-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI: China CFETS Yuan Index Up 0.01% In Week of Nov 29

MNI EUROPEAN OPEN: Jackson Hole On The Mind

EXECUTIVE SUMMARY

- ECB’S NAGEL WANTS MORE HIKES, SAYS GERMAN RECESSION LIKELY (BBG)

- LABOUR TAKES BIGGEST POLL LEAD IN TEN YEARS AS COST OF LIVING CRISIS BITES (TIMES)

- CHINA CUTS LENDING BENCHMARKS TO REVIVE FALTERING ECONOMY (RTRS)

- POWER CRUNCH IN SICHUAN ADDS TO INDUSTRY'S WOES IN CHINA (BBG)

- TOP RUSSIAN DIPLOMAT DISMISSES HOPES OF NEGOTIATED END TO UKRAINE WAR (FT)

- GAZPROM TO SHUT PIPELINE FOR THREE DAYS IN NEW SHOCK TO EUROPE (BBG)

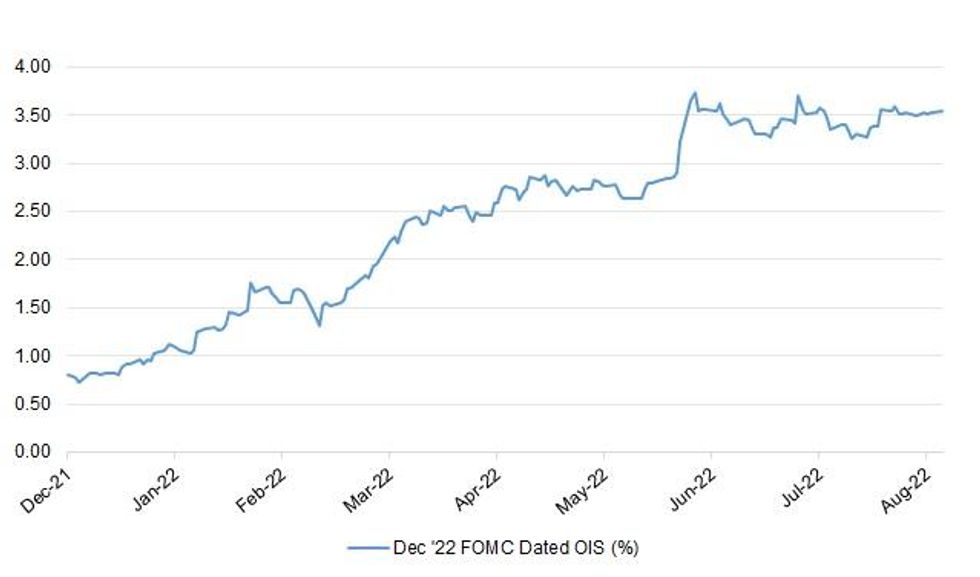

Fig. 1: Dec '22 FOMC Dated OIS (%)

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

POLITICS: Labour hold their biggest poll lead over the Conservatives for almost ten years amid mass dissatisfaction with the government’s handling of the cost of living. A YouGov poll for The Times showed Labour with the backing of 43 per cent of voters, 15 points ahead of the Conservatives on 28 per cent. It is the biggest Labour lead recorded by the pollster since February 2013. (The Times)

POLITICS: Conservative voters have “sellers’ remorse” over the ousting of Boris Johnson and would prefer him as prime minister over the two rivals vying to be his successor, focus group research and polling for The Times reveals today. (The Times)

FISCAL: Chancellor Nadhim Zahawi is looking at options for bailing out businesses this winter, amid concerns that thousands of smaller companies will go bust because of sky-high electricity prices. (Sunday Times)

FISCAL: Liz Truss, the frontrunner to become Britain’s next prime minister, has signalled she would intervene to help companies and households deal with soaring energy bills this winter, pledging assistance “across the board”. (FT)

FISCAL: Liz Truss, the front-runner to become Britain’s next prime minister, will rethink taxes paid by self-employed workers and try to limit disruptive strikes, according to an interview with the Sun newspaper. (BBG)

FISCAL: Kwasi Kwarteng is planning to clamp down on wind and solar energy firms as a new forecast predicted the energy price cap will hit £6,000 in April. (Telegraph)

SCOTLAND: Scotland is more likely to become independent if Liz Truss becomes prime minister, according to a survey of opinion across the Union. The research also suggests that Northern Ireland is on course to leave the UK within 20 years. (Sunday Times)

EUROPE

ECB: The European Central Bank should continue increasing rates, according to Bundesbank Chief Joachim Nagel, who warned that Germany faces a recession if the energy situation escalates. (BBG)

GERMANY: German Finance Minister Christian Lindner said he opposes the extension of the popular 9-euro ticket for local transport as it would cost 14 billion euros ($14.1 billion) that could be better deployed elsewhere. (BBG)

GERMANY: Germany may not be able to replace all its imports of Russian natural gas this winter and might have to resort to nuclear power to plug part of the gap, the nation’s two most powerful leaders said. (BBG)

GERMANY: The water level at a key German chokepoint on the Rhine River jumped on Saturday, easing a crisis that’s hampered energy and industrial production this month. (BBG)

FRANCE: French President Emmanuel Macron’s approval rating dropped by 1 point in the past month as he was overtaken by his prime minister, Elisabeth Borne, the Journal du Dimanche reported, citing a poll by Ifop. (BBG)

GREECE: Greece's exit on Saturday from the European Union's so-called enhanced surveillance framework for its economy ends 12 years of pain and allows the country greater freedom in policy making, its prime minister said. (RTRS)

RATINGS: Sovereign rating reviews of note from after hours on Friday included:

- Fitch affirmed Estonia at AA-; Outlook changed to Negative from Stable

- Fitch affirmed Slovakia at A; Outlook changed to Negative from Stable

- Moody's affirmed Cyprus at Ba1; Outlook changed to Positive from Stable

- S&P affirmed Estonia at AA-; Outlook Stable

U.S.

FED: The U.S. Federal Reserve will raise rates by 50 basis points in September amid expectations inflation has peaked and growing recession worries, according to economists in a Reuters poll, who said the risks were skewed towards a higher peak. (RTRS)

OTHER

GLOBAL TRADE: Motech Industries, TSEC will raise prices in the 2H as demand outpaces supply amid power crunch in Sichuan, Taipei-based Economic Daily News reports, citing the cos. (BBG)

GLOBAL TRADE: More than 1,900 workers at Britain's biggest container port are due on Sunday to start eight days of strike action which their union and shipping companies warn could seriously affect trade and supply chains. (RTRS)

GEOPOLITICS: Eric Holcomb, governor of the US state of Indiana, arrived in Taiwan on Sunday night, kicking off a string of foreign visits that defy China’s increasing attempts to deter third countries from engaging with Taipei. (FT)

U.S./CHINA/TAIWAN: Taiwan and the United States are key security and economic allies in the Indo-Pacific region and democratic allies must stand together, Tsai Ing-wen, president of the self-ruled the island, told a visiting U.S. official on Monday. (RTRS)

JAPAN/CHINA: Japan is considering the deployment of 1,000 long-range cruise missiles to boost its counterattack capability against China, the Yomiuri newspaper reported on Sunday. (RTRS)

JAPAN: Japanese Prime Minister Fumio Kishida tested positive for Covid-19 and has relatively mild symptoms, the government said. (BBG)

JAPAN: Support for Japanese Prime Minister Fumio Kishida's government has tumbled, battered by questions about the ruling party's ties to the Unification Church and its response to the coronavirus pandemic, according to a public opinion poll. (RTRS)

AUSTRALIA: Australian Prime Minister Anthony Albanese said one of his new government’s priorities is to take the pressure off inflation, which was running at the fastest pace in 21 years in the second quarter and is forecast to accelerate even more by year end. (BBG)

RBNZ: New Zealand’s central bank is open to the possibility of raising its benchmark rate as high as 4.25% amid uncertainty over the amount of tightening needed to regain control of inflation. (BBG)

RBNZ: Stronger inflation pressures recently were a surprise for New Zealand's central bank and the reason it has forecast that the cash rate will reach 4.0% sooner, monetary-policy committee member Adam Richardson said Monday. (Dow Jones)

NORTH KOREA: South Korea and the United States began their annual joint military drills on Monday with a resumption of field training, officials said, as the allies seek to tighten readiness posture over North Korea's potential weapons tests. (RTRS)

TURKEY: Turkey is pushing commercial lenders to slash interest rates charged on loans to companies after the central bank moved this week to stimulate the economy with a surprise rate cut. (BBG)

MEXICO: Mexico’s central bank is very likely to follow the US Federal Reserve’s next interest rate hike, Deputy Governor Jonathan Heath said in an interview. (BBG)

RUSSIA: Ukraine’s president has warned that Russia could do something “particularly cruel” as Ukraine prepares to celebrate Independence Day on Wednesday — a day that also marks six months of Moscow’s invasion. (CNBC)

RUSSIA: Moscow sees no possibility of a diplomatic solution to end the war in Ukraine and expects a long conflict, a senior Russian diplomat has warned, as President Vladimir Putin’s full-scale invasion reaches the six-month mark this week. (FT)

RUSSIA: More than 15 Russian banks are in talks with Indian lenders about payments in rubles and Indian rupees and creating a reference exchange-rate framework, Economic Times reports, citing unidentified people familiar with the matter. (BBG)

RUSSIA: U.S. Deputy Treasury Secretary Wally Adeyemo told Turkey's Deputy Finance Minister Yunus Elitas that Russian entities and individuals were attempting to use Turkey to bypass Western sanctions imposed over Moscow's war in Ukraine, the Treasury Department said. In a phone call, the two also discussed ongoing efforts to implement and enforce sanctions against Russia, the department said in a statement. (RTRS)

RUSSIA: Japanese trading house Mitsui & Co. will retain its stake in the Sakhalin-2 liquefied natural gas project under a new operator established by the Russian government, Nikkei has learned. (Nikkei)

RUSSIA: Russian Finance Ministry may resume spending extra oil and gas revenue to buy foreign currency as soon as in September, once the concept of the new fiscal rule is approved, Vedomosti reports, citing unidentified officials. (BBG)

IRAN: President Joe Biden spoke Sunday with fellow Western leaders looking to revive a nuclear deal with Iran, as the US weighs a response to Tehran’s position on the latest proposal. (BBG)

IRAN: The Biden administration in recent days has been seeking to reassure Israel that it hasn’t agreed to new concessions with Iran and a nuclear deal isn’t imminent, U.S. and Israeli officials told Axios. (Axios)

IRAN: Some details about alleged US sanctions concessions to Iran in case of a nuclear deal is circulating among hardliners in Tehran, obtained by Iran International. (Iran International)

ENERGY: China’s coal imports from Russia jumped 14% in July from a year earlier to their highest in at least five years, as China bought discounted coal while Western countries shunned Russian cargoes over its invasion of Ukraine. (RTRS)

GAS: Gazprom PJSC will stop delivering natural gas to Europe through its main pipeline for three days, further squeezing energy supplies just as Germany is trying to build up stocks for the winter. (BBG)

OIL: Russia held its spot as China's top oil supplier for a third month in July, data showed on Saturday, as independent refiners stepped up purchases of discounted supplies while cutting shipments from rival suppliers such as Angola and Brazil. (RTRS)

OIL: Caspian Pipeline Consortium (CPC) has suspended oil loadings from two of three single mooring points (SPM) at its Black Sea terminal Yuzhnaya Ozereyevka for inspections, two sources familiar with the loadings told Reuters. (RTRS)

OIL: Libya's oil production is running at 1.211 million barrels per day (bpd), Libya's National Oil Corp (NOC) said in a statement on Sunday. (RTRS)

CHINA

PBOC: China cut its benchmark lending rate and lowered the mortgage reference by a bigger margin on Monday, adding to last week's easing measures, as Beijing boosts efforts to revive an economy hobbled by a property crisis and a resurgence of COVID cases. The one-year loan prime rate (LPR) was lowered by 5 basis points to 3.65% at the central bank's monthly fixing, while the five-year LPR was slashed by 15 basis points to 4.30%. (RTRS)

ECONOMY: The Chinese province of Sichuan extended industrial power cuts and activated its highest emergency response on Sunday to deal with “extremely outstanding” electricity supply deficiencies, adding to manufacturers’ woes in the region as they shut down factories. (BBG)

BONDS: International investors are returning to the Chinese bond market, with last week's surprise PBOC rate cut fueling bullish sentiment, Yicai.com reported. There was a net inflow of USD5.6 billion into Chinese bonds on the part of international investors during the first half of August, reversing the bulk of the net outflow of ~USD6.9 billion observed in the prior six months, the newspaper said. Many traders believe that yields will move lower based on expectations for slower economic growth and further PBOC easing, the newspaper said, citing analysts. (MNI)

NPLS: The pressure stemming from banks’ non-performing loans will continue to increase as economic headwinds gradually feed through to the financial sector, Yicai.com reported, citing Shang Fulin, former chairman of the China Banking Regulatory Commission, speaking at a weekend forum. The policy implemented to defer loan repayment for struggling enterprises may delay the risk exposure of some “zombie” companies and weaken economic vitality, Shang said. Banking regulators should continue to fully expose and increase the disposal of non-performing assets, emphasising the expansion of capital replenishment for small and medium-sized banks to enhance their risk resistance capabilities, the newspaper wrote, citing Shang. (MNI)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Monday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5530% at 9:59 am local time from the close of 1.4391% on Friday.

- The CFETS-NEX money-market sentiment index closed at 45 on Friday vs 49 on Thursday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8198 MON VS 6.8065

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8198 on Monday, compared with 6.8065 set on Friday.

OVERNIGHT DATA

SOUTH KOREA AUG 1-20 TRADE BALANCE -$MN; JUL $8,102.0MN

SOUTH KOREA AUG 1-20 EXPORTS +3.9% Y/Y; JUL +14.5%

SOUTH KOREA AUG 1-20 IMPORTS +22.1% Y/Y; JUL +25.4%

MARKETS

SNAPSHOT: Jackson Hole On The Mind

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 153.89 points at 28776.39

- ASX 200 down 71.16 points at 7043.3

- Shanghai Comp. up 18.459 points at 3276.537

- JGB 10-Yr future down 44 ticks at 149.76, yield up 1.3bp at 0.215%

- Aussie 10-Yr future down 12 ticks at 96.46, yield up 12bp at 3.525%

- U.S. 10-Yr future +0-01+ at 118-05, yield up 0.18bp at 2.974%

- WTI crude down $1.24 at $89.53, Gold down $2.08 at $1744.98

- USD/JPY up 19 pips at Y137.16

- ECB’S NAGEL WANTS MORE HIKES, SAYS GERMAN RECESSION LIKELY (BBG)

- LABOUR TAKES BIGGEST POLL LEAD IN TEN YEARS AS COST OF LIVING CRISIS BITES (TIMES)

- CHINA CUTS LENDING BENCHMARKS TO REVIVE FALTERING ECONOMY (RTRS)

- POWER CRUNCH IN SICHUAN ADDS TO INDUSTRY'S WOES IN CHINA (BBG)

- TOP RUSSIAN DIPLOMAT DISMISSES HOPES OF NEGOTIATED END TO UKRAINE WAR (FT)

- GAZPROM TO SHUT PIPELINE FOR THREE DAYS IN NEW SHOCK TO EUROPE (BBG)

US TSYS: Bear Flattening Asia, 10s Fail To Break 3.00%

TYU2 prints +0-01 at 118-04+, around the middle of its 0-09 range. Cash Tsys are flat to 3bp cheaper across the curve, bear flattening.

- Spill over from Friday’s softness in Tsys and focus on the impending Jackson Hole symposium (due to be held Thursday-Saturday) provided the points of interest overnight.

- 5- to 20-Year Tsys showed below their respective Friday cheaps, with the failure of 10s to break above the 3.00% level in yield terms allowing a base to form overnight.

- A block buy of FV futures (+3K) also helped the space to move away from session cheaps, while Asia-Pac trade also saw some light downside interest expressed via low delta put options (TYUS 115.50 puts).

- Weekend headline flow failed to provide much impetus, with the UK political backdrop, European energy woes, familiar ECB speak and the continuing Russia-Ukraine war headlining.

- Monday’s NY docket is headlined by the latest national activity index reading from the Chicago Fed, although that lower tier data release is unlikely to impact the market.

JGBS: Futures And Long End Struggle

JGBs adjusted to Friday’s cheapening in core global FI markets during early Tokyo trade, which allowed futures to extend on their overnight session weakness.

- A base then formed alongside a similar dynamic in the wider core global FI markets, before a fresh round of softening became apparent as we moved towards the bell, although no clear catalysts were observed. Futures last -43, just off lows.

- Cash JGBs run little changed to 4bp cheaper, with 7s providing the weakest point on the curve, driven by the softness in futures.

- Demand in the super-long end on the part of Japanese life insurers and pension funds seems to have abated, at least for today, after signs of active capital deployment from that cohort at the tail end of last week.

- Flash PMI data and a liquidity enhancement auction for off-the-run 5- to 15.5-Year JGBs headline tomorrow’s local docket, although the swings in broader financial markets ae likely to provide more of a meaningful input than either of those events.

AUSSIE BONDS: Off Lows, But Comfortably Cheaper

Aussie bonds sit a little above session lows after cheapening during early Sydney trade, with spill over from the general gyrations in wider core FI markets at the fore on Monday,

- Cash ACGBs run 10.5-12.5bp cheaper across the curve, with the 7- to 15-Year zone leading the weakness. YM is -11.5 while XM is -12.5. Elsewhere, the 3-/10-Year box steepened, while Bills run 1 to 16 ticks cheaper through the reds, bear steepening.

- The latest round of ACGB Jun-51 supply saw no major hiccups, although the cover ratio wasn’t convincing when adjusted for the size of the auction, with overall interest likely limited by well-documented headwinds for demand and inversion in the longer end of the ACGB curve.

- Tuesday’s local docket will see the release of the flash S&P Global PMI readings and weekly ANZ-Roy Morgan Consumer Confidence data. Also, A$150mn of Nov-32 index-linked paper will be on offer from the AOFM.

AUSSIE BONDS: AOFM sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

The Australian Office of Financial Management (AOFM) sells A$300mn of the 1.75% 21 June 2051 Bond, issue #TB162:

- Average Yield: 3.8759% (prev. 3.8350%)

- High Yield: 3.8800% (prev. 3.8450%)

- Bid/Cover: 2.3633x (prev. 1.5533x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 34.3% (prev. 38.2%)

- Bidders 46 (prev. 60), successful 22 (prev. 36), allocated in full 14 (prev. 31)

EQUITIES: Mixed In Asia As Chinese, Hong Kong Stocks Inch Higher On LPR Cut

Most Asia-Pac equity indices are softer, tracking a negative lead from Wall St. On the other hand, Chinese and Hong Kong stock benchmarks have reversed earlier losses at writing, drawing limited support from the PBOC’s LPR fixing for August.

- The Hang Seng sits 0.2% better off, up from opening ~1.0% lower. The property sub-index (+0.8%) led peers after the PBOC delivered larger cuts to the 5-Year LPR, offsetting sharp losses in the utilities sub-gauge (-2.9%), with the latter dragged lower by ENN Energy Holdings (-10.9%) after reporting H1 results.

- The Chinese CSI300 trades 0.8% firmer at writing after opening 0.4% lower, with gains observed in every sub-gauge. Consumer staples and real estate stocks outperformed, although gains elsewhere were muted, with caution evident re: the smaller-than-expected cut to the 1-Year LPR.

- Keeping within China, agriculture-related stocks have outperformed, reflecting rising worry re: lower domestic grain production amidst extreme weather conditions.

- The ASX200 sits 0.9% weaker, backing away from 11-week highs made on Friday. Virtually all sectors are in the red at typing, with tech stocks leading the way lower (S&P/ASX All Tech Index: -1.9%).

- E-minis deal 0.3-0.5% softer, a little off fresh one-week lows at writing.

OIL: Lower In Asia; Iran Nuclear Deal Eyed

WTI and Brent are ~$0.90 worse off apiece, consolidating after a pullback from their respective one-week highs made on Friday, with both contracts on track to snap a three-day streak of higher daily closes amidst optimism re: a return of Iranian crude to global supplies.

- To elaborate, unconfirmed, leaked reports by Iran International pointed to potential U.S. concessions to Iran, including measures on sticking points such as U.S. sanctions against the IRGC.

- Al Jazeera sources on Friday also placed a U.S.-Iran nuclear deal as “imminent”, with plans to allow Iran to export crude “within 120 days of signing the agreement”.

- Crude also faces limited headwinds on economic growth worry amidst power rationing in China’s Sichuan province (19 of 21 cities were ordered to halt industrial production for six days last week), although the power cuts are currently much less extensive than those witnessed in ‘21.

- Due to Sichuan’s unique reliance on hydroelectricity (~80% of the grid), the shortage is expected to remain limited, barring the impact of drawdowns on energy supplies from surrounding provinces.

- RTRS sources have said that the Caspian Pipeline Consortium (CPC) has suspended some oil loadings at a Black Sea terminal, although the impact on overall loadings is reportedly limited owing to lowered output due to ongoing maintenance at major Kazakh oil fields (since early-Aug).

GOLD: Fresh Four-Week Lows In Asia

Gold is little changed, printing $1,747/oz at writing, operating just above four-week lows ($1,744.9/oz) made earlier in the session. The precious metal continues to drift lower after a brief show above $1,800/oz earlier in August, facing headwinds from a simultaneous rally in the USD (DXY) and U.S. real yields.

- To recap, gold closed ~$12/oz weaker on Friday, ending lower for the week on the back of five consecutive lower daily closes, snapping a four-week streak of higher weekly closes in the process.

- Gold dipped to fresh lows on Friday amidst Fedspeak from Richmond Fed Pres Barkin (‘24 voter), after he stated that the Fed would “do what it takes” to bring inflation back to 2% even if it caused a recession, adding to the recent chorus of hawkish Fedspeak.

- Looking ahead, the key risk event for gold this week looks to be Fed Chair Powell’s keynote speech at the annual Jackson Hole Symposium, to be delivered on Friday.

- From a technical perspective, gold has broken key short-term support at $1,754.4/oz (Aug 3 low), exposing further support at $1,711.7/oz (Jul 27 low). On the other hand, key resistance is situated at $1,807.9/oz (Aug 10 high and bull trigger).

FOREX: Aussie Takes Lead, Yen Goes Offered

The BBDXY index made a round trip from is session high of 1,289 and had a look above last Friday's high in the process. E-mini futures operated in the red but are off earlier lows, while U.S. Tsy yield curve bear flattened a tad.

- Cuts to the PBOC's Loan Prime Rates sent spot USD/CNH to a new cyclical peak (CNH6.8517) before the pair trimmed gains to last trade ~50 pips better off. The People's Bank cut the 5-Year LPR by a larger-than-expected 15bp, which was coupled with a smaller-than-expected 5bp decline in the 1-Year LPR.

- The yen was the worst G10 performer, with USD/JPY adding ~30 pips after completing a short-term double bottom pattern last week. Across the curve, risk reversals consolidated above par, suggesting options traders were more bearish on the yen.

- The Aussie dollar turned bid, which put it on track to snap a five-day losing streak. The kiwi gradually caught up with its Antipodean cousin despite underperforming in early trade. AUD/NZD lurked above last Friday's high before paring gains, with Australia/NZ 2-year swap spread moving away from highs.

- The global economic docket is light today as participants await this week's Jackson Hole symposium

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 23/08/2022 | 2300/0900 | *** |  | AU | IHS Markit Flash Australia PMI |

| 23/08/2022 | 0030/0930 | ** |  | JP | IHS Markit Flash Japan PMI |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Services PMI (p) |

| 23/08/2022 | 0715/0915 | ** |  | FR | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Services PMI (p) |

| 23/08/2022 | 0730/0930 | ** |  | DE | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Services PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Manufacturing PMI (p) |

| 23/08/2022 | 0800/1000 | ** |  | EU | IHS Markit Composite PMI (p) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Manufacturing PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Services PMI (flash) |

| 23/08/2022 | 0830/0930 | *** |  | UK | IHS Markit Composite PMI (flash) |

| 23/08/2022 | 0900/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 23/08/2022 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 23/08/2022 | 1100/1300 |  | EU | ECB Panetta at ECB Policy Panel at EEA Annual Congress | |

| 23/08/2022 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/08/2022 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/08/2022 | 1345/0945 | *** |  | US | IHS Markit Services Index (flash) |

| 23/08/2022 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 23/08/2022 | 1400/1000 | *** |  | US | New Home Sales |

| 23/08/2022 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.