-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI BRIEF: RBA Details Hypothetical Monetary Policy Paths

MNI EUROPEAN OPEN: China Property Woes Back To The Fore

EXECUTIVE SUMMARY

- HAWKISH KASHKARI - NO TRADEOFF AMID INFLATION FIGHT (MNI)

- SHIELDING UK FAMILIES FROM FUEL BILLS CRISIS FORECAST TO COST £100BN (FT)

- WIDENING US-CHINA RATE SPREAD HAS LIMITED IMPACT ON YUAN (SECURITIES TIMES)

- CHINA PROBES REAL ESTATE EXECUTIVES FOR POSSIBLE LAW VIOLATIONS (BBG)

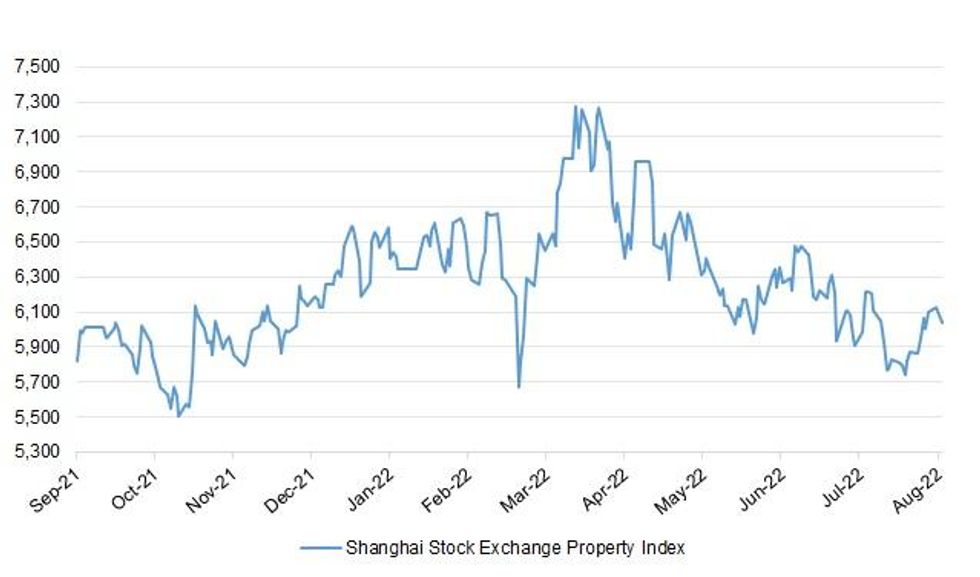

Fig. 1: Shanghai Stock Exchange Property Index

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

FISCAL/ENERGY: One of the UK’s largest energy groups has told ministers that a rescue plan to protect households from rising bills will need funding of more than £100bn over two years, underlining the scale of the crisis engulfing Britain as gas prices surge. (FT)

ECONOMY: The minimum wage should be raised to £15 an hour, the Trades Union Congress says, as it declares it is "time to put an end to low-pay Britain". (Sky)

EUROPE

EU: Brussels is eyeing tectonic transformations which could shift the EU’s political centre of gravity away from its north-south divide towards an emerging east, which could influence the outcome of key policy decisions in the coming years, EU officials believe. (MNI)

U.S.

FED: The Federal Reserve must keep raising interest rates in an economy dominated by high inflation and it will be a long time before policymakers must debate any tradeoff with its full employment goal, Minneapolis President Neel Kashkari said Tuesday, in comments that showed just how hawkish an official that was considered a key dove on the FOMC has become. (MNI)

FED: The boards of directors of the Minneapolis and St. Louis Federal Reserve banks voted in mid-July for a full-percentage-point increase in the rate charged to commercial banks for emergency loans, minutes of their discount rate meetings showed on Tuesday. Directors on the Kansas City Fed's board voted for a half-percentage-point rate increase, the meeting showed. (RTRS)

FED: Federal Reserve policymakers could be forced to raise interest rates more than their own forecasts and market expectations suggest because of persistent inflation pressures and a strong labor market, former Fed Vice Chair Donald Kohn told MNI. (MNI)

FISCAL: The White House on Tuesday revised down its projected fiscal 2022 deficit to $1.032 trillion, a $383 billion reduction from its budget forecast in March, reflecting stronger revenues, slightly reduced spending and some technical re-estimates of healthcare outlays. (RTRS)

FISCAL: White House officials are planning for President Biden to make an announcement on Wednesday about his proposal for dealing with student-loan debt, according to people familiar with the matter. (WSJ)

POLITICS: U.S. President Joe Biden's public approval rating rose this week to its highest level since early June, following a series of legislative wins for his Democratic Party, according to a Reuters/Ipsos opinion poll completed on Tuesday. (RTRS)

EQUITIES: The S&P 500 will end the year a little above its current level after a recent rally that has lifted the index from its bear market lows, according to a new Reuters poll of strategists. (RTRS)

OTHER

GLOBAL TRADE: The European Union and the Association of Southeast Asian Nations will hold a summit of national leaders in December for the first time to discuss expanding trade and infrastructure assistance as the EU seeks to strengthen ties with the Asian bloc and counter Russian and Chinese influence. (Nikkei)

U.S./CHINA/TAIWAN: Representative Don Beyer, a Virginia Democrat who was part of a five-member congressional visit to Taiwan earlier this month, said he and the rest of the delegation affirmed their support for the US’s long-standing “One China” policy. (BBG)

JAPAN: In a step that brings Japan’s border control policy closer to that of other major economies, the country will soon stop mandating pre-arrival coronavirus tests and raise the cap on the number of daily arrivals from the current 20,000, Prime Minister Fumio Kishida announced Wednesday. (Japan Times)

RBA: A senior Reserve Bank of Australia official said climate change is likely to have a “significant impact” on the economy’s structure with implications for the stability of the nation’s financial system. (BBG)

SOUTH KOREA: South Korea President Yoon Suk-yeol said on Wednesday volatility is increasing in financial and foreign exchange markets amid uncertainties over inflation and monetary tightening in major countries. (RTRS)

SINGAPORE: Singapore is set to allow non-fully vaccinated travelers to skip quarantine on arrival starting Monday, authorities announced Wednesday. (CNBC)

MEXICO: Market participants broadly believe that the Bank of Mexico will not be able to separate itself from the U.S. Federal Reserve's monetary actions throughout the current interest rate hiking cycle, the central bank's deputy governor Galia Borja said in an Aug. 15 interview with Citi economists published on Tuesday. (RTRS)

MEXICO: Mexico Foreign Minister Marcelo Ebrard said US Secretary of State Antony Blinken will visit in September for high level economic talks. (BBG)

BRAZIL: Brazil central bank President Roberto Campos Netoexpects consumer prices to fall for three consecutive months through September and close the year with a smaller increase than most economists forecast. (BBG)

BRAZIL: Former president Luiz Inacio Lula da Silva said that he’s not scared of the size of Brazil’s public debt, given that indebtedness isn’t bad when it’s adding investments. The presidential candidate said, if elected, he’d announce an infrastructure program in January 2023. (BBG)

RUSSIA: The United States will announce a new security assistance package for Ukraine of about $3 billion as early as Wednesday, a U.S. official said on Tuesday, in what would be the single largest tranche to Kyiv since Russia's invasion six months ago. (RTRS)

RUSSIA: The U.N. nuclear watchdog will visit the Russian-occupied Zaporizhzhia nuclear power plant in Ukraine within days if talks to gain access succeed, it said in a statement on Tuesday. (RTRS)

IRAN: The Biden administration is expected to weigh in this week on Iran’s latest offer to resume its compliance with the 2015 Iran nuclear deal, but neither side is offering a definitive path to revive the agreement, which has been on life-support since former President Donald Trump withdrew from it in 2018. (Washington Post)

IRAN: Iran has officially dropped a key "red line" demand that had been a major sticking point in efforts to revive the Iran nuclear deal, a senior administration official told CNN. (CNN)

MIDDLE EAST: The U.S. military said it conducted airstrikes in Syria on Tuesday, targeting infrastructure used by groups with ties to Iran’s Islamic Revolutionary Guard Corps. (Washington Post)

EQUITIES: Energy companies reaping record profits from soaring oil and gas prices have helped global dividend payments to shareholders soar above pre-pandemic levels and to a record quarterly high, data showed on Wednesday. (RTRS)

ENERGY: Canada intends to start shipping green hydrogen produced by wind farms to Germany by 2025, the first step in a partnership to help Europe’s biggest economy reduce its reliance on fossil fuels. (BBG)

GAS: U.S. liquefied natural gas (LNG) producer Freeport LNG aims to return 85% of production from its fire-hit Texas plant by late November and achieve full operation by March, the company said on Tuesday. (RTRS)

GAS: Norway plans to maintain its current high gas production level until the end of the decade as Europe plans to ditch Russian imports over Moscow's invasion of Ukraine, its energy minister said on Tuesday. (RTRS)

OIL: Saudi Arabia and some of its oil-producing allies have suggested cutting crude production, disappointing U.S. officials who predicted the kingdom would be instrumental in cooling the market after President Biden met Crown Prince Mohammed bin Salman for the first time in office. (WSJ)

OIL: Flows of Russian crude oil and products may drop by more than 1m b/d as a fresh round of of EU sanctions begins in December followed by additional curbs in February, according to Citigroup Inc. (BBG)

CHINA

YUAN: Moderate depreciation for the yuan is conducive to maintaining export competitiveness against the backdrop of a global economic downturn, and is a positive when it comes to stabilizing China’s growth, the Securities Times wrote. The yuan has shown resilience when compared with the recent sharp decline in the euro and Korean won, as the U.S. dollar index reached a 20-year high. The newspaper played down any impetus from the recent movement in interest rate differentials, suggesting such moves have a limited impact on the yuan, as no obvious foreign capital outflows were triggered after the PBoC’s surprise rate cut in mid-August. (MNI)

YUAN: It is widely expected that there will be some depreciation pressure on the yuan in Q4, given the upward trend of the U.S. dollar index, with most foreign banks' year-end forecasts for the yuan sitting between 6.70 and 6.95 against the dollar, Yicai.com reported. This round of yuan depreciation will be milder than what was seen in the second quarter as the Chinese economy is still likely to recover in H2, with fiscal stimulus and monetary easing kicking in, the newspaper wrote, citing HSBC. Some analysts believe any yuan movement will be tied to the degree of resilience observed in Chinese exports through the remainder of the year, the newspaper highlighted. (MNI)

CORONAVIRUS: A city that borders Beijing has been locked down after detecting eight new Covid-19 infections, raising the risk of spread into China’s capital. Zhuozhou, in the northern province of Hebei, imposed the lockdown from Tuesday and will mass test its 700,000 residents. (BBG)

CORONAVIRUS: Nationwide, China reported 1,641 infections for Tuesday. The southern island province of Hainan remains the country’s hotspot, with 600 cases. Elsewhere, Yiwu, the world’s biggest hub for Christmas goods, is lifting its lockdown from Wednesday. (BBG)

POWER: The recent power rationing observed in several provinces in Southwest China, owing to the well-documented heatwaves, reveals an urgency to promote the market-based reform of the country’s power system, said Yicai.com in an editorial. Provinces such as Sichuan are facing peak load demand, while high temperatures resulting in 40% lower rainfall levels have more than halved hydropower generation capacity, the newspaper said. China should build a power grid that conforms to the future power structure and adapts to the volatility of new energy sources such as wind and solar, the newspaper said. Furthermore, the country aims to add more than six times the level of current new energy capacity to achieve carbon neutrality, the newspaper noted. (MNI)

PROPERTY: China is probing a number of executives at state-owned real estate companies, signaling an expansion of the government’s crackdown on misconduct that has centered on the financial and technology sectors. (BBG)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Wednesday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.6794% at 9:45 am local time from the close of 1.3864% on Tuesday.

- The CFETS-NEX money-market sentiment index closed at 46 on Tuesday, flat from the close of Monday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8388 WEDS VS 6.8523

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8388 on Wednesday, compared with 6.8523 set on Tuesday.

MARKETS

SNAPSHOT: China Property Woes Back To The Fore

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 down 131.66 points at 28320.71

- ASX 200 up 36.994 points at 6998.80

- Shanghai Comp. down 45.113 points at 3231.11

- JGB 10-Yr future down 3 ticks at 149.75, yield down 0.1bp at 0.220%

- Aussie 10-Yr future down 4.5 ticks at 96.36, yield up 4.1bp at 3.620%

- U.S. 10-Yr future +0-04+ at 117-24+, yield down 1.3bp at 3.033%

- WTI crude down $0.32 at $93.42, Gold down $0.92 at $1747.21

- USD/JPY down 39 pips at Y136.38

- HAWKISH KASHKARI - NO TRADEOFF AMID INFLATION FIGHT (MNI)

- SHIELDING UK FAMILIES FROM FUEL BILLS CRISIS FORECAST TO COST £100BN (FT)

- WIDENING US-CHINA RATE SPREAD HAS LIMITED IMPACT ON YUAN (SECURITIES TIMES)

- CHINA PROBES REAL ESTATE EXECUTIVES FOR POSSIBLE LAW VIOLATIONS (BBG)

US TSYS: Light Bull Steepening Overnight

Tsys richened at the margin in Asia with the major cash Tsy benchmarks running 1.0-2.5bp richer at typing, bull steepening.

- TYU2 stuck to a narrow 0-05+ range, last +0-05 at 117-25, running on volume of ~81K (~33K of which is roll-related).

- Weakness in Chinese equities, with focus back on woes for the property sector, provided some incremental support.

- Still, participants were seemingly happy to remain on the sidelines ahead of the upcoming Jackson Hole symposium.

- A Q&A session with Minneapolis Fed President Kashkari (’23 voter) failed to provide any surprises, as the former dove underscored the need to fight inflation, highlighting the lack of trade-off between the central bank’s inflation and employment mandates at present, noting the Fed can only relax re: rate hikes when there is compelling evidence of inflation heading towards 2%.

- TU (3,279) & UXY (1,014) blocks headlined on the flow side, crossing at the same time, although both appeared to be sellers (there was a clear DV01 overweighting to FV if it was a curve play).

- Wednesday will see the release of prelim durable goods data, pending home sales and MBA mortgage apps, in addition to 5-Year Tsy & 2-Year FRN supply

JGBS: Curve A Touch Flatter

JGB futures coiled for much of the day, sticking comfortably within the confines of their overnight range, last -8, consolidating modest overnight session losses as we head towards the bell.

- Cash JGB trade has seen some light twist flattening, with the major benchmarks running 0.5bp cheaper to 1.0bp richer. Note that there has been a lack of steepening pressure for JGBs today, despite what was seen in global bond markets on Tuesday (super-long JGBs had come under selling pressure during the first two sessions of the week).

- The latest round of speculation surrounding fiscal matters failed to generate anything in the way of a notable market reaction.

- Meanwhile, Japanese PM Kishida confirmed speculation that vaccinated travellers will not have to take COVID tests when visiting Japan (from 7 September), although there was no news on the potential upping of the number of permitted daily inbound travellers.

- BoJ Rinban operations covering 1- to 10-Year JGBs saw steady to slightly lower offer/cover ratios, which may have provided some light support to that area of the curve during early afternoon dealing, although that zone now underperforms on the day.

- Looking ahead, services PPI data, the weekly international security flows and an address from BoJ’s Nakamura provide the domestic highlights on Thursday. There will also be a liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs.

AUSSIE BONDS: Curve Twist Steepens

Aussie bonds have edged higher as we have worked our way through the Sydney day, alongside an uptick in U.S Tsys (aided by weakness in Chinese and Hong Kong equities), with front-end ACGBs more than unwinding their earlier cheapening bias derived from the overnight bear steepening in Aussie bond futures.

- Cash ACGBs run 4.0bp richer to 3.5bp cheaper across the curve, twist steepening, and pivoting around 5s. YM is +3.0 and XM is -4.0, with the former operating just shy of session highs at typing. EFPs have narrowed a little, while Bills run 3 to 8 ticks richer through the reds.

- The latest round of ACGB Nov-33 supply was smoothly absorbed, with the weighted average yield printing 0.82bp through prevailing mids (per Yieldbroker), while the cover ratio improved to 2.75x against 2.25x at the previous auction, albeit with a smaller amount on offer (A$800mn vs. A$1.0bn prev.)

- No domestic economic data releases of note are scheduled for Thursday.

AUSSIE BONDS: AOFM sells A$800mn of the 3.00% 21 November 2033 Bond, issue #TB166:

The Australian Office of Financial Management (AOFM) sells A$800mn of the 3.00% 21 November 2033 Bond, issue #TB166:

- Average Yield: 3.6843% (prev. 3.0913%)

- High Yield: 3.6875% (prev. 3.0950%)

- Bid/Cover: 2.7462x (prev. 2.2450x)

- Amount allotted at highest accepted yield as percentage of amount bid at that yield: 16.1% (prev. 86.5%)

- Bidders 43 (prev. 47), successful 21 (prev. 21), allocated in full 13 (prev. 15)

EQUITIES: Mostly Lower In Asia

Most Asia-Pac equity indices are lower at typing on a limited, negative showing from Wall St. (major cash indices closed flat to 0.4% softer on Tuesday), with domestic developments (particularly earnings) largely driving matters for regional stocks.

- The CSI300 sits 1.0% worse off, a little above fresh two-week lows at writing. Tech and semiconductor equities have struggled, with the ChiNext (-2.9%) underperforming, dragged lower by losses in large-cap CATL Ltd (-4.3%) after the latter reported weaker battery margins.

- The Hang Seng deals 1.4% softer at typing on losses in ~90% of its constituents, taking the index to fresh 15-week lows. The property (-2.1%) sub-index leads losses as Chinese developer Logan has resumed trading (suspended since May 12), with the latter falling by as much as 58% earlier after missing revenue expectations.

- China-based tech (HSTECH: -2.6%) struggled as well, with sentiment worsened by a sharp selloff in EV stocks after XPeng’s (-13.3%) dismal earnings beat on Tuesday.

- The ASX200 has bucked the broader trend of losses, dealing 0.5% at writing on strength in the energy (+2.0%) and materials (+0.9%) sub-gauges, countering underperformance in consumer staples mainly on losses in Coles Group (-3.3%) despite beating profit expectations. Tech outperformed as well (S&P/ASX All Technology Index: +1.1%), led higher after strong earnings from WiseTech Global (+11.0%).

- E-minis are 0.3-0.4% softer apiece, with Dow contracts operating through Tuesday's low, effectively ceding all of its gains for August at current levels.

OIL: Just Off Recent Highs; U.S. Response To Iran Eyed

WTI and Brent are ~$0.10 weaker apiece at writing, consolidating a little below their respective two- and three-week highs made on Tuesday.

- To recap, both benchmarks closed ~$3.50 firmer apiece on Tuesday, rallying after Saudi Arabia raised the prospect of OPEC+ supply cuts, with the prompt spread for Brent rising to highs of ~$1.15 (vs. opening at ~$0.67), reflecting exacerbated worry re: tightness in global crude supplies.

- WTI and Brent nonetheless capped gains after RTRS source reports suggested that potential OPEC+ production cuts are unlikely to be implemented in the near-term, and may coincide with the return of Iranian crude to global oil markets upon a U.S.-Iran nuclear deal.

- On the latter issue, the U.S. is expected to formally respond to the latest offer from Iran by “as early as Wednesday” this week.

- Elsewhere, major crude benchmarks were little changed near session highs on Tuesday after the release of U.S. API crude inventory estimates, with reports pointing to a larger than expected decrease in crude stockpiles, with builds observed in gasoline, distillate, and Cushing hub stocks.

- Looking ahead, U.S. EIA inventory data is due later on Wednesday, with BBG estimates calling for a drawdown in crude and gasoline stockpiles.

GOLD: Little Changed In Asia; Some Reprieve As Dollar Rally Pauses

Gold deals ~$2/oz softer to print ~$1,746/oz in fairly limited Asia-Pac dealing, holding on to the bulk of Tuesday’s gains at writing.

- To recap, gold closed ~$12 firmer on Tuesday amidst a downtick in the USD (DXY) and U.S. real yields, snapping a six-day streak of lower daily closes as participants reacted to weak U.S. economic data prints (flash PMIs, new home sales, and the Richmond Fed m’fing index).

- Sep FOMC dated OIS currently price in ~63bp of tightening at that meeting (pointing to approx. even odds of a 50bp vs a 75bp hike at the meeting), a little below levels observed prior to Tuesday’s U.S. data prints.

- Comments from Minneapolis Fed Pres Kashkari (‘23 voter) provided little fresh insight against recent Fedspeak, emphasising the need to fight inflation, stating that the Fed would only relax rate hikes should “compelling evidence” point to inflation “well on its way back down to 2%”.

- From a technical perspective, conditions for gold remain bearish following its recent failure to break its trendline resistance. Initial support is seen at $1,727.8/oz (Aug 22 low), while initial resistance stands at ~$1,764.9/oz (20-Day EMA).

FOREX: Yen Outperforms Amid Demand For Safety

Participants sought shelter in safe-haven currencies amid pre-Jackson Hole caution, with e-mini futures losing altitude as the Asia-Pac session progressed. Headline flow failed to offer much in the way of notable catalysts.

- The greenback garnered some strength, with the BBDXY index chewing into yesterday's losses, even as U.S. Tsy yields faltered across the curve.

- Softer U.S. Tsy yields allowed the yen to outperform the U.S. dollar; USD/JPY shed over 35 pips as a result, building on Tuesday's decline.

- There is a $1.3bn option expiry with strikes at Y136.80-00 due to roll off at today's NY cut, but USD/JPY moved away from these levels nonetheless.

- Antipodean currencies sagged amid aversion to risk. AUD/NZD printed one-month highs before easing off towards neutral levels.

- Today's data highlights include flash U.S. durable goods orders. Comments are due from Riksbank's Floden.

FX OPTIONS: Expiries for Aug24 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9835-50(E811mln), $0.9925(E570mln), $1.0140-55(E972mln)

- USD/JPY: Y135.00($637mln), Y136.00-05($840mln), Y136.80-00($1.3bln)

- EUR/GBP: Gbp0.8750(E893mln), Gbp0.9000(E1.2bln)

- USD/CAD: C$1.2835-55($565mln)

- USD/CNY: Cny6.7900($1.0bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/08/2022 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/08/2022 | 1230/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/08/2022 | 1230/0830 | ** |  | US | durable goods new orders |

| 24/08/2022 | 1400/1000 | ** |  | US | NAR pending home sales |

| 24/08/2022 | 1430/1030 | ** |  | US | DOE weekly crude oil stocks |

| 24/08/2022 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/08/2022 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 24/08/2022 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.