-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: RBNZ Remains Committed To The Cause

- A hawkish RBNZ hke dominated the wires in Asia, with the Bank delivering the widely expected 50bp hike, while its OCR track was pulled higher.

- U.S. Tsys coiled ahead of the release of the minutes covering the most recent FOMC monetary policy meeting, while G10 FX markets struggled to generate any lasting directional momentum.

- Looking ahead, focus will turn to UK inflation data, flash Eurozone GDP and U.S. retail sales. Elsewhere, the FOMC will release the minutes from its most recent monetary policy meeting. Comments are also due from Fed Governor Bowman.

US TSYS: Tight Range In Asia As Market Awaits FOMC Minutes

TYU2 stuck to a narrow 0-05 range during Asia-Pac hours, dealing either side of late NY levels, last -0-00+ at 119-12 on sub-par volume of ~45K, with Antipodean influences (namely the previously covered Australian wage data and RBNZ monetary policy decision) having very modest impact on price action. Cash Tsys run flat to 1.5bp cheaper on the day at present, with 7s providing the weakest point of the curve.

- Looking ahead, UK CPI data will provide some interest during London hours, as will Eurozone GDP. Further out, Wednesday’s NY docket consists of the minutes from the most recent FOMC monetary policy meeting, retail sales data, weekly MBA mortgage apps. 20-Year Tsy supply and Fedspeak from Governor Bowman (although the topics of the discussion may limit the room for comments on monetary policy).

JGBS: Twisting Flatter

JGB futures stuck to a narrow range during Tokyo trade, dealing either side of late overnight levels to sit -11 ahead of the bell. When it comes to wider cash JGB trade it would seem that the curve took direction from the twist flattening of the U.S. Tsy curve on Tuesday, which we suggested may be the case ahead of the Tokyo open, with the major benchmarks running ~1.0bp cheaper to ~2.5bp richer across the curve, as 20+-Year paper richens.

- There hasn’t been much in the way of meaningful domestic headline flow to note today, with the monthly trade balance data revealing a record wide deficit in adjusted terms, while core machinery orders data was marginally softer than expected, but still rose in M/M terms. These data points failed to impact the space, as is the norm.

- BoJ Rinban operations yielded the following offer/cover ratios:

- to 3-Year: 1.99x (prev. 1.80x)

- 5- to 10-Year: 2.13x (prev. 2.97x)

- 25+-Year: 3.61x (prev. 3.44x)

- JGB futures initially nudged lower during the Toko afternoon, perhaps on spill over from the wider core global FI moves linked to the RBNZ monetary policy decision, before regaining some poise, aided by the downtick in the offer/cover ratio for Rinban operations covering JGBs with 5- to 10-Years until maturity.

- Looking ahead, 20-Year JGB supply provides the focal point of tomorrow’s domestic docket.

AUSSIE BONDS: Bear Flattening

Aussie bonds operate off their extremes, with cheapening in ACGBs on the back of the RBNZ’s monetary policy decision helping to pull the space away from best levels observed after a modest miss in Q2 wage price inflation data provided support. Cash ACGBs run 2.5-4.5bp cheaper across the curve, with 5s leading the way lower. YM is -4.5, back from a brief look above its overnight high, while XM is -4.0 after failing to test its own overnight extremes. EFPs are wider, with the 3-/10-Year box flattening, while Bills run 1 tick richer to 6 ticks cheaper through the reds.

- In terms of the details, Q2 wage price data saw a slight miss in both headline readings (+2.6% Y/Y vs. BBG median +2.7%; +0.7% Q/Q vs. BBG median +0.8%). A note that the reading was in line with the projections in the RBA’s latest SoMP and is not expected to move the needle re: the RBA’s near-term rate hike trajectory.

- STIR market pricing re: tightening for the RBA’s Sep meeting initially blipped lower to ~37bp before rising to ~41bp after the RBNZ’s monetary policy decision, sitting little changed from levels observed ahead of today’s risk events.

- The latest round of ACGB May-32 supply saw mediocre demand, with the cover ratio declining to 2.65x from the 3.00x observed at the previous auction, below the six-auction average of 2.83x. Things were firmer on the pricing side, with the weighted average yield printing 0.72bp through prevailing mids (per Yieldbroker). The lack of relative value due to the flatness of the ACGB curve as well as the structurally rich status of the line (due to its benchmark 10-Year status) likely contributed to the softer cover ratio at the auction, with the continued sidelining of international investors on uncertainty re: RBA policy, as well as the proximity of the auction to today’s Antipodean risk events, providing additional headwinds for demand.

- Looking ahead, labour market data for July will headline Thursday's domestic data docket, with little else on offer.

FOREX: Antipodeans Dominate

AUD and NZD FX flows have dominated today, following key event risks in both economies.

- AUD/USD dipped sub 0.6990, following the weaker than expected Q2 wages print, which came in at 0.7% versus 0.8% expected. Annual growth was also weaker than expected at 2.6%YoY, but in line with the recent RBA forecast projection. AU rates dipped on the data print, but there wasn't a great deal of follow through. The 2yr bond yield is back to levels that prevailed prior to the data release (2.77%).

- Helping these moves was a hawkish 50bps RBNZ hike, the central raised their OCR peak to above 4%, while also noting a larger increase was considered at the meeting. NZD/USD spiked higher, gaining above 0.6380 before selling interest emerged. We dipped back below 0.6340 during RBNZ Governor Orr's press conference as he stated the central bank didn't get close to a 75bps hike announcement today. NZD/USD is now back at 0.6350.

- AUD/NZD initially dipped sub 1.1000, touching a low of 1.0990 before support kicked in. We are back around 1.1030/35 now. Note the 100 day MA comes in at 1.1014 for the cross.

- Tight ranges have prevailed elsewhere, with EUR/USD not getting much beyond a 1.0165/1.0180 range. USD/JPY has had a wider range, with a brief dip below 134.00 supported. We are now back at 134.15. US equity futures have been quiet, not too far away from flat for most of the session, while US yields have been relatively steady as well.

- Coming up, focus will turn to UK inflation data, flash EZ GDP and U.S. retail sales. Comments are also due from the Fed's Bowman. Elsewhere, the FOMC will release the minutes from its most recent monetary policy meeting.

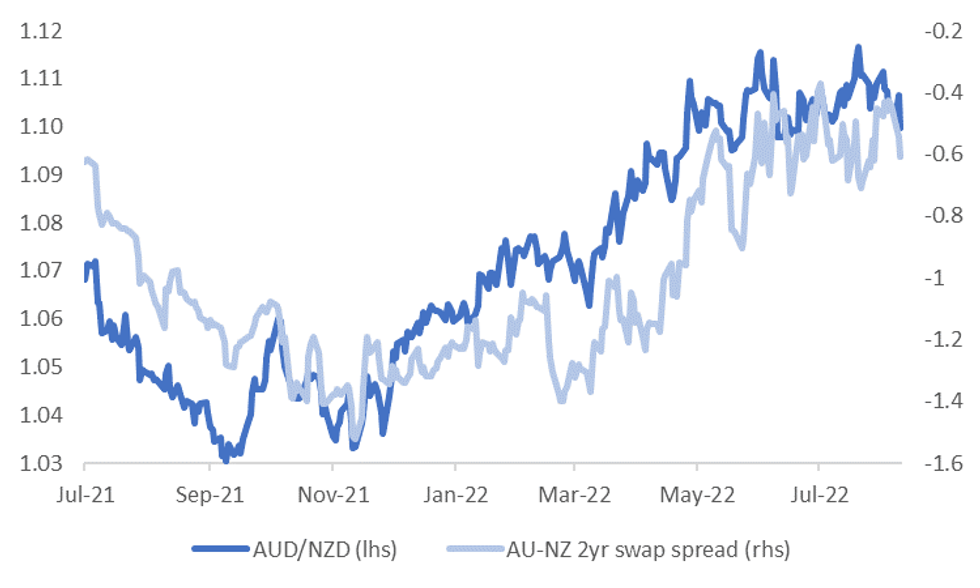

AUDNZD: AUD/NZD Dip Below 100 Day MA Supported For Now

The AUD/NZD cross dipped back below 1.1000 before support emerged. The combination of Australia's weaker than expected wages outcome and the RBNZ's hawkish 50bps hike drove a sharp move lower. The RBNZ has a higher peak for the RBNZ track, while also noting the central bank considered a larger move at today's meeting. In contrast, market futures for the RBA September meeting dipped, although this proved to be short lived. The implied rate is back at 2.20%, so little changed on the day. Market pricing is below a 50bps move at this meeting though, given the current RBA cash rate sits at 1.85%.

- The cross has stabilized somewhat now, back above the 1.1000 handle (last 1.1020/25), while note the 100 day-MA comes in at 1.1014. We haven't spent meaningful time below this MA level since early December 2021.

- The 2yr AU-NZ swap spread is back to -60bps. We were closer to -40bps around a week ago. The current level of the cross is roughly in line with these shifts, perhaps a little more downside in the cross is a risk, see the chart below.

Fig 1: AUD/NZD & AU-NZ 2yr Swap Spread

Source: MNI/Market News/Bloomberg

Source: MNI/Market News/Bloomberg

- As we noted last week, the AUD/NZD cross has tended to bounce following RBNZ hikes in this policy cycle. A repeat outcome may be challenged today's outcomes, but note we have AU employment data tomorrow, so RBA expectations can still be shifted ahead of the September policy meeting.

FX OPTIONS: Expiries for Aug17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1000-15($1.2bln), $1.0190-00($727mln), $1.0300(E697mln)

- USD/CAD: C$1.2855($515mln), C$1.3065($864mln)

- USD/CNY: Cny6.7600-14($685mln)

ASIA FX: CNH Recovers Further, INR Rebounds

CNH has once again traded on a firmer footing, with USD/CNH dipping back below 6.7800 before support emerged. This has helped the rest of the region regain some composure in the FX space. INR has opened up firmer, after onshore markets were closed for the first 2 days this week. USD/KRW has steadied on reports that North Korea test fired 2 cruise missiles.

- CNH: The China currency is again on the front foot today. Onshore and Hong Kong equities are higher, with some likely positive spill-over from headlines around re-opening the China/HK border. It was also reported that Premier Li is pushing key provinces for more pro-growth policies. Other than these factors, it's difficult to see what has driven CNH strength today.

- KRW: 1 month USD/KRW has been range bound today, with a slight downside bias, as USD/CNH fell through the afternoon session. Onshore equities are weaker in Korea, the Kospi off by 0.7%, the Kosdaq -1.00%, which has likely limited won gains to a degree. A short time ago, it was reported that North Korea had fired two cruise missiles earlier today into the west sea. 1 month USD/KRW has edged back above 1309 on these reports.

- INR: Spot USD/INR has re-opened lower, after onshore markets were closed for the first 2 days of this week. We are around 0.45% below closing levels from last week, currently sitting just under 79.30. Since onshore markets closed on Friday, the DXY is higher and we had a strong USD/CNH bounce at the start of the week, so the rupee strength has outperformed those trends to a degree. Onshore equities continue to push higher, while lower oil prices, particularly since the end of last week, is helping.

- PHP: Spot USD/PHP has drifted a little lower this afternoon. We traded above 55.90 early on, but the pair is now back sub 55.80. The main focus is on tomorrow's BSP decision. We expect Bangko Sentral ng Pilipinas to raise its key policy rate by 50bp this week in a bid to curb above-target inflation and defend the beleaguered peso. Governor Medalla repeatedly signalled that the decision this week would be between a 25bp or 50bp rate rise (see this link for our full preview).

- THB: Spot USD/THB last deals -0.040 at THB35.385, consolidating below its 50-DMA. Global funds have been net buyers of Thai equities on each day since Aug 5, buying a net $141.2mn in local stocks on Tuesday. The SET index has extended its bullish run today, breaking above its 200-DMA/61.8% retracement of the Apr - Jul slide.

EQUITIES: Higher In Asia; Walmart Earnings Lifts Retailers

Major Asia-Pac equity indices are higher at typing, bucking a mixed lead from Wall St. Retail-related equities across the region were bid after Walmart’s better-than-feared earnings beat on Tuesday, while Chinese developers are on track to close higher for a second day.

- To elaborate, sentiment in China-based developers continues to improve amidst recent reports of increased house purchasing inquiries in cities with lower mortgage down payment ratios, with the Hang Seng Mainland Properties Index (+1.0%) on track to notch a second day of gains, extending a rise off of recently made record lows.

- The Hang Seng is 0.8% firmer at writing, seeing the finance (+0.6%) and property (+0.4%) sub-indices lead the way higher. China-based tech rose modestly (HSTECH: +1.0%) alongside a strong rally in Meituan (+4.7%), although the performance in the latter comes after a 9.1% decline on Tuesday.

- The CSI300 is 0.7% better off after reversing earlier losses, on track for its highest daily close in over two weeks. Real estate names outperformed (CI300 Real Estate Index: +2.9%), augmenting relatively shallow gains observed across much of the CSI300.

- The ASX200 is off its extremes, trading 0.3% higher at writing. Losses in healthcare and tech were countered by gains in the consumer staples sub-gauge (+1.6%), with retailers such as Woolworths (+1.4%) outperforming.

- E-minis operate on either side of neutral levels at typing after a fairly limited Asia-Pac session so far, sitting just off fresh multi-month highs made on Tuesday.

GOLD: Treading Water Above $1,770; FOMC Minutes Eyed

Gold is little changed, printing ~$1,776/oz at writing. The precious metal operates a little above one-week lows, with recent Dollar strength providing evident headwinds for the space.

- To recap, the precious metal closed ~$4/oz lower on Tuesday, worsening Monday’s steep ~$23/oz decline amidst an uptick in U.S. real yields, with the USD (DXY) closing little changed on the day, holding on to the bulk of its gains from a two-day rally prior.

- Measures of investor interest have continued to weaken as well, with total known ETF holdings of gold on track to fall for a ninth consecutive week, hitting levels last witnessed in end-Feb at typing.

- Looking ahead, focus will centre on the minutes for the Fed’s July FOMC, with U.S. MBA mortgage applications, retail sales data, and Fedspeak from the Fed’s Bowman expected to provide additional points of interest prior (noting that Bowman’s scheduled speaking topics may limit the scope for commentary on monetary policy).

- From a technical perspective, Tuesday’s moves lower in gold has seen it break initial support at ~$1,772.0/oz (20-Day EMA), exposing further support at $1,754.4/oz (Aug 3 low, key short-term support). On the other hand, initial resistance is seen at $1,807.9/oz (Aug 10 high and bull trigger).

OIL: A Little Above Multi-Month Lows; Iranian Matters At The Fore

WTI is ~+$0.60 and Brent is ~+$0.50 at typing, edging away from their respective multi-month lows made on Tuesday.

- To recap, both benchmarks shed ~$3 apiece on Tuesday for a third consecutive lower daily close, with WTI hitting levels last witnessed in end-Jan during the session. The weakness in crude was facilitated by perceived progress in a U.S.-Iran nuclear deal, adding to pressure from wider worry re: global economic growth.

- To elaborate on the former, BBG sources have pointed to the EU describing Iran’s response to its “final draft” as “constructive”, with the Biden administration due to respond as well. The U.S. State Dept has however maintained that the Islamic Revolutionary Guard Corps will remain a designated terrorist organisation - a sticking point in past negotiations. A note that Goldman Sachs has since weighed in on the agreement as “unlikely” in the short-term (details fleshed out in earlier bullets).

- The prompt spreads for WTI and Brent have continued their descent, printing ~$0.40 and ~$0.61 respectively at typing, a little above fresh multi-month lows observed on Tuesday.

- WTI rose off worst levels on Tuesday after the latest round of API inventory estimates, with reports pointing to a significant drawdown in gasoline stocks, easing worry from some quarters re: demand destruction, while a decline in crude, distillate, and Cushing hub stockpiles was reported as well. Up next, U.S. EIA data is due later today, with BBG median estimates looking for drawdowns in crude and gasoline stockpiles.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/08/2022 | 0600/0700 | *** |  | UK | Producer Prices |

| 17/08/2022 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 17/08/2022 | 0600/0800 | ** |  | NO | Norway GDP |

| 17/08/2022 | 0830/0930 | * |  | UK | ONS House Price Index |

| 17/08/2022 | 0900/1100 | * |  | EU | Employment |

| 17/08/2022 | 0900/1100 | *** |  | EU | GDP (p) |

| 17/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 17/08/2022 | 1230/0830 | *** |  | US | Retail Sales |

| 17/08/2022 | 1330/0930 |  | US | Fed Governor Michelle Bowman | |

| 17/08/2022 | 1400/1000 | * |  | US | Business Inventories |

| 17/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 17/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 17/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 17/08/2022 | 1820/1420 |  | US | Fed Governor Michelle Bowman |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.