-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: Xi & Putin G20 Attendance Confirmed

EXECUTIVE SUMMARY

- XI AND PUTIN TO ATTEND G-20 SUMMIT IN INDONESIA, JOKOWI SAYS (BBG)

- FED’S BULLARD LEANS TOWARD FAVORING 0.75PPT SEPTEMBER RATE RISE (WSJ)

- FED'S GEORGE SAYS PACE, ENDPOINT OF RATE HIKES STILL MATTER OF DEBATE (RTRS)

- FED MUST GET INFLATION DOWN URGENTLY, KASHKARI SAYS (RTRS)

- RBNZ ORR SAYS GETTING TOWARDS POINT WHERE NEXT RATE MOVE NOT OBVIOUS (STUFF NZ)

- RBNZ’S ORR SAYS DEMAND MUST SLOW TO PUT INFLATION BACK IN BOX (BBG)

- CHINA'S CYBERSPACE REGULATOR: SUPPORTIVE OF DOMESTIC FIRMS SEEKING FOREIGN CAPITAL (RTRS)

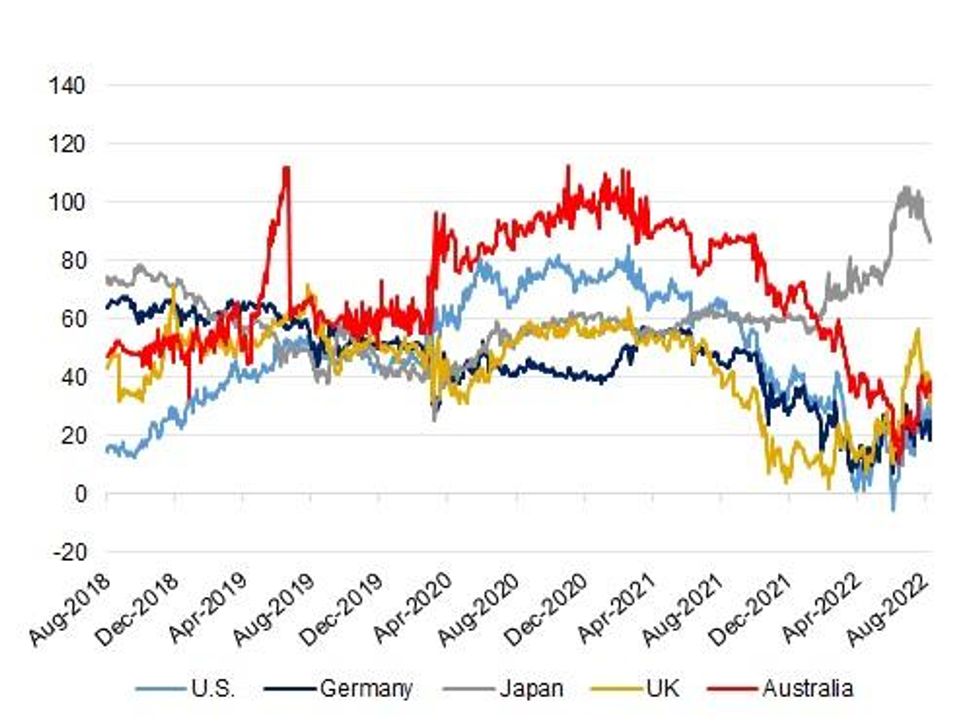

Fig. 1: U.S., German, Japanese, UK & Australian 10-/30-Year Yield Curves (bp)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BOE: Long-term sickness amongst the UK labour force is more widespread than headline official data suggest, with ongoing work by Bank of England Monetary Policy Committee member Jonathan Haskel and Bank economist Josh Martin suggesting strongly that simply looking at the main reason why people say they are not participating is misleading, Haskel told MNI in an interview. (MNI)

EUROPE

GERMANY: The economic outlook for Germany, Europe's largest economy, is gloomy due to energy price rises and supply chain disruptions, the Finance Ministry said in its August monthly report, published on Friday. (RTRS)

RATINGS: Potential sovereign rating reviews of note scheduled for after hours on Friday include:

- Fitch on Estonia (current rating: AA-; Outlook Stable) and Slovakia (current rating: A; Outlook Stable)

- Moody’s on Cyprus (current rating: Ba1; Outlook Stable)

- S&P on Estonia (current rating: AA-; Outlook Stable)

U.S.

FED: Federal Reserve Bank of St. Louis President James Bullard said Thursday he is considering support for another large rate rise at the central bank’s policy meeting next month and added he isn’t ready to say the economy has seen the worst of the inflation surge. (WSJ)

FED: The recent easing of U.S. financial conditions, including a surge in stock prices, may have been based on an overly optimistic sense that inflation was peaking and the pace of interest rate increases was likely to slow, Kansas City Federal Reserve President Esther George said on Thursday. (RTRS)

FED: Minneapolis Federal Reserve Bank President Neel Kashkari on Thursday said the U.S. central bank needs to get "very very" high inflation down as soon as possible, even at the cost of possibly triggering a recession. "We need to get inflation down urgently," Kashkari said at an event at the YPO Gold Twin Cities. "We need to get demand down" by raising interest rates. Economic fundamentals are strong, he said, but whether the Fed can lower inflation without sending the economy into a recession, he said, "I don't know." (RTRS)

FED: Federal Reserve Chair Jerome Powell will address the annual global central banking conference in Jackson Hole, Wyoming, on Aug. 26, a highly anticipated speech that could signal how high U.S. borrowing costs may go and how long they will need to stay there to bring down soaring inflation. (RTRS)

US TSYS: The argument that China is accelerating the liquidation of its holdings of U.S. debt is misleading, with sales not matching the speed implied by some press reports, wrote Guan Tao, a former FX official and now global chief economist of BOC International, in a blog post. China's holdings of U.S. debt have decreased by USD88 billion in the first five months of 2022, with net sales of mid-to-long-term debt only accounting for 24% of the reduction. The remaining 76% of the shrinkage can be attributed to some non-trading factors including negative valuation effect and the failure to roll over holdings after maturity. The remaining maturity of U.S. debt held by China is relatively short, with valuations of such paper greatly impacted by the rapid rise in short-term interest rates, said Guan, adding that the yields of 2-year, 5-year and 10-year U.S. Treasury bonds rose by 180bp, 155bp and 130bp, respectively, in the Jan-May period. (MNI)

OTHER

GLOBAL TRADE: U.N. Secretary-General Antonio Guterres urged Russia and Ukraine on Thursday to show a "spirit of compromise" and ensure the continued success of a U.N. brokered deal that enabled Ukraine to resume grain exports from its Black Sea ports. Guterres said after talks in the western Ukrainian city of Lviv that 21 ships had departed from Ukrainian ports under the deal in less than a month, and 15 vessels had left Istanbul for Ukraine to load up with grain and other food supplies. (RTRS)

GEOPOLITICS: Chinese President Xi Jinping and Russian leader Vladimir Putin are both planning to attend a Group of 20 summit in the resort island of Bali later this year, Indonesian President Joko Widodo said. (BBG)

RBNZ: Reserve Bank governor Adrian Orr says increasingly diverse opinions about where the bank should set interest rates are a pleasing sign, as that would suggest the bank must be getting close to the point where its next decision is getting really hard to make. (Stuff NZ)

RBNZ: RBNZ Governor Adrian Orr comments in a presentation to the Canterbury Employers Chamber of Commerce in Christchurch. Says labor sources are “acutely scarce” and inflation is too high, requiring tighter monetary policy. Domestic demand is robust but is running too fast and needs to slow “to put inflation back in its box”. Says household, business balance sheets are strong. (BBG)

SOUTH KOREA: South Korea will preemptively manage risk factors such as rising short-term external debt and concerns over increase in capital flow volatility, finance ministry says in statement. (BBG)

NORTH KOREA: The sister of North Korean leader Kim Jong-un said Friday her regime will never accept the South Korean government's "audacious initiative" that seeks to help Pyongyang improve its economy in return for denuclearization steps. (Yonhap)

NORTH KOREA: North Korea has no intention to deal with South Korean President Yoon Suk Yeol’s offer in exchange for giving up nuclear weapons, sister of North Korean leader Kim Jong Un says in a statement released through state media KCNA. (BBG)

TURKEY/RATINGS: Turkiye’s growing current account deficit (CAD) and its unconventional economic policy mix, highlighted by today’s central bank decision to cut its policy rate, will keep the sovereign’s external finances under pressure, Fitch Ratings says. This is notwithstanding a short-term boost to international reserves from strong tourism numbers and a one-off bilateral transfer. (Fitch)

BRAZIL: Luiz Inacio Lula da Silva remains the front-runner to win Brazil's presidential election in October, a poll of voter support showed on Thursday, although incumbent President Jair Bolsonaro is gaining ground. Lula received 47% voter support versus Bolsonaro's 32% in the latest survey by pollster Datafolha, compared with 47% and 29% respectively in July. (RTRS)

BRAZIL: Brazilian Economy Minister Paulo Guedes said on Thursday he hopes President Jair Bolsonaro changes the way state-controlled oil firm Petrobras is treated if he is reelected this year. Speaking at an event hosted by lender BTG Pactual, Guedes said that a more "adequate treatment" would de-verticalize the company's production chain, ensuring an increase in its oil production. (RTRS)

RUSSIA: Russia is likely using the Zaporizhzhia nuclear power plant in southern Ukraine to shield its troops and equipment, undermining the safety of the plant’s operations, according to European intelligence officials. (BBG)

RUSSIA: Ukrainian President Volodymyr Zelenskiy said he agreed the parameters of a possible mission of the International Atomic Energy Agency to the Zaporizhzhia nuclear plant at talks on Thursday with Turkey's leader and the U.N. secretary-general. (RTRS)

RUSSIA: Turkish President Recep Tayyip Erdogan said he discussed avenues to end the Russia’s war during talks with his Ukrainian counterpart, as well as conditions for a possible prisoners exchange. (BBG)

RUSSIA/CHINA: Russia has charged up to third place in a list of countries outside mainland China using the yuan for global payments, highlighting how it is being affected by Western sanctions. (RTRS)

SOUTH AFRICA: South African Finance Minister Enoch Godongwana plans to continue exercising his duties, after the police informed him that a criminal complaint of sexual assault has been made against him. (BBG)

CHINA

BONDS: The People's Bank of China has exerted its influence on two occasions since the start of August, in order to accelerate the development of over-the-counter bond trading between commercial banks as it aims to improve the liquidity of the bond market and form a more continuous and effective secondary market pricing mechanism, the Securities Daily reported. Regulators should diversify bond varieties to generate demand from individual investors, as over-the-counter bonds trading is dominated by treasury bonds, financial bonds issued by policy banks and local government bonds with higher credit ratings but lower yields, the newspaper said, citing analysts. Also, regulators can guide the issuance of some special bonds to support green finance and rural revitalization to expand the OTC bond market, the newspaper added. (MNI)

EQUITIES: China's cyberspace regulator said on Friday that it was supportive of domestic companies seeking foreign capital and that the focus of its review was whether there was the risk of data they held being abused by foreign governments. (RTRS)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Friday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5974% at 9:53 am local time from the close of 1.4193% on Thursday.

- The CFETS-NEX money-market sentiment index closed at 49 on Thursday vs 51 on Wednesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8065 FRI VS 6.7802

The People's Bank of China (PBOC) set the dollar-yuan central parity rate lower at 6.8065 on Friday, compared with 6.7802 set on Thursday.

OVERNIGHT DATA

JAPAN JUL NATIONAL CPI +2.6% Y/Y; MEDIAN +2.6%; JUN +2.4%

JAPAN JUL NATIONAL CORE CPI +2.4% Y/Y; MEDIAN +2.4%; JUN +2.2%

JAPAN JUL NATIONAL CORE-CORE CPI +1.2% Y/Y; MEDIAN +1.1%; JUN +1.0%

NEW ZEALAND JUL TRADE BALANCE -NZ$1,092MN; JUN -NZ$1,102MN

NEW ZEALAND JUL EXPORTS +NZ$6.68BN; JUN +NZ$6.27BN

NEW ZEALAND JUL IMPORTS +NZ$7.77BN; JUN +NZ$7.38BN

NEW ZEALAND JUL 12-MONTH YTD TRADE BALANCE -NZ$11,640MN; JUN -NZ$10,935MN

NEW ZEALAND JUL CREDIT CARD SPENDING +3.2% M/M; JUN +1.3%

NEW ZEALAND JUL CREDIT CARD SPENDING +4.9% Y/Y; JUN +3.5%

UK AUG GFK CONSUMER CONFIDENCE -44; MEDIAN -42; JUL -41

MARKETS

SNAPSHOT: Xi & Putin G20 Attendance Confirmed

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 9.82 points at 28932.32

- ASX 200 down 1.176 points at 7111.60

- Shanghai Comp. down 0.418 points at 3277.126

- JGB 10-Yr future down 9 ticks at 150.19, yield down 0.4bp at 0.2%

- Aussie 10-Yr future down 6.5 ticks at 96.585, yield up 6.1bp at 3.395%

- US 10-Yr future down 0-06+ at 118-20+, yield up 2.37bp at 2.9059%

- WTI crude down $0.34 at $90.16, Gold down $5.61 at $1753.00

- USD/JPY up 39 pips at Y136.28

- XI AND PUTIN TO ATTEND G-20 SUMMIT IN INDONESIA, JOKOWI SAYS (BBG)

- FED’S BULLARD LEANS TOWARD FAVORING 0.75PPT SEPTEMBER RATE RISE (WSJ)

- FED'S GEORGE SAYS PACE, ENDPOINT OF RATE HIKES STILL MATTER OF DEBATE (RTRS)

- FED MUST GET INFLATION DOWN URGENTLY, KASHKARI SAYS (RTRS)

- RBNZ ORR SAYS GETTING TOWARDS POINT WHERE NEXT RATE MOVE NOT OBVIOUS (STUFF NZ)

- RBNZ’S ORR SAYS DEMAND MUST SLOW TO PUT INFLATION BACK IN BOX (BBG)

- CHINA'S CYBERSPACE REGULATOR: SUPPORTIVE OF DOMESTIC FIRMS SEEKING FOREIGN CAPITAL (RTRS)

US TSYS: Bear Flattening Overnight

TYU2 is -0-06 at 118-21 ahead of London dealing, 0-01+ off the base of its 0-10 Asia-Pac range, on limited volume of ~51K. Cash Tsys run 2-4bp cheaper across the curve, bear flattening after yesterday’s bull steepening.

- Early cash Tsy trade saw some light cheapening aided by news that Chinese President Xi & Russian President Putin will be attending the G20 summit in Indonesia, which is due to take place in November. A reminder that there is an expectation that U.S. President Biden will speak with Xi in South East Asia in November, owing to previous press reports and the U.S. confirming that planning for such a meeting is underway. In addition, the Kremlin had previously flagged Putin’s desire to attend the November summit, meaning that this headline flow doesn’t come as much of a shock. Cross-asset moves aren’t definitively risk-off or -on in nature, with e-minis marginally lower, the USD bid and Tsys cheaper. Note that some suggested that Putin’s presence could bolster the Sino-Russian power axis at the meeting, with no firm consensus amongst the remainder of the G20 re: his attendance of the summit (although we don’t believe such a view is driving market moves given the leg higher in USD/JPY, with the USD strength aided by a technical break through Thursday’s high in the BBDXY).

- The cheapening then extended later in the session as Aussie bonds leaked lower, with little in the way of fresh, overt headline drivers noted (next week’s AOFM issuance schedule perhaps provided some background pressure for ACGBs).

- Friday’s NY session will be headlined by Fedspeak from Richmond Fed President Barkin (’24 voter).

JGBS: Futures Cheapen A Little, Long End Remains Bid, Lifers Likely At Work

JGBs were relatively resilient in the face of the broader downtick in core global FI markets, with futures down a mere 6 ticks on the day ahead of the bell after giving back a modest early uptick, while cash JGBs run flat to 3bp richer, with the curve flattening. 7s underperform on the curve owing to the downtick in futures, while super-long end outperformance has been evidence from early Tokyo trade, with the resilience likely a clue re: continued domestic lifer & pension demand when it comes to the longer end of the JGB curve.

- Domestic headline flow remains limited, with the only real point of note being the 0.2ppt uptick observed across each of the 3 major Y/Y CPI readings (which was in line with exp., outside of the CPI excluding fresh food and energy measure, which provided a 0.1ppt beat vs. expectations). Note that the excluding fresh food and energy measure remains some way shy of the BoJ's 2% target, operating at +1.2% Y/Y.

- Monday’s docket lacks any meaningful events of note.

JGBS AUCTION: Japanese MOF sells Y4.54002tn 3-Month Bills:

The Japanese Ministry of Finance (MOF) sells Y4.54002tn 3-Month Bills:

- Average Yield: -0.1295% (prev. -0.1126%)

- Average Price: 100.0323 (prev. 100.0281)

- High Yield: -0.1162% (prev. -0.1042%)

- Low Price: 100.0290 (prev. 100.0260)

- % Allotted At High Yield: 48.9934% (prev. 38.4144%)

- Bid/Cover: 2.608x (prev. 3.955x)

AUSSIE BONDS: Bear Steepening

ACGBs sit a little off session lows after cheapening throughout the Sydney session, more than unwinding the limited bull steepening in Aussie bond futures overnight. The move lower was aided in part by a modest early downtick in U.S. Tsys (fleshed out elsewhere), with little in the way of overt macro headline drivers and local economic data releases to further explain the move lower later in the day. Cash ACGBs run 5.0-6.5bp cheaper across the curve, bear steepening. YM and XM are -4.0 and -6.0, respectively, after breaching their overnight lows and deal a shade above worst levels of the Sydney session. The 3-/10-Year EFP box is steeper, with 3-Year EFP little changed and 10-Year EFP wider, while Bills run +1 to -10 through the reds, twist steepening.

- The AOFM’s weekly issuance slate announced for next week will see a total A$1.8bn in ACGBs and A$2.5bn of Notes on offer. Aussie bonds moved lower after the release, with the step up in ACGB DV01 on offer possibly aiding the weakness, which accelerated on the aforementioned break of overnight lows in YM & XM.

- The latest round of ACGB Nov-27 supply went well, with the weighted average yield printing 2.68bp through prevailing mids (per Yieldbroker) while the cover ratio improved to 3.41x, bouncing from the 2.53x seen previously (albeit with a lower amount on offer at today’s auction). Outright yield levels were sufficient to drive demand at the auction despite their recent move away from cycle cheaps, with the cheapness of 5s against 3s and 10s (in z-spread terms) providing another positive for smooth digestion.

- Monday’s local docket will see A$300mn of ACGB Jun-51 on offer, with no economic releases of note scheduled.

AUSSIE BONDS: AOFM sells A$700mn of the 2.75% 21 November 2027 Bond, issue #TB148:

The Australian Office of Financial Management (AOFM) sells A$700mn of the 2.75% 21 November 2027 Bond, issue #TB148:

- Average Yield: 3.1318% (prev. 3.2963%)

- High Yield: 3.1400% (prev. 3.3000%)

- Bid/Cover: 3.414x (prev. 2.520x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 22.3% (prev. 66.3%)

- Bidders 40 (prev. 36), successful 9 (prev. 18), allocated in full 5 (prev. 9)

EQUITIES: Mixed In Asia; Chinese Developers Gain Ahead Of PBOC LPR Fixing

Chinese, Japanese, and Australian equity index benchmarks sit little changed at writing, with a lacklustre showing from Wall St. on Thursday providing little direction for regional equities (major cash indices closed 0.1-0.2% firmer). Stocks of Chinese developers were notably bid, with participants eyeing the PBOC’s benchmark LPR fixing next week (with BBG median estimates calling for a cut to rates).

- The Hang Seng outperformed, dealing 0.6% firmer at typing, aided by a strong showing from China-based tech (HSTECH: +1.1%), adding to gains in the properties (+0.5%) and finance (+0.5%) sub-gauges. Some pre-earnings optimism may have also fed into the bid, with the likes of Orient Overseas (+3.5%) and China Merchants Bank (+1.0%) outperforming ahead of their respective earnings calls later today.

- The CSI300 is little changed after falling by as much as 0.5% earlier, with the benchmark index on track to close virtually unchanged on the week at current levels. A rebound in the consumer staples (+1.1%) sub-index (after a 1.5% lower close on Thursday) was offset by shallow weakness in consumer discretionary and healthcare stocks, while elsewhere, Chinese tech equities are mostly lower,

- The Nikkei 225 sits 0.1% better off at writing, back from as much as 0.7% higher earlier. The benchmark index is set for its third higher weekly close, with major export-oriented names contributing most to the move higher, aided by recent weakness in the JPY.

- E-minis sit 0.1-0.2% worse off at writing, having traded comfortably within Thursday’s range in a fairly directionless Asia-Pac session.

OIL: On Track For Lower Weekly Close; Supply Outlook Remains Tight

WTI and Brent are ~$0.40 weaker apiece, backing away from their respective Thursday peaks at writing. Both benchmarks remain on track for a lower weekly close but are off multi-month lows made earlier in the week, having found some poise in recent sessions after U.S. inventory data pointed to persistent tightness in crude supplies, with wider optimism re: increases to global supplies of oil moderating from their extremes as well.

- To recap, WTI and Brent closed between $2-3 firmer on Thursday for a second consecutive higher daily close, drawing support from a moderation in demand destruction worry from better-than-expected prints for the Philly Fed survey and jobless claims (both initial and continuing).

- OPEC Sec Gen al-Ghais on Thursday said that the demand for crude remains “robust” despite the group reducing its forecast for demand growth in ‘22 to 3.1mn bpd last week, while also hinting at possible production cuts in coming OPEC+ meetings “if necessary”.

- Turning to supply matters, Argus source reports on Thursday re: OPEC+ compliance pointed to the group missing collective output targets by ~2.9mn bpd for July, highlighting consistent production problems amongst some members.

- Elsewhere, preliminary data from analytics firm Kpler has shown Russian crude exports for Aug so far remaining above levels observed prior to the Russia-Ukraine war for a fifth straight month, pointing to the limited impact of Western sanctions so far. Further measures are however expected to kick in in H2 ‘22 (e.g. EU’s ban on Russian oil and shipping insurance), potentially affecting >3mn bpd in current crude exports.

- Little by way of fresh, discernible progress has been made towards a U.S.-Iran nuclear deal, with the Biden administration yet to formally comment on the EU’s “final draft”.

GOLD: Fresh Two-Week Lows In Asia; Test Of Key Support Eyed

Gold deals ~$3/oz weaker to print ~$1,756/oz, a little above two-week lows made earlier in the session amidst an uptick in the USD, with the DXY trading just shy of fresh one-month highs at writing.

- The limited move lower in gold comes after headlines re: the attendance of Russian Pres Putin and Chinese Pres Xi at the G20 summit in November, with the event possibly contributing to the aforementioned bid in the USD, while nominal U.S. Tsy yields have edged a little higher as well (details fleshed out in earlier bullets).

- Gold is on track for its first weekly decline in five, with recent Dollar strength and debate re: the size of incoming Fed rate hikes remaining in focus for the space.

- Elsewhere, Chinese imports of gold from major refiner Switzerland has hit a five-year high for the month of July, with the rise in demand attributed to the relaxation of domestic COVID measures.

- From a technical perspective, gold’s move lower has taken it to the threshold of key short-term support at $1,754.4/oz (Aug 3 low), with a clear break of that level potentially exposing further support at $1,711.7/oz (Jul 27 low).

FOREX: Dollar Back To Mid July Highs

The USD has continued to strengthen, with the DXY at +0.20% above NY closing levels, putting the index at 107.70, fresh highs back to around mid-July.

- We highlighted earlier that DXY trends this past week have generally been outperforming US yield momentum. However, as the session has progressed we have seen yields moving higher in this space. The US 2yr is up nearly 4bps to 3.24% at the time of writing. The 10yr is +2bps to 2.91%.

- Aggregate US data surprises continue to trend higher, while there is also focus on next week's Jackson Hole Symposium, where Powell will speak on Friday (the 26th of August).

- Japan inflation data came in close to expectations, with a modest upside surprise to core (ex energy) +1.2%, versus +1.1% expected. There was no reaction in JPY though. USD/JPY spiked above 136.00 in early trade and has stayed above this level for the session (last 136.20).

- Some USD strength was attributed to plans for Xi and Putin to attend the G20 meeting in Indonesia, later this year. The meeting could serve to bolster the Sino-Russian power axis, although price action today in terms of higher USD/JPY levels is not consistent with such a backdrop.

- AUD and NZD are both lower, although more so Kiwi, as the trade position remained comfortable in deficit. NZD/USD fell to sub 0.6230 before support kicked in. The AUD/NZD cross has pushed higher to 1.1080, but can't gain a foothold above this level. AUD/USD's dip sub 0.6900 was supported (last at 0.6910).

- Looking ahead, UK and Canadian retail sales data round off the week. There is no US data on Friday which should keep any FedSpeak and geopolitical developments in focus.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/08/2022 | 0600/0700 | *** |  | UK | Retail Sales |

| 19/08/2022 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 19/08/2022 | 0600/0800 | ** |  | DE | PPI |

| 19/08/2022 | 0800/1000 | ** |  | EU | EZ Current Acc |

| 19/08/2022 | 1230/0830 | ** |  | CA | Retail Trade |

| 19/08/2022 | 1300/0900 |  | US | Richmond Fed's Tom Barkin |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.