-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN OPEN: PBoC Shows Some Discomfort Ahead Of Jackson Hole

EXECUTIVE SUMMARY

- PBOC LEANS AGAINST CNY WEAKNESS VIA FIXING

- BIDEN UNVEILS PLAN TO FREE STUDENTS FROM ‘UNSUSTAINABLE DEBT’ (BBG)

- KWASI KWARTENG IN CRISIS TALKS WITH UK ENERGY BOSSES TO FREEZE BILLS (TIMES)

- BOJ POLICYMAKER VOWS TO KEEP ULTRA-LOW RATES, WARNS OF ECONOMIC RISKS (RTRS)

- BOK HIKES POLICY RATE TO FIGHT SOARING INFLATION AMID WORRIES OVER SLOWING GROWTH (YONHAP)

- IRAN REVIEWS U.S. RESPONSE TO EU NUCLEAR TEXT FOR REVIVAL OF 2015 PACT (RTRS)

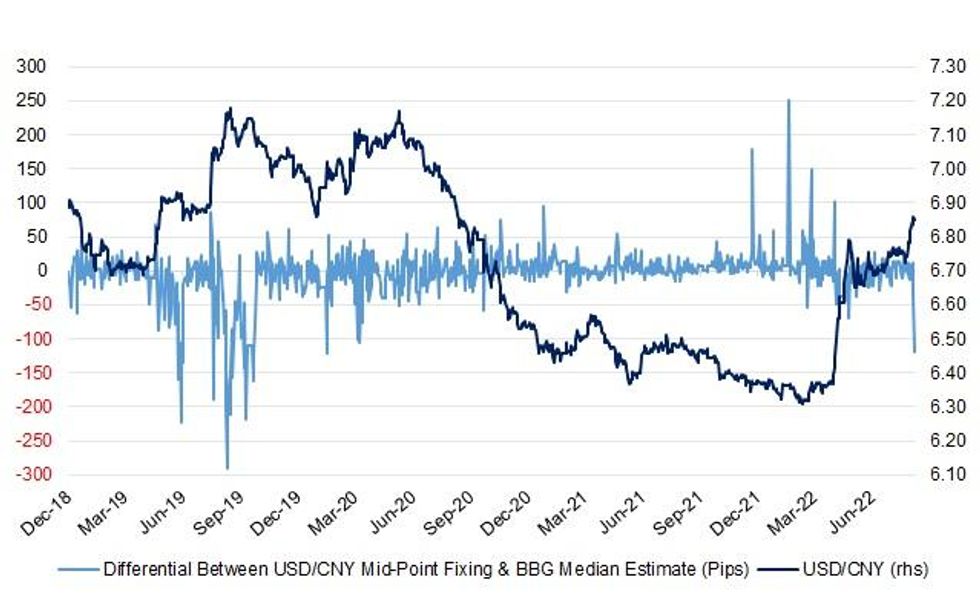

Fig. 1: Differential Between USD/CNY Mid-Point Fixing & BBG Median Estimate Vs. USD/CNY

Source: MNI - Market News/Bloomberg

Source: MNI - Market News/Bloomberg

UK

BREXIT: British steel producers will have to pay a 25 per cent tariff to sell certain construction products into Northern Ireland after EU quotas for global imports were exhausted earlier than expected. (FT)

FISCAL/ENERGY: Liz Truss’s probable chancellor has held talks with energy bosses about freezing bills for two years. Kwasi Kwarteng, who is widely expected to take the helm at the Treasury should Truss succeed Boris Johnson in less than two weeks, met Scottish Power to discuss an industry plan to keep energy bills at their current levels. (The Times)

ECONOMY: Business confidence has tumbled into negative territory as companies struggle with soaring costs, staff shortages and transport chaos. Confidence has suffered a steep decline this summer after reaching a record high a year ago, according to the Institute of Chartered Accountants in England and Wales. (The Times)

EUROPE

GERMANY: German state lender KfW is prepared to extend a credit line to struggling gas importer Uniper as one way to offset losses that have accelerated with soaring fuel prices, two people familiar with the matter said on Wednesday. (RTRS)

GERMANY: Germany's government is concerned about possible problems with the coal supply for power plants in the autumn and winter due to low water levels on the river Rhine and the oil supply in eastern parts of the country, a document seen by Reuters said. (RTRS)

U.S.

FISCAL: President Joe Biden announced a sweeping package of student-debt relief that forgives as much as $20,000 in loans for some recipients, a move he said would help a generation “saddled with unsustainable debt.” (BBG)

OTHER

CHINA/TAIWAN: A senior member of Taiwan’s main opposition party, the Kuomintang (KMT), has told a top Chinese official of Taiwanese people’s concerns about Beijing’s war games near the island, in what the party described as “frank” talks. (RTRS)

CHINA/TAIWAN: Taiwan unveiled a proposed 12.9% year-on-year increase in its defence budget for 2023 to T$415.1 billion ($13.72 billion) on Thursday amid tensions with China, which has sharply increased military activities near the democratically governed island. (RTRS)

BOJ: The Bank of Japan must maintain massive stimulus to support an economy facing a resurgence in COVID-19 infections and slowing global demand, one of its board member said, reinforcing the BOJ's outlier status in a global wave of monetary tightening. (RTRS)

JAPAN: Japan's government described its economy as "moderately picking up" in its monthly economic report, keeping the overall assessment unchanged from the previous month, while noting an upward revision to factory output. While sounding cautiously optimistic on the world's No. 3 economy, the government flagged risks of a global downturn amid overseas trend of monetary tightening and rising inflation while households face slower wage growth. (RTRS)

BOK: South Korea's central bank raised its key interest rate by a quarter percentage point Thursday as it struggles to rein in inflation expected to hit the highest level in more than two decades this year. (Yonhap)

HONG KONG: Hong Kong health officials said tighter social distancing restrictions could be considered if rising Covid-19 cases increase the pressure on the city’s medical system. (BBG)

BRAZIL: Brazil's 2023 budget bill that the president will send to Congress this month will erase the current budget surplus and put the country back into a primary deficit, two sources from the Economy Ministry told Reuters on Wednesday. (RTRS)

RUSSIA: Consumer prices in Russia declined for the seventh week running, as the rouble's appreciation in the past few months and a drop in consumer demand slow the pace of price growth, although households' expectations of future inflation increased. (RTRS)

RUSSIA: Russia’s industrial sector recorded the smallest contraction in four months in the latest sign the economy is adapting to the sweeping sanctions imposed by the US and its allies for the Kremlin’s invasion of Ukraine. (BBG)

RUSSIA: Japanese trading houses Mitsui & Co and Mitsubishi Corp have decided to join the new Russian entity that took over the Sakhalin-2 liquefied natural gas (LNG) project, the two firms said on Thursday. (RTRS)

IRAN: Iran has received Washington's response to an EU-drafted final offer for saving Tehran's 2015 nuclear deal with major powers, Iran's foreign ministry said on Wednesday, giving no firm indication of how close they are to narrowing remaining gaps. (RTRS)

MIDDLE EAST: The U.S. military carried out a counter-attack after taking rocket fire by suspected Iran-aligned militia in Syria on Wednesday, two U.S. officials told Reuters. (RTRS)

EQUITIES: "It will be a chilly winter for global stocks, according to analysts in a Reuters poll who cut year-end predictions for most major indices from three months ago and warned the risks to that already-dull outlook were skewed to the downside." (RTRS)

OIL: OPEC nations are circling the wagons after the group’s biggest member said that action may be needed to stabilize world oil markets. (BBG)

OIL: Algerian energy minister Mohamed Arkab believes that elevated oil price volatility in recent weeks is driven by fears of an economic slowdown rather than oil market fundamentals, he said in a statement seen by Reuters on Wednesday. (RTRS)

OIL: Iran is aiming to fill the void left behind by Russia in the European oil market if the Middle Eastern country can secure a deal with world powers over its nuclear program. (BBG)

OIL: US crude sales overseas are set to hit fresh records through next year as American oil increasingly takes market share in Europe. (BBG)

CHINA

PBOC: Money market interest rates will gradually move higher, closing the gap with the 7-day reverse repo rate (which currently stands at 2.00%), after the PBOC conducted a partial roll over of the maturing Medium-term Lending Facility on Aug 15, draining liquidity, the Shanghai Securities News reported, citing analysts. The DR007 rate, which hovered around 1.30% in the first half of August, has climbed for a few days, briefly rising above 1.40%, while the DR001 rate has also edged higher, moving away from the 1.00% area that it operated in for around half a month. The PBOC may continue to drain medium- and long-term liquidity with less MLF rollovers in the coming months, in a bid to guide money market rates closer to the policy rate, the newspaper said, citing Ming Ming, chief economist of CITIC Securities. (MNI)

ECONOMY: The sprawling Chinese region of Chongqing, home to several large global automakers, has extended power curbs at factories as a prolonged heatwave and drought continue to wreak economic and environmental damage throughout the country's southwest. Industrial firms were originally ordered to restrict output from Aug. 17 until Aug. 24, but formal curbs have been extended until Aug. 25, according to a notice issued by the Chongqing authorities on Wednesday. (RTRS)

PROPERTY/CREDIT: The bond financing channels for private property developers are gradually recovering, with more developers planning to issue bonds aided by credit enhancement support from China Bond Insurance, the Securities Times reported, citing industry insiders. Private developers' difficulty when it comes to issuing bonds overseas has further aggravated repayment pressures, while promoting their bond financing with a full guarantee from credit enhancement firms will help improve cash flows and boost market confidence, the newspaper noted, citing an unnamed insider. On Tuesday, the first fully-guaranteed private developer bond was issued by Chongqing Longhu Enterprise Development, totaling CNY1.5 billion, with the company aiming to repurchase or repay overseas dollar bonds, the newspaper said. (MNI)

CHINA MARKETS

PBOC INJECTS CNY2 BILLION VIA OMOS, LIQUIDITY UNCHANGED

The People's Bank of China (PBOC) injected CNY2 billion via 7-day reverse repos with the rate unchanged at 2.0% on Thursday. This keeps the liquidity unchanged after offsetting the maturity of CNY2 billion repos today, according to Wind Information.

- The operation aims to keep liquidity reasonable and ample, the PBOC said on its website.

- The 7-day weighted average interbank repo rate for depository institutions (DR007) rose to 1.5899% at 9:38 am local time from the close of 1.3747% on Wednesday.

- The CFETS-NEX money-market sentiment index closed at 49 on Wednesday vs 46 on Tuesday.

PBOC SETS YUAN CENTRAL PARITY AT 6.8536 THURS VS 6.8388

The People's Bank of China (PBOC) set the dollar-yuan central parity rate higher at 6.8536 on Thursday, compared with 6.8388 set on Wednesday, marking the weakest fixing in two years since Aug 31, 2020.

OVERNIGHT DATA

JAPAN JUL SERVICES PPI +2.1% Y/Y; MEDIAN +2.2%; JUN +2.0%

NEW ZEALAND Q2 RETAIL SALES EX INFLATION -2.3% Q/Q; MEDIAN +1.7%; Q1 -0.9%

SOUTH KOREA Q2 PPI +9.2% Y/Y; JUN +10.0%

MARKETS

SNAPSHOT: PBoC Shows Some Discomfort Ahead Of Jackson Hole

Below gives key levels of markets in the second half of the Asia-Pac session:

- Nikkei 225 up 185.81 points at 28499.28

- ASX 200 up 45.876 points at 7044.00

- Shanghai Comp. up 13.057 points at 3228.26

- JGB 10-Yr future down 29 ticks at 149.39, yield up 0.2bp at 0.230%

- Aussie 10-Yr future down 5.5 ticks at 96.3, yield up 4.7bp at 3.676%

- U.S. 10-Yr future +0-01 at 117-09, yield down 0.75bp at 3.096%

- WTI crude up $0.37 at $95.26, Gold up $6.21 at $1757.45

- USD/JPY down 48 pips at Y136.64

- PBOC LEANS AGAINST CNY WEAKNESS VIA FIXING

- BIDEN UNVEILS PLAN TO FREE STUDENTS FROM ‘UNSUSTAINABLE DEBT’ (BBG)

- KWASI KWARTENG IN CRISIS TALKS WITH UK ENERGY BOSSES TO FREEZE BILLS (TIMES)

- BOJ POLICYMAKER VOWS TO KEEP ULTRA-LOW RATES, WARNS OF ECONOMIC RISKS (RTRS)

- BOK HIKES POLICY RATE TO FIGHT SOARING INFLATION AMID WORRIES OVER SLOWING GROWTH (YONHAP)

- IRAN REVIEWS U.S. RESPONSE TO EU NUCLEAR TEXT FOR REVIVAL OF 2015 PACT (RTRS)

US TSYS: Modestly Richer Overnight

A weaker USD, which was a result of the PBoC leaning against CNY weakness via its daily mid-point fixing mechanism, seemingly provided a very modest bid for the Tsy space during Asia dealing.

- Cash Tsys run 1.-1.5bp richer across the curve.

- TYU2 deals +0-02+ at 117-10+, at the top of a very narrow 0-04+ range, operating on volume of ~120K, with ~67K of that being roll related.

- Thursday’s NY docket includes weekly jobless claims data, the second Q2 GDP print and the release of the Kansas City Fed manufacturing index. 7-Year Tsy supply is also due.

- In the background, continued setup for the upcoming Jackson Hole symposium will also factor into price action, with the Fed’s hawkish musings setting the tone in recent weeks. We have suggested that a dovish Powell pivot on Friday is unlikely (see our full preview of that event here).

JGBS: Futures Off Lows Aided By Super-Long End Bounce, Curve Still Steeper

A two-way afternoon for JGB futures saw the contract show further below it overnight low before benefitting from a bid in the super-long end, leaving it -16 as we move towards the close, 20 ticks off worst levels.

- Cash JGBs now run 0.5bp richer to 1.0bp cheaper, twist steepening, with a pivot around 3s as 20s providing the weakest point on the curve.

- The long end unwound most of the steepening/weakness observed in the morning (30s cheapened by over 4bp at one point) on the back of a liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs, with this week’s concession seemingly doing enough to result in the smooth passage of supply.

- Note that the cover ratio still printed below 2.50x, while the spreads observed remained wide by a historical standard, but the previous auction came in June, which generated a particularly wide tail and low cover ratio as the markets challenged the BoJ’s YCC settings, so skewed optics may have aided the long end rally.

- Comments from BoJ’s Nakamura failed to move the needle, as he stuck with the central bank’s core view.

- Looking ahead, Tokyo CPI data headlines Friday’s dockets, but shouldn’t impact the BoJ given its insistence that it will not act on the current cost-push inflation dynamic, amid its hunt for more notable wage growth.

JGBS AUCTION: Japanese MOF sells Y499.2bn of 15.5-39 Year JGBs in liquidity enhancement auction:

The Japanese Ministry of Finance (MOF) sells Y499.2bn of 15.5-39 Year JGBs in a liquidity enhancement auction:

- Average Spread: +0.029% (prev. +0.084%)

- High Spread: +0.034% (prev. +0.099%)

- % Allotted At High Spread: 46.2311% (prev. 13.5446%)

- Bid/Cover: 2.403x (prev. 1.952x)

AUSSIE BONDS: Off Cheaps

Aussie bonds have unwound the bulk of the modest cheapening observed during the early part of the Sydney session alongside an uptick in U.S. Tsys (with the latter seemingly aided by weakness in the USD after the PBOC set the daily CNY mid-point fixing at a stronger-than-expected level), returning them to levels observed near the Sydney open.

- Cash ACGBs run 1.5-4.5bp cheaper across the curve, with the 10- to 12-Year zone leading the way lower.

- YM is -2.0 after failing to breach its overnight low, while XM is -4.0, after breaking its overnight levels. EFPs have narrowed a little, while Bills run 1 to 3 ticks cheaper through the reds.

- The latest round of semi supply (a A$1bn tap of May-28 paper) from the South Australian Financing Authority (SAFA) saw little by way of a meaningful move in XM futures around pricing but may have factored into the early downtick for XM.

- Friday will see A$700mn of ACGB Apr-29 on offer at auction followed by the release of the AOFM’s weekly issuance slate, with no domestic economic data releases of note scheduled.

EQUITIES: Higher In Asia; Chinese Stimulus Does Little To Lift Gloom

Most Asia-Pac equity indices are modestly higher at typing, tracking a positive lead from Wall St. A note that Hong Kong’s morning session was cancelled owing to heightened weather warnings, with trading scheduled to resume at 1300 HKT.

- The CSI300 deals 0.2% firmer at writing, back from three-week lows made earlier in the session, with news of additional economic support measures from China’s State Council doing seemingly little to shore up broader sentiment in equities amidst an ongoing power crisis (Chongqing has extended industrial power cuts for another day) and well-documented concerns re: the property sector.

- Keeping within the country, tech equities struggled (ChiNext: -2.5%; STAR50: -1.5%), with heavyweight CATL Ltd (-2.5%) falling for another day amidst recent weakness in EV stocks.

- The Nikkei 225 trades 0.6% firmer, on track to halt a five-session streak of daily lower closes, with large-caps Tokyo Electron (+1.4%) and Daiichi Sankyo (+4.9%) contributing the most to gains.

- The ASX200 deals 0.7% firmer, led by gains in materials and energy equities, with the major miners adding 0.7-0.9% apiece. On the other hand, the consumer staples index has struggled for another day, with retailer Woolworth’s (-3.9%) declining after reporting sluggish profit growth.

- E-minis sit 0.1-0.3% better off apiece, operating within the upper end of Wednesday’s range at writing.

OIL: Fresh Highs In Asia As U.S. Inventories Extend Decline

WTI and Brent are ~$0.60 firmer apiece, operating a little below fresh three-week highs at writing, with both benchmarks firmly on track to end the week higher amidst a spread of supply-negative developments (i.e. potential OPEC+ production cuts, uncertainty re: a U.S.-Iran nuclear deal etc).

- To recap, WTI and Brent closed higher for a third straight session on Wednesday after EIA data pointed to a larger than expected drawdown in crude inventories, and a surprise decline in distillate stockpiles. Gasoline inventories were little changed (vs. expectations for a drawdown), while there was a build in Cushing hub stocks.

- Looking into the details, total U.S. exports of crude and refined products came in at the highest on record, exacerbating worry re: tightness in global crude supplies amidst shrinking U.S. stockpiles and an end to the release of crude from the U.S. SPR in October.

- Elsewhere, the U.S. has responded to the EU’s “final draft” re: a U.S.-Iran nuclear deal. While no details re: progress in the negotiations were forthcoming, Tehran has begun a “careful review”, with an Iranian reply to the EU due.

- Oil loadings at Caspian Pipeline Consortium (CPC) facilities on the Black Sea are due to be disrupted by ~30-40% (per RTRS calculations) over the next few months, as the operator arranges for repairs to previously-flagged weather damage to port facilities.

GOLD: Nudging Higher As Dollar Eases

Gold sits $3/oz firmer to print $1,754/oz at writing, a little below best levels after a brief show through Wednesday’s peak, with the limited move higher aided by a downtick in the USD (DXY) and nominal U.S. Tsy yields.

- To recap, gold closed ~$3/oz firmer on Wednesday for a second consecutive higher daily close, aided by a continued pullback in the DXY from Tuesday’s highs above the 109.00 mark.

- Elsewhere, gold drew limited support from a fresh 19-point policy plan from China’s State Council on Wednesday focused on addressing specific challenges to economic growth, with bullion demand in the country continuing to rise from its ‘22, COVID-induced lows.

- Looking ahead, gold currently sits a little towards the lower end of a ~$60 trading range established in August in the run-up to the Fed’s three-day Jackson Hole Symposium, with focus turning to Fed Chair Powell’s keynote speech on Friday.

- From a technical perspective, gold remains weak following its recent failure to break trendline resistance. Initial support is seen at $1,727.8/oz (Aug 22 low), while initial resistance stands at ~$1,763.39/oz (20-Day EMA).

FOREX: Greenback Sags, Redback Gains

The greenback lost attitude in the lead-up to the Jackson Hole symposium, with the BBDXY index grinding through yesterday's trough amid generally softer U.S. Tsy yields. Headline flow contained little in the way of notable catalysts.

- USD/JPY went offered over the Tokyo fix before stabilising ~30 pips below neutral levels. Its downswing was correlated with a decline in broader greenback strength.

- USD/CNH declined from the off, extending losses as the PBOC set the mid-point of is USD/CNY tolerance band 120 pips below sell-side estimate after offshore yuan printed fresh two-year lows on Wednesday.

- The Antipodeans turned bid as a move higher in e-mini futures testified to an improvement in risk sentiment. Some suggested that a new CNY1tn stimulus package announced by China's State Council generated additional demand for offshore yuan as well as AUD and NZD.

- The kiwi dollar knee-jerked lower after data showed a surprise contraction in New Zealand's retail sales. While the initial move was quickly unwound, the weak outturn may have underpinned demand for AUD/NZD, which printed a new one-month high.

- USD/KRW was trending lower as the BoK delivered the expected 25bp rate hike, while Gov Rhee said at a press conference that the central bank is monitoring the impact of the FX rate on domestic economy.

- German GDP & Ifo survey, U.S. GDP & jobless claims as well as the minutes from the ECB's July monetary policy meeting take focus from here.

FX OPTIONS: Expiries for Aug25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E888mln), $1.0000(E2.1bln), $1.0090-00(E1.0bln)

- USD/JPY: Y135.00($912mln), Y135.90-00($809mln), Y137.00($503mln), Y139.30-45($614mln)

- GBP/USD: $1.1820(Gbp574mln), $1.2150(Gbp682mln)

- NZD/USD: $0.6110-30(N$1.0bln)

- USD/CAD: C$1.2850-65($881mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($2.2bln)

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/08/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/08/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/08/2022 | 1130/1330 |  | EU | ECB publishes accounts of July 20-21 meet | |

| 25/08/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 25/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/08/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 25/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/08/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.