-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US CPI Preview: Setting The Tone For 2025

MNI ASIA MARKETS OPEN: NY Fed Inflation Expectations Gaining

MNI ASIA MARKETS ANALYSIS: Tsy Ylds Drift Higher Ahead CPI/PPI

MNI EUROPEAN MARKETS ANALYSIS: USD Softens A Touch On Signs Of PBoC Unease

- A firmer than expected CNY fixing from the PBoC pointed to discomfort re: CNY weakness ahead of the Jackson Hole Symposium, weighing on the USD in Asia hours.

- Participants continue to look forward to the Jackson Hole Symposium.

- German GDP data & the Ifo survey, U.S. GDP & weekly jobless claims, as well as the minutes from the ECB's July monetary policy meeting take focus from here.

US TSYS: Modestly Richer Overnight

A weaker USD, which was a result of the PBoC leaning against CNY weakness via its daily mid-point fixing mechanism, seemingly provided a very modest bid for the Tsy space during Asia dealing.

- Cash Tsys run 1.-1.5bp richer across the curve.

- TYU2 deals +0-02+ at 117-10+, at the top of a very narrow 0-04+ range, operating on volume of ~120K, with ~67K of that being roll related.

- Thursday’s NY docket includes weekly jobless claims data, the second Q2 GDP print and the release of the Kansas City Fed manufacturing index. 7-Year Tsy supply is also due.

- In the background, continued setup for the upcoming Jackson Hole symposium will also factor into price action, with the Fed’s hawkish musings setting the tone in recent weeks. We have suggested that a dovish Powell pivot on Friday is unlikely (see our full preview of that event here).

JGBS: Futures Off Lows Aided By Super-Long End Bounce, Curve Still Steeper

A two-way afternoon for JGB futures saw the contract show further below it overnight low before benefitting from a bid in the super-long end, leaving it -16 as we move towards the close, 20 ticks off worst levels.

- Cash JGBs now run 0.5bp richer to 1.0bp cheaper, twist steepening, with a pivot around 3s as 20s providing the weakest point on the curve.

- The long end unwound most of the steepening/weakness observed in the morning (30s cheapened by over 4bp at one point) on the back of a liquidity enhancement auction for off-the-run 15.5- to 39-Year JGBs, with this week’s concession seemingly doing enough to result in the smooth passage of supply.

- Note that the cover ratio still printed below 2.50x, while the spreads observed remained wide by a historical standard, but the previous auction came in June, which generated a particularly wide tail and low cover ratio as the markets challenged the BoJ’s YCC settings, so skewed optics may have aided the long end rally.

- Comments from BoJ’s Nakamura failed to move the needle, as he stuck with the central bank’s core view.

- Looking ahead, Tokyo CPI data headlines Friday’s dockets, but shouldn’t impact the BoJ given its insistence that it will not act on the current cost-push inflation dynamic, amid its hunt for more notable wage growth.

AUSSIE BONDS: Off Cheaps

Aussie bonds have unwound the bulk of the modest cheapening observed during the early part of the Sydney session alongside an uptick in U.S. Tsys (with the latter seemingly aided by weakness in the USD after the PBOC set the daily CNY mid-point fixing at a stronger-than-expected level), returning them to levels observed near the Sydney open.

- Cash ACGBs run 1.5-4.5bp cheaper across the curve, with the 10- to 12-Year zone leading the way lower.

- YM is -2.0 after failing to breach its overnight low, while XM is -4.0, after breaking its overnight levels. EFPs have narrowed a little, while Bills run 1 to 3 ticks cheaper through the reds.

- The latest round of semi supply (a A$1bn tap of May-28 paper) from the South Australian Financing Authority (SAFA) saw little by way of a meaningful move in XM futures around pricing but may have factored into the early downtick for XM.

- Friday will see A$700mn of ACGB Apr-29 on offer at auction followed by the release of the AOFM’s weekly issuance slate, with no domestic economic data releases of note scheduled.

JAPAN: Foreign Bond Buying Run Ends, Offshore Investors Still Buy Japanese Bonds

Japanese investors were small net sellers of foreign bonds last week, according to the weekly international security flow data released by the Japanese MoF, bringing an end to a run of four consecutive weeks of net purchases.

- Japanese investors also lodged a third straight round of weekly net sales of foreign equities.

- Elsewhere, foreign investors were net buyers of Japanese bonds for a fourth straight week, net purchasing over Y1tn of Japanese paper for the fifth time in seven weeks. This could still represent an element of JGB short covering after the BoJ’s defence of its YCC settings in June but may also represent foreign investors taking advantage of FX-hedged yield pickups.

- Finally, foreign investors recorded a marginal round of net buying of Japanese equities for a third consecutive week.

| Latest Week | Previous Week | 4-Week Rolling Sum | |

|---|---|---|---|

| Net Weekly Japanese Flows Into Foreign Bonds (Ybn) | -79.2 | 1154.7 | 1943.2 |

| Net Weekly Japanese Flows Into Foreign Stocks (Ybn) | -506.3 | -234.8 | -1421.7 |

| Net Weekly Foreign Flows Into Japanese Bonds (Ybn) | 1294.1 | 231.3 | 3832.6 |

| Net Weekly Foreign Flows Into Japanese Stocks (Ybn) | 28.5 | 45.3 | 13.9 |

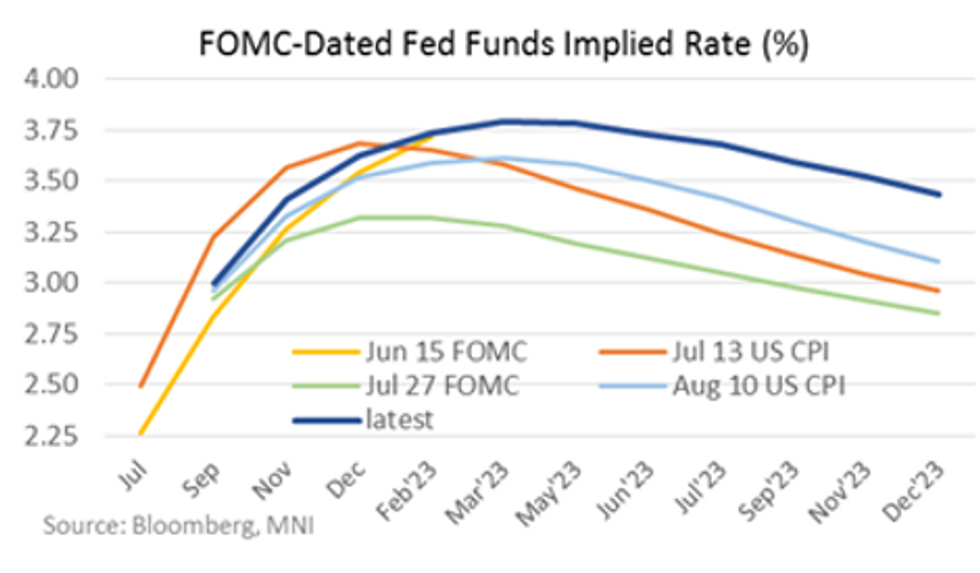

FED: MNI 2022 Jackson Hole Preview - Premature To Pivot

EXECUTIVE SUMMARY

- Fed Chair Powell is unlikely to signal a major policy “pivot” in his 2022 Jackson Hole speech.

- He could reiterate that slower hikes will likely be appropriate “at some point”, but is very unlikely to endorse market pricing for 2023 cuts, or to provide concrete guidance for future decisions.

- Recent rate repricing raises risks that expectations have gotten too hawkish in the run-up to Jackson Hole.

- MNI's Preview of Jackson Hole includes what we know so far is scheduled for the event, sell-side analysis, a run-down of recent Fed communications, and our policy team's interviews and podcasts with ex-Fed officials on what to watch for at the symposium.

- Click for full pdf analysis.

FOREX: Greenback Sags, Redback Gains

The greenback lost attitude in the lead-up to the Jackson Hole symposium, with the BBDXY index grinding through yesterday's trough amid generally softer U.S. Tsy yields. Headline flow contained little in the way of notable catalysts.

- USD/JPY went offered over the Tokyo fix before stabilising ~30 pips below neutral levels. Its downswing was correlated with a decline in broader greenback strength.

- USD/CNH declined from the off, extending losses as the PBOC set the mid-point of is USD/CNY tolerance band 120 pips below sell-side estimate after offshore yuan printed fresh two-year lows on Wednesday.

- The Antipodeans turned bid as a move higher in e-mini futures testified to an improvement in risk sentiment. Some suggested that a new CNY1tn stimulus package announced by China's State Council generated additional demand for offshore yuan as well as AUD and NZD.

- The kiwi dollar knee-jerked lower after data showed a surprise contraction in New Zealand's retail sales. While the initial move was quickly unwound, the weak outturn may have underpinned demand for AUD/NZD, which printed a new one-month high.

- USD/KRW was trending lower as the BoK delivered the expected 25bp rate hike, while Gov Rhee said at a press conference that the central bank is monitoring the impact of the FX rate on domestic economy.

- German GDP & Ifo survey, U.S. GDP & jobless claims as well as the minutes from the ECB's July monetary policy meeting take focus from here.

FX OPTIONS: Expiries for Aug25 NY cut 1000ET (Source DTCC)

- EUR/USD: $0.9950(E888mln), $1.0000(E2.1bln), $1.0090-00(E1.0bln)

- USD/JPY: Y135.00($912mln), Y135.90-00($809mln), Y137.00($503mln), Y139.30-45($614mln)

- GBP/USD: $1.1820(Gbp574mln), $1.2150(Gbp682mln)

- NZD/USD: $0.6110-30(N$1.0bln)

- USD/CAD: C$1.2850-65($881mln)

- USD/CNY: Cny6.8500($1.4bln), Cny6.9500($2.2bln)

ASIA FX: CNH & KRW Higher, INR Lags

USD/Asia pairs are lower today, amidst broad USD weakness and positive spill over from CNH and KRW gains. INR is the main outlier on the negative side, where rebounding oil prices are weighing.

- CNH: USD/CNH dipped sharply following the much stronger than expected CNY fixing (firmest outcome since early 2020, relative to expectations). We got towards the low 6.8515/20 region before rebounding. Moves above 6.8600 have drawn selling interest though and we are now threatening to break sub 6.8500 as we approach the London cross-over. Today's fix comes after the FX regulatory warned against shorting the yuan overnight, so clearly the degree of concern around FX depreciation pressures has risen.

- KRW: Spot USD/KRW has mostly tracked lower. Onshore equities are around 1% higher for the Kospi, which has helped. The BoK hiked by 25bps as expected and is also focused more on the exchange rate and its influence on the domestic economy. This echoes comments from other officials around FX levels in recent session. Dips below 1334 were supported in the 1 month NDF, we were last at 1335.80.

- INR: The rupee is underperforming the broader FX trend today. Spot USD/INR is above 79.80, while the 1 month USD/INR NDF has crept back above 80.05. Higher oil prices, with Brent continuing to recover, is weighing at the margin.

- IDR: Spot USD/IDR is lower by -19.5figs to 14828, in line with the regional trend. The gov't said it will submit the findings from its assessment on subsidised fuel price hikes to President Widodo this week. It will then announce the decision on price increase, which will be closely watched due to the ramifications for inflation dynamics.

- PHP: The Philippine peso has found poise as domestic FX and bond markets re-open after a one-day pause caused by adverse weather conditions. Spot USD/PHP last deals -0.075 at PHP56.015, with bears looking for losses past the 50-DMA, which kicks in at PHP55.523.

- THB: The baht outperforms its peers in emerging Asia, shrugging off the suspension of PM Prayuth until the Constitutional Court resolves a dispute on his term limit. Spot USD/THB trades -0.16 at THB35.89. From a technical standpoint, bears look for a dip through the 50-DMA (THB35.828) towards Aug 11 low of THB35.160.

CNH: Market Implied Probabilities Still Suggest USD/CNH Can Breach 7.00 Before Year-End

USD/CNH is threatening to test below 6.8500 as we approach the London/EU cross-over. To recap, today's fixing, was the weakest relative to expectations in USD/CNY terms since early 2020 at -120pips. It also comes after the overnight warning from the onshore FX regulator for local financial institutions around yuan shorts.

- Clearly concern around yuan depreciation is rising amongst the China authorities. Some analysts have stated this may reflect some jitters ahead of Powell's Jackson Hole speech, coming up tomorrow.

- These developments have filtered through into the option space. The table below presents the implied probabilities of USD/CNH touching 7.00 before year end, which is the first column. The second column is the implied probability of being above 7.00 at year end.

- The one-touch probability is down from yesterday's highs, but remains above 50%. We are above levels from last week and also well above levels that prevailed on August-12th. This was just prior to the surprise MLF cut and disappointing July activity data released on August 15th.

- The probability of being above 7.00 at year end hasn't gone much beyond 20%, but we are still comfortably above recent lows.

- Historically, the fixing trend has been used to slow the direction of the CNY rather than alter the trend. The market may still feel relative fundamentals are skewed towards higher USD/CNH levels, particularly with further monetary easing possible from China before year end.

Table 1: USD/CNH Implied Probabilities

| Implied Probability By Year End | ||

| Date | One-touch of 7.00 | Above 7.00 |

| Today | 51.2% | 19.4% |

| Aug-24 | 59.1% | 22.1% |

| Aug-23 | 52.4% | 19.8% |

| Aug-22 | 57.4% | 21.7% |

| Aug-19 | 48.2% | 18.5% |

| Aug-18 | 37.2% | 14.9% |

| Aug-12 | 18.6% | 9.6% |

Source: MNI/Market News/Bloomberg

EQUITIES: Higher In Asia; Chinese Stimulus Does Little To Lift Gloom

Most Asia-Pac equity indices are modestly higher at typing, tracking a positive lead from Wall St. A note that Hong Kong’s morning session was cancelled owing to heightened weather warnings, with trading scheduled to resume at 1300 HKT.

- The CSI300 deals 0.2% firmer at writing, back from three-week lows made earlier in the session, with news of additional economic support measures from China’s State Council doing seemingly little to shore up broader sentiment in equities amidst an ongoing power crisis (Chongqing has extended industrial power cuts for another day) and well-documented concerns re: the property sector.

- Keeping within the country, tech equities struggled (ChiNext: -2.5%; STAR50: -1.5%), with heavyweight CATL Ltd (-2.5%) falling for another day amidst recent weakness in EV stocks.

- The Nikkei 225 trades 0.6% firmer, on track to halt a five-session streak of daily lower closes, with large-caps Tokyo Electron (+1.4%) and Daiichi Sankyo (+4.9%) contributing the most to gains.

- The ASX200 deals 0.7% firmer, led by gains in materials and energy equities, with the major miners adding 0.7-0.9% apiece. On the other hand, the consumer staples index has struggled for another day, with retailer Woolworth’s (-3.9%) declining after reporting sluggish profit growth.

- E-minis sit 0.1-0.3% better off apiece, operating within the upper end of Wednesday’s range at writing.

GOLD: Nudging Higher As Dollar Eases

Gold sits $3/oz firmer to print $1,754/oz at writing, a little below best levels after a brief show through Wednesday’s peak, with the limited move higher aided by a downtick in the USD (DXY) and nominal U.S. Tsy yields.

- To recap, gold closed ~$3/oz firmer on Wednesday for a second consecutive higher daily close, aided by a continued pullback in the DXY from Tuesday’s highs above the 109.00 mark.

- Elsewhere, gold drew limited support from a fresh 19-point policy plan from China’s State Council on Wednesday focused on addressing specific challenges to economic growth, with bullion demand in the country continuing to rise from its ‘22, COVID-induced lows.

- Looking ahead, gold currently sits a little towards the lower end of a ~$60 trading range established in August in the run-up to the Fed’s three-day Jackson Hole Symposium, with focus turning to Fed Chair Powell’s keynote speech on Friday.

- From a technical perspective, gold remains weak following its recent failure to break trendline resistance. Initial support is seen at $1,727.8/oz (Aug 22 low), while initial resistance stands at ~$1,763.39/oz (20-Day EMA).

OIL: Fresh Highs In Asia As U.S. Inventories Extend Decline

WTI and Brent are ~$0.60 firmer apiece, operating a little below fresh three-week highs at writing, with both benchmarks firmly on track to end the week higher amidst a spread of supply-negative developments (i.e. potential OPEC+ production cuts, uncertainty re: a U.S.-Iran nuclear deal etc).

- To recap, WTI and Brent closed higher for a third straight session on Wednesday after EIA data pointed to a larger than expected drawdown in crude inventories, and a surprise decline in distillate stockpiles. Gasoline inventories were little changed (vs. expectations for a drawdown), while there was a build in Cushing hub stocks.

- Looking into the details, total U.S. exports of crude and refined products came in at the highest on record, exacerbating worry re: tightness in global crude supplies amidst shrinking U.S. stockpiles and an end to the release of crude from the U.S. SPR in October.

- Elsewhere, the U.S. has responded to the EU’s “final draft” re: a U.S.-Iran nuclear deal. While no details re: progress in the negotiations were forthcoming, Tehran has begun a “careful review”, with an Iranian reply to the EU due.

- Oil loadings at Caspian Pipeline Consortium (CPC) facilities on the Black Sea are due to be disrupted by ~30-40% (per RTRS calculations) over the next few months, as the operator arranges for repairs to previously-flagged weather damage to port facilities.

UP TODAY (Times GMT/Local)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/08/2022 | 0600/0800 | *** |  | DE | GDP (f) |

| 25/08/2022 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 25/08/2022 | 0700/0900 | ** |  | ES | PPI |

| 25/08/2022 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/08/2022 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/08/2022 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/08/2022 | 1130/1330 |  | EU | ECB publishes accounts of July 20-21 meet | |

| 25/08/2022 | 1230/0830 | * |  | CA | Payroll employment |

| 25/08/2022 | 1230/0830 | ** |  | US | Jobless Claims |

| 25/08/2022 | 1230/0830 | *** |  | US | GDP (2nd) |

| 25/08/2022 | 1230/0830 | ** |  | US | WASDE Weekly Import/Export |

| 25/08/2022 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/08/2022 | 1430/1030 | ** |  | US | Natural Gas Stocks |

| 25/08/2022 | 1530/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 25/08/2022 | 1530/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 25/08/2022 | 1700/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.