; Q1 +0.5%

JAPAN Q2, P NET EXPORTS CONTRIBUTION % GDP +0.0%; MEDIAN +0.0%; Q1 -0.5%

JAPAN JUN, F INDUSTRIAL PRODUCTION +9.2% M/M; FLASH +8.9%

JAPAN JUN, F INDUSTRIAL PRODUCTION -2.8% Y/Y; FLASH -3.1%

NEW ZEALAND JUL PERFORMANCE SERVICES INDEX 51.2; JUN 54.7

BusinessNZ chief executive Kirk Hope said that after two consecutive months of healthy activity in the sector, the fall in expansion levels was evident across all the sub index values. The two key sub-indexes of New Orders/Business (52.5) and Activity/Sales (54.4) both dropped, with the former down from consecutive 60+ values. Employment (49.2) fell back into contraction, while Supplier Deliveries (47.3) has remained in contraction since July 2020. Despite the drop in expansion with the previous month, the proportion of negative comments in July (58.2%) was relatively close to 59% in June. (BusinessNZ)

UK AUG RIGHTMOVE HOUSE PRICES -1.3% M/M; JUL +0.4%

UK AUG RIGHTMOVE HOUSE PRICES +8.2% Y/Y; JUL +9.3%

MARKETS

SNAPSHOT: Soft Data Pushes PBoC Into Rate Cuts

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 344.96 points at 28891.94

- ASX 200 up 39.893 points at 7072.40

- Shanghai Comp. down 2.021 points at 3274.867

- JGB 10-Yr future up 9 ticks at 150.35, yield down 0.5bp at 0.185%

- Aussie 10-Yr future up 6.5 ticks at 96.615, yield down 6.4bp at 3.364%

- U.S. 10-Yr future +0-02+ ticks at 119-11, yield up 0.37bp at 2.835%

- WTI crude down $0.84 at $91.25, Gold down $8.55 at $1793.88

- USD/JPY down 20 pips at Y133.22

- CHINA’S XI JINPING PLANS TO MEET WITH BIDEN IN FIRST FOREIGN TRIP IN NEARLY THREE YEARS (WSJ)

- MORE U.S. LAWMAKERS VISITING TAIWAN 12 DAYS AFTER PELOSI TRIP (POLITICO)

- PBOC CUTS RATES, DRAINS MEDIUM-TERM LIQUIDITY, WHILE CHINESE DATA DISAPPOINTS

- GOVERNOR 'OPEN TO REVIEW' OF BANK OF ENGLAND'S MANDATE AFTER CRITICISM FROM LIZ TRUSS (TELEGRAPH)

- WALL STREET REVIVES RUSSIAN BOND TRADING AFTER U.S. GO-AHEAD (RTRS)

- RUSSIAN OIL FLOWS TO CZECH REPUBLIC HAVE RESUMED, PIPELINE OPERATOR SAYS (RTRS)

US TSYS: Tight Session, Even With The PBoC Easing

TYU2 trades +0-03 at 119-11+, sitting 0-01+ off the peak of its 0-05 overnight range, on light volume of ~41K. Cash Tsys are -0.5 to +0.5bp across the curve, with the belly cheaper and the wings richer, at the margins.

- Tsys experienced a rangebound round of Asia-Pac trade, initially looking through weekend news flow which was headlined by 5 U.S. lawmakers travelling to Taiwan less than 2 weeks after House Speaker Pelosi’s visit (and shortly after Friday’s reports of plans being drawn up for a Biden-Xi meeting in November).

- The PBoC then livened things up with a surprise 10bp rate cut to both the 1-Year MLF and 7-Day reverse repo rates, alongside a CNY200bn drain in medium-term liquidity, with the latter in line with wider expectations. That applied very modest cheapening pressure to the space, before a softer than expected round of Chinese economic activity data put a bottom on the space, before a modest bid to crept in alongside a pullback from best levels in Chinese equities and e-minis.

- The combination of softer than expected economic activity data and Friday’s very soft Chinese credit data were touted as the tipping points for the PBoC when it came to today’s easing, while the liquidity drain came at a time whereby money market rates are trading sharply below policy rates, with banks seemingly unwilling to channel liquidity out to the economy, while the ZCS policy in China may be limiting demand for credit, to a degree.

- Looking ahead, Empire manufacturing and NAHB housing market data headline the NY docket on Monday.

JGBS: Futures Lead The Bid In The Afternoon

The previously outlined softer than expected Chinese economic activity data has helped support JGB futures (and wider core global FI markets) during the Tokyo afternoon after a fairly limited morning session. That leaves JGB futures +9 as we move towards the bell, while cash JGBs run flat to 1.5bp richer across the curve, with 7s leading on the bid, which was quite futures-centric.

- Preliminary Japanese Q2 GDP data provided a downside surprise, rising by 0.5% Q/Q & 2.2% in annualised terms vs. BBG median exp. Of +0.7% & +2.6%, respectively, although Q1 data was revised higher, with the previously outlined 0.1% Q/Q fall adjusted to 0.0%. Misses in private consumption and inventories seemingly provided the most notable contributions to the headline miss, with net exports flat, in line with expectations, and business spending beating expectations

- Elsewhere, following the previously announced meeting re: inflation, Japanese Prime Minister Kishida noted that he has asked the trade minister to come up with plans to curb fuel prices, in addition to formulating extra steps when it comes to rising energy and electricity bills. Kishida also instructed the agriculture minister to make no changes to imported wheat prices from October. Further measures are set to be announced in September.

- Looking ahead, 5-Year JGB supply headlines Tuesday’s domestic docket.

AUSSIE BONDS: Just Off Best Levels

Aussie bonds are a little off session highs, catching a bid in the wake of soft Chinese economic activity data prints midway through the Sydney session. The move higher more than unwound the cheapening observed after the PBoC’s rate cuts & liquidity drain (fleshed out elsewhere), building on the initial richening impetus from Friday’s move in longer-dated U.S. Tsys. Cash ACGBs run 2.5-6.0bp richer across the curve, bull flattening. YM is +4.0 and XM is +6.0, through their respective overnight highs, while Bills run 2 to 4 ticks richer through the reds.

- There was little else of note re: drivers for ACGBs with U.S. cash Tsys sticking to a tight range, while there were no domestic data releases. Looking to issuance matters, the SAFA is set to price its May-32 bond today, while IFC launched a 3.5-Year A$ bond.

- Tuesday will see CBA household spending data for July hit the wires ahead of the release of minutes for the RBA’s August policy meeting.

EQUITIES: Japanese Stocks Outperform; Chinese Data Disappoints

Major Asia-Pac equity indices are mixed, with Chinese and Hong Kong equity index benchmarks whipping from gains to losses as an initial bid from the PBoC’s cut to the MLF rate was countered by weak Chinese activity data for July (fleshed out elsewhere).

- The Hang Seng index is off its extremes, sitting 0.3% worse off at typing. The property (-0.6%) and finance (-0.7%) sub-indices contributed the most to losses, neutralising shallow gains in consumer and industrial stocks as sentiment in China’s property sector remains weak (with Chinese new home prices for July falling for an 11th straight month).

- The Chinese CSI300 deals 0.1% weaker at typing, erasing gains of as much as 0.7% earlier on the aforementioned miss in Chinese activity indicators, mainly on weakness in richly-valued sectors such as consumer staples and healthcare. Elsewhere, the tech-heavy ChiNext (+1.1%) was an outlier, with a strong showing from heavyweight CATL Ltd (+3.3%, after having announced plans for a ~$7.6bn car battery plant in Hungary with Mercedes-Benz Group AG) offsetting weakness across more than half of the index’s constituents.

- The Nikkei 225 leads gains amongst regional peers, dealing 1.0% firmer at typing, putting the benchmark narrowly in the green (+0.1%) for the YTD, outperforming most major Asian benchmarks (MSCI Asia Pacific Index ~-15% YTD). Large-caps and major exporters lead gains in the index, with the broader TOPIX (+0.5%) lagging.

- E-minis trade 0.2% lower apiece at typing, operating a little shy of their respective multi-month highs made on Friday.

OIL: Lower In Asia on Soft Chinese Data; Saudi Oil Output Pledge Eyed

WTI and Brent are ~$0.80 firmer apiece, operating around session lows, having briefly tracked the earlier two-way trade in e-minis and Chinese & Hong Kong equity index benchmarks after an initial bounce from the PBoC’s surprise cut to the MLF and reverse repo rate was countered by softer-than-expected prints across all Chinese activity indicators (apart from a marginal downtick in the surveyed jobless rate).

- Crude has also come under pressure after Saudi Aramco on Sunday announced their readiness to increase production to 12.0mn bpd at “any time”, while announcing progress towards raising “maximum sustainable capacity” from 12mn bpd to 13mn bpd by 2027.

- The recent pull lower in major crude benchmarks comes as worry re: the persistent feed of disruptions to global crude supplies earlier in the year has receded (e.g. Libya’s political crisis, Shell’s Gulf of Mexico disruption last week, and the threat of halts in Kazakhstani crude through the Caspian Pipeline Consortium (CPC) pipeline).

- On the latter topic, RTRS source reports have pointed to Kazakhstan’s state oil firm potentially exploring ways to export crude without crossing Russian territory.

- Elsewhere, progress towards a U.S.-Iran nuclear deal remains scant, with the Iranian parliament due to review a “final draft” from European negotiators following the conclusion of indirect talks

GOLD: Lower In Asia; $1,800/oz In The Balance

Gold sits ~$6/oz weaker to print $1,796/oz, backing away from last Friday’s late session highs ($1,802.8/oz) at typing amidst an uptick in the USD (DXY) on the PBOC’s MLF and reverse repo rate cut, as well as the broad miss in Chinese activity indicators.

- To recap, gold added ~$13/oz on Friday to close above $1,800/oz for the first time in over three months, capping a fourth straight week of gains. The move higher in gold came despite an uptick in the DXY, as the latter ultimately ended the week lower for a third week in four, extending a pullback from cycle highs observed in mid-July.

- Sep FOMC dated OIS now price in ~62bp of tightening for that meeting from ~60bp prior to Fedspeak from Richmond Fed Pres Barkin (‘24 voter) on Friday (fleshed out elsewhere), pointing to nearly even odds for a 50bp vs. a 75bp hike. Looking ahead, focus will turn to minutes of the Fed’s July meeting, due to be released on Wednesday.

- Elsewhere, total known ETF holdings of gold continue to trend lower, hitting its lowest level in over five months on Friday despite the recovery in the price of gold from lows witnessed in June.

- From a technical perspective, previously-flagged technical levels remain in play for gold. Initial resistance is located at $1,807.9/oz (Aug 10 high and the bull trigger), while support is seen at $1,754.4 (Aug 3 low, key short-term support).

FOREX: Underwhelming Chinese Data Weighs On Risk

Participants shied away from risk after Chinese activity indicators undershot forecasts. This amplified selling pressure to offshore yuan, which had earlier suffered as the PBOC unexpectedly cut the interest rates applied to its 1-Year MLF and 7-Day Reverse Repo operations.

- The BBDXY index followed USD/CNH on two legs higher in response to PBOC action/Chinese data. The greenback was the second-best performer in the G10 basket, with U.S. Tsy yields little changed as we type.

- The yen remained the frontrunner after good demand for the Japanese currency emerged into the Tokyo fix. USD/JPY moved away from its session lows on the back of greenback purchases linked to the Chinese catalysts.

- Regional risk barometer AUD/JPY gave away ~50 pips as Friday's gains virtually evaporated, with Antipodean currencies pacing losses.

- U.S. Empire State Manufacturing Survey will take focus later in the day.

FX OPTIONS: Expiries for Aug15 NY cut 1000ET (Source DTCC)

- USD/JPY: Y133.80-00($950mln), Y135.35($660mln)

- EUR/GBP: Gbp0.8535-50(E1.2bln)

- USD/CAD: C$1.2950($655mln)

- USD/CNY: Cny6.75($655mln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/08/2022 | 2350/0850 |  | JP | GDP First Estimate | |

| 15/08/2022 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/08/2022 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/08/2022 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/08/2022 | 1300/0900 | * |  | CA | Home Sales – CREA (Canadian real estate association) |

| 15/08/2022 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 15/08/2022 | 2000/1600 | ** |  | US | TICS |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.